Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

This column aims to cover the low-risk return strategies based on stablecoins (and their derivative tokens) in the current market (Odaily Note: systemic risks can never be eliminated) to help users who hope to gradually increase the scale of funds through U-based financial management to find more ideal interest-earning opportunities.

Previous records

New opportunities

Aave will support Pendle PT

Aave has begun to advance proposals to support Pendle PT assets, with the first phase expected to support sUSDE PT expiring on May 29.

This is undoubtedly a great blessing for fixed-rate players. Using Pendle PT for revolving loans has always been an effective strategy to amplify fixed income. Previously, some players also used relatively small lending markets such as Morpho to implement this strategy. If Aave opens support for PT assets, it will undoubtedly greatly improve the execution efficiency and operating capacity of this strategy.

OpenEden launches Pendle

OpenEden, an RWA project invested by YZi Labs (Binance Labs) and Ripple, has been launched on Pendle. The current real-time annualized rate for cUSDO LP is 6.384%, and a 10-fold bonus on bills can be obtained.

Currently, the total number of participants in the OpenEden points program is reported to be 12,251. Similar to other interest-bearing stablecoin projects such as Level , the competition is relatively small.

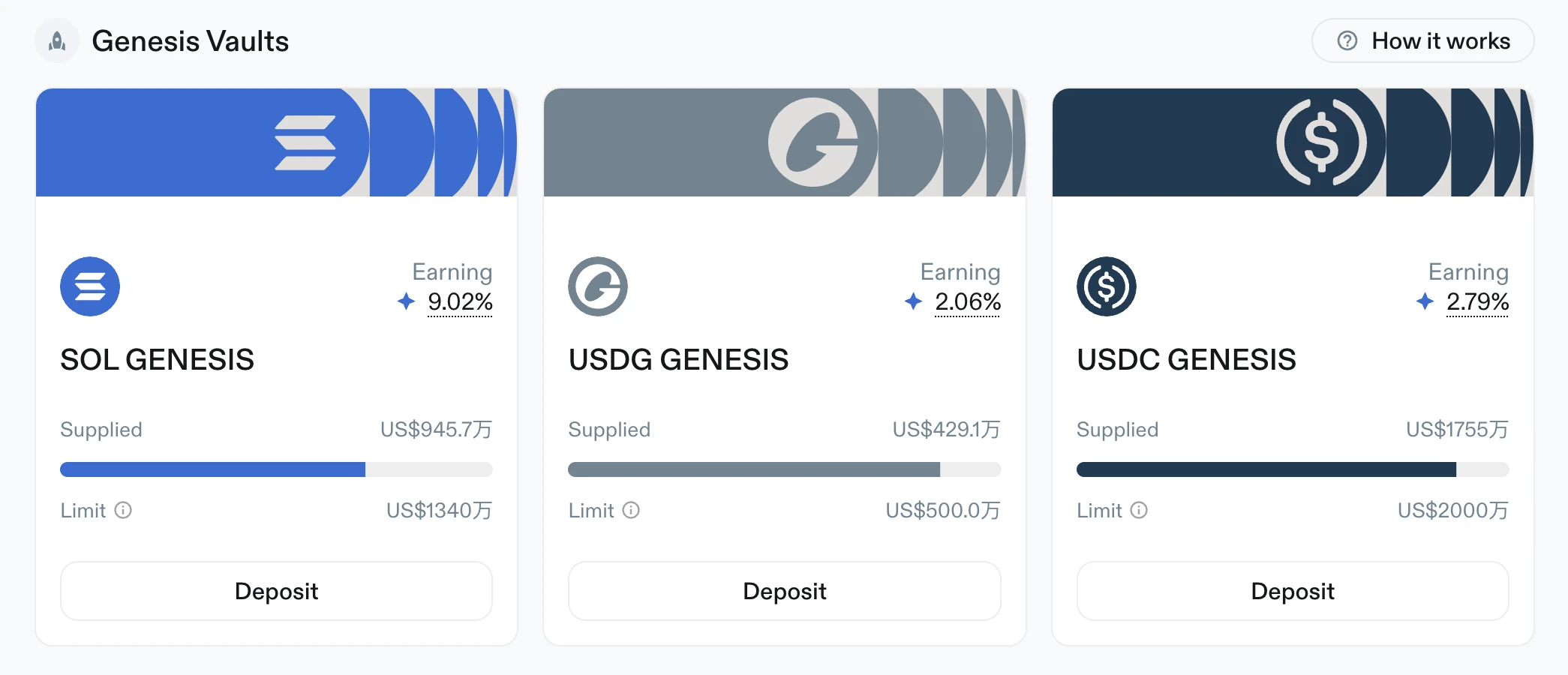

Loopscale is now live

Last week, the Solana ecosystem order book lending protocol Loopscale announced the end of closed beta and officially launched. At the same time, Loopscale also disclosed that it had received investments from CoinFund, Solana Ventures, Coinbase Ventures, Jump, and Room 40.

Loopscale also mentioned that it will provide four-week points incentives for several Genesis pools. Although the current yield is not high (USDC 2.79%), you can get a 6-fold points bonus for the time being, so you can consider mining the full incentive period first.

StandX launches points program

The decentralized contract exchange StandX officially launched its points program last week.

The co-founder of StandX was a founding member of the Binance Futures team. The project has been very popular in the Chinese community recently, but some users have some concerns about it because there is no financing endorsement for the time being. On April 11, StandX announced that it had received funding from the Solana Foundation, which to some extent dispelled market concerns.

Currently, StandX supports multiple modes for accumulating points: minting and holding DUSD can enjoy 6.65% APY, but there is no point rate bonus; providing USDT/DUSD LP can obtain 2.5 times the point rate bonus, but the USDT part in the pool cannot generate interest (there will be more transaction fee income).

Huma 2.0: The quarrel became heated

The most popular deposit project in the community last weekend was undoubtedly Huma .

Huma is positioned as a PayFi track and has previously received $38 million in financing. Last week, the project launched version 2.0, which allows users to earn points by making deposits. The mining method is similar to Nobles pooling model.

Classic mode: supports no lock-up, three-month lock-up, and six-month lock-up, corresponding to 1x, 3x, and 5x points increase, and can also enjoy 10.5% APY;

Maxi mode: lock the position for 6 months in one step, corresponding to a 25-fold increase in points, but the basic income is not included.

The reason for the sudden rise in popularity is that several KOLs and Huma team members had a heated discussion on the projects business model over the weekend. During the discussion, a member of the Huma team was severely criticized by the community for making inappropriate remarks. Huma founder Richard Liu also published an open letter to apologize. Interested readers can go to the post for a closer look.