Highlights of this issue:

Follow Medium @snapfingers for English version

Highlights of this issue:

Glassnode sorts out the valuation method of DeFi governance tokens: there is no general indicator, and it is meaningful to compare projects of the same category. Reasonable valuation requires a full understanding of valuation indicators and frameworks.

Art Blocks 30-day transaction volume increased by 6 times, leading the boom in encrypted generative art.

Delphi Digital released a THORChain research report: After being attacked, THORChain has come out of chaos, and the future synthetic asset system is worth looking forward to.

Rarible, the second largest integrated NFT market, has launched the open source tool Rarible Protocol, which will benefit the Rarible ecosystem and drive innovation.

No.1 Agency Report

Glassnode: Comparing several DeFi governance token valuation methods

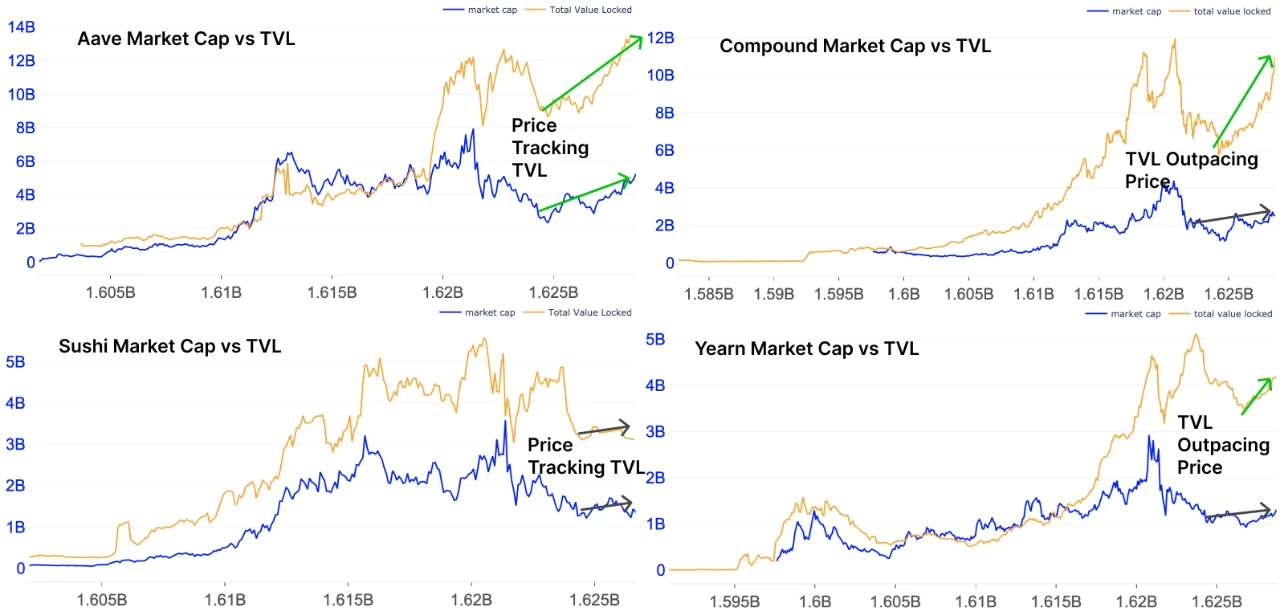

-01 Total Value Locked (TVL) / Market Cap in the Protocol

TVL reflects the liquidity and market demand added to the protocol. It cannot fully reflect the adoption, efficiency and future value of the protocol, but it can be a useful indicator of short-to-medium term price.

For projects with a strong correlation between TVL and market value, the changing trend of TVL can be used as the basis for valuation, such as Aave and Sushi. And for Compound and Yearn, market capitalization outperformed TVL.

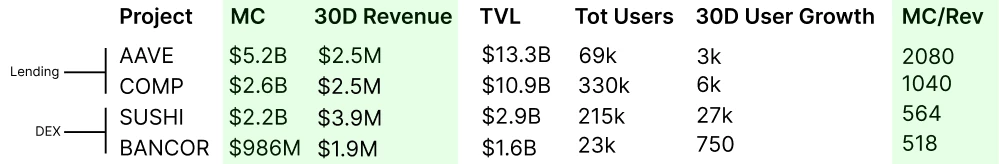

-02 Market Cap/Agreement Revenue

The higher the ratio (last column), the less value token holders theoretically receive from each dollar invested.

Assessed by this metric, COMP is less undervalued than AAVE.

-03 TVL/agreement revenue

The higher the ratio (last column), the lower the protocol revenue generated per $1 locked.

Assessed by this indicator, COMP is still underestimated than AAVE.

-04 Market capitalization/number of users

The higher the ratio (last column), the lower the number of historical users supporting the same market capitalization phase.

According to this indicator evaluation, COMP is underestimated than AAVE, and Sushi is underestimated than Bancor.

-05 An indicator worthy of attention: FDV (fully diluted valuation = current price x maximum supply).

Some projects ranked in the top 100 by FDV cannot enter the top 100 when ranked by market capitalization (such as Curve). For projects with high token inflation, there will be greater pressure to unlock and sell tokens in the future. A good understanding of valuation metrics and frameworks can reveal the truth.

Translation source:

https://www.odaily.com/post/5171612

No.2 tuyere field

Art Blocks leads generative art

Generative art is an art form that is generated by computers through algorithms. One of the projects leading the charge is Art Blocks, a platform where artists and collectors can create and buy unique generative artwork. In the past 30 days, the trading volume of Art Blocks has increased by 658% (8/17, dappradar), ranking third among NFT collectibles (the first two are Axie Infinity and CryptoPunks).

Last week, the works of Art Blocks were sold at a price of more than 400,000 US dollars, as shown in the picture below:

What is the charm of generative art? An intuitive example, the following images were created by the same program, just by running it multiple times, you get two completely different results, but they are very related elementally, aesthetically.

0xBEWs NFT Investment Collection summarizes a publicity: (novel * timeless * practical) ^ community. novelty,

There is a multiplier effect between eternity and practicality, and the community is an exponential effect. The author believes that ArtBlocks is the project that best embodies eternity. It interprets crypto art as a legitimate art movement, and we are in the early stages of a new chapter in art history. The popularity of ArtBlocks Ringers and Fidenza series shows that there is a huge demand for high-quality art in the NFT community, while the large number of 19 ArtBlocks works sold through Sothebys auction house (Soethby) shows the traditional art world. Institutional endorsement of ArtBlocks.

refer to:

refer to:

https://www.chainnews.com/articles/253379628710.htm

https://www.odaily.com/post/5171656

https://mp.weixin.qq.com/s/2hPbU4NTgnDQoQ29mAjWzg

No.3 project attention

-01 THORChain: out of chaos, the synthetic asset system is worth looking forward to

https://www.chainnews.com/articles/738445662776.htm

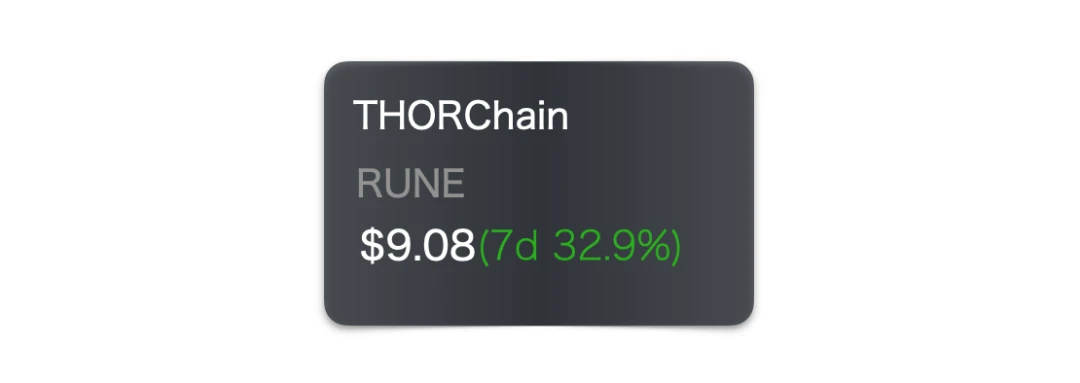

In February of this year, Multicoin released a THORChain analysis report, indicating that RUNE (THORChain token) is one of the largest public positions in Multicoin, and the price was $4.5 when the report was issued. Subsequently, RUNE rose to an all-time high of $20 (5/19) as the overall market rallied. Afterwards, THORChain suffered three attacks and lost about $7.5 million, which affected the currency price.

For this attack, the vulnerability was fixed in time, the loss was borne by the treasury (the treasury has more than 60 million US dollars in funds), and two security audit companies were hired. In terms of project progress, since the launch of the multi-chain network ChaosNet on April 13, the progress has been stable. The synthetic asset THORSynths planned to be launched in the future, and iRune, the synthetic version of Rune, will bring continuous growth momentum to THORChain.

THORChain is a cross-chain liquidity protocol designed to connect all blockchain assets into a liquidity market, and each asset is secured by a network node (1 million + RUNE can be pledged to run a THORNode node). Due to the utilization of Tendermint, Cosmos-SDK and Threshold signature scheme, THORChain is suitable for various blockchain networks and assets, and can achieve massive expansion without sacrificing security. Thorchains multi-chain trading system uses the fund pool model (AMM) to incentivize liquidity by paying additional RUNE to liquidity providers.

Delphi Digital recently released a THORChain research report, introducing the operation status of ChaosNet and the product logic of THORSynths and iRune:

THORChains total liquidity is approximately $140 million distributed across 26 pools. As the size of the capital pool grows, transaction costs become lower.

In order to ensure network security, THORChain sets the ratio of the Runes bound in the node to the Runes in the liquidity pool to 2:1, which limits the upper limit of the existing Runes in the fund pool, thereby limiting the size of the fund pool. When the number of Runes bound to a node is large enough, the upper limit will be removed, and a large amount of liquidity will be added to the fund pool.

BinanceSwaps between Binance accounts accounted for roughly half of multi-chain ChaosNet swap volume. Furthermore, the transaction volume from THORChain to Binance exceeded the total transaction volume from THORChain to Bitcoin and Ethereum.

The core essence of THORSynths is an IOU for assets, 1 synthetic asset is always backed by 50% of the asset and Runes equivalent to 50% of the assets value. The main purpose of THORSynths is to increase trading volume by enabling cheap and fast exchanges THORSynths allow LPs to actually hold a leveraged long position on Rune.

The synthetic version of Rune, iRune (Interest-bearing Rune), can be locked into a savings account for a fixed income of Rune. Demand for iRune is expected to significantly increase the liquidity cap.

On August 13, NFT marketplace Rarible announced the launch of a set of open source tools (called the Rarible Protocol) to greatly simplify the online process of NFT projects and ideas. This agreement will benefit the Rarible ecosystem and drive innovation.

On August 13, NFT marketplace Rarible announced the launch of a set of open source tools (called the Rarible Protocol) to greatly simplify the online process of NFT projects and ideas. This agreement will benefit the Rarible ecosystem and drive innovation.

The core of Rarible Protocol is a decentralized exchange. Applications built on the Rarible Protocol have a shared order book.

One of the most powerful features of the protocol is its ability to split fees during transactions, which makes it possible to co-create NFTs.

Rarible Protocol has implemented a royalty standard for protocol-minted NFTs and externally minted NFTs, regardless of which platform the transaction is on, the creator and platforms royalties will be complied with.

The Rarible Protocol is currently deployed on Ethereum and will soon be available on Flow and Polygon.

There are currently 20 different projects building applications on the protocol, includingRarible.com。

Rarible DAO provides support for projects based on the protocol in two ways: a total of about 40,000 USD in RARI tokens are allocated every week, and the RARI obtained by each application is proportional to the sales volume of the week; developers based on the protocol are provided with up to 100,000 USD USD funding.

RARI ranks 25th on Coingeckos NFT market capitalization leaderboard.

https://www.panewslab.com/zh/articledetails/D31300363.html

No.1 Market Data

#Overall#Bitcoin#Ethereum

Coingecko data on August 16: The total market value of the top 100 cryptocurrencies by market value reached 2.1 trillion US dollars, BTC accounted for 42.4%, and ETH accounted for 18.3%. Since July 19th, the crypto market has seen a significant rise, and the current panic and greed index is 72 (greed, 8/17).

CFTC: Bitcoin futures net short positions reached the lowest level since mid-May.

Okey Cloud chain master data: On August 10, the balance of Ethereum on the centralized exchange was about 11.1973 million pieces, which fell to a low level in the past three years, accounting for only 9.56% of the supply of Ethereum.

#DeFi

DeBank data shows that the total lock-up volume of the DeFi protocol has returned to above 100 billion US dollars (8/16, the total lock-up volume is 109.2 billion US dollars, and the net lock-up volume is 81.5 billion US dollars).

The top 4 DeFi protocols with locked positions are Aave V2, Maker, Compound, and Curve (breaking through $10 billion for the first time).

The total lock-up volume broke through $100 billion for the first time on April 27, and reached an all-time high of $130 billion on May 10.

Uniswap has become the first DeFi protocol with a total historical revenue of more than $1 billion. (8/11, Twitter @haydenzadams)

The total number of Uniswap users reached 2.51 million, a record high. (8/12, Dune Analytics)

#NFT

The cumulative transaction volume of Axie Infinity exceeded US$1 billion, ranking first in the NFT market. (8/7)

The total transaction volume of CryptoPunks hit a record high of $700 million. (8/15)

#liquidityETF #fund#exchange

Crypto asset manager Valkyrie has submitted a proposal for a bitcoin futures ETF to the US Securities and Exchange Commission (SEC).

A new cryptocurrency bill in Ukraine will soon “legalize cryptocurrency payments.” The bill will only allow the purchase of cryptocurrencies through intermediaries, and will also allow local payment processors to provide services for converting cryptocurrencies into fiat currency.

No.2 Encryption Project Progress

#Ethereum Square#Expansion#Layer2

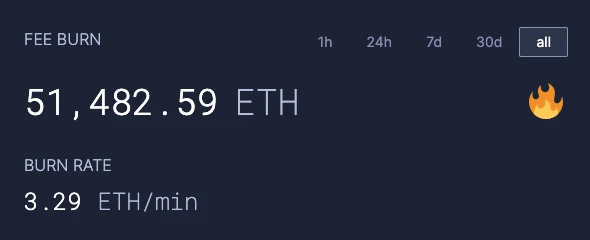

ETH burning data (8/16 17:00) Ultrasound.money

Polygon acquires Ethereum scaling solution Hermez Network for $250 million. The two also merged their native tokens, MATIC and HEZ, in the first transaction of its kind in the cryptocurrency space. In the future, HermezNetwork will focus on developing zkEVM technology and provide native smart contract scalability within ZK-Rollup.

Arbitrum launched the Arbitrum One ecological portal, which includes 70 DApps, wallets or tools.

Optimism, the second-layer scaling solution of Ethereum, already supports USDC.

#New public chain

#New public chain

Cardano plans to launch the Alonzo hard fork on the mainnet on September 12, which will bring smart contract functionality.

#DeFi

Trust company Delaware Trusts plans to partner with MakerDAO to create a decentralized credit facility with community bank WSFS Bank as trustee, using real-world assets for collateralized loans.

Perpetual Protocol officially released the ecological fund - Perp Ecological Fund, with a total of 3 million PERPs (worth more than 30 million US dollars), which will be exchanged for tokens with eligible projects. The first batch of cooperative projects include Charm, dHEDGE, and Lemma.

16 projects including Polygon, PoolTogether, and dHEDGE jointly launched the Social DeFi Alliance. In the future, a series of activities will explore the possibility of combining decentralized social networks with DeFi, helping users enter the decentralized world of Web 3.0 from Web 2.0 social networks.

#NFT

The NFT trading platform Rarible launched the Rarible Protocol, an open source cross-chain tool for NFT, to simplify the marketization process of NFT projects and ideas.

#asset management

#asset management

Private investment firm Neuberger has authorized its funds to invest in regulated bitcoin and ethereum futures. Assets under management currently amount to US$402 billion. (U. today)

#CeFi #Service #Channel

DBS Vickers, the securities business of Singapores DBS Bank (DBS), has received approval-in-principle from the Monetary Authority of Singapore (MAS) to provide cryptocurrency-related businesses.

MassMutual has partnered with NYDIG to offer institutional clients exposure to bitcoin funds.

#Blockchain+

#Blockchain+

AMC, the worlds largest cinema chain, plans to accept bitcoin payments by the end of 2021. (CNBC)

Italian fashion house Dolce Gabbana will launch its NFT collection on luxury marketplace UNXD later this month. (Coindesk)

Lionel Messis financial plan to move to French club Paris Saint-Germain includes payment in cryptocurrency fan tokens. (Reuters)

The NFT digital blind box Rivermen created by the well-known domestic B station UP owner National Architect was launched for sale, which once caused the Ethereum network to be blocked.

#CeFi #financing

FalconX, a digital asset financial service organization, completed a $210 million Series C round of financing at a valuation of $3.75 billion.

Lending start-up Upgrade has completed $105 million in Series E financing and launched a bitcoin consumption rebate card last month

CoinDCX, an Indian encrypted asset exchange, completed a $90 million Series C round of financing, with a post-money valuation of $1.1 billion.

Pintu, an Indonesian cryptocurrency exchange, has raised $35 million in Series A funding.

Digital asset exchange Blocktrade completed a $25.8 million Series A round of financing.

Reddit has announced a $410 million Series F round led by Fidelity Investments, which values the company at $10 billion.

Reddit has announced a $410 million Series F round led by Fidelity Investments, which values the company at $10 billion.

It was valued at $6 billion in February. Reddit, which has 52 million daily active users, is also expanding its community point crypto token rewards program.

Sporting goods company Fanatics raised $325 million at a valuation of $18 billion. We hope to transform into a global digital sports company, providing services for merchandise, ticketing, NFT, etc. in the sports industry.

No.4 Sound point of view

Bloomberg: Regulating stablecoins must be nip in the bud.

If the Facebook Inc.-backed Diem stablecoin project catches on, these privately issued currencies could go from fringe assets in the crypto community to vast pools of consumer wealth.

Twitter CEO: Twitter may allow each user to add a Bitcoin wallet that supports the Lightning Network.

No.5 encryption project investment and financing

#DeFi

DeFi Safety, a DeFi transparency and project rating platform, completed a $1 million seed round led by Andre Cronje.

DeFi Safety, a DeFi transparency and project rating platform, completed a $1 million seed round led by Andre Cronje.

#DAO

The decentralized autonomous organization BitDAO conducted an IDO on the SushiSwap Launchpad platform MISO, and the ETH crowdfunding pool was full, raising a total of 112,670 ETH (worth 349 million US dollars), and 9,269 addresses participated.

Cryptocurrency derivatives exchange Bybit has donated approximately $47.2 million to the treasury of the decentralized autonomous organization BitDAO.

#infrastructure

#infrastructure

Decentralized wireless network Helium announced the completion of $111 million in financing through a token sale, led by a16z

Blockchain developer SIMBA Chain has completed a $25 million Series A round led by Valley Capital Partners. Previously, it has completed 5 rounds of financing, with a total of 15.6 million US dollars.

Blockchain auditing firm Certik has raised $23 million in Series B funding.

Blockchain auditing firm Certik has raised $23 million in Series B funding.

#data service

Nakji Network, a blockchain big data startup, announced the completion of $8.8 million in financing.

Encrypted data analysis platform Dune Analytics has completed a $8 million Series A round of financing led by USV. In September last year, Dune Analytics completed a $2 million seed round of financing, led by Dragonfly Capital.

#Crypto Fundraising

#Crypto Fundraising

Venture capital firm AppWorks has raised $150 million for its third fund, focusing on blockchain and AI.

SevenX Ventures announced the completion of the second round of blockchain fundraising of US$30 million. Projects that have been invested include: Zerion, DODO, YGG, Acala and other star projects. The new fund will continue to focus on new public chain ecological directions such as DeFi, NFT, Web3.0, Arweave ecology, cross-chain solutions, Polkadot, and Near .

No.6 Security and Supervision

#attack

On August 10, Poly Network confirmed that it was attacked, and assets on the BSC, Ethereum, and Polygon chains were transferred for a total of 610 million US dollars. On August 13, the white hat hackers returned all assets other than Tethers frozen funds.

A total of 7 million U.S. dollars was stolen from DAO Maker, and 5521 users were affected, with an average of 1250 U.S. dollars stolen per capita. (8/12)

#Regulatory risk

Crypto derivatives exchange BitMEX has agreed to pay $100 million to settle with the U.S. Commodity Futures Trading Commission (CFTC) and the Financial Crimes Enforcement Network (FinCEN).