After a week of intense geopolitical offensives by the U.S. against other countries, markets finally had a good end to the week when President Trump appeared to make a major concession by announcing that smartphones, computers and other electronic devices would be excluded from reciprocal tariffs. U.S. Customs and Border Protection later said those goods would also be excluded from the 10% global tariff imposed on most countries.

The Chinese government responded positively, saying the move was a small step toward correcting Washingtons wrongful behavior and canceling the remaining tariffs.

Risk assets reacted enthusiastically, with the Nasdaq up 1.5% and Chinese stocks up more than 3% in early Asian trading. Even though Commerce Secretary Lutnick and the Trump administration subsequently retracted some of their comments, it did not dampen risk appetite, with investors cautiously hoping that the worst of the tariff storm has temporarily passed.

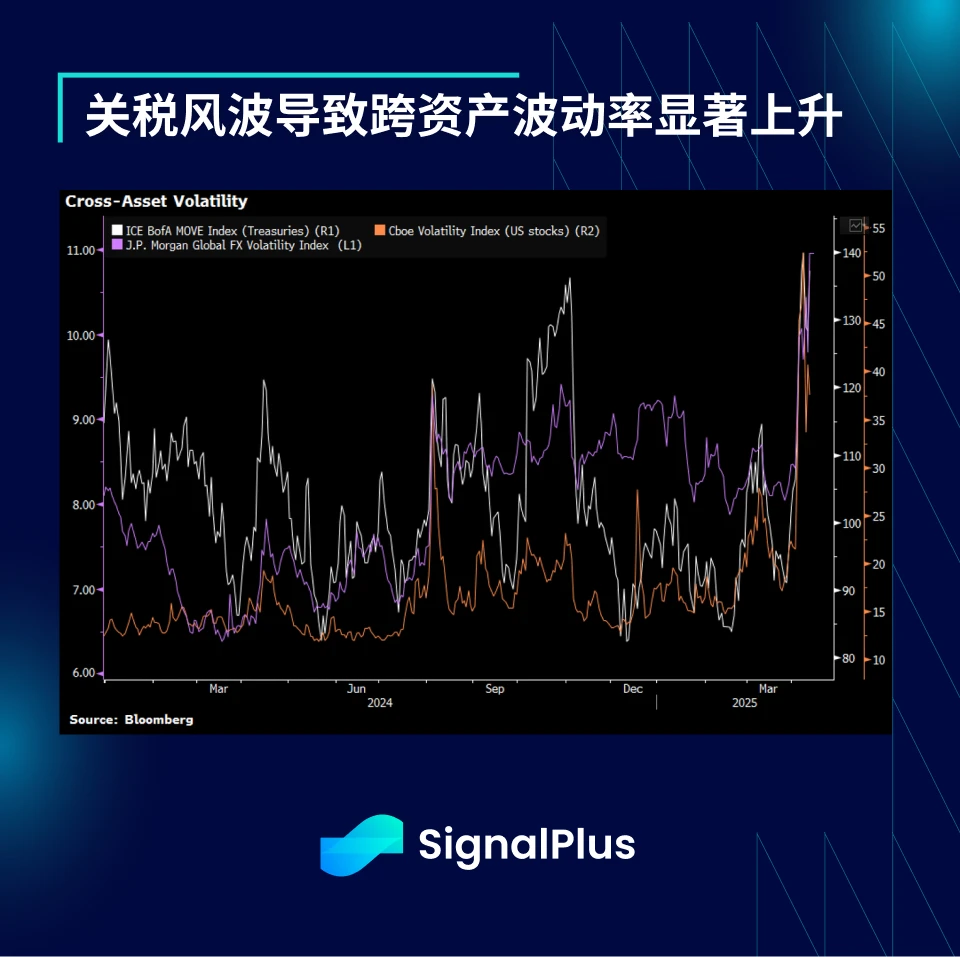

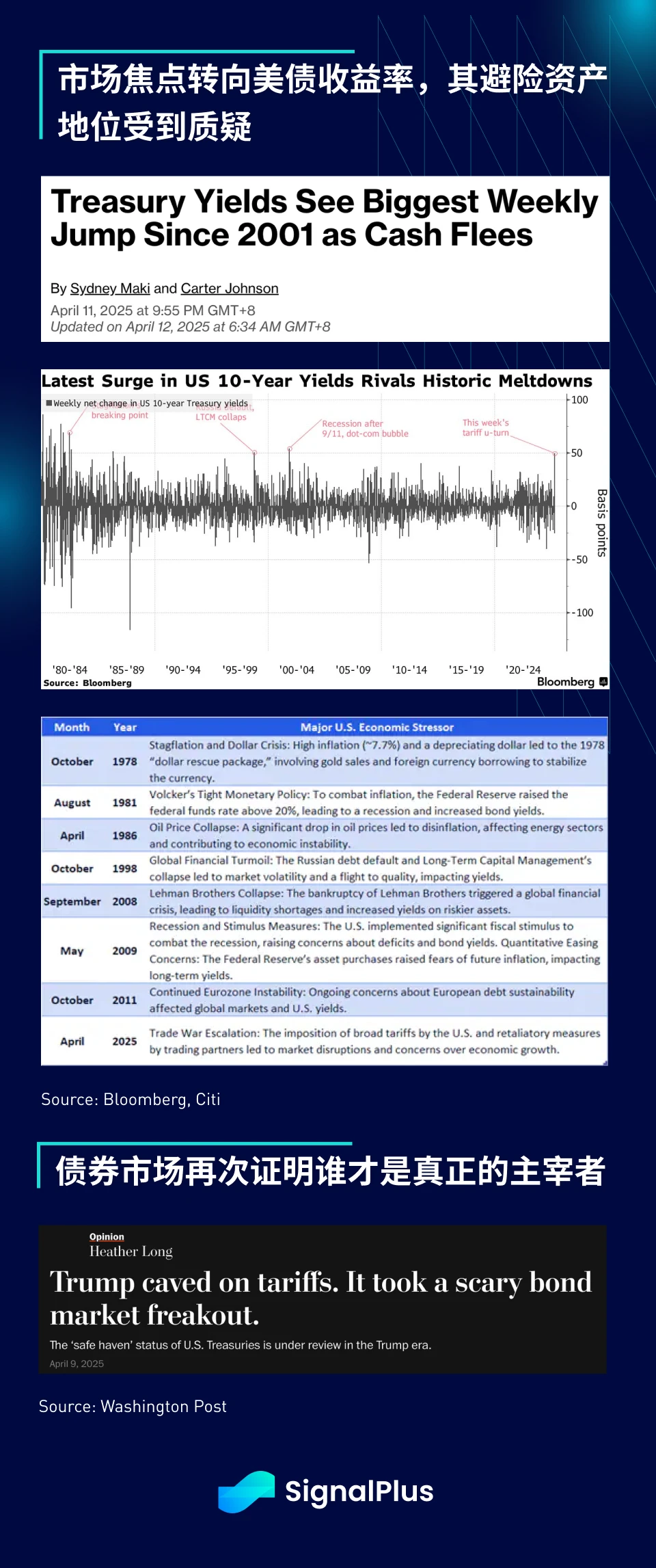

Despite a nice rebound in risk markets, U.S. assets have already suffered a significant blow throughout the tariff storm, with the dollar falling about 3% last week and 10-year Treasury yields soaring nearly 60 basis points. According to a Citi report, there have been about 13 similar situations in history, with the dollar depreciating by more than 2% and the 10-year yield rising by more than 30 basis points, including the stagflation crisis in the late 1970s, the Volcker shock in the early 1980s, and the eurozone crisis in the early 2010s. From historical experience, the SPX index has mostly rebounded by double digits afterwards, but is the situation different this time? Only time can tell.

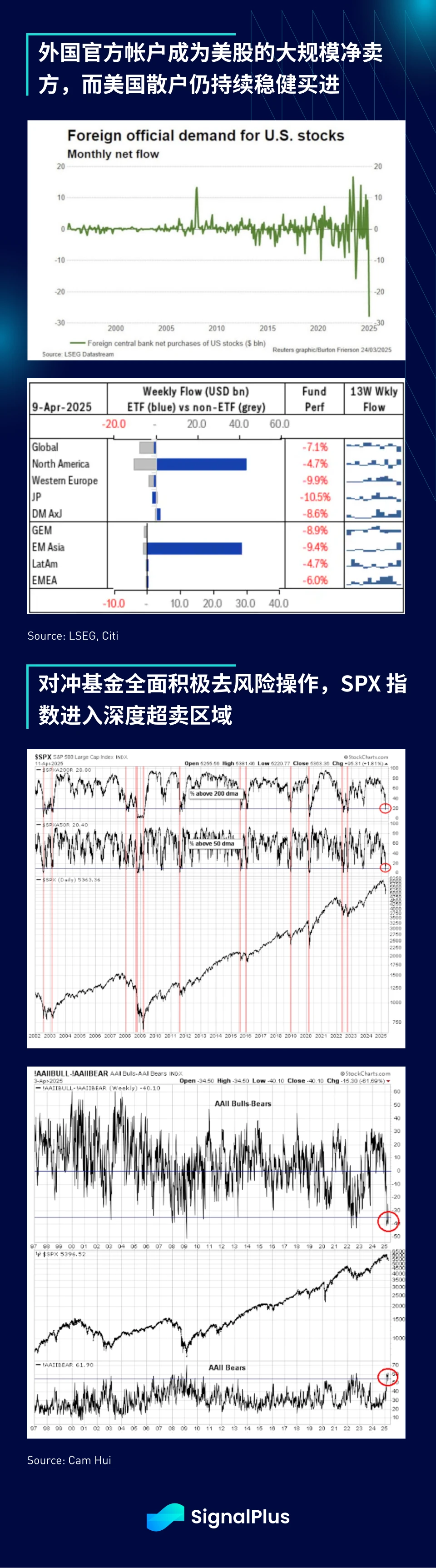

Net demand for U.S. stocks from international official institutions has fallen sharply over the past month, as central banks around the world have reduced their holdings of U.S. dollar assets in response to U.S. tariff policies. However, retail demand for U.S. and Chinese stocks remains robust, with investors generally in a buy on dips mode, which has offset aggressive selling by hedge funds to some extent. The selling pressure from these hedge funds has pushed the U.S. stock market into a deeply oversold area.

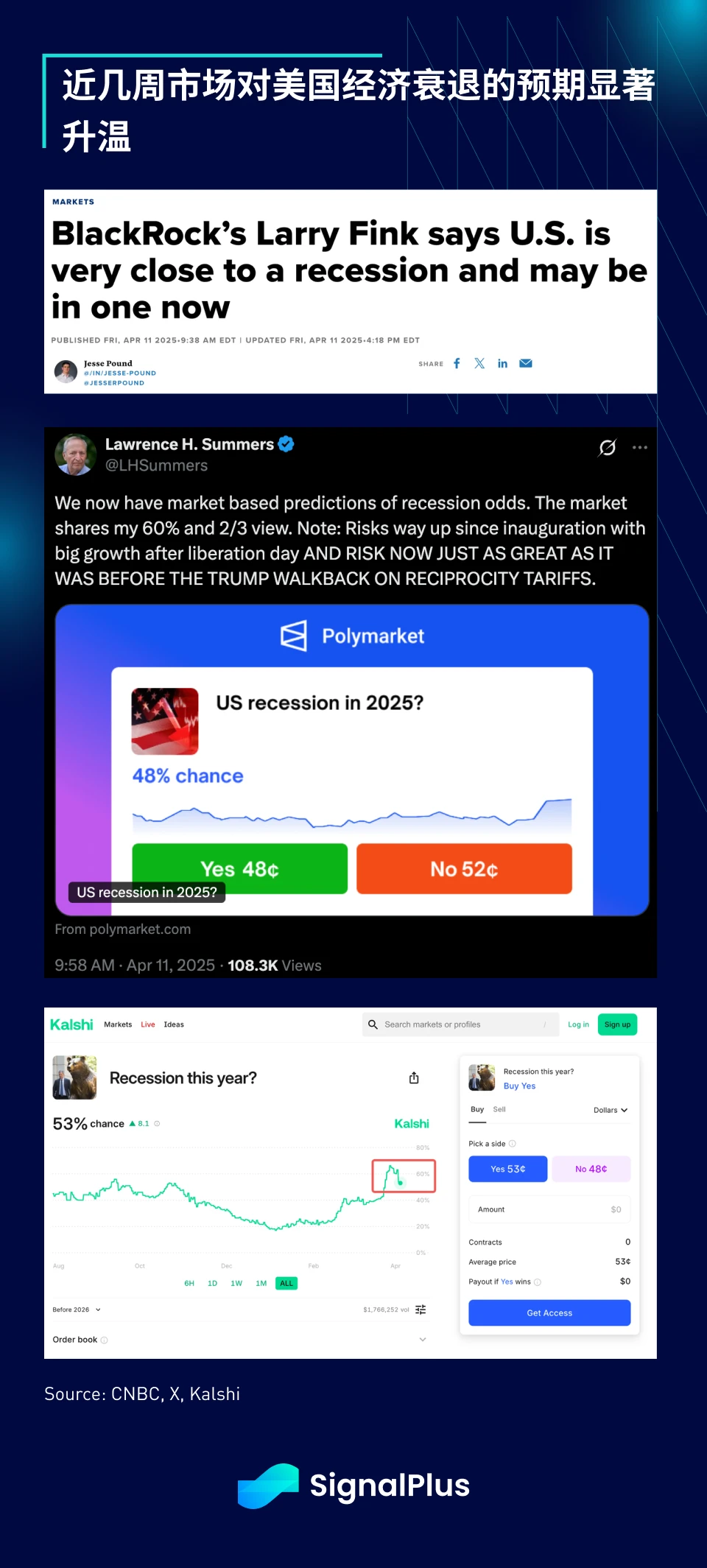

Tariffs aside, the most critical question for stocks is whether the U.S. economy is headed for a recession. Prominent financial figures have begun to warn that the U.S. economy could be headed for a recession in the near term, with bookmakers putting the odds of a recession in 2025 at 40% to 60%. Is this a scare tactic by Wall Street to convince the president to tone down his trade stance? Or is it genuine concern about the economic outlook? Our view is that the distinction is immaterial, as market sentiment often shapes reality, not the other way around.

As the U.S. stock earnings season heats up, the market focus will turn to valuation, and any consideration of reasonable market value will ultimately depend on whether the U.S. economy falls into recession. Currently, the forward price-to-earnings ratio of SPX is around 19 times, which is within the historical range, but if it is further revised down to around 15 times, it means that there is a chance of a further decline of 25% to 30% in the future.

However, if the economy does fall into recession and corporate earnings decline further by 15% to 20%, then the SPXs valuation could fall below 4,000 points, and market estimates for corporate EPS have already begun to be revised downwards before the earnings season begins.

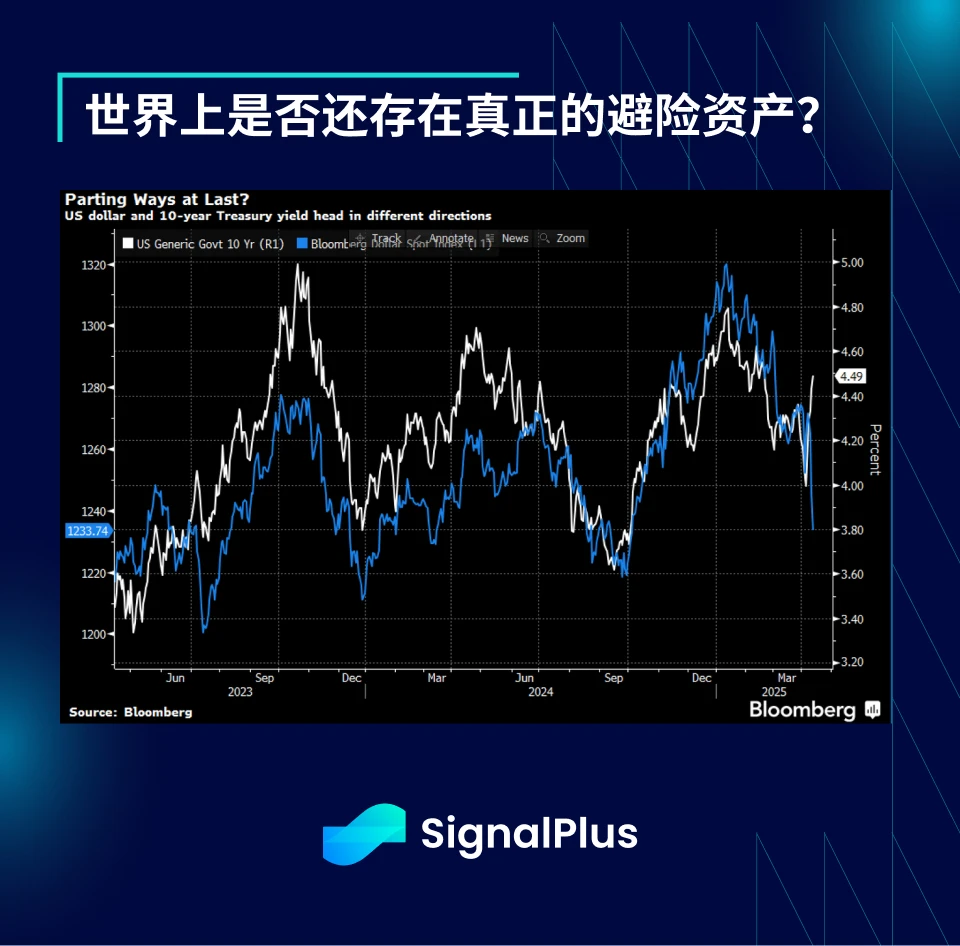

In addition to the stock market, the biggest concern last week actually came from the sharp sell-off in the fixed income market, which also made the market begin to question whether the Trump administrations aggressive measures have damaged the status of US Treasuries as a global safe-haven asset. The market is worried that foreign central banks will sell US bonds in response to tariffs. US bond yields have seen the largest weekly increase in more than 20 years. It is rumored that the sell-off of US bonds led by Japan last Wednesday was the fuse that prompted Trump to make his first tariff concession.

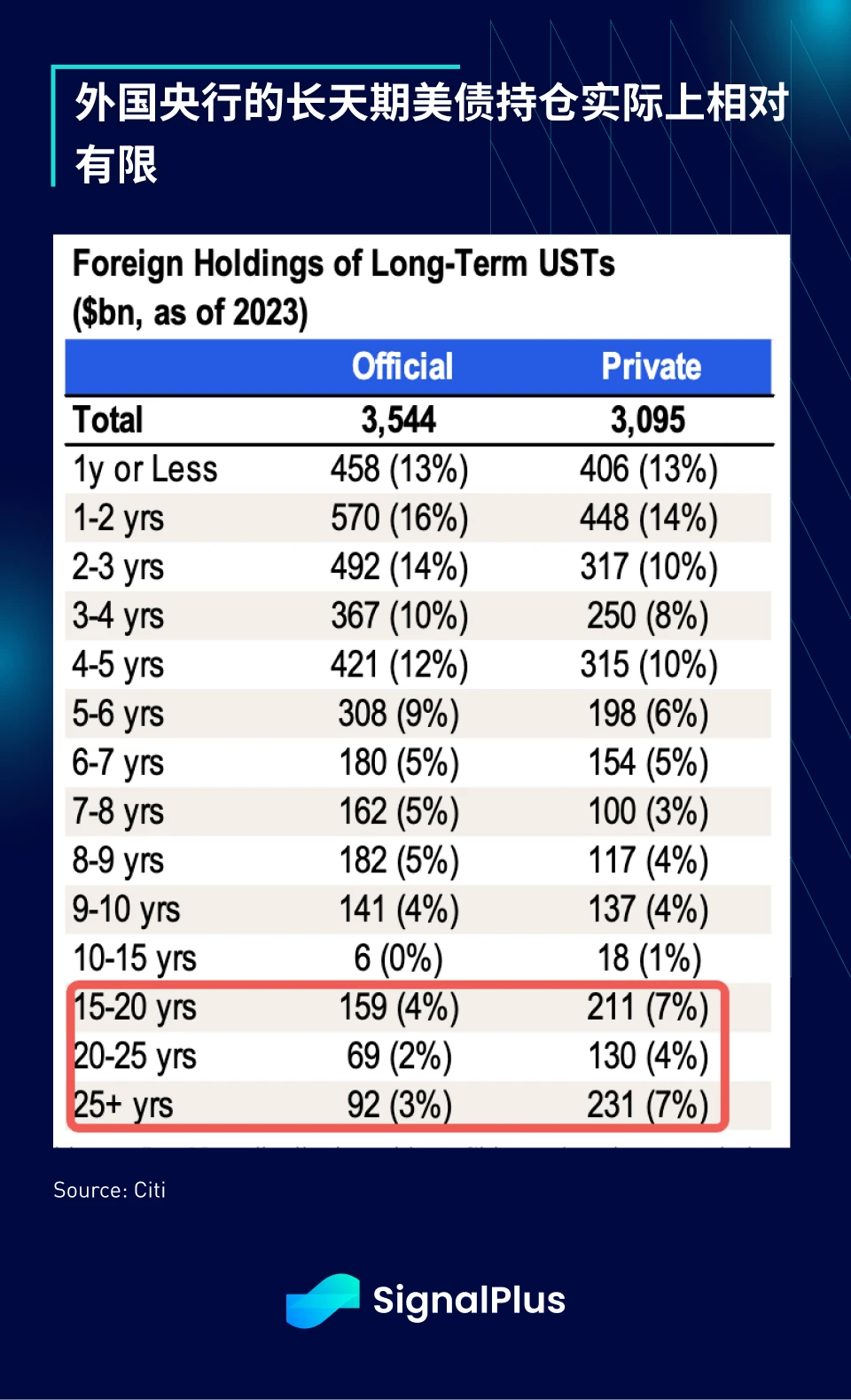

Although the market is full of speculation and concerns about Chinas massive selling of US Treasuries, we still have reservations about this statement. First, the scale of Chinas holdings of US Treasuries has continued to decline over the past decade. Second, most of the recent losses are concentrated in long-term bonds (20-30 year bonds), and in fact, central banks hold very little of this part.

Regardless of who sells first (we speculate that it may be Japanese life insurance companies and pension funds), the weaker dollar and the surge in 10-year Treasury yields are indeed worrying and send potential warning signals. Capital account surpluses and current account deficits are supposed to be mutually reinforcing, so once the latter begins to normalize, it means that there will be fewer dollars available to flow back into the debt financing market.

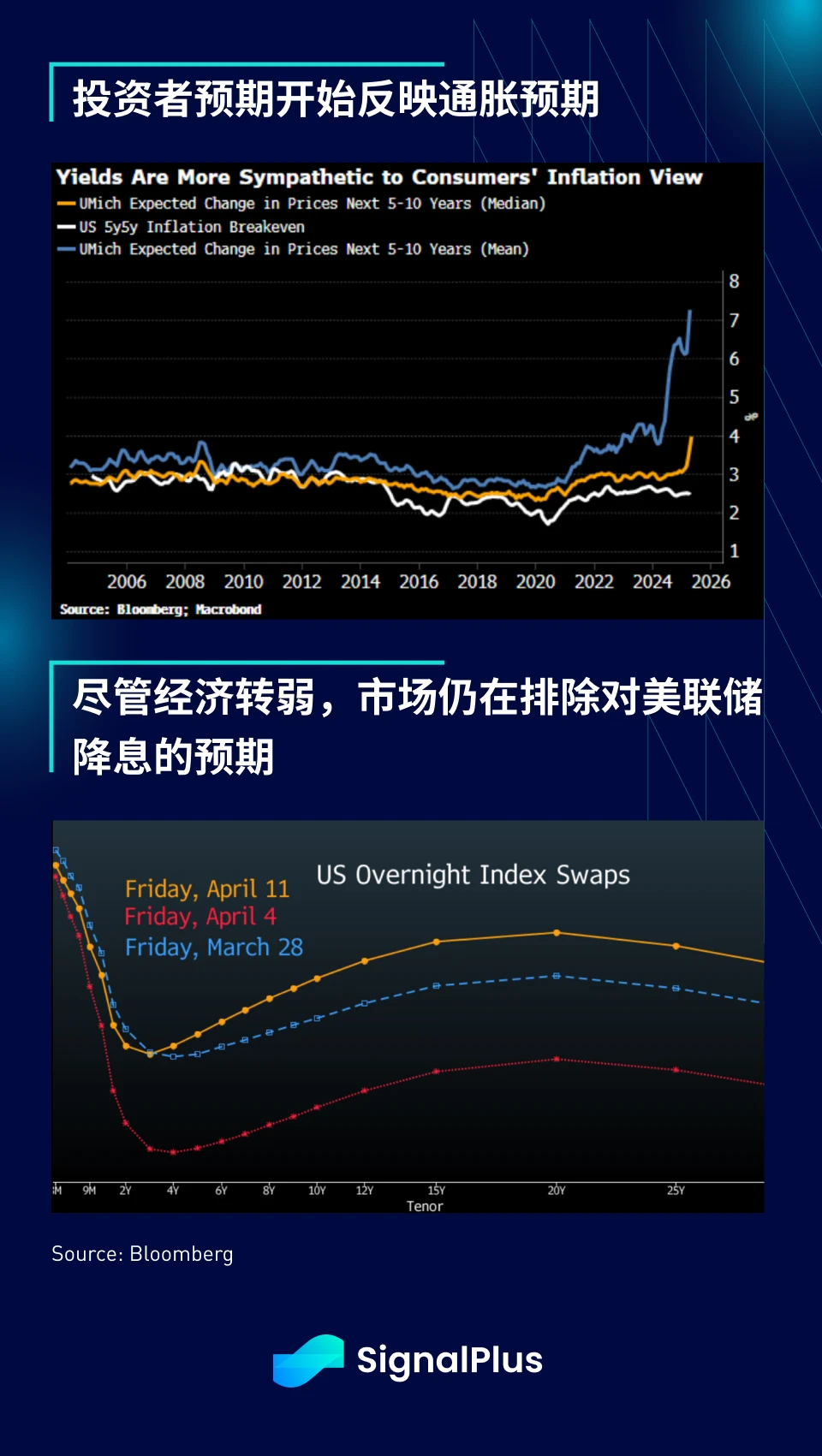

To make matters worse, the University of Michigans consumer inflation expectations jumped, diverging from recent fundamental data, making the situation more difficult for the Fed and bond market participants. The market began to question whether the Fed still had room to maintain a dovish stance in the face of inflationary pressures from a new round of tariffs, and as a result, short-term interest rate pricing moved back up (less rate cuts) over the past week.

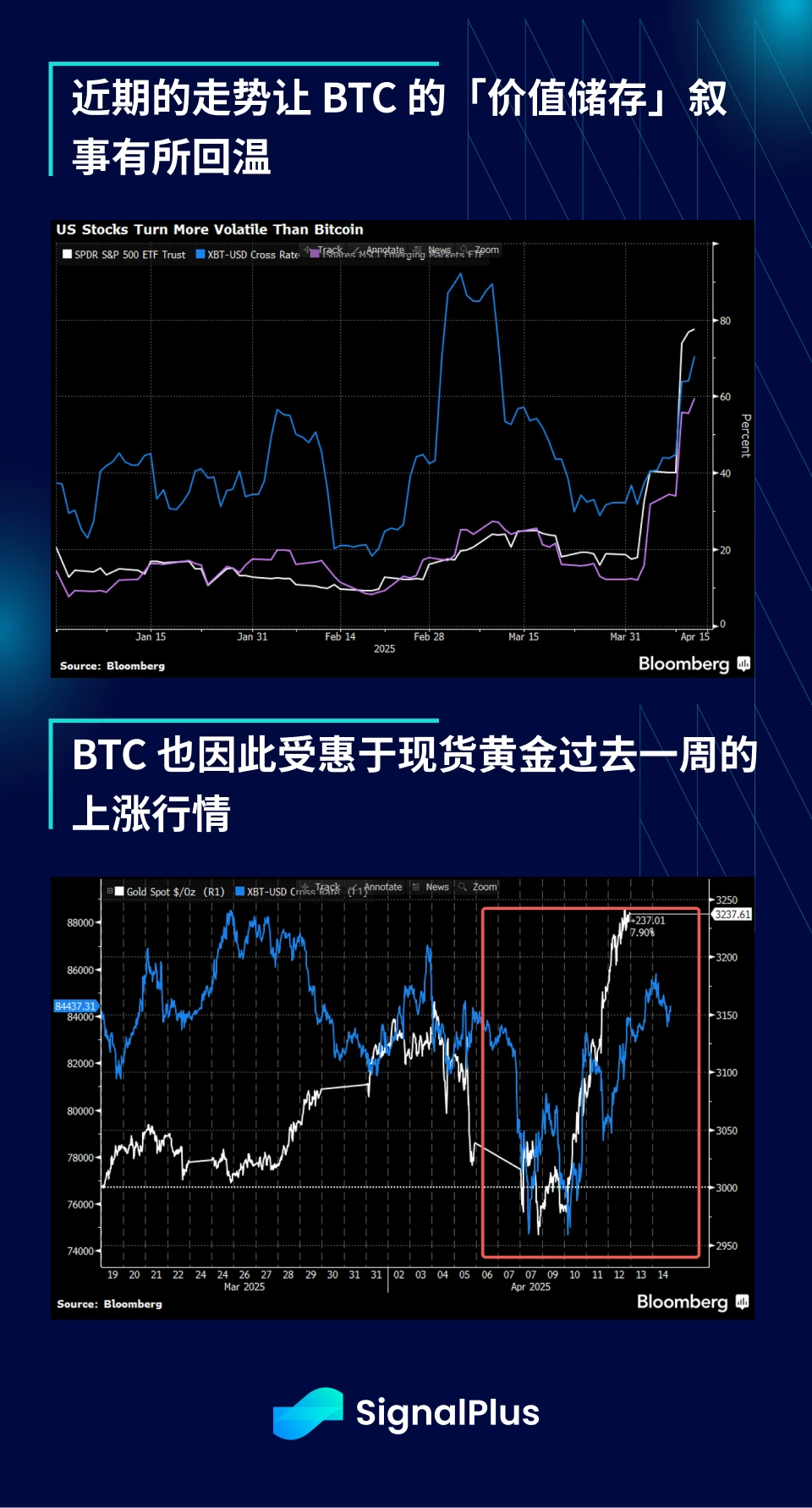

This wave of market turmoil unexpectedly made cryptocurrencies the beneficiaries. In this wave of risk aversion, the volatility of the stock market is higher than that of BTC. In addition, the beggar-thy-neighbor tariff policy adopted by various countries has also pushed spot gold to a record high, and BTC has also taken the opportunity to regain its long-lost value storage narrative positioning.

From a technical perspective, BTC has successfully broken through the trend line since the beginning of this year and is expected to further challenge the 90-95k USD range. In addition, this is the first time in several months that memecoins and alcoins have regained momentum, and memecoins loved by many native communities have seen an increase of more than 100% in the past week.

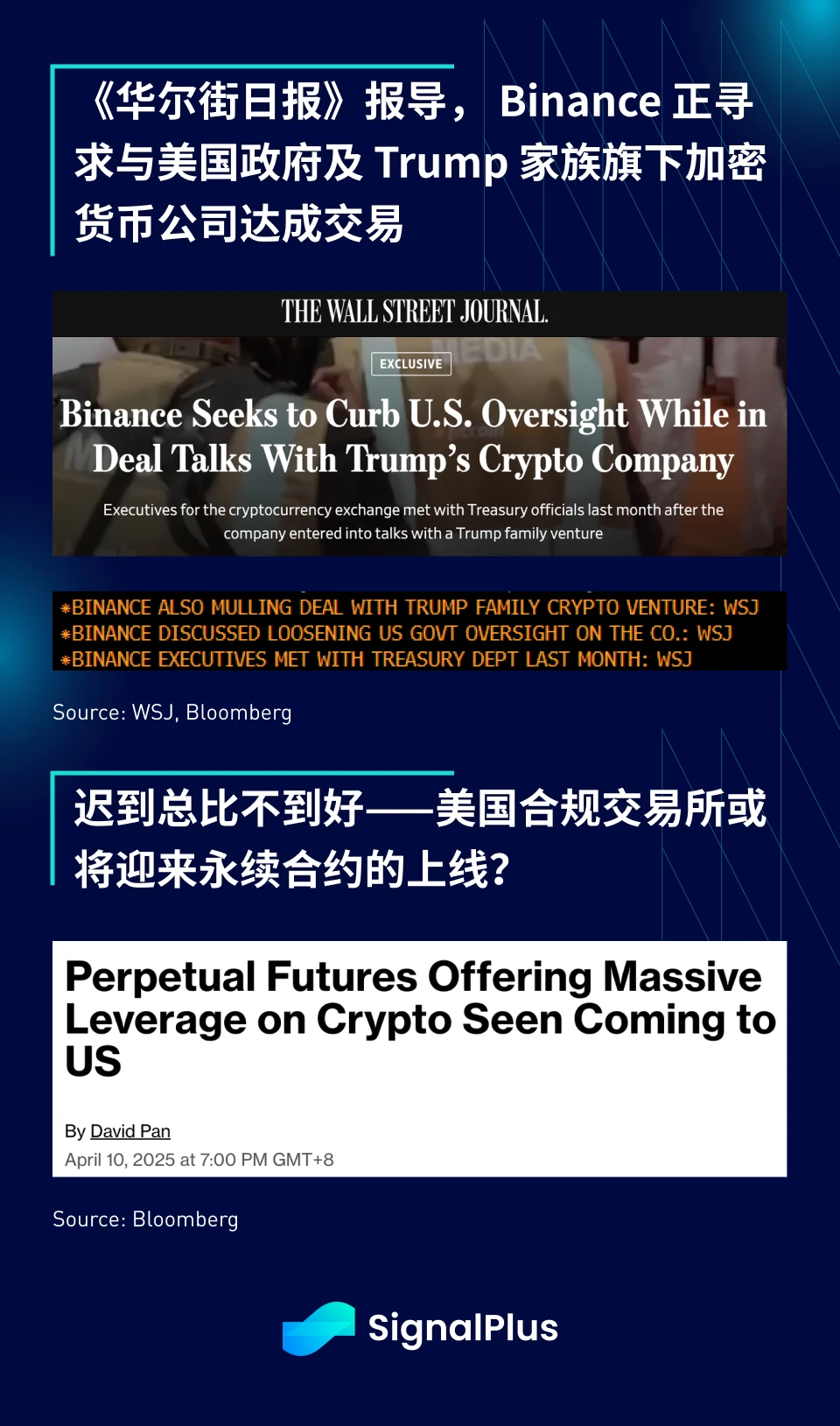

Finally, from the perspective of long-term structural fundamentals, the market still has reason to believe that the price of cryptocurrency assets will continue to rise. According to the Wall Street Journal, Binance is actively seeking to reach a deal with the US government and Trumps cryptocurrency companies in exchange for a more relaxed regulatory environment. At the same time, Bloomberg reported that market expectations for the listing of perpetual contracts on US exchanges are rapidly heating up, and it is expected to be launched in the next few quarters, aligning it with the products provided by existing offshore platforms, significantly increasing leverage tools and secondary liquidity in US regulated venues, and accelerating the overall process of mainstream adoption.

You can use the SignalPlus trading vane function for free at t.signalplus.com/news , which integrates market information through AI and makes market sentiment clear at a glance. If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between English and numbers: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com