Original|Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser2010 )

As one of the key figures in promoting Bitcoin strategic reserve legislation, U.S. Senator Cynthia Lummis recently said , The Trump administrations executive order is just the beginning. Subsequently, she and U.S. Representative Nick Begich of Alaska jointly announced : Major events related to Bitcoin policy will be announced on March 11 (this Tuesday).

On March 11, Cynthia Lummis announced the latest news as expected: a new version of the Bitcoin Act was reintroduced, and the legislation would incorporate President Trump’s vision of establishing a U.S. strategic Bitcoin reserve .

Previously, Odaily Planet Daily had made a judgment: Trumps order to establish a cryptocurrency reserve through a presidential executive order still retains the possibility of the previous purchase of 1 million BTC in 5 years Bitcoin strategic reserve. Combined with the specific content of the new version of the Bitcoin Act released today , the possibility of the US government purchasing BTC as a strategic reserve is still not small. Odaily Planet Daily will sort out the latest progress of the Bitcoin Act in this article for readers reference. Recommended reading: Trump established a BTC strategic reserve as promised, but the source of funds is purely from fines and confiscations? .

Bitcoin bill update: 1 million BTC to be held for at least 20 years, Treasury and Fed may jointly fund

Cynthia Lummis speaks at the Bitcoin Policy Institute Bitcoin Conference on March 11 Said: The Bitcoin Act to purchase $1 million of Bitcoin will be reintroduced.

Bitcoin Magazine CEO David Bailey echoed this, saying: “What people miss about the SBR (Strategic Bitcoin Reserve) is that it is not just implemented through executive action or legislation. We need both. Executive action clears the political path and tells Congress that this is a priority. Now is the time for the Bitcoin Act.”

The bill is also co-sponsored by Republican Senators Jim Justice of West Virginia, Tommy Tuberville of Alabama, Roger Marshall of Kansas, Marsha Blackburn of Tennessee and Bernie Moreno of Ohio.

The collective appearance of 7 Republican congressmen

It is worth mentioning that the new Bitcoin bill has not only received strong support from Republicans, but also from Democrat and California Congressman Ro Khanna, who stated : Bitcoin should be a bipartisan system. We cant have a president issuing an executive order and another revoking it, leading to uncertain policies. We need to reach a consensus that Bitcoin is good for the United States and the world... The Democratic Party should embrace Bitcoin. According to Cynthia Lummis herself , the bill also has the support of Trump himself.

On March 12, at the Bitcoin For America Summit, Alaska Republican Congressman Nick Begich announced an updated version of the Bitcoin Act for 2025 in response to Senator Lummiss Bitcoin Strategic Reserve proposal last year, proposing that the United States will acquire 1 million Bitcoins in a way that does not increase the burden on taxpayers and protect the right of American citizens to self-custody Bitcoin. The bill explicitly protects the right of individuals to freely own, hold and trade Bitcoin, said Congressman Begich, It regards self-custody as a fundamental right.

On March 13, the latest version of the Bitcoin Act was officially launched on the Congressional website , with the following key differences:

The purchase quantity is clear: The 2025 version of the Bitcoin Act sets a stricter plan to purchase 200,000 bitcoins per year (rather than the maximum 200,000 in the 2024 version).

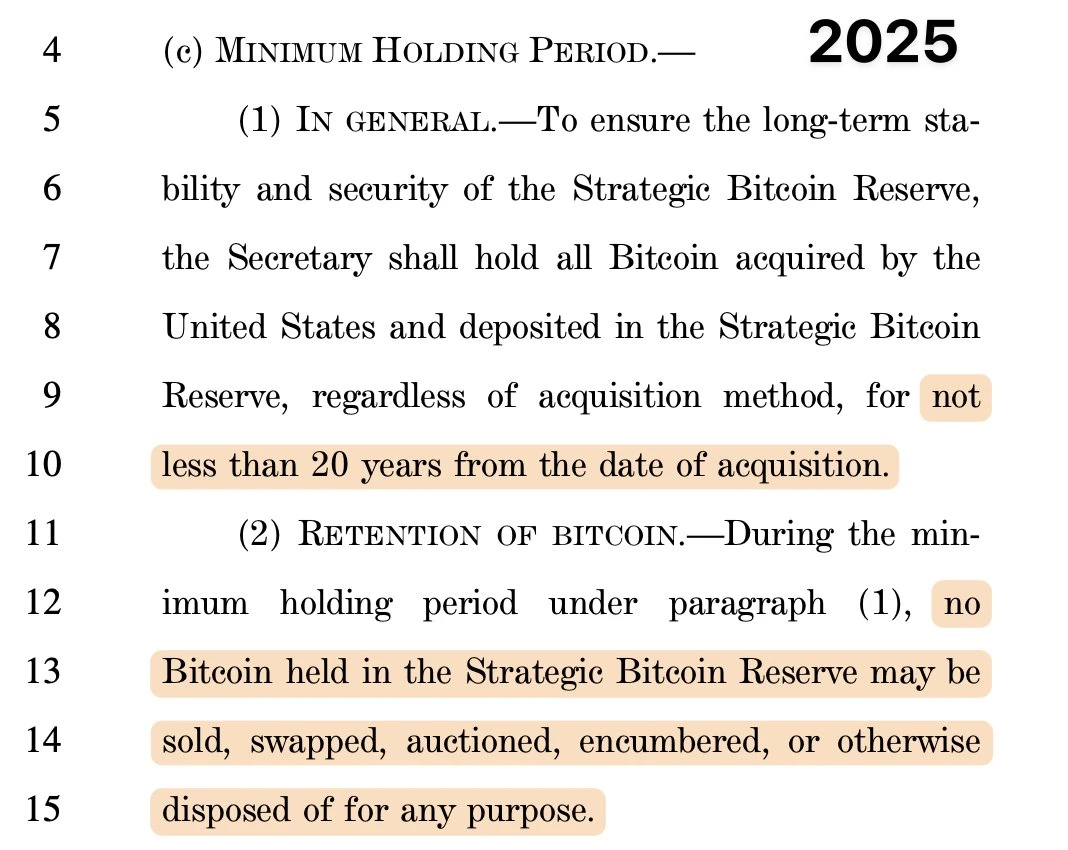

Strict holding restrictions: The new version also strengthens the holding requirements, requiring at least 20 years, and removes the exception clause regarding the strategic reserve BTC being used as a tool to repay federal debt. In other words, the holding requirements for purchased BTC are more stringent.

Contents of the latest version of the bill

Source of funds for purchase: The bill adds a clause to coordinate the purchase of Bitcoin with the Exchange Stabilization Fund (ESF) (Note: ESF is a reserve fund under the U.S. Treasury Department with approximately $39 billion in assets. The executive branch may use the fund to purchase BTC; in terms of gold revaluation, the latest version explicitly stipulates that the proceeds from the revaluation of Federal Reserve gold should be used to purchase Bitcoin, while the previous version only included these funds in the general fund, which is a major change; in addition, the latest bill also mentions existing diversified funding channels from the Federal Reserve system - between 2025 and 2029, the first $6 billion of remittances from the Federal Reserve will be used to establish reserves each year.

In addition, aspects such as BTCs quarterly reserve certification, voluntary participation of state forces, and financing through federal government revenue transfer remain basically unchanged.

Still 4/5 of the way to becoming law: depends mainly on 2 votes, and Trump will decide in the end

According to information on the official website of Congress, the bill has been read twice and transferred to the Committee on Banking, Housing and Urban Affairs.

After a series of votes, debates, or amendments, if the bill is able to pass the Banking, Housing, and Urban Affairs Committee by a simple majority (218 out of 435 votes), the bill will then be sent to the Senate for committee debate and voting, also subject to a simple majority (51 out of 100 votes) principle for passage. Finally, a joint committee composed of members of the House and Senate will resolve any differences between the House and Senate versions of the bill, and the resulting bill will return to the House and Senate for final approval. The Government Publishing Office prints the revised bill in a process called registration. At that time, as the final step of the presidential decision, Trump will have 10 days to sign or veto the registered bill.

In other words, the 2025 version of the Bitcoin Act still needs to wait for four steps before it can finally become a written law and then promote its specific implementation.

Congressional website related information interface

It is worth mentioning that in this update of the Bitcoin Act, in addition to using gold revaluation gains as a source of channels for purchasing Bitcoin, the Bitcoin strategic reserves were also compared with the gold strategic reserves, giving equal importance to the scale and strategic importance of the two.

As Representative Nick Begich said in his speech: “The war on innovation is over, and the golden age of digital currency has arrived.”

As of March 12, according to the Bitcoin Voter Project’s disclosure on the X platform, the bill has received strong support from 12 congressmen.

Cynthia Lummiss Second Group of Allies

Industry insiders commented: Praise the latest version of the Bitcoin bill, which is expected to become the next Louisiana merger case

Jack Mallers, CEO and co-founder of Bitcoin payment company Strike, said at the Bitcoin For America conference that the strategic reserve of Bitcoin is a turning point in American history.

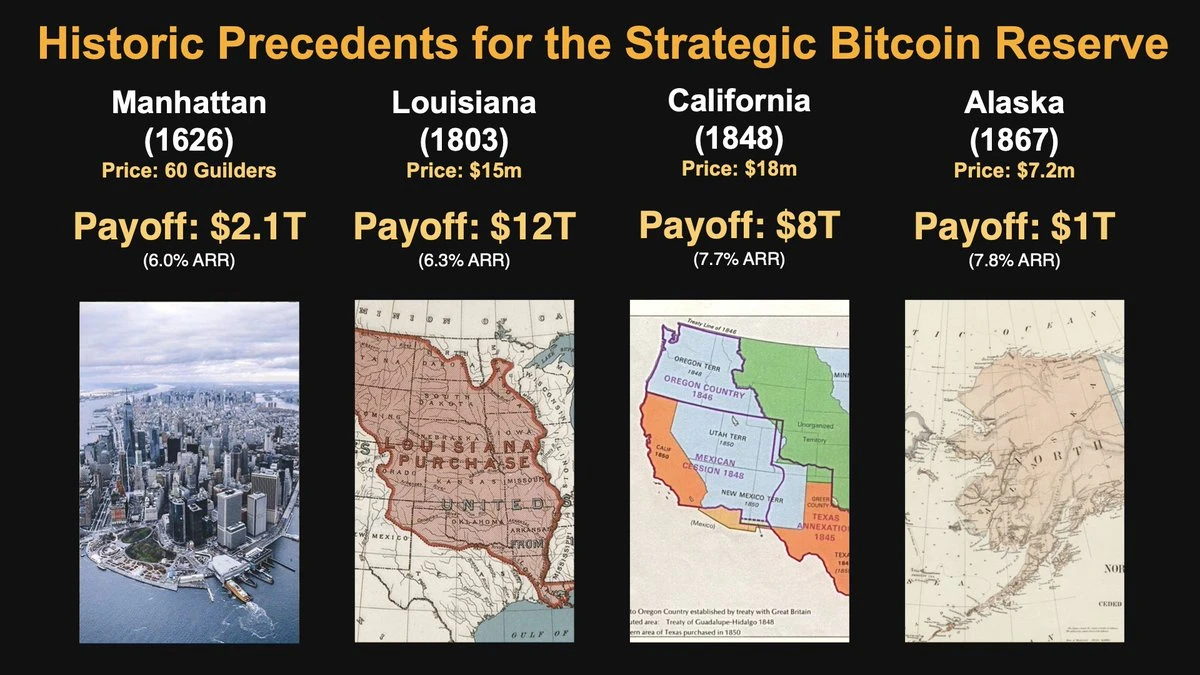

Michael Saylor, founder of Strategy (formerly MicroStrategy), and X Platform published an article that placed the significance of Bitcoin strategic reserves on an equal footing with the land acquisitions that accompanied the expansion of the United States’ territory in history. He said: “We once bought 78% of the land in the United States for $40 million. The United States should buy Bitcoin.” (Note from Odaily Planet Daily: The United States has spent different amounts of money to buy Manhattan, Louisiana, California, and Alaska in history)

The “Bitcoin Reserve Moment” in American History

It has to be said that in terms of ensuring the leading economic position of the United States, the strategic reserve of Bitcoin is considered to be a crucial link in the eyes of many professionals in both the political and cryptographic fields.

Conclusion: America’s financial future is protected by Bitcoin

After Trump came to power, he vigorously formulated a series of tariff protection policies. Affected by the policy news, the US stock market and the crypto market have been in a downward trend. Some people believe that the Trump administration may have taken this action to take advantage of the slight recession in the US economy to prompt the Federal Reserve to make more interest rate cuts, so as to provide support for the recovery and even re-development of the US economy.

On the other hand, the strategic reserve of Bitcoin may become a touchstone for Trump to promote the implementation of various policies. On the one hand, it can gradually resolve the pressure of U.S. debt; on the other hand, it may become an important part of the struggle for economic decision-making power between the Trump cabinet government, including the Treasury Department, and the Federal Reserve.

In ensuring the financial future and economic hegemony of the United States, the role of Bitcoin will gradually become apparent.