On September 15, 2022, Ethereum officially shifted from the original PoW mechanism (with foundation pre-mining) to PoS. There was a lot of voices in the encryption field, and some voices even said that this is the history of the greatest financial innovation of mankind on the right path. Sexual step, seems to mark the end of the historical mission of PoW.

first level title

Fool, its the currency that matters

The goal of Ethereum has changed several times due to market changes. From the world computer, dApp that never stops, to the token issuer, the world financial settlement layer, the story of Ethereum has been changing, and recently it has become a super-sound currency. It is worth noting that the initial design of Ethereum explicitly excluded ETH as a currency: it is only used as Gas (gasoline) to drive the energy of Ethereum, the worlds largest machine. But now that has changed, the Ethereum.org website and the documentation for the project have been revamped.

In my opinion, the initial vision of the world computer (programmable blockchain platform) is the most suitable story for Ethereum. Change and change. The problem is only that the world computer can cater to a much smaller market than Bitcoins world currency because there are essentially not that many businesses that need to incur the enormous costs of decentralization, money machine derivatives The financial needs of the public are the ones that most need decentralization and can afford the cost of decentralization, so the story slowly turns to ETH is Money (ETH is currency).

From EIP-1559 to the achievement of PoS Merge, ETH has the opportunity to realize the reduction of circulation, thus becoming a fashionable new species among the enthusiastic supporters of Ethereum: ultra-sound currency. This is pure conjecture, as supply is only one of dozens of indicators (theory of monetaryity) used to assess the soundness of a currency. However, Ethereum’s problems in other aspects (pre-mining ICO, continuous changes in vision, complex underlying protocols, secondary project syndrome, unstable monetary policy, centralized management, risk of government sanctions, etc.) doom it to be unable to assume the function of future currency , the most serious flaw of which is the PoS mechanism.

secondary title

1) Collectible currency theory

Human beings love for collectibles has accompanied the entire history of civilization, and even appeared on a large scale in the prehistoric period when we were still ape-men. Animal teeth, shells, flint, jade, bronze, silver, gold, antiques, clothing, artwork, etc. have all become valuable objects in different civilizations and times, and are collected by everyone.

Collectibles are actually a low-velocity currency in primitive society or special periods, and only participate in a small number of high-value transactions; correspondingly, metal currency has a higher circulation velocity and can assist a large number of low-value transactions.

From the article The Origin of Currency by Nick Szabo, the father of smart contracts, we can know that in order for a specific item to be selected as a valuable collection, it must have the following attributes:

Safer, less prone to accidental loss and theft. For most of history, this attribute meant portability and ease of concealment;

Its value attribute is more difficult to forge. An important subset of this attribute is those extremely luxurious and almost unforgeable products, these items will be considered extremely valuable;

It is easier to estimate its actual value by simple observation or measurement. That is, more reliable conclusions can be obtained by simple observation, and it takes less effort.

It seems very wasteful to manufacture an item just because it is a luxury. However, these unforgeable luxury objects can continuously increase in value through the medium of valuable wealth transfer. Whenever it takes a transaction from impossible to possible, or from prohibitively expensive to affordable, some of the cost is recovered. Its manufacturing costs start out as complete waste, but are amortized over time as transactions are made. The monetary value of precious metals is based on this principle. The same goes for collectibles, the rarer and less easy to manufacture, the more valuable it is. That is to say, compared with the first manufacturing cost of these collections, the value they create in the process of continuous circulation and changing hands is much higher. The same holds true for products that can be shown to contain highly skilled and unique human labor, such as works of art.

Taking it a step further, collectibles are much more than just a pretty ornament. It must have several main functional attributes, such as portability, easy concealment, and condensed unforgeable luxury consumption. Moreover, this luxury attribute is verifiable by the recipient (the verification technique must be simple enough) - they will use the same technique that many collectors still use today.

This collection desire of human beings can be called collection instinct. Foraging for rare materials, such as shells and teeth, and making collectibles took up a considerable amount of time in ancient humans, just as many modern humans devote considerable energy to these activities as a habit. Such hunting and knocking activities turned out to our ancestors to give the first reliable expression of value that was very different from practicality, and the predecessor of our currency today.

secondary title

2) Commodity Money Theory

In the modern world, producing money and producing goods are two fundamentally different things.

But we go back to the era when precious metals such as gold, silver or copper were used as currency, or even the ancient times when salt, sheep, and shells were used as the medium of exchange. Money at that time was not special, but an ordinary currency with value itself. At this time, producing money and producing goods are the same thing: both require a certain cost, and fierce competition in an open access market where anyone can participate in production will reduce the money price or money price. Profit in the production of money is always limited to a level indistinguishable from the production of other commodities.

The situation changed after entering the industrial revolution. The increasingly large and rapid economic development began to gradually make physical commodity currencies such as precious metals unable to meet peoples daily payment and long-distance frequent trade needs due to the constraints of their physical properties. Credit currencies that circumvent the problems of bulky, non-portable, uneven texture, and high circulation costs of physical currency in the form of accounting or debt such as gold coupons, precious metal warehouse receipts, and checks have emerged.

Credit currency solves the defects of commodity currency, but it still has its own defects: astute bankers or bankers find that people will not exchange all their gold back at the same time. People dont notice that there are too many bills of exchange, and shameless bankers call these super-issued credit currencies a gift to myself.

From then on, production of money (that is, the production of paper) has become a cost-free thing, and there is no need to print paper at all. You only need to move your fingers to modify an entry in the database software, and you can quietly Create a huge amount of wealth out of nothing. The competition from commercial expansion of banks makes this kind of credit over-issuance increasingly bold and reckless, and the entire credit system is gradually extremely fragile. In the end, some minor events cause runs that will lead to the credit collapse of the entire banking system, and the financial crisis in the modern sense has been repeated since then. Appeared and became more and more out of control.

Due to the inherent instability of credit currency, the power to issue credit currency was later nationalized, and the exchange relationship with any physical commodity was completely severed. In this case, people seem to have fully accepted that money can only be credit and should not be what it is: a commodity for decades.

PoW enables the information world to produce encrypted goods that have the same actual value as physical goods. The entire currency returns to the commodity currency era. Credit currency is to solve the defects of commodity currency. In the era of encrypted commodity currency, the defects of physical currency (bulky and inconvenient, difficult to separate and combine, high identification cost, easy to wear, and different colors) no longer exist, so we no longer need The unnecessary form of credit currency or legal paper currency is gone.

It can be seen from the recent regulatory actions and information disclosed by the US government that PoS is more likely to be defined as a security. Because the blockchain of the PoS mechanism needs the first distribution of tokens in order to start, the individuals and institutions that get the PoS for the first time are the issuers of this kind of securities. With PoW, there is no such initial issue problem, and its energy-intensive and open-to-competition production method is essentially the same as the production of any other commodity.

3) Energy Monetary Theory

The history of human scientific and technological civilization is the history of the development of energy efficiency.

In 1921, American industrialist Henry Ford proposed to establish a"energy currency", as the basis for the new monetary system. The currency bears a striking resemblance to the peer-to-peer electronic money system outlined in Satoshi Nakamotos 2008 Bitcoin white paper. That year, the New York Tribune published an article outlining Fords vision to replace gold with an energy currency that he believed could break the banking elites grip on global wealth and end wars. He intends to build"worlds largest power plant"and build a"power unit"A new monetary system to do this.

Ford told reporters: Under the energy currency system, the standard is the amount of energy produced per unit of time, equivalent to a dollar. Its just an example of thinking and counting in different terms than what were used to being set for us by international banking groups, We therefore believe that no other criterion is advisable. He added: The specifics on the value of the currency will be resolved when the government is willing to hear about it.

Under Fords energy currency theory, there is no difference between available energy itself and proof that energy has been consumed for currency. The former is oil and coal, while the latter is a PoW mechanism similar to Bitcoin. produced electronic currency.

From the most primitive wood, to coal, to oil, then to hydropower, wind power, solar power, and finally nuclear fission and nuclear fusion, the efficiency of human energy use has been improving, and energy acquisition methods and energy utilization efficiency represent The productivity and technological level of this civilization. Taking human transportation as an example, from human transportation, to animal-drawn carts, to coal-burning steam locomotives, to internal combustion engines, and finally to electric motors, the energy utilization methods of all things are becoming more direct, reducing unnecessary intermediate process. Money is no exception: the best money will be the one that is produced directly by consuming energy and cutting out all other intermediate processes.

There is a common mistake here that PoS is a more green and economical way of producing money, but in fact the opposite is true and PoW is the most efficient. PoS just obfuscates costs, but it is impossible to eliminate them.

The cost of electricity is only a part, not all, but the energy utilization method directly consumed by the mining machine is the most efficient.

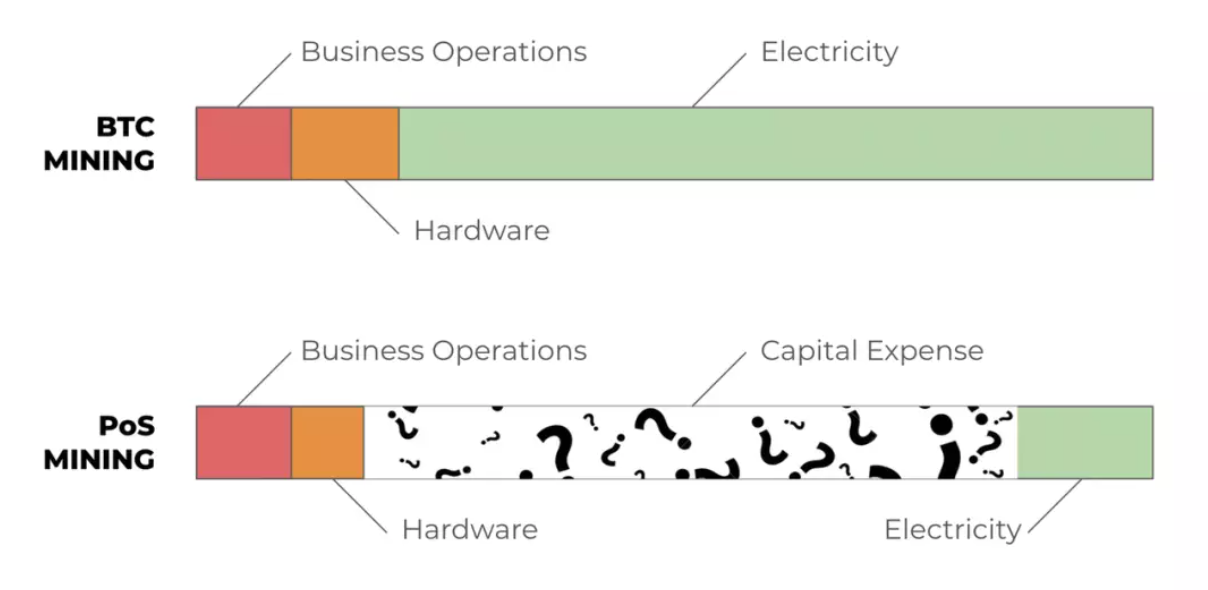

When people say bitcoin wastes energy what they mean is that electricity is needed to power the mining equipment that produces bitcoin blocks; ironically, on the one hand, this energy is clearly not all the energy used to run the bitcoin network , but only a part; on the other hand, this part is the most directly used to protect the blockchain, so it is the least wasteful. To fully measure Bitcoin’s carbon footprint, we also have to factor in hardware costs (manufacturing and scrapping costs) as well as normal business operations (furnishing a decent office and flying around to Bitcoin conferences). The latter two types of costs are more vague and difficult to estimate. But they are equally important to understand what impact the system as a whole has.

The more a cryptocurrency spends its security budget directly on electricity, the more secure it is; the more it spends money on commercial operations, the less secure it is. Proof of Stake does not (and cannot) eliminate miner expenses, it just converts the portion of PoW system expenditures on electricity into capital expenditures. How the externality of locked capital compares to the externality of electricity consumption is a complex and delicate question - but unfortunately, proponents of PoS systems often pretend that electricity is the only price that needs to be paid (for the system to operate).

secondary title

4) Clear cost theory

A successful currency needs to have the widest circulation in the world. Different regions, environments, technological levels, cultural customs, social systems, etc. all need to reach a general consensus on the value of this currency. The free competition of currencies will allow everyone to choose the currency that can most easily and directly evaluate its value as the medium of exchange, because both parties to the transaction are willing to accept it. The most direct manifestation of this value is the production cost, and preferably the direct cost under the energy price. Because only energy is the cost expenditure method that can be objectively observed and directly understood by the population of all backgrounds in the world.

A sound currency that can be used globally on a large scale must require the most objective, clear and easily observable production cost as a value support. Otherwise, how to reflect the hardness of hard currency? Otherwise, how to evaluate the power of purchasing power?

The electricity cost of PoS is only a very small part. Some people regard this low energy consumption and high monetary premium ($0.1 production cost but $100 face value) as the advantages of green savings. So, what reason do we have to convince people outside the market Is it objective, just, and necessary for people to accept this $99.9 currency premium?

Costless paper or credit money has value for only two reasons:

One is that valuable physical goods are inconvenient to carry for transaction and payment. Some organizations use banknotes as exchange vouchers for goods through goodwill, such as bank notes, spot warehouse receipts, and checks.

The second is that if the banknotes are not linked to any physical goods, then someone must force you to agree that the banknotes have value. As soon as there is no pressure, the value of these notes will go to zero.

Paper money with no cost and no peg cannot survive in a market of free choice that does not involve violent coercion. Judging on objective value, you can temporarily deceive some people locally, but you cannot deceive everyone all the time.

The kind of thing that everyone agrees to treat a piece of waste paper as a valuable currency has never happened in history, and it will never happen in the future. In summary, money is a commodity, not an agreement. If it is a commodity, it will definitely be subject to market competition and cost curve competition. The market will not accept a commodity that can be manufactured in large quantities at almost no cost at any time, but whose face value is much higher than the actual cost.

In a free market, the prerequisite for an item that can undertake large-scale currency functions is that the production cost (that is, the value) of this item can be effectively observed in a simple and generally feasible way, at least more objectively than other items. , Undoubted cost calculation method, the subjective, short-term, artistic, ambiguous, time-changing, illusory value that lacks a unified calculation method, or the market consensus value that depends entirely on mood, cannot Backed by the value of money. Moreover, the production of this currency should be completely open, so that all human beings can have the opportunity to participate, and the cost of production can be assessed in a decentralized and objective manner, so that a consensus on the value of this currency can be formed for all human beings. The cost of PoW is the most directly and effectively observed production method. There is no production method on the earth that can directly observe the cost directly and timely than the direct consumption of energy (electricity). There is no one, so pow is The basis of future money. Human beings will not choose an item whose production cost is unknown and unclear, as the hard currency that everyone can accept with the largest circulation in the economic world.

Therefore, PoS cannot be used as a currency production method, because the observable cost of the new currency issued by PoS is basically zero, which means that the newly acquired currency is diluting and cannibalizing the wealth of others at no cost. Everyone is not stupid. Under the same conditions, people will definitely choose Tokens (such as PoW coins) that have objective production costs that match their prices as currencies.

On the other hand, buying PoS tokens for pledge is actually cost-free, because there is no capital loss in the pledge investment (the risk of fluctuations in the value of tokens has been offset by its value-added profits), which is equivalent to buying machines and consuming electricity to mine gold, and The difference between buying gold and automatically producing new gold at home. In addition, after a lot of attempts, the reality that no unsecured pure algorithmic stablecoin can remain successful also shows a principle that tokens issued at no cost cannot maintain their currency premium for a long time in the free market.

secondary title

5) The theory of judgment fees

Before going into the theory, lets think about it, why is there a currency? Why havent scarce items like diamonds become money? Will oil be a good currency?

In the transaction behavior, both parties to the transaction inevitably have to judge the cost of the goods or services provided by the counterparty, and the transaction costs paid in the process of judging the quality of the goods are called judgment costs.

The size and frequency of transactions in general is of course subject to transaction costs as a whole (information costs, contracting costs, substantiation costs), but the problem becomes less problematic as soon as we focus on the following scenarios: to be clearer:

Why is it better to have some mutually acceptable commodity when people have already decided to trade with each other? What conditions does this product have (or why does one product meet this condition more than others)?

Youll quickly realize that this has basically nothing to do with contracting costs, adopting a commodity (currency) that everyone likes doesnt change the contracting costs; nor does it have that much to do with information costs, because After the formation of a large-scale market, currency as a commodity, its information cost (the cost of discovering the market price) may not be much different from other commodities.

Therefore, the key lies in the judgment fee. That is, if the two parties exchange goods, both parties must pay a lot of costs to judge the quality of what the opponent gives. Sometimes this quality inspection is expendable (such as inspecting the quality of oil), but there may be some commodities whose other The change in quality is very small, and its quality is easy to detect, so everyone can easily trade this kind of thing, at least one of the parties does not have to pay so much quality judgment fees. And because the quality judgment fees of different commodities are different, the advantages suitable for being used as currency are also different.

There have been countless kinds of currencies in human history: gold, silver, stones, even cigarettes, eggs; but all these currencies have clear characteristics in the corresponding societies: under certain technological conditions, their judgment fees are the lowest, Gold and silver only have the dimension of purity, and the inspection fee is very low, just melting; cigarettes produced in the United States are standardized products, so they were used as currency by the people in Germany some time after the war.

Therefore, judging the quality of currency is actually tantamount to determining the quality of the item. The lower the judgment fee, the more suitable it is to be used as a currency. This is the insight of Alchian, a master of property rights economics.

For currency, the focus is not on the quality (90% of gold and 95% of gold are only different in market price), but on the quality of the quality (the quality of gold is lower than that of diamonds). Therefore, it is not the level of security that determines which distributed ledger is suitable for carrying currency, but the cost of determining the security of the ledger determines their currency quality.

In PoW, the work of determining the security of the ledger is extremely simple, just verify the block hash and check the difficulty requirements of the entire network; although the difficulty requirement cannot directly reflect how difficult it is to rewrite the ledger, it directly shows how many times it will take Hash calculation.

In PoS, at least as far as I know, there is no way to check the security of the ledger so easily:

In the non-staking PoS system, the verification of the legitimacy of the block depends on the state data, because only the state data can tell you how much money is in which address at any moment, and whether the block can be generated, but each block will be more Part of the state data; in the worst case, this difficulty can make PoS completely ineffective against Sybil (an attacker can attack a node with a high-level previous fork chain and pay nothing);

In the pledged PoS system, the block production process is completed by the verifier through initiation-pre-voting-voting (signature), and one step in verifying the security of the ledger is to verify the verifiers signature. Moreover, no matter whether the signature is aggregated or not, the amount of calculation required for verification is difficult to reduce.

In other words, whether it is to judge the production cost of currency or the security of ledger, PoS is much less efficient and more complicated than PoW.

Money is money because it needs to change hands countless times as a medium of exchange. The quality judgment fee will continue to increase with the long-term accumulation in the transaction circulation process, which will eventually cause its circulation cost to be much higher than the production cost.

secondary title

6) Open system theory

The means by which the PoS consensus mechanism ensures security is to confiscate the tokens of the perpetrators. So, on a technical level, how exactly does the slashing mechanism work? Do we have to build a list of all witnesses before we can confiscate something? Thats right, thats it. To be a witness in Ethereums PoS consensus mechanism, you first move ETH to a special staking address. This is not only for applying the slashing mechanism, but also for voting, as checkpoint blocks require a 2/3 majority.

Maintaining such a list of all witnesses around the clock has some interesting implications. Is it difficult to join the ranks of Witnesses? Can I leave at any time? Can witnesses vote on the state of other witnesses? This brings us to the principle behind PoS: PoS is a system with access.

The first step to becoming a witness is to deposit some ETH into a special staking address. How much ETH do you need? Minimum 32 ETH, about $50,000 at current prices. Just to add some background, decent bitcoin mining rigs are typically a few thousand dollars each, and if youre home mining, you can start with an S9 thats a few hundred dollars each. To be fair, there are technical reasons for the high threshold of the ETH PoS consensus. A higher threshold means fewer witnesses to participate, which can reduce bandwidth requirements.

So, the barrier to entry is high, but wouldnt anyone with 32 ETH be able to participate if they wanted to? Really not. There is a security risk if a large number of witnesses leave or enter at the same time. For example, if a majority of witnesses in the network leave at the same time, they can double-spend funds on a fork (the one they didnt exit) without penalty on either side. In order to mitigate this risk, both entering the PoS consensus and leaving the PoS consensus have a built-in queuing mechanism (throuthput limit, literally translated as throughput limit). In addition, although the witness can now issue an exit transaction and stop participating in the PoS consensus, the code for actually withdrawing funds has not yet been completed.

The last point is the economic incentive for approving new witnesses to join. Suppose you are a shareholder of a large company, and the companys business is stable, and it will pay you dividends every quarter. Would you be willing to issue additional shares for free? Of course not, because this will reduce the dividends of all current shareholders. A similar incentive structure also exists in PoS. Because every new witness joins will dilute the benefits of all current witnesses. In theory, witnesses could directly censor all transactions that add new witnesses, but, in reality, I dont think such an explicit approach would work. This would be very obvious, and would destroy Ethereums decentralized image overnight (and possibly cause the price to plummet). I think people will use more subtle ways. For example, using security or efficiency as an excuse to slowly change the pledge rules makes the threshold for participating in PoS higher and higher. Any policy that favors existing Witnesses at the expense of new Witnesses will be supported financially, whether it is on the table or not. Now, we can see why PoS becomes an oligarchy.

The PoW mining method adopted by Bitcoin is not just a consensus agreement, but more to raise the issuance cost spontaneously by opening the currency production to market competition, so as to prevent anyone from being in a position to enjoy the benefits.

The money begets money consensus protocols like PoS, etc., are not an open access system in essence: the distribution of new currency in the future depends on who owns more currency now, and the current distribution depends on the earlier This system is essentially a closed power distribution system rather than an open system.

At present, only PoW can realize this kind of open system: the subsequent production of new currency has nothing to do with the current status of currency distribution. It can be seen from this that the energy consumed in the mining process is not wasted unreasonably or unnecessarily, on the contrary, it is a necessary guarantee that must exist — a law of thermodynamics that ensures that the entire system is always fair Hard physical constraints on sex and effectiveness.

secondary title

7) Intergenerational Distribution Theory

Saifedean Ammous, author of the book Bitcoin Standard, believes that: Theoretically, the ideal money supply should be locked, so that no one can produce more money. In such a society, the only legal way to make money The way is to create something of value for others and then exchange it with them.

This is wrong, and it is a bluntly fabricated rationale for the existing flaws of the Bitcoin total cap. The PoS currency production mechanism faces the same flaws as the fixed distribution: the new currency is issued proportionally to the holders of the old currency, just playing a digital game, and nothing has changed. With money, its your share of the total that matters, not the units shown in your account.

Imagine a more extreme situation: I issue a fixed upper limit of 1 million NiceCoins, and put them all in the account that I control the private key. I will never issue more, and the supply is locked. I am also very willing to buy all kinds of NiceCoins around the world Products and services, promise to spend at least 100 NiceCoins every day, will everyone in the world happily accept NiceCoin as a perfect currency? If everyone is unwilling to recognize NiceCoin, why? I think everyone knows the answer: not fair. I didnt do anything, but I was able to sit back and enjoy the support of people all over the world. Therefore, the supply of currency must not be locked, but must be moderately sustainable production, so that other people and future generations who later joined the currency distribution can hedge and eliminate this sitting and enjoying by participating in currency production. Life, through a certain part of professional people participating in the production of new currency, while most of the other people are engaged in other industries, through the competition of profit margins to balance and eliminate this exploitative effect.

Failing to do this, these latecomers will simply start over or simply turn the table over if they are stopped by power.

Any monetary system with a fixed upper limit will face the fatal paradox of first distribution. But this sustainable production of money is definitely not a reason to favor fiat currencies and a central bank system. Currency production requires market competition, and cannot be handed over to a certain organization for management, otherwise it will still cause some people to enjoy their gains, and it is much more serious than a fixed upper limit. After all, a fixed upper limit If more currency is spent, one less part will be lost, while the central bank can continue to issue the same proportion of currency indefinitely and first lend money to a certain group of people.

secondary title

8) Expectation Stability Theory

The rapid collapse of the Luna/UST algorithm stablecoin to zero, unfortunately, is not a reliable solution for the currency.

A more important reason why PoW that consumes energy to produce currency, rather than PoS or algorithm stability is more suitable as currency is: PoW has the total historical mining cost as a reference for the current total value of tokens. Anyones confidence and the real value level transferred by any subjective idea, having such a rigid value reference will help the currency not suddenly rise above the sky, nor suddenly return to zero tomorrow , because the market will think that if the current token price is lower than the historical average mining cost, the token price is undervalued, and some people in the market will buy it. Of course, this does not mean that the currency price completely follows the cost. Most of the time, demand determines the cost, but it means that we have a unified, fixed, objective, and rigid value reference in PoW. This objective value reference is conducive to maintaining price stability.

However, for costless issuance methods such as algorithm generation or PoS output, since there is no hard value reference that everyone agrees with and objectively recognizes, its price depends purely on the market game under completely subjective evaluation (also It is market confidence that determines everything), which will bring about a problem: no one knows what price is reasonable, or any price is reasonable, which will bring about more serious price fluctuations, It is not conducive to the realization of its currency function. Algorithmic stability is an endogenously unstable system without reference. Its operating mechanism is similar to a performance in which the left foot is stepping on the right foot in mid-air. There is no certainty whether the actor remains stable in the air or falls suddenly. The value rope it relies on depends entirely on the audiences thinking. Such a confidence system will eventually collapse due to some unexpected price downward spiral in the long run.

The PoS currency production mechanism lacks any anchor of objectively observable value, which will lead to very serious price fluctuation feedback. Some unexpected events lead to a temporary price drop. Confidence in turn leads to lower prices, an ever-continuous jump between confidence and price.

The production cost of PoW will be more objectively expected to achieve the effect of stabilizing the confidence of holders. Moreover, it would be even better if the supply can be dynamically scaled according to market demand under the PoW mechanism.

Written on September 15, 2022, the Ethereum PoS merger day, time will tell

---- Hacash lovers

References:

Nick Szabo: The Origins of Moneyhttps://mp.weixin.qq.com/s?__biz=MzIwODA3NDI5MA==&mid=2652531645&idx=1&sn=b99e4cb243ccccebbd69532d86e3792e

Understanding Hacash in Five Minuteshttps://medium.com/@HacashFans/%E4%BA%94%E5%88%86%E9%92%9F%E4%BA%86%E8%A7%A3-hacash-%E4%B8%80%E4%B8%AA%E4%BB%A5-%E8%B4%A7%E5%B8%81%E6%80%A7-%E4%B8%BA%E6%A0%B8%E5%BF%83%E7%9B%AE%E6%A0%87%E7%9A%84%E5%8A%A0%E5%AF%86%E9%A1%B9%E7%9B%AE-13e232ea146f

Why Cant ETH Sustain Currency Premium in the Long Run? https://mp.weixin.qq.com/s?__biz=MzIwODA3NDI5MA==&mid=2652529084&idx=1&sn=ed80e7714b5c9fbad194b648221512a6

The real difference between PoW and PoS: the judgment fee determines who is more suitable for building currencyhttps://mp.weixin.qq.com/s?__biz=MzA4MzE1MzQ3MA==&mid=2450142006&idx=1&sn=eb2db2deffb99aa44180516721bb8338

Beyond Electricity — PoS Is Not a Saviorhttps://mp.weixin.qq.com/s?__biz=MzIwODA3NDI5MA==&mid=2652532279&idx=1&sn=529354cb507ffc6a2654c972d535832f

Proof of Stake Guide for Bitcoinershttps://news.marsbit.co/20220915201906231889.html