Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

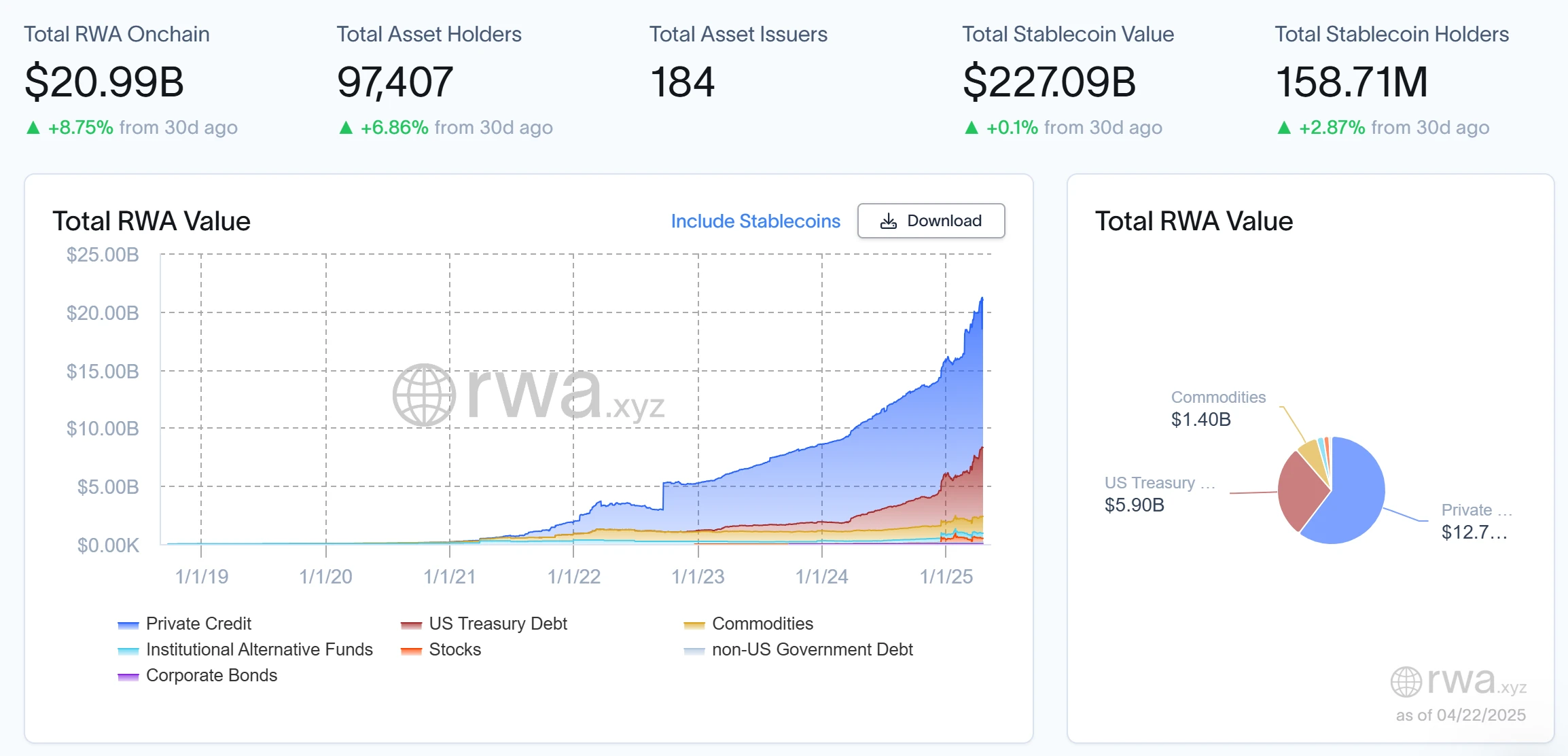

RWA Sector Market Performance

According to RWA.xyz data, as of April 22, 2025, the total value of RWA on the chain reached 20.99 billion US dollars, an increase of 8.75% from 30 days ago. The total number of on-chain asset holders is 97,407, an increase of 6.86% from 30 days ago, and the number of asset issuances is 184. The total value of stablecoins is 227.09 billion US dollars, an increase of 0.1% from 30 days ago, and the number of stablecoin holders is 1.5871 million, an increase of 2.87% from 30 days ago.

From the historical trend, the total value of RWA chain has shown significant growth since 2019, especially after 2023, and reached a peak in early 2025, showing the rapid popularization of tokenized assets. In the distribution of asset categories, private credit dominates, with a value of US$12.7 billion, accounting for 61% of the total value; US Treasury Debt is worth US$5.7 billion, accounting for 27%; International Alternative Funds is US$4.36 billion, accounting for 21%; Commodities is US$1.4 billion, accounting for 7%. Stocks, non-US Government Debt and Corporate Bonds account for a relatively small proportion.

Review of key events last week

According to an official announcement, Securitize announced the acquisition of MG Stovers fund management business, and its subsidiary Securitize Fund Services (SFS) has become the worlds largest digital asset fund management platform. After the acquisition, SFS manages a total of $38 billion in assets, covering 715 funds, including the $2.45 billion U.S. Treasury tokenization fund BUIDL launched in cooperation with BlackRock.

Securitize now provides integrated services covering fund management, token issuance, brokerage services, transfer agents and alternative trading systems (ATS). The companys CEO Carlos Domingo said the acquisition strengthens Securitizes position as an institutional-grade real-world asset (RWA) tokenization and fund management integrated platform. With the accelerated adoption of blockchain by traditional finance, asset tokenization is becoming one of the fastest growing digital asset tracks. According to BCG and Ripples forecasts, the global tokenized asset market is expected to reach $18 trillion by 2033.

Payment giant Visa will join the stablecoin alliance led by Paxos USDG

Payment giant Visa will join the stablecoin alliance USDG led by Paxos, along with cryptocurrency and fintech giants such as Robinhood, Kraken and Galaxy Digital, according to two people familiar with the matter. Visa is the first traditional financial institution to join USDG, and the first members of USDG also include Anchorage Digital, Bullish (owner of CoinDesk) and Nuvei. Visa has not yet responded to a request for comment, and a representative of Paxos said the company could not comment on potential partners.

Ethena Labs Partners with Re to Introduce Real-World Stablecoin Reinsurance with USDe and sUSDe

Ethena Labs has partnered with blockchain reinsurance platform Re to enable innovative applications of USDe and sUSDe stablecoins for global reinsurance. This collaboration enables users who hold these tokens to lock them up as reserve funds to support global insurance companies while participating in the real-world insurance ecosystem. Users will receive 5x rewards after locking up sUSDe tokens, further incentivizing capital to flow into reinsurance platforms.

This marks the first time that crypto-native assets have been connected to the broad reinsurance market, which is different from the traditional crypto yield farming model and provides non-correlated returns based on premiums. The cooperation covers multiple insurance areas such as real estate, health, and climate resilience, providing protection for communities and businesses. Ethena Labs said that this integration not only contributes to the contribution of digital assets to global economic stability, but also expands the influence of stablecoins in practical applications, providing an opportunity to promote global welfare while obtaining financial benefits.

Ondo Finance has surpassed $2.5 billion in total value locked (TVL), becoming a key player in the real world asset (RWA) space. The project is preparing to launch Ondo Global Markets, which aims to disrupt traditional financial assets. Mastercard has partnered with Ondo Finance to provide U.S. Treasury bonds through RWA tokenization, thereby strengthening the application and accessibility of blockchain.

LIQI and XDC Join Forces to Launch $500 Million in Tokenized Assets in Brazil

Through a strategic partnership with blockchain infrastructure provider XDC Network, fintech innovator LIQI plans to issue up to $500 million in real-world asset (RWA) tokenized assets on the XDC Network, bringing significant impact to Brazil’s financial ecosystem and the evolution of global capital markets.

Through this collaboration, LIQI and XDC plan to leverage innovative initiatives such as Brazils open banking and central bank digital currency (DREX) to accelerate transparency, liquidity and traceability in financial markets and provide better market access for global investors. The first tokenized issuance will be launched within 90 days and is expected to cover multiple industries and fields.

LIQI CEO Daniel Coquieri said the move will connect Brazil to global tokenized financial liquidity, drive historic financial operations in Latin America, and promote broader participation in global capital markets.

Hot Projects Latest News

R2 Yield (R2)

Official website: https://www.r2.money/

Introduction: R2 Yield is a stablecoin yield protocol that integrates physical assets (RWA), traditional finance (TradFi) and decentralized finance (DeFi), aiming to provide users with stable income opportunities through blockchain technology. Its core product, R2 USD, is a stablecoin backed by physical assets, including on-chain tokenized U.S. Treasuries, money market strategies, and real estate rental income. This design allows R2 USD to have both stability and yield-generating capabilities, breaking the limitation of traditional stablecoins (such as USDT and USDC) that do not directly generate income for users.

Latest developments: On April 17, the launch of the testnet was announced, allowing users to participate in the testing of R2 USD by minting, staking, and providing liquidity . The testnet activity is completely free and aims to attract early users and test the stability of the protocol.

Usual (USUAL)

Official website: https://usual.money/

Introduction: Usual ( @usualmoney ) is a decentralized stablecoin protocol that aims to create a fair, community-driven financial ecosystem through tokenized real assets (RWA). Its core goal is to transform the centralized profit model of traditional stablecoins (such as USDT) into a user-owned and governed model, redistributing value and control to the community through its stablecoin products USD 0 and USD 0++, as well as the governance token USUAL. The project combines the stability of physical assets with the composability of DeFi, and is committed to providing users with secure, transparent and high-yield financial tools.

Recent developments: On April 16, Sky Vault was launched ; on April 17, the Usual community released UIP-7: Early Redemption Fee Reallocation Proposal, which plans to distribute 67 million USUAL tokens to USUALx and USUAL holders (a total of 134 million, of which 94 million will be distributed through the TWAP mechanism and 40 million will be distributed based on loyalty until June 2025). The proposal was successfully passed on April 18 , and the first batch of 8.4 million USUALx has been redistributed to eligible holders.

Plume Network

Official website: https://plumenetwork.xyz/

Introduction: Plume Network is a modular Layer 1 blockchain platform focused on the tokenization of real-world assets (RWA). It aims to transform traditional assets (such as real estate, art, equity, etc.) into digital assets through blockchain technology, lowering the investment threshold and improving asset liquidity. Plume provides a customizable framework that supports developers to build RWA-related decentralized applications (dApps) and integrate DeFi and traditional finance through its ecosystem. Plume Network emphasizes compliance and security, and is committed to providing solutions that bridge traditional finance and the crypto economy for institutional and retail investors.

Latest developments: On April 16, it launched the Easter Egg Hunt event, inviting users to obtain the Golden Egg Basket NFT by exploring its ecosystem, completing tasks, and collecting hidden codes; On April 19, it announced a deepening of cooperation with AethirCloud to expand its RWAI GPU program . The program combines RWA, AI, and decentralized cloud computing to promote the integration of on-chain AI and RWA.

Related articles

RWA: The Elephant in the Cracks

The article comes from YBB Capital Researcher Zeke, and interprets RWA in the current context from the author’s personal perspective.

SPACE original transcript: Odaily Planet Daily invited three industry pioneers, Rania from Ondo Finance, Laura from Pharos, and Jeffrey from R2 Protocol, to discuss in depth how RWA can ensure asset credibility, solve traditional financial pain points, improve transaction efficiency, and share cooperation experience with top institutions. They also had a wonderful conversation around regulatory challenges, industry vision, and the opportunity for RWA to explode, revealing the opportunities and future of this track.