Vitalik’s 10-year review: the latest thinking on not being optimistic about the growth of BTC and BCH, and misestimating the technical difficulty (full text)

Editor's note:

Editor's note:

Just today, V God shared on Twitter some things he said and did in the past 10 years, and expressed his latest views on these things, involving Bitcoin, BCH, POW, POS, sharding, altcoins, and stablecoins and many more.

For the purpose of learning, the author compiled the Twitter content as soon as possible. Due to the rush of time, some content may be different, welcome to correct me:

1. In 2013, I wrote an article on "How Bitcoin Really Helps Iranians and Argentines". Core point: The main benefits of Bitcoin are internationality and censorship resistance, not the "21 million limit". I predict that stable currencies will prosper.

Last week, I went to Argentina. My conclusion is: roughly correct. Cryptocurrency adoption is high, but so is stablecoin adoption; many businesses are already operating in USDT. Of course, that could change if the dollar itself starts to have more problems.

2. Published an article in 2013 on the consequences of "regulation" of Bitcoin services, the core point: Bitcoin's resistance to censorship is not because it belongs to a new legal category, but is achieved through technology.

My take today: Sure, Bitcoin’s decentralization allows it to “survive” in a super hostile regulatory environment, but it cannot “thrive.” Successful censorship resistance strategies require a combination of technical robustness and public legitimacy.

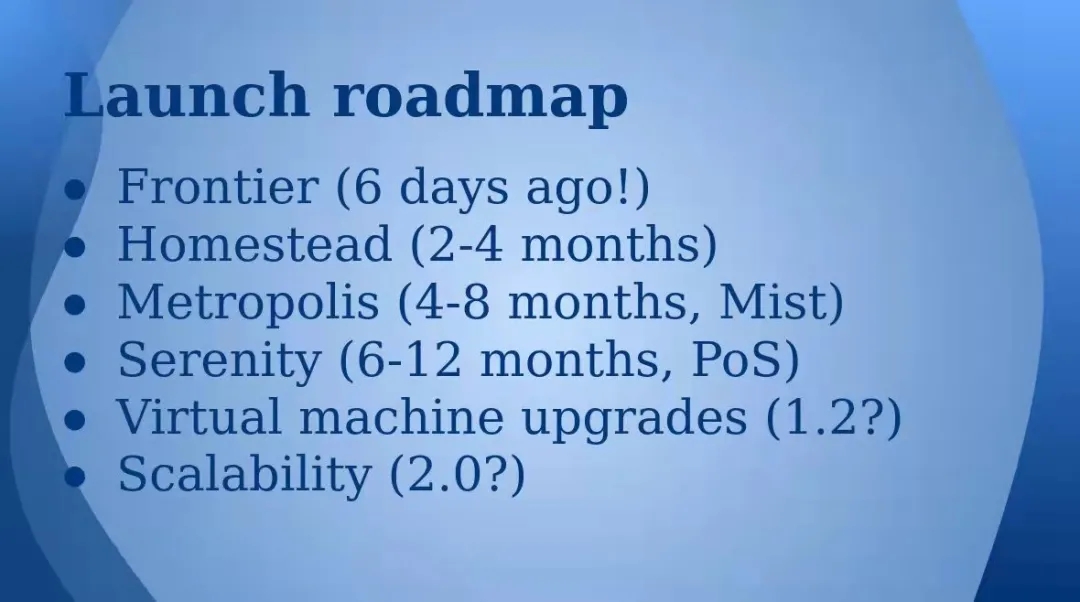

3. In 2015, I predicted when PoS and sharding would be realized. Honestly, these are all very wrong and deserve to be laughed at; sharing a screenshot of a talk I gave in 2015 so people can laugh more easily:

What is the core error? In my opinion, I grossly underestimated the complexity of software development. Today, the Ethereum research team pays more attention to simplicity—whether it is the simplicity of the final design or the simplicity of the implementation path, it is more inclined to a pragmatic compromise. Dankrad's latest sharding design is in this spirit.

4. "The internet of money shouldn't cost more than 5 cents per transaction." This was the goal in 2017, and it's still the goal, and I still stand by my opinion 100%, which is why we spend a lot of time researching possible for extensibility reasons.

5. I should also add that the core concept of sharding has survived intact.

Blockchain 1.0: Each node downloads everything and has a consensus

BitTorrent: each node downloads only a few things, but no consensus

Ideal: BitTorrent-like efficiency, but with blockchain-like consensus

The core supporting technologies come from the community, ZK-SNARK and data availability sampling.

6. In 2012, I was a supporter of POW. Luckily though, by 2013 I was excited about POS. Then in 2014, I changed my mind again.

This reflects a broader evolution of my thinking: from "X is what I have to defend, so whatever is good for X must be right" to "I like X, but X has flaws and it looks like Y fixed them, I Now supports X+Y".

Soldier mentality --> Scout mentality.

7. In 2014, he published an article on automatic execution of contracts. Basically, it's trying to demonstrate that making society as a whole more like a formal system is good and we should be excited about it.

Through thorough research, I've seen the limitations of this way of thinking: the problem with pushing everything into a formal system is that almost any formal system with more than two actors is hackable.

8. I loved altcoins long before altcoins were popular. See my article published in September 2013 (2 months before Ethereum was born). Three core arguments:

(i) Differential Chain Optimization for Differential Objectives

(ii) The cost of having multiple chains is lower

(iii) In case the core development team makes mistakes, external forces are required

Do I still agree now?

The above parameters are less important today because (i) chains are more general, (ii) applications are more complex and thus bridging is more dangerous, and (iii) experiments are feasible at L2.

Even so, I think there are some things that cannot be done in L2, and there is room for a different L1.

9. I was particularly optimistic about Bitcoin Cash, because in this scale war, I agree with the views of large block supporters more than small block supporters.

Today, I think BCH is a loser. My main point is this: Communities that form around rebellion, even if they have a good reason, usually have a long period of difficulty because they value courage over ability, rallying around resistance rather than a consistent path forward .

10. The posts in 2016-2017 are basically advocating the construction of Uniswap.

"Do something simple and stupid, even if it is suboptimal", although this is the current philosophy, it took me a long time to find the basis for POS and sharding design.

11. Applications envisioned in the Ethereum white paper:

*ERC 20 standard token

* Algorithmic stablecoin

*Domain Name System (eg ENS)

* Decentralized file storage and computing

*DAO

*Wallets with withdrawal limits

*Oracle

* Prediction market

While incentivized file storage + computation has not yet been realized, many of the above assumptions are correct (essentially predicted DeFi). Of course, I'm completely ignoring NFTs.

I would say that the biggest problem missing in the details is the problem of collusion in DAO governance.

12. An article on stablecoins was published in 2014. A large part of the article is trying to use blockchain data as a price reference instead of an oracle.

in conclusion:

in conclusion:

*My thinking about politics and large-scale human organization was naive back then, too preoccupied with simple and complete formal models... I know now.

*I did have a good instinct early on to avoid the craziest parts of bitcoin maximization thinking. There were a couple of early mistakes, which I quickly corrected.

*X being wrong does not mean that any resistance against X will go well. This faces another organizational difficulty.

*Technically, I am more accurate in abstract ideas than I am in software development. Over time, one must learn to understand the latter.

*I now realize more deeply that what we need is simpler than I thought.

Reminder: The above content is for reference only and does not constitute investment advice