Footprint Analytics Analyst: grace

Data Source: Footprint Analytics December Monthly Report Dashboard

Following the comprehensive breakthrough growth in all fields of the encryption market in November, the growth of the encryption market gradually slowed down in December.DeFi The total lock-up volume (TVL) of the platform failed to break through 300 billion US dollars, but fell to 270.69 billion US dollars, a decrease of 5.23% from the previous month. BTC and ETH once had a flash crash, and the NFT trading market increased slightly. Next, fromFootprint AnalyticsData to analyze in detail the overall situation of the encryption market in December.

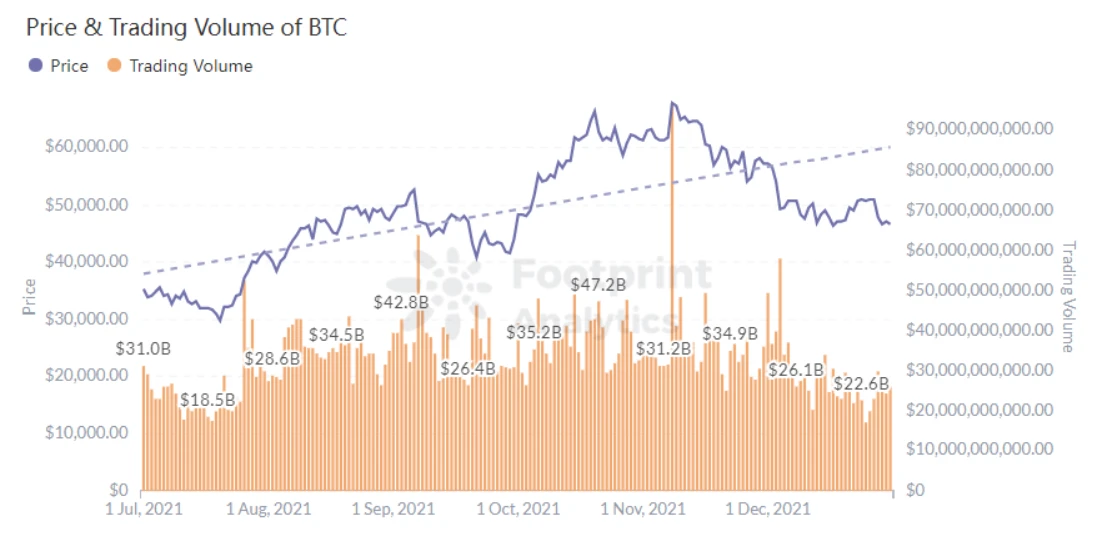

BTC and ETH crashed, falling by more than 20%

Footprint AnalyticsData shows that the price of BTC fell from $57,179 to $46,472 in December, a drop of 23%. The highest daily trading volume in the month was $57.7 billion. As of December 31, BTCs Market Cap was $8.8 trillion. The price of ETH fell from $4,592.82 to $3,695.60, down 24.2%. The highest daily trading volume in the month was $40.3 billion. As of December 31, ETHs Market Cap was $4.4 trillion.

image description

Footprint Analytics - Price & Trading Volume of BTC

Footprint Analytics - Price & Trading Volume of ETH

DeFi month-end TVL decreased by 5.23% month-on-month

In December, affected by the downturn in the cryptocurrency market, from Footprint Analytics image description

Footprint Analytics - TVL of DeFi

Footprint Analytics - TVL of Categories Change

image description

Footprint Analytics - TVL by Protocols

image description

Footprint Analytics - Market Share of TVL For Chains

On December 20-27,TerraTVL once surpassed Binance and became the second largest public chain. On the 28th, Binance overtook and regained second place. Terra was able to counter the trend and increase despite the decline in TVL of mainstream public chains, mainly due to the Anchor for Lending and Lido for Staking on its chain. For a detailed introduction to Terra, see image description》

Footprint Analytics - TVL by Chain For Binance&Terra

image description

Footprint Analytics - Top 5 TVL Growth Rate For Chains

Footprint Analytics - TVL of Aurora

NFT trading volume returned to positive for the first time since August, an increase of 0.78%

image description

Footprint Analytics - NFT: Monthly Trading Volume

The increment is mainly affected by some collectibles on Ethereum and the virtual land sale of Metaverse. fromFootprint AnalyticsJudging from the NFT trading volume in the past 7 days, Doodles, which was sold publicly and attracted a large number of users, increased by 84%, Mutant Ape Yacht Club, a mutant boring ape, increased by 39%, and virtual landThe Sandbox image description

Footprint Analytics - NFT Top 30 D7 Growth Rate

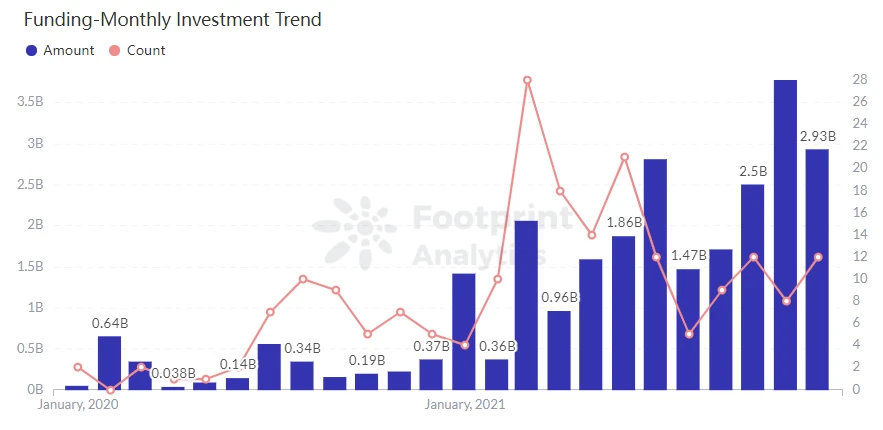

Investment institutions not only invest in popular DeFi and NFT, but also prefer Web3

image description

Footprint Analytics - Funding-Monthly Investment Trend

Footprint Analytics - Funding-Monthly Investment by Category

Financing is still in the early stage, mostly seed rounds

Summary of the month

Footprint Analytics - Funding-Fundraisig Rounds(2021)

Summary of the month

In December, the development of the encryption market slowed down and entered a dormant period. The prices of mainstream cryptocurrencies fell. The price of BTC fluctuated between 40,000 and 50,000 US dollars, and the price of ETH fluctuated between 3,000 and 4,000 US dollars. DeFi’s TVL was $270.69 billion, slightly lower than November’s TVL. NFT rebounded slightly, and Mutant Ape Yacht Club, Capsule, and The Sandbox all contributed to the increase in trading volume.

The public chain Terra and Binance compete for the second position of the public chain. Investment institutions are still relatively interested in the DeFi and NFT fields, and more funds flow to the Web3 field. Whether the Web3 field can help the new development of the encryption market in 2022, and who will take the second place in the public chain, let us wait and see.

policy current affairs

policy current affairs

South Korean crypto exchanges expected to ban transfers to unverified wallets after March 25 next year

Courts in multiple places in China ruled that Bitcoin and other virtual currency related transaction contracts are invalid

Türkiyes central bank to ban purchases of goods and services with cryptocurrencies

Dubai World Trade Center to become cryptocurrency regulator

financing

financing

Blockchain analytics firm TRM Labs closes $60 million Series B round

Loot Squad, the blockchain game trade union, completes a $5 million seed round of financing

NFT mortgage lending platform Arcade completes $15 million in Series A financing

Avalanche Ecosystem Accelerator Colony Closes $18.5M in Funding

public chain

public chain

Ethereum Launches First Public Testnet for Full Upgrade to Proof-of-Stake

Binance Smart Chain: BEP95 real-time BNB burning mechanism has been activated

Kava 9 testnet is online, IBC has been integrated and Cosmos ecological assets cross-chain support

Optimism cancels the whitelist and will fully open the right to deploy applications

Web3 content delivery network AIOZ Network has been launched on the main network

DeFi

The Sandbox plans to migrate to Polygon in 2022 and launch DAO

The cross-chain protocol Anyswap officially changed its name to Multichain, starting a new cross-chain journey

GameFi project Tap Monster renames to PunkMonster

Constitution DAO permanently relinquishes access to multisig

The total value of encryption artist Pak surpasses Beeple and ranks first

NFT

NFT Market Mintable Launches NFT Layer 2 Solution Immutable X

The total transaction volume of NFT market OpenSea exceeded 12 billion US dollars, a record high

On December 14, the daily trading volume of OpenSea exceeded 150 million US dollars, a new high since September 16

Sothebys to make $100 million from NFT sales in 2021

stable currency

stable currency

Coinbase begins to connect to DeFi protocols, initially supporting the stablecoin DAI

Stablecoin Supply Soars 388% in 2021, Driven by DeFi and Derivatives

The issuance of the US dollar stablecoin USDC exceeded 40 billion US dollars, a record high

Tether issued an additional 1 billion USDT on the wave field blockchain

security incident

security incident

The NFT project Monkey Kingdom was attacked by phishing and lost about $1.3 million

Rug Pull occurred in METADAO, the loss is about 3.25 million US dollars

Visor Finance was attacked by DeFi hackers and lost more than $8.2 million

Grim Finance Suffers Over $30 Million in Flash Loan Attack

This work is original by the author, please indicate the source for reprinting. Commercial reprinting needs to be authorized by the author, and those who reprint, extract or use other methods without authorization will be investigated for relevant legal responsibilities.

About Footprint Analytics:

Footprint Analytics is a one-stop visual blockchain data analysis platform. Footprint assisted in solving the problem of data cleaning and integration on the chain, allowing users to enjoy the zero-threshold blockchain data analysis experience for free. Provide more than a thousand tabulation templates and a drag-and-drop drawing experience, anyone can create their own personalized data chart within 10 seconds, easily gain insight into the data on the chain, and understand the story behind the data.

Footprint Analytics official website: https://www.footprint.network

Discord community: https://discord.gg/3HYaR6USM7

Telegram: https://t.me/joinchat/4-ocuURAr2thODFh

The above content is only a personal opinion, for reference and communication only, and does not constitute investment advice. If there are obvious understanding or data errors, feedback is welcome.

Copyright Notice:

This work is original by the author, please indicate the source for reprinting. Commercial reprinting needs to be authorized by the author, and those who reprint, extract or use other methods without authorization will be investigated for relevant legal responsibilities.