Original author: SHAYON SENGUPTA

Original compilation: Block unicorn

Price is newsis a frequently used motto in the cryptocurrency community and is quoted whenever there is a rapid price movement on the network that attracts more participation and attention. However, I find that the opposite of this statement may be even more profound:News is price。

In my contribution to What to Expect in Multicoin 2024, I described a clear change in the way assets are priced, which I dubbed the “Value Focus Theory.” In the crypto space, the primary input to asset pricing is not around risk premiums or multi-factor models of cash flows, but around the perceived amount of time, effort, and capital invested by the community surrounding an asset. It’s important to note that this is not a normative statement, but rather an observation of how tokens as an asset class have historically flowed.

The Internet enables arbitrary, two-way information transmission. Cryptocurrencies build on these foundations by enabling arbitrary, two-way transfers of value. Today’s consumer internet—streaming platforms, online media, mobile apps, social media, etc.—can be summed up as an attention marketplace, and as such, money and attention increasingly have similar characteristics.

In the 1930s, Benjamin Graham waited for quarterly reports and financial statements to purchase paper stock certificates through human brokers to express his value investing thesis. In 2020, there was news that hedge funds were going to short Gamestop. Retail investors spread the news to every corner of the Reddit community, attracting thousands of retail investors to buy Gamestop shares on Robinhood, causing the stock price to soar within thirty days. 15 times - Confronted with hedge funds and exploded hedge funds positions (retail investors vs. Wall Street).Consumer Internet and encryption infrastructure make the basic unit of information and value smaller (Block unicorn note: when the information gap continues to shrink, the price difference in the market will also be smoothed out), and at the same time increase the number of data consumption and value transactions. quantity and frequency. As this trend develops, value focus theory becomes even tighter—information is money and money is information.

While markets for attention and value exist in reality, we haven’t really seen them collide. When we think about crypto consumer applications, this is what were looking for. Crypto enables new assets to be quickly created around attention and traded where that attention is gathered: consumer-facing applications.

In the coming years, we expect consumer developers to meaningfully incorporate cryptocurrencies into the structure and user experience of their applications, massively changing the scope of what can be traded and where. Internally, we call this type of application Publisher Exchange.

Block unicorn Note: Publisher Exchange refers to the ability to publish content and trade on Web3 social platforms. Allow users to publish content, attract attention, complete transactions, and obtain benefits.

publisher exchange

Exchanges have natural product-market fit in the crypto space because one of the core uses of cryptocurrencies is to transfer value. Coinbase (fiat currency exchange and centralized exchange), Tensor (digital collectibles exchange), Jito (trading intention and block space exchange), and Phantom (order flow exchange) are all different forms of exchanges.

In the crypto space, exchanges have a similar position to major publishers in the consumer internet (such as X, Instagram, and the New York Times): publishers control the flow of attention on the consumer internet, while exchanges control the crypto space capital flows in.

As we think about the next generation of consumer applications, we expect to eliminate the boundaries between exchanges and publishers, creating new experiences that combine currency and attention.

Kyle (Multicoin CEO) wrote about UI layer composability in his 2024 Ideas contribution. The simplified implication of this argument is that the next big online exchange wont have traditional order books, depth charts, etc. like Coinbase; instead, it will be more like a short video app where users can bet on upcoming creations the virality of user content, or a group chat where friends can instantly launch NFT collections based on inside jokes or memes, or an are.na-style curation platform where designers can create content based on their taste. And gain fame and wealth. In other words, through cryptographic unique functionality, consumer applications are both publishers and exchanges: publisher exchanges.

Publisher Exchanges increase the surface area for new asset issuance by embedding issuance and native trading into application front-ends, and allow these assets to be interacted and coordinated in novel ways. Introducing trading into familiar venues may seem narrow or analog, but we believe narrow markets are the beginning of the discovery of emerging behaviors that will lead to the creation of huge new platforms.

This will be a golden age of experimentation—a white space for developers to experiment with combining native issuance and transactions with new types of app experiences. Crypto-native consumer applications will treat these design principles as first-class citizens.

The emerging publisher exchange category

The goal of Publisher-Exchange is to meet the needs of users by trading at the same time as the content that users care about at any given moment. The next generation of consumer applications in the crypto space will allow users to natively issue and trade assets, thereby directly monetizing the user attention they capture.

For founders looking to build Publisher-Exchanges, we believe some design principles from publisher and exchange history will be relevant.

In the history of the consumer internet, publishers have essentially been content marketplaces, and marketplaces are driven by two core attributes: 1) discovery and curation (presenting content users want to see and interact with), and 2) trust and reputation (showing content to users) User provided guarantee). Successful publishers can generate strong liquidity by measuring the attention time users spend on them. That’s why Upworthy measures success in “minutes of attention,” and why Elon Musk is obsessed with “never regretting what you see every minute” and “never regretting every second you see.” ——To put it simply, it means that the content users see every minute and second is valuable and will not make users feel disgusted.

For publisher-exchanges, the key is to first build an engaging core experience that attracts users time and commitment, and then embed asset issuance and transfer consistent with the unique engagement they generate.

We do not think of an exchange simply as a trading venue, but as an Athenian marketplace where people interact and exchange experience, value and information in a strictly defined, context-specific environment. With this in mind, we conceived of several broad application categories where we believe opportunities arise for Publisher-Exchanges.

communication tools

Messenger (messaging app) is a prime candidate to become a publisher exchange.

An early example of this argument can be seen in WhatsApp and WeChat. Both platforms have rich developer ecosystems in India and China and are built on strong, state-mandated digital payments infrastructure. This allows teams like Sama and Meesho to embed AI annotation and local merchant e-commerce labor markets directly into the contextual state of users in their social graphs on these platforms.

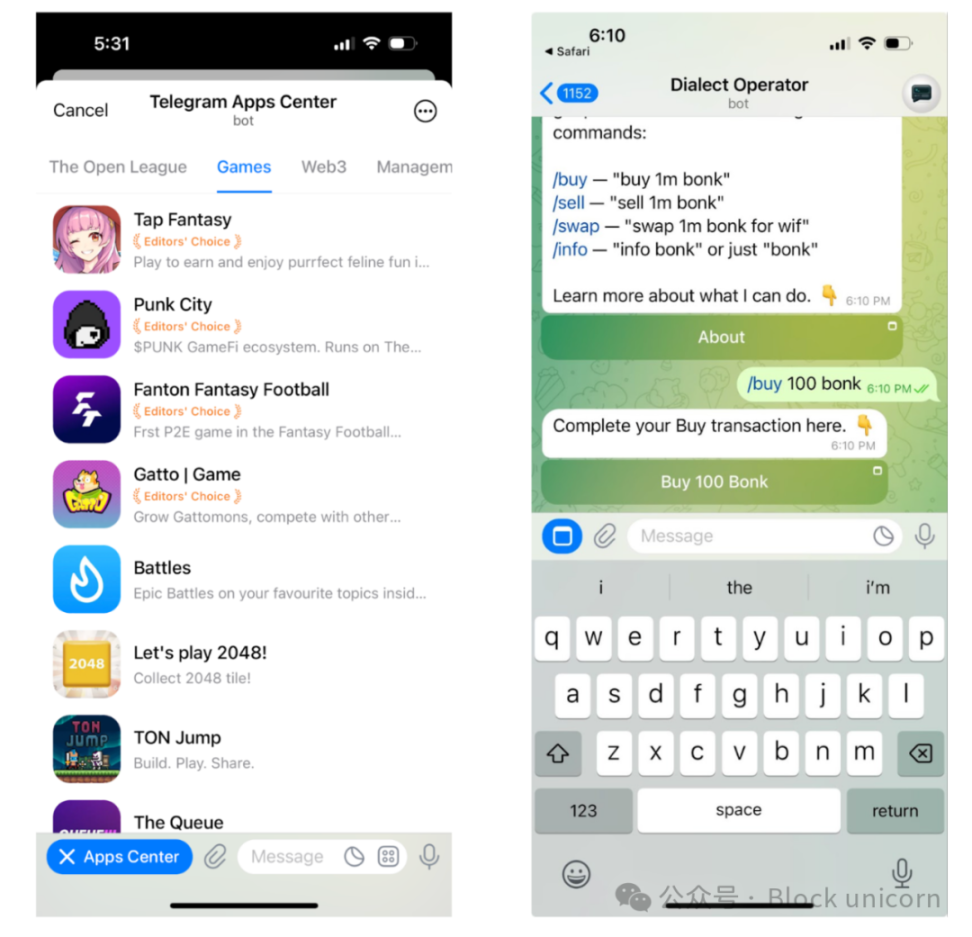

In the crypto space, Telegram is the de facto messaging app, and their bot API creates a vast design space into which issuance and value exchange experiences can be embedded. Products like Dialect Operator and Maestro exemplify this perspective. They indicate that users want to be able to conduct transactions directly within their chat. These Telegram trading bots fit the definition of a publisher exchange because they bundle discovery and intent with execution, closing the loop between attention and value delivery. Telegram has its own hidden app store (go to search and type “tapps”) with hundreds of bots that allow users to send payments, play games, discover content, and more.

While these publisher exchange bots are used to reduce execution times for retail traders looking for super-high returns in closed chat groups, there are further opportunities to significantly increase the range of assets that can be issued and traded. We expect chat groups to become the base layer for new forms of work (get paid for completing tasks directly in chat), special projects (crowdfund new initiatives in large conversations), and entertainment (issue memecoins like sending gifs), all of which The Publisher Exchange experience.

Content Networks The largest social media applications (Instagram, TikTok, X, Youtube) are content marketplaces where creators of music, posts, videos, or other user-generated content compete for users’ attention. Creators can then use the attention they accumulate to sell content or brand products.

The north star of crypto content networks is that audiences support individual creators or pieces of content, with creators receiving a significant share of the revenue from the content they create. This was the original theory for creator tokens, but we found that if these creator tokens were disconnected from the platforms their audiences were on, they alone might be less likely to succeed.

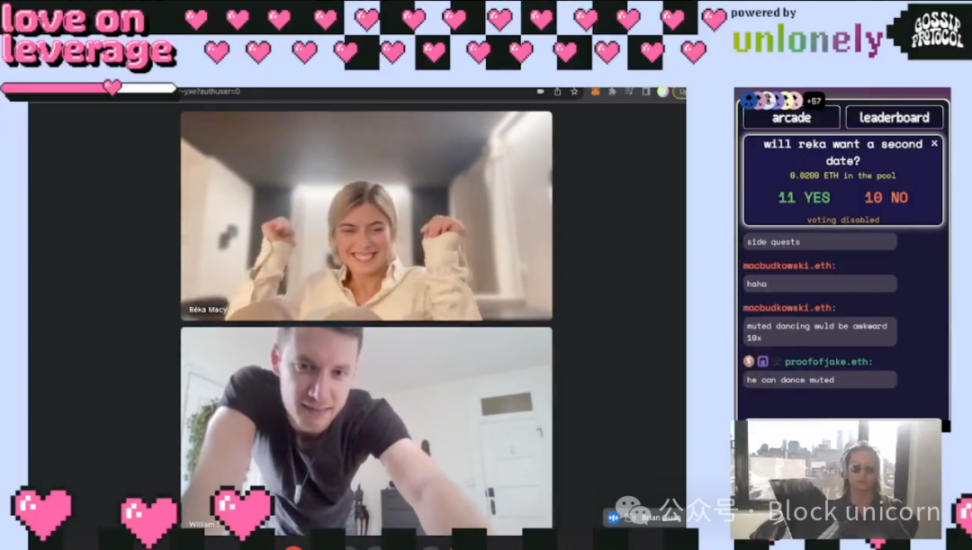

We are seeing early experiments today with new types of content networks, each issuing and trading new types of assets within applications. We envision a new type of content market where users come for entertainment but stay for the market.

Unlonely is a streaming platform that embeds token issuance and prediction games directly into streams and chats. Farcaster Frames are another example of their ability to interact directly in on-chain state, in food, providing endless opportunities to issue and trade assets in familiar venues.

Today, most content networks monetize user attention through display ads. Ad-based customer acquisition models often suffer from poor funnel conversions and are decidedly a sub-optimal solution as it often interrupts the user experience; the user is aware that they are being marketed to.

Display advertising is a relic from the pre-crypto era. A more basic method for merchants to acquire users is through Direct Value Issuance (DVI)—that is, paying users directly with tokens.

Advertisers should be able to deliver value directly to users rather than providing targeted ads based on user behavior/group building. A content network wouldnt need to place an ad about a sports betting platform between the posts of a user scrolling through an NBA game broadcast — instead, it could allow sports betting platforms to airdrop $50 worth of credits directly to users.

Rather than transacting through platforms as rental intermediaries, advertisers are handing their customer acquisition cost budgets directly to end users. In turn, content marketplaces can offer their users a superior product: they move from being a venue where their attention is actively mined and seeing no resulting benefit (by displaying ads), to one where they earn based on their attention patterns and spend assets and have direct exposure to this financialization process (through DVI).

A backdoor embedded in an ad network may be even more compelling - by providing each user with an address, it allows apps to cost-free embed universal financial services that can add to the deep interactions a user already has.

information market

Search engines in the 1990s were dedicated to organizing information on the Internet, initially focusing on static web pages and then expanding to new forms of media and content. Initially, the cost of accessing this information was subsidized through advertising.

Today, the information on the Internet is much more than just web pages—its spread across thousands of forum posts, group chats, podcasts, and private databases. Information markets (e.g., prediction markets, sports betting platforms, alternative data providers) are a way for users to sift directly from all these sources for signal rather than noise, and to distill the probabilities of outcomes from large amounts of qualitative information.

Although the most successful information markets do not currently rely on cryptorails, we believe they can be enhanced by cryptographic primitives. Design spaces will either financialize the information itself based on quality, or embed these markets directly into venues for first-party information sharing.

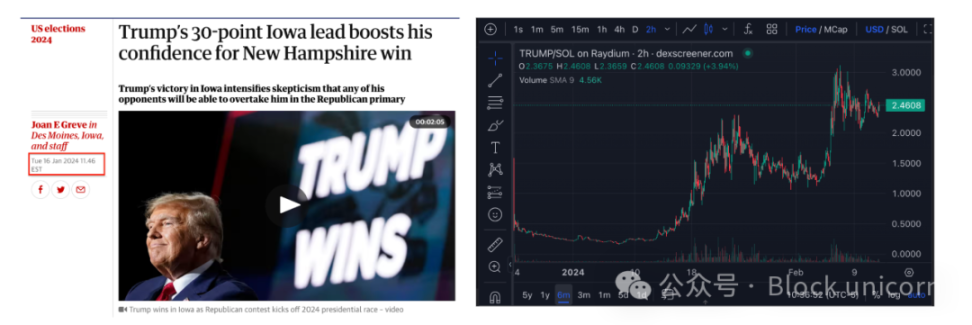

Prediction markets like Polymarket are essentially binary call options surrounding future outcomes, such as elections or sporting events. Historically, they have failed to accumulate enough liquidity or attention to serve as a reliable source of information. In contrast, cultural assets (such as meme coins or NFTs) have proven to be more interesting (and informative) than closed prediction markets because they do not have a fixed expiration date and can have their own life cycle . For example, the trading volume of Trump-related NFTs and tokens has been higher than the Polymarket prediction market.

Therefore, new spot assets that directly track attention may represent agents more interested in attention or information flow. Embedding these types of assets into a news distribution platform or editorial publisher may be more attractive than the binary, fixed expiration constructs of the past. Just like Numerai borrowed from the principles of token curation registries to run machine learning competitions on obfuscated financial data, we believe a universal information marketplace for new categories of information can be built along the same principles.

Imagine a StackExchange-style forum where voting and reputation primitives have financial value, or a Pinterest-style curated board where users can stake their reputations on emerging trends and behaviors. There is a vast amount of high-quality information on the Internet today, mostly contributed by users without any financial motivation - what is missing is a form of proper aggregation and monetization, and this is where cryptographic primitives are most useful.

Were excited about new manifestations of this argument and, in general, about tokenizing intangible quantities in content networks: accuracy, reputation, humor.

professional interest community

Tokens allow communities to focus on novel problems and direct resources toward them. ConstitutionDAO proved that a memecoin could pool enough funds to bid for a rare artifact, and after the auction ended, the network itself began to come alive.

The point in this case is that when tokens have a mission attached to them, they are more likely to coordinate real-world actions. This collaborative funding model can support new ventures that are often overlooked by traditional financing and research lines: for example capital-intensive projects like VR headsets, corners of open source software, art spaces or drug discovery for rare diseases.

Tokens uniquely facilitate capital formation from distributed sources and give capital providers strong ownership of that capital product. This means that groups around the world can coordinate capital to conduct experiments at scale, commoditize the results of those experiments, and return the proceeds to token holders.

HairDAO and VitaDAO are current examples of this situation. We are already seeing new platforms for collaborative research that are funded and sustained by the accumulated attention around a variety of neglected issues.

Unlimited trading canvas

Consumer crypto adoption will be a generative shift, not an imitative one. We describe the tight connection between crypto-native attention, capital formation, and coordination in this article because the main unlock of crypto is that transactions can happen anywhere. Rather than simply moving existing economies onto the chain, crypto unlocks a new economy of attention, allowing like-minded groups to exchange minutes for dollars and vice versa.