Author | Qin Xiaofeng

Editor | Mandy

Produced | Odaily

Produced | Odaily

With the DeFi movement that flourished last year as the dividing line, the right to speak of the transaction payment carrier in the encrypted market began to gradually shift.

Previously, the market share of stablecoins has been occupied by centralized stablecoins such as USDT and USDC, while over-collateralized stablecoins (DAI, etc.) and elastic currencies (Ampleforth) have been regarded as niche experimental products.

However, with the explosion of the DeFi market, the latter two have gradually entered the field of view of users, and have become the first echelon in the payment field: in the past year, the circulation of DAI has increased by more than 18 times, becoming the decentralized stable currency with the highest market value; the circulation of AMPL is The surge has exceeded 30 times, and the number of currency holding addresses has exceeded 100,000.

Elastic currency has also set off an upsurge after liquidity mining and has become the focus. Although many projects ended in collapse, its mechanism has been widely recognized and discussed by the encryption industry, and it is a rare currency experiment.

As the ancestor of elastic currency, Ampleforth, after experiencing the initial price shock, the volatility began to decrease, and now it has become an important building block of the DeFi market, and has entered the ecosystem of various DeFi protocols such as AAVE to become a denominated currency.

In April of this year, Ampleforth announced the launch of the governance token FORTH, which handed over the governance authority from the founding team to the community, marking that it has officially become a fully decentralized DeFi protocol. Recently, Ampleforth announced the launch of the second version of Geyser (Geyser v2), which improves user capital utilization by introducing new standard universal vaults.

From the beginning of its birth in 2018, no one cared about it, to the detonation of the market after a long accumulation, and now to deepen the industry and expand its application, what problems does the elastic currency designed by Ampleforth have to solve, how to ignite the encryption market again, and even go out of the encryption market and move towards mainstream commodities Currency of the world? The Ampleforth team accepted an exclusive interview with Odaily to answer the above questions.

first level title

1. AMPL: encrypted native denomination currency, resisting centralization risks

In the past 18 months, with the development of encrypted finance, as an indispensable part of market transaction valuation, the size of the stablecoin market has increased dramatically. According to Coingecko data, the total market value of stablecoins has grown from US$5.9 billion in January 2020 to US$100 billion today, an increase of nearly 2000%.

The bright data not only proves the potential of the encrypted market to the outside world, but also exposes the fragility and hidden dangers of encrypted finance: fiat currency stablecoins may be at risk of thunderstorms.

Todays top three stablecoins are USDT ($61.884 billion), USDC ($26.634 billion) and BUSD ($11.178 billion), all of which are fiat currency stablecoins, with U.S. dollars as collateral and exchanged at a 1:1 exchange rate. Due to long-term operating habits, many people also believe that fiat currency stablecoins are more convenient, stable and reliable.

The problem is that trust based on centralized institutions is not reliable, and no one can guarantee that there are sufficient dollar reserves behind it. Taking USDT, which accounts for more than 60% of the market size, as an example, its officials once admitted that only 75% of cash and its equivalents are used as reserves, and the remaining 25% are various types of mortgage debt, which poses a risk of loss. This also means that USDT cannot achieve 100% rigid redemption.

In addition, the compliance of fiat currency stablecoins is always in doubt, and the regulatory edge hanging overhead is also an issue that has to be considered. Many organizations, including the World Bank, have repeatedly issued documents requiring stablecoins to meet appropriate anti-money laundering and supervision requirements, and currency holders should accept user identity verification KYC; the United States also drafted a stablecoin-related bill (STABLE Act) at the end of last year. ), requiring stablecoin issuers to obtain a banking license...USDT, the king of stablecoins who worked without a license, has recently encountered the review of the US Department of Justice again (this is not the first time), and its executives may face criminal punishment for bank fraud .

All in all, the faster the fiat currency stable currency develops, the deeper the impact on the encryption market will be. Once there is a thunderstorm, it will inevitably lead to a major collapse of encrypted finance. For the cryptocurrency ecosystem, there is an urgent need for native denominated currency as a payment medium and carrier to avoid the risk of thunderstorms from regulatory and centralized institutions. The rise of the DeFi movement has provided a good opportunity for development.

After the wave of liquidity mining, the flexible (algorithmic) currency represented by Ampleforth has aroused enthusiasm for market participation by virtue of its characteristics of reflexivity, speculation, and arbitrage, and has become a momentary focus, pushing cryptocurrency experiments to new heights .

The so-called elastic (algorithmic) currency is a currency that automatically adjusts the currency supply mechanism according to an algorithmic program. Increase the market supply when the token price is higher than the anchor price, and reduce the market supply when the stablecoin price is lower than the anchor price, so that the token price maintains a balance near the target price.

Specific to the Ampleforth (AMPL) protocol, every 24 hours, the total supply of AMPL may trigger a rebase function to automatically increase or decrease AMPL’s Market supply:

When the price is maintained between US$0.95 and US$1.05, the base will not be triggered, and the current supply will remain unchanged;

When the price is above $1.05, a positive base is triggered, increasing the supply and prompting the market to sell to drive down the price;

When the price is lower than $0.95, the negative base is triggered, reducing the supply, prompting the market to increase the willingness to buy and drive up the price.

And, more critically, the tokens in each AMPL wallet address will change proportionally the same.

To give a simple example, Xiaoqin is an AMPL holder and holds 1,000 AMPLs before returning to the base; if the price triggers the positive base and the total supply of AMPL increases by 10%, Xiaoqins account now holds 1,100 AMPLs ,vice versa. In short, the proportion of tokens held by Xiaoqin in the entire AMPL network has not changed.

This design is also the original intention of the founding team. Traditional commodity currencies (U.S. dollar, etc.) are subject to the centralized institutions behind them, and may face inflation that will lead to dilution and plundering of users personal wealth. Ampleforth is a truly independent financial element that exists independently of any central authority like Bitcoin, effectively avoiding currency devaluation.

“AMPL is the first and largest elastic currency. Its value is closely tied to $1, which means it can be stable-denominated for contracts. Unlike traditional stablecoins, AMPL is not formally pegged to the U.S. dollar, making it Affected by the possible inflationary pressures that fiat currency stablecoins may face, and provide DeFi users with more flexibility when creating contracts.” Ampleforth team told Odaily.

The development of AMPL is not only the result of its own protocol design, but also an important manifestation of the efforts made by the encryption field to pursue native denomination currencies. It marks another important step in the direction of decentralization in the encryption field.

first level title

2. Analyze the stability, elasticity and reflexivity of Ampleforth

However, these latecomers were short-lived after all, and eventually ended in a price collapse. It is also the demise of many imitation disk projects that highlights the superiority of Ampleforth design.

secondary title

(1) How does Ampleforth stand out?

First of all, network-wide Rebase is the biggest difference between the Ampleforth algorithm model and the seigniorage share model adopted by other protocols.

Just like Uniswaps automated market maker mechanism, Ampleforths model also has an elegant simplicity unmatched by similar competitors. It is very easy for ordinary users to understand the core of its basic operation, which is conducive to the better spread of the protocol. More importantly, after each return to base of Ampleforth, all token holders can maintain the same network share, which is attractive to users who are suffering from commodity currency inflation pressure.

In contrast, agreements such as ESD, through the introduction of multi-token and seigniorage share models, make the rule design more complicated and difficult to spread. Moreover, price changes are highly dependent on subsequent capital investment, and eventually become a fund relay race. Looking at these projects, the growth paths are basically the same:

In the early days, through the opening of liquidity mining, funds were attracted to enter the market, and the amount of locked positions increased sharply;

In the mid-term, the currency price rose for a short time, which led to a sharp increase in mining revenue, creating a wealth effect that drove more funds into the market; at this time, the currency price deviated from the target price, triggering a positive basis, and the number of tokens increased—but the currency price did not. The decline further stimulates the entry of incremental capital into the market, reaching its peak;

In the later period, no new funds entered the market to receive orders, and the currency price fell, triggering a negative base; more funds began to leave the market, accelerating the decline in currency prices, forming a death spiral, and the project eventually collapsed.

Old projects die, new projects are reborn, and the market enters a new cycle. In such a game, flexible currency has long deviated from its original intention and has become a tool and helper for making money. Because of this, many people commented that flexible currency is a scam, and its core is Ponzis capital disk model.

Secondly, the price of Ampleforth is more stable than competing projects, which is also an important condition for it to become a basic payment tool in the encryption market.

Of course, the stability of AMPL is relative, not absolute, and its team has always declared that AMPL is not a stable currency. According to statistics, from its establishment in 2019 to the end of February this year (more than 500 days), the time-weighted average price of AMPL has exceeded the target range (0.95-1.05) for three-quarters of the time; especially when the DeFi boom just started in June last year , AMPL spent more than a full month above the target range, with the price topping out at $3.83. Since February, however, the target range has been exceeded less than a quarter of the time. This also means that AMPL prices start to stabilize over time. Considering that the protocol is currently in its infancy, there is still a lot of room for development.

secondary title

(2) Elastic money paradox

In fact, for AMPL and other elastic tokens, if they want to run for a long time and be adopted by more protocols as pricing currencies, they must achieve stability, and the volatility must be reduced to maintain it within a specific target range.

However, this is elusive for the vast majority of elastic currency projects because it is highly reflexive: demand is driven by market sentiment and momentum; these demand-side forces are diverted into the token supply, This in turn creates further directional momentum, which could end up being a violent feedback loop. To put it simply, the increase in demand leads to an increase in the price of elastic currency. After the increase in supply, the market does not turn around, but further stimulates demand, forming a positive cycle, and vice versa.

At this time, we can find that there is a paradox: in order to achieve price stability, the market value of the elastic currency must be large enough to minimize the impact of reflexivity on the market, that is, the new (decrease) supply will not cause price volatility Volatility; however, the market value of elastic stablecoins can only be expanded through a high degree of reflexivity, and the two form a contradiction.

Therefore, for elastic currency, it should be started through arbitrage, speculation and other modes in the early stage to expand the market value as much as possible; at the same time, it needs to gain resilience, loyal users and market recognition from the reflexive cycle to maintain its own price stability. Thereby reducing the impact of reflexivity. It should be noted that speculation is only a means to achieve resilience towards eventual stability, but not an end. For AMPL, it has gone through these three stages:

In the early stage, the market value was low, there were few users, and the price fluctuated greatly;

During the DeFi period, through liquidity mining (described later) and a high degree of reflexivity, a large number of users were attracted, and the market value soared 18 times within 20 years, reaching hundreds of millions of dollars, but it also led to further increase in volatility;

Now the market value tends to be stable, it can bear the reflexive volatility, and the price tends to the target price.

Although there is a long way to go and a long way to go, I think AMPL, as the native encrypted currency, will have a market value comparable to that of DAI in the future. Todays AMPL, like Bitcoin in 2011, is still fragile and has not had time to develop.

first level title

This years encryption market continues to flourish, with various DeFi projects emerging one after another, and the amount of locked positions on the chain also continues to break through new highs. The DeFi industry is changing with each passing day, and Ampleforth has not stopped moving forward, and has continuously made new breakthroughs, mainly focusing on the following: issuing the governance token FORTH; cross-chain entering the BSC ecology, and launching the second version of Geyser (Geyser v2).

secondary title

(1) Enable DAO governance

Today, DAO (Decentralized Autonomous Organization) has become an important direction for many DeFi projects, and Ampleforth is one of them. To put it simply, DAO initiates proposals through blockchain and smart contracts to coordinate member actions and resources. Members can vote on proposals by voting. The more TOKEN you hold, the greater your voting rights.

In April this year, Ampleforth officially announced the launch of the governance token FORTH, marking a new stage of its official DAO governance.

The launch of FORTH governance token is an important milestone and a crucial step for Ampleforth to take the road of decentralization. Through FORTH, the management process of Ampleforth is officially handed over to the community. The Ampleforth team explained the respective positions of AMPL and FORTH, The launch of AMPL (currency asset) + FORTH (governance token) is the realization of Ampleforths original vision.

AMPL is a unit of account that exists outside the scope of traditional banks. FORTH ensures that this system cannot be managed by a single, Fed-like entity. The will of the community will drive the development of AMPL.

Specifically, the use of FORTH for governance mainly includes two aspects: economic governance and technical function governance.

Economic governance includes changes in the economic ecosystem that determine AMPL, such as the setting of the supply base, changes in the number of AMPL, etc. FORTH holders decide how many of these parameters can be set through voting; technical function governance includes the characteristics of supply policies , the characteristics of the programmer, the characteristics of the oracle middleware, etc. Users can use FORTH directly to vote, or they can entrust their own tokens to representatives to vote.

Large holders of currency cooperate with each other to initiate proposals that are superior to large holders but harm the interests of retail investors. Due to the large proportion of large holders of currency holding more votes, the proposal is passed. Recently, the DeFi Education Fund obtained millions of UNI Tokens through Snapshot voting and smashed them.

Voting rights are too concentrated, some retail investors are not interested in voting, and insufficient participation leads to unfair voting results.

Voting rights are too concentrated, some retail investors are not interested in voting, and insufficient participation leads to unfair voting results.

In order to prevent the above situation from happening, the initial allocation of FORTH governance tokens is inclined to the community, truly realizing decentralized community governance and preventing totalitarianism.

It is worth noting that after the launch of FORTH governance tokens, major mainstream platforms such as Binance, Huobi, OKEx, and Crypto.com have successively launched token transactions. Currently, FORTH has a market value of 130 million US dollars in circulation.

secondary title

(2) Geyser V2 improves capital utilization

As early as the midsummer of 2020, Ampleforth announced the launch of a liquidity mining incentive product called Geyser (Geyser) on Uniswap v2. Users who provide liquidity to AMPL will be rewarded with AMPL tokens.

At that time, Geysers annualized yield (APY) once exceeded 100%, and its liquidity mining project attracted tens of thousands of participants to participate in pledges on major decentralized exchanges such as Sushiswap, Uniswap, Balancer and Mooniswap, and in It played an important role in the DeFi boom in the summer of 2020, and also opened up the situation for the rapid rise of AMPL.

Ampleforth is not the first project to launch a liquidity plan, but compared to other projects, Ampleforth has also made some innovations. For example, the introduction of the bonus period (Bonus Period), the longer the period of holding AMPL, the greater the reward for users, so as to prevent users from suddenly withdrawing liquidity. Moreover, Ampleforth has successively launched multi-phase liquidity plans since then. Although the income has declined, it has always occupied a certain market in the DeFi mining market.

In July of this year, Ampleforth announced the release of the second version of Geyser (Geyser v2). Compared with Geyser v1, the V2 version has the following advantages:

One is that v2 allows users to retain token custody rights. In v1, participants must hand over token supervision to the Geyser smart contract, and v2 introduces a new standard - universal vaults. Universal Vault is a composite NFT standard that provides an interface for locking and unlocking tokens, providing users with a non-custodial pledge option.

The third is that V2 supports the NFT standard and can receive NFT tokens. Moreover, all LP tokens are stored in the general treasury, and the treasury itself can also accept rewards, so NFT can be issued based on the ownership of the general treasury and become a building block of other DeFi protocols.

secondary title

(3) Cross-chain access to BSC, Acala and TRON

Since September 2020, Ampleforth has been discussing the possibility of multi-chain development. At that time, Binance Smart Chain became a hot topic in the market, and the listing of AMPL on BSC became the most discussed topic.

However, until this year, the cross-chain was not really realized. In June of this year, Ampleforth core software engineer Nithin Krishna announced that cross-chain formation: $AMPL on BSC is ready and should be launched within the next two weeks, and we are finishing some final tests.

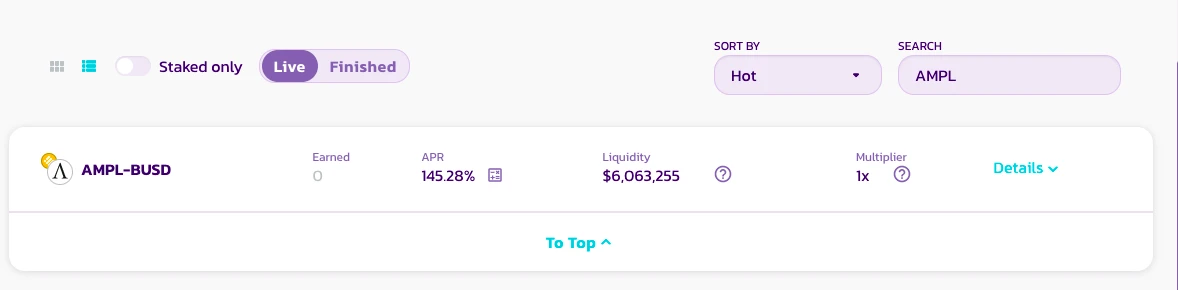

Then, AMPL launched PancakeSwap. Odaily Daily found that the current annualized profit of AMPL-BUSD mining on Pancake can reach 145%.

“We definitely want to see Ampleforth continue to be deployed on other blockchains. DeFi is increasingly adopting a multi-chain approach, and AMPL must follow suit. By deploying on multiple chains, we can leverage each The advantages of the platform, and anywhere where anyone stores value or conducts transactions. We hope to provide a common, decentralized and stable contract pricing option for the entire DeFi ecosystem. The Ampleforth team told Odaily that they have also recently cooperated with Acala, TRON has built new cross-chain integrations to support the growing needs of these communities.

As for the AMPL token contracts on other chains, they will share the same supply pool, they can replace each other, and they will be governed by the same monetary policy.

first level title

4. Can flexible currency enter the mainstream society?

As Bitfinexs first IEO project, Ampleforth once raised $4.9 million in 11 seconds, and the market is very optimistic about its development potential. In the past two years, Ampleforth has also met market expectations. Whether it is the 312 crash in 2020, or the failure of the oracle machine in December 2020, and this years 519 plunge, Ampleforth has withstood the test and has become more and more courageous. Ampleforth eventually grew into the elastic currency with the highest market capitalization, as well as one of the safest and most battle-tested protocols in the DeFi field.

Of course, the ultimate question is: Can the flexible currency advocated by Ampleforth go out of the encryption market in the future, move towards the mainstream market and become a currency in the real commodity world?"In this regard, the Ampleforth team has sufficient confidence. “Ampleforth can be a key building block for DeFi in the crypto world, partly because it’s so well suited for smart contracts. The reality is that Ampleforth can be used to denominate any type of contract, not just"intelligent

contracts, thereby providing a wider range of potential use cases.

As Ampleforth continues to gain adoption in the crypto market and DeFi world, it can also be easily extended to denominate real-world contracts similar to those outside the DeFi ecosystem. The opportunity here is huge, and its still nascent.