Source of original text: The first class warehouse blockchain research institute

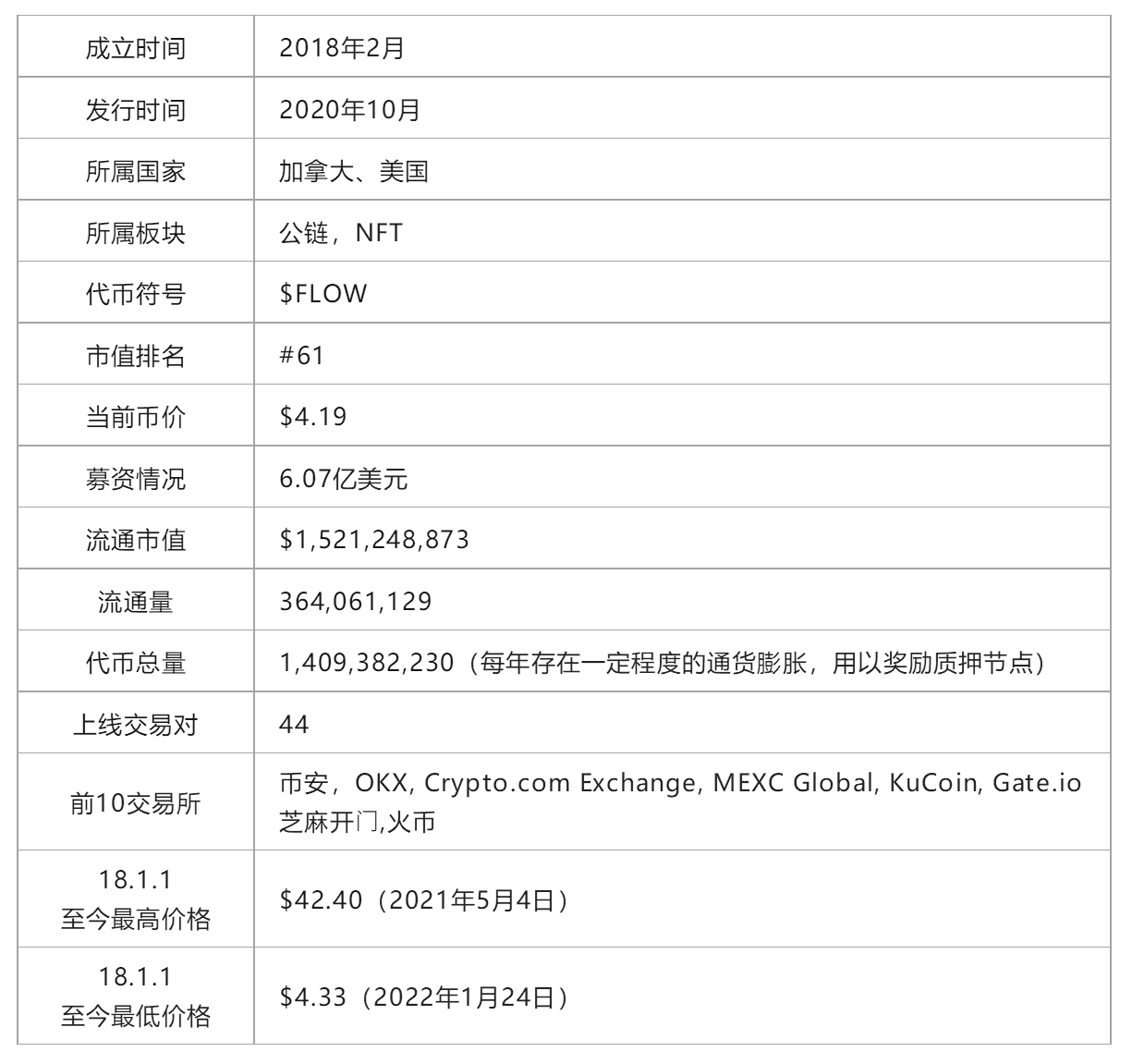

summary

summary

Flow is a Web3.0 underlying platform public chain for digital assets and applications, empowering blockchain games, applications and digital assets.Flow has a strong team. It is the project party of CryptoKitties and NBATop Shot. It has received investment from well-known investment institutions such as a16z. It has raised more than 600 million US dollars and has sufficient funds.

In terms of product design, Flow creates an environment friendly to developers and ordinary consumers, including three aspects: First, the multi-node architecture, by setting nodes with different functions, the transaction efficiency of the blockchain is improved and the transaction cost is reduced. two isEasy for developers to participate, develop a programming language Cadence that is more in line with encrypted assets and applications, and provide developers with a language that is easier to learn, write, and modify. three isConsumer friendly, the main consideration is to set up for ordinary consumers rather than stock encryption users, and pursue convenient and safe operations.

From the perspective of product operation, Flow's development strategy is to combine the influence of well-known IPs in traditional industries with NFT technology to bring more ordinary users into the blockchain world and the NFT market.The IP organization ability of the project end is strong, and the basic accumulation of the user end has been completed. Team with NBA (American Basketball League), NFL (National Football League), UFC (Ultimate Fighting Championship), ICC (Cricket World Cup), LaLiga (Spanish top football league, also known as "La Liga"), Warner Music, Universal Music , Attack on Giant, Billboard, etc. have cooperated. Among them, NBATop Shot has accumulated sales of more than 1 billion 100 million U.S. dollars, and its cumulative sales ranks sixth in the NFT series in the entire market, second only to AxieInfinity, CryptoPunks and BoredApe YachtClub. The cumulative number of transactions More than 19 million times and more than 670,000 holders, much higher than other projects, with better universality and activity. The current daily active users are around 20,000.

The focus of future development is to enhance the degree of decentralization of the Flow network and continue to expand the user base of ordinary consumers.Through a series of investment activities, DapperLabs attracts projects that conform to the development concept of Flow to participate in the ecology, provides more convenient construction tools and richer blockchain activity experience, and tries to let users enter the web3.0 world "unconsciously".

Flow has chosen a development strategy that is different from other public chains or NFT markets. Other public chains mainly compete for shares among encrypted stock users,Flow's strategy is to expand into the traditional world and to win incremental customers in the encryption industry.

The choice of this strategy, Flow has certain advantages:

1) NFT is the carrier of digital assets and the foundation of the metaverse, which can realize the value transfer of various digital assets. In the digital age and the era of globalization, well-known IP itself has accumulated a large amount of digital assets, and it is necessary to find a good way to provide them to consumers. And these IP community users also have the habit of consuming IP-related derivatives, and consuming digital derivatives is an extension of this habit. It is an appropriate choice to start with a sports IP with a huge number of fans and long-lasting consumption habits. The success of NBATopShot also confirms this point.

2) The Flow team itself, from the understanding of the industry, to the development of technology, and the operation of specific projects, has had successful cases. At this stage, it has achieved cooperation with many well-known IPs. The NFT of Bingdundun, the mascot of the 2022 Winter Olympics, is also issued on the Flow chain. For traditional IP, Flow is a competitive partner.

It should be noted that, first, the cultivation of NFT consumption habits is a relatively long process. It is necessary to find a way to better integrate IP, IP fan needs, and NFT representations to create highly recognized products and increase conversion rates. At present, NBATop Shot has achieved success thanks to the tradition of NBA star card transactions, but the transaction amount of other NFT series is much smaller and needs to be further cultivated. The second is that the concentration is too high, and it is highly dependent on top brands such as NBA Top Shot, which has not yet formed an ecology in which a hundred flowers bloom and a hundred schools of thought contend. The third is that encryption-native users pay limited attention to Flow ecology, and the encryption-native market is not hot enough.

first level title

Project Description

Project Description

Flow is a public chain for the NFT field of Web3 applications. Based on a multi-role architecture, it improves transaction speed and creates an environment that is friendly to developers and complies with ACID (atomicity, consistency, isolation, and persistence). Blockchain games, applications and digital asset empowerment.

first level title

secondary title

team 2

The team behind Flow is DapperLabs, founded by Roham Gharegozlou and Dieter "dete" Shirley, CEO of CryptoKitties, DapperLabs and founders of NBA Top Shot. CryptoKitties is an NFT star project born in 2017. This project adopted the ERC-721 standard for the first time. This standard was initiated and written by Dete. It caused a rush to buy from the end of 2017 to the beginning of 2018, and caused Ethereum transaction congestion. Therefore, DapperLabs has attracted much attention since its establishment. At present, DapperLabs has more than 500 employees and 16 employees worldwide, including 150 technical developers. The core members are introduced as follows:

RohamGharegozlou, CEO and founder of CryptoKitties, Flow and NBA Top Shot. Holds a dual bachelor's degree and master's degree in economics and biological sciences from Stanford University. Before founding DapperLabs, Roham was the founder and CEO of AxiomZen.

Dieter“dete”Shirley, the founder and CTO of Flow, co-founded CryptoKitties, and authored the ERC-721 proposal, which defines a non-fungible token standard on Ethereum. He started his career at Apple and worked as a senior software engineer; then, he joined an iPhone game company as the head of the development department; in 2016, he joined AxiomZen as the chief architect; and finally joined DapperLabs.

MikhaelNaayem, Chief Commercial Officer at Flow, who helped start DapperLabs. A month before the launch of CryptoKitties, he joined AxiomZen full-time and became a member of AxiomZen's board of directors. Before joining AxiomZen, Mik was the founder and CEO of Fuel, where he developed the platform and had over 225 million users before being sold to Animoca in 2017.

AlexShih, CFO of AxiomZen and Flow, serves on the boards of directors of DapperLabs, AxiomZen and Flow. Alex holds a BS and MS in Management Science and Engineering from Stanford University. He has also held positions at KKR, HighfieldsCapital and most recently as leader of the private equity practice.

LayneLafrance, the product owner, joined DapperLabs in March 2018, responsible for the collaborative management of Flow's engineering, recruitment, marketing, product development and business cooperation, and promoting team work efficiency.

CatyTedman, Director of Partnerships, Caty focuses on helping prominent sports brands and communities enter the blockchain. Before joining DapperLabs, Caty worked at AxiomZen as Vice President of Partnerships. Prior to that, she spent a decade in sports in various roles in the NHL, NFL and ESPN.

secondary title

funds 3

Since its establishment in February 2018, with its achievements in CryptoKitties, DapperLabs has won the favor and funds of well-known investment institutions for many times, with a total of 9 rounds of financing, with a cumulative financing amount of more than 607 million US dollars, and abundant development funds. The specific financing situation of DapperLabs is as follows:

secondary title

Product 4

product logic

Flow belongs to the public chain.DapperLabs had no intention of developing a public chain. However, in 2018, when DapperLabs negotiated cooperation with the NBA, it found that the performance of Ethereum could not support the huge user needs of the NBA. CryptoKitties caused Ethereum congestion, transaction delays, and high transaction fees in 2018. The team read more than 100 public chain white papers and talked to 20 teams, but no team built the blockchain with an eye toward creating high-quality, consumer-facing applications. 5

under such a circumstance,DapperLabs decided to build Flow, a public chain suitable for digital assets and applications, Flow focuses on the following aspects: First, the multi-node architecture, by setting up nodes with different functions, the transaction efficiency of the blockchain is improved and the cost is reduced. The second is to develop a programming language Cadence that is more in line with encrypted assets and applications, providing developers with an easy-to-learn and use language. The third is consumer-friendly, mainly considering setting for ordinary consumers rather than stock encryption users, and pursuing safe and convenient operations.

text

Multi-node Architecture 6

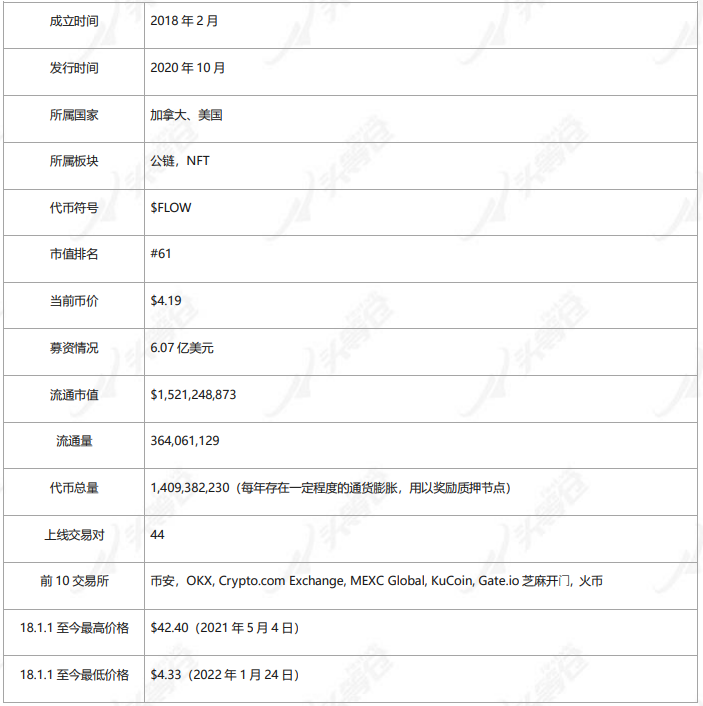

Flow adopts a method similar to pipeline operations, and distributes the work of verification nodes into 4 different roles: collection, consensus, execution and verification. The vertical division of labor between nodes is responsible for different verification stages of the same transaction, which allows nodes to concentrate on specific stages, thereby improving the efficiency of the blockchain.

The core point of the Flow network architecture is to divide transactions into non-deterministic tasks and deterministic tasks, that is, the separation of consensus and calculation, so that nodes with great computing power do not have to wait for consensus results to stagnate computing, but keep running. Let the computing power be fully utilized, and cooperate with other nodes with different functions to achieve high-speed network performance.

This is an improvement over traditional blockchains. In a traditional blockchain, each node stores the full state (account balances, smart contract code, etc.) and performs all work related to processing transactions on the chain. It is similar to having one worker to manufacture the entire car, which is less efficient.

1) Collection node (consensus)

The collection nodes are the nodes responsible for network transaction data processing. The collection nodes are equally stacked and randomly divided into clusters of roughly the same size. At the beginning of an epoch, each collection node is randomly assigned to a cluster. Each cluster of collection nodes acts as a traffic gateway to the outside world.

image description

Figure 2-1 The running relationship between nodes

After submitting to the consensus node, the cluster will be in the closed state until the consensus node will package the block, and then the next round of cluster generation will be started to start a new cluster and process the transaction data contained in the new cluster. deal with.

2) Consensus nodes (verifiers)

In Flow, consensus nodes are responsible for maintaining blocks and extending the chain by adding new blocks. Consensus nodes receive hashed references to sets generated by collection nodes and, by running a Byzantine Fault Tolerant (BFT) consensus algorithm, agree on set verification.

The consensus node performs a complete BFT consensus algorithm on the set, confirms the order of transactions and forms a block, called the final block. In Flow, blocks include transaction data and other input data. For example, the random seed needed to perform calculations.

Consensus nodes are also responsible for sealing blocks at the end. The sealing of the block is the final step performed after the block is executed and verified by the node to complete the calculation and verification. In addition, consensus nodes are responsible for maintaining the part of the system state related to the stake of the nodes, receiving and adjudicating slashing challenges, and slashing failed nodes.

3) Execution node (executor)

The execution node is the node with the largest computing power in the Flow network, and is mainly responsible for expanding the computing power of Flow. Execution nodes execute finalized blocks produced by consensus nodes and provide required information to validators so they can check the execution results. In order to improve calculation efficiency, the execution node decomposes the calculation of the block into small blocks, and publishes additional information about the block in the block that executes the calculation, so that the verification node can verify it.

4) Verification nodes (collectors)

The verification node is responsible for verifying the correctness of the results published by the execution node. Each validator checks only a small subset of blocks, and the validator requests the execution nodes for the information it needs to recompute the blocks it is checking. Dividing the validation work into small chunks enables validator nodes to independently and parallelize the execution of the check blocks for high efficiency.

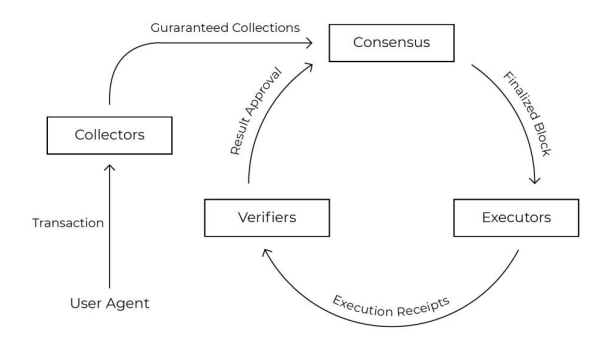

image description

Figure 2-2 Node work flow chart

The collection node packs the transaction data to the consensus node. After the consensus node reaches the BFT consensus, it is handed over to the execution node for calculation, and then the verification node verifies the execution result, and finally publishes the result, so that the consensus node completes the encapsulation into the block and broadcasts it. Start the next block.

Developer tools: Cadence and open source tools

Cadence is a resource-oriented programming smart contract language that can encode digital assets. It combines linear types with object functions. By ensuring that resources (and their related assets) can only exist in one location at a time, they cannot be copied and created. , thereby creating a secure declarative model for digital ownership that cannot be accidentally lost or deleted.

At the same time, based on functional security, it requires that access rights be limited to the owner and those who have valid references, that is, each resource has an owner, and only the owner of the resource can call on it. This way can prevent the logical flow of re-entry attacks, that is, attacks such as double spending.

Cadence is an upgradeable smart contract that allows developers to deploy smart contracts to the main network in a "test state" and gradually upgrade them later. Once developers are confident that their code is safe, they can relinquish control of the contract, the decision is irreversible, and the code is completely immutable from then on.

This design balances the user's need for the right to know the code, that is, whether an application or smart contract really does not need to be trusted, and at the same time gives developers enough flexibility. If a bug occurs within a period of time after the release, the code can be edited. Adjustment without more complex operations.

Cadence is a nestable smart contract,

Developer open source tools include the following:

1) Flow CLI, which provides the most comprehensive one-stop command line tool for building Flow applications. This is the most important developer tool on the Flow chain, which can build applications on the Flow chain. Developers can install FlowCLI on macOS, Linux and Windows, create accounts, deploy, update, delete contracts, and implement transactions. 1) FlowGo SDK, a developer tool with friendly scalability and back-end integration, has performance advantages.

2) FCLFlowJavaScript SDK (FlowClient Library), for front-end developers, JavaScriptSDKFCL and wallet discovery service can help developers easily integrate the front-end into Flow and interact with it. Build composable interoperability without using an ABI, creating Dapps that delight users.

3) FlowGo SDK, a developer tool with friendly scalability and back-end integration, has performance advantages.

4) VisualStudio Code plug-in, which can statically test Cadence code and test smart contracts.

5) FlowPlayground GUI, a development environment in a virtual host and browser, developers can test smart contracts on the Playground, and at the same time allow ordinary users to experience the Cadence smart contract language.

6) Flow Emulator, a local emulator used with FlowCLI, developers can use the Flow emulator to conveniently carry out local development.

At present, any developer is free to enter Flow to design and test smart contracts. However, before the official release, it needs to be audited by the Flow team or an authorized third party. In order to improve efficiency, DapperLabs plans to launch stableCadence in June 2022, at which time developers can directly deploy smart contracts by themselves.

Getting Started: Improving Account Management Security

Since Flow is mainly sold to ordinary users, they have developed a wallet and account system that is more in line with the payment habits of ordinary users, increasing convenience and security, and making it easier for ordinary users to get started.

Currently, the Flow ecosystem has 3 wallets, namely:

1. DapperWallet: Fully managed wallet, fully pays the handling fee. The wallet is maintained by DapperLab and is currently used by NBATopshot, NFL, UFC and other projects.

2. Blocto: semi-custodial wallet, fully pay the handling fee, and some transactions are charged by Blocto points as an alternative fee. Currently, most third-party DApp accesses use this wallet.

in,

in,Fully managed wallets and semi-custodial wallets are more friendly to ordinary users, and mainly have the following advantages:

The wallet can support a secure account recovery process, and consumers will not lose their assets or lose access to their ID accounts because they forget their secret keys.

When the wallet interacts, it provides readable information, which clearly informs the user which permissions are approved when authorizing a transaction. In this way, clear instructions can be given to the user, and the occurrence of some deceptive behaviors can also be effectively avoided. In the NFT field, incidents of asset loss due to misclicked links and wrong authorizations have occurred frequently. The readable wallet interaction information increases the security of the interaction.

DapperWallet supports fiat currency payment, lowering the entry barrier for ordinary users.

Third-party payment function for handling fees.When using DapperWallet, the service fee is paid by the wallet service provider, and the user is free. When using Blocto, most DAPPs are also free for users, and for transfer transactions, the Blocto wallet charges an additional fee of one Blocto credit.

From a technical point of view, a transaction on the flow chain is completed with a two-layer signature structure: the first layer is responsible for the relevant parties of the transaction: the signer is the proposer, and the Authorizers (because the native supports multi-signature, each transaction has these two parameter, if the two addresses are the same during single signing); the second layer is responsible for the fee payer: the signer is the payer, and the fee payer will sign. These two layers can be separated, signed by different subjects, and have high flexibility.

Summarize:

Summarize:

Flow has a strong team. It is the project party of the star products CryptoKitties and NBATop Shot. It has received investment from well-known investment institutions such as a16z. It has raised more than 600 million US dollars and has sufficient funds.

Flow belongs to the public chain for digital assets and applications. It focuses on three aspects: First, the multi-node architecture, which improves the transaction efficiency of the blockchain and reduces transaction costs by setting up nodes with different functions. The second is to develop a programming language Cadence that is more in line with encrypted assets and applications, and provide developers with a language that is easier to learn, write, and modify. The third is consumer-friendly, mainly considering setting for ordinary consumers rather than stock encryption users, and pursuing convenient and safe operations.

In this regard, it should be noted that Flow created a new programming language Cadence, which is different from Solidity, the smart contract language currently used by Ethereum. For developers familiar with the Solidity language, it takes a certain amount of learning time to enter Flow. However, for developers new to the blockchain field, Cadence is easy to learn and audit, and can be upgraded to facilitate developers to make changes early in the projecthistory

3. Development

history

status quo

status quo

secondary title

Network node operation

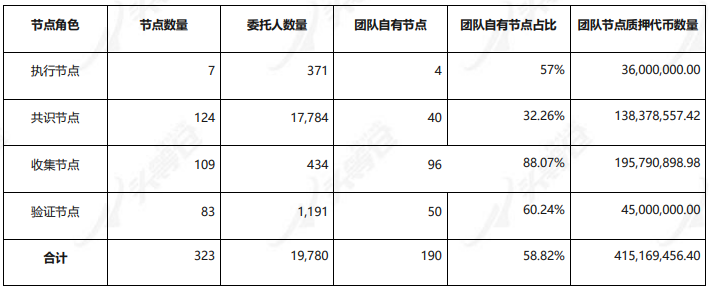

As of April 29, 2022, Flow has a total of 323 nodes, a total of 19,780 principals, and a total of about 732.86 million FLOW has been pledged. The information of various nodes is shown in the following table:

Table 3-2 Basic Information List of Flow Network Nodes 8

secondary title

network performance

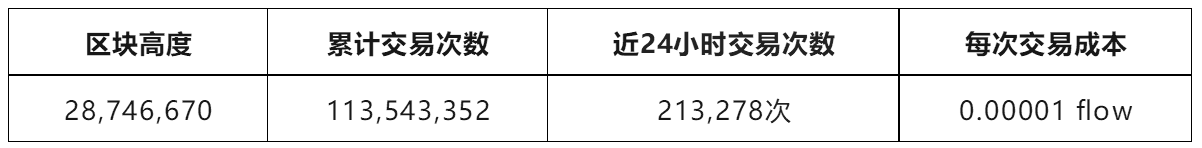

The original intention of Flow's development is to improve the transaction efficiency of the blockchain and reduce transaction costs. As of April 29, 2022, the performance-related indicators on the Flow chain are as follows:

Table 3-3Flow Network Performance 9

secondary title

Market operation

Transactions

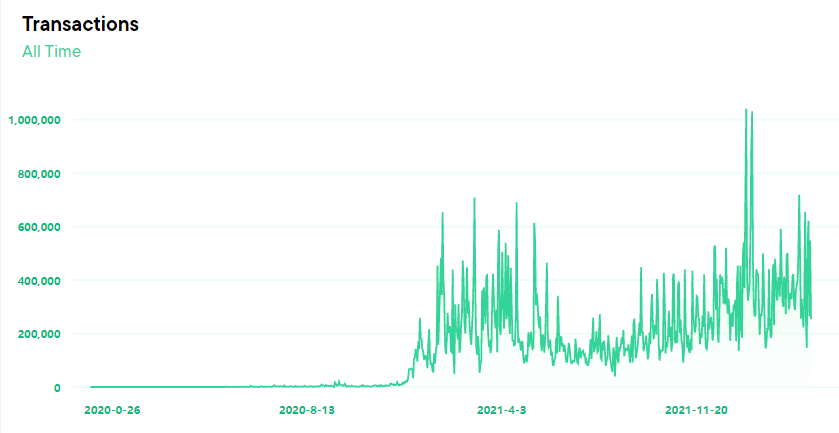

As of May 54, 2022, the cumulative number of transactions on the Flow chain is 116,061,887. Flowscan records the changes in the number of daily transactions since the launch of Flow. Since its launch in October 2020, changes in the number of transactions are highly correlated with the popularity of the NFT market.

It can be roughly divided into 4 stages. The first stage: From October to December 2020, the number of transactions will remain at around 10,000. The second stage: It will start to grow sharply in early 2021. From February to early May 2021, the average number of daily transactions will be between 150,000 and 400,000, and the peak will exceed 600,000. The third stage: From the end of May to the beginning of October 2021, the number of times will be less than 150,000, and from October to December it will be about 200,000. The fourth stage: From January to February 2022, the number of transactions will increase significantly, with a peak of more than 1 million. Since March, the number of transactions has dropped to about 200,000-300,000 times.

image description

Figure 3-1 The number of transactions per day Figure 10

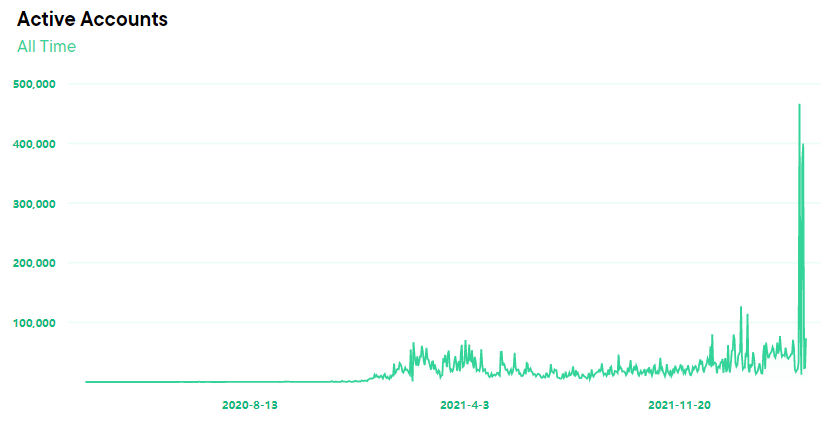

Daily active users

image description

Figure 3-2 daily active users

Ecological construction

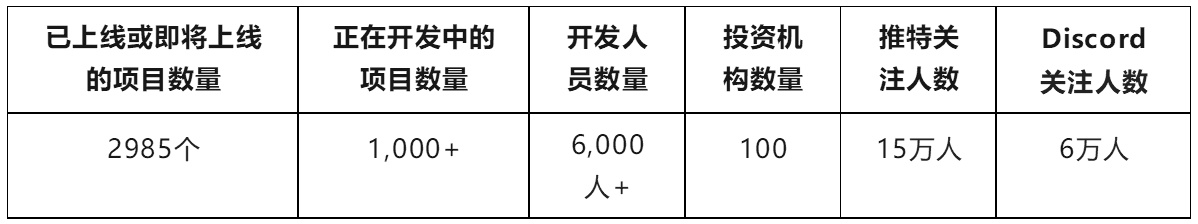

From Table 3-4, we can see that the Flow ecology has basically formed, and the project side, investment side, and user side have all completed initial accumulation and have a certain degree of attention.

Table 3-4 Overview of Flow Ecosystem Construction 11

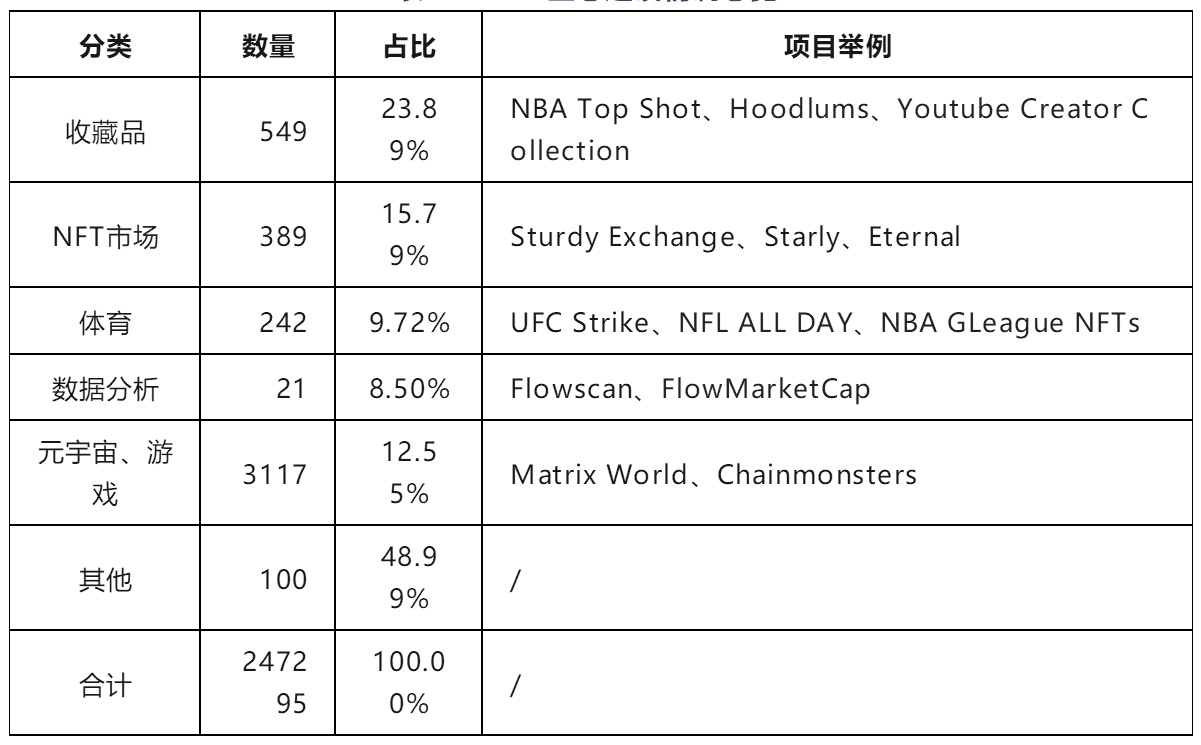

Among them, 29,547 projects cover NFT markets, collectibles, sports, games, data analysis, music, art, DEFI, DAO and other fields. Collectibles account for the largest proportion, and sports products also account for a relatively high proportion, and most of the partners are well-known sports brands. The specific classification is shown in the table below:

Table 3-4 Overview of Flow Ecological Construction 12

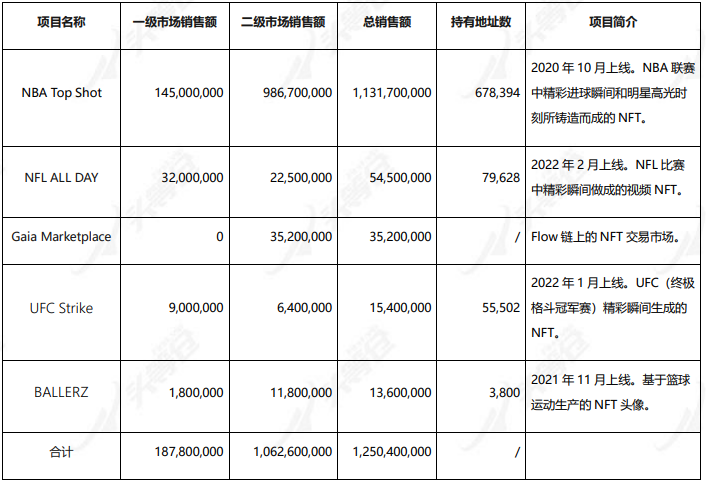

According to the data of Flowverse, the total sales of the top five projects with cumulative transaction value on the Flow chain are about 1.25 billion U.S. dollars, of which NBATop Shot occupies the vast majority of shares and users, with a total sales of 1.026 billion U.S. dollars and about 6.7 billion users. Ten thousand. The total sales and number of users of other projects are much smaller than NBATop Shot, and more in-depth user training is needed. The specific rankings are as follows:

Table 3-5 Top five projects with accumulative transaction amount on the Flow chain (amount unit: USD) 13

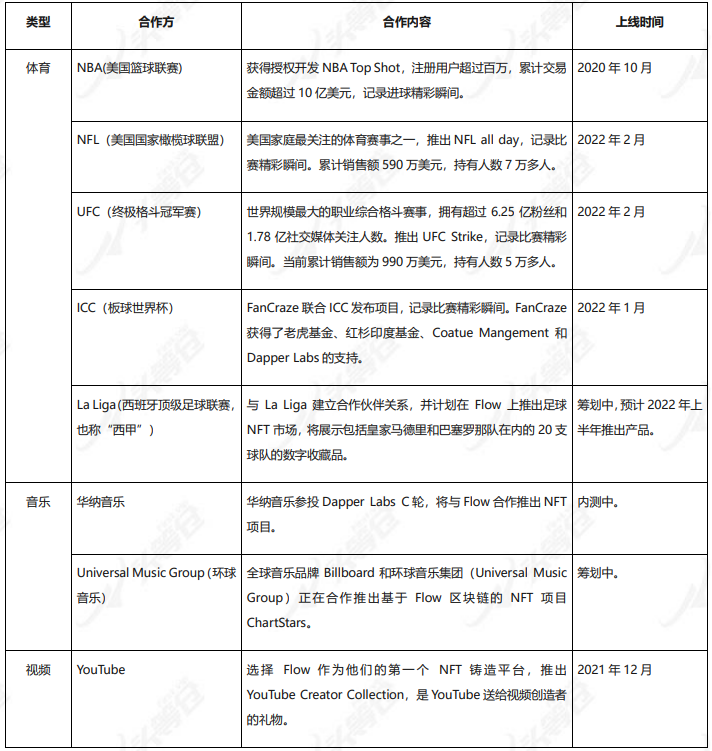

Cooperating with various traditional IP brands is Flow's characteristic and competitiveness.Flow has carried out in-depth cooperation with a large number of sports event operators, and at the same time, is gradually expanding the scope of cooperation, such as Youtube and other cooperation. Including Bingdundun, the mascot of the Winter Olympics, has also been authorized by the Olympic Organizing Committee to issue NFT on the nWayPlay market on Flow. The current major cooperative project parties include:

secondary title

Future 15

Flow's goal is to become the first blockchain with 1 billion users, and the strategy it adopts is to develop blockchain users in the IP product user group and mainstream consumers. For the future development of Flow, one is to attract young people and ordinary consumers to participate, and the other is to take a gradual decentralization route. In June this year, the permissionless deployment of the entire network contract will be fully launched.

At the current stage, its main approach is to cooperate with NBA, NFL, UFC, LaLiga and other popular IPs, focus on the huge user groups of these products, and bring them into the Flow ecology and web3.0.

Flow develops from the future. It builds a series of tools to attract more young people and ordinary consumers to participate in it, and expand a wider field for the blockchain industry. mainly include:

1) Build tools suitable for millennials and Gen Z. As one of the specific measures, DapperLabs acquired Brud and established DapperCollectives. The team is developing various tools for young users, such as model building tools and design tools, so that they can participate deeply.

image description

Figure 3-3 Miquela on the Brud website

2) Build products and metaverses suitable for young users, Genies and Cryptoys are two of the main projects.

GeniesIt is a non-encrypted avatar project launched by AkashNigam and EvanRosenbaum in 2016. For its first five years, Genies has focused on letting users create their own personalized avatars, which they can dress up in clothing and accessories (including Gucci clothing as a partner) to express their individuality. The main users of Genies are girls aged 14-16. In 2021, the founding team seeks NFT development and cooperates with Flow.

The Genies team believes that Flow can best help teenagers understand the working principles and tools of the blockchain, and ultimately create their own decentralized ecosystem. These avatars also cost only a few dollars, not thousands of dollars. This is a real NFT user, and digital assets will widely exist in the form of NFT. In January 2022, the team identified the development goal of genies as "enabling humans to create their own digital identity ecosystem." On March 16, 2022, former Disney CEO Bob Lger invested and joined Genies' board of directors. GeniesNFT is scheduled to go live on Flow this summer.

CryptoysIt is a digital toy company with original IP, games, toys, etc., and its main customers are children and gamers. Its parent company OnChainStudios received US$7.5 million in investment from investment institutions such as a16z and DapperLabs in October 2021. The Cryptoys team hopes that "parents and grandparents will be able to buy Cryptoys for their children at Christmas". The team believes that the ease of use and composability of Flow can enable users to enter web3.0 without too much strangeness, where they get digital asset projects with ownership, composability and fun.

In terms of decentralization construction, in 2022, Flow will launch or improve the following products, the degree of decentralization of the platform will be enhanced, and the ecology will be more open:

1) DapperCollectives will release its first DAO tool and start supporting the community on Flow.

2) Genies will be live on Flow and everything they build will be owned by the community.

3) DapperWallet will be available for integration by all third-party developers.

4) DapperWallet and all Dapper projects and possibly many projects developed by third-party developers will support FLOW.

Summarize:

Summarize:

Flow has a clear development goal, and its original intention is to build a public chain for the NFT field, empowering blockchain games, applications and digital assets. Since its inception, it has basically carried out operations around this goal.

The main line of the operation strategy is clear, and the stage development requirements are clear. From 2018 to the first half of 2020, the team is committed to building the underlying technology of the Flow public chain. Starting IP cooperation and market operations in the second half of 2020, NBATop Shot will lead the first wave of NFT boom in 2021.

The IP organization ability of the project end is strong, and the basic accumulation of the user end has been completed. The team has cooperated with NBA, NFL, UFC, LaLiga, Universal Music, Warner Music, Attack on Giants, etc. Among them, NBATop Shot has a cumulative sales of more than 1.1 billion US dollars, and its cumulative sales rank sixth in the NFT series, only It is less than AxieInfinity, CryptoPunks, BoredApe Yacht Club, MutantApe Yacht Club and ArtBlock, but the cumulative number of transactions is as high as 19 million, much higher than other projects. The current daily active users are around 20,000.

The focus of future development is to enhance the degree of decentralization of the Flow network and continue to expand the user base of ordinary consumers. Through a series of investment activities, DapperLabs attracts projects that conform to the development concept of Flow to participate in the ecology, provides more convenient construction tools and richer blockchain activity experience, and tries to let users enter the web3.0 world "unconsciously".

first level title

secondary title

supply

secondary title

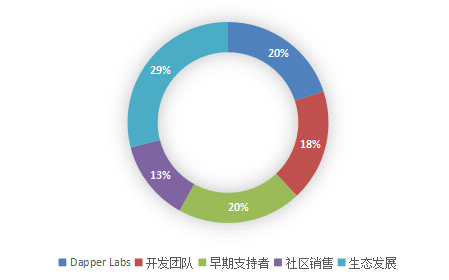

Token Distribution Mechanism

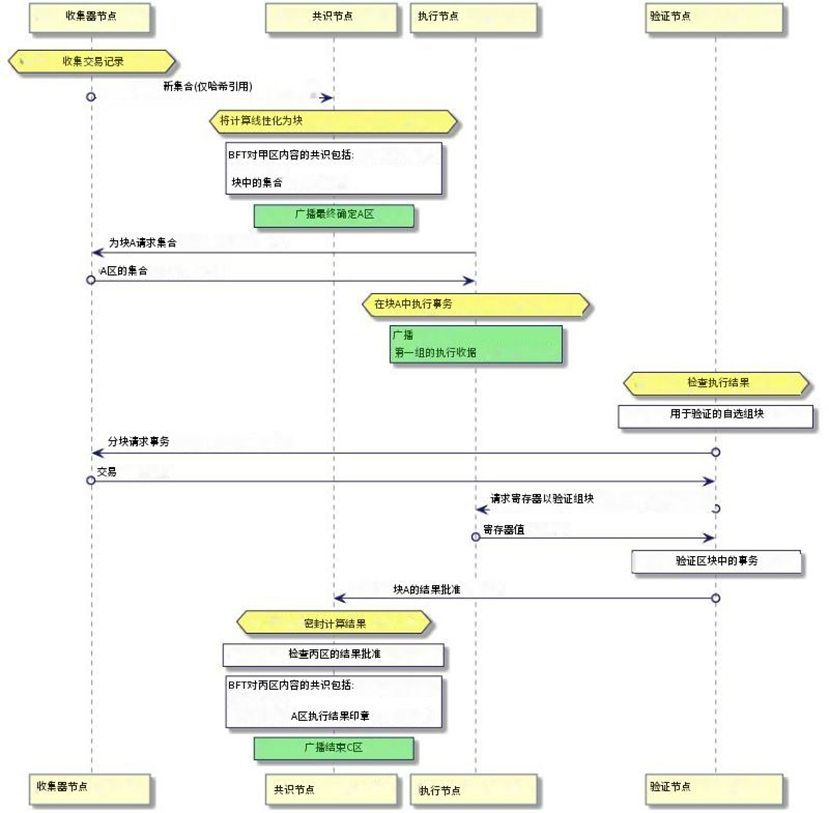

image description

Figure 4-1 Schematic diagram of token distribution

early backers sectionBefore the start of Flow development, the DapperLabs team completed a financing of about 24.6 million US dollars as the project's start-up capital, which is expected to be converted into FLOW tokens. This part of tokens is also locked for one year and released linearly for 12 months.

Early supporters include a16zcrypto, Union Square Ventures, Coinbase Ventures, Samsung NEXT, Fenbushi Digital, Accomplice, Venrock, Blockchange, DistributedGlobal, BlockTower, Valor Capital, and Warner MusicGroup, etc. Early supporters who received more than 1,000,000 tokens are as follows:

Table 4-1 List of early supporters who received more than 1,000,000 tokens

development teampart, mainly rewarding or compensating about 90 people from Flow, Dapper Labs and other companies. In addition, a portion of it is reserved for the developer community, funding developers who make ongoing contributions to Flow core and other open sources.

DapperLabsalso,

also,It should be noted that staking token rewards. As a POS proof-of-stake network, the Flow network requires validator nodes to lock up deposits denominated in FLOW. Flow is passed annually by new issuance (inflation) and transaction fees (combined with inflation, i.e."total reward"), distribute FLOW as a reward to stakers. The current plan is set at 3.75% of the total annual issuance, so when transaction fees fall short of this fixed reward, new tokens will be minted to make up the shortfall. As the gap between transaction fees and rewards narrows, the issuance rate approaches 0%. If the transaction fee exceeds the fixed reward, the excess will be kept in a third-party escrow account. According to the original smart contract version, this part of the transaction fee will be used to hedge future inflation; but currently, after the agreement is updated, this part of the transaction Fees will be destroyed.

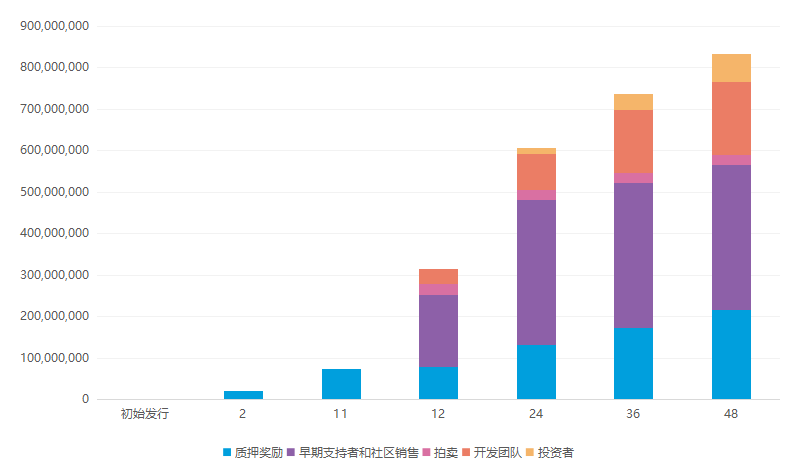

Token Release Mechanism

In the token release rules, the DapperLabs part (250,000,000), the collateral reserve part (125,000,000), and the foundation reserve part (160,185,841), a total of about 535 million tokens have no clear release time. Among them, the DapperLabs part is held for a long time. If there is a sale, there will be a one-year lock-up period from the date of sale. The part of the collateral reserve does not directly enter the circulating supply. A portion of the Foundation Reserve is used for pledge, commission, fundraising, or lease to community organizations.

In addition to the above-mentioned parts, the remaining tokens are about 715 million, and the release rules of this part of the tokens are determined; plus the pledged token rewards, the number of tokens released is shown in Figure 4-2. 24 months after Flow went online, the circulation of tokens was about 607 million; 36 months after the launch, the circulation was 736 million; 48 months after the launch, the circulation of tokens was 833 million.

image description

Figure 4-2 Schematic diagram of token release

need

The main uses of FLOW tokens include: 1) payment of computing and verification services (ie transaction fees); 2) transaction medium; 3) pledge deposit; 4) storage deposit; 5) mortgage assets of secondary tokens; 6) participation in governance .

Transaction processing:Flow charges users or the apps they use. There are two kinds of fees, one is the processing fee, which is the fee to submit and package the transaction; the other is the calculation fee, when the user needs to perform other transactions except updating the balance, they need to pay FLOW.

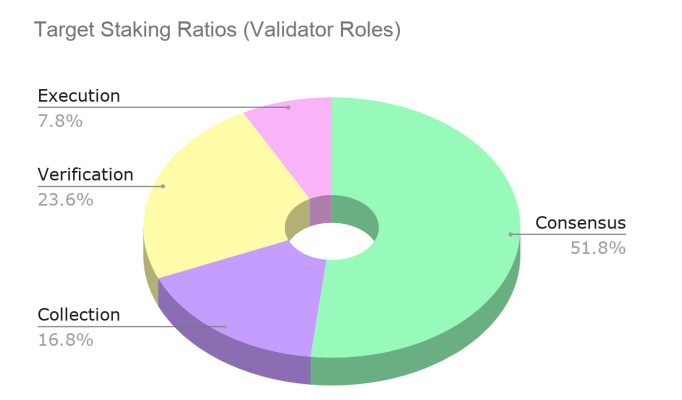

Pledge deposit:image description

Figure 4-3 Staking Reward Ratio of Different Types of Nodes

Storage Margin:Governance:

Governance:Summarize:

Summarize:

At this stage, FLOW tokens are mainly used as transaction fees, pledge deposits, storage deposits, etc. Most of the tokens will be released within 12 to 24 months, that is, from October 2021 to October 2022. 500 million tokens entered the circulation market, which may cause market selling pressure. It is worth noting that DapperLabs developed Dapperwallet, which is the wallet used by NBATop Shot, NFLAll Day, UFCStrike and other projects, and will support Flow as a token for payment this year. This may increase the consumption of Flow.

first level title

secondary title

Industry overview

NFT asset transactions have grown significantly in the second half of 2020 and will explode in 2021. With the popularity of PFP avatars and the rise of GameFi and Metaverse, NFT transactions, which are the basic form of digital assets, will achieve hundreds of times of growth in 2021.

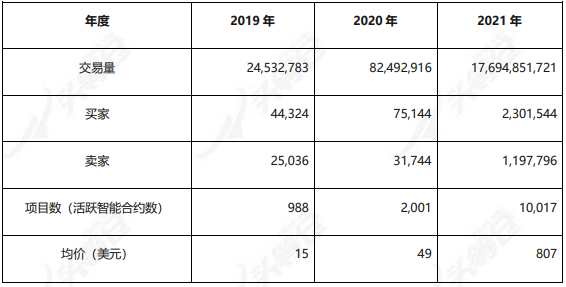

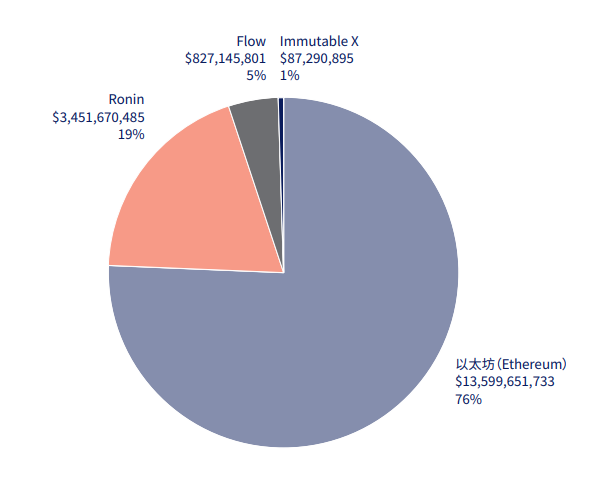

Different statistics agencies use different calibers, and the specific growth figures vary. According to NonFungible's statistics, the total amount of NFT transactions in 2020 will be approximately US$82 million, and in 2021 it will be US$17.6 billion17. According to DappRadar data, NFT sales will reach approximately US$25 billion in 202118. Since NonFungible counts the data of Ethereum, Ronin, Flow, and IMX, and identifies and eliminates false transactions (tests, robots, knock-on transactions, etc.), its data is used for industry analysis.

Table 5-1 Comparison of NFT industry development

As can be seen from Table 5-1, the NFT industry will experience explosive growth in terms of transaction volume, buyers, buyers, number of items, and average transaction price in 2021. The total market transaction volume has increased by more than 200 times, buyers have increased by about 30 times, sellers have increased by 36 times, the number of items has increased by 4 times, and the average price has increased by 15 times.

In the case of hot market conditions, a number of leading NFT projects have also formed, obtaining higher liquidity. From Table 5-2, we can see the status of the top six projects (markets) in terms of cumulative NFT transaction value. Currently, Ethereum occupies a dominant position on the list, but Ronin and Flow have also formed their own NFT brands. The cumulative transaction volume of NBATop Shot ranks sixth in terms of transaction volume, but the number of transactions ranks first, reaching 1,900 million times. NBATop Shot is a consumer-level application, and more players buy it out of consumer psychology. It is economically universal, and the price is not too high, but it has a high degree of activity.

Table 5-2 The top six and five largest NTF projects by cumulative transaction value19

competition analysis

competition analysis

Transaction amount, users and revenue

Amount of the transaction

image description

user

user

The main flow of NFT on Ethereum is on Opensea, and the main flow of NFT on Ronin is on AxieInfinity, so the data of these two markets are used for comparative analysis. As of April 29, 2022, the comparison of the number of users is shown in the table below:

Table 5-3 Comparison of the number of users between major NFT blockchains 20

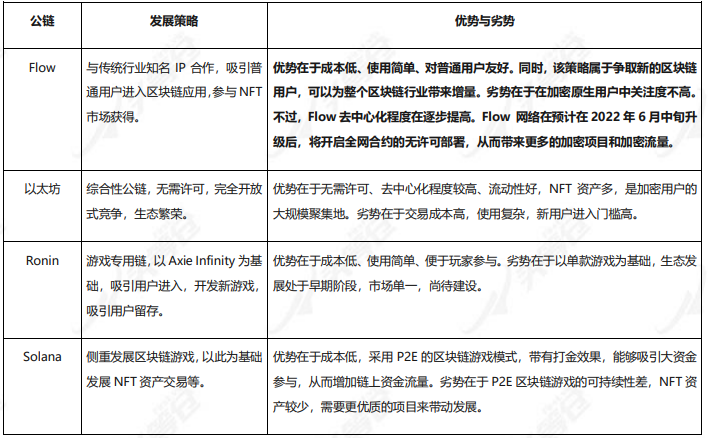

Development Strategy

Development Strategy

For the NFT field, different public chains, combined with their own characteristics, have chosen different development strategies. Some public chains are comprehensive public chains, starting with DeFi, providing high-yield liquidity mining projects to attract funds to enter; at the same time, developing the NFT market to attract funds to enter NFT. Some public chains are dedicated public chains, such as focusing on games or NFT assets. At the beginning, they use popular games or NFT projects as an opportunity to attract users to enter and retain them. In terms of NFT market expansion, the main public chain development strategies are compared as follows:

Table 5-4 Comparison of development strategies adopted by public chains for the NFT market

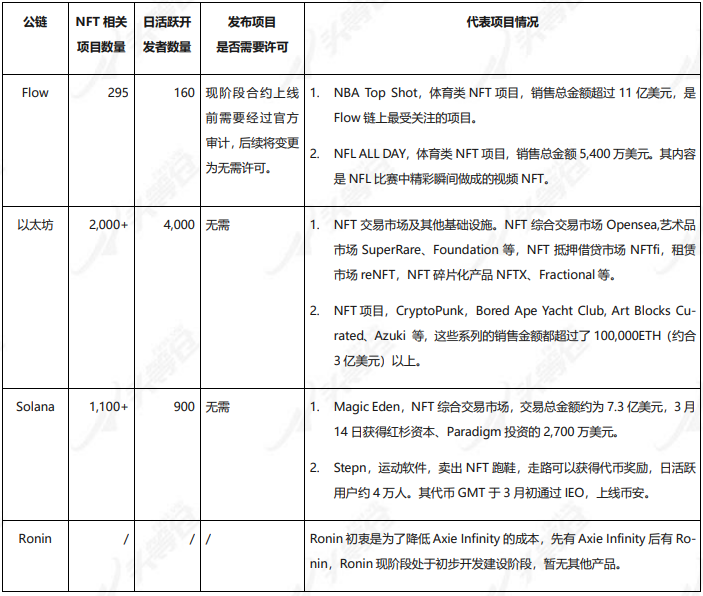

Ecological construction

"2021 Electric Capital Developer Report" divides the number of daily active developers of the public chain into different levels to analyze the activity of public chain development activities. The first echelon is developers with more than 2,000 people, and only Ethereum is at this level. The second echelon is Polkadot with 1,000 to 2,000 people. The third echelon consists of 300 to 1,000 people, a total of three companies, namely Bitcoin, Cosmos and Solana. The fourth echelon has 100 to 300 people. Flow belongs to this echelon. There are also public chains such as Avalanche, Terra, and Celo in this area. It can be seen that the developers of Flow are highly active. In addition, the number of Flow developers is also growing steadily and continuously. Compared with December 2020, the number of Flow developers in December 2021 increased by 191%, roughly doubling. 21 Therefore, Flow is a public chain with more active developers and faster developer growth. The more active developers are, the more projects they can provide, and the richer the ecology will be. The relevant ecological construction is shown in the table below:

Table 5-5 Public chain NFT ecological construction situation

Summarize:

Summarize:

Flow's development strategy is to combine the influence of traditional industry IP with NFT technology to bring more ordinary users into the blockchain world and NFT market. This is quite different from other public chains. Other public chains are mainly competing for shares among existing crypto users, while Flow’s strategy is to expand into the traditional world and to win incremental customers in the crypto industry, which will benefit the overall development of the blockchain industry.

This strategic choice requires further consideration of two levels of issues:

Is it an appropriate development direction to promote NFT to ordinary consumers? What is the potential market and customer size?

First of all, NFT is the form of ownership of digital assets. After adopting NFT technology, digital assets can be transferred in the virtual network. This is the foundation of web3.0 and metaverse. With the development of the digital age, people's digital assets are increasing significantly, including game account assets, social networking site content, various digital collectibles, etc. People are increasingly aware of the existence and value of digital assets. The technology of NFT gives digital assets a specific way of value transfer.

At the same time, well-known IP fans have always had the habit of collecting and consuming IP-related derivatives. Previously, well-known IP mainly obtained income through various physical derivatives, such as various cards, posters, models, clothes, shoes, toys, etc. The birth of NFT technology has given these well-known IP a new technical form, which can directly sell digital assets. No matter what technology is used, for the IP side and the user side, they are sharing the community culture, which is not fundamentally different from all kinds of physical sales. Therefore, if the well-known IP community itself has a good habit of consuming collectibles, then the conversion rate of community users to consume NFT collectibles will also be high.

The success of NBATopShot is related to the large number of fans in its native community. The NBA star card was first born at the end of the 19th century. It was originally a baseball star card, and then gradually expanded to basketball and football. It was all the rage in the middle of the 20th century. As the NBA league has received widespread attention in the United States and the world, NBA basketball star cards have also been relatively active in the market. Thanks to this collection culture formed over the years, NBATop Shot has attracted much attention after its launch, and the number of collection addresses is currently close to 670,000.

Therefore, Flow chooses to cooperate with well-known IPs in traditional industries to expand the market to ordinary consumers, which has its applicable scenarios and advantages. Traditional IP has completed the cultivation of user consumption habits, and purchasing NFT collectibles is a habit that can be further expanded and extended naturally. At this stage, Flow focuses on the development of sports IP, which is also related to the huge fan community and fan spending power of sports projects. The NBA has more than 65 million followers on Instagram. The number of fans of well-known NBA stars on Twitter ranges from millions to tens of millions, and James of the Lakers tops the list with 41.3 million fans. The average number of people watching the live broadcast of the 2021 NBA Finals is about 9.91 million, with a peak of 16.54 million. The Lakers Club, one of the Odaily teams, created an estimated value of US$199 million in the 2019-2020 season only for jersey advertising space22. NFL reaches 29 million followers on Twitter

Flow's strategy has also been successful in practice. Flow's flagship project, NBA TopShot, has a total sales volume of more than US$1 billion, ranking fifth in the total sales volume of NFT projects, and has attracted much attention. In terms of ecological construction, it has attracted many well-known IP brands, NBA (American Basketball League), NFL (National Football League), UFC (Ultimate Fighting Championship), ICC (Cricket World Cup), LaLiga (Spanish top football league, also Known as "La Liga"), Warner Music, Universal Music Group (Universal Music), YouTube and other well-known brands have cooperated with Flow on projects. At the same time, it has accumulated a large number of developers, and the number of developers is comparable to popular projects such as Terra.

Is Flow attractive enough to well-known IP to form a moat?

Well-known IP usually has many types of partners. The depth and duration of cooperation may change, and there may be competition among the products of various cooperative institutions. For example, Chiliz mainly cooperates with football clubs to issue fan tokens. Sorare also cooperates with football clubs to issue football star cards and develop football games. TerraVirtua is an immersive interactive platform for encrypted collections. It has obtained the genuine authorization of several big movie IPs, such as "Pacific Rim", "The Godfather", "Top Gun", "Godzilla vs. King Kong" and so on.

At present, Flow has a big advantage in the competition. First, the Flow team has a forward-looking understanding of the development of the industry and has sufficient technical reserves. In 2017, it defined the ERC721 standard and launched successful projects such as CryptoKitties and NBATopShot. The second is that Flow has demonstrated strong operational capabilities during its operations in the past year. The ecological construction has attracted many well-known IP brands and a large number of developers, and has formed a first-mover advantage. The just-concluded 2022 Winter Olympics also chose to issue an NFT of the mascot Bingdundun on Flow. This superposition of influence and first-mover advantage is expected to create a moat for Flow.

first level title

6. Risk

1) Development strategy risk

Flow's development strategy is to combine the influence of traditional industry IP with NFT technology to bring more ordinary users into the blockchain world and NFT market. There are several risks in this strategy: First, intellectual property cooperation is not exclusive, thus forming a competitive relationship with other NFT products. The second is the cultivation of NFT consumption habits, and it takes a long time to expand new users. The third is that encrypted native users have limited attention to the Flow ecosystem, and the market is not hot enough.

2) Risk of high product concentration

References

References

Flow:Separating Consensus and Compute– Block Formation and Execution –

ElectricCapital Developer Report (2021)

Flow First Class Warehouse Research Report

note

1https://www.coingecko.com/zh/%E6%95%B0%E5%AD%97%E8%B4%A7%E5%B8%81/flow, data from May 9, 2022

2https://zh.onflow.org/team

3https://www.crunchbase.com/organization/dapper-labs/investor_financials

4https://zh.onflow.org/primer

5https://www.notboring.co/p/flow-the-normie-blockchain?s=r

6https://arxiv.org/pdf/2002.07403.pdf

7 https://zh.onflow.org/blog,https://mp.weixin.qq.com/s/LhXppAi9gavA-RICDqcgsw

8https://flowscan.org/staking/overview

9https://flowscan.org/metrics/blocks

10 Figures 3-1 and 3-2 are from https://flowscan.org/metrics/blocks

11https://www.flowverse.co/

12https://www.flowverse.co/projects

13https://www.flowverse.co/rankings

14https://www.chaincatcher.com/article/2070099

15https://www.notboring.co/p/flow-the-normie-blockchain?s=r

16https://zh.onflow.org/token-distribution,https://zh.onflow.org/flow-token-economics#tokenomics-intro

17https://nonfungible.com/reports/2021/en/yearly-nft-market-report

18https://m.jiemian.com/article/7003095.html

19https://dappradar.com/nft/collections

20 https://docs.google.com/spreadsheets/d/1g4d2lzBytC-Wo4_rKGHjR3vGeJHb8hd1jb55qRf_S2g/edit#gid=0,https://flowscan.org/metrics/accounts,https://dune.xyz/hildobby/LooksRare-VS-OpenSea,https://dune.com/rchen8/opensea

21https://medium.com/electric-capital/electric-capital-developer-report-2021-f37874efea6d

22https://www.forbeschina.com/billionaires/55522