This article comes from: DeFi Cheetah

Compiled by Odaily Planet Daily ( @OdailyChina )

Translated by Azuma ( @azuma_eth )

Berachain has officially launched the Proof of Liquidity (PoL) mechanism today. This article aims to provide the most comprehensive analysis of PoL and its potential impact on the ecosystem (especially BERA price). We will start with the basic mechanism, emission schedule, and token economic model, and gradually carry out the analysis.

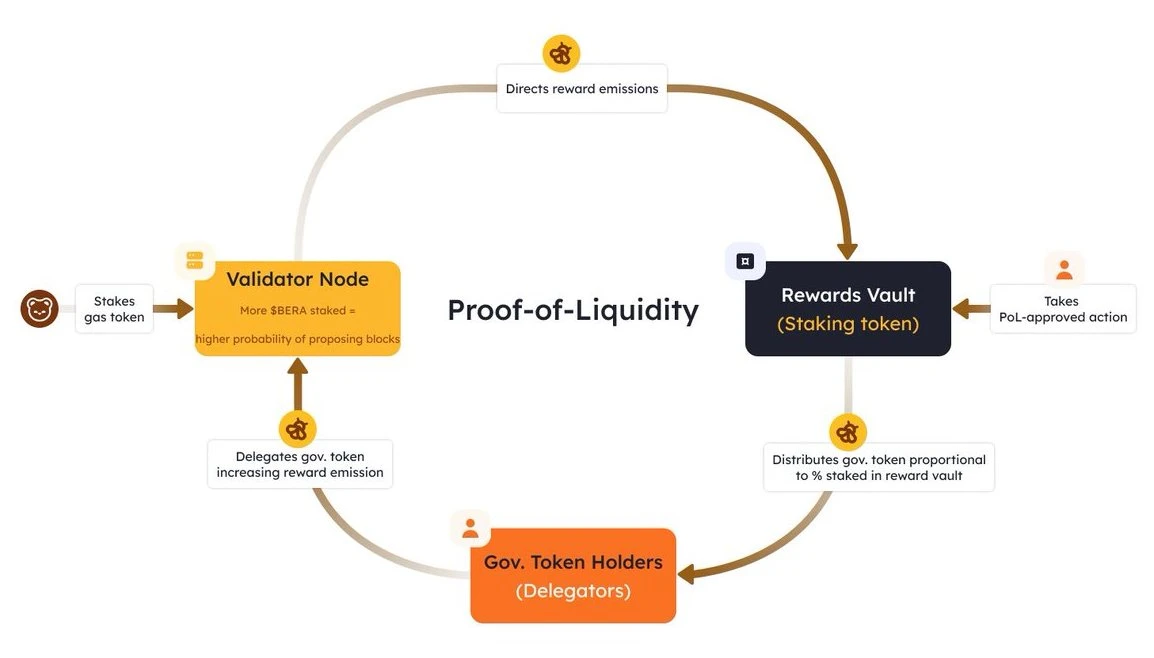

Berachains PoL mechanism is designed to solve the incentive mismatch problem in PoS blockchains. In traditional PoS mechanisms, users need to lock assets to receive staking rewards, which leads to a distortion of the incentive mechanism - because DeFi projects built on these blockchains also require assets and liquidity, resulting in a situation where assets are directly competing with the PoS mechanism. By restructuring the incentive mechanism, PoL successfully shifted the incentive focus from asset locking to DeFi activities, while improving the security and decentralization of the network.

Basic Mechanics

Berachain has two core native assets: BERA and BGT:

BERA is a gas token and a staking token, and is mainly responsible for validator screening (the specific mechanism is described later);

BGT is a governance token (non-transferable, but redeemable for BERA at a 1:1 ratio). Its core function is to regulate the distribution of economic incentives and determine the size of the reward vaults allocated to whitelisted DApps.

BGT can be exchanged (or destroyed) for BERA at a 1:1 ratio, and BERA cannot be reversed to BGT.

Note: Whether a validator can obtain the block production qualification depends entirely on the amount of BERA staked by the validator; the reward a validator can obtain when producing a block is positively correlated to the amount of BGT held by the validator.

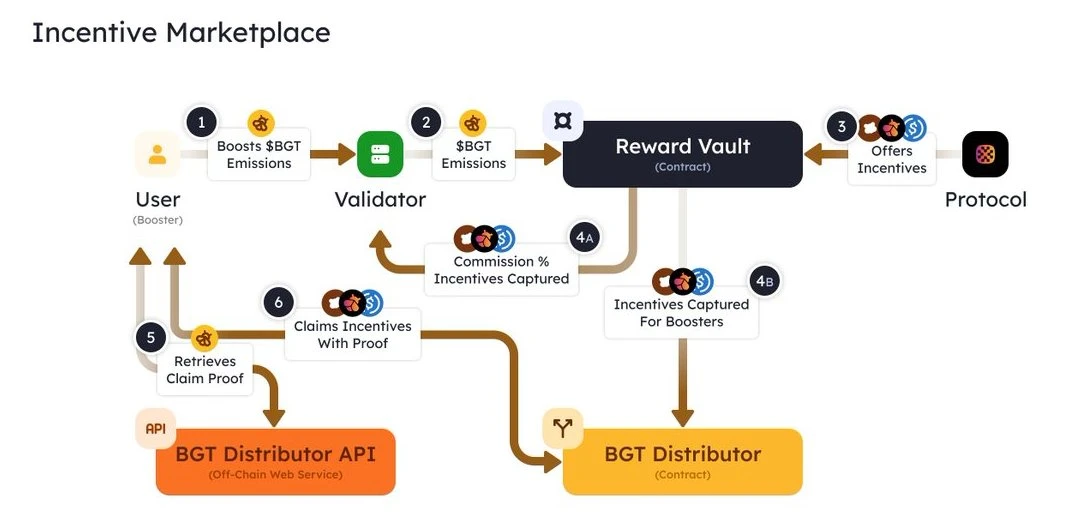

Unlike traditional PoS, where validators can directly receive issuance rewards by performing transaction verification, and delegators can receive a portion of the total reward based on the amount staked, on Berachain, validators can earn BGT (by receiving BGT from the BlockRewardController contract through the Distributor smart contract - the latter is the only entity that can mint BGT), but most of the BGT must be immediately distributed to the reward pools (Reward Vaults) of whitelisted DApps.

In these pools, the relevant protocols can exchange BGT emissions by bribing validators (such as 1 BGT = xxx token). The more attractive the bribe, the more likely the validator will allocate its BGT to the most powerful DApp pool.

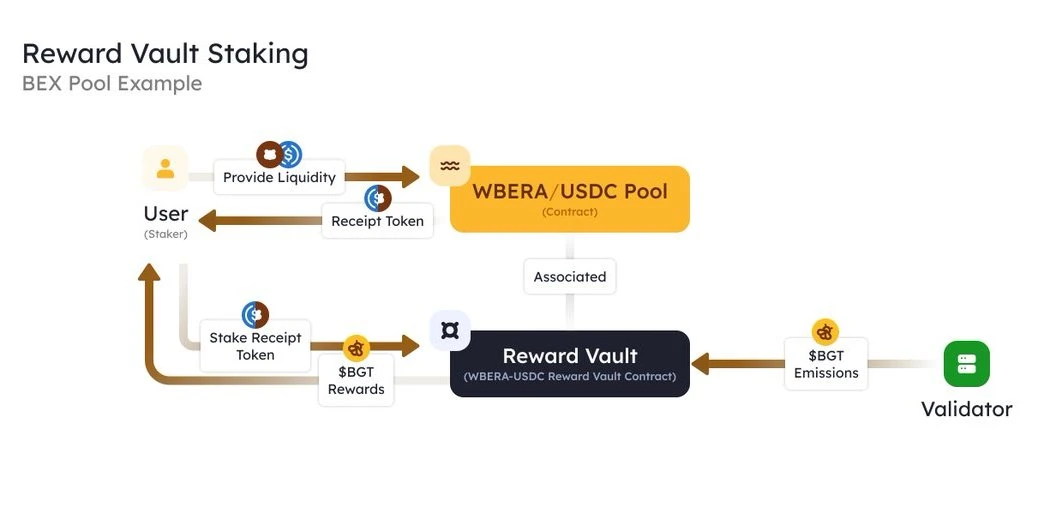

For example, users can make markets in certain liquidity pools of the native DEX to earn LP fees. Afterwards, users can deposit LP tokens into the reward pool of a specific trading pair of the DEX to receive additional BGT release rewards on top of the LP fees. After receiving BGT rewards, users can choose to delegate these BGT to validators, or directly stake BGT. It is worth noting that the amount of BGT released by validators will increase as the scale of BGT delegated to them by users increases.

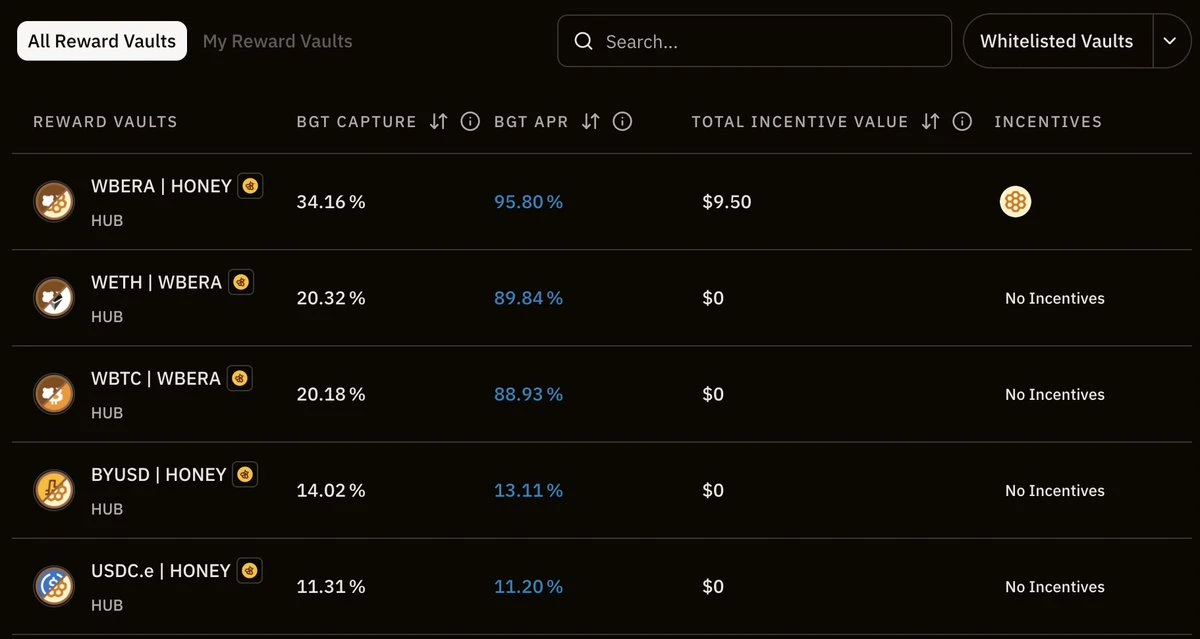

Note: With the official launch of the PoL mechanism, more whitelist prize pools are now open (see the official announcement ).

In terms of BGT allocation, validators can actively or passively decide which pools to allocate their BGT to based on the amount of bribes provided by the DApp. Users who are delegators can choose validators that are more in line with their interests as the object of delegation based on the validators strategy and the bribe income that the validator is expected to earn for the delegator - so those validators who can bring the most value to the delegator may be entrusted with more BGT.

As for BERA staking, the staker will share the BGT and BERA income obtained by the verification node in proportion by increasing the own stake amount of the verification node.

Block production and BGT emissions

Validator selection criteria: Only the top 69 validators by BERA staked are eligible for block production (minimum 250,000 BERA, maximum 10,000,000 BERA) , the block proposal probability is proportional to the amount of BERA staked, but this does not affect the emission allocated to the reward pool.

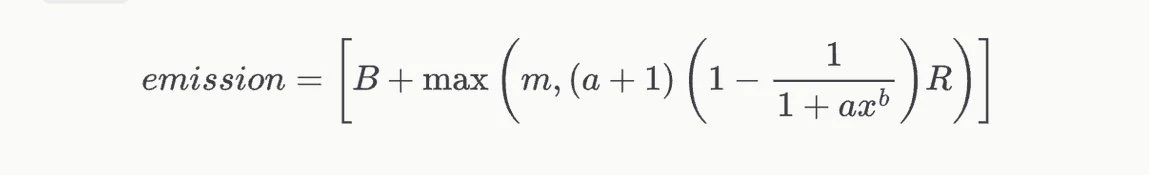

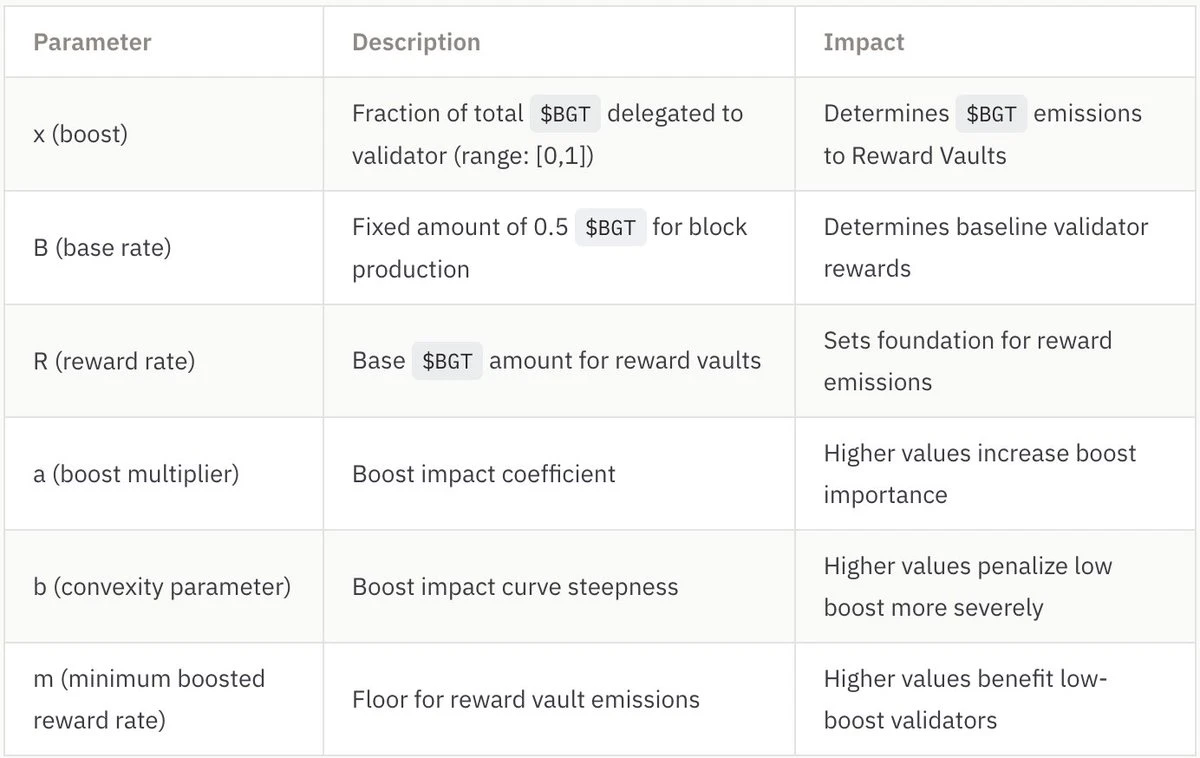

BGT emissions per block: This part is very important and the exact amount depends on how the formula is designed.

BGT emission is divided into two parts: Base Emission and Reward Vault Emission. Base emission is always a fixed amount (currently 0.5 BGT), which is paid directly to the validator who produces the block; Reward Vault emission depends largely on the boost, which is the proportion of BGT delegations obtained by the validator to the total BGT delegations of the network. Both parameters a and b affect the effect of the boost on the final reward pool emission. In other words, the larger the values of a and b, the greater the impact of the boost on the reward pool emission. In other words, the reward pool emission is proportional to the weight configured in the validator reward distribution formula.

In other words, the more BERA staked, the higher the probability that the validator will be selected to produce the next block; the more BGT delegated, the more BGT the validator will mint from the BlockRewardController smart contract, the more BGT that can be allocated to different reward pools, and the more bribe incentives the validator will receive from the protocol.

To summarize, the top 69 validators by BERA stake are eligible for block production. They can direct BGT emissions to specific reward pools in exchange for a certain percentage of bribe incentives, and the remaining bribe incentives will be distributed to the delegators. The BGT in the reward pool will then be distributed to users who provide liquidity to the corresponding pool. Once these users obtain non-transferable BGT, they can choose to delegate it to the validator and act as a delegator to enjoy bribe benefits from other protocols, or irreversibly redeem it for BERA to cash out.

PoL launch scale analysis

During Berapalooza 2, over $500,000 in bribes were pledged in the first 24 hours of RFRV proposal submission alone. If this momentum continues and doubles before PoL goes live, we could see bribes of $1 million per week - a huge amount of incentive funds are pouring into the Berachain ecosystem.

At the same time, Berachain emits 54.52 million BGT per year (about 1.05 million BGT per week). Since 1 BGT can be destroyed and exchanged for 1 BERA, and BERA is currently trading at $8.43 (note: the price at the time of the original authors writing), this means that Berachain can distribute incentives worth $8.8 million per week. Among them, only 16% of the emissions go directly to the verification nodes, and the remaining $7.4 million will be allocated to the reward pool - therefore, the protocol can get $7.4 million in BGT incentives by paying only $1 million in bribes per week, which is a very impressive return on investment.

Bribery mechanism improves capital efficiency

This system is disruptive for the protocol. Instead of spending a lot of money to attract liquidity, it is better to improve incentive efficiency through this bribery model.

For users, this means that PoL will see super high annualized returns in the early stages of its launch. As protocols compete to attract liquidity, they will offer higher BGT rewards, creating excellent mining opportunities. If you want to maximize your returns, now is the time to prepare, make accurate calculations, and lay out the incentive wave brought by Berachain PoL.

Flywheel Effect

Berachain’s positive cycle mechanism is as follows:

The more BGT a user delegates, the more BGT incentives can be used to guide trading pair liquidity. The more liquidity the pool attracts. As slippage decreases due to increased liquidity, the greater the trading volume facilitated by the pool. The handling fee increases accordingly, thereby attracting more BGT emissions to be directed to the corresponding pool.

This mechanism can form a self-reinforcing closed loop:

Increased liquidity → users gain more benefits;

More BGT delegations → more incentives for verification nodes;

Increased incentives for validating nodes → Network security is enhanced and in sync with DeFi growth.

PoL creates a positive-sum economy. Unlike traditional staking, PoL can sustainably expand Berachains economic activities while improving capital efficiency:

Users provide liquidity → earn BGT → delegate to verification nodes ;

Validation nodes guide emission → incentivize the development of DeFi protocols;

Increased liquidity → attracting more users → generating more revenue → the cycle repeats…

Why is this important?

Because increased liquidity means improved trading conditions, reduced slippage, and larger lending scale, and developers tend to prefer building applications on blockchains with stable liquidity growth. Under this flywheel model, as more liquidity enters the ecosystem, it will attract more users, developers, and funds, thereby enhancing the long-term sustainability and security of the network.

Berachain’s Token Economic Magic

No matter how the team packages it, the core design of the token economic model can ultimately be summed up in one point - minimize selling pressure and smooth the startup process.

This can be analyzed from two dimensions:

Sources of inflation: Only part of BGT will be exchanged for BERA (only “partially” because it will receive incentive tokens from other protocols in the Bera ecosystem as subsidies).

Deflation mechanism: staking BERA can obtain block qualification and increase the probability of block generation; delegating BGT to verification nodes can obtain more benefits; the irreversible property of BGT exchange forms a certain deterrent (especially considering that BGT cannot be obtained from the secondary market); higher transaction volume generates more handling fees (thanks to the expected liquidity growth brought by PoL).

In the traditional PoS staking scenario, the selection and gain of validators are determined by the number of staked native tokens and the total amount of all staked tokens. Berachian has a clever design here: by separating functions such as Gas and staking from functions such as governance and economic incentives, the function of guiding economic incentives is assigned to a token with lower liquidity, thereby raising the threshold for obtaining economic incentives (i.e. people cannot buy directly in the secondary market) to prevent holders from selling in large quantities.

This is like Curves veCRV governance model, but Berachain goes a step further - veCRV can be converted from CRV that can be purchased on the secondary market, while BGT can neither be purchased on the secondary market nor converted from BERA. This has a greater deterrent effect on BGT holders. If they convert a large amount of BGT into BERA and sell it, they will face a high threshold when they want to regain ecological project incentives later - they can only obtain it by providing liquidity for certain whitelisted reward pool trading pairs.

In addition, the dual-token PoS model is also worth mentioning: validators must stake BERA, but this only means that they are eligible for block production, so they need to stake more BERA to increase the probability of producing the next block. At the same time, validators must earn more incentive tokens from the protocol for BGT delegators to attract more BGT delegations. This dynamic mechanism can create a strong deflationary force and absorb the huge selling pressure caused by the initial higher BGT inflation . This is because validators need to stake more BERA to obtain a higher probability of block production, and users need to hold and delegate BGT in exchange for high returns.

One fatal risk I can think of at the moment is that if the intrinsic value of BERA exceeds the yield of BGT, BGT holders may line up to redeem and sell BERA. The landing of this risk depends on a game dynamic, where BGT holders need to judge whether the profit of holding BGT in exchange for yield is higher than the profit of directly redeeming and selling BERA. This depends on how prosperous the Bera DeFi ecosystem can develop - the more competitive the incentive market, the higher the yield of BGT delegators.