Last week, Shenyu, the co-founder of Cobo & Yuchi, was a guest on Mars Finance and Economics live broadcast. He discussed the pros and cons of the Ethereum EIP 1559 proposal with several guests, discussed layer 2, Ethereum expansion plan, on-chain governance model, cross-chain, etc. There are a lot of dry goods and opinions to share. This article extracts the views of Shenyu and shares them with you.

What exactly is EIP 1559? According to the explanation of A Jian, editor-in-chief of Ethereum enthusiasts:

Why did Shenyu vote for 1559?

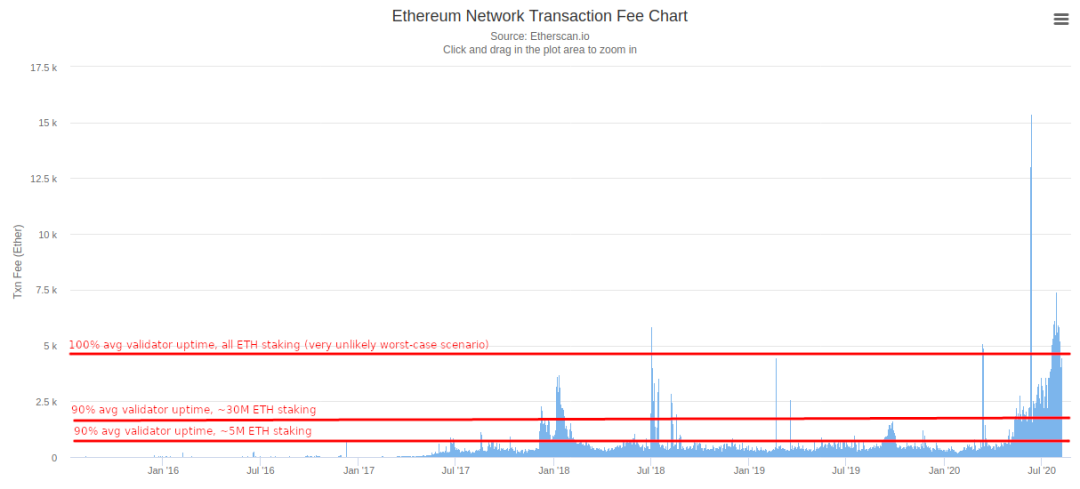

Moderator: I noticed that there are about a dozen mining pools that are against 1559, and no more than 10 are in favor, most of them are against, and there are also a few neutral ones. As the leading mining pool of Ethereum, F2Pool firmly voted for 1559 votes. I wonder why Shenyu voted for it?Shenyu: From our point of view, this matter is relatively simple. If we look at the development of this proposal from a slightly longer-term perspective, will it be beneficial to the entire ecology? Now in the Ethereum ecosystem, especially from the perspective of experienced users using DeFi, Ethereum has a very big fatal problem, that is, every transaction sent is uncertain, and I don’t know the current or guessed gas fee Will there be drastic changes.In order to make his transaction confirmed faster, many miners will give a gas fee higher than the average, but then in a short period of time, the network changes quickly and the transaction will not be confirmed. I believe that many DeFi players will encounter this situation and keep accelerating transactions. If multiple transactions are initiated at the same time during this process, it is likely to be messed up, causing DeFi to fall into a chaotic experience. With better performance, such as the exchange public chain BSC, the tps is very high, and the experience is very good. silky. There is still a big difference between the two experiences. The experience on Ethereum is very bad. It even takes hours to wait for several transaction confirmations, which makes the development of the entire DeFi ecosystem very slow. This is also one of the reasons why many users have to transfer to other public chains. The 1559 fundamentally changes the experience, especially for high-frequency users.Second, 1559 changed monetary policy. In the past, there was no upper limit for inflation, but now it can increase everyone's expectations for the price of ETH, and allow ETH to truly capture the ecological value of Ethereum. These two points will greatly improve the ecology of Ethereum.

There is still a big difference between the two experiences. The experience on Ethereum is very bad. It even takes hours to wait for several transaction confirmations, which makes the development of the entire DeFi ecosystem very slow. This is also one of the reasons why many users have to transfer to other public chains. The 1559 fundamentally changes the experience, especially for high-frequency users.Second, 1559 changed monetary policy. In the past, there was no upper limit for inflation, but now it can increase everyone's expectations for the price of ETH, and allow ETH to truly capture the ecological value of Ethereum. These two points will greatly improve the ecology of Ethereum.Will Ethereum Fork?

Moderator: Venture capital Dragonfly once wrote an article, to the effect that it is impossible for Ethereum to fork because of DeFi. A previous fork of Ethereum produced ETC, and two hacking incidents occurred last year. Webster Rating commented that the ETC public chain has no value and necessity. So now if the miners object, do they have the ability to fork? If users are willing to pay more for gas fees, will miners get higher fees?Shenyu: I think forking is a game process. The fork can be divided at will, anyone can. We have seen a huge number of forks in 2017, and everyone seems to be used to forks. Whether it can develop its own ecology after the fork is a more critical issue, because an ecosystem is forked from the old one and carries many users and assets. If some users disagree, they will throw away the assets in hand. In the new ecology, it really grows up, and something different from other ecology is born. So it depends more on the developers and users of the ecology.1559 Impact on the Ethereum Economic Model

Moderator: V God himself also called for the order in 1559, which is at least beneficial to the economic model of Ethereum. And I see most of the support from the community, but I see that there are also many people in the market who may think that this proposal is not very helpful, and may even have some opposite effects. So I would like to invite two more guests to talk about it. What are the potential impacts of 1559 on Ethereum's economic model?Shenyu: We can see the impact of this monetary policy from two perspectives. I think one advantage is that Ethereum is in a relatively bear market cycle. If it is assumed that Ethereum expands smoothly, shards, and layer 2, in fact, a large number of user behaviors and transactions will go to the second layer network, and the procedures that can be captured by the layer network Fees will be relatively small, assuming that the lower network is not congested in a bear market, and most economic activities develop on the first layer network. Under such a condition, if the block reward is gradually reduced and it is close to 0, the network security of Ethereum is very worrying. If it is in the PoW state, the miners actually do not have a strong motivation to maintain security.There will be some similar problems in PoS, so after the monetary policy reserves the rewards for this area, I think it will guarantee the long-term network security. Because of the final performance and a large number of economic activities, according to current calculations, it will take place on the second-tier network. The second factor is that when the market is relatively good, the entire economic cycle is on the rise. A large number of economic activities may not necessarily be captured by Ethereum at this stage. Then, through the form of mandatory token destruction fee, the entire Ethereum can capture the ecological development.secondary title

Talk about on-chain governance

Shenyu: Regarding on-chain governance, I actually think there are many imperfections, including PoW and PoS. PoW is under the control of Bitcoin, and there is actually a long-term dilemma, that is, developers. Core participants in the community and miners have had years of disputes over some future routes. In this process, it is very difficult to reach a consensus, because everyone has a different point of view, no matter how big or small. When a community develops to a certain level, multiple voices are bound to emerge. At this time, how to maintain a relatively unified opinion and move forward together will become very difficult, and there may be branches of multiple routes.Layer 2 and Ethereum Scalability

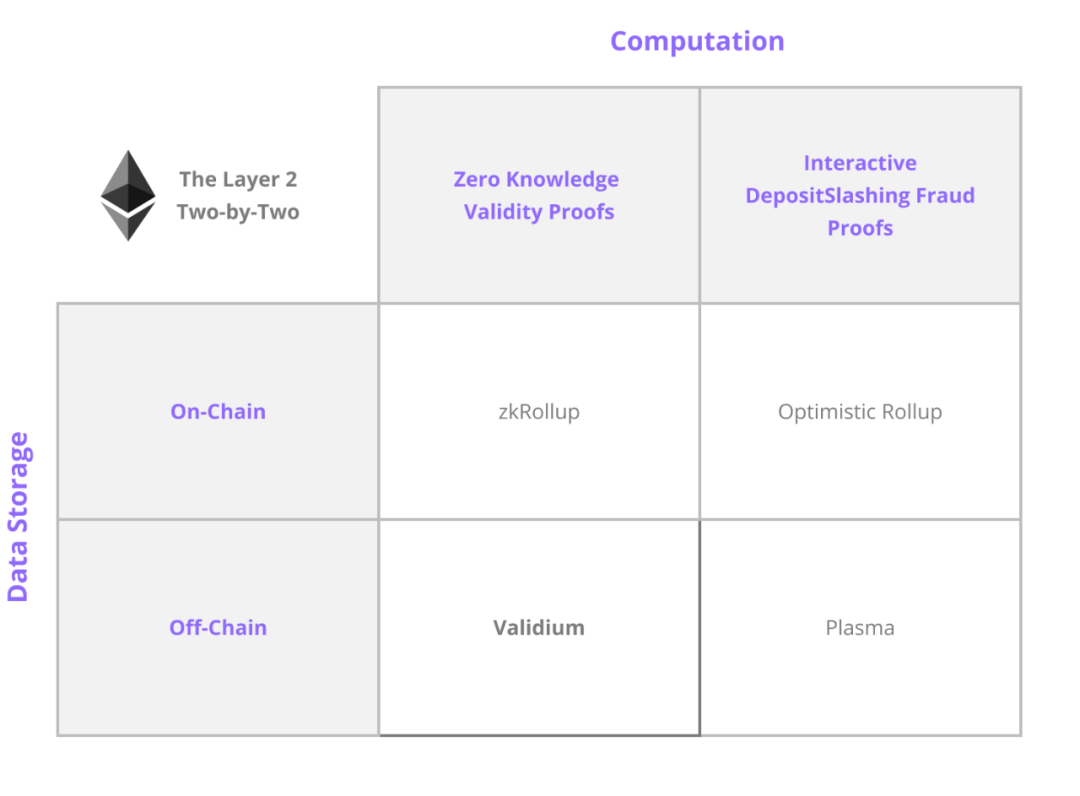

Moderator: We talked a lot about 1559 topics, let's talk about layer2 which is very popular recently. For example, the "optimistic" plan received a16z investment, zk rollup received Dragonfly and other venture capital support, and the public chain of the exchange has also begun to develop, such as the Binance Smart Chain, which runs 1inch and DODO, and Huobi HECO. These transactions After the development of the public chain, are you still optimistic about layer2?Shenyu: I have always been optimistic about the development of layer2. I think the world of blockchain should be layered. The resources that can run in the top layer of the network are very limited. It is actually a big contradiction to ensure absolute security and high performance. In this case, different application layers will inevitably run to different levels. Going back to Ethereum, because there are a large number of application scenarios and combinations between DeFi protocols on the chain, but at present, we have seen that there is no perfect solution for layer 2, for example, it can fully guarantee sufficient security , Composability of DeFi protocols. However, I'm pretty good-looking in the short to medium term, and am looking forward to some breakthrough developments.Moderator: When Feng Bo was a guest at Wang Feng’s Ten Questions, he said that we should believe that we will solve the scalability problem of Ethereum, just like the Internet will finally solve the bandwidth problem. It’s really impossible to play casually on Ethereum without more than a hundred thousand now. DeFi on the Ethereum chain has almost become a toy for big players. If the scalability of Ethereum is really solved this year, what kind of impact will it have on the currency price, Ethereum ecology, and public chain competition?Shenyu: After the gas and performance problems are solved, the ecology of the entire blockchain should be greatly developed. Because I see that both the number of users participating and the scale of transactions are subject to the performance of the entire blockchain. The Cryptokitties in 2017 blocked the entire Ethereum. This year, there are many DeFi protocols with a large number of user groups. When we start to look for some native applications on the blockchain, and even some cross-industry applications begin to intensively use blockchain technology, we must solve this performance problem. We In the future imagination space, the application scenarios that can be implemented will be greatly expanded, so the value of the entire industry will be enhanced. Moderator: Rollup is about to go online, and the official Ethereum community seems to be saying that the scalability problem will be completely resolved before the end of this year. Do you think performance issues will be fully resolved this year?Shenyu: I don't think it will be done once and for all, maybe step by step. Because of these problems, the technology is still very complicated, and there will not be a perfect solution, it may only be a quantitative improvement.

Moderator: Rollup is about to go online, and the official Ethereum community seems to be saying that the scalability problem will be completely resolved before the end of this year. Do you think performance issues will be fully resolved this year?Shenyu: I don't think it will be done once and for all, maybe step by step. Because of these problems, the technology is still very complicated, and there will not be a perfect solution, it may only be a quantitative improvement.