Original Author: Living Opera

Original title: Pricing Tokens in a Web3 Economy

According to Statista, there are more than 10,000 tokens in circulation, but most of them may not be worth much. Some of these tokens are blatant scams, but many others are more obscure, they may be interesting and they may have great development prospects, but it has to be said that it is a confusing picture.

How do you tell which choices are the right ones, and how do you tell if all the actions youre taking are wise decisions? While many have recognized the red flags behind the scam, there has been very little written about the actual pricing of the tokens. Therefore, Shaun, a member of the DAOrayaki community, compiled the article Token Pricing in the Web3 Economy by Living Opera to discuss the issue of token pricing in the web3 economy. Like most other activities, pricing tokens is more of an art than a science.

Explain the reason for the token price growth

Lets start with the basics: risk and reward.

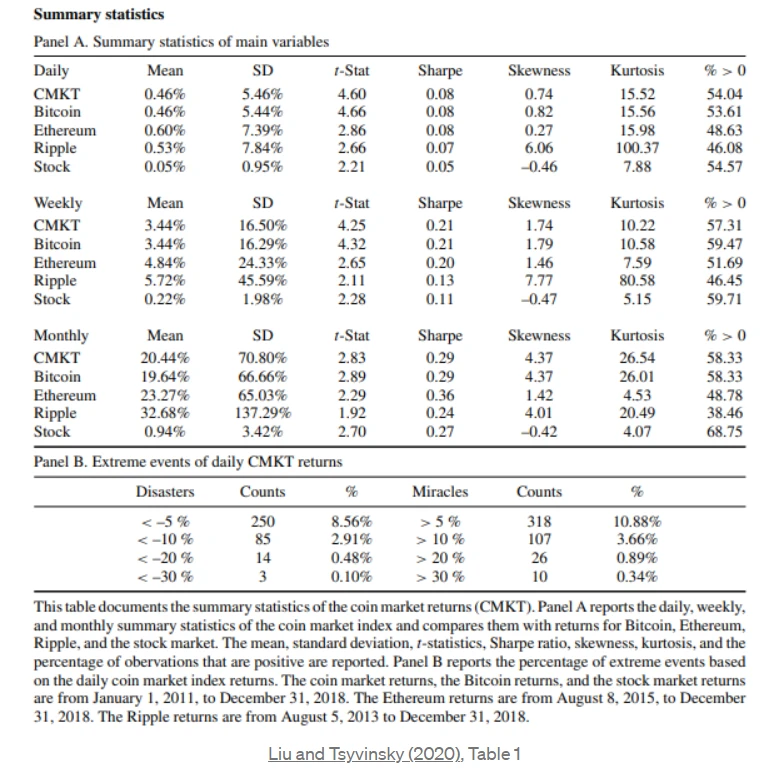

Cryptocurrencies are much more volatile than standard securities in the stock market. For example, Yukun Liu and Aleh Tsyvinski wrote a groundbreaking research paper in 2020 that found that cryptocurrencies had a daily return of 0.46%, while stocks had a daily return of 0.05%. Likewise, cryptocurrencies have returned 20.44% per month, while equities have returned 0.94% per month. These are obvious differences, not to mention differences in skewness and kurtosis.

Astounding tables like this one, even if it’s just a simple report listing distributions across different dimensions, convey a wealth of information about token volatility.

The question is, what is driving all these changes?

There are two most commonly cited factors:

Network utilization (ie, how many users are on the network)

The cost of executing the transaction (i.e. how expensive the consensus mechanism is)

Which of these factors is more important? Interestingly, Liu and Tsyvinsky (2020) found that measures of production costs, such as electricity prices or computing power, were not correlated with rates of return."Overall, there is limited evidence that calculation factors are important drivers of token returns". They also found that fluctuations in the macroeconomy and other currencies were not material factors that led to price growth.

However, they found that network effects matter. The more users there are on a platform, the better the currency price is likely to perform. In the Web2 world, its easy to draw similar conclusions, like if youre the only user on Facebook, its worthless to you because you cant communicate with other people.

However, this is less clear and not necessarily true for Web3.

After Yukun and Tsyvinski analyzed the network effect by quantifying the number of users and the number of active wallets, they found that these variables are highly predictive of token price growth. Of course, this conclusion is not surprising, and coins with more users may indeed perform better.

In fact, a major advantage of the Web3 era is that cross-chain operability is easier. Because data, whether explicit or implicit based on a consensus mechanism, is usually owned by individuals, this creates an impetus for the formation of cross-chain bridges.

Yukun and Tsyvinski (2020) also explore the role played by investors attention to market events and find that it is also important. For example, they found that a one-standard-deviation increase in investors’ attention to “bitcoin hack” searches led to a 2% drop in overall cryptocurrency market returns over the next week.

(Investor sentiment matters. They use the ratio of positive to negative stories as a proxy for token price growth).

However, its really difficult when youre trying to get to the bottom of the actual fundamentals behind a coin. token no"Book value", to update a standard physical asset. Here are five examples from Yukun and Tsyvinski.

Cumulative token market return over the past 100 weeks

user market ratio

(Wallet) Address Market Ratio

Transaction market value ratio

pay market ratio

Everyone Trying To Capture Cryptocurrency Assets Over A Long Time"Book value", and take the current market value as the standard.

Interestingly though, they found that these measures were also not predictive of token growth."Overall, the relationship between future token returns and the current ratio of token fundamentals to value is very weak". This is prime evidence that token fundamentals don’t matter. However, fundamentals will always matter, at least in the end, because the laws of physics cannot be avoided, and these results show more fully that more work needs to be done on how we think about the fundamentals of tokens. We currently The analysis of tokens in various communities is still mainly in the"forms of art", instead of"scientific practice"。

How tokens are different from equity

While tokens share many similarities with equity, they also have some important differences, such as the utility value they provide on the blockchain. This consensus mechanism based on the use of blockchains adds an additional layer of security.

In a traditional startup, founders and venture capitalists own equity. This means that decision-making is fairly centralized. It also means that few employees and participants will feel that they are real shareholders.

In the Web3 economy, the concept of shareholders becomes broader. Suddenly, anyone who owns tokens can be a shareholder in the underlying platform. That is, when there is a transaction, token holders get a cut of the entire transaction. Additionally, if tokens are empowered with governance, token holders can vote on the development of the protocol, which means they can even influence the fee structure.

In addition to spreading governance capabilities on a larger scale, tokens offer an infinite number of ways to create utility for users. For example, in Living Opera, people are building NFTs around artwork, allowing holders to use NFTs to access live concerts. Equity itself just provides an entry point for cash, but utility tokens provide experience and cash.

Just like equity can be diluted, so can tokens. It is important to see how a platform decides to pursue different economic policies for its token supply, whether it is more inflationary or more deflationary, and this decision should be influenced by the following factors.

What is the market of potential users?

How has the composition of new users changed?

What are the existing users like?

Heuristics for Token Pricing

It may be difficult for someone to think that tokens have an exact price, but in order to make that idea a reality, we can create a provisional valuation by asking questions, as a guiding indicator.

What is the price per token to buy on the platform today?

How much is the community expected to grow, and what will be the fee structure during these various stages of growth?

What is the discount rate and what are the comparable investments?

These are obviously not an exhaustive set of questions, but they are probing questions that you can tie into the broader context presented throughout the article. Because there is currently no comprehensive evidence to explain the fragmented nature of token price growth, the best we can do right now is ask sensible questions and create a provisional valuation that serves as a guiding metric.