Author: OP Research

Author: OP Research

The popularity of NFT (Non-Fungible Token) has been soaring since 2020. From the emergence of Cyptopunk, to the emergence of PFP NFT projects such as BAYC, Doodle, and Azuki, NFT has gradually entered the public eye and has become known to people at an extremely fast speed. For a while, BAYC issued APE tokens and Otherside land NFT, which pushed the popularity of PFP NFT to a new climax.

Since the popularity and longevity of NFT are the result of many factors, we choose to focus on the fundraising ability of NFT. Therefore, this article will explain from the perspective of fundraising: how NFT, as a new form of fundraising, develops a In emerging markets, what are the unique advantages of NFT as a new form of fundraising. For the convenience of understanding, before discussing NFT as a new form of fundraising, we first sort out and introduce the form of Crypto fundraising and its evolution process.

secondary title

1. Evolution of Crypto Fundraising Forms

ICO

From the chaos and disorder in the early days of the Crypto industry to the gradual formation of scale today, the form of Cryptos fundraising has undergone a series of evolutions. The early fundraising form of Cyrpto is similar to the traditional financial model, such as the initial ICO (Initial Coin Offering), and the subsequent Private Sale (Angel Round, Seed Round, A Round, B Round, etc.), and then evolved into IEO (Initial Coin Offering). Exchange Offering), IDO (Initial Dex Offering), IFO (Initial Farm Offering) and other Launch forms, and even Grant Prize forms such as Gitcoin, hackathon, etc., which allow the project party to have more choices when raising funds. One of the most suitable ways to obtain financial support.IPO(Initial Public Offering)ICO and Traditional FinanceThere is a certain similarity. IPO refers to the issuance of new sharesIssuance of private company stock to the publicA process that provides companies with the opportunity to obtain capital through the issuance of shares in the primary market. However, companies conducting an IPO must meet theExchanges and the Securities and Exchange Commission (SEC)requirements to hold an IPO, and companies generally need to hireinvestment bankConduct marketing, assess demand, set an IPO price and date, and more. While ICO does not have so many restrictions on IPO, using ICO to raise funds means that the company will directly issueown tokenAnd allow the public to trade in BTC, ETH or stable currency (such as USDT, USDC, DAI, etc.)in exchange for its tokens. Without the review and publicity of exchanges and investment banks, companies raising funds usually publish awhite paperwhite paper, for investors to learn about their projects. because it directly faces, so the entire fundraisingcyclecyclerelative private equity financingshorter, and there is no need to repeat the value of the project to investors. At the same time, due to ICO fundraising, and can usesmart contractsmart contractTo speed up the process, ICOs are very popular in the start-up industry. But this also means that investors need to spend a lot of time and energy to understand ICO projects through white papers and smart contracts, which will undoubtedly increaseand investmentTime costsTime costs, which also gives the itemCheatingspace, making fundraisingtrust costextremely high, while the ICO periodmix

Chaos also confirmed this.STO(Securities Token Offering)Based on ICO, a special form of fundraising has been designed, that is, STO combines traditional IPO and ICO,assets as collateral, to issue securitized virtual tokens. The process is similar to an IPO, subject toSecurities LawRegulatory, which endows STO with high credibility, but at the cost ofred tapewith variousRegulatory restrictions

Private Sale

. Due to strict restrictions, most projects have given up the use of STO, so it has gradually faded out of peoples sight.After the disorderly fundraising in the ICO period, investors and project parties have turned their attention to private equity financing. Private placement and financing in the Crypto industryTraditional financial industryIt can be said that it follows the model of the traditional financial industry, and will go through angel rounds, seed rounds, A rounds, B rounds and other rounds. Each round of financing is mainlysingle large amount of fundsrecruitment, and only forSmall partInstitutional investors or individual investors, can occur at various stages of the project. The advantage of private equity financing is that the project can berepeatedlyFinancing through private placement, using the development of the project to prove the project to investorsQuality and Investment Value, and investors may also invest inresources other than money. However, although the single investment amount of private equity is relatively large, the cycle required for the entire financing is relatively long, and the number of people participating in a single fundraisingrelatively few investors, and the project party needs to repeatto lobbyInvestor, so even if the investor confirms the investment,total investment amountUsually relative to the total valuation of the project is also comparedlimited, especially the itemThe initial phase

Launch

financing.In order to solve the ICO, saving items filtered byTime costsTime costs, while facingmore investors, IEO, IDO and IFO, which evolved from ICO, appeared after the private placement. The main difference is that throughCentralized Exchange (IEO)still passDecentralized Exchange (IDO)Fundraising activities conducted, the exchange acts as a bridge between investors and project partiesmiddleman, to make announcements for the project side, and at the same time screen projects for investors. This form of fundraising is also named Launch by the exchanges. IFO is a variant of IDO, which willdirect subscriptionThe project token was changed to passThe amount and time of pledged miningSubscribe the corresponding amount of project tokens. Although this can avoid the disadvantage of random ICO issuance, it increases the project partysFundraising costs(need to pay the launch fee to the exchange). In addition, since exchanges usually require investors to use the tokens issued by the exchange to subscribe, investors need to additionally consider the value of their tokens.Currency price fluctuationsThe impact brought by the exchange, and at the same time, the exchanges also have certainInternal trading

Grant & Prize

possible.Donations or bonuses like Gitcoin or hackathons are more valuable than previous forms of fundraising.simple and direct. The project party only needs to sign up to participate in the current activities, and investors can donate or vote according to their preferences. Although the whole process takes a long time, the project party is almostNo fundraising costs, it is not even necessary to provide the corresponding amount of tokens, and the morequality itemThe more you can get more donations or bonuses and market attention under the background of other projects, the more important is that you can harvest a group of highly activeearly adopters

. This will help the project to carry out subsequent financing, so more and more projects choose to participate in Gitcoin or hackathon as a cold start to accumulate early resources at the beginning of their launch.

ICOIn general, each of the above financing methods has its own characteristics:

Private SaleThe fundraising speed is fast and the amount is free, without any restrictions on the financing process, but this also leads to a very high cost of trust, requiring investors to have sufficient experience and energy to screen and judge.

The single amount is huge, and additional support from investors can be obtained after successful financing, but its efficiency is low and difficult. Usually, if it is not a particularly high-quality project, it will be difficult to obtain funds corresponding to the project valuation.IEOs, IDOs and IFOs

Grant & PrizeThe efficiency of the fundraising form is the lowest. Its cycle is long and the amount of fundraising is relatively small, but its almost zero fundraising cost, early resources and active Crypto community can also have a great impact on the project score. Great attraction.

secondary title

2. Types and evolution of NFT fundraising forms

Compared with the traditional ICO, IEO, IDO and other fundraising forms in the encryption industry, INO (Initial NFT Offering) means that the project party raises funds in the form of issuing NFT. Compared with traditional encryption industry ICO, IEO, IDO and other fundraising forms, INO is mostly used in PFP NFT projects, blockchain games, Metaverse, SocialFi and financial NFTs. There are fewer applications in infrastructure, public chain, and DeFi, which mainly depends on whether NFT has application scenarios in the project. At present, INO is mainly divided into two categories:

Asset INO (asset NFT):

This type of INO is similar to the traditional ICO, IEO, etc. in the encryption industry, but the fundraising method has changed from traditional FT to NFT. Asset-type NFTs are mainly used in blockchain games, Metaverse, Socialfi, and financial NFTs, such as AXIEs pets, RACAs metabeasts, and sandbox land plots. The raised funds have clear usage rules, and investors have clear profit expectations and logic, such as holding NFT to generate FT in the game, holding in the metaverse to generate income, etc.

Profile Picture INO (Avatar NFT/PFP NFT):

Early PFP projects often have lower INO prices or even free airdrops (such as Cryptopunks), and the subsequent development of the project is led by the community. With the development of the NFT industry, this type of NFT is also undergoing a process of development and change from community-led to project-led. The project side tends to be specialized and capitalized, and the unit price of INO continues to increase. The change process of pursuing investment profits, with the continuous increase in the strength of PFP NFT project parties, the threshold continues to increase, the investment rules are more transparent, the profit logic is clearer, and investors are increasingly able to expect their own investment returns and understand the profits behind them logic.

secondary title

3. INO (Initial NFT Offering)

1. Fundraising method, scale and efficiency

Different from traditional financial channels, NFT fundraising is aimed at a wider audience, and the fundraising is faster and more efficient. Compared with ICO, IEO and other fundraising forms in the encryption industry, INO can better meet the diversified fundraising needs of project parties.

As far as financing methods are concerned, traditional financial channels are more inclined to go from top to bottom, where project parties or developers directly contact investors for targeted fundraising, or use intermediaries to do IEO, IDO, and IFO, etc. Compared with traditional financial fundraising, NFT fundraising is more free and diversified. The most commonly used NFT fundraising method is that the project fundraising quota will be composed of whitelist quota and public fundraising quota. The whitelist quota ensures a certain stable and predictable financing amount, and the public fundraising part maximizes the amount of financing funds through public participation. The criteria for obtaining the whitelist can be freely set by the project. In addition, Dutch auctions, directional airdrops and a mixture of various fundraising methods are also frequently used. In addition, the security of INO’s fundraising method is relatively high, because of the characteristics of NFT itself-poor uniqueness and liquidity. Compared with FT that can be laundered through tornado cash mixing after being stolen, NFT is less stolen, because once the theft is discovered, there are many ways to mark the stolen NFT, making it difficult for the thief to cash out.

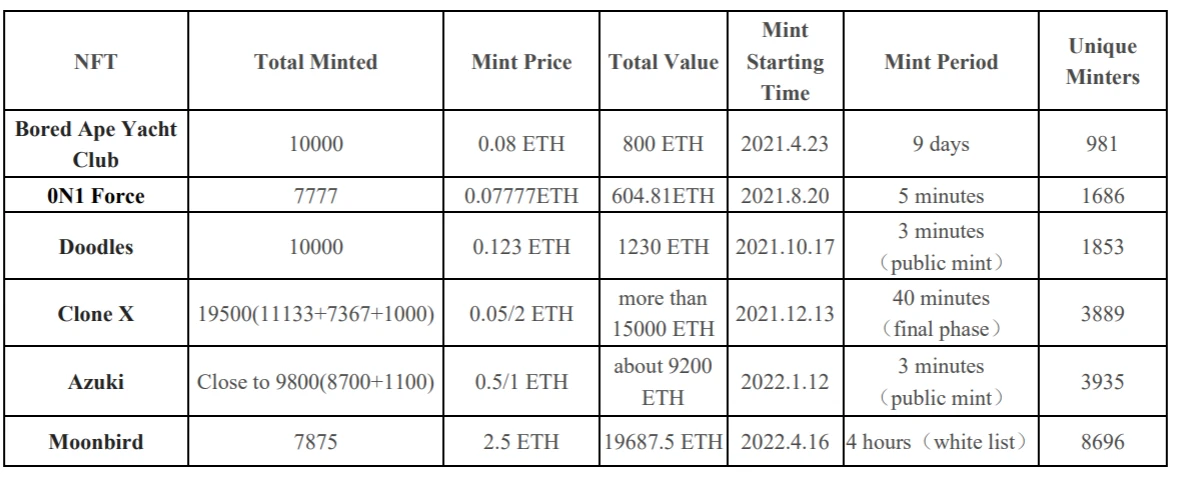

In terms of financing scale and efficiency, INO is also making continuous progress, from BAYC’s 9-day fundraising of 800 ETH in April 2021 to the new blue chip MoonBird’s extremely high attention in April 2022 The fundraising amount of PFP INO is close to 20,000 ETH in a short period of time. As people become more accustomed to and accept such a financing method, the scale and efficiency of PFP INO are rapidly increasing. The formation of this trend comes from the comprehensive improvement of project party endorsement and fundraising environment.

Table the financing situation of mainstream PFP NFT projects:

2. Community atmosphere and social attributes

As mentioned above, private equity financing is directly targeted by the project party or developer to contact investors, and only for a small number of investors or investment institutions, so private equity financing is relatively closed. At the same time, compared with ICO, IEO and other fundraising forms in the encryption field, NFT financing naturally pays more attention to community building and is more open. The project party attaches great importance to the communication and interaction with community members.

First of all, in terms of RoadMap, proposal mechanism, and event organization, the NFT project has its own cultural attributes and identity attributes, so the community is more active, and community members are more willing to express their opinions in the project proposal area and social media platforms. During the interaction between members and project parties, the stickiness between the community and NFT projects increases, and the community atmosphere strengthens. For example, RoadMap will provide holders with a variety of unique rights and interests, making holders more sense of gain and enhancing the identity of the community. Another example is the proposal mechanism, where community members can put forward their own proposals and participate in the future development of the project, so that users also feel like project owners and owners. At the same time, the community will regularly hold some online and offline activities to continuously maintain and expand the community. Most of the currently issued NFT projects will have an official Discourd, and there will be a dedicated person to maintain the popularity. The dedicated person will chat with community members on the Discourd and issue announcements. And compared to ICO and IEO, in addition to price fluctuations, NFT project chat content also includes project follow-up planning, understanding of the project, understanding of the underlying cultural connotation of the project, or simply expressing love for NFT. The content of the chat is deeper. This is also a feature of the NFT project itself.

On the other hand, before the NFT project is minted, most projects will require users to obtain a whitelist. At this stage, users need to complete the corresponding tasks and procedures according to the requirements of the project party to obtain the whitelist. In this process, on the one hand, users have spent time and energy in completing the corresponding task procedures. Due to the previous payment, users will pay more attention to the subsequent development and planning of the NFT project, hoping that their early efforts can get more generous returns , the stickiness between users and the project will increase accordingly; on the other hand, in the liver white stage, there will be a certain spread effect, and those who complete the task on the white list will drive a group of people who dont know much about the project to understand the project and give it a try. Drive these incremental users to join the community. In the whitelist stage, the community is initially formed.

The nature of the NFT project and the construction and maintenance of the community in the later stage enable the project party to have a stable community, and a strong community can greatly promote the development of the project. Almost all blue-chip NFT projects have super-high-quality communities. In addition to their own marketing attributes, such communities continue to push up NFT prices, increase NFT transaction volume, and earn royalties for the project side. They will also feed back the project itself in various aspects, including But it is not limited to formulating or optimizing project development routes, empowering NFT, endowing NFT with new consensus or connotation, extending rights and interests in real life, etc. In addition, in the subsequent fundraising activities, the project party can continue to carry out corresponding publicity and financing based on the existing community members and community scale, so that the previous and subsequent financing activities are more continuous.

3. Consensus and narrative

The logic and rules around the profit target of traditional financing methods are clear. For example, the allocation and use of funds have clear logic and rules, and there is a certain degree of transparency. Although the method of raising funds through the issuance of NFT is essentially for profit, there is a clear difference in the way of implementation between the two: traditional project financing is mainly for better development, optimizing the project itself, and being able to occupy market share and bring profits. However, due to some reasons (such as the project itself with MEME attributes, limited real profitability, lack of long-term project planning, etc.), the PFP NFT project is more inclined to establish an ALPHA community with a strong consensus in terms of behavior after fundraising. The establishment of consensus is a very important (even the most important) part of the PFP NFT project. At present, the development path of most PFP NFT projects is to establish a strong consensus in the community in the early stage, and then the community and the project party develop together to achieve the common profits of investors and project parties. This means that NFT fundraising has become an effective measure to build a high-quality consensus community. For example, Bored Ape Yacht Club is known as a noble club. The investment price of this type of NFT is high, and it lacks elements such as clear profit logic in the early stage. Instead, it becomes a good filter for joining the club, finding like-minded friends and building consensus.

In addition, there is another essential difference between NFT and FT at the consensus level, that is, although everyone has different original intentions for buying NFT and FT, maybe they are optimistic about the development of this project, or maybe fomo has risen, but they just invest In terms of the psychological state after a loss, NFT investors will have a more peaceful mentality than FT investors. Because PFP and works of art as NFTs can give basic consensus/value, which makes the consensus of NFT investors change from investment to collection when the price of NFT continues to fall, which is something that FT cannot do of.

In addition to the transferability of the consensus, NFT also has good scalability and rich composability, which gives it a rich imagination and allows the project party to make a grander narrative. To give an example of using financial NFT, Solv Protocol makes NFT into a casting voucher (Vesting Vouchers) that automates tasks, supports people to deposit ERC-20 Token into this casting voucher, and flexibly sets the release of ERC -20 Token method and speed. The minted certificate is tradable and negotiable, and can be split at the right time. In fact, not only in the expansion of financial attributes, but also in the transfer of the original power of the blockchain, NFT also has unique applications (such as domain name, lock-up liquidity release, separation of ownership and use rights), which also allows the project party There is an opportunity to tell a brilliant story to attract users and investors, and to guide a more fascinating idea by realizing the original plan step by step. And another bright NFT’s expandable direction is the metaverse. Almost all INO project parties will tell you a story about the future development of the metaverse at the end, and the NFT they issue now is their entry into the metaverse. At the same time, it will also give certain airdrops or whitelist expectations after the Metaverse goes online in the future. Therefore, with the further development of NFT, NFT-based innovation can make the entire NFT industry have more possibilities, making everyone willing to give NFT projects greater expectations, which means that everyone believes that NFT projects can have higher expectations. ceiling, and more significant future growth.

4. Entity scalability

Compared with traditional FT, NFT has the characteristics of visualization. Based on this characteristic, NFT has excellent scalability in the real world, which will give project parties more diverse choices for brand and IP construction, and will also Bring more benefits and updated experience to investors.

At present, the physical scalability of NFT financing is mainly manifested in the following aspects:

(1) The project party can build an exclusive IP and extend its influence in the cultural industry - such as creating trendy brands to shoot movies for IP or even building theme parks;

(2) Fans secondary creation of NFT - such as the animation of NFT, derived from the music self-media field, etc.;

(3) Large-scale popularization and application in the retail industry and service industry - this also applies to project parties and holders, such as NFT brand bars, NFT brand fashion stores, NFT clothing brands, etc.;

(4) Social groups and activities - offline fan gatherings, NFT player clubs, etc.

If it is the mission of NFT to get out of the circle and break the game, then Bored Ape Yacht Club may be the Trojan horse that broke through the gate of Troy. Although it has only been born for one year, BAYC has already made great achievements in breaking the dimensional wall between the Crypto industry and the real world. Set an example: BAYC grants its holders complete commercial copyrights, which means that holders can use the BAYC they hold to completely create their own brands and conduct related business activities, including but not limited to NFT peripherals, movies, games and even Form a band, etc., and all the income will go to the holder. This strategy is undoubtedly successful. This decentralization of commercial copyright and secondary creation rights later became an important reference factor for the demonstration standard of NFT financing methods.

Here are some examples of BAYC scaling up in the real world:

Grammy winner Timbaland and BAYC members co-founded APE-IN productions, a brand that will expand, launch and promote Bored Apes as a successful music artist in the virtual world; Myth Division produces animation and manga for BAYC; Apesthetics is the first batch of products to be included One of the streetwear fashion brands whose entity has combined with BAYC, it even has a consumer-unique smart contract sewn into the fabric, which enables its owner to verify the authenticity of the product, becoming a physical NFT; worth mentioning Whats more, Greenland Group also purchased BAYC and used it as its own digital strategic NFT image. China Lining also acquired BAYC 4102 and issued brand derivative products around the NFT.

In addition to BAYC, the physical scalability of NFT has actually become normalized: Azuki opens up secondary creation rights for holders, and will launch an Azuki store in the real world, selling streetwear, toys, statues, etc. In addition, Azuki will also hold live events such as meetups, exhibitions, and music festivals; Doodles plans to expand IP to music and animation, and allows commercial activities within US$10W; CloneX and Nike jointly launch physical clothing products, planning to let Holders can use the NFT on different digital platforms, even their own games, and VR/AR virtual worlds.

This real-world scalability based on the characteristics of NFT itself endows NFT investment with more value than traditional investment channels, which is undoubtedly very attractive to investors and makes this This new financing paradigm has more practical implications.

5. Regulatory Compatibility

Another advantage of NFT financing is that it is quite compatible with current laws and regulations. Of course, from another perspective, this is also because there is currently a lack of clear laws and regulations at home and abroad to formulate a specific specification for NFT financing. It is believed that with the continuous development of the NFT industry and the normalization of NFT financing, the laws and regulations on the NFT industry and financing in various countries will be further improved, and the returns of investors will be better protected, which will also promote the scale and development of NFT financing. normalization.

The characteristics and advantages of INO are described and analyzed above. It can be seen that INO has high fundraising efficiency. The project party has a community foundation for subsequent financing, easy to form consensus and expectations, and has good physical scalability and compliance compatibility. Sex and other multiple features and advantages. However, as a nascent fundraising method, INO also has some problems:

The first is that the sustainability of fundraising is not strong. From the perspective of the project side, the sustainability of PFP NFTs fundraising form is not strong, and the issuance of multiple rounds of NFT faces resistance and has the risk of affecting consensus. Generally speaking, the focus of fundraising is on the first round of NFT issuance.

Secondly, the rights and interests of investors in INO are vague and lack investment protection. Compared with traditional financial fundraising forms and traditional encrypted ICO, IEO and other fundraising types, most current PFP NFT project fundraising concepts are between commodity sales and fundraising, and the project party does not promise or guarantee capital returns to investors. There are no or unclear rules for capital utilization. Most projects only have a rough RoadMap. Project development and operation lack transparency, and the degree of centralization is high. It is prone to problems such as additional NFT/FT issuance and dilution of rights and interests. Investors have limited understanding of project fundamentals when participating in NFT project fundraising, and cannot predict the later development route and risks of the project. For example, some projects may issue derivative NFTs or FTs again after the initial issuance of NFTs, diluting or sacrificing investors rights and interests.

Finally, in terms of the financial attributes of NFT, the liquidity of NFT is poor, and it also lacks stable value-added means such as Staking and LP Farming to slow down the selling pressure. be guaranteed.