President Trump carefully selected the token? WLFI introduction and the latest holdings list

Original | Odaily Planet Daily ( @OdailyChina )

Author: Golem ( @web3_golem )

Trump was sworn in early this morning.

What is a little regrettable for the crypto industry is that Trump did not mention cryptocurrencies in his nearly one-hour inauguration speech, and did not mention Bitcoin or Crypto in the many executive orders he signed on the first day. This made us who stayed up late to watch Trump's inauguration somewhat disappointed, as if it was not him who issued the Meme coin TRUMP on the Solana chain a few days ago, and further caused people to doubt the implementation schedule of the crypto support policy.

However, some people have defended the name of this "crypto president". Bitcoin Magazine CEO David Bailey wrote today that , “It was confirmed that Bitcoin or cryptocurrency-related executive orders were included in the first 200 executive orders issued by Trump since he took office. I don’t know specifically what made them selected, but it’s good news.”

In addition, the most convincing evidence that Trump will not abandon Crypto may be the DeFi project World Liberty Financial (WLFI), which is inextricably linked to his family. Yesterday, in order to celebrate Trump's 47th term as the 47th President of the United States, World Liberty Financial announced the purchase of a variety of crypto assets, including ETH, wBTC, Aave, LINK, TRX and ENA, with each token purchased for $47 million or $4.7 million, with a total cost of more than $112.8 million (rich people really celebrate in different ways).

So, what is the origin of WLFI and the Trump family, why is the token purchased jokingly called "Presidential Strict Selection", and what tokens does WLFI currently hold? If you still have a vague understanding of World Liberty Financial or want to follow the "Crypto Presidential Token List", Odaily Planet Daily will introduce it in this article.

World Liberty Financial and the Trump family relationship

At the end of August , Trump's second son Eric Trump announced the launch of the crypto project WLFI on social media. However, the project was controversial as soon as it was launched, including unreasonable token distribution ratio, centralized governance structure, and exemption clauses.

WLFI's official website shows that WLFI is the only DeFi platform inspired by Trump, shaping the future of decentralized finance through WLFI tokens. At the same time, the relationship between the Trump family and WLFI is also clarified in the small print at the bottom of the website.

DT Marks DEFI LLC, an entity affiliated with Trump and certain members of his family, owns approximately 60% of WLF Holdco LLC, which in turn holds the sole membership interest in World Liberty Financial, Inc., a Delaware non-stock corporation that is developing the WLF Protocol and operating the WLF governance platform. Under the terms of its agreement with World Liberty Financial, Inc., WLF Holdco LLC has all rights to the net protocol proceeds from the WLF Protocol (except for the net proceeds from the sale of $WLFI tokens). Neither Trump nor any of his family members nor any director, officer or employee of the Trump Organization or DT Marks LLC is an officer, director or employee of WLF Holdco LLC or World Liberty Financial, Inc., except that Eric Trump is a manager on the board of directors of WLF Holdco LLC. DT Marks DEFI LLC and certain members of the Trump family also hold 22.5 billion $WLFI tokens, and DT Marks DEFI LLC is entitled to receive fees from World Liberty Financial, Inc. under a service agreement equal to 75% of the proceeds from the sale of $WLFI tokens after deducting agreed reserves, fees and other amounts.

It can be seen that although the Trump family did not directly manage WLFI, it had indirectly controlled the project through equity and could legally obtain 75% of WLFI's income . Therefore, it is understandable to classify WLFI as one of the Trump family projects.

Despite the initial FUD, the WLFI project has not stopped its development. On January 20, WLFI announced that it had successfully sold 20% of the $WLFI tokens, or 20 billion, through public offerings, earning a total of $1 billion at a public offering price of $0.05. The public offering round lasted about 3 months from October 15, 2024. After completing the original 20% token sales target, WLFI announced an additional 5% token sales due to strong market demand. So far, a total of 2.16 billion $WLFI tokens have been sold.

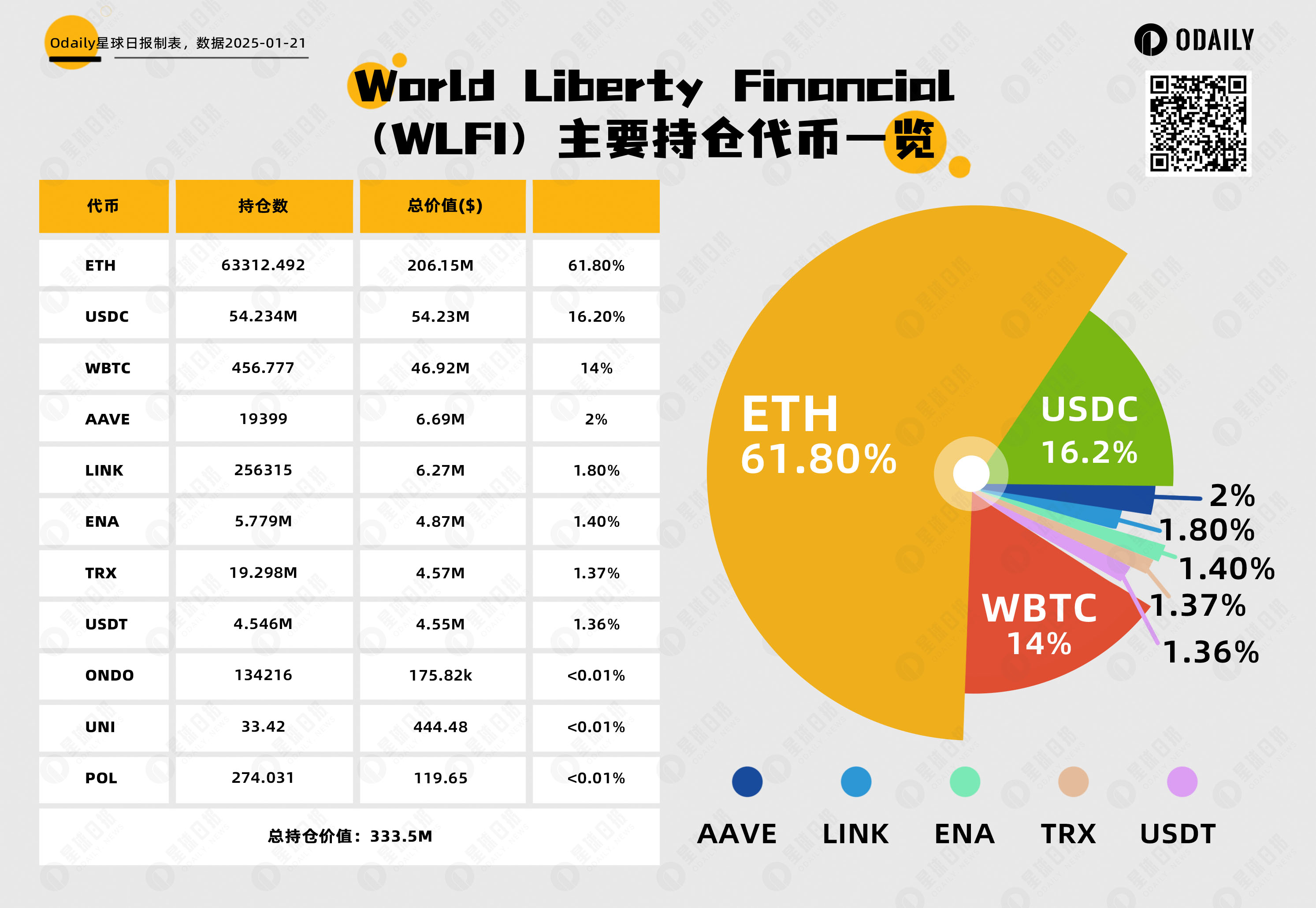

World Liberty Financial's major holdings at a glance

Due to its close relationship with the Trump family, and now that Trump has moved into the White House, WLFI will be seen as a potential positive as long as it buys and holds a certain crypto asset, bringing the label of "American attributes". So what are WLFI's main holdings at present?

As shown in the figure, WLFI holds the largest proportion of ETH, accounting for 61%. Previously, because Trump's personal meme token TRUMP was issued on the Solana chain instead of Ethereum, coupled with the long-term sluggish price of ETH, many people on social media were shorting Ethereum and clearing ETH for SOL, such as "The President of the United States is issuing coins on the Solana chain, why are you still holding Ethereum?" But then WLFI's continued purchase of ETH caught everyone off guard.

At the same time, TRX is more prominent in the holdings. On January 20, WLFI spent $4.7 million to purchase TRX, a TRON token. This was WLFI's first investment in a Chinese project. If you dig deeper, you will find that the relationship between WLFI and TRON is not simple. As early as November 26, 2024, Sun Yuchen, the founder of TRON, announced that he would invest $30 million in the Trump family's crypto project WLFI, becoming its largest investor. He then joined WLFI as an advisor . In addition, TRON representatives were also invited to attend the presidential inauguration on January 20.

In addition, ENA project owner Ethena Labs has also reached a cooperation with WLFI.

The WLFI holdings list has become a "list of the emperor's confidants", and projects that have cooperation or close relations with it will be honored to be selected. According to the on-chain data, WLFI has previously purchased small amounts of UNI and POL. I wonder if there will be any linkage with WLFI in the future.

Although every large purchase of WLFI will bring short-term FOMO to the corresponding token, in the long run it still depends on the substantive cooperation and whether Trump can quickly implement crypto-friendly policies.