Weekly Editors Picks is a functional column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days, and bring new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, come and read with us:

invest

Dialogue with trader Stewart: What are the characteristics of the 100x coins in this cycle?

The overall judgment framework is to buy and hold based on the fundamentals of a project and the appropriate price.

Valuation can actually be divided into two categories, one is conceptual and the other is business-based. The representative of the conceptual type is MEME, and its characteristic is that the ceiling can be very high as long as funds are willing to push it to that height. The business type relies on data, which is divided into the old track (benchmarking method) and the new track (there is no very accurate method, and pricing is determined by the leader).

It is actually very difficult to find Alpha in this round, because the characteristics of this cycle are little money, many tickets, and a large market, so there can only be local market conditions. So far, the sectors with relatively good local market conditions include MEME, Inscription, and Solana.

Mentally, no longer obsessed with value investing. Logically/thinking, no longer looking at what the market will use, but thinking about what the market will hype. In terms of action, either participate or not participate but also observe and accumulate samples.

We also recommend Dialogue with Trader Jason: Has fundamental analysis failed? and Dialogue with Trader Raymond: He escaped from Wall Street and captured 60 times of SOL in the last cycle, and is now waiting for a big drop in the next three months to buy at the bottom .

From Novice to Alpha Expert, a List of 50 Crypto Research Tools

The introduction covers areas such as fundamentals, news, financing, etc., helping users improve their market insight and data analysis capabilities.

Entrepreneurship

What is the real moat of a crypto project?

There are three unique structural differences in crypto applications:

Forkability: The forkability of applications means lower barriers to entry in the crypto market.

Composability: Because applications and protocols are interoperable, switching costs for users are inherently lower.

Token-based user acquisition: Using token incentives as an effective user acquisition tool means that the customer acquisition cost (CAC) for crypto projects is structurally lower.

Together, these unique properties accelerate the laws of competition for crypto applications. Once an application turns on the “fee switch,” not only will there be countless other indistinguishable applications that offer a similar but cheaper user experience, but there may even be some applications that subsidize users through token subsidies and points.

Logically, without a moat, 99% of applications will inevitably fall into a price war and thus be unable to avoid commoditization. In the short to medium term, relying solely on liquidity may still be an ineffective moat. Instead, liquidity and TVL are more like prerequisites, while real defensibility may come from intangible assets such as brand, differentiation in user experience (UX), and most importantly, the ability to continuously launch new features and products.

Who is actually making money in the infrastructure sector with overcapacity?

The article provides a detailed analysis of the performance of leading representatives in the oracle, cross-chain, storage, DA, and L2 sectors.

For infrastructure projects with huge current valuations, maintaining sky-high FDVs depends more on the imagination of their narratives. However, the current situation where the exaggerated valuations of infrastructure projects are inconsistent with their actual operating conditions will not only cause the market to fall into the bubble of the last round of bull market, but also bring hidden dangers of the tragedy of the commons to Crypto.

In-depth analysis of the impact of the EU Crypto-Asset Market Regulation Act on the market structure

MiCA aims to establish a single regulatory framework that strengthens consumer and investor protection, ensures market integrity and financial stability, and promotes innovation and competitiveness.

It applies to crypto-asset issuers, crypto-asset service providers (CASPs), and stablecoin issuers; it does not apply to regulated crypto-assets and central bank digital currencies ( CBDCs ) .

The opportunities that MiCA brings to Swiss and European Web3 companies are: market access, investor confidence, and an innovative environment; the challenges are: compliance burden, regulatory uncertainty, and competition .

Bitcoin Ecosystem

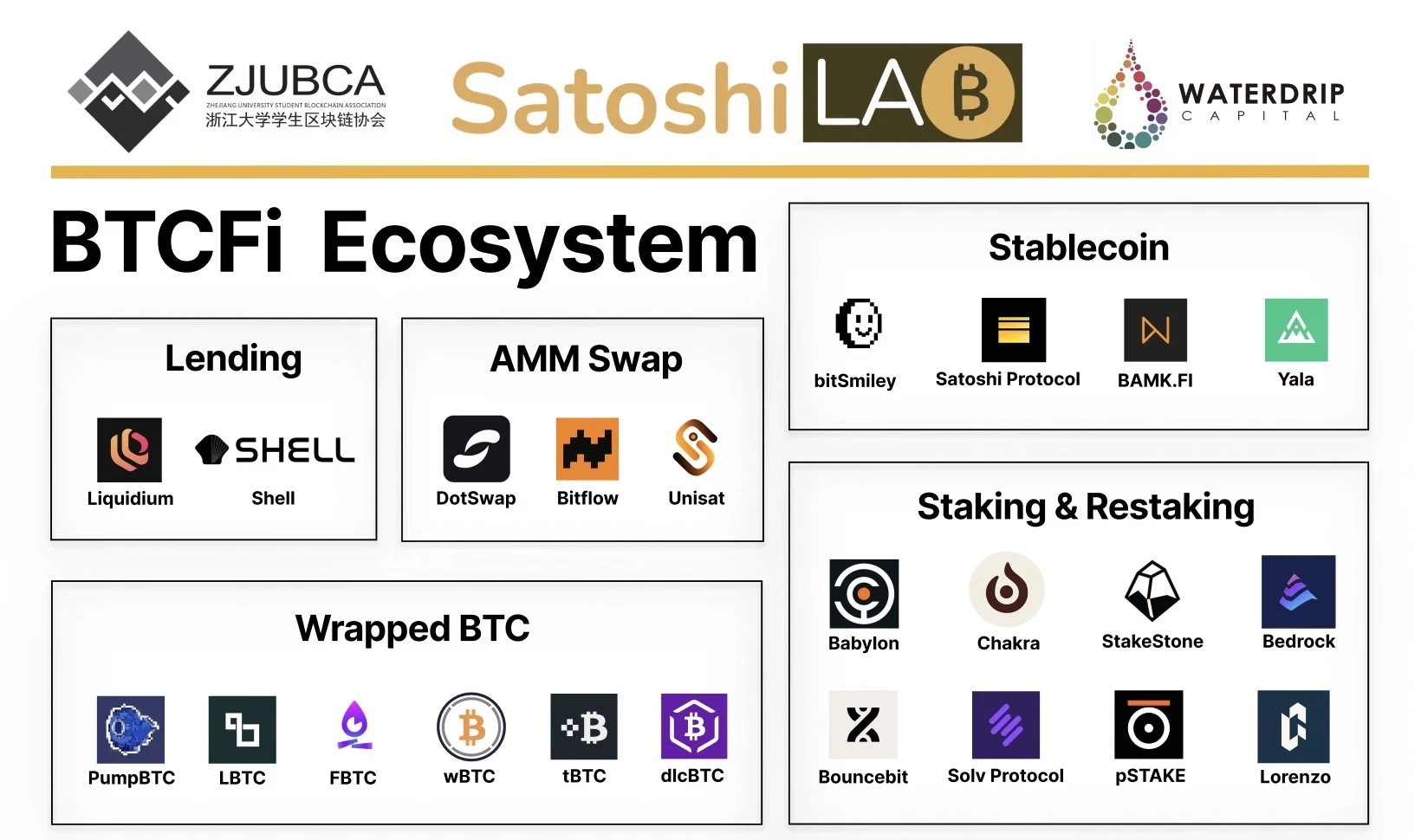

BTCFi: Build your own mobile Bitcoin bank, a comprehensive explanation from Lending to Staking

A large and comprehensive introductory report.

Multi-ecology and cross-chain

Ethereum is a gathering place for big players. Solana is still the main theme of the market. Arbitrum is the L2 that inherits the most Ethereum genes. Sui is catching up with Solana. BNB Chain user profile is similar to Ethereum. TON’s money-grabbing party failed to bring in funds. Base funds are mainly deposited in exchanges and other institutions.

Sui Chain DEX Aggregator Inventory: A Must-Have for Fighting Dogs and Brushing Interactions

The article introduces Hop Aggregator and DEX on Sui.

DeFi

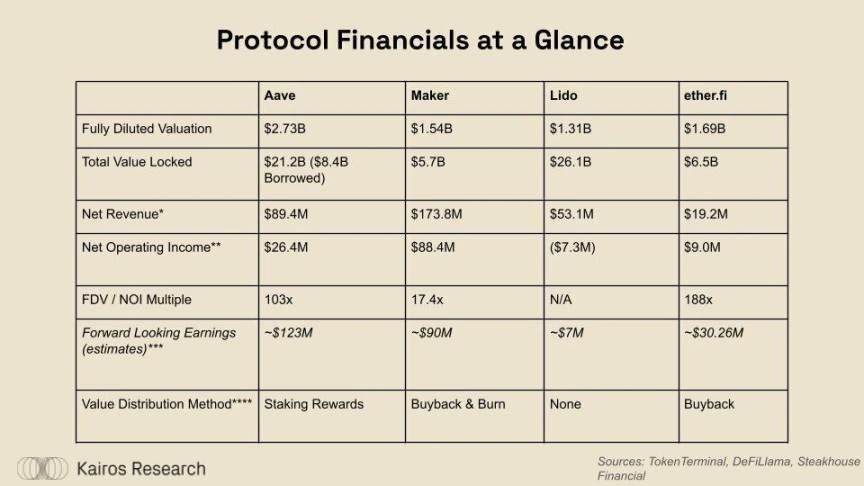

DeFi’s Breakout Moment: Ether.fi, Aave, Sky, and Lido’s Financial Transformation

This report aims to explore some of the most influential DeFi protocols from a financial perspective, including a brief technical overview of each protocol and a deep dive into their revenues, expenses, and token economics.

After years of liquidity bootstrapping and moat building, we are witnessing some protocols transition to sustainable profitability. For example, Aave has reached an inflection point, achieving profitability for several consecutive months and is rapidly developing a new, higher-margin lending product through GHO. ether.fi is still in its infancy, but has accumulated more than $6 billion in total locked value, ensuring it ranks among the top five DeFi protocols in terms of scale. The liquidity re-hypothecation leader has also learned from some of Lido’s shortcomings and launched a number of other ancillary products with higher interest rates to make the most of its billions of dollars in deposits.

Crypto Magic: A Deep Dive into Polymarket, SX Bet, Pred X, and Azuro Prediction Markets

The article introduces the order book tradable prediction market Polymarket, the single bet prediction platform SX Bet, the AI-based topic push prediction market Pred X, and the betting protocol Azuro supported by liquidity pools.

Although Polymarket has opened up free trading of conditional tokens themselves, it is difficult to implement a flexible betting mechanism. There is no expectation of high returns, and some ordinary players have lost their fun. Liquidity pool solutions such as Azuro are obviously still somewhat complicated and lack the ability to trade after betting.

Rather than a mechanism and technological innovation, the current popularity of the prediction market should be described as another mass adoption of crypto culture and a victory for the free market culture behind it, which is particularly valuable now that algorithmic authority is gradually monopolizing information.

Delphi Researcher: Do prediction markets work?

Market efficiency is critical to the accuracy of prediction markets because without efficiency, there will be probability biases (bias bias, hedging bias, and timing bias).

For large events, adding a margin of error to the forecast can help account for bias, hedging, or time-induced deviations.

NFT, SocialFi

Compared with cryptocurrencies, the non-financial characteristics of NFTs can actually lower the psychological threshold of users. The low liquidity that has been criticized makes users psychologically classify this type of asset as a safer category, making it easier to accept.

NFT also has unique social and emotional value, and can represent personal identity and interests in social networks, thereby showing personal characteristics. This is a huge part of the digital lifestyle.

Over the past three years, StepN has accumulated the following experiences: verification of the Move-To-Earn model, the importance of anti-cheating systems and activation codes, the challenges of Web2 user guidance, and the real needs of Web3 social networking.

In terms of attracting user attention, we understand the scarcity of attention, the timeliness of information transmission, the incentive mechanism of zero investment, and the simplified mechanism to enhance understanding.

The HAUS System and FSL ID are new mechanisms of StepN. The HAUS system is a running shoe rental system launched by StepN Go, where Web3 users can rent running shoes to Web2 users through a revenue sharing plan. FSL ID allows Web2 users to enter the platform completely seamlessly through Email and FSL ID.

In order to motivate users to continue consuming, the following strategies can be adopted: building internal consensus, cooperating with big brands, and IP cooperation.

In the End-game stage, social sharing becomes an important means to promote user consumption. Projects can promote social sharing through: Show off mechanism and social media marketing.

SocialFi’s “narrative failure”, does encrypted social networking still have a future?

Existing problems in the SocialFi track: hand-to-hand combat with traditional social giants, using short-handed attacks to defeat long-handed ones; no alternative value, and no Trojan Horse of its own; Fi for the sake of Fi, making Social a joke; unable to establish a closed loop of value, becoming a capital toy; a business model that is not pure enough and wavers from side to side.

The Fi chain of traditional social products: from free products to paid subscriptions to value-added services.

The SocialFi project’s breakthrough: from the fringe to the mainstream, from niche to the mainstream.

Hot Topics of the Week

In the past week, a US judge approved FTXs bankruptcy plan ( Ten Key Questions about FTXs Compensation); HBOs documentary revealed several reasons why it believed Peter Todd was Satoshi Nakamoto, including postings and spelling habits; former Bitcoin Core developer Peter Todd denied that he was Satoshi Nakamoto;

In addition, in terms of policies and macro markets, US prosecutors sued four companies and 14 people for suspected crypto market manipulation and false transactions , and the FBI created tokens for fishing enforcement; Gary Gensler : Cryptocurrency is unlikely to become a mainstream currency, and there is no need to create a special regulatory framework; OpenAI seeks to dismiss Musks lawsuit , calling it a roaring harassment campaign; Trump and Musk returned to the attempted assassination site to hold a campaign rally , and multiple related Meme coins rose;

In terms of opinions and voices, the founder of 10 T Holdings: Regardless of the outcome of the US election, Bitcoin is expected to rise to $100,000 ;

In terms of institutions, large companies and leading projects, Fidelity plans to launch a blockchain-based money market fund; OKX becomes the first crypto trading platform to obtain a full operating license from the UAE ; Binance’s pre-market trading function is officially launched; Uniswap Labs launches Unichain ; Vitalik once again donates 100 ETH to the Tornado Cash developer legal defense fund ; Vitalik once again sells 10 billion MOODENGs and transfers 260.16 ETH to charity ; Vitalik sells coins becomes the engine of Meme growth ; Telegram launches the Gifts function , and limited edition gifts can be exchanged for NFTs based on the TON network; UniSat releases a fourth-quarter roadmap , including activating runes on FB, supporting CAT 20, updating PizzaSwap, etc.; Scroll is listed on Binance Launchpool ; CARV token airdrops are open for collection; Puffer announces PUFFER token economics : total supply of 1 billion, 7.5% Used for the first quarter airdrop; Trump family project WLFI proposed to build a custom market based on Aave V3 and will provide 7% of tokens to Aave DAO;

In terms of security, EigenLayer encountered a hacking and unlocking incident; a user lost 15,079 fwDETH worth more than 35 million US dollars due to a phishing attack 5 hours ago... Well, its another week of ups and downs.

Attached is a portal to the “Weekly Editor’s Picks” series.

See you next time~