Original author: Nico

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator | Ethan ( @ethanzhang_web3 )

I have been deep in the trenches of cryptocurrency trading for a while now, at a time when many crypto people on X are declaring the field dead.

The volume generated by trading Memecoin is currently lower than it was a few months ago. TRUMP did reach a local peak in Memecoin mindshare, trading volume, and liquidity attraction. But at that time, SOL was as high as $290, BTC broke the $100,000 mark, and the entire bull market was in full swing. BTC then pulled back to the 74-88K range, and SOL formed a local low at $95. But now SOL has rebounded strongly to above $140 (up 46% in 15 days), and BTC has returned to the $90,000 mark. Its time to reassess the current situation.

Despite the lower SOL price and generally bearish and languid market sentiment, the data tells a different story. Let’s look at the statistics from April to date:

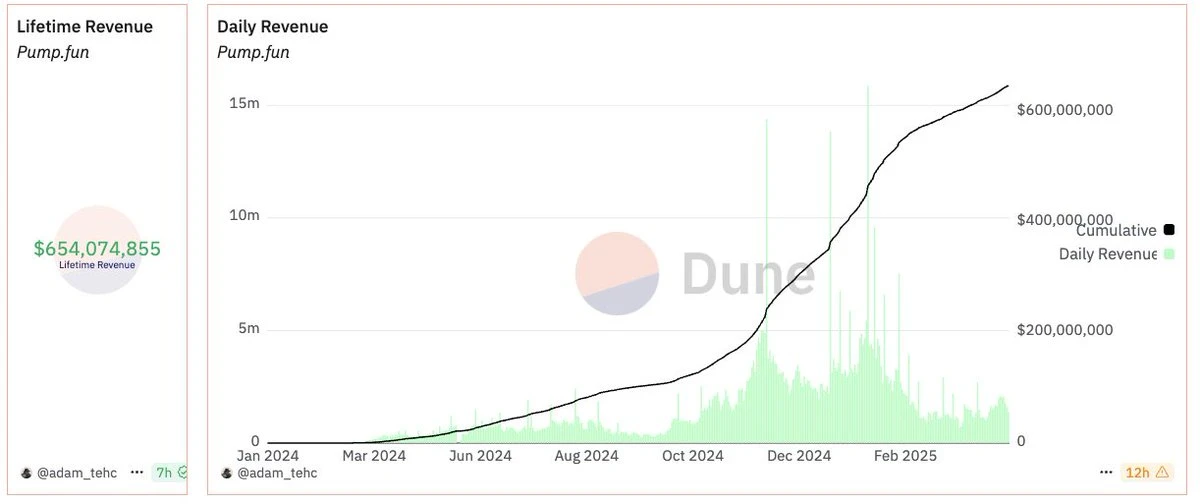

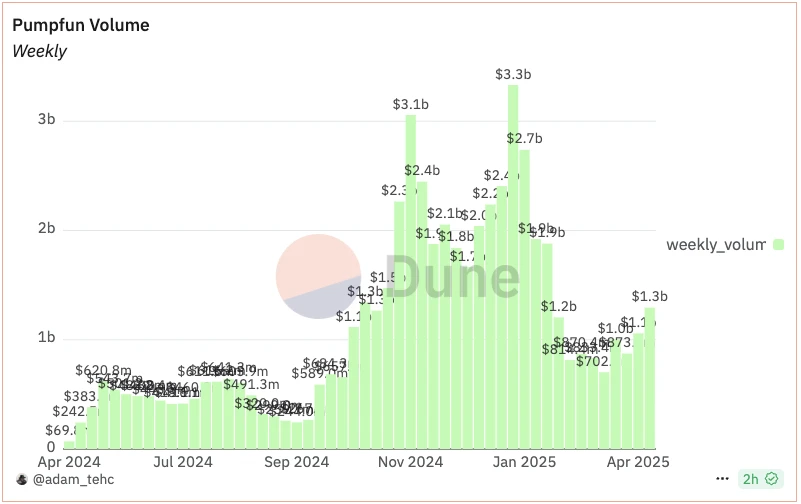

The pump.fun platform has generated approximately $650 million in trading volume to date, with average daily trading volume fluctuating between $1 million and $2.7 million in April, with an average high of $1.5 million to $2 million.

After a decline in trading volume during the SOL high price period and after the TRUMP craze, trading volume has rebounded significantly in April. With the launch of PumpSwap and a nearly seamless migration mechanism, the trading experience around token migration events has been optimized, which is reflected in the continued increase in the platforms weekly trading volume.

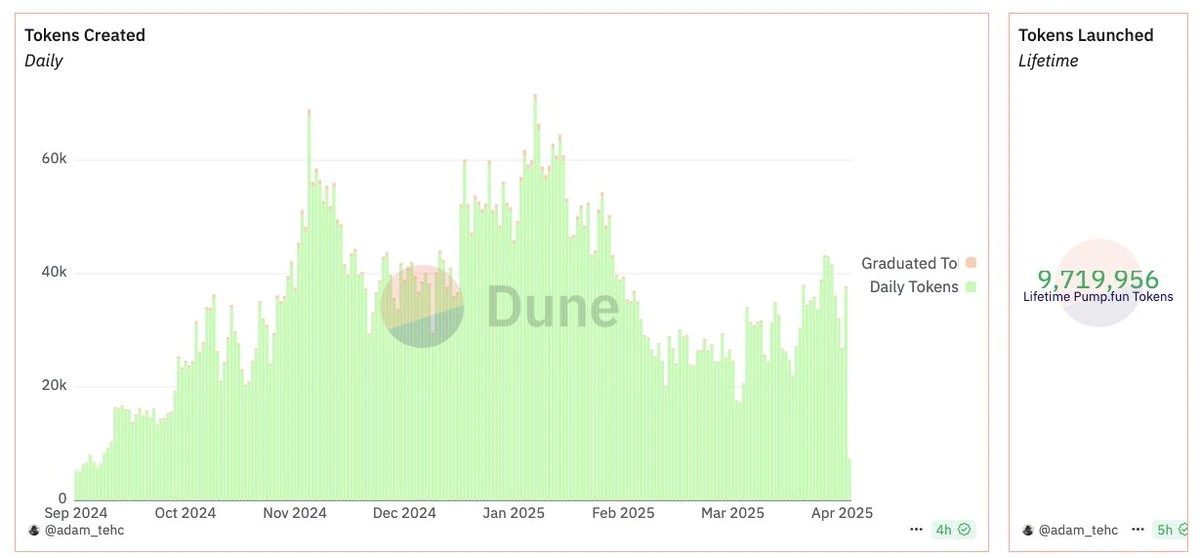

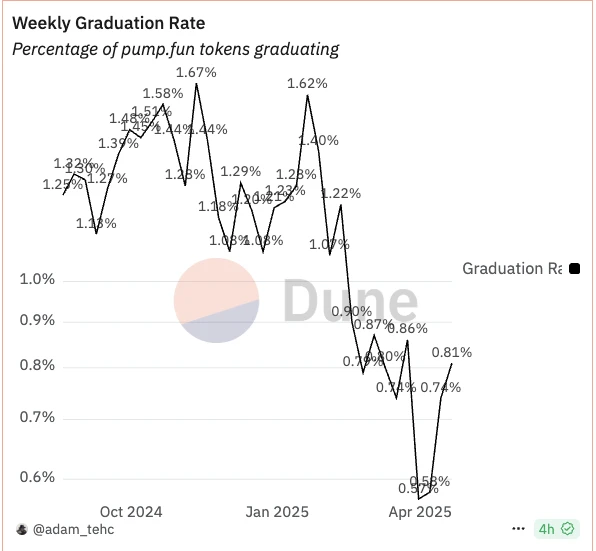

So far, 9.7 million tokens have been created, with an average daily issuance of 20,000 to 40,000 tokens in April. 100 to 350 tokens graduate every day, and the graduation rate remains at 0.4-0.8% .

The phenomenon of decreasing graduation rate over time is correlated with the decline in users and trading volume, indicating that the current trench is more about small groups hoarding chips when new tokens are issued, and then dumping each other. When they cannot attract enough liquidity to maintain the token price, these groups often choose to withdraw their funds early.

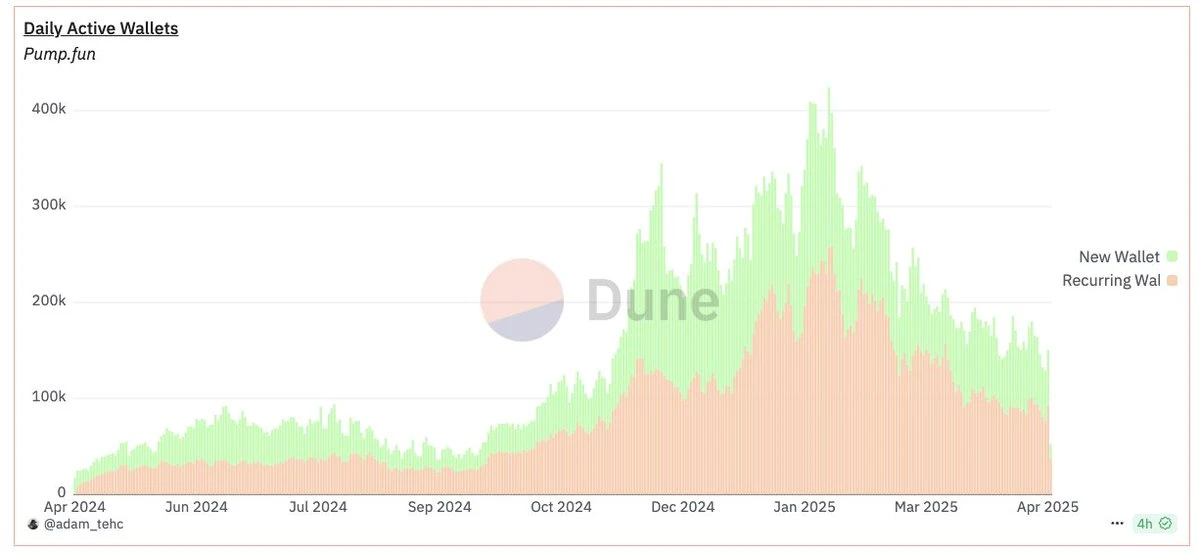

Active user analysis

During the peak period from December 2024 to February 2025, 200,000 to 400,000 users traded Memecoin through pump.fun every day. Since then, the number of users has continued to decline, and has remained below 200,000 in the past two months. Currently, the number of daily active wallets is stable at around 150,000, with a balanced ratio of new and old users. It should be noted that most trench traders use a multi-wallet strategy and will regularly change active wallets.

Trading robot data at a glance

As we all know, Memecoin trading activities are highly concentrated in the top five trading terminals:

@AxiomExchange

@tradewithPhoton

@gmgnai

@TrojanOnSolana

The following is a comparison of key indicators (daily dimension):

Together, these platforms contribute more than 100,000 daily active users and $100 million in daily trading volume, which is consistent with market observations.

Calculation of platform cumulative fees and assets under management (AUM) (SOL based on $140)

Bullx: $186 million in accumulated fees | AUM 215,000 SOL (about $30 million)

Axiom: $39 million in cumulative fees | AUM estimate is comparable to BullX (maybe slightly lower)

Photon: $382 million in accumulated expenses | AUM 539,000 SOL (about $82.6 million)

GMGN: Cumulative fees of US$66 million | AUM estimated to be at least half of Bullx

It is estimated that the total value of SOL liquidity circulating in the Memecoin space is over $200 million. The next article will take a deeper look at the total value of all liquidity pools (LPs) and tokens.

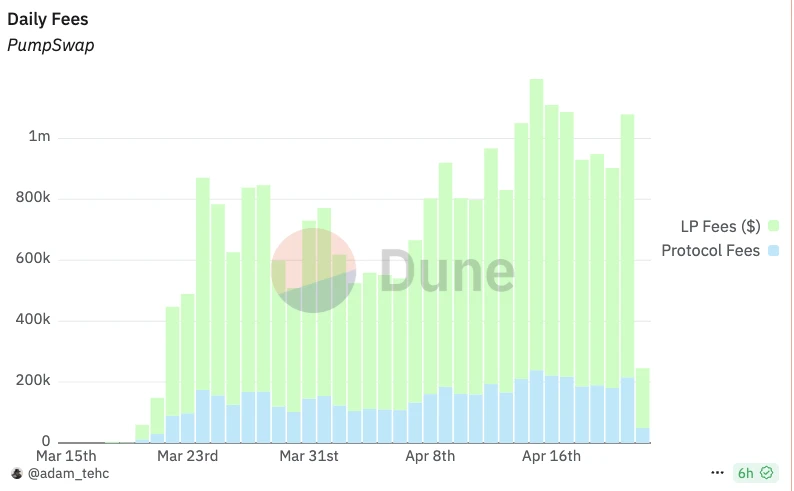

PumpSwap Ecosystem Observation

PumpSwap currently has a daily trading volume of $300-480 million, accounting for 9-19% of the market share of DEX trading volume on the Solana chain. It is worth noting that since all new pump.fun tokens are issued and traded on PumpSwap, this shows that a large number of transactions are still occurring on old tokens traded through Raydium/Meteora.

PumpSwap charges a 0.25% transaction fee, of which:

0.20% is allocated to liquidity providers (LPs)

0.05% belongs to the agreement

In the first month of launch, the platform generated approximately $25 million in fees ($100,000-240,000 per day), $20 million in liquidity providers, and $5 million in protocol revenue. As PumpSwap continues to gain market share (currently showing a steady growth trend), this figure is expected to continue to rise, which also confirms the trend that traders prefer new tokens over old currencies .

Insights

The priority trading model of new tokens is completely consistent with my prediction of the development of the Memecoin field. It is an open secret that the difficulty of survival in the trench has increased recently, and most of the remaining players are veterans who have experienced the winter test of low SOL prices, shrinking trading volume and user loss.

The vitality of the Memecoin space depends on the injection of new liquidity, which initially came from senior crypto investors who were trapped in the losses of mainstream altcoins and turned to seek quick profit opportunities. As the space expands, retail investors are also beginning to get involved in this high-risk, high-return deep water zone.

Compared to DeFi tokens that require sophisticated operations and deep understanding of protocols, Memecoin has always been the preferred carrier for speculative activities due to its low threshold, high asymmetric returns (i.e. low investment and high return possibilities), and unlimited creative space for tokenization of everything (characters/content/events/memes, etc.). Solana is firmly sitting on the throne of the crypto casino dealer.

If you ask me about potential opportunities in other fields? In addition to Memecoin, Hyperliquid and its ecosystem, as well as fartcoin (because the heat is always rising) may have opportunities. But if someone thinks that the trench is dead - the mission is not yet completed, everything has just begun.