Author: Yash Agarwal

Original title: How to value a community?——DAO Valuation Frameworks

Apple is the most highly valued company in the world, currently valued at around $2.83 trillion, and we all know why its so highly valued - cash flow! All companies have profit/revenue as their core motivation and the entire valuation is calculated based on revenue potential. This is the mainstream valuation method, but how to value the community, especially the current DAO, is still a topic worth exploring. Therefore, DAOrayaki will discuss some possible valuation methods in this article. 🤯.

First, lets understand what a community is 👇Context:

What gives a community value?

Communities are inherently valuable. They pool members resources, skills, knowledge and experience to create value for members and other stakeholders with whom they interact. From crowdsourcing advice, to supporting nonprofit causes, and even raising funds and saving lives during the COVID wave, communities have historically been used to achieve and advance a variety of goals. In many rural Indian societies, for example, community-based initiatives such as cooperatives are a long-established tool for enabling millions of unbanked people to access credit and other financial services.

As weve spent more and more time on the Internet over the past few years, weve created and built more online communities. For example, we are members of groups on WhatsApp, Facebook, Discord, Reddit, Quora, etc. These Internet-based communities are able to utilize more resources and operate more efficiently because membership has no geographical boundaries. People from different backgrounds can bring different perspectives and skills, making their communities more valuable. The influence and value of these communities can also affect more people around the world. Communities no longer have to be made up of people who look like us; they can form around more diverse factors, such as ideologies, hobbies, or even arbitrary interests.

Depending on the communitys goals, brick-and-mortar communities can often create and assign financial value to their members. For example, a local community of teachers could pool funds to start a business that allows members to share profits. They can do this because it is easier to build the level of trust and coordination needed to manage financial resources when community members are close to each other.

This is not the case for online communities whose members are often strangers spread across the globe. Building trust and coordinating decision-making is next to impossible. For example, if you are part of an online group of digital art enthusiasts, and your group decides to go beyond discussing art to maintain a collection, it can be nearly impossible to manage. Thus, the financial value created by todays Internet-based communities is ultimately captured by community leaders or hosting platforms such as Reddit.

In order to coordinate financially, members need to:

legal infrastructure

Bank account for making and receiving payments

A scalable way to make decisions in a democratic and fair manner

Traditional communities lack all this 👆 but Web3 solves this problem! How does it work? 🤔

Community - the Heart of Web3

In Web3, everything from DeFi to NFTs is community-centric. The community becomes the first adopters of the project, incentivizing community members to contribute, drive distribution, and create enormous value through tokens in exchange for benefits. In the Web2 world, communities are more of an engagement function, where different companies embed communities so that their users stick to the platform and ultimately help companies monetize this stickiness. They have no intrinsic value in themselves. The fuel that creates value for the web3 internet is tokens.

After any Web3 project releases its first version, it tries to build a community around it—community members are like early adopters. Just like in open source development, companies try to invite community participation, give bounties, grants, and other incentives, develop in the open, build community, and introduce consensus on decision-making. The Web3 project follows a similar strategy. But here they go one step further - offering tokens (equity) in addition to fees/grants, which is a game changer!

To make things even cooler, the community in Web3 also has its own name - DAO! Think of a DAO as a group of people with a shared bank account. They are digitally native communities centered around a common mission.

DAOs are a new way to fund projects, manage communities, and share value. If blockchains, NFTs, smart contracts, DeFi protocols, and DApps are tools, then DAOs are the groups that use them to create new things. This is a common term for someone who decides to pool resources into a smart contract and then uses some form of decision-making mechanism (voting) to allocate those resources.

Now, after understanding the fundamental aspects of communities and DAOs, lets get to the core question - how do we value them?

Revenue and Cash Flow: Drivers of DAO Valuation? (as a companys DAO)

DAOs are often referred to as decentralized organizations or a new type of LLC (Limited Liability Company). They are also considered as transitions from corporate hierarchies to value creation networks. For traditional companies, the core is to generate cash or income in the present or near future, and value it based on this.

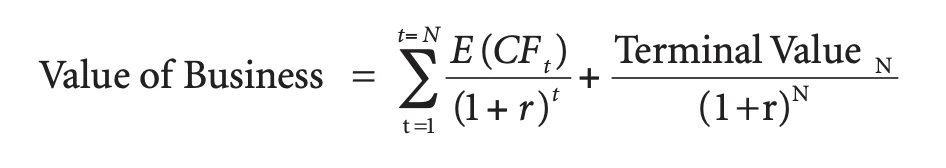

DCF model:

Typical companies are widely valued using the DCF (Discounted Cash Flow) valuation method - the intrinsic value of a company comes from its expected cash flows.

DCF is a complex valuation model! For simplicity, lets understand what drives traditional companies value to the DCF model:

What cash flows will be generated?

What is the growth rate?

How risky is the business?

image description

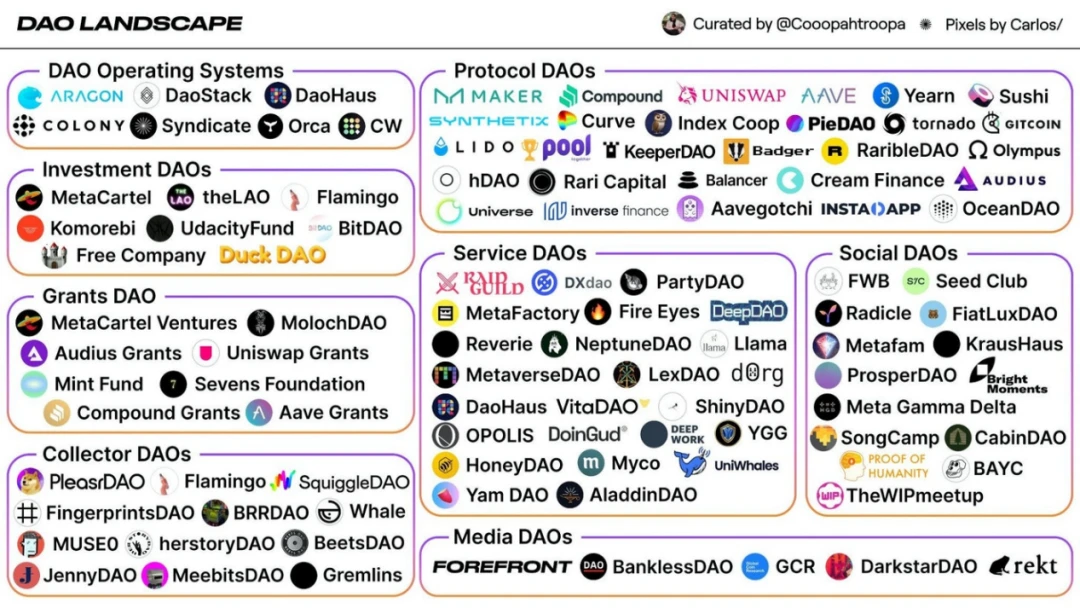

Types of DAOs

For example, Service DAOs will generate cash through the various types of projects they undertake, Social DAOs will generate cash from their fans purchasing tokens or NFTs, and Protocol DAOs will generate cash through lending generate cash.

For example, Uniswap is a decentralized exchange (DEX) DAO that facilitates people trading cryptocurrencies. It charges a fee of around 0.3**%** (ranging from 0.05% to 1%), split between liquidity providers and the Treasury. In this case, cash flow comes from expenses. The Uniswap DAO generates $1 billion in daily transaction volume and about $3 million in daily transaction fees, or as much as $1 billion in annual cash flow! Therefore, we can calculate its value by discounting its estimated cash flows over the past years and applying the appropriate growth rate and risk factors.

Revenue Multiple:

Another typical approach used by startups is the revenue multiple, which is simple: Valuation/Revenue

It measures the value of a businesss equity relative to the revenue it generates. A high revenue multiple indicates that it has a lot of growth potential that will eventually generate huge revenues and is therefore overvalued in the short term.

For example, early stage revenue-generating startups trade at 20-40x revenue multiples, while companies like Uber trade at 4-5x revenue multiples. Now, lets go back to Uniswap:

Uniswap generates approximately $3 million in transaction fees per day, distributed by liquidity providers (LPs). So lets assume this is Uniswap as a daily income for the community, we get about $1 billion in annual income for the community or DAO. Based on its current market cap, its valued at around $10 billion, which gives it a revenue multiple of 10! But why only 10 times? The reason for this may be that Uniswap is quite stable as a protocol, the growth prospects are not very high, and the risk of forking is everywhere.

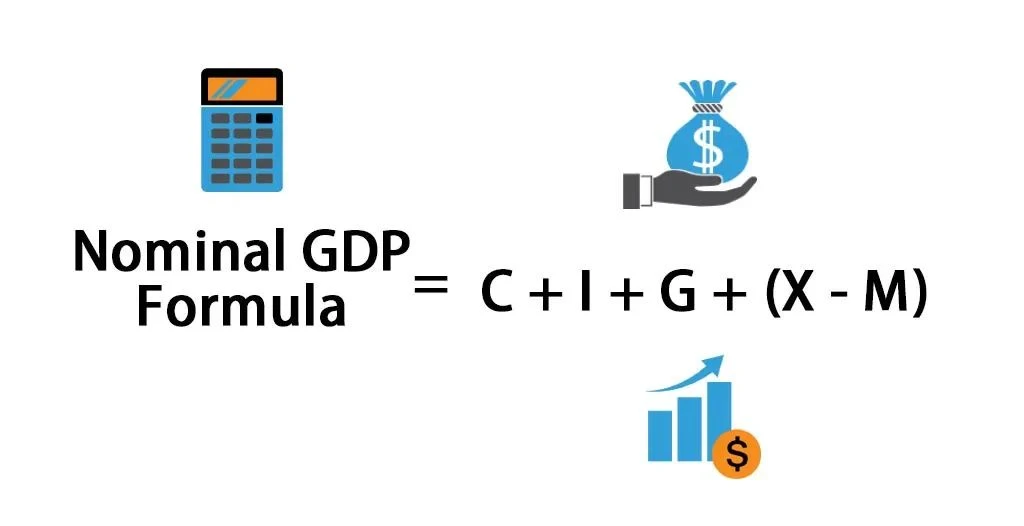

GDP: The DAOs magic metric? (DAO as state form)

What is a nation—a group of people with a constitution and an economic system? The same goes for DAOs or any Web3 community! Lets use an analogy to make it sound more convincing:

A country relies on its people to create value or GDP - a DAO relies on its community.

Countries draft a constitution that sets the laws of the land. For DAOs, this charter is written into the rules of the smart contract.

The state determines its political structure, and related governance and distribution of power, just as the Web3 community determines its governance and token distribution.

Foster an emerging culture that emanates from the community members themselves.

Create boundaries through applications or tokens.

Develop a vibrant economy, whether through tokens or other revenue-generating processes.

Shared treasury - central reserve

What is GDP?

It is the total monetary or market value of all goods and services produced within a country during a given period of time.

Now, lets try to demystify all these components and draw some analogies:

C → Consumer spending: In a country, each citizen spends money to buy their wants and luxuries. In the Web3 community, people usually spend their legal currency/tokens to buy NFTs, trade on DeFi protocols, and these can essentially form the consumption part.

I → Investment: Just as individuals and companies invest in a country, community members invest in community projects.

G → Government spending: The government spends money for national welfare, just like DAO can spend money to upgrade community functions, perform airdrops, etc. The DAOs treasury balance can serve as another measure.

XM → (exports minus imports): Just like a country exports or imports, Service DAOs might export their services, Investment DAOs might import services, etc. We can see a lot of transactions between DAOs in the near future.

Output as a measure - depends on the type of DAO:

Another way to measure a communitys GDP is to measure the output of the community:

Distribution (how big is the reach of the DAO)

Opportunity (how many opportunities a member of the DAO has access to the opportunity)

Capital (how much capital is deployed)

Depending on the type of DAO, the value of the output can vary widely, for example:

1) Protocol DAO: Metrics here will be specific to the protocol, for example:

DeFi ->Total Value Locked

L1/L2 Blockchains: Unique Wallets, Transaction Volume

Consumer Applications: Revenue Generated

2) Service DAO: total revenue generated through services

3) Social DAO: Collection treasury, membership income

4) Investing in DAOs: Return on Investment (ROI), AUM (Assets Under Management)

5) Media DAO: Channels covering DAO, such as Podcast, Newsletter, etc.

Overall, the ratio between opportunity, distribution, and capital depends largely on the type of DAO. For Media DAO, the distribution (influence) ratio is very high, while for Investment DAO, the capital ratio is very high.

L1 Metrics: Metrics That Can Drive Community Valuations

Besides GDP, various other indicators such as employment, foreign direct investment, GNI, etc. also determine the health and wealth of a country. Again, lets look at some interesting community metrics to measure the health of the community and its valuation:

1. Contributor level:

GDP per capita (represents how individuals earn their income) → average/median community income

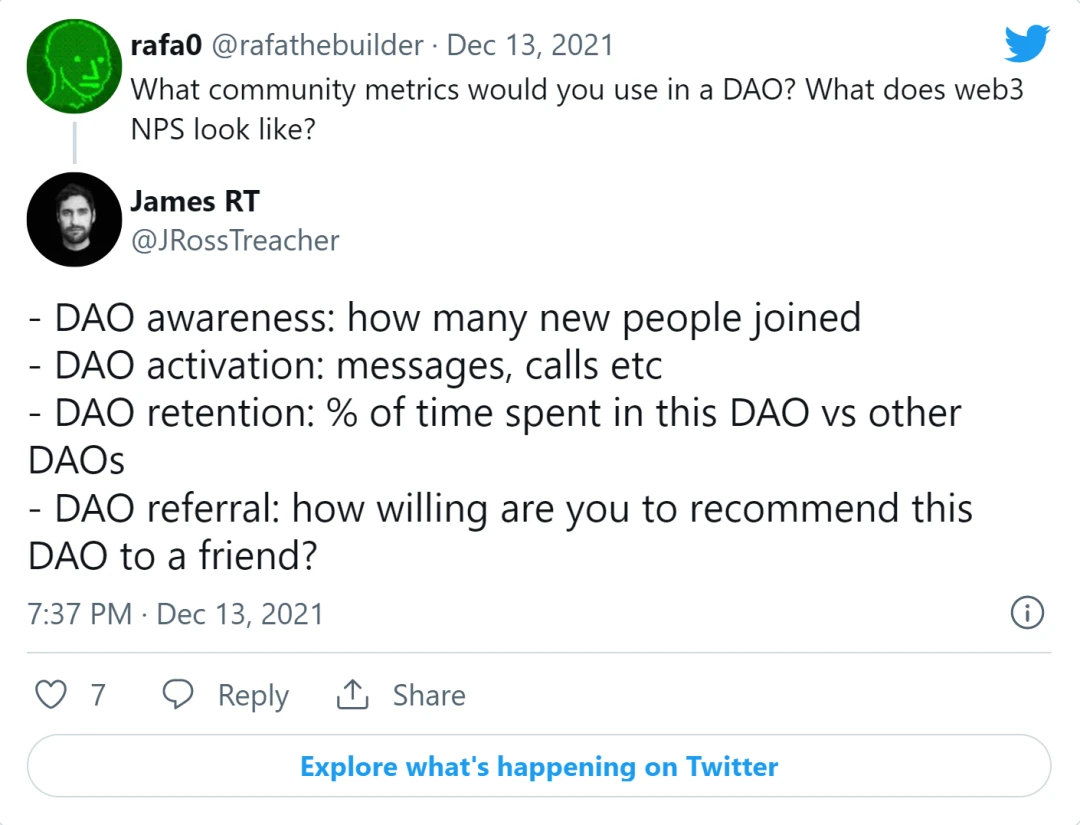

Happiness index (represents the degree of happiness of citizens) → NPS (Net Promoter Score), community utility satisfaction (CSAT), visual perception and consistency of the community

Employment level → % of active contributors, retention level

DAOrayaki Note: The Retention Level here refers to employee retention. Employee retention was an economically developed concept in the early and mid-20th century. Retention is defined as the process by which a company ensures that its employees do not resign. Every company and industry has a different retention rate, which indicates the percentage of employees who stay with an organization over a fixed period of time.

2. Network activities:

The activity of an economy is determined by indicators such as GDP and manufacturing index. Likewise, we can measure metrics such as interaction pairs, average number of responses, TAT (turnaround time) per conversation, topic starter (daily, unique),

The DAOs Moat: The Driver of Valuation

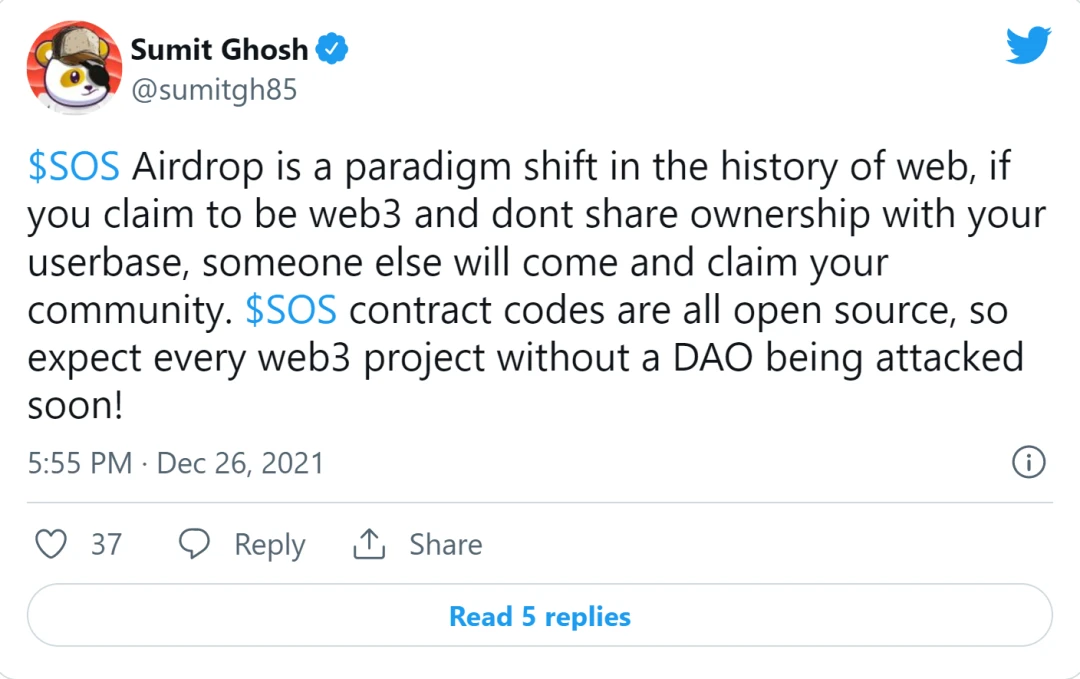

With so many DAOs launching on the market, maintaining a moat in the form of a competitive advantage will be one of the biggest drivers of valuation. Switching costs for communities or DAOs are very low. A given person can be part of many communities, which can certainly feed the numbers. Plus, those people can easily switch between communities. While tokens do create some friction, there are also many DAOs and project airdrops that can easily take away a communitys user base.

So, what is the possible moat of the community? Lets discuss:

Network Economy: As new users join the network, the value of each users service increases. The network economy is where DAOs have the potential to outperform their traditional counterparts. This is probably the strongest moat for a successful DAO. A great example of the internet economy is Instagram, every time one of your friends joins it becomes more valuable to you because you can talk to them and see what theyre up to. DAOs are built on top of crypto networks that directly combine innovative protocols with currencies (tokens), enhancing their network effects. With a DAO, the user is the owner, and each time someone else joins the DAO and/or uses the protocol, the users tokens would theoretically become more valuable. Also, as the DAO gets stronger, more people build on top of it, which makes it stronger, attracts more people, etc. For example, the Solana platform network effect is like the financial effect of Windows. Once the DAO rises, it is difficult to reverse.

Switching costs: The customers expected loss of value resulting from making additional purchases by switching to an alternative supplier. This is a tricky question. On the one hand, DAO members incur switching costs, as the tokens they own in one DAO may become less valuable if switched to a competing DAO, and the fear of forks is pervasive. For example, SushiSwap was forked from UniSwap because all the code is completely open to the world - meaning the DAO could easily be replicated exactly. While this scores poorly as a moat, low switching costs are part of DAOs: it creates an interesting dynamic in which protocols are constantly competing to keep their stakeholders happy and well compensated . If the DAO does something that some members dont agree with, those members could be lost very quickly. The Moloch DAO rewards grants to advance the Ethereum ecosystem, and even has a built-in angry exit mechanism by which members can rage exit and withdraw their tokens if they disagree with a particular community decision.

Brand: A durable attribution of higher value for an objectively identical product derived from historical information about a seller. Part of the reason certain brands are able to charge higher prices for the same item is that people associate their identities with those brands. Carrying a Louis Vuitton handbag is different from a regular handbag. Likewise, people will tie their identities to the members they contribute to and the DAO they own. If you think of Solana as a DAO, consider all the people whose identities are associated with owning Solana. They are willing to sell Solana for free, buy in and bash non-believers.

Monopoly Resources: Prioritized access to coveted assets that increase in value independently, on attractive terms. The DAOs community is its monopoly resource. Although many DAOs hire or otherwise compensate people for their contributions, in many cases people contribute to the DAO simply to make it, or the blockchain on which it is built, more valuable. Moloch DAO provides grants from the ETH pooled by its members themselves to make ETH more valuable and can submit proposals to do free work to make Ethereum better. The time of these engineers is independently valuable.

Community as Product

Just like a product has a range of metrics based on its user journey, we can observe a range of metrics based on a contributors journey through the community:

In summary, by providing economic incentives to the DAOs users, contributors, and broader ecosystem of stakeholders, and giving these stakeholders a voice in the DAOs governance, the DAO has the opportunity to build a very strong moat. The strongest are network effects - once a DAO reaches a certain growth rate, it will be very difficult to dismantle it, especially given that community governance means it should be able to adapt and develop long-term value in a way that the community believes will create the longest lasting value.

That said, DAOs should be wary of getting too comfortable with these moats. They shouldnt extract too much value, delegate too much power to too few stakeholders, move too slowly, or do anything else that might piss off enough community members. If the DAO community does this, it will be giving others a chance. The threat of forks is always there. Its survival of the fittest.

Mergers and acquisitions:

At the end of 2021, we saw one of the largest DAO mergers, Rari Capital (DeFi protocol) and Fei Protocol (algorithmic stablecoin) merged to form a $2 billion liquidity participant, integrated into a single governance token ——TRIBE, which is Fei’s governance token. As we go forward and we can see more of these mergers and acquisitions happen, it becomes critical that a valuation framework be used by all stakeholders in a DAO to evaluate and vote accordingly. Another element of synergies, i.e. how the various communities/DAOs would benefit from the combined entity, would be an interesting consideration.

Conclusion: Overvalued or Undervalued?

A good valuation always contains a story and is the bridge between the story and the numbers. Behind every number in a valuation there is a story, and every story about a company must have a number attached to it. For example, Uber, an urban car service, was initially valued at $6 billion. However, when positioned as a logistics company, the valuation rises to $53 billion. Likewise, the valuation of the Web3 community depends heavily on the communitys story and vision.

Valuation is not just a number, its a story - Ashwath Damodaran