Author: Mario Gabriele

Original translation: Block unicorn

Author: Mario Gabriele

Original translation: Block unicorn

Multicoin Capital may be the best performing venture fund of all time. The crypto investor has hit big wins by making highly concentrated, non-consensus bets on Solana, Helium, The Graph, and more.

If you only have a few minutes to spare, investors, operators, and founders should learn about the origins of Multicoin Capital. (We will refer to this company as Multicoin.)

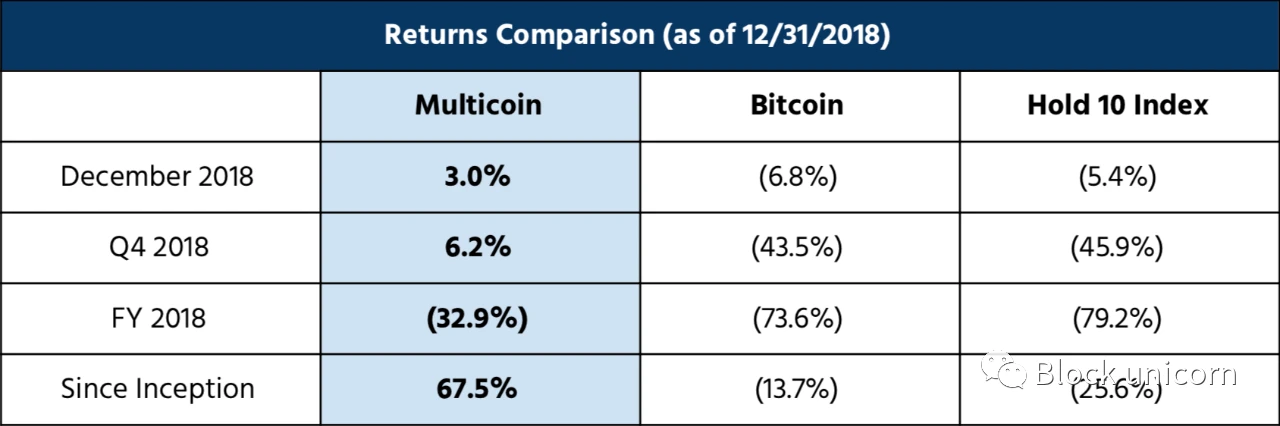

Multicoin may be the highest return venture fund ever. Firms such as Union Square Ventures and Lowercase Capital are known for funds that have returned 14x and 76x, respectively. Multicoins first VC vehicle seems to have them beat.

The company took a contrarian approach and emerged victorious. When Multicoin started, the investment landscape was dominated by funds focused on Bitcoin and Ethereum. Founders Kyle Samani and Tushar Jain saw opportunity elsewhere, making reverse bets on Helium, The Graph and Solana.

To drive excess returns, focus betting. Part of the genius of Multicoin is its willingness to back its beliefs with capital. Many of the firms top-performing investments are very large, contributing to the funds outperformance.

Investing in EOS was a failure...which resulted in the biggest winner in Multicoin. The companys outspoken support for an alternative blockchain, EOS, has drawn some false attention. When the project floundered, critics celebrated Multicoins mistakes. But it was through supporting EOS that Multicoin realized the potential of Solana.Multicoin has its detractors, but the founders are very positive. In the partisan world of cryptocurrencies, Multicoin’s strong support for its investment could anger dissidents. As a result, the company is loathed by some and loved by entrepreneurs. Portfolio founders have been exceptionally active in their contributions to Multicoin.

In 2017, Kyle Samani (founder of Multicoin) and Tushar Jain decided to start a cryptocurrency hedge fund. None of them had worked in investing before, let alone run their own funds. They have not worked at emerging startups in the industry, nor have they established protocols. Theyre not friends with Vitalik Buterin or Gavin Wood or other crypto luminaries who might lead them to buy Ethereum at public offering prices. Their names mean nothing, and apart from a few smart personal investments starting in 2016, they have almost no track record of being a good fit for the endeavor at hand.

In short, they are outsiders in the crypto space.

It has proven to be their most powerful weapon. While Samani and Jain may not have the sincerity of a tenured manager or the expertise of a blockchain builder, they bring strong flair, not least a willingness to question the status quo. Even in a space as new and fluid as cryptocurrency in 2017, there are holy cows and accepted wisdom. With no preconceptions to cherish or factions to protect, Samani and Jain can hone their investment acumen without bias, conducting deep research and reasoning from first principles.

The result was a portfolio that looked radically different from almost any other company of the era. Today, Multicoin is not only a viable player in the crypto investment space, but one of its dominant forces. It has earned a formidable reputation by making centralized, non-consensus bets on big winners like Solana, The Graph, Helium, and more. This is high conviction, contrarian investing at its best.

Earning such returns has not been easy, and not only have several of Multicoins best investments come close to collapse on all fronts, but the company itself has weathered negative performance and brutal market shocks. Some of its most high-profile investments, like EOS, have failed ignominiously. However, Samani and Jain outperformed their peers, generating returns that are likely to be historic.

In today’s article, we’ll unpack what makes Multicoin so special, covering:

unlikely origin. Kyle Samanis first venture involved building apps for the ill-fated Google Glass device. Tushar Jain also started an unsuccessful company.

Think in public. Without an established investment track record, Samani and Jain have built a reputation through their thoughtful writing about the crypto space.

Evaluation of LPs. Those investing in Multicoins early tools saw more than just two smart, eager investors. They see a particular strategy with asymmetric upside.

strategic shift. Although Multicoin started out as an American hedge fund, it has expanded its remit over time.

Four bets. Multicoin’s personality as a fund can best be understood by looking at four investments, three of which were big winners and one a disaster (EOS).

rewards and reputation. Investors may be judged primarily by their financial returns, but reputation among founders may be a more important leading variable.

In Parts 2 and 3 we will delve deeper into the companys operations, decisions and future.

Origin: Genesis block

If they succeed in building their first business, Kyle Samani and Tushar Jain will be entrepreneurs in the healthcare space, but failure has set the couple on a path strange road.

empire city

Every August, Washington Square Park welcomes a new cohort of teens. Surrounded by New York University (NYU) dorms and classrooms, the Greenwich Village landmark is home to the institutions newest residents: the freshman class.

Among those who arrived in midtown Manhattan in late summer 2008 were Kyle Samani and Tushar Jain. Six-foot tall, broad-shouldered and outspoken, Kyle Samani stands out. The son of a dentist and tech entrepreneur — his father started a medical records platform called VersaSuite — he conveys a haughty Texan confidence. Although he grew up reading tech blogs and remembering the processing power of Nvidia graphics cards, he enrolled with the goal of making his mark on the old world of finance. I think programmers are losers, Samani said. Finance is where an aspiring alpha like him goes.

Tushar Jains journey is shorter. He grew up in Queens and shares Samanis interest in technology, especially games. He spent many afternoons and evenings playing world builders like Age of Empires and Civilization. Like Kyle Samani, Jain saw himself succeeding on Wall Street. They met during their first week on campus and became friends.

The global financial crisis soon exposed the fragility of Samanis and Tushar Jains ambitions: Wall Street was burning. A few weeks into his freshman year, Merrill Lynch sold, Lehman Brothers collapsed, and AIG narrowly avoided the same fate. Finance is not a sector of promise and power, it is a declining industry.

With Wall Street capitulating, Silicon Valley has grown stronger. Steve Jobs launched the App Store that year, spawning a new wave of startups. Not long after he arrived on campus, Samani found himself retreating from finance and turning to technology. With the likes of Uber, Venmo, WhatsApp and Instagram coming to the fore, Samani began to see himself less as a budding financier and more like a budding entrepreneur. Every day, I read funding announcements, he said of the period. It had a really big impact and made me realize that I wanted to start a business.

Samanis clarity is combined with an admirable confidence and some naivety. For a while I was convinced that VCs couldnt find enough 20-somethings to put millions of dollars into building. I absolutely believed that to be true.

Eager to start his adventure, Samani returned to Austin for his senior year to learn business construction by working at his fathers company. When midterms and finals were called for, he flew back to New York City and fell down on the Jain couch.

Upon graduation, Jain evaluated three options. He could take a job at Credit Suisse, where he interned for a summer, join another financial institution where he received an offer, or move to Austin. Samani had told him he could find a job for his friend at VersaSuite, even though it wouldnt pay the salary he got on Wall Street. What he loses in pay, he will gain in freedom and responsibility.

Four years ago, Jain would jump at the opportunity to work for a well-known company like Credit Suisse. However, he found himself turning down the bank job and accepting a position that paid a third of what he set. Like Samani, he was drawn to the chance to learn the ropes of building a company.

first level title

shiny objects

Samani and Jain have been with VersaSuite for a year. While it overcomes the grunt work and unwieldy tedium of entry-level finance, the duo is ambitious enough to sit still, Jain said. In May 2013, both left to build their own healthcare businesses. Despite living together and choosing the same field, Samani and Jayne set out in different directions.

Just a month before they made the leap, Google released a device that quickly became a symbol of tech industry optimism: Google Glass. An augmented reality headset is like a pair of bifocal glasses, but frames a small screen instead of a lens.

By his own admission, Samani found himself succumbing to shiny new object syndrome, preoccupied with ideas of how devices might disrupt industries of all kinds. After all, this is a new form of computing — Glass is sure to generate meaningful innovation and provide opportunities for savvy entrepreneurs, just as the App Store has done. Soon after, Samani identified a use case for surgeons and other healthcare professionals. Equipped with a Google Glass device, practitioners can pull up electronic medical records or related images to guide care. The front-facing camera makes it simple to record patient interactions or actions for later review. Fueled by his passion and budding healthcare career, Samani managed to raise $5.5 million for his new business: Pristine.

Jain is more cautious about Googles latest toy. Even though he and Samani did pretty much everything together and seemed to form a good team, he didnt want to spend the next phase of his life building apps for unproven wearables. Instead, Jain focused on leveraging the observations he made at VersaSuite. His year at the software company showed him just how quickly electronic medical records are proliferating, thanks in large part to the economic incentives included in the American Recovery and Reinvestment Act, better known as the 2009 stimulus package. plan. As Jain recalls, qualified physicians earned as much as $40,000 for digitizing documents, which led to a proliferation of patient data. Whats the best use for this data? Jain recalls. The answer, he decided, was clinical trial recruitment. Not only does it cost pharmaceutical companies dearly, but matching patients to new treatments can actually save lives. Like Samani, Jain raised a seed round to bring ePatientFinder to life. His platform makes it easy for physicians to query their database and identify patients who are eligible for new trials.

As it happens, both companies followed similar trajectories, growing to several million in revenue and dozens of employees before negotiating a sale. Samanis company, Pristine, has had a particularly tumultuous journey. Not only did Samani find that the lack of a hands-free display wasnt among the surgeons three most pressing concerns, but Google effectively killed the Glass project. As Samani deadpanned our discussion, Thats the problem. The focus on servicing the insurance business kept the lights on, but in the end, Pristine was sold. No one is making money, Samani said.

Jain fared slightly better, avoiding the kind of disaster that Samani had to go through. He raised $11 million in total for ePatientFinder, but has struggled to keep up with bigger players. The sluggishness of innovation in this space has hindered rapid iteration: Sales take a year, trials last months, and product feedback comes quarterly at best. Its always slow. Like, so slow, Jayne sighed. Realizing he needed to raise more money to endure this endemic lethargy, he opted to sell. Rival Eligo Health Research, with more money and a deeper product, stepped in.

Nearly four years out of college, Samani and Jayne quickly realized their various ambitions, though not the results they dreamed of. Theyve managed to sidestep the lure and profits of a Wall Street startup, raise venture capital funding, attract real customers, and secure an exit. However, neither seemed too happy with how things turned out. As they did in their first year of college, Samani and Jain began to look outside, looking for the next horizon to run.

Jain was the first to understand the potential of cryptocurrencies. Even though Satoshi’s white paper was published in 2008, Jain learned about it in 2013, just weeks after the two arrived in Manhattan to start school. Finding this interesting, he bought two bitcoins through Coinbase, which at the time were worth a few hundred dollars per unit. I learned about it and thought, Okay, this is cool, Jain said. But Im busy. I cant build anything with it. Interested but not forced, he turned his energy to startups.

While Jain was the first to touch Bitcoin, Samani was the first to discover Ethereum. After selling Pristine, he spends his free time browsing AngelList, looking for a startup to join, or a business that will spark his next idea. Samani has set himself the goal of reviewing at least 100 companies in various industries every day. He might choose healthcare one morning, and switch to fintech the next. It didnt take long, though, for him to realize that most of his time was focused on AngelLists business under the Blockchain category. As he delved into the emerging startups in the space, he saw the same name popping up over and over again: Ethereum. Almost every company he follows builds on that foundation. Samani found the white paper, read it, and sent it to Jain. Soon, both parties were invested.

Over the next nine months or so, Samani and Jain fell down the crypto rabbit hole. What started as a curiosity about Ethereum developed into a widespread obsession. Samani finds his free time increasingly taken up by research in distributed systems, cryptography, monetary policy, and Austrian economics. To sharpen their minds, Samani and Jain sought out other devotees who could exchange notes, becoming core members of local bitcoin meetups. One in particular has attracted an interesting group, including enterprise blockchain founder Factom. Future Multicoin LP Adam Mastrelli attended these meetings and described their gist. Discussions range widely, though they usually focus on how encryption might change the world. Lynn Ulbricht, the mother of Silk Road founder Ross Ulbricht, occasionally joined the proceedings, reading her sons letters from prison. Mastrelli also singled out one person: Kyle Samani. You can tell pretty quickly who knows what theyre talking about and who doesnt, Mastrelli said of the meetings. Samani certainly did. In Mastrellis recollections, he always seemed to own the room, a tall, stocky figure with long hair and outspoken opinions.

Through these meetups and their independent studies, Samani and Jain realized that their attention had irrevocably shifted to cryptocurrencies. As Jain recalls, I thought, I cant do anything else. Im fascinated. All I want to do is think about this and talk about this. As Samani puts it, by the spring of 2017, he and Jain realized that Theyve developed a full-time internet hobby waiting to become a career.

Evolution: The Making of Multicoin

Over the next five years, Samani and Jain managed to build one of the preeminent investment firms in the crypto space. Multicoin’s rise owes much to the duo’s willingness to think openly.

thinking in public

At first, it wasnt immediately obvious what form Samani and Jains new careers would take. They are entrepreneurs - maybe their best bet is to start their own crypto project? This is certainly its time. As enthusiasm for the space grew, optimists, hawkers, and opportunists of all sorts set out to launch their own coins, funded by initial coin offerings (ICOs).

The ICO boom of 2017 saw the debut of surreal projects like Dentacoin, which proposed to disrupt the dental industry by offering tokenized rewards to improve oral hygiene. Jain summed up the idea of market insanity: People think youre going to buy coffee with this coin and youre going to buy bananas with this coin... thats just the dumbest thing Ive ever seen. It doesnt make any sense. Jain and Samani realized that while the industry showed technological promise, few were thinking critically about investing. In FUD and FOMO, who is the Benjamin Graham of cryptocurrency? The famous financier defined the practice of value investing, creating heuristics for valuing companies. Few frameworks help navigate the sick candy of an ICO.

Both Jain and Samani are skilled writers despite their more quantitative education. Maybe by sharing their analysis of different projects and trends, they might have an impact? As the Jains say:

We thought, “Oh, what if we shared our heuristics? It would help the money in the ecosystem be better distributed to people who are actually building interesting things, not people like Dentacoin.

This seems like the right place to start. Another question naturally ensues: If the two have outlined their thoughts on what makes a strong investment in the industry, shouldnt they be investing in themselves?

Their early investment in ethereum paid off, with the currency growing from around $10 per token to over $200, and Jain’s 2013 bitcoin investment did well. While these victories have given them some latitude, they will need outside capital if they want to run a real fund. They get to work, using their apartment as their de facto headquarters.

For Samani and Jain, the opportunity is clear. Cryptocurrencies are poised to shake up the world, but no one really knows how to judge them yet. Those who are the first to understand the industry will make the best use of capital, locking in potentially huge returns. Even better, few institutional investors appear to be chasing the opportunity -- and so are the ones who are keeping a low profile. As Jain recalls, the only notable crypto funds in early 2017 were Polychain and MetaStable — neither of which shared research publicly. If they do it right, Samani and Jain may be able to build their own sound and brand in this vacuum.

Just because they see an opportunity doesnt mean the LPs will. Winning converts proved to be a challenge. Institutional investors have shown little interest in an industry plagued by scammers, and most traditional venture capital firms see cryptocurrencies as a fad. With few other options, Samani and Jain raised money from friends, family and former supporters. They also invested a lot of their own money. By August 2017, they had raised about $2 million to run the hedge fund strategy. In an announcement that month, Samani and Jain revealed the name of their new company: Multicoin Capital.

By December 2017, Multicoin had built some momentum. The addition of Brian Smith, a former Tiger Management analyst and former vice president of finance at a publicly traded e-commerce software provider, as COO and CFO is a major coup for the young fund. Multicoin has also added another general partner, Vinny Lingham. The founder of Civic, the beneficiary of the $33 million ICO boom, brings builder expertise to the table. Although nominally a GP, Lingham left the decision-making to other Multicoin partners. Shortly thereafter, longtime investment banker Matt Shapiro joined as principal -- and Shapiro quickly established himself as a key member of the team, becoming a partner.

In addition to adding talent to the roster, Multicoin also ended 2017 going viral. Samani’s post, “Understanding Token Velocity,” has taken crypto Twitter and related chat rooms by storm, drawing the attention of entrepreneurs and investors alike.

first level title

unique design

Throughout 2018, Multicoin has been finding and winning new LPs - many of them with real impact. That March, Reuters published a story about some of the funds newest investors, including Mark Anderson, Chris Dixon and David Sacks. Shortly after that article was published, Fred Wilson joined. Years later, when Jain asked Union Square Ventures GP why he invested, Wilson replied, You guys are willing to be wrong in public. He seemed to see others being bold enough to express their convictions. Thanks to savvy capital management and the influx of these investors, Multicoins assets under management (AUM) reached $50 million at this point.

What is it about Multicoin that attracts LPs? While researching this article, I had the opportunity to chat with others in the industry.

First, the writing of Multicoin makes a difference. When I asked Marcos Veremis, former managing director of Cambridge Associates, how he discovered the company, he replied, It was simple, I started reading their articles...they wrote some great articles. Jain points out , many have followed this path:

Well-known VCs saw what we posted. They realize were thinking about it in interesting ways, coming up with frameworks and heuristics to understand whats going on. This is what makes the flywheel spin for us.

In fact, the idea of Multicoin is not only interesting, but different. In 2018, funds emerged that shared an Ethereum-centric view of the industry. “Back in 2018, it was all about Ethereum, Bitcoin, and some new Layer 1,” Veremis noted.

Multicoin does not have this perspective, relatively early on the fund started supporting non-consensus projects and taking a contrarian view. John Robert (JR) Reed, partner and head of corporate communications at Multicoin, remembers the downside of this non-consensus positioning:

In the early days, every other fund was screaming about Bitcoin from the rooftops. Were not talking about Bitcoin at all. So, we sit down at investor meetings and theyre like, Why dont you talk more about Bitcoin? Its been a weird sticking point for a long time. People are not ready to look at the entire asset class.

In some cases, Multicoin has also directly challenged Ethereum — a sensitive position given the industry’s many advocates. As we’ll discuss later, Multicoin’s support for EOS — a blockchain that seeks to offer a high-speed alternative — will prove particularly controversial.

Multicoins move makes them unpopular, even as it sets them apart. Ray Hindi, managing partner at L1 Digital, spoke about this dynamic when evaluating an investment in Multicoin: The Ethereum community will say, Yeah, Multicoin...bad fund. But in Hindis view, , those who dismiss Multicoin do not appreciate the intelligence and value of the team from a portfolio construction standpoint. While every other manager is doubling down on Ethereum, Multicoin has made a series of high beta positions. You look at the obvious funds at the time, they all had the same name, the same theme, Hindi said. One active crypto investor at the time summed up Multicoin’s appeal well: “They were as smart as everyone else, but their portfolios looked completely different.”

Besides Multicoins public writing and contrarian views, other attributes are also attracting investors. Ray Hindi pointed out the quality of the team, in particular Samani and Jain seem to work well together. “They really compliment each other,” he said, adding that because of their long-term relationship, the risk of a breakdown in the partnership seemed particularly low — which was not the case with other managers he had assessed.

Despite these advantages, many LPs rejected Multicoin - a decision that is sure to be heartened in hindsight. Walls recalls hosting a hedge fund conference that included Kyle Samani and other prominent cryptocurrency managers like BlockTowers Ari Paul and Polychains Olaf Carlson-Wee. According to Walls, the study proposed by the trio passed like a lead balloon. The traditional financial crowd has little interest in the innovation of cryptocurrencies. Theyre kind of a classic incumbent, Wall said. They have their own business, they have their own investment strategy, they manage their money.

One source recalled a conversation with the endowment around this time. Considering the investment in the Multicoin Fund, they mentioned the risks posed by such an unproven team. If Multicoin fails, the jobs of endowment managers may be at stake. In contrast, investing in Sequoia Capital or even Paradigm, boasting partnerships with big-name companies, carries no such risks. The endowment went through, a decision that likely cost millions given Multicoins subsequent performance. “Right now, they totally want to get into Multicoin if they can,” the source said with a laugh.

first level title

private market opportunity

In addition to bringing new prominent backers, 2018 also prompted a change in Multicoin’s strategy — arguably its first major shift. The idea of applying the venture capital model to the crypto space didnt make sense when the fund was established. Instead of selling equity in private financing, the new tokens offer products to public investors through an ICO. As the SEC began to clamp down on the practice, which resembled the sale of unlicensed securities, a new model emerged. The more serious class of crypto entrepreneurs recognize that they need more than crazy money to successfully build something durable. Advice, guidance and professional support are helpful. As a result, some projects started offering private token sales ahead of public liquidity.

At first, Multicoin created a side pocket to capture these opportunities, but it didnt fit the hedge fund model. In taking this step, though, the company realized that LPs wanted private financing. “Our LPs started coming to us,” recalls Jain, “and they were like, ‘Hey, we read about this deal you did. Can you put more of my money into VC?

To accommodate this situation, Multicoin began raising a dedicated private market fund. Even after attracting a celebrity like Mark Anderson, lifting the vehicle is far from simple. Matt Shapiro, who oversees much of Multicoins investor relations business, remembers the period between mid-2018 and mid-2020 as very tough...very tough.

These difficulties have been caused in large part by a painful bear market. Although the year began with a surge in cryptocurrency prices to frenetic all-time highs, it ended in a downturn. In January 2018, Ethereum was near $1,400; by December, it had fallen below $85.

“Everyone saw it go up and then it went down 90%,” Shapiro said, adding, “A lot of tourists or people who were just starting to pay attention got washed away.”

The company performed particularly well in the second half of the year. When the market took a tumble in November, Multicoin shined. While this helps performance in the short term, one LP noted that it may have contributed to unfounded optimism. “Since then, they have had the confidence to time the market,” the source commented, adding, “time doesn’t exist [in crypto].”

Despite their relatively positive performance, many have enjoyed a bad year for Multicoin. An unnamed source recalls the sentiment being that Multicoin was “fortunately in the bull market and now these guys are going to learn their lesson”. Samanis oft-controversial online persona has made enemies, especially when he takes a shot at Ethereum. “People are really ready to hate Kyle and therefore Multicoin,” the same source reported.

first level title

Expansion in Asia

The situation improved in 2019. Bitcoin bottomed out below $4,000 in December 2018, reaching $13,000 by the following summer. Multicoin thrives in better weather, making many of the most impactful investments. While the company first took a stake in Solana in May 2018, it increased its stake the following year, acquiring several existing private holders. In July 2019, CoinDesk reported that Multicoin raised $20 million for the blockchain, acquiring tokens rather than equity. (The firm added to the position in 2021 with its second venture capital vehicle.) Other savvy investments in 2019 included Helium, Arweave and Binance Coin.

Multicoins investment in Binance reveals some of the funds peculiarities and opens new horizons. It’s worth noting that Samani was initially apprehensive about using Binance: “I remember the Binance ICO,” he said. “I thought they misspelled financial. I thought it was a scam. We dont expose our LPs to counterparty risk.” Soon, his and Jains views changed. The breadth of assets available on the platform makes it invaluable, and the speed of execution by the Binance team — regulation be damned — is impressive. In a matter of months, Samani went from skeptic to believer, willing to back his optimism.

One source emphasized that the bet is indicative of Multicoin’s different risk profile, especially the company’s willingness to defend itself against reputational damage. At the time, few U.S. funds were willing to approach Binance because it was lax about following the rules. To this source, Multicoin seemed to be asking, “What has to lose?” They followed up, adding, “You either lose badly or you win. Multicoin wins.” The company traded at close to $6 The bottom bought Binance’s token, BNB; today, it’s trading at $388.

While investigating Binance, Samani came to realize how little the company knew about the Asian crypto market: “We started to feel like we needed to be closer to what was happening there. As an American, that wasn’t going to happen.” Multicoin began looking for areas to embed Investors in the ecosystem, although it wont be easy. According to Samani, some of the largest global recruiting firms turned down their business, saying it was too challenging a task. Eventually, Samani relocated for a month and a half to conduct field interviews. At a conference in Shanghai, he met Mable Jiang, an investor in a family office focused on cryptocurrencies. An initial friendly debate about the regions Tier 1 potential led to further meetings. It didnt take long before Samani made a suggestion to Jiang:

At the end of the year, Multicoin established a position on another exchange. In the spring of 2019, Sam Bankman-Fried introduced FTT, the native token for investing in FTX, to the company. We passed, Samani said. We were all keen on Binance at the time. Still, Multicoin will follow Bankman-Frieds work. By Q4 2019, they had seen enough convincing to buy FTT when the token was trading below $5; last year it peaked near $80 before falling back to $43.

After a tumultuous previous year, 2019 ended on a high. While markets have been volatile, with bitcoin soaring and ether sinking, Multicoin has executed on multiple fronts, finding unusual investments and expanding its opportunity set. Samani and Jain must have ended the year in relatively good spirits. After all, Bitcoins production will be halved in May 2020, an event that many believe will boost prices. During the preparations, Samani and Jain decided to go a long way. It hasn’t been long in 2020, and optimism has sparked for Multicoin.

first level title

collapse

In hindsight, we know that Multicoin made several great investments in 2019 and 2020. However, the funds outperformance was not obvious at the time. Many who associate Multicoin almost exclusively with EOS blame it for the projects various woes. Meanwhile, The Graph, Helium, and Solana havent taken off yet. To make matters worse, all three are running out of money. Things are about to get worse.

In 2020, Bitcoin plummeted 50% in two days, falling below $4,000. In Samanis view, the sudden downturn stems from a fundamental flaw in the industrys market structure. Due to the fragmentation of trading venues and the slowness of the Bitcoin and Ethereum networks, arbitrageurs are unable to rebalance pricing during periods of high usage, resulting in huge variances. As prices fell, cryptocurrency mining became unprofitable, causing miners to shut down operations, further exacerbating network congestion. With cascading liquidations, the market entered a death spiral, and if popular exchange BitMex hadn’t stumbled unexpectedly, Jain thinks it would have continued to its logical conclusion:

Im ready for the Bitcoin price to drop to zero on BitMex. If BitMex hadnt fallen the moment it did, I think Bitcoin would have dropped to zero that day. BitMex said they did a maintenance, I think that was very fortuitous timing.

Reflecting on the impact of that day on Multicoin, Samani said: “We were never insolvent. But we were hit hard.” Jain called it “one of our darkest moments.”

There are bright spots in the downturn. Multicoin made another strategic adjustment, deciding to stop actively trading its portfolio. “We realized you can’t predict a black swan like this,” Jain said, “In January 2020, you can’t predict what’s going to happen in March. We decided to stick to our strengths: asset selection and thesis formation.” The market has timed itself to barely paying attention to them. “Limited partners keep asking me for my opinion on the market,” Jain said. I dont know. I have no problem.

Ray Hindi from L1 Digital noticed an improvement after the Multicoin switch. “I still remember we had discussions with them that what they were really good at was taking idiosyncratic risks.” According to Hindi, after digesting this, Multicoin “turned things around in a big way.”

The breakup of the market also gave Multicoin the opportunity to prove their conviction to themselves and the rest of the market. At a time when most investors are taking a step back from aggressive deployments, the team is doubling down on Solana. Theyve also invested in music streaming platform Audius, an act of validation insisted by founder Roneil Rumberg. Its not like someone was lining up outside the door to lead that round, Lemberg said. “[Multicoin] is firmly moving forward.”

The companys investment in dForce was almost an even bigger failure. Just four days after the DeFi protocol announced its investment in Multicoin, hackers stole $25 million. For Mable Jiang, it felt like a disaster — dForce was the first project she supported. It was very, very big news for the company at the time, Jiang said, especially because our AUM wasnt that big. A concerned LP called Samani and Jain to find out what was going on.

Miraculously, the money came back, recalls Jiang. Just days after it disappeared, the hackers returned what they had taken. Aside from the episodes happy ending, what impressed Chiang most was the GPs handling of the crisis and her unwavering support. Multicoin has weathered yet another storm, and the good times are finally about to start again.

first level title

on fire

If Multicoin had trouble raising funds early in its life, it wont have such trouble by the end of 2020. They turned down funding, recalls Bridge Alternatives Brian Walls. Many who mysteriously “didn’t see the email from Multicoin’s first venture capital firm” suddenly jumped at the chance to gain asymmetric exposure to the burgeoning cryptocurrency space.

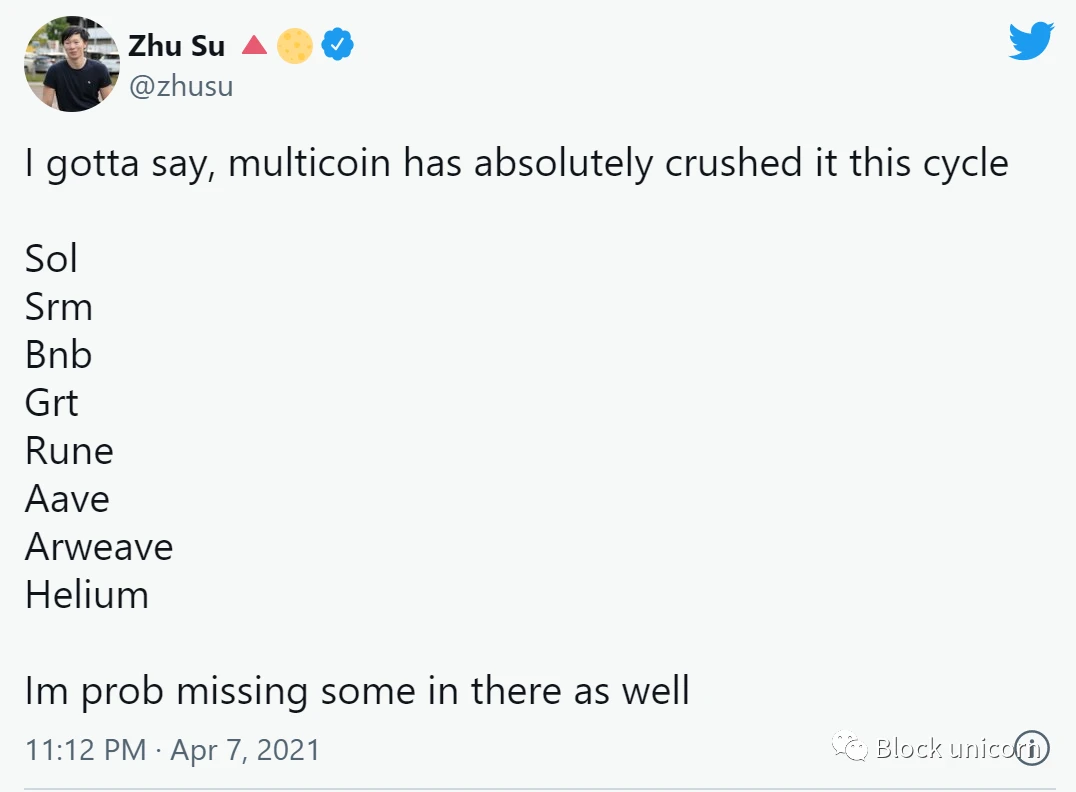

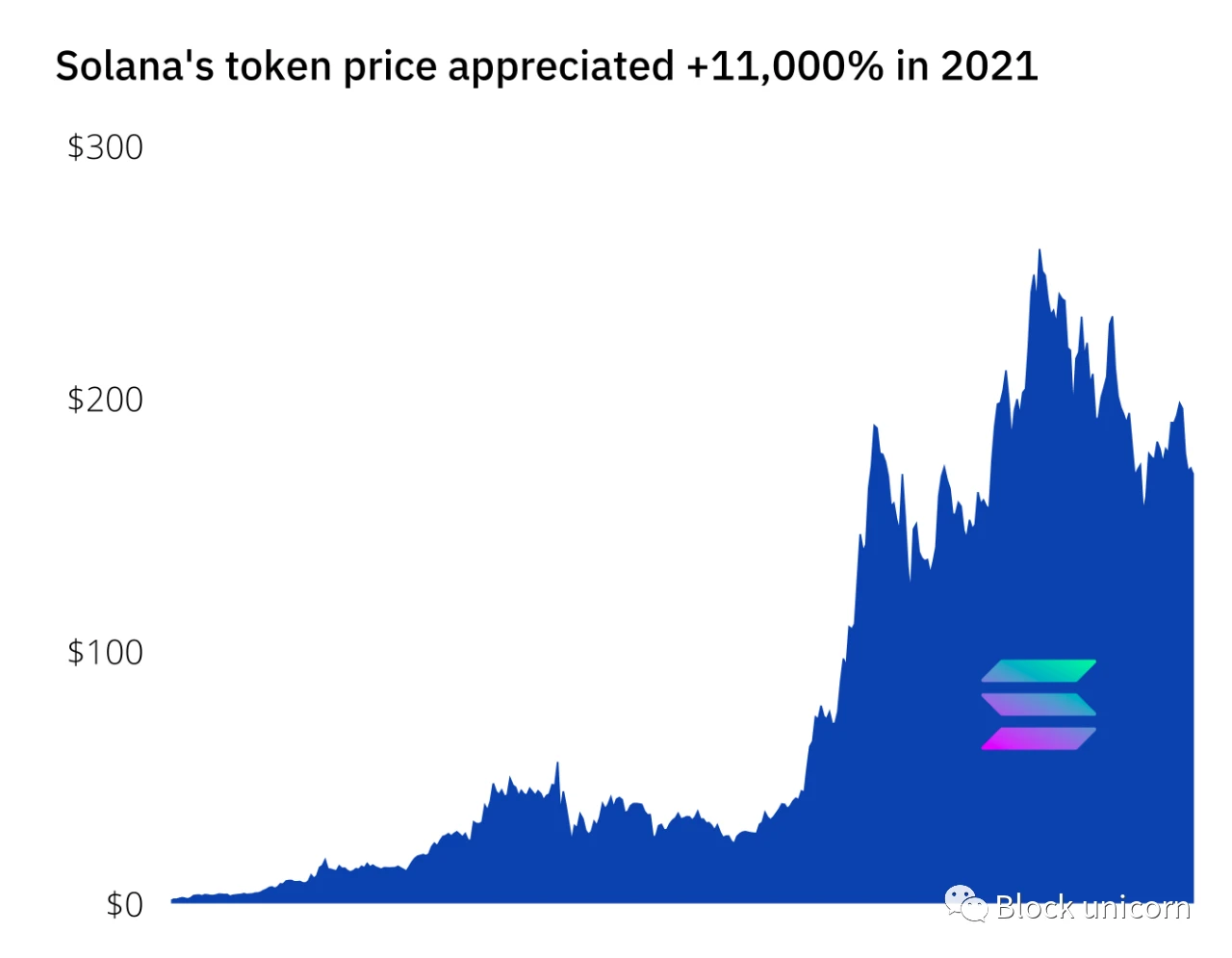

In May 2021, Multicoin announced the launch of a new $100 million vehicle called Venture Fund II. By then, the sector was in the middle of a ludicrous rise, with both established and rebel currencies making new all-time highs. Things are only going to get better for Multicoin. Heliums token rose to a high of $55.22 from $1.30 at the start of the year. Solana started 2021 at $1.52 before surging above $260, attracting users, developers and investing heavily in the process. While many others have benefited from the bull market, Multicoin appears to have won more than any other fund, with many of its long-term bets appearing to pay off immediately.

Zhu Su, founder of Three Arrows Capital, summed up the sentiment, listing Samani and Jain’s investments, adding: “I’d say [M]ulticoin absolutely smashed the cycle.”

As we will soon learn, the extent to which Multicoin “smashed it” may not only be extraordinary, but historic.

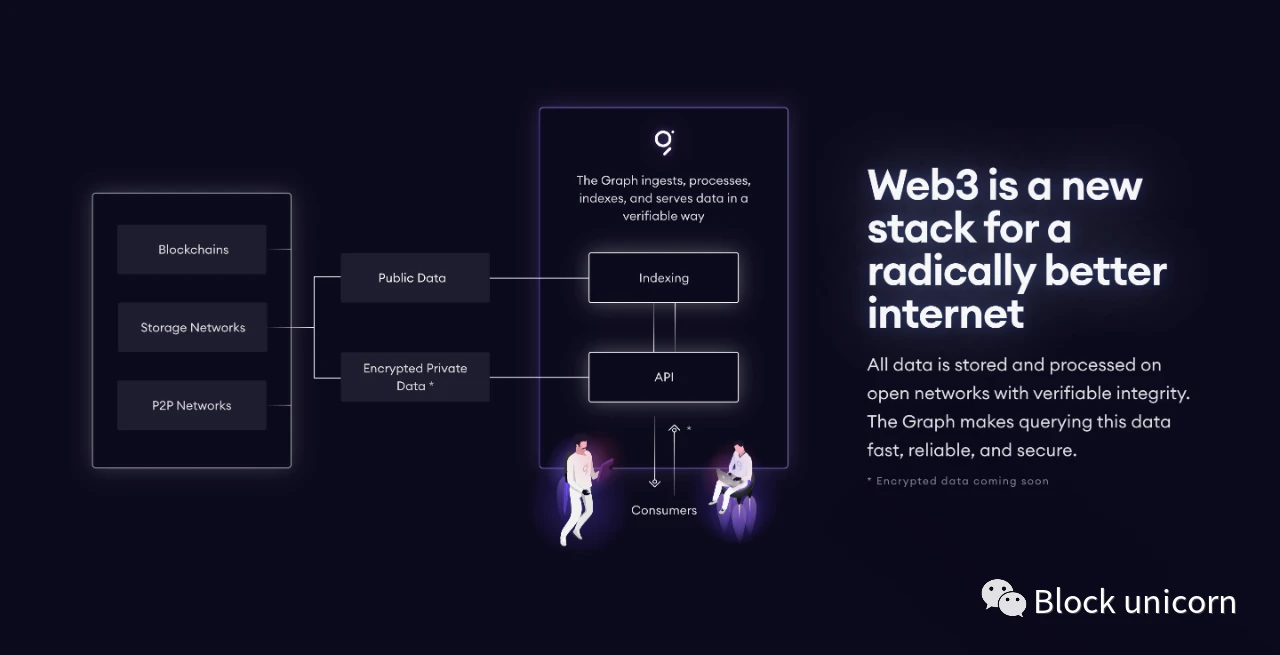

The Graph

Four bets: GRT, HNT, EOS, SOL

Multicoin lists 27 projects and companies in its portfolio; over the course of its five-year life, the company has undoubtedly held and traded dozens of other assets. While all of these are part of the Multicoin story, four investments define what Samani and Jain have built more than anyone else: Graph, Helium, EOS, and Solana.

In February 2018, Kyle Samani received a cold Twitter DM from Yaniv Tal, founder of a protocol for querying blockchains. Tal was impressed by Samanis article titled A New Model for Utility Tokens, which explored token models and mechanisms. After a few quick thoughts, the two answered the phone to discuss Tals startup: The Graph.

In a quick phone call, Tal explained the need for a network query protocol like ethereum. While MetaMask founder ConsenSys has created a centralized alternative called Infura, Tal thinks its unlikely to be the right long-term solution. His project leverages the open-source GraphQL coding language developed at Facebook six years ago.

Multicoin’s investment in The Graph not only demonstrated the company’s willingness to pool its positions, but also prompted one of the aforementioned strategic changes. After spinning off some hedge funds to invest, Multicoin realized it could potentially invest in other private market rounds, pushing the company to spawn a venture capital vehicle.

Helium

Although The Graphs development path has had many bumps and challenging fundraising campaigns, Multicoins faith has been rewarded multiple times. Today, the protocol’s token, GRT, has a fully diluted market cap of $4.1 billion.

secondary title

Notably, the founder of Helium also reached out to Samani after reading a post from him — further evidence of the high ROI of Multicoin written works. Amir Haleems distributed wireless network initially did not utilize cryptocurrencies. However, as Haleem learned more about the nascent space, he realized it was a perfect fit for what he was building. The problem is that he has very little experience in structuring economics for such a project. “In the beginning, I was very naive about token economics,” Haleem said.

Haleem and Samani established a correspondence link. Over the next few years, they exchanged e-mails, answered the occasional phone call, and met in person when circumstances permitted. In January 2019, Haleem was finally ready for a new round of funding. He immediately asked if Multicoin would invest. Multicoin is again highly concentrated betting on the business, deploying over 11% of venture funds, following through with hedge funds, and operating SPVs for LPs.

They then began helping Haleem develop the projects token economics strategy. “We spent three months helping Amir think about what a token is because we strongly believe token incentives could be a meaningful differentiator for Helium,” Jain said. Haleem could not believe the level of support provided by Multicoin. During our conversation, he talked about how VCs often use the phrase “let me know how I can help” as a goodbye kiss, but Multicoin rolled up its sleeves in a way he hadn’t seen before.

EOS

In addition to funding and strategic assistance, Multicoin stepped up at the launch of the Helium network, purchasing 75 hotspots during a launch event in Austin and setting them up in the city. Amir made us pay the full retail price, Jain said with a laugh. Once again, such efforts have paid off handsomely. Helium has a fully diluted market cap of $5.1 billion. Given the size of the telecommunications industry, there is a lot of room to grow. Jainism commented on this topic, stating:

Weve spent a lot of time developing Heliums strategy because we care deeply about it and want to see it play out. Everyone in the world deserves an internet connection, and it needs to be cheap. The market is big enough to be worth our time.

Not all Multicoin investments have been so successful. Among the funds missteps, none were more serious than its investment in EOS. Multicoin’s partnership with Layer 1 failed to pay off and tarnished the company’s reputation in the eyes of some in the industry.

By February 2018, Kyle Samani was disillusioned with Ethereum. The agreement wasnt being sent as fast as hed hoped. To make matters worse, many of the most talented contributors have left. In the two years Ive been following Ethereum, the scaling roadmap has changed three or four times. I realized all the developers retired, theyre gone. Gavin Wood, one of Ethereums co-founders, has moved to A new project, Polkadot, and Vitalik Buterin couldnt move fast enough.

Multicoin, frustrated by the inactivity, started looking for an alternative to Ethereum. One of the firms analysts suggested looking into what Dan Larimer was building at EOS. Although he has yet to achieve significant success, Larimer has built several high-profile projects, including decentralized exchange Bitshares and blockchain social media platform Steemit.

“By early 2018, we started looking at EOS,” recalls Samani. We said to ourselves, You know what? This guy has learned a lot about shipping blockchain, and hes shipped more in crypto than almost anyone else.

It doesnt hurt that Larimers latest project, EOS, raised $4 billion in a year-long ICO and gave it execution resources. Larimer also attracted a strong team with the skills to meet the June release deadline.

In addition to Larimers experience, an important part of Multicoin computation is the congestion of the Ethereum network. Launched last November, CryptoKitties demonstrates how increased demand can drive gas prices to exorbitant levels. Samani and Jain believe that blockchains that solve this problem will inevitably emerge, enabling low cost and high throughput. In order to achieve this speed, EOS has made compromises in terms of decentralization, which is a view that industry purists find difficult to accept. “At the time, the idea of not moving in the direction of being as decentralized as possible was considered a curse,” said Marcos Veremis, a limited partner at Multicoin.

In April 2018, Multicoin shared their thesis on EOS and announced their investment:

EOS is a blockchain and smart contract platform focused on speed, scalability and user experience. EOS uses Delegated Proof of Stake (DPoS) and a token ownership as bandwidth model to achieve high throughput and zero transaction fees.

On the day of Multicoin’s post, the EOS token was trading at $15.34.

Had Multicoin stopped making this announcement, it might have avoided much of the rally. But thats not the style of the company. When Samani and Jain invest in a company, they have their full support and are not afraid to let the world know. On Twitter in particular, Samani and Jain evangelized EOS to an audience that mostly wanted nothing to do with it. Followers of ethereum found it ridiculous that someone could topple their favorite network, while the libertarian element of cryptocurrency bristled at the idea of a centralized project.

When EOS struggled, many were keen to poke fun at the outspoken fund. We think its a really smart, innovative model, Samani said. It turned out not to work. The system became unusable within six months.

Beyond simple schadenfreude, some commentators have questioned Multicoins intentions. At that time, it was not uncommon for investors to pump and sell, that is, after retail investors bought and speculated, they expanded their investment to sell. Twitter critics at the time often suggested that Samani and Jain were no better than EOS holders, and they were trying to shift the blame to bigger fools.

An outside source with knowledge of Multicoins trading history commented: If they exited that position, you could accuse them of adding to it. But theyre not exiting. While Multicoin did support EOS at every opportunity at the time, They never seem to use it as a catalyst for exit. Samani shared that the firm exited its EOS position in late 2018. We may have sold the bottom of EOS, he said. Another source said: I think they lost a lot. I dont think its about a quick flip.

Solana(SOL)

Ultimately, while the unpretentiousness of Multicoin caused some errors, the main complaint seems to be a stylistic one. Every investor backing an early-stage company in a volatile industry should not be expected to have a 100% hit rate. They had a thesis, but apparently they were wrong, noted L1 Digitals Hindi. Its an unavoidable risk.

secondary title

If Multicoin hadnt invested in EOS, it might have missed its biggest winner. Speaking of EOS, Marcos Veremis said: “It ended up leading them to Solana. It was one of the biggest home runs ever for the fund.”

After spending months researching Larimers project, Multicoin is ready to realize the potential of another high-throughput blockchain. In April 2018, Samani was introduced to former Qualcomm developer Anatoly Yakovenko, who was working on a project called Loom. According to Samani’s recollection, Yakovenko’s pitch platform referred to it as “the Nasdaq of blockchain.”

In the pairs first meeting, Yakovenko came across as impressive -- though not entirely positive. “Several things stood out to me from that first conversation,” recalls Samani. One is that he has a hard time explaining how it works. The second is that he has a specific use case. While many entrepreneurs Samani meets tend to think about their projects from an academic and theoretical perspective, Yakovenko focuses on Build a high-performance blockchain-based order book.

As impressed as Yakovenko was, it took the team several months to grasp the full potential of what he was building. By early summer 2018, it clicked. In May, Multicoin led a round in the project now called Solana. As mentioned earlier, the company aggressively ramped up its bets in 2019 and 2020, buying stakes from less committed investors.

Like EOS, some cryptocurrency commentators have criticized Multicoins relationship with Solana. In many ways, these accusations follow a similar logic, referring to Solana’s relative focus on speed over decentralization and Multicoin’s role as a vocal supporter. Beyond the blows, critics point to Solana raising private money, giving venture capital firms the chance to buy at a better price. While there are debates about the trade-offs involved in selling a project to insiders, focusing too much on this misses the reality of Solanas history. Helium founder Amir Haleem summed it up nicely, noting that when it came to Yakovenkos project, access wasnt really a challenge. Apart from Multicoin and one or two others, for most of the projects time , no one is claiming SOL tokens. A related criticism is that by allowing whales to buy, projects allow their tokens to be unfavorably centralized. If a major VC sells its stake, the entire ecosystem could shake and collapse. Worse, bad actors with this power can conspire to drive up prices or coordinate sell-offs.

secondary title

again

Making these arguments in Multicoins case seems to vastly underestimate the companys influence and misunderstand the fundamental relationship between investors and businesses. “They were very closely involved in every major turning point, every major decision, every funding round for us,” Raj Gokal said of the company. Multicoin was like a third co-founder for me and Anatoly. Perhaps Multicoins most impactful contribution was its partnership with Sam Bankman-Frieds project, who agreed to build a decentralized exchange. Not only does it bring Yakovenkos vision to life, but it also brings Solana to the attention of the wider ecosystem, sparking its extraordinary 2021.

To this day, when Solana has problems, Gokal said of Multicoin, “They were the first people I called.”

There are many ways to evaluate investors, how much ownership can they reliably acquire in the business? How often do they go head-to-head with other companies? What weapons do they have that other dispensers dont?

Ultimately, two factors may matter most: financial return and market reputation. Turning $1 into $10 or more is the most important thing at the end of the day for most LPs - but its a lagging indicator. Especially in risk trading markets, where trading is restricted and reputation is of the essence. In the current market, the founders opinion matters most. The builders hold the power, and to keep winning in the VCs iterative game, the money must please the entrepreneurs they back. On both fronts, Multicoin appears to be doing well.

secondary title

return

In discussions with various Multicoin LPs, I have a clear picture of the companys financial performance. With their help, I was able to write what I believe to be the most thorough and up-to-date assessment of Samani and Jains return. Multicoin declined to comment on performance.

Currently, Multicoin has four entities that can be evaluated: three venture capital vehicles and an evergreen hedge fund. Notably, Multicoin has yet to confirm its latest venture fund, although an October report from The Information put the fund at around $250 million. Given its novelty, we can safely ignore it for now.

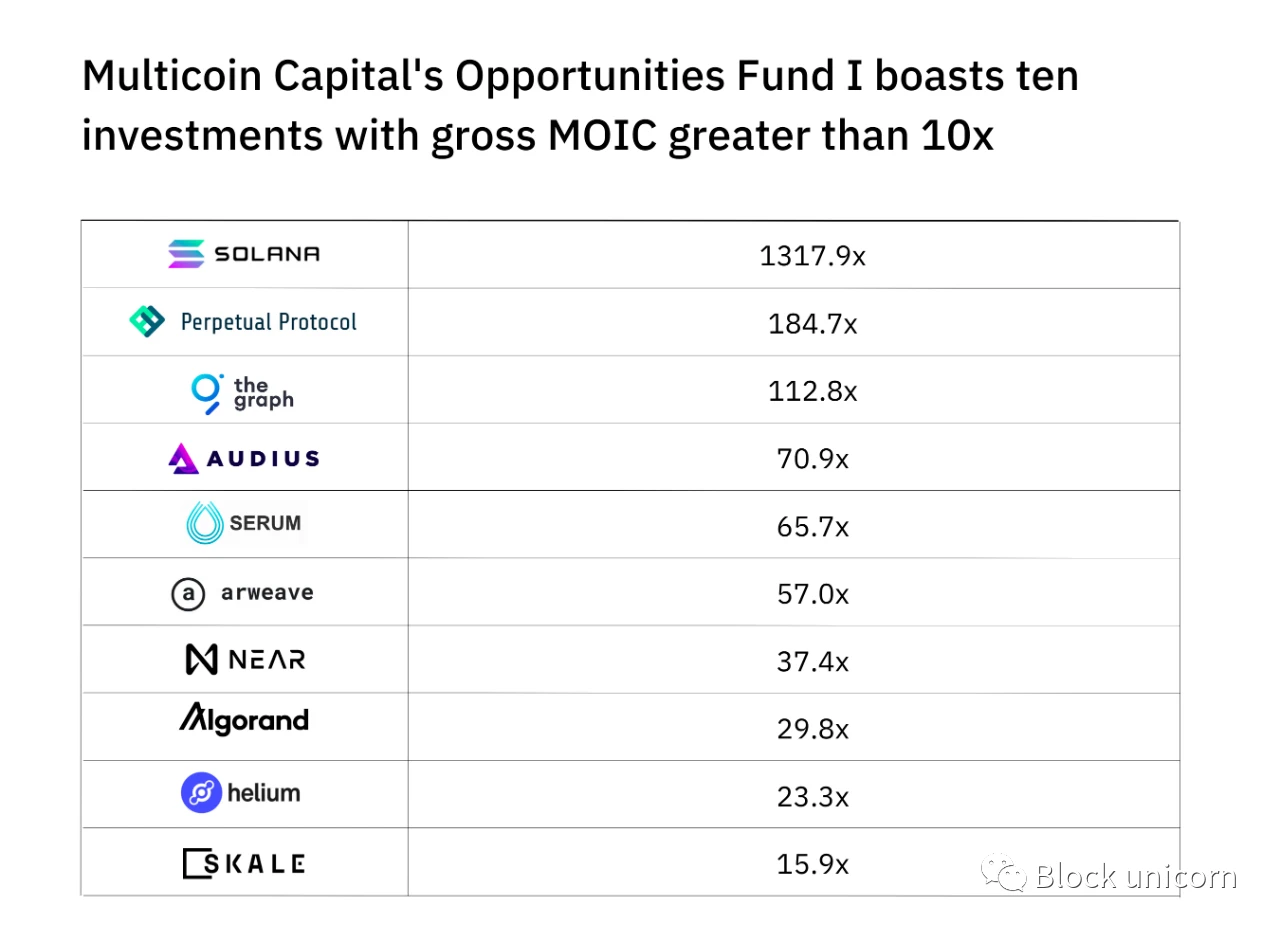

We can start by looking at Opportunities Fund I, a venture capital vehicle raised by Multicoin in July 2018. As of Q3 2021, one LP shared the funds returns, including multiples of invested capital (MOIC) and distribution of paid-in capital (DPI). Frankly, the numbers are mind-boggling:

The total MOIC is 114.7 times

Net MOIC of 89.1x

DPI is 47.0 times

For context, a venture capital firm with a 10x return on invested capital is considered legendary. Union Square Ventures is one of the most reliably good investors ever, with a whopping 13.87x valuation for the 2004 vintage, at least in 2018. The fund includes Twitter, Zynga and Tumblr.

It’s worth noting that Multicoin’s Opportunities Fund I is only 4 years old, making it younger than both of these long-established instruments. Of course, the volatility of the crypto industry means that Multicoins numbers fluctuate - and these come from the heart of a bull market. Conversely, many of Multicoins winners have yet to reach full value. It may already be the best-performing venture fund ever; four more years from now, and its returns could be even crazier.

The Solana is the cars biggest winner, but by no means the only one. Ten of the 27 investments have achieved or exceeded a total MOIC return of 10x, with many well exceeding that figure:

image description

According to information shared by Multicoin Capital LP

As mentioned earlier, Multicoin has done an excellent job of sizing its biggest winners, particularly with concentrated bets on Helium, Arweave, Solana, Serum, and Algorand.

One of the challenges for well-performing crypto funds is managing LP allocations. Since Multicoin is a significant investor and backer of its portfolio, it doesnt make sense to convert its winners into cash. Not only will it hit the position itself, but it may lead to meaningful growth. Projects like Solana have appreciated rapidly but could still compound over a long period of time. To solve this problem, Multicoin distributes some of the rewards in the form of tokens. Firms only do this for assets that they intend to maintain on their own for future appreciation.

Although relatively new, Venture Fund II appears to be off to a good start. While I received less detailed information about the car from LP, I was able to share a high level of performance. As of September 2021, the funds total MOIC has risen 5-6 times. LP sources I spoke to noted that they believed the numbers were conservative because holdings were flagged as if auditors had done so. Therefore, they may not include locked tokens or discounts. These numbers are impressive given that Venture Fund II has been around for less than 18 months.

Interestingly, Hindi pointed out that from a return perspective, he also saw another fund operating in the Multicoin Alliance: 1kx. Founded by the former founder of the German ride-sharing service, 1kx has achieved success by taking the opposite approach to Multicoin. While Samani and Jains funds pursued alternative Layer 1 and other idiosyncratic projects, 1kx leaned toward Ethereum and its spinoff ecosystem, getting into DeFi, NFTs, and DAOs early on. These two guys have outperformed everyone we know, Hindi said, and theyve both done really well for different reasons.

Multicoins first VC vehicle is an LPs wildest dream. Its stellar performance in Fund II and its hedge funds demonstrates not only its ability to generate extraordinary returns, but its consistency in sustaining those returns.

secondary title

reputation

Sequoia launches a crypto fund in 2022. Its very existence is a testament to the industrys growing power, but the time it has taken for the agency to embrace the movement hints at broader trends. The funds that dominate the web2 venture capital world have been slow to recognize the opportunities presented by the likes of Bitcoin. Among Tier 1 companies, it can be said that only a16z took the initiative to jump up.

Inaction at the top of the food chain leaves room for insurgents. Ask a cryptocurrency founder who they think is the most influential investor in the space and they might list companies that didn’t exist a decade ago: Multicoin, Polychain, Paradigm, Dragonfly, Libertus, 1kx, Variant, Electric , frameworks, prototypes, etc. These firms emerged as a direct response to the crypto revolution and have established themselves as venture capital leaders in the space, able to win duels with the big funds and monoliths of the old world.

Multicoins track record certainly puts them at the top of this illustrious group, though some still see the companys investment in EOS and outspoken style working against them. “People either love them or hate them,” said one cryptocurrency investor. In a few cases, they introduced founders to companies that were turned off by Samanis dismissive, rude and aggressive style, another person noted.

Those who knew Samani said there was no malice in the intensity. The same source who spoke of Samani’s outspokenness to the founder explained that while the GP may call it “bullshit” on a point he disagrees with, “he’s just expressing an opinion.” Co-founder of Audius Roneil Rumberg made a similar point: Kyle can be rude at times, but hes actually a really sweet guy. I think its just his way of arguing with ideas.

For some founders, the immediacy of Multicoin is an attraction. When asked about the funds style, Tegan Kline, The Graphs head of operations, said it was very much in line with The Graphs culture: put your ideas on the table and fight for them.

Multicoin and its partners are also popular for other reasons. While Samani may not always have been the smoothest of speakers -- though some think hes become more refined in recent years -- there are a few whispers about him. Kyle is very special, said LP Ray Hindi. One of Samanis most notable strengths is the way he fights for founders. Hes going to fight for his fucking company, says one cryptocurrency investor, whom hes going to fight for. No fight is too big for Kyle Samani. Those who find themselves People on the side of the conflict dont like Samani; those on his team adore him for it.

In addition to his unwavering commitment to the founder, Samani is an unusual thinker. Those who worked with him described his handling as almost masterful. Partner Matt Shapiro said:

In my life, I have dealt with many people. Im in the room with well-known successful people -- CEOs of big companies, and all of those people. Ive never met anyone who thought, Oh my God, this guy is smarter than me. Kyle made me feel that way. The neurons in his brain... he just gets the right answer faster than anyone else.

Samani is the perfect foil to the subtle Tushar Jain. Audius Rumberg described him as gentle, contemplative and very accurate in speech. When a Jain speaks, he usually has something important to say. Tushar is very strategic, Klein said, a quality that has huge implications for the portfolio business. I met him in Lisbon, Klein said of Solanas developer conference, and we had a 10-minute conversation that completely changed my next three months.

With Samani and Jain at the helm, Multicoins leadership appears particularly balanced. “Their relationship is yin and yang,” says Audius co-founder Forrest Browning.

Multicoin may have detractors, but the people who matter most — the company’s entrepreneurs — are uncharacteristically bullish on its work. “Multicoin is the two funds that have been most helpful to us,” Klein said. Helium’s Amir commented that even though Multicoin did help him build his network, “they seem to be looking for ways to have value.” Solana’s Raj Gokal mentioned that the general market “doesn’t know” the company’s softer side:“ Anyone who has worked with Multicoin knows that these guys are the best, even in crypto, in tech.”