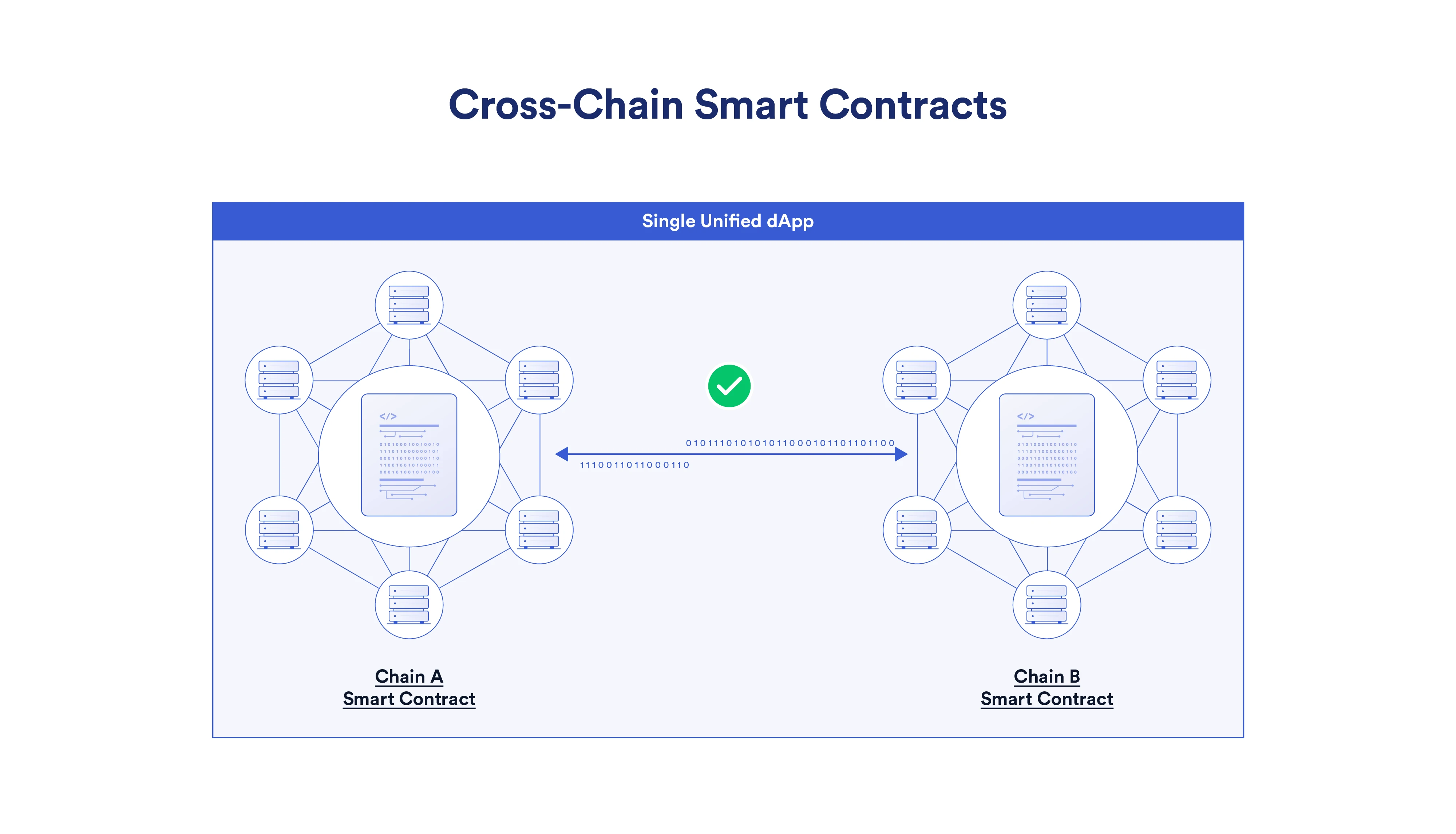

Cross-chain smart contracts are decentralized applications consisting of multiple smart contracts deployed on different blockchain networks. These smart contracts can achieve interoperability and together form a complete application. This innovative design paradigm has played a key role in promoting the development of multi-chain ecology, and will have the potential to leverage the unique advantages of different blockchains, sidechains and layer 2 networks to create new smart contract use cases.

Cross-chain Interoperability ProtocolCross-chain Interoperability Protocolfirst level title

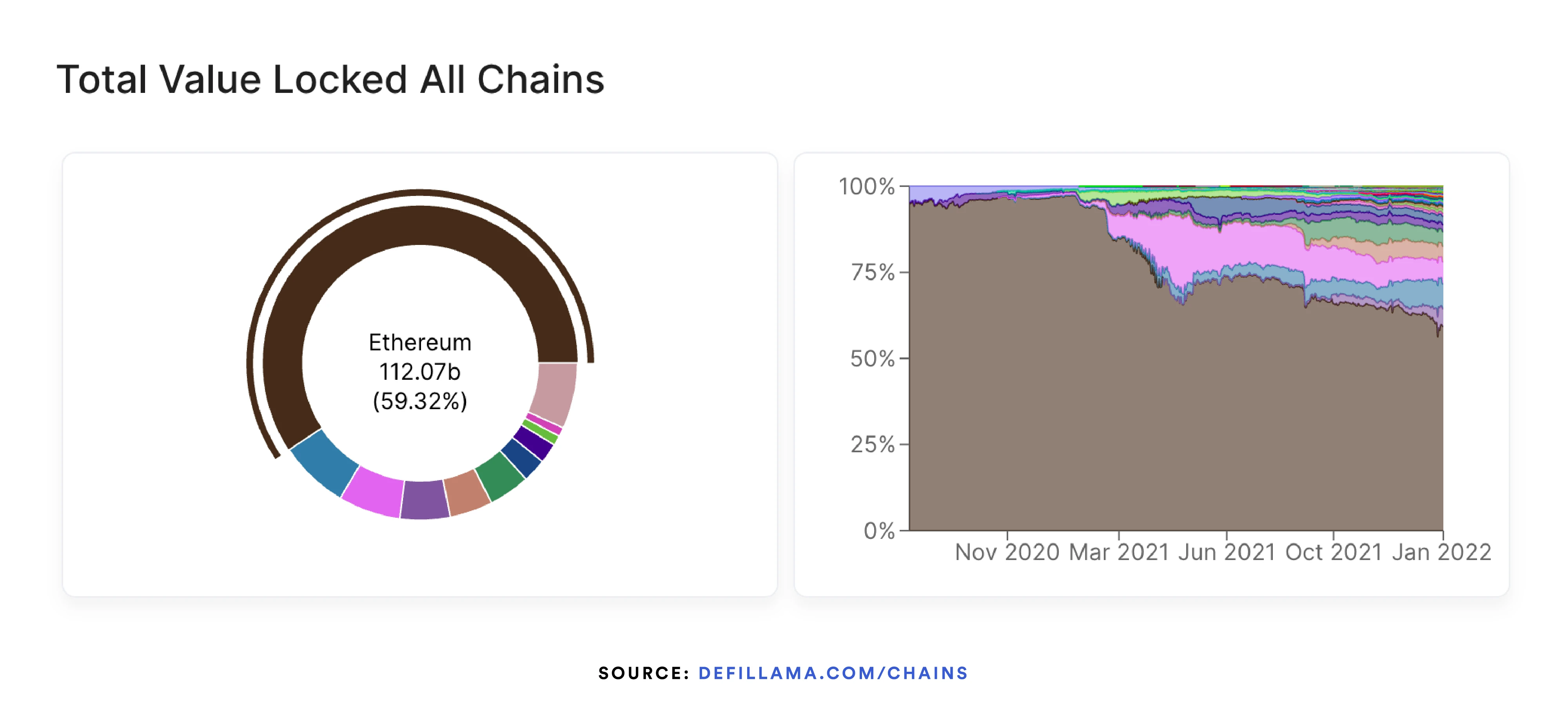

The rise of multi-chain ecology

smart contractsmart contractApplications are deployed on the Ethereum mainnet, as Ethereum is the first network to support fully programmable smart contracts. Ethereum became a mainstream smart contract network not only because of its first-mover advantage, but also because it created a growing network effect, decentralized infrastructure, mature development tools, and a large Solidity developer community. However, as users’ demand for Ethereum smart contracts continues to rise, the supply of Ethereum block space (that is, computing resources) is in short supply, which has also led to a surge in transaction fees on the Ethereum network. While the Ethereum mainnet remains the safest option for deploying smart contracts, many end users are looking for lower-cost alternatives.

image description

text

With the continuous emergence of various new blockchains, the total amount of the smart contract economy has skyrocketed, attracting more new users to join and start transactions at a lower cost. In addition, each side chain and layer 2 has its own unique expansion plan and decentralization plan, and also has its own characteristics in terms of mechanism design, consensus, transaction execution, data availability, and privacy. In a multi-chain ecology, all these different modes can be parallelized, tested in practice, and ultimately push the ecology forward.

The Ethereum community has also embraced this multi-chain strategy, adopted a rollup-centered development route, and improved the throughput of the Ethereum ecosystem by deploying multiple layer 2 expansion solutions. The Layer 2 network improves the transaction throughput of the Ethereum smart contract, so the single transaction fee can be reduced, while maintaining the security advantages of the Ethereum main network. The specific solution is to verify off-chain calculations on the Ethereum blockchain using fraud proofs or validity proofs. Later, data sharding technology will be used to expand the performance of rollup calldata.

first level title

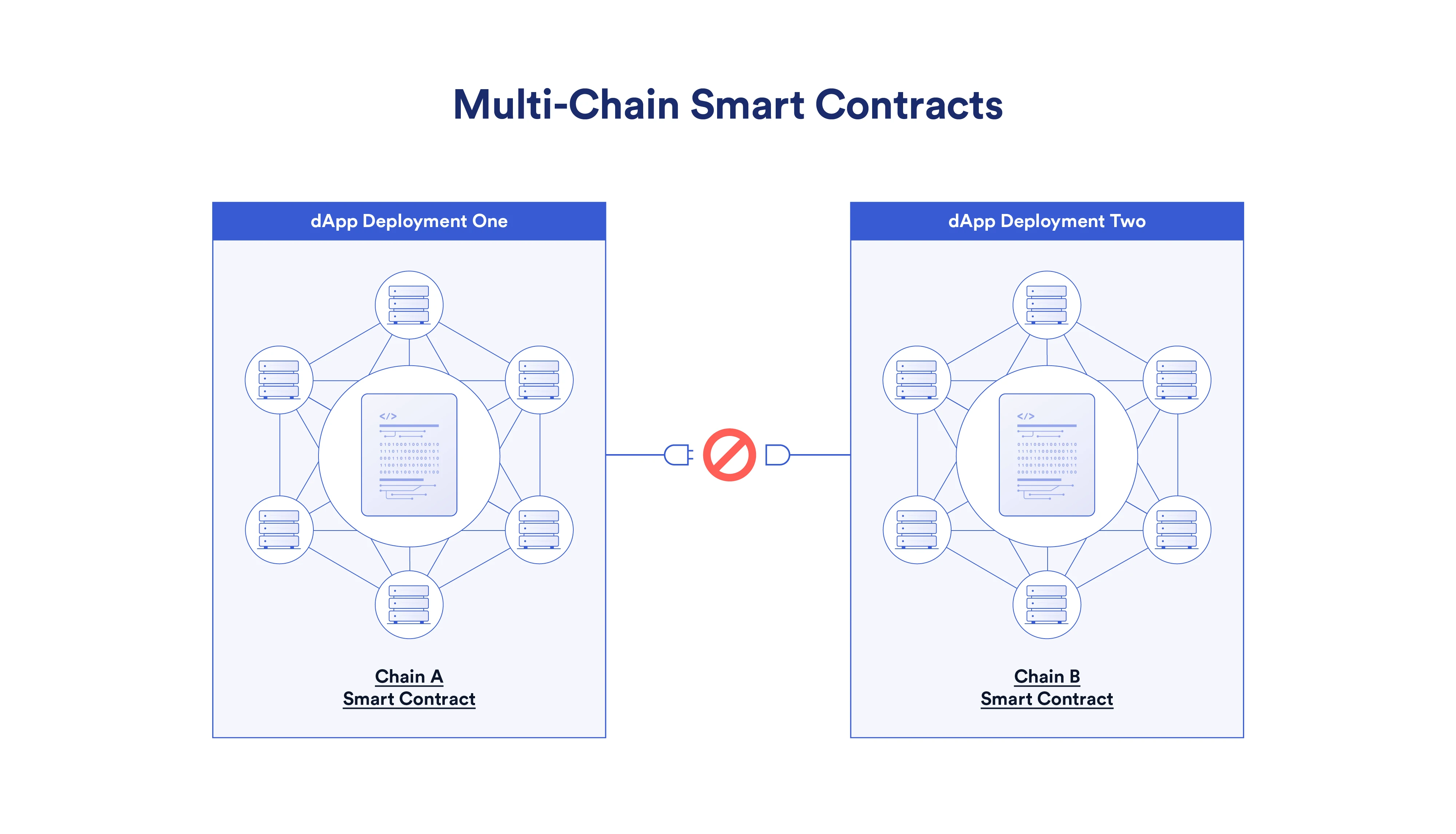

The bottleneck of multi-chain smart contracts

Although the multi-chain ecosystem can bring many benefits to users and developers, there are still a series of special challenges and trade-offs when deploying the code of the same smart contract to multiple blockchains.

image description

Multi-chain smart contracts are essentially isolated copies of dApps on different chains.

This phenomenon is particularly prominent on decentralized trading platforms, especially multi-chain automated market makers (AMMs). Since user assets can only exist on one blockchain at the same time, the liquidity of the application will be dispersed on different blockchains. As a result, the amount of locked positions applied on each chain will be reduced, which will lead to increased transaction slippage and reduced transaction fee income. In addition, every time an AMM application is deployed to a new blockchain, liquidity needs to be created from scratch. If the new chain also adopts yield farming for cold start, then this will lead to the continuous dilution of the original token of the protocol.

If the application needs to maintain a single source of truth for its state, such as an on-chain domain name system with a unified registration, it is difficult to achieve multi-chain deployment. If separate registries are deployed on each chain, then different people may register the same domain name on different chains, which will cause confusion. Therefore, if the application needs to ensure the consistency of the global state, it is usually only deployed in one blockchain network.

In addition to application-level challenges, multi-chain systems can also create problems for end users. Users may need to learn how to interact with other blockchains. Since assets on a certain blockchain can only be used in dApps on this chain, users must manually use the token bridge to send tokens to dApps on other blockchains for use. Users not only need to reconfigure the wallet, be familiar with the operation process on the new chain, and hold the underlying blockchain pass to pay the gas fee; they also have to sacrifice security to a certain extent, because many cross-chain pass bridges currently have security question.

Cross-chain smart contract

Cross-chain smart contract

image description

A cross-chain smart contract is actually a complete dApp that deploys its logic on different blockchains.

Although this deployment can be achieved in various ways, at the lowest level it is necessary to design a cross-chain smart contract that allows developers to divide the application into different modules. That is to say, smart contracts on different chains can perform different tasks, while all smart contracts are kept in sync and jointly realize the same application scenario. In this way, developers can take advantage of different blockchains to realize unique value. For example: decentralized applications can use the anti-manipulation of the first blockchain to track asset ownership; use the high throughput of the second blockchain to achieve low-latency transactions; use privacy to identify users; and use the decentralized storage capabilities of the fourth blockchain to store metadata.

secondary title

Cross-chain trading platform

When users execute transactions on the cross-chain decentralized exchange platform (DEX), they can obtain liquidity across the token pools of various blockchains to solve the problem of multi-chain DEX liquidity differentiation. For example, when a user trades, the tokens they deposit can be split and bridged to different blockchains to obtain the best transaction execution price; and then the tokens after the transaction are bridged back to the original blockchain and Deposited into the users wallet. In this way, the liquidity on all blockchains will be revitalized, users can enjoy lower transaction slippage, and liquidity providers on each chain can obtain higher transaction fee income.

secondary title

Cross-chain income aggregation

Cross-chain income aggregation can place the funds deposited by users in the DeFi protocols on each chain. In this way, users do not need to manually bridge token assets to other chains to maximize returns, and easily obtain higher returns. Therefore, this will greatly improve the experience of multi-chain yield farming, and all tedious processes will be simplified.

currency market

Cross-chain lending

Cross-chaincurrency marketIt can promote the development of the cross-chain lending market. Users can deposit mortgage assets (ETH) on one chain and borrow token assets (such as USDC) on another chain. In this way, users can not only put mortgage assets on a more secure blockchain, but also lend token assets on a blockchain with higher throughput, and put assets into applications on this chain generate income.

secondary title

Cross-chain DAO

Decentralized autonomous organizations (DAOs) can take advantage of cross-chain interoperability to conduct on-chain voting in one or more high-throughput blockchain networks, and the cost of sending voting results back to the core governance contract is relatively high on the blockchain. Doing so can not only reduce transaction costs for DAO participants, but also achieve transparency and anti-manipulation on the chain, and encourage more people to participate.

secondary title

text

Users of the cross-chain NFT marketplace can issue or bid for NFTs on any blockchain. This will improve the liquidity of NFT, and NFT can be seamlessly transferred between different blockchains after the auction. Alternatively, games on one blockchain could use cross-chain interoperability to track NFT ownership on another blockchain. Therefore, users can safely store NFTs on any blockchain and use these NFTs in games on other blockchains at the same time.

first level title

Store-style smart contracts

Existing single-chain or multi-chain smart contracts can deploy storefront smart contracts to take full advantage of the multi-chain ecology. Store-style smart contracts provide users with an entry through which they can access smart contract applications on other chains. Through such smart contracts, users can store assets in decentralized applications on another chain without leaving the original blockchain environment.

Users dont need to manually bridge assets to smart contracts on other blockchains, and they dont even need to know which blockchain, sidechain or layer 2 the smart contract is running on. For users, applications on other blockchains are no different from native applications.

first level title

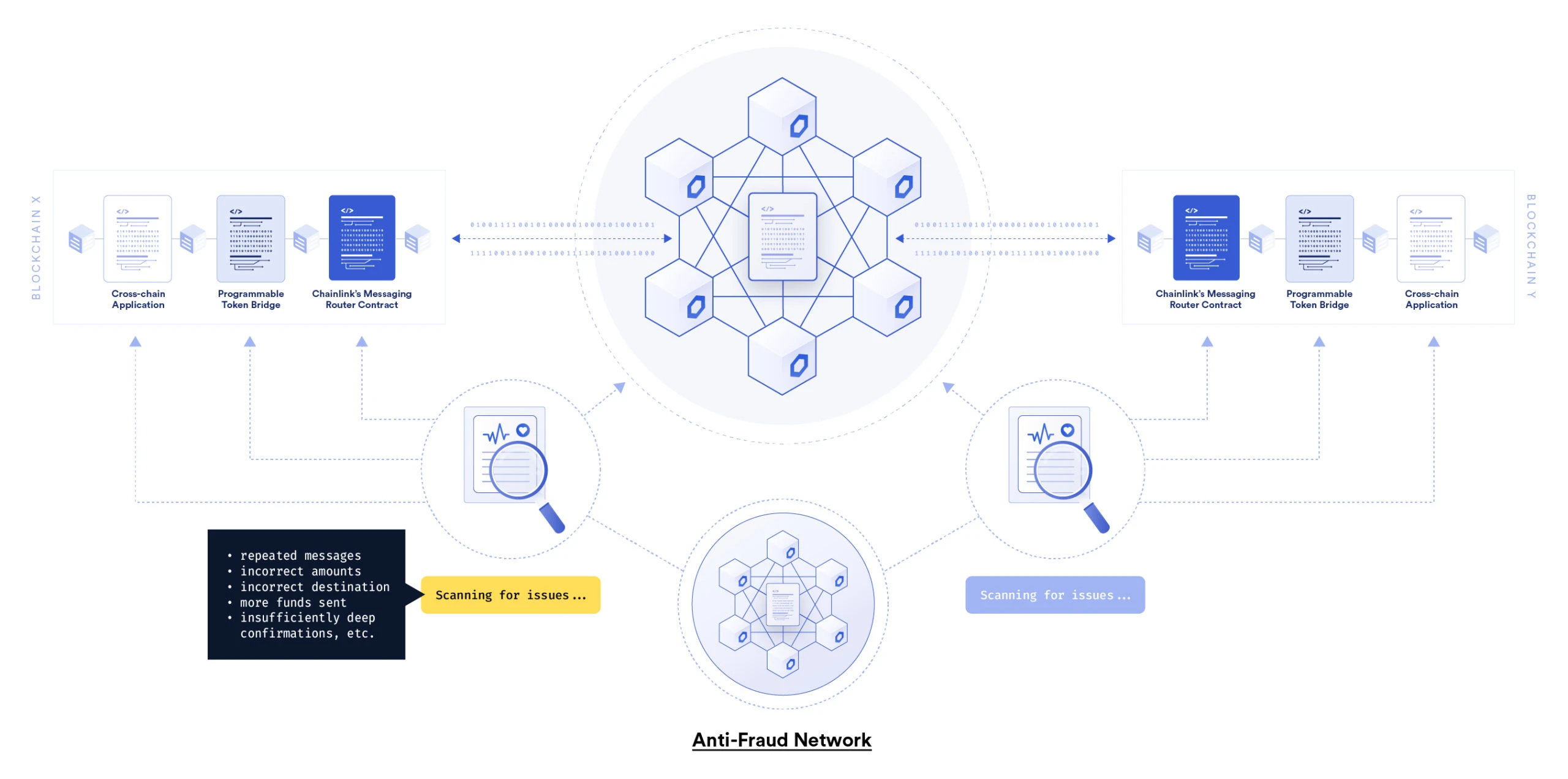

How CCIP will escort the cross-chain ecology

While cross-chain smart contracts have revolutionized the development of decentralized applications, most blockchain networks today are still inherently isolated from each other. That is, data cannot be sent and received directly between these blockchains. To realize cross-chain smart contracts, it is necessary to build a cross-chain bridge between chains.

The blockchain oracle problemThe blockchain oracle problem(ie: the blockchain cannot access off-chain resources); similarly, DON can also securely achieve blockchain interoperability.

The Chainlink network is compatible with protocols on any blockchain, and has been integrated into a series of blockchains, sidechains and layer 2. Therefore, Chainlink has sufficient capabilities to promote the transformation of multi-chain ecology to cross-chain smart contracts. To achieve this goal, Chainlink is currently developing a global open-source standard for cross-chain communication, the Cross-Chain Interoperability Protocol (CCIP).

Unlike ordinary cross-chain bridges, CCIP allows smart contracts to securely transmit data and tokens across all blockchains. Smart contracts can encrypt or decrypt data messages in any way, so they are extremely flexible. It’s worth mentioning that CCIP will utilize Chainlink’s oracle nodes already in operation. These nodes are not only highly reliable and tamper-resistant, but also compatible with any blockchain, and have already secured tens of billions of dollars in value for the multi-chain DeFi economy.

image description

The Cross-Chain Interoperability Protocol (CCIP) will transfer messages between the various blockchains.

Summarize

Summarize

Today, the multi-chain ecosystem is full of innovation opportunities, and more and more developers are deploying applications in the multi-chain environment to attract more users and traffic. Although the multi-chain smart contract design paradigm faces some bottlenecks, the emergence of cross-chain smart contracts will bring huge opportunities to not only eliminate these bottlenecks, but also unlock a series of innovative use cases.

CCIP aims to create a safe and reliable cross-chain infrastructure to help decentralized applications securely transmit arbitrary data to smart contracts on any blockchain, thereby accelerating this transformation. In the 1990s, no one could predict all the application scenarios of the Internet today; similarly, we cannot accurately predict most of the future application scenarios of cross-chain smart contracts.

and follow on Twitterchain.link/solutions/cross-chainorContact a Chainlink Expert。

To learn more, please visitchain.link,subscriptionChainlink newsand follow on Twitter@chainlink。