Original author: 0xTodd (X: @0x_Todd )

Isn’t Uni going to restart liquidity mining on April 15? This time it involves 12 pools, many of which are $ USDT0 related pools. So I’d like to take this opportunity to talk about USDT0 .

First of all, what is USDT0 ?

To put it simply, it is a cross-chain version of USDT. The parent asset USDT exists on ETH, and it becomes USDT0 when it is transferred to other chains through Layer0 .

Those that support USDT0 can also cross each other, such as ETH-Arb-Unichain- Bear Chain-megaETH and so on.

Who is the team behind USDT0 ?

This is the trickiest part, and it took me a long time to figure it out.

The USDT0 project is the result of the joint efforts of 1+ 3 parties:

1. It is led by Everdawn Labs;

2.1 The underlying technology used is Layer0 ;

2.2 Endorsed by Tether;

2.3 Got the endorsement of the INK public chain (which is the chain launched by Kraken).

However, there is no clue on the Internet as to who Everdawn Labs is.

I reasonably suspect that it is a Tether disguise.

This is quite consistent with their tone:

If nothing goes wrong, everyone can enjoy the multi-chain convenience of USDT as usual;

If something goes wrong - its Everdawn Labs fault, not Tethers.

One of the reasons for this speculation is that after USDT0 came out this year, Tether immediately expressed its support, and Bitfinex also published a special article to interpret it. If there is no strong relationship, they (BF and Tether) will not give such support.

How to evaluate?

I think it would be a great achievement if Tether built this bridge itself , as it would allow USDT on different chains to cross each other without loss, saving the trouble of using various stupid three-party cross-chain bridges.

However, my level of trust in Layer0 is limited.

There are many cases of top cross-chain bridges failing in the past, from multichain to thorchain. The cross-chain technology has no threshold at all, it is nothing more than multi-signature.

In the past, USDT used the official bridge instead of the third-party bridge like L0.

Official bridges are generally safer, but the downside is that liquidity is dispersed.

For example, if you want to transfer a large amount of funds from Arb to OP without loss, you must go from Arb back to ETH and then to OP. It costs money to go through a three-party process faster.

PS: Not to mention the public chain Sei, which is a scam and charges entry and exit fees on the official bridge.

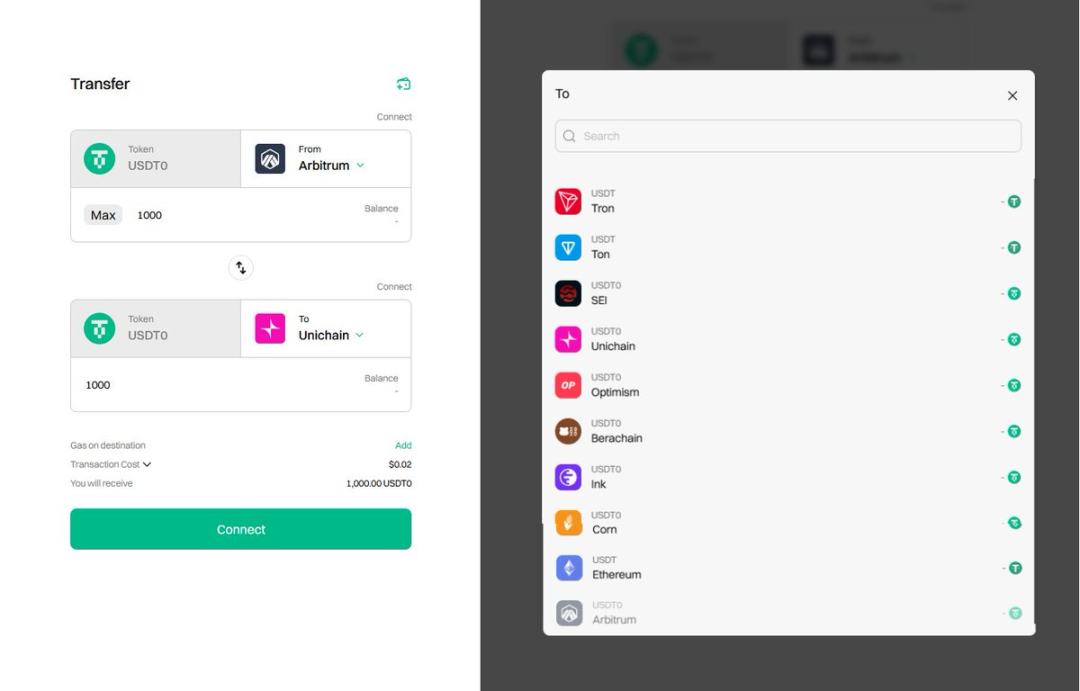

If the USDT 0 solution is adopted, Arb can go directly to OP, lossless and within seconds.

PS: Of course, there is a historical problem here in OP, that is, the USDT on OP is the old version of the ETH cross-chain version, and it has not yet been unified with USDT0 , the youth version of the ETH cross-chain version. Therefore, Arb cross-OP is nominally feasible, but it is actually useless. This is just an example.

The new public chain supports USDT0 right from the start and has no historical issues, so its availability is much higher.

but!

Tether officials themselves were reluctant to personally build the bridge, and had to secretly send Everdawn Labs to do it. This is a bit...

In the past, when I mined $UNI on ETH, I only had to bear two small third-party risks, Tether and Uniswap. Now I have to bear four more, namely:

Everdawn, dont mess up

L0 Dont make trouble

Unichain, stay out of trouble

USDT0 supports N other public chains, and each one should not cause any trouble

(If other public chains are hacked, USDT0 will be issued unlimitedly, and USDT0 on other chains will also be contaminated)

That sounds a bit overwhelming.