Author | Crypto Native. Zhiyu

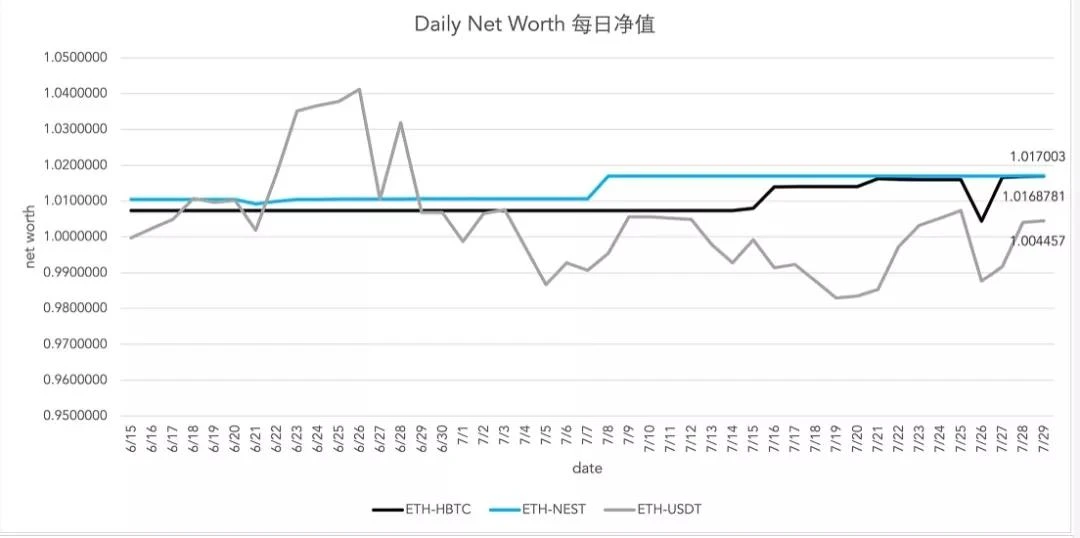

image description

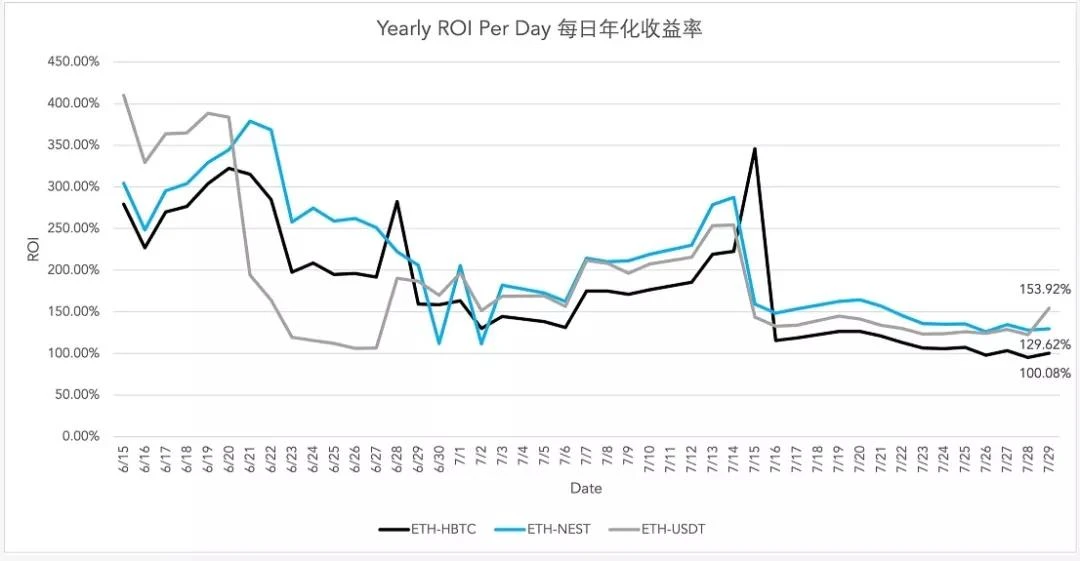

image description

Data comes from the chain

secondary title

in,

in,ETH - COFIIt is necessary to provide bilateral assets for liquidity mining, and the initial fixed ratio is1 :2000, that is, providing 1 ETH requires providing 2000 COFI at the same time, the price comes from the NEST Protocol oracle machine, and the mining speed is0.4 COFI / Ethereum block, producing about2240COFI Token.

ETH - PETH(ETHs 1:1 anchor asset) is to provide unilateral assets for liquidity mining, that is, single currency pledge, no ratio limit, providing liquidity without calling the oracle machine, and the mining speed of the two assets is0.15 COFI / Ethereum block, producing about 840COFI Token.

USDT - USDC - PUSDT(USDTs 1:1 anchor asset) also provides unilateral assets for liquidity mining, that is, single currency pledge, no ratio limit, no need to call oracle for liquidity provision, and the mining speed of the two assets is0.1 COFI / Ethereum block, producing about560 secondary title

2. Modify the liquidity mining parameters of the original fund pool;

ETH - USDTBilateral mining fund pool, initial size fixed ratio adjustment from 1:3000Adjusted to 1:2000, that is, to provide 1 ETH, you need to provide 2000 USDT at the same time. The price comes from the NEST Protocol oracle machine, and the mining speed is 0.45 COFI / Ethereum blockAdjusted to 0.2 COFI / Ethereum block, producing about 1120COFI Token.

ETH - HBTCBilateral mining fund pool, initial size fixed ratio20:1 unchanged, that is, to provide 1 ETH, you need to provide 0.05 HBTC at the same time. The price comes from the NEST Protocol oracle machine, and the mining speed is 0.45 COFI / Ethereum blockAdjusted to 0.2 COFI / Ethereum block, producing about1120COFI Token.

ETH - NESTBilateral mining fund pool, initial size fixed ratio adjustment from 1:20000Adjusted to 1:100000, that is, to provide 1 ETH, you need to provide 100,000 NEST at the same time. The price comes from the NEST Protocol oracle machine, and the mining speed is 0.9 COFI / Ethereum blockAdjusted to 0.4 COFI / Ethereum block, producing about2240secondary title

3. Exchange currencies support PETH, PUSDT, USDC, COFI;

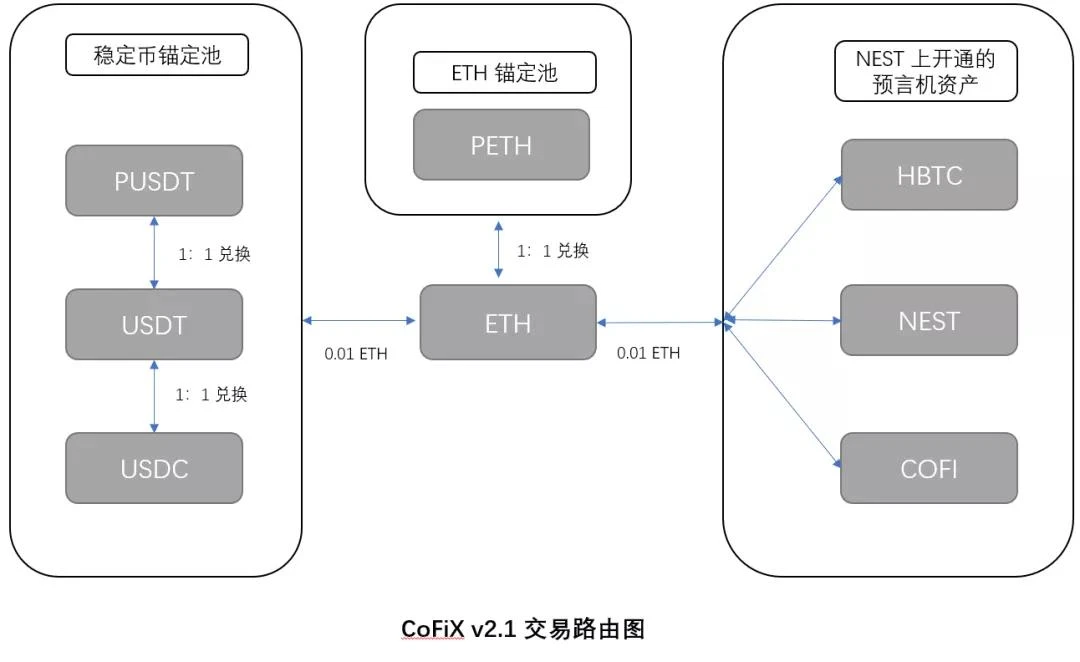

Including the newly added assets, the total convertible assets of CoFiX v2.1eight, respectivelyETH 、PETH、USDT、PUSDT、USDC、HBTC、NEST、COFI。

All assets can be exchanged for each other, and assets of different fund pools can be routed to each other, as shown in the figure:

Stable currency anchor pools can exchange 1:1 with each other. Since the NEST Protocol oracle machine is an ETH/USDT quotation pair, the internal transaction logic when PUSDT and USDC are exchanged for other assets is to first exchange 1:1 for USDT and then pay the oracle machine Call fee to interact.

The ETH anchor pool and ETH can be exchanged 1:1. When interacting with other assets, the internal transaction logic is to exchange 1:1 for ETH first, and then pay the oracle machine call fee for interaction.

Each oracle asset opened on NEST is exchanged with each other or with assets of other anchor pools. The internal transaction logic is that each step needs to go through ETH to pay the oracle call fee.

Any transaction requires payment of the transaction size 0.2%transaction fees,secondary title。

4. Sell back supports COFI to sell back USDT;

Summarize

Summarize

CoFiX v2.1 continues the EPM model of version 2.0, which effectively solves the disadvantages of the AMM model, which can be readInterpretation | CoFiX 2.0 —— The Thought and Future of the New Generation Exchange, the overall interactive interface and data display have also been greatly improved (CoFiX interactive website: cofix.tech), andOpened up the asset interaction and underlying interaction between NEST Protocol and Parasset, laying a good foundation for computable finance.

Note: Without full understanding, it does not constitute any investment advice.