Indian Encryption Market: Investment Targets Targeted by Global Markets

For a long time, India has been regarded by mainstream institutions as one of the markets with investment potential: India has the sixth largest economy in the world, and young people account for a high proportion of the total population.

In the encryption market in the first half of 2021, "Indian characteristics" are being released.According to Chainalysis's global DeFi adoption index in mid-October (the index measures the adoption of Bitcoin and Crypto by three indicators: the reception and transfer of Crypto value on the chain and the measurement of related activities), it shows that in the 154 counted countries Among the countries and regions, India has ranked second in the adoption of Crypto.

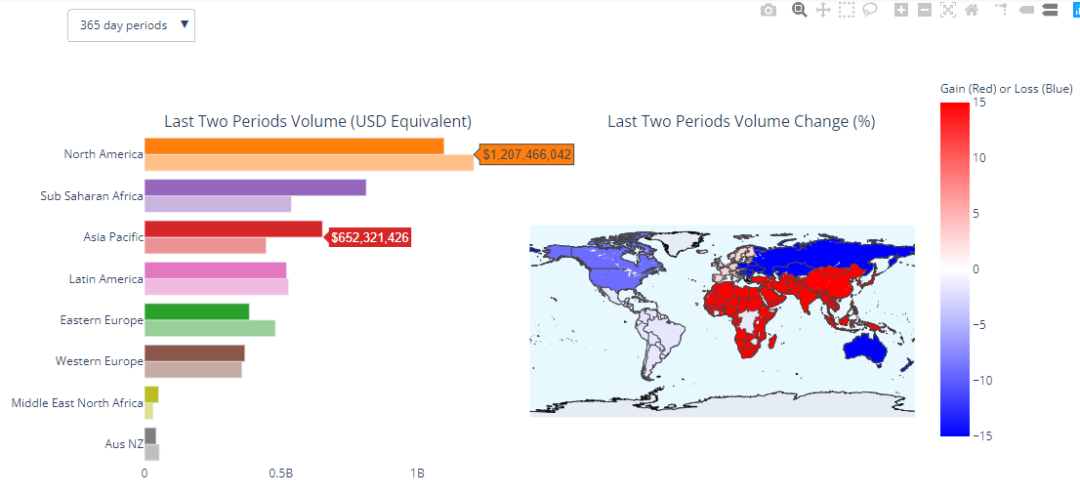

image description

(Data source: usefultulips)

Data Rally and Policy Easing

India's Supreme Court in March 2020 lifted the RBI's former "crypto ban," which became a turning point for the region. After banking services reopened to the industry, a series of changes followed.

This impact was quickly reflected in the distribution and usage of DApps in the region. The Indian project Polygon (Matic Network at the time) ushered in an increase in the usage rate, and the number of DApps based on Polygon increased by more than 60 in a single month. , and a quarter are from India. In addition, in the following two months, the number of registrations of the Indian Crypto exchange WazirX in India increased by 150%, and the transaction volume increased by 66%.

This is only the short-term data at that time. Looking at the long-term period, this growth has continued. Localbitcoins data shows that after April 2020, the trading volume of Crypto P2P in India has started a long-term growth trend.

Taking June 2021 as the observation point, in the first half of this year, the digital asset investment of Indian residents continued to rise from US$200 million in 2020 to US$40 billion in the first six months of this year. Daily trading volume on the four largest crypto exchanges has soared to $102 million from $10.6 million a year ago. According to comprehensive data, it was estimated that 15 million Indians had participated in Crypto transactions, mainly from young people aged 18-35.

This number is still expanding. Just in the past October, Nischal Shetty, founder of WazirX, India's largest Crypto trading platform, tweeted: It is estimated that there are now close to 20 million Crypto users in India.

On the other hand, also in June this year, the Indian government's stance on Crypto became a little more moderate. That month, local media The New Indian Express reported that the Indian government's stance on Bitcoin was changing. The Indian government had abandoned its original attitude of banning Bitcoin comprehensively, and proposed to classify Crypto currency as an alternative asset class.

This proposed regulatory method has also made progress in the near future. According to the content of multi-media reports, India is likely to regulate encrypted digital assets as "commodities" and conduct appropriate taxation on transactions and income. Further supervision The method will be introduced in February next year. In addition, the Securities and Exchange Commission of India will also cooperate with the Ministry of Finance of India to jointly oversee the formulation of Crypto regulations in the country. The Ministry of Finance and the Reserve Bank of India (RBI) will also participate in the adjustment of the Crypto regulatory framework.

It is worth noting that treating digital currency as a kind of "commodity" is different from the qualitative approach of "securities" that has long been favored by the mainstream regulatory thinking in the United States, which once again released a new signal to the market. Officials of the Indian Congress also publicly expressed the particularity of the relevant Indian bills, and their position is to recognize the importance of the Crypto field. The country has not yet achieved full account conversion, and India is unlikely to adopt the Crypto-related policies of advanced economies, and will not follow the example of the United States, Japan, or El Salvador.

Currently, the Indian Ministry of Finance has set up a committee to review the taxation scope of Crypto currency. A few details of the Crypto deal they are exploring: whether the income is taxable as a capital gain, and whether a new tax category is to be created.

India: an investment target targeted by the global market

Against this background, between 2020 and 2021, the global market's investment in Crypto in India will surge.

Statistics show that since the beginning of this year, the Indian blockchain industry has completed 16 transaction financings with a total amount of more than 627 million US dollars, which is 14.25 times that of last year. Last year, there were 10 local deals with a total value of only US$44 million.

In this year's market, India's most representative encryption projects have appeared Layer 2 project Polygon (Matic), Indian Crypto exchange WazirX, Layer 0 expansion protocol Marlin, etc., mainly based on blockchain native infrastructure. In addition, the global market is increasingly investing in the Crypto field in India, and trading platforms have become popular investment targets for VCs and institutions.

For example, just this past October, CoinSwitch Kuber completed a $260 million Series C round at a valuation of $1.9 billion, led by Andreessen Horowitz (a16z) and Coinbase Ventures, with investors Tiger Global and Sequoia Sequoia Capital India participated in the investment.

This is a very representative financing case: this is a16z's first investment in India, and it is also Tiger Global's first investment in an Indian Crypto company.

This enthusiasm also quickly spread to the Indian financial market. A month ago, the fund management giant Invesco Mutual Fund submitted documents to the Securities and Exchange Commission of India to invest in the Invesco Elwood Global Blockchain Stock ETF.

Crypto has also brought changes to the Indian blockchain industry. According to a market analysis released by the British blockchain consulting company Dappros, as of November this year, the number of blockchain developers in India has ranked second in the world. After the US, the UK, Canada and France follow. A total of 12,509 developers in India use Ethereum, Solidity, blockchain, and hyperbooks for development (the number is 2,381, 1,432, 19,627, and 1,579, respectively). Relative to the population, roughly calculated based on the population of India, there is one blockchain developer per 100,000 people.

India's home-grown National Association of Software and Service Companies (Nasscom) stated in "Indian Crypto Industry" that the Crypto industry, which includes transactions, applications, P2P payments, remittances, and retail, has grown in size over the past five years 39%, Indian retail investors have invested about $6.6 billion in crypto assets. The industry has brought jobs for 50,000 employees, more than 230 startups and more than 150 concepts and projects to India. At the same time, it is predicted that by 2030, India's Crypto technology market has the potential to create more than 800,000 jobs and $184 billion in economic value-added.

first level title

Unique Preferences for "Indian Concepts"

The rapid expansion of the Indian Crypto market is based on a certain market environment and historical background. Some people believe that during the new crown epidemic"blockade"To a large extent, the shortage of local financial services has been intensified, and the demand for digital banking services in the Indian market has increased significantly.

In the report "Interpretation of the Status Quo of Digital Currency Ecosystem in India" released by Coinpaprika and OKEx, in the first quarter of 2020, mainstream trading platforms ushered in a substantial increase in Indian traffic. During the same period, OKEx’s new registered users from India increased by 4100%.

Nischal Shetty, founder of the Indian encryption exchange WazirX, also agrees with this statement. During the "Great Blockade" in 2020, Crypto has become an important choice for those who are sitting at home due to the blockade and want to learn new things and learn about new opportunities in the outside world. One of the top choices. In WazirX's public information, the transaction volume in 2020 has increased by more than 1,000% compared to the previous year, and even stated that "every two to three months, the number of new registered users has almost doubled."

Against this background, young people aged 25 to 34 in India's second- and third-tier cities are the main force in the Crypto field, and have formed some market preferences with local characteristics.

In 2021, due to the government's regulatory attitude and specific details are still unclear, many Crypto users turned to Telegram and WhatsApp to participate in transactions, and accounted for 60-80% of the total transaction volume in some specific time intervals.

Another very influential and driving event was in May of this year, Vitalik transferred SHIB worth 960 million at that time to the Indian Encryption Anti-epidemic Foundation. After that, the holdings of SHIB in India soared, and SHIB once became a hot topic on Twitter in India. In last week's Meme Market, trading platform WazirX said SHIB had overtaken Bitcoin as the most traded token in the Indian rupee market with $489 million in trade volume.

The concept of "Crypto" is still spreading in India. During this year's Olympic Games, the trading place Bitbns also launched Crypto-related rewards for Indian athletes participating in the Olympic Games. The athletes can receive Crypto as a gift if they win medals. For example, a gold medalist can get about $2,700 in Crypto. This asset will be acquired on the platform after athletes complete KYC. In India, the first athletes to receive free awards were weightlifter award winner Mirabai Chanu and badminton player PV Sindhu.

This impact and change may bring enlightenment to investors who pay attention to the Indian market: India used to be a relatively recognized investment hotspot for gold and precious metals, but after the emergence of Crypto, the investment process is simplified and the coverage is wider. for extensive. Although the value of digital assets held by Indian investors is still only a part of the gold market, some trends have already been reflected.

In the future, with the further clarification and improvement of the risks and regulatory rules of the Indian government's regulatory environment, it may further affect the local development of this industry.