Key Takeaway

secondary title

The blue ocean market is an emerging market with high profit margins and no vicious competition; while the red ocean market is a known and highly competitive market with high barriers and strict industry competition rules.

Among markets of different sizes and shapes, some markets can bring innovative value to both parties to the transaction, while some markets simply copy the revenue-generating models of other markets.

Some platforms that use Token provide users with new value through incentive design, such as LooksRare and Magic Eden.

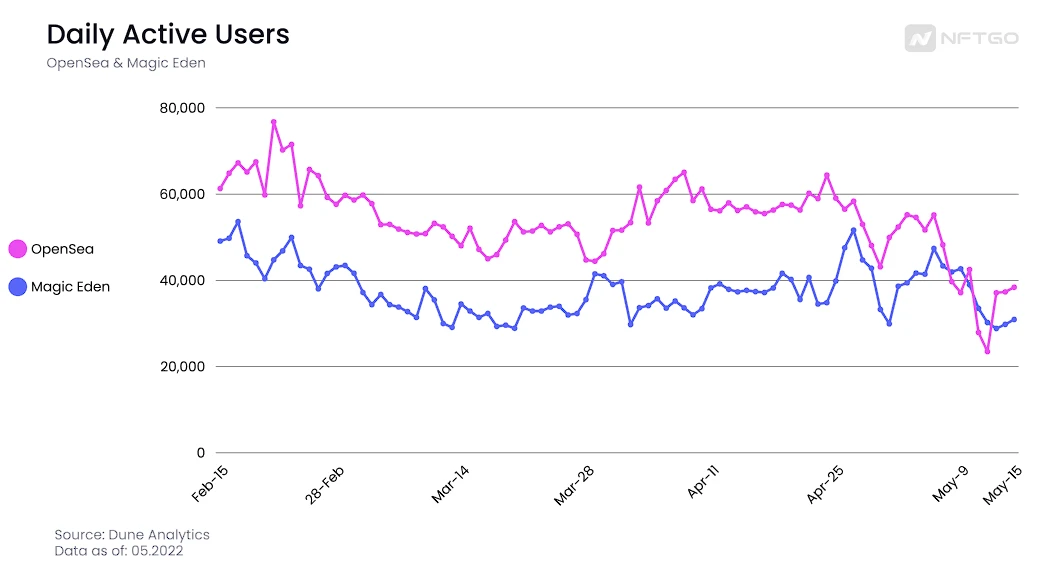

On May 16, 2022, the daily trading volume of Magic Eden was 47.22 million US dollars, while the trading volume of OpenSea was 32.88 million US dollars. The number of daily active users of ME has also surpassed that of OS.

With OpenSea adding support for SOL, the cross-chain and full-chain NFT market may be one of the future trends. According to Magic Eden, Solana NFT sales on OpenSea are approximately 9% of what they have been since Magic Eden launched.

With the maturity of the NFT secondary market and derivative transactions, the NFT trading market needs to rethink the methods and user experience of NFT index transactions, fragmented transactions and derivative transactions.

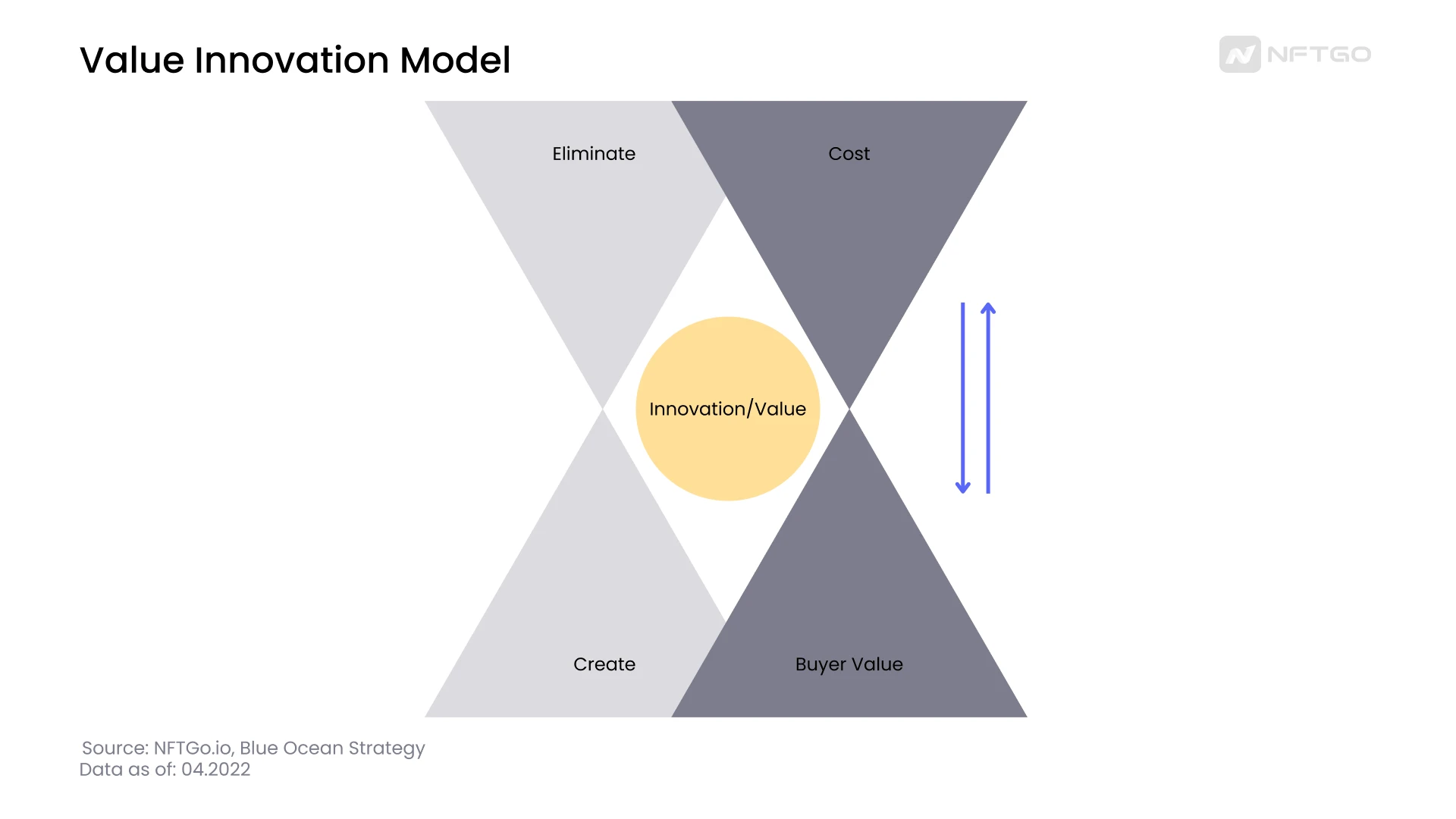

The concept of Blue Ocean Strategy was first put forward by W. Chan Kim and Renée Mauborgne, which refers to the initiative of enterprises to explore new and uncompetitive markets. This strategy does not focus on segmenting the market and meeting user preferences, but achieves value innovation by changing the industry, resetting the rules of the game, merging market segments, and integrating needs. On the contrary, Red Ocean (Red Ocean) is that everyone in the market is a competitor, and there are strict barriers between the markets.

In the past few months, new trading platforms such as X2Y2, LooksRare, and Coinbase NFT have emerged continuously, and the secondary market has gradually become saturated. This is what we mentioned above——Red Sea: Crowded market, lack of growth momentum, and sustained profit margins Going down, and finally moving towards fierce competition. In other words, the Red Sea means a battle for interests between project parties. There are more wolves and less meat, so promoting innovation and identifying market positioning will be the key to success.

secondary title

As emerging competitors enter the market, many project parties have begun to seek value innovation and pursue a development model that increases revenue and reduces expenditure. The boundaries between the existing markets are clear, which kind of services users need, and which types of markets will emerge as the times require. For example, some investors prefer unique artistic niche NFT and 1/1 art works. The trading market for unique NFT works such as Foundation or Nifty Gateway can meet the needs of these users.

image description

Value Innovation Model; Data source: NFTGo.io, Blue Ocean Strategy

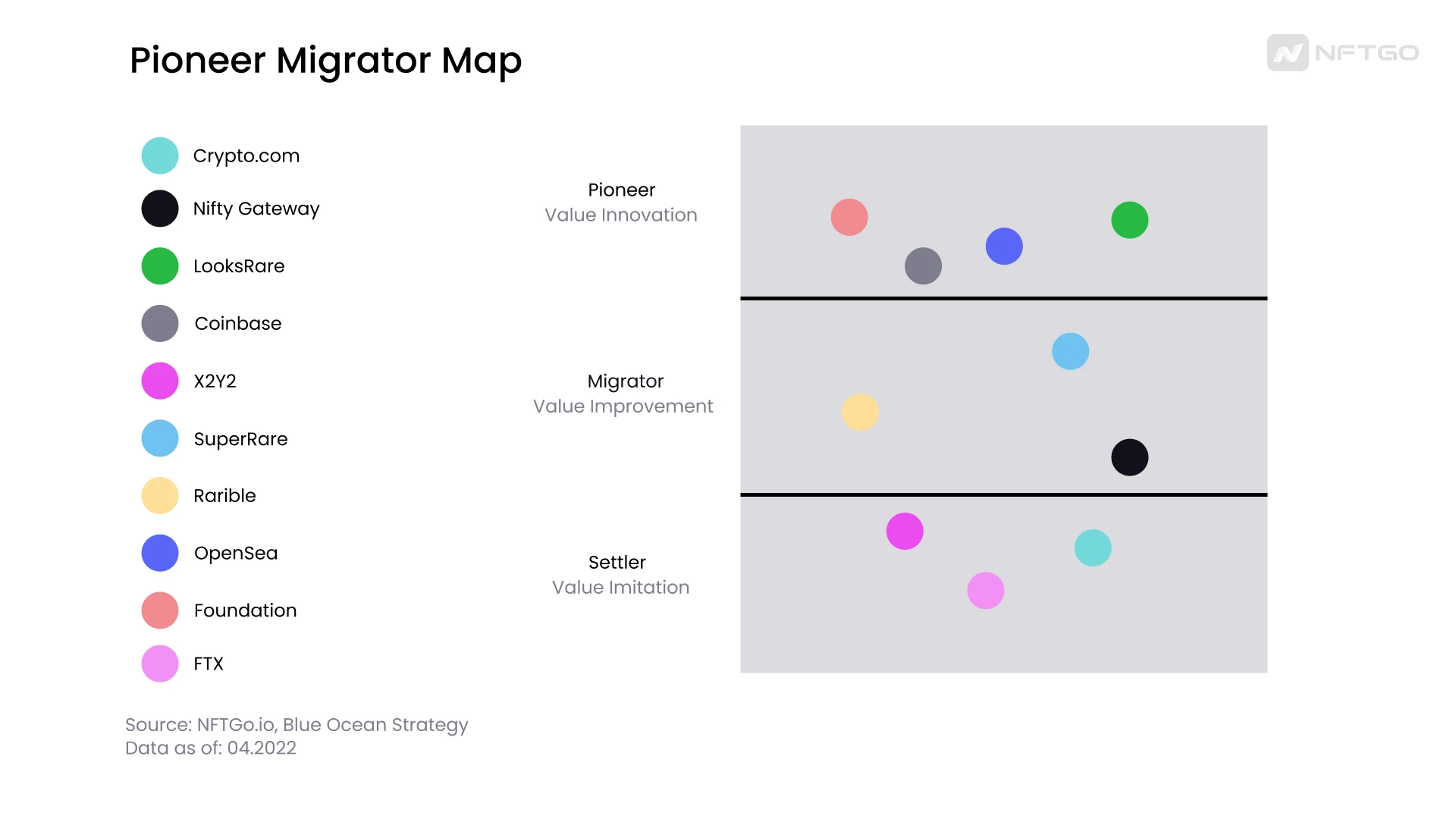

Through the Pioneer Migrator Map, we can easily distinguish which websites are creating value for users and improving user experience, and which websites may just copy the original operating model.

image description

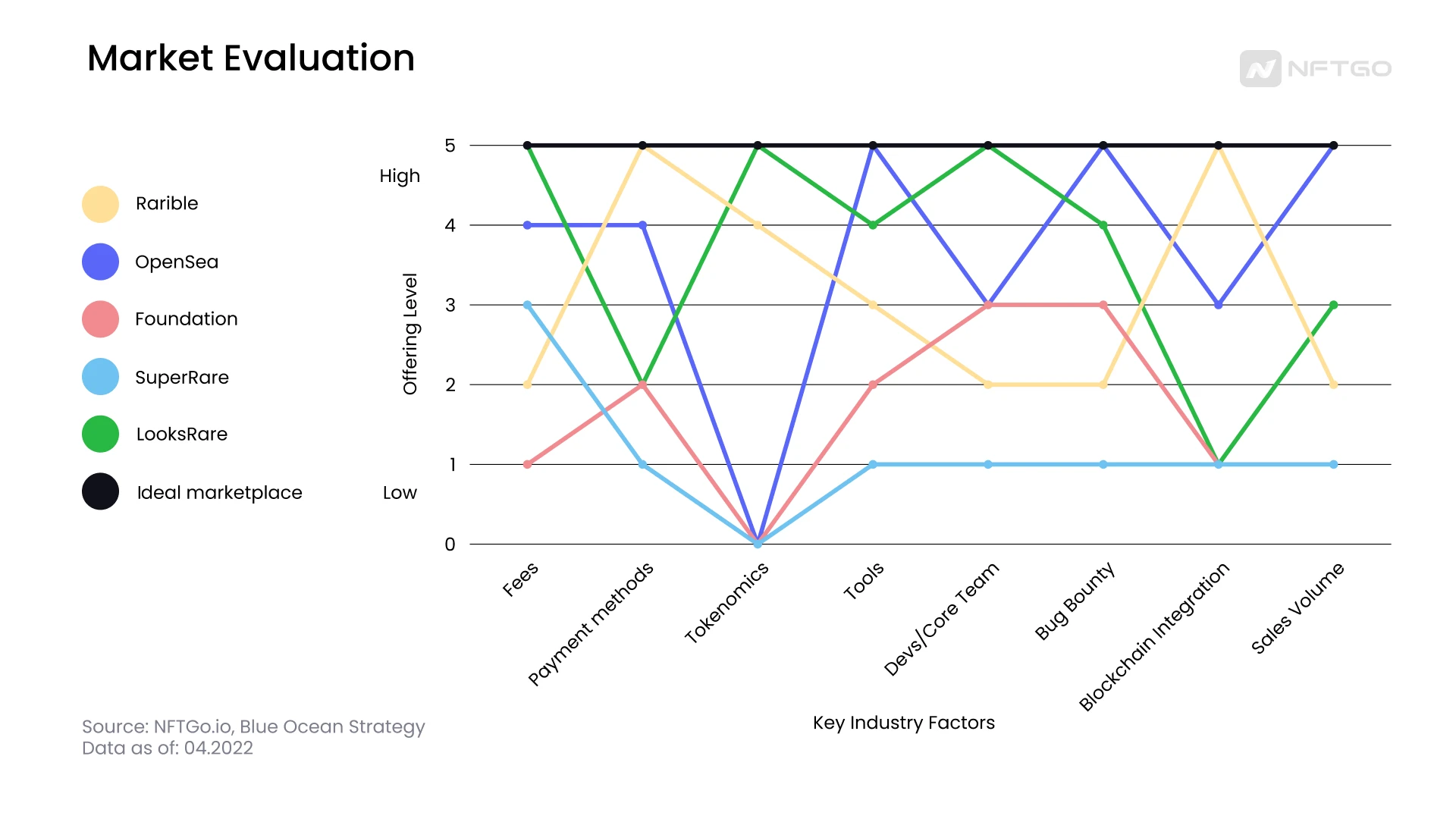

There are many platforms that provide NFT trading services, but the overall operating strategies of these platforms are convergent. We can use the Market Evaluation to measure the core competitiveness of different platforms. The y-axis of the figure below shows the performance of each platform on different competitiveness factors. In addition to several indicators shown on the figure, we also newly Several indicators of cost structure, multi-chain aggregation, and complex operation have been added. The higher the score on the y-axis, the more value the platform brings to both parties of the transaction. Conversely, the less the score, the more The value created is less.

image description

Although the services that users enjoy between different platforms are similar, among all NFT trading platforms, OpenSea is still a well-deserved head project. With the launch of more and more trading platforms, it is foreseeable that the data line on the market value assessment map in the next few years is bound to become more dense. Now creating new value from NFT transactions will also become a problem that platform developers need to think about.

secondary title

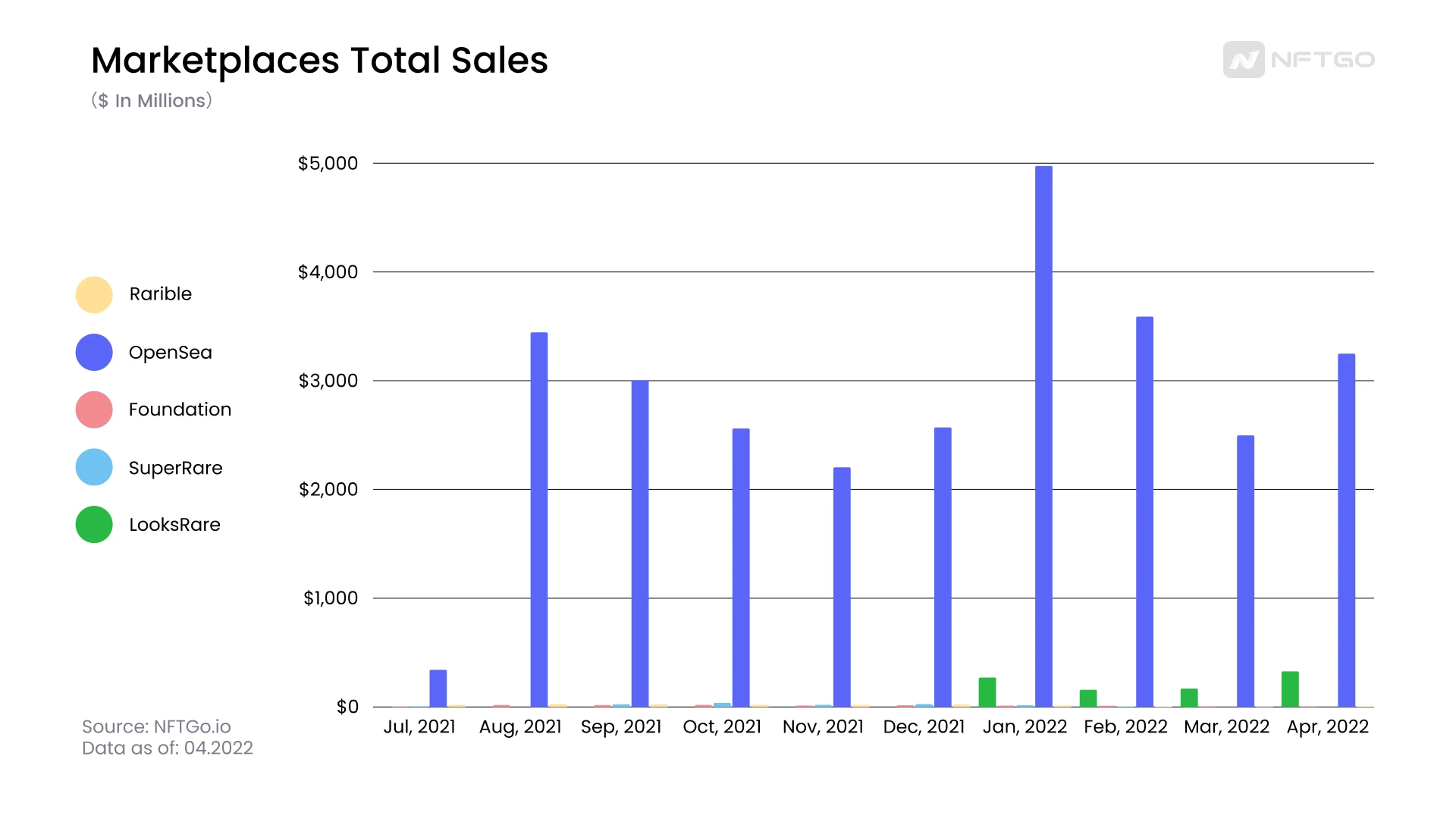

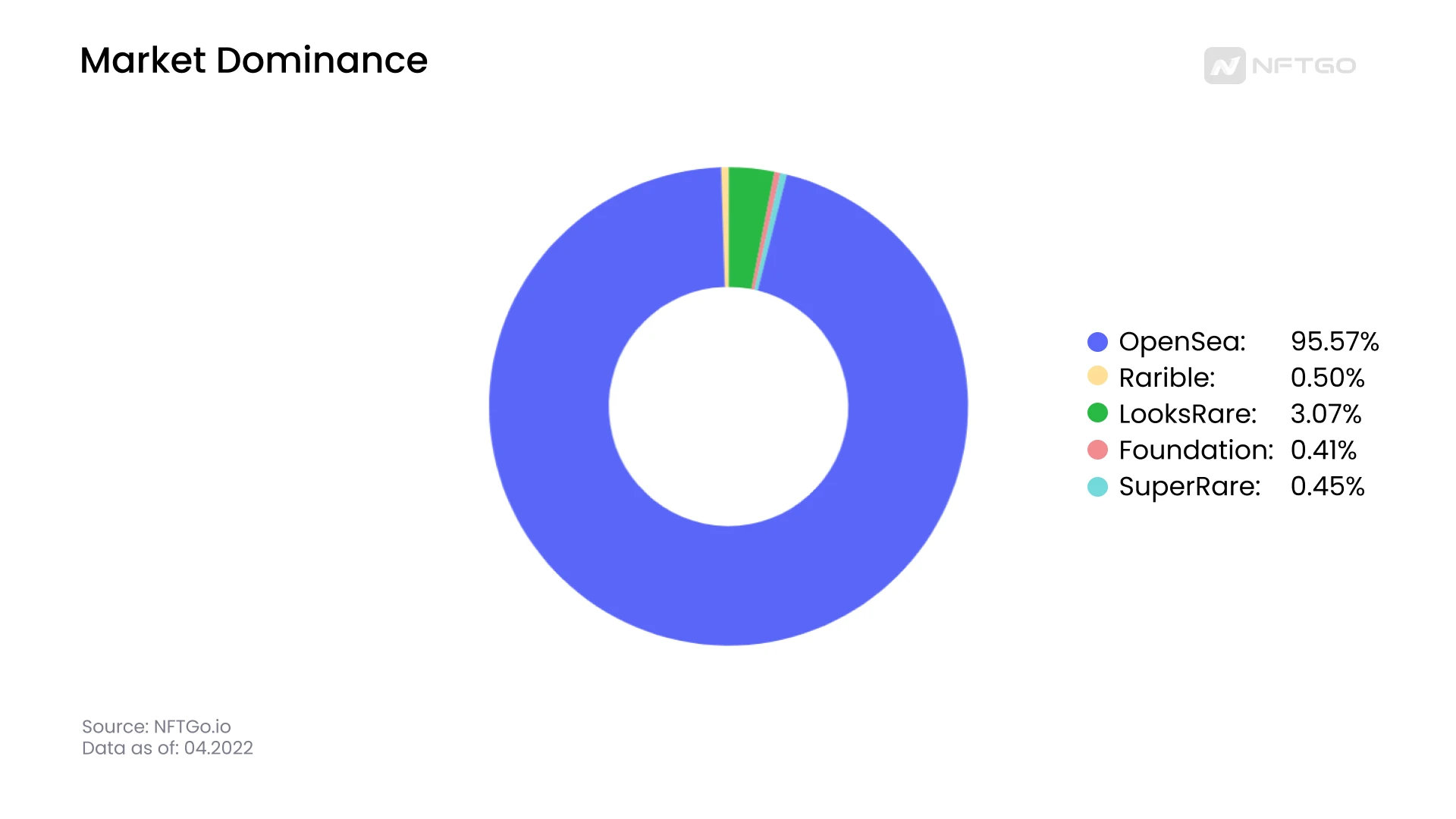

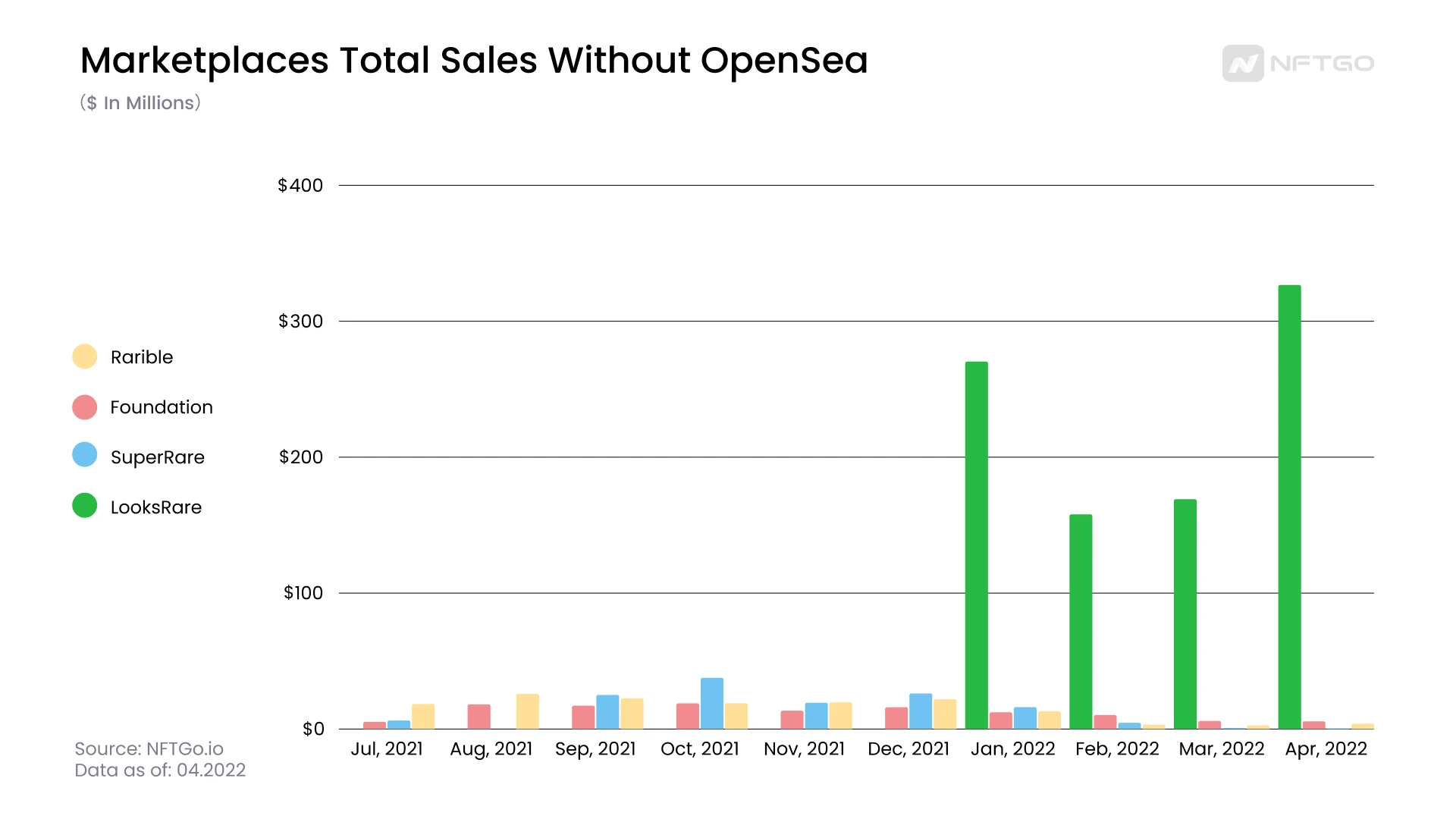

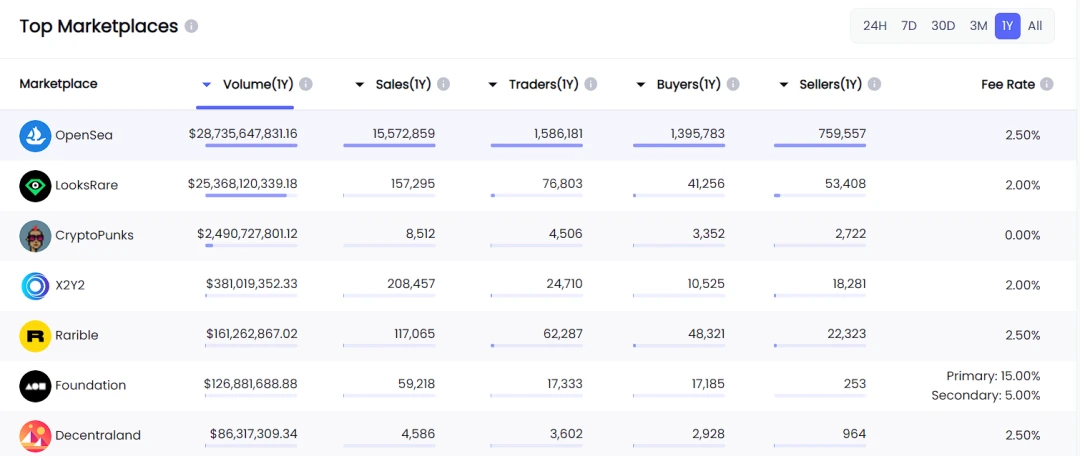

Whether it can create value is the key factor for the trading platform to win in the long-term competition. Marketplaces Total Sales and market value evaluation graph are key indicators to measure value. The more value a platform provides to users, the more transactions will be made through the platform. In the image below, we can see the total sales data of the 5 top trading platforms (LooksRares statistics remove wash trades and top sales).

image description

After LooksRare was launched, thanks to the new value it brought to users, it quickly occupied a considerable market share and developed into the second largest NFT trading platform on Ethereum.

image description

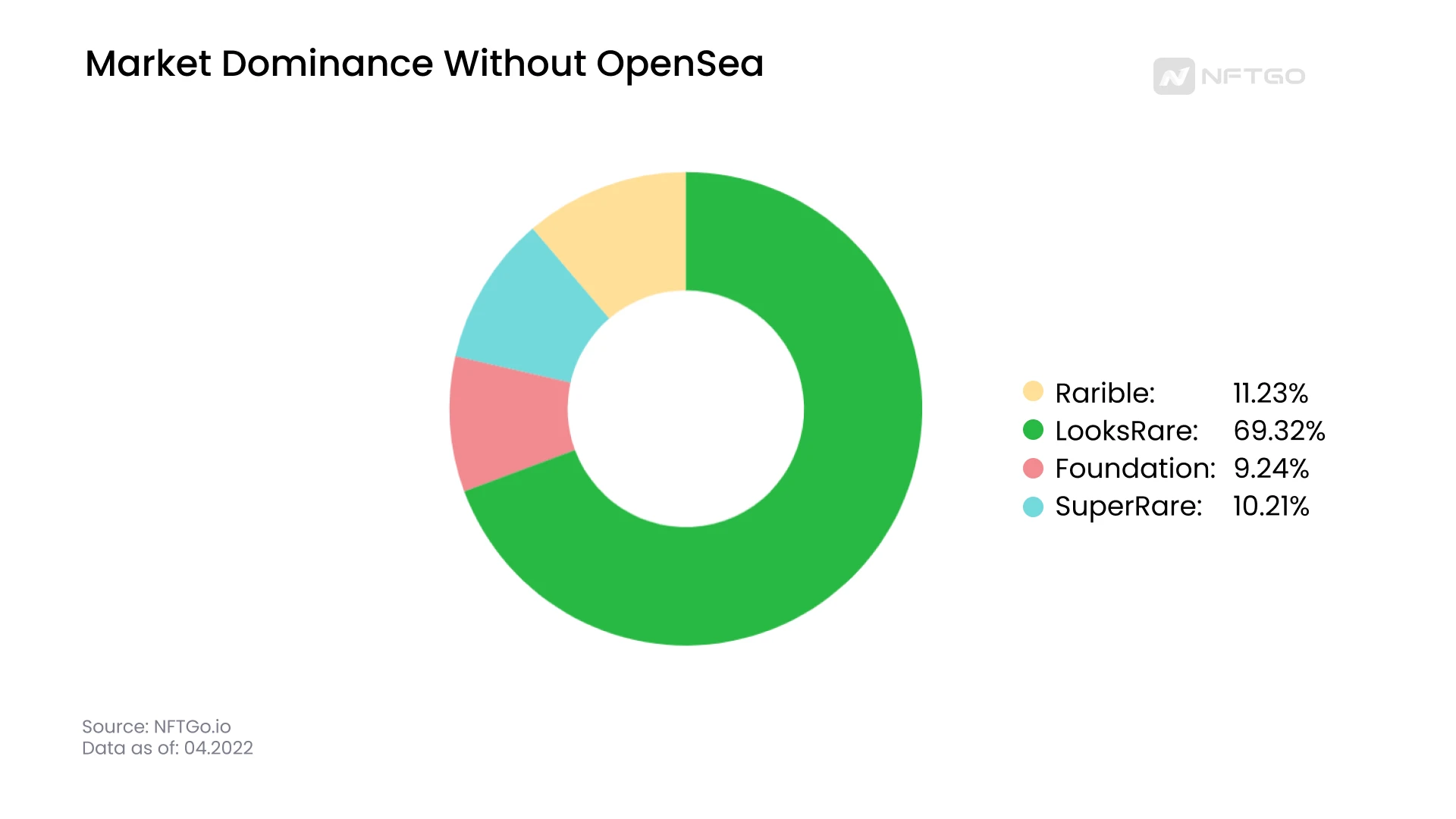

Leaving aside the behemoth of OpenSea, it is not difficult to find that since the three trading platforms Rarible, Foundation and SuperRare provide users with relatively similar services, the competition among the platforms is also relatively fierce.

image description

Looksrare has brought new product value to users and is the trading platform with the highest market share among the four trading platforms except OpenSea.

Market share (except OpenSea); data source: NFTGo.io

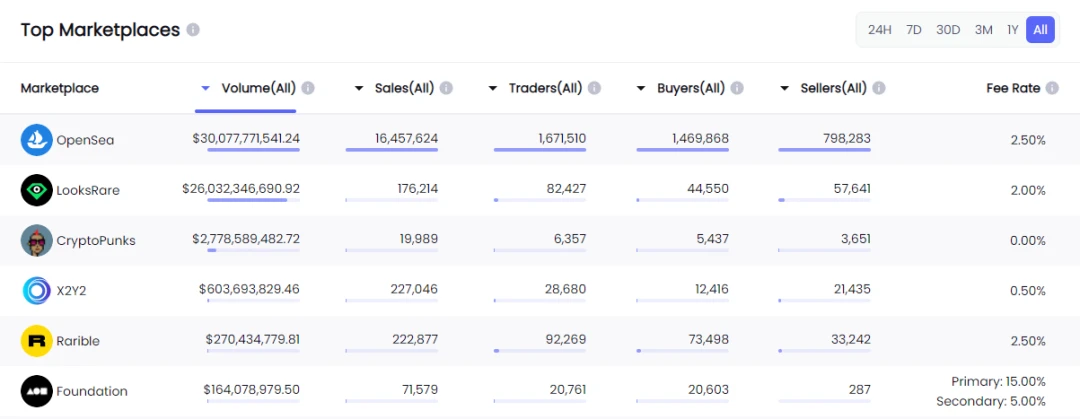

Transaction fee (2% for Looksrare, 2.5% for OpeSea, 0.5% for X2Y2); data source: NFTGo.io

secondary title

Recently, Solanas NFT trading market MagicEden issued its own Token. To some extent, Token provides the possibility for the platform and traders to grow together. OpenSea has obtained considerable income through high handling fees and service fees, but it has not returned the income to users. It is worth noting that the number of daily active users of Magic Eden has also surpassed that of OpenSea.

image description

The two platforms, LooksRare and Rarible, also issue tokens ($LOOKS and $RARI) to bind the platform with users to a certain extent. For example, users can get a share of the service fee by staking $LOOKS. The more staking, the more active the platform transactions, the more rewards (WETH) the user can get. The introduction of Token allows users and the platform to grow together. In the Web3 era where the community is paramount, how to integrate user interests into the platform is also an issue that needs to be considered by major NFT markets, compared to unilaterally allowing users to be consumers.

secondary title

Yuga Labs: The Next Trading Platform?

Bored Ape Kennel Club

Bored Ape Yacht Club

Mutant Ape Yacht Club

Otherdeed

CryptoPunks

Meebits

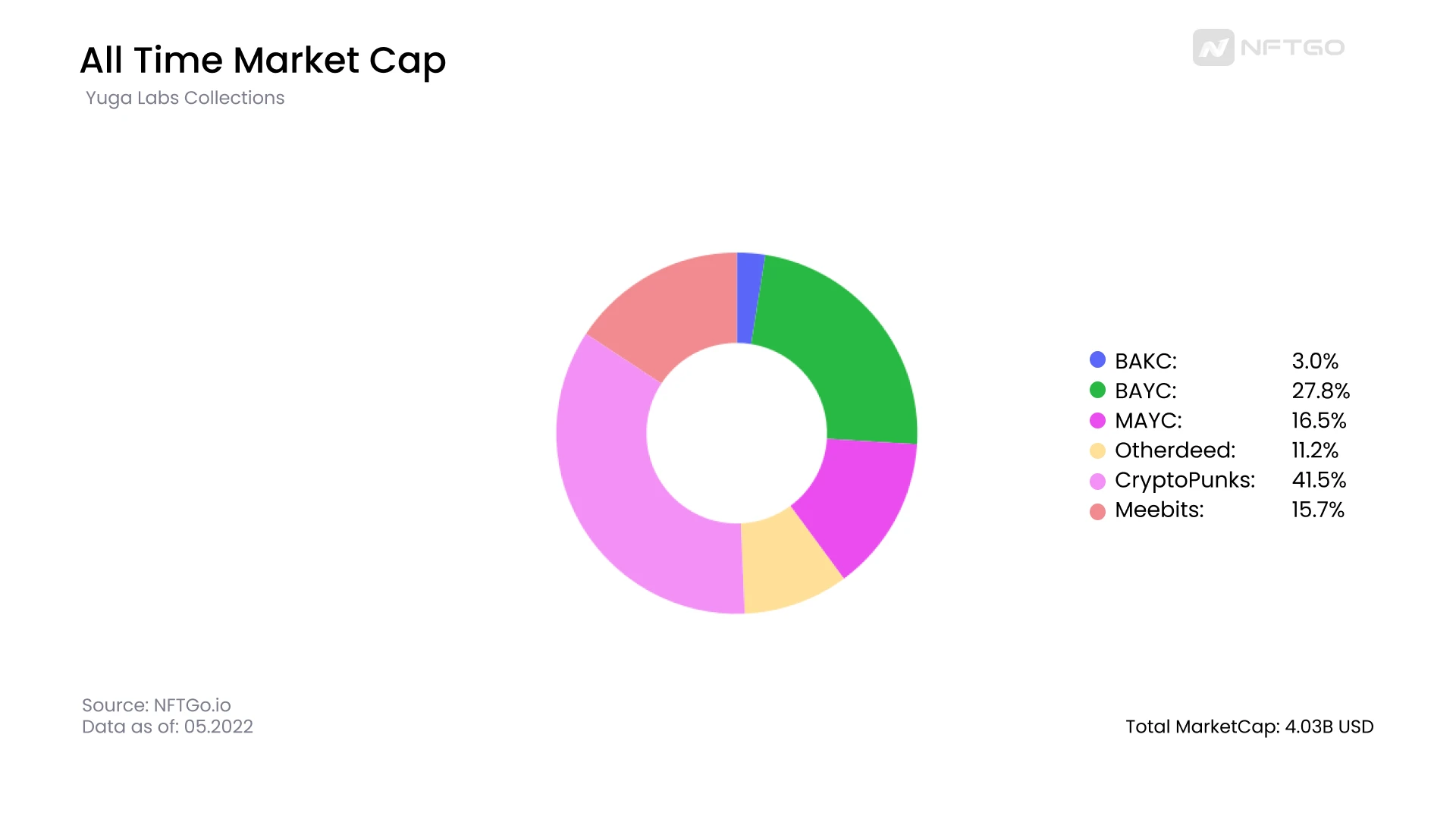

Yuga Labs ambitions are not limited to MetaRGP games and PFP. As the top competitor in the NFT market, its major projects have won the trust and support of the public. More importantly, these projects have also achieved long-term growth in the number and value of transactions. The sale of $APE tokens is a key step in the success of Yuga Labs. Currently, Yuga Labs has a total market cap of $4.03 billion, compared to LooksRare’s $441 million market cap. Yuga Labs may have the second largest addressable market size of any Ethereum trading platform.

image description

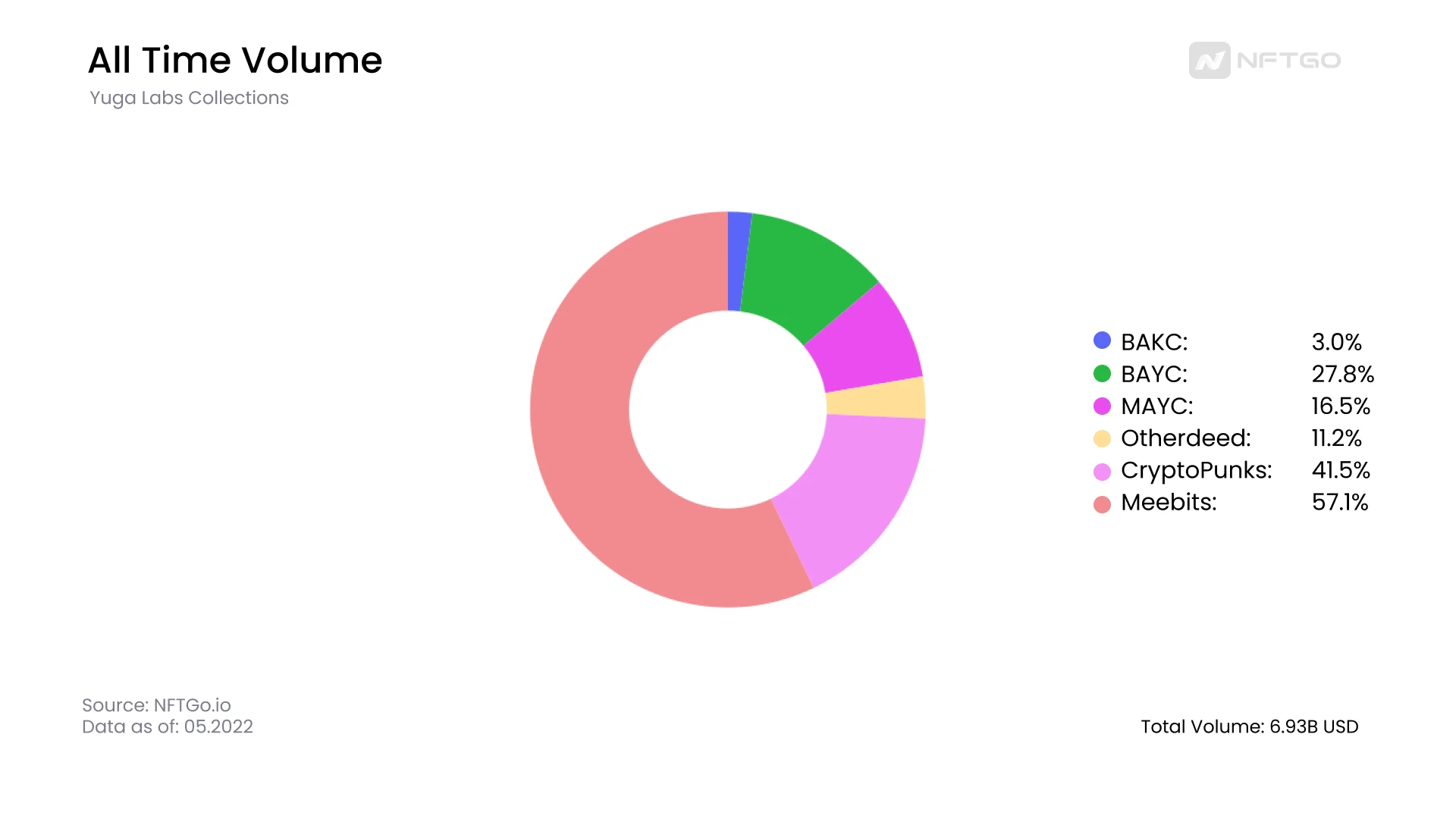

All Time Volume (All Time Volume) calculates the total amount of transactions in US dollars realized by each Collection since its launch.

image description

From the Top Marketplaces, we can see that although Yuga Labs has just been developed for one year, once it goes public, it will definitely be a strong competitor compared to other trading platforms.

image description

secondary title

epilogue

epilogue

At present, the number of transactions in the market and the overall liquidity have declined, and the instability of the market has prompted people to invest in more stable blue-chip NFT assets. Due to the obvious head projects of Ethereum, the single transaction volume ranks first, but the NFT market on other chains has a trend of small and large transactions. The multi-chain market can bring more new liquidity in the market dominated by blue chips , driving innovation and growth.

In addition, platforms also need more original campaigns to attract users. For example, the newly launched market Blur has achieved some success in formulating marketing strategies. The platform has created a preferential treatment model for early investors. At the same time, in order to promote the upcoming beta version, Blur also allows each OG to invite 5 friends to share Experience the beta version of the platform, and use the beta version to earn points, which can be used to redeem useful tools in the platform. The success of Blurs marketing strategy lies in converting users into platform spokespersons, allowing them to speak for the platform and attract other NFT investors.

The beneficiaries of the Red Sea battle will always be users. However, in the Red Sea competition, the boundaries between NFT trading platforms have become increasingly clear, and the trading model of the Web3 platform will also change subtly. Traffic, discourse power and community will also be propositions that require continuous attention in the NFT trading market.