first level title

1. 2008-2012 Genesis era of encryption industry

On November 1, 2008, a mysterious person named Satoshi Nakamoto published the article Bitcoin: A Peer-to-Peer Electronic Cash System in his cryptography mail group, which is the Bitcoin white paper. Therefore, 2008 is known as the first year of Crypto, and the Bitcoin white paper is regarded as the Bible of Crypto. It opened the entire era of Cryptos initial enlightenment, allowing people to realize that the combination of cryptographic algorithms and blockchain technology can create An unprecedented digital currency - censorship resistant, decentralized, anonymous. On January 3 of the following year, Satoshi Nakamoto dug up the Bitcoin creation block on a small server in Helsinki, Finland. This day is called Genesis Day by Bitcoin believers. After that, the concept of Bitcoin quickly spread to all parts of the world like a prairie fire, and the concept of Code is Law also spread. According to the introduction on Bitcoin.org, based on the principles of cryptography and blockchain technology, Bitcoin has the durability, portability, substitutability, scarcity, divisibility and identifiability as a currency. Especially on May 22, 2010, a programmer in Florida, USA exchanged 10,000 bitcoins dug out of his computer for two pizzas. This is the first purchase behavior of Bitcoin as a currency with definite records, which makes the use of Bitcoin as a currency from theory to reality, so the attributes of Bitcoin as a currency are verified and believed by people. After that, individual merchants began to accept bitcoin payments one after another, and the worlds first bitcoin online exchange MT.GOX was also established (founded on July 11, 2010). With the emergence of bitcoin exchanges, bitcoin has a price that can be traded as a commodity for the first time, and its price continues to increase, attracting more and more people to participate in bitcoin mining.

Especially after the US Wired magazine reported on Bitcoin in April 2011, the price of Bitcoin soared rapidly, became famous, and began to be talked about by people. But most people are skeptical about Bitcoin, question its credibility, and even say it is a pyramid scheme, but this does not affect everyone to join Bitcoin mining for profit. At the same time, Bitcoin believers are also growing. They firmly believe that Bitcoin has investment value and is truly decentralized. Bitcoin will break the existing currency system and become an unregulated real world currency, thus establishing A unified world currency system. It was at this time that the fundamentalism of Bitcoin began to be admired by everyone, that is, openness and transparency, immutability, anonymity, and decentralization. But everything has its two sides. With the increase of popularity, Bitcoin began to be paid attention to and used by hackers and dark nets. Finally, under the dual influence of the Mentougou money theft incident and the dark net Silk Road, Bitcoin was released in 2011. After peaking in June, it entered the first cold winter since its birth. In order to distinguish from those who hope to profit from Bitcoin by speculating on it and those who simply look at the anonymity of Bitcoin for money laundering, Bitcoin believers began to call themselves Crypto Native, which means actually owning and trading Bitcoin. People who believe in the cryptographic algorithm and blockchain technology behind Bitcoin, and who advocate Code is Law. The Crypto Natives of that period preached based on fundamentalist ideas, and gained a lot of consensus around the world for the establishment of Bitcoin. At the same time, the cold winter of Bitcoin did not affect the Crypto Natives who continued to explore the encrypted world. On October 7, 2011, Bitcoin had its first follower or challenger - Litecoin (Litecoin-LTC). A key step in the encryption world from life to life.

image description

image description

Source:https://history.btc 123.fans/

first level title

Source:https://explorer.btc.com/zh-CN/btc/insights-hashrate

2. 2013-2015 Enlightenment Age of Encryption Industry

It can be seen from the Bitcoin computing power trend chart that during the one-year winter of Bitcoin from 2011 to 2012, people gradually recognized the technical status of Bitcoin and began to try to participate in this social experiment. During the period, in addition to being challenged by Litecoin to gain recognition in encryption technology, Bitcoin payment was also publicly accepted by real economy suppliers, gaining recognition in terms of currency value. On November 28, 2012, Bitcoin ushered in the first output halving. The deflation effect reminded people of the value-added potential of Bitcoin. big outbreak. The sharp rise in the price of Bitcoin, coupled with the mass production of ASIC mining machines and the launch of exchanges such as Coinbase, Huobi, and OKEX, has given more people the opportunity to join Bitcoin mining and let more people know about Bitcoin. and other cryptocurrencies. It was at this time that Bitcoin was given the title of digital gold by people. Its commodity attributes stole the thunder of currency attributes, and the unit price of Bitcoin also exceeded the price of an ounce of gold on November 29, 2013. price.

Due to the entry of a large number of people and funds, the early infrastructure and cognition of the encryption industry were gradually built and improved during this period. Mining machines, payment scenarios, exchanges, and financial derivatives were gradually matured. The rapid growth of Bitcoin computing power is the Good proof. So people began to explore new possibilities, so various cryptocurrencies other than Bitcoin and Litecoin, such as Bitcoin Cash BCH, Ripple Coin XRP, Dogecoin, etc., emerged. Their birth made people truly realize that cryptocurrencies are not only Bitcoin, but also other products using cryptography and blockchain technology, and made the concept of Crypto expand from Bitcoin to Crypto Currency in peoples minds.

But it was at this time that the Crypto Natives had differences. A considerable number of people insisted on fundamentalism and resolutely defended the status of native Bitcoin; while others believed that the world is developing, and Crypto should not be limited. It’s not about Bitcoin, it’s about Bitcoin, it’s about Bitcoin.

While Bitcoin and its followers are attracting the attention of the public in turn, another event of cross-age significance to the encryption industry happened—Ethereum founder Vitalik Buterin released the first version of the white paper of Ethereum, and in July 2014 A pre-sale of ether was held on 24th. At the beginning of its birth, Ethereum contained a great mission, which is to change the encrypted world. The emergence of smart contracts marks that the encryption industry has found its future direction in the chaos, that is, the next generation of smart contracts and decentralized application platforms. As a distributed computer that cannot be turned off, Ethereum uses the blockchain as ROM, realizes CPU functions through the calculations of miners, and runs smart contracts as programs. Its encryption architecture and Turing completeness have enabled the birth and development of a large number of emerging industries, and the encryption industry has gradually evolved from a purely peer-to-peer currency system to a decentralized world-class computer system.

image description

image description

Source:https://history.btc 123.fans/

first level title

Source:https://explorer.btc.com/zh-CN/bch/insights-hashrate

3. 2016-2019 Industrial Revolution in the Encryption Industry

The industrial revolution is recognized as a singularity in the development of human history. Since the outbreak of the industrial revolution, science and technology have advanced rapidly and productivity has increased significantly. The birth of Ethereum and smart contracts is the industrial revolution of the encryption industry. After this time scale, the scale of the industry began to expand rapidly, and more and more practitioners joined, allowing various projects to emerge. This era can develop so rapidly, on the one hand, due to the emergence of the typical public chain track with Ethereum and the discovery of the value of smart contracts, such as the emergence of new financing methods such as ICO (Initial Coin Offering) and various The ecological prosperity of DAPP on the chain has made people gradually realize the potential value of the blockchain and the encryption industry. On the other hand, thanks to the development and improvement of the encryption industry trading platform represented by exchanges and related derivatives, people can conduct spot and contract transactions based on various currencies, injecting vitality into cryptocurrencies.

Specifically, at this stage, the infrastructure of the encryption industry has further developed, and derivatives such as contracts and loans have become more complete. In 2017, the Binance Exchange was officially launched, and later quickly grew into the worlds largest cryptocurrency exchange and even the giant of the entire encryption industry. In addition, the main theme of this era is the public chain battle that began in 2018, so 2018 is also known as the first year of the public chain. The new generation of public chains represented by EOS challenged Ethereum. Competitors such as EA, ADA, NEO, and BTM appeared like a tide, and started new stories in terms of performance, compatibility, and security.

As a challenger, the innovation of Ethereum smart contracts has brought prosperity to the entire industry: the emergence of a new financing paradigm represented by ICO, which means that any project or even an individual can directly issue their own tokens and Allowing the public to exchange their tokens with common tokens such as BTC, ETH or stable coins (such as USDT, USDC, DAI, etc.), which greatly reduces the financing threshold. At the same time, the explosion of the public chain track has brought initial prosperity and development to the ecology of the chain, mainly based on gambling and game DAPP, and the emergence of phenomenal DAPP games represented by F 3D, among which the gaming industry also perfectly fits the needs The transparent and fair blockchain technology features were favored by DAPP developers during this period, and people also discovered for the first time that the combination of blockchain technology and the gaming industry was a blow to traditional gaming and related industries. The highly stimulating and favorable characteristics of gambling and games also promote users to open the door to the ecology on the chain.

With the rapid development of encrypted exchanges and the fading of the ICO craze, IEO (Initial Exchange Offering) has gradually become one of the melodies of the new era. IEO made up for the disadvantage of ICO without supervision through the review and endorsement of the exchange, and became one of the hottest financing methods at that time, making a large number of platform coins discovered as the value of breaking new thresholds. Therefore, the infrastructure construction represented by the exchange in the encryption industry has been further improved. At the same time, the exchange represented by Binance still represents the rise of the centralized power in the encryption industry, but it must be completely decentralized and centralized. It is inevitable, but this is a manifestation of the industrys maturity.

Together with the huge changes in productivity and the ecological environment, it has brought about an impact on peoples thinking and cognition. Some disadvantages of decentralization in terms of safety and efficiency began to appear slowly. In June 2016, the largest Ethereum public chain at that time The smart contract crowdfunding project The DAO was hacked. When Ethereum was facing a huge crisis, the founder Vitalik Buterin adopted a hard fork to recover most of the losses. Ethereum has since forked into two chains, ETC and ETH. Most people choose ETH, but there are still a group of people who insist that Ethereum should operate in the most decentralized native way and choose to stay in ETC, and this controversial handling has left a long-term concern in the encryption industry. Crypto Native discussion: In the face of security and efficiency, how can we make the right choice between centralization and decentralization? Is the native spirit of encryption such as decentralization the only solution or the ultimate solution to encryption utopia? If not, where is the ultimate solution? How can we find a balance between efficiency and security in the spirit of native encryption such as decentralization?

As early as 2014, Chang Jia, the founder of BTM, once proposed the Blockchain Trilemma, which means that blockchain technology cannot achieve decentralization, security and scalability at the same time. Scalability. Generally speaking, decentralization refers to nodes with a large number of block production and verification. The more nodes, the higher the degree of decentralization; security is the cost of obtaining network control, which is usually anchored in the design of the consensus mechanism. Assets in the real world, such as the proof-of-work mechanism, are rivets of computing power; efficiency is the number of transactions processed per second, that is, TPS, and the main reason for the low efficiency of blockchain projects is that each transaction must consensus on all nodes. Of course, the Impossible Triangle is just a summary of past blockchain technology experience at that time, and there is no strict theoretical derivation support. In this triangle, decentralization and the fairness it brings are the core values of the encryption industry, so early native encryption projects are often built in strict compliance with the principle of complete decentralization.

With the development of the industry, practitioners have gradually realized that if only complete decentralization is considered and security and efficiency are ignored, the development of the encryption industry can be described as full of difficulties. In the new generation of public chains represented by EOS and TRON in this generation, the latest DPoS consensus mechanism was adopted at that time. Unlike the PoW of BTC and ETH at that time, which required the confirmation of the entire chain node, the DPoS mechanism of EOS only required the confirmation of the entire chain node. The coin-holding voting mechanism selects 21 super nodes, and the super nodes take turns to confirm transaction data and bookkeeping, and give them certain rewards. This is the inclination of the public chain in the latest era to the operating efficiency of the public chain under the premise of sacrificing a certain degree of decentralization. At the same time, this is also a compromise and attempt to balance the original encryption idea and efficiency.

Coincidentally, in 2018, when the ecology of the chain initially exploded, due to the lack of effective oracles, gambling DAPPs often used the last few digits of the block hash as the lottery result certificate because they could not generate real random numbers. Determining random gambling results, this choice has a certain risk of centralization, but it is an expedient strategy to ensure the reasonable and normal operation of DAPP in the early chain. This is also a reasonable use of centralized means at this stage to balance project feasibility and risk. One of the sexual attempts.

image description

image description

image description

Figure 6: Blockchain Impossible Triangle

4. 2020-2022 Encryption Industry Great Navigation Era

After experiencing the cold winter of the encryption industry in 2018-2019 and the pains affected by the epidemic, in 2020-2022, with the entry of institutional-level funds and loose monetary policies around the world, the market ushered in the third since its birth. In the second bull market, this time we have a bigger narrative and better innovation.

In the summer of 2020, the dimensional wall of traditional finance in the decentralized world was broken. After that, the lending platform Compound took the lead in launching tokens, which were used to distribute tokens to users as rewards in a process called liquidity mining. Other protocols emulating the concept of DeFi emerged, token prices soared, and DeFi exploded. This summer, we call it DeFi Summer. In March of the following year, the digital work Everydays: The First 5000 Days by American artist Beeple was finally sold at a price equivalent to about RMB 450 million. NFT blue chips went online and exploded rapidly in this environment.

At the same time, because of the explosion of Axie Infinity, GameFi has also re-entered peoples attention. After the initial development of the on-chain ecology in 2016-2018, along with the more complete underlying infrastructure conditions such as public chains and the popularity of on-chain projects such as DeFi and NFT, the on-chain ecology has finally achieved considerable development in this era. More and more professional traditional game producers have entered the encryption industry, such as Blizzard and Ubisoft, and some excellent innovative Web3.0 games such as StepN have also emerged.

On the other hand, the FTX exchange, which was established in 2019, has established a business of 40 billion U.S. dollars in less than three years, with a valuation of more than 26 billion U.S. dollars. The founder Sam Bankman-Fried has gained fame because of this, from Alameda Research to FTX and then Now that Mingpai is the new generation of public chain Solana, SBFs territory is rapidly expanding, and it has become one of the encryption giants comparable to V God and CZ.

The encryption industry has finally got rid of the previous monotonous narrative and has completely entered the era of great voyages. The on-chain ecology represented by DEX and DeFi has exploded one after another, and the ecology represented by NFT has gradually prospered and completely out of the circle. The market value of the industry has exploded. These staged achievements also benefited from the gradual improvement of the ecology brought about by the construction of industry infrastructure in the past ten years, and the long hard work finally ushered in temporary gains. After absorbing the experience of the previous era, the projects of this era have adopted solutions that are more in line with the market on issues such as the impossible triangle of the blockchain.

For example, the POH consensus mechanism of the public chain upstart Solana adopts measures such as disclosing the list of block producers in advance. These features have reached the extreme in the direction of Layer 1 expansion at the cost of sacrificing part of the decentralization feature, basically touching the pointless The TPS ceiling of the public chain. At present, Solanas 132 nodes account for 67% of the pledge share, of which 25 nodes occupy 33% of the pledge share, which basically constitutes the monopoly of the elite class on the project. Secondly, Solana has high requirements on the hardware level of nodes. Most of the individuals running Solana nodes are giant whales, institutions, and enterprises. It achieves vertical expansion at the cost of equipment costs, which is obviously not conducive to decentralization in the true sense. But to a certain extent, the efficiency characteristics have been pushed to a new level.

Another example is the BSC chain (Binance Smart Chain). BSC is a fork version of ETH, initiated by Binance in early 2020, and officially launched in September of the same year. Because of the resources of Binance, the ecological activity has long been ranked among the top three in the industry. Since DeFi Summer, TVL has been above 6 billion US dollars for a long time. Since the ecological explosion of Ethereum, in addition to bringing ecological prosperity to Ethereum, the currency price has soared In addition, there are high gas fees and poor user experience, so the market lacks an alternative to Ethereum, and lacks a public chain option with low gas fees and good user experience. In this context, Binance dominates The BSC came into being.

BSC is compatible with the Ethereum virtual machine EVM, which allows Ethereum developers to quickly access BSC, and emphasizes low gas fees and user experience, and is backed by Binance, which has launched a $100 million incentive plan to support its development . BSC introduced the Proof of Stake Authority (PoSA) consensus mechanism and reached a consensus by pledging BNB. A total of 21 verifiers are required, almost all of which are controlled by Binance. This mechanism is often criticized for being too centralized, but BSC has greatly improved network efficiency. .

In addition, DAO (Decentralized Autonomous Organization) is also an exploration of various forms of decentralization in the industry. DAO is an autonomous group spontaneously established around a mission. The autonomous group shares rules for coordination and cooperation. To some extent, DAO is an off-chain form of blockchain projects. DAO is often used as a community product of a certain project and exist. Fairness and spontaneity are the characteristics that all DAOs value, so they are more transparent than traditional companies, which greatly reduces the risk of centralized evil, but because of its spontaneity, the threshold is often lower. On the other hand, compared with traditional corporate forms, DAOs at this stage still have many shortcomings, such as lower thresholds and unclear division of powers and responsibilities. For example, it is impossible to effectively determine the organizational form of DAOs. Ensuring the decentralization of power and truly reflecting the public opinion of the community, such as how to balance the influence of most decision-making and stakeholders, etc., the essence of these issues is actually the oldest and most difficult political problem in human history. Thinking from ancient Greece has never been There is no end, and with the support of blockchain technology, we hope to get a better answer. The specific form of DAO is still in the early stage of exploration.

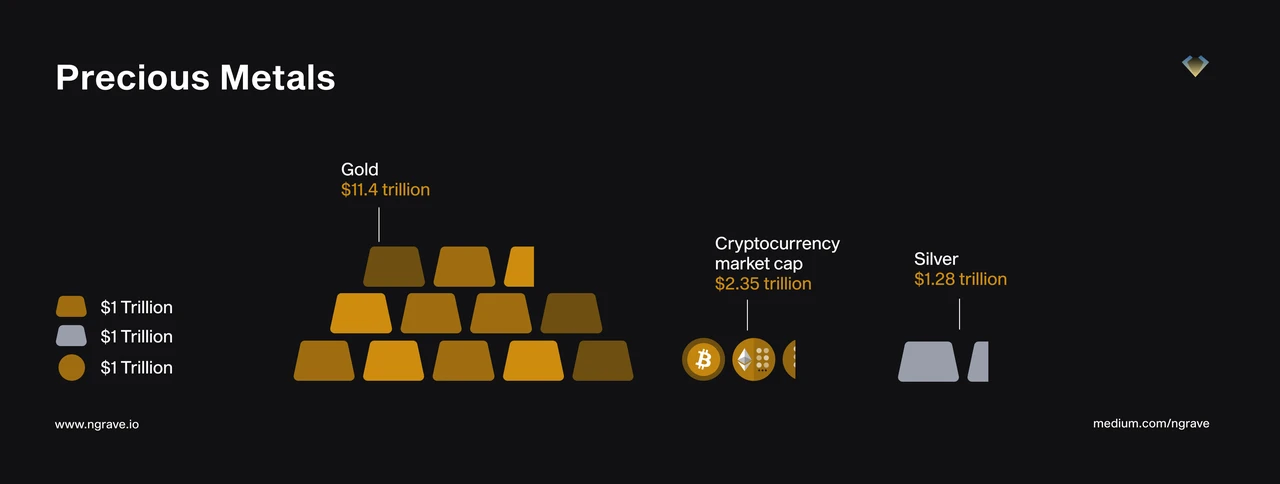

image description

image description

Source:https://medium.com/ngrave/too-big-to-fail-crypto-market-size-vs-traditional-assets-eff 4 bb 2 ec 529

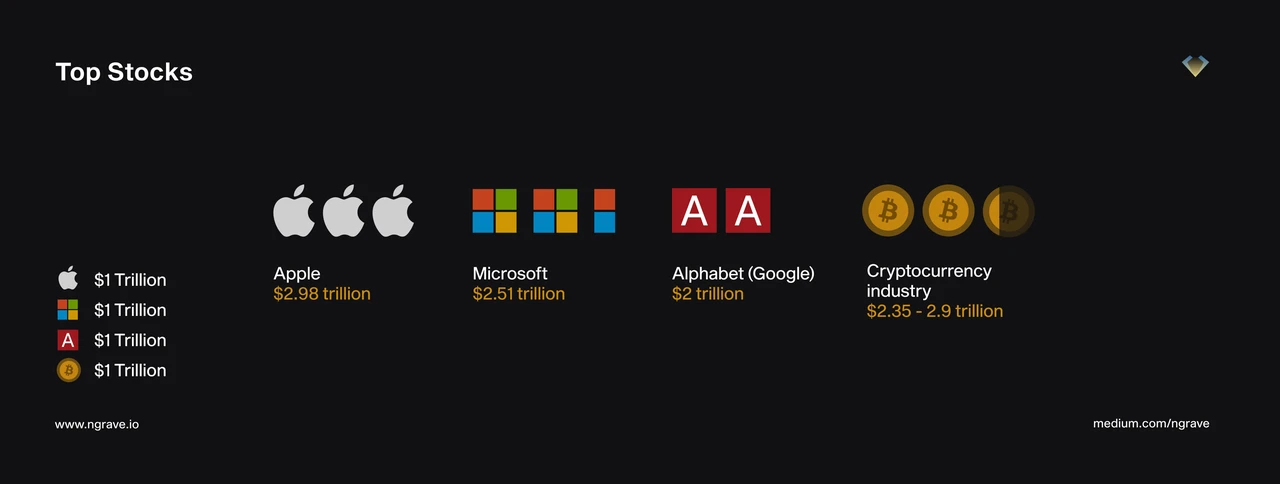

image description

Source:https://medium.com/ngrave/too-big-to-fail-crypto-market-size-vs-traditional-assets-eff 4 bb 2 ec 529

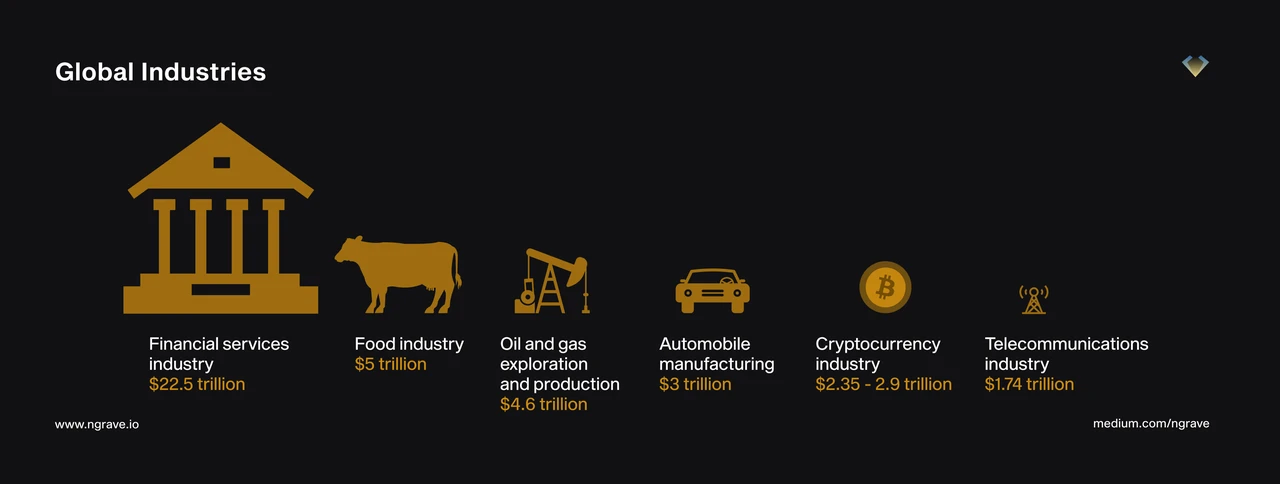

image description

Source:https://medium.com/ngrave/too-big-to-fail-crypto-market-size-vs-traditional-assets-eff 4 bb 2 ec 529

Now the encryption industry is in the process of transitioning from fully complying with the principle of decentralization in the early stage to exploring the balance of decentralization, efficiency and security. Blockchain fundamentalism believes that projects in the encryption industry must have resistance to censorship. , Non-tamperable, transparent, anonymized and other completely decentralized features, this is the embodiment of free will. However, more and more practitioners believe that value application is the ultimate goal of technology, and blockchain technology must be combined with various vertical fields to find a landing point, and finally promote the improvement of the efficiency of social organizations to be valuable. They realize that the beautiful utopian vision of fundamentalism is beautiful, but in realizing it, it is necessary to be down-to-earth, recognize objective facts, and respect laws, which is the only way to utopia.

Today, thirteen years later, Bitcoin and even the encryption industry have experienced countless deaths and then the phoenix nirvana, triggering huge changes in various fields such as finance, games, and art. This is already a trillion-dollar industry. Thousands of changes and innovations are still happening in the industry, and new narratives often include changes and changes in thinking, industry expansion and the formation of new tracks. However, we believe that Bitcoin and various encryption technologies are only the concrete manifestations of narratives, and the ideas behind these concrete representations are the spirit and real soul of the encryption industry, namely: fairness and justice represented by decentralization. The encryption spirit of Crypto Native is actually closer to a kind of human sociology and philosophical thinking. Since the history of mankind, the struggle between centralization and decentralization has never stopped. If we look back at history, we can clearly see It can be seen that the entire human history is actually a history of evolution and exploration from centralization to decentralization at the realistic and social levels. Blockchain technology is the first hope in human history to use technical means to solve such problems, which will represent the innovation of traditional order and the establishment of new connections in the world. In the exploration of new technology vision, we firmly believe that the encryption industry will It is a key link for mankind to advance to Utopia.

In Math We Trust.