Original Author: Mark, Sangkuan

The current world is in a turbulent period, and uncertainty is flooding the entire market. Therefore, the rapid changes in the macro environment highlight the necessity of macro analysis at this time. Only by grasping the trend can we better avoid risks and look for future opportunities. In this article, we will start from a macro perspective, starting with the game between the market and the Federal Reserve, and analyze the high inflation situation that the market is currently facing and the crisis and recession that are likely to occur in the future.

Bitcoin Risk Status: High

Summary of Macro Analysis

The current world is in a period of turmoil, uncertainties are flooding the entire market, and risk factors are emerging everywhere. These include:

Monetary policy risks of the Federal Reserve and the European Central Bank.

The climate cycle in Europe and the United States has turned, and the economic recovery in China is weak.

Geopolitics continued to be turbulent, and the Russia-Ukraine war continued to affect the macro market.

European and Japanese debt crisis concerns.

The new crown epidemic continues to change the old economic cognition and form a new normal.

Therefore, the rapid changes in the macro environment have highlighted the necessity of macro analysis of the market at this time. Only by grasping the trend can we better avoid risks and look for future opportunities. In this article, we will start from a macro perspective, starting with the game between the market and the Federal Reserve, and analyze the high inflation situation that the market is currently facing and the crisis and recession that are likely to occur in the future.

introduction

introduction

text

text

image description

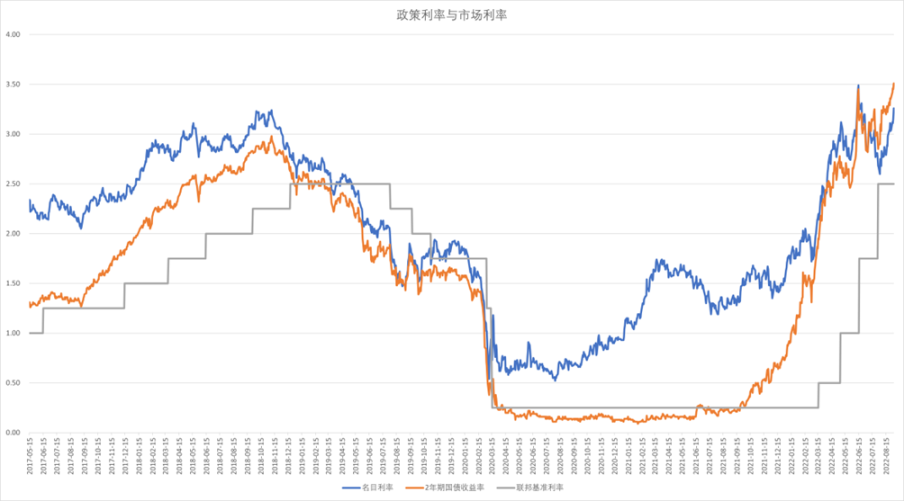

Figure 1-1 Policy rate and market rate [1]

image description

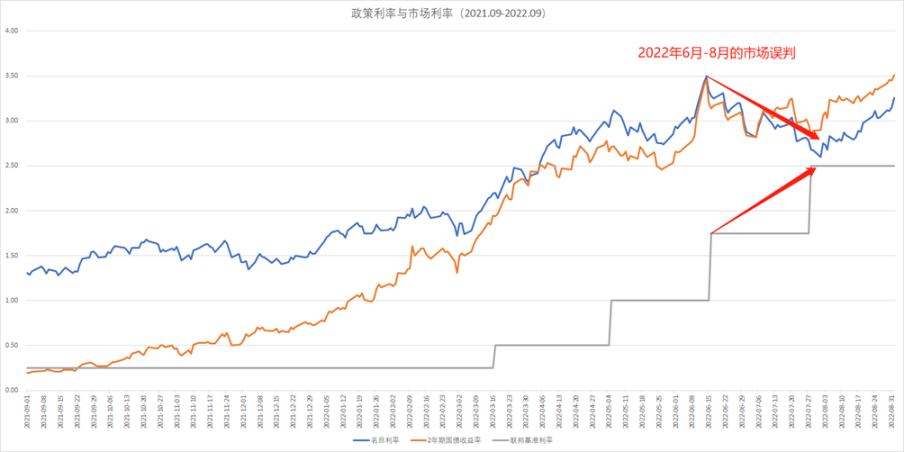

Figure 1-2 The manifestation of market policy misjudgment

Specifically, the reason why the market makes policy and strategic misjudgments is that the Fed will adopt different policy orientations in different environments. According to the U.S. Federal Reserve Act, there are two main objectives of U.S. monetary policy:Control inflation and promote full employment.These two targets correspond to two important indicators that the Fed cares about, namely inflation rate and unemployment rate. Inflation rate and unemployment rate reflect the changes in the supply and demand of the commodity market and labor force respectively, indicating the level of the business cycle.

Changes in the inflation rate and unemployment rate are generally divided into the following four situations:

High inflation, high unemployment:Corresponds to the middle and end of stagflation. The traditional economic view holds that the main reason for this situation is insufficient aggregate supply or excess aggregate demand. In this case, managing unemployment is more important and more feasible than inflation, because monetary policy will lose efficiency at this stage, or cause more serious unemployment problems. Therefore, the policy should focus on fiscal policy, stimulate the total supply of society, bridge the gap between supply and demand, and increase employment at the same time.

High inflation, low unemployment:Corresponds to the early period of stagflation, ordinary inflation or the high point of the business cycle. Generally speaking, at this stage, the direction of monetary policy is unclear, because not every high point in the business cycle will cause inflation, and not every inflation will evolve into stagflation.This stage is often the main stage of the game between the market and the Fed.

Low inflation, low unemployment:Corresponding to the initial stage of deflation, the normal range of the business cycle. This stage corresponds to the economic normality faced by stable economies, especially those of developed countries. No special economic policy intervention is generally required at this stage.

Low Inflation, High Unemployment:Corresponds to the middle and end of deflation or the low point of the business cycle. The main problem reflected at this stage is actually the insufficient aggregate demand of the society, so both fiscal policy and monetary policy should exert force at this time to reverse the expectation of deflation.

From the above four situations, we can find that the policies implemented by the Fed and the interaction with the market are determined in most cases. Only in an environment of high inflation and low unemployment can the game take place between the two sides, which is the current market situation.

In an environment of high inflation and low unemployment, pre-stagflation is much more likely than normal inflation and the high point of the business cycle. Business cycle highs and ordinary inflation are usually just normal phenomena in economic fluctuations and will not have a lasting impact on the economy. Therefore, the Fed generally does not adopt aggressive tightening policies. Even if the tightening is carried out, the Fed will always take into account the growth of the economy in the process, and adjust or stop the tightening policy in due course. So in this case, the best strategy for the market is to avoid risks at the beginning of tightening and buy bottoms when inflation peaks. Because according to the Phillips curve, the peak of inflation will lead to an increase in the unemployment rate, and the Fed may loosen tightening after seeing the increase in the unemployment rate.

But stagnant inflation will continue to induce self-fulfilling inflation expectations, forming stubborn inflation, which will have a devastating blow to social production. Therefore, the Fed tends toadopt aggressive austerity policies, in order to reverse inflation expectations. in this case,The Fed is unlikely to ease tightening until inflation expectations are completely reversed and returned to the inflation target. In this process, the market will not have a predictable Fed policy turning point. In this case, the best strategy for the market is to wait for inflation to fall back into the inflation range, or for the Fed to send a clear signal of a policy shift.

The difference between the market and the Fed at the moment is that,The market generally believes that the United States is now facing the high point of the economic cycle or ordinary inflation.image description

image description

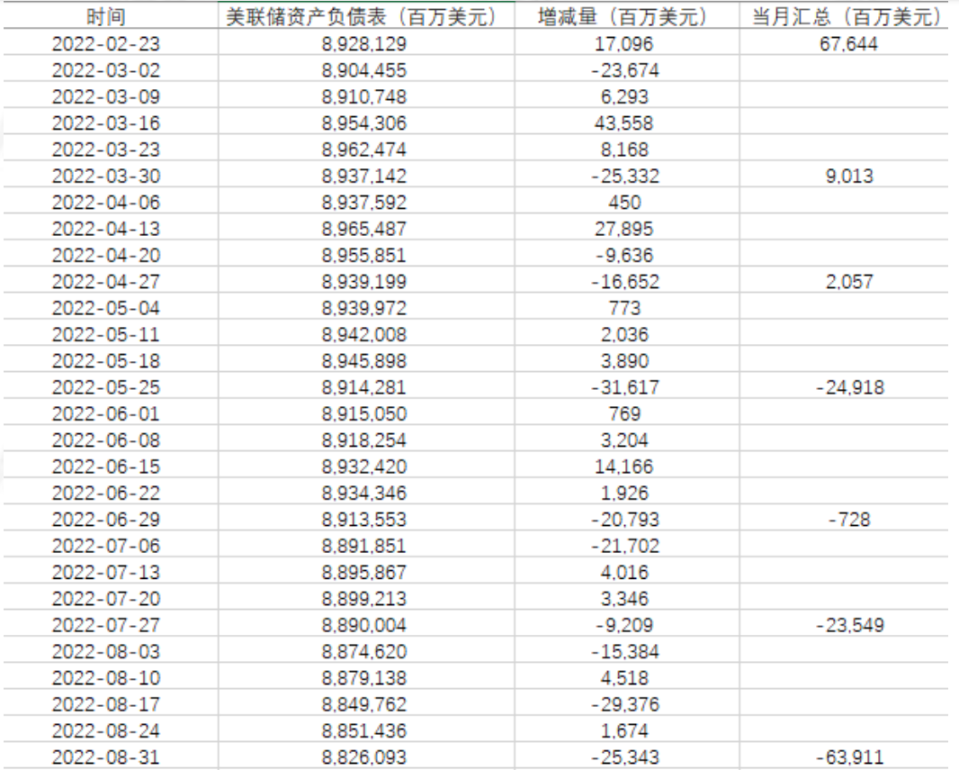

Figure 1-4 Federal Reserve Balance Sheet [2]

Facing the optimism in the market, the Federal Reserve continued to emphasize its policy goals, raised interest rates by three yards at the interest rate decision-making meeting at the end of July, and accelerated the shrinking of its balance sheet in August. Finally, after entering September, the market began to wake up to its strategic misjudgment and began to re-price risks, which also opened the prelude to the second round of market correction. During the second round of correction, the discussion on the nature of this inflation began to re-enter the markets field of vision. Whether and when inflation will fall this time, analyzing these two issues will help us make a reasonable judgment on the market outlook in the future.

introduction

introduction

text

text

Inflation, in essence, is a market supply and demand phenomenon expressed in the form of currency under a specific time and space background.

So there are three key points:

Has a specific time and space background. The occurrence of inflation is often limited to a period of time in a country. Universal and permanent inflation does not exist, because the crisis caused by inflation will destroy production, suppress demand, and finally bring the economy into a new normal.

Expressed in monetary form. Inflation is a price indicator measured in terms of money rather than the actual exchange value of the market. Therefore, the value of the currency itself is also an important consideration for inflation.

It is a market supply and demand phenomenon. This is easier to understand, because the price itself is the result of the game of supply and demand.

Therefore, we will proceed from these three perspectives to dismantle the causes of this inflation.

First of all, this inflation will start in the first quarter of 2021. This is the time when the American regime is being transferred, so there are several special time and space backgrounds in terms of specific policies:

After a year of strict epidemic control, states in the United States have gradually relaxed their epidemic control measures.

After the Democratic Party came to power, Biden signed the $1.9 trillion economic rescue plan and the new crown bailout bill in March.

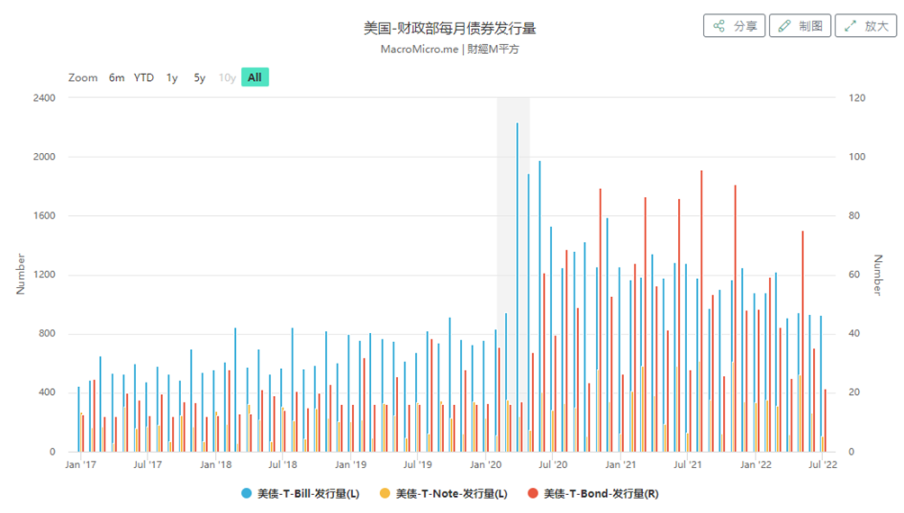

image description

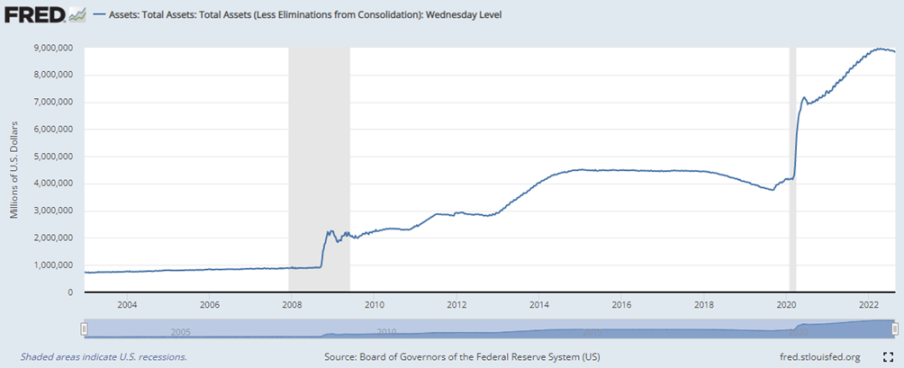

Figure 2-1 Federal Reserve Balance Sheet [2]

image description

Figure 2-2 US Treasury bond issuance [3]

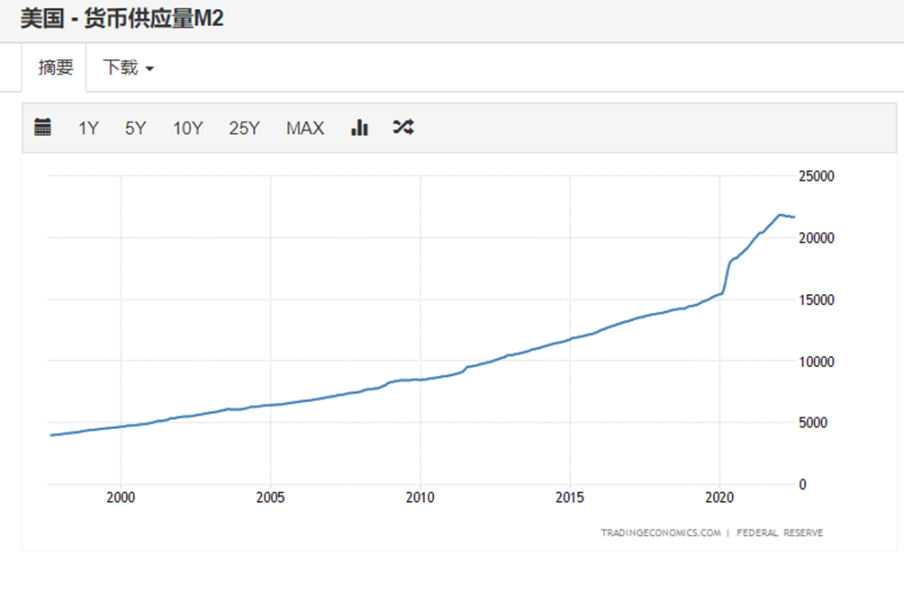

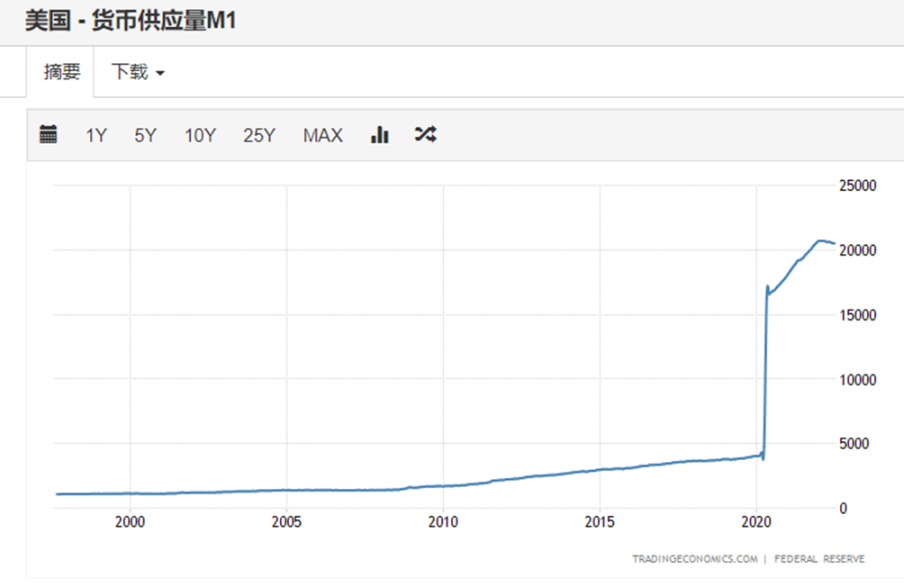

image description

image description

image description

Figure 2-5 US money supply M1[6]

During the epidemic, the broad money supply M2 in the United States increased by about 44%, and the narrow money supply M1 increased by 311%. The scissors difference between M2 and M1 quickly converged to an unprecedented level, and at that time, a large dose of booster was injected into the US economy in deep crisis, which provided assistance for economic recovery. But at the same time, a large amount of over-issuance of currency has seriously damaged the actual purchasing power of the currency. In particular, the inclusive helicopter money has made the financial market, which could have been a currency reservoir, unable to bear such a large amount of over-issuance of currency, causing inflation. The fire started to burn gradually.

The most basic logic of supply and demand in the market began to slowly change, which completely released the energy of inflation.

We divide the supply and demand logic into the production side and the demand side:

On the production side, the two trends of globalization ebb and supply chain crisis have begun to accelerate:

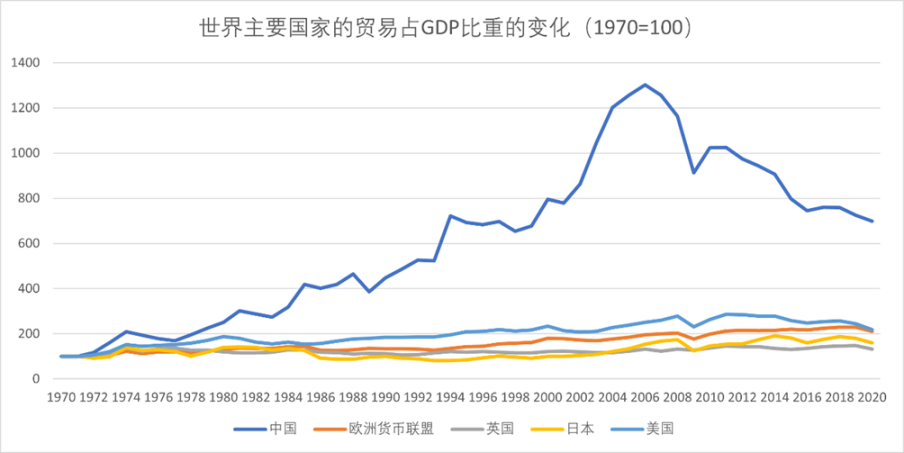

1) The ebb tide of globalization is accelerating:

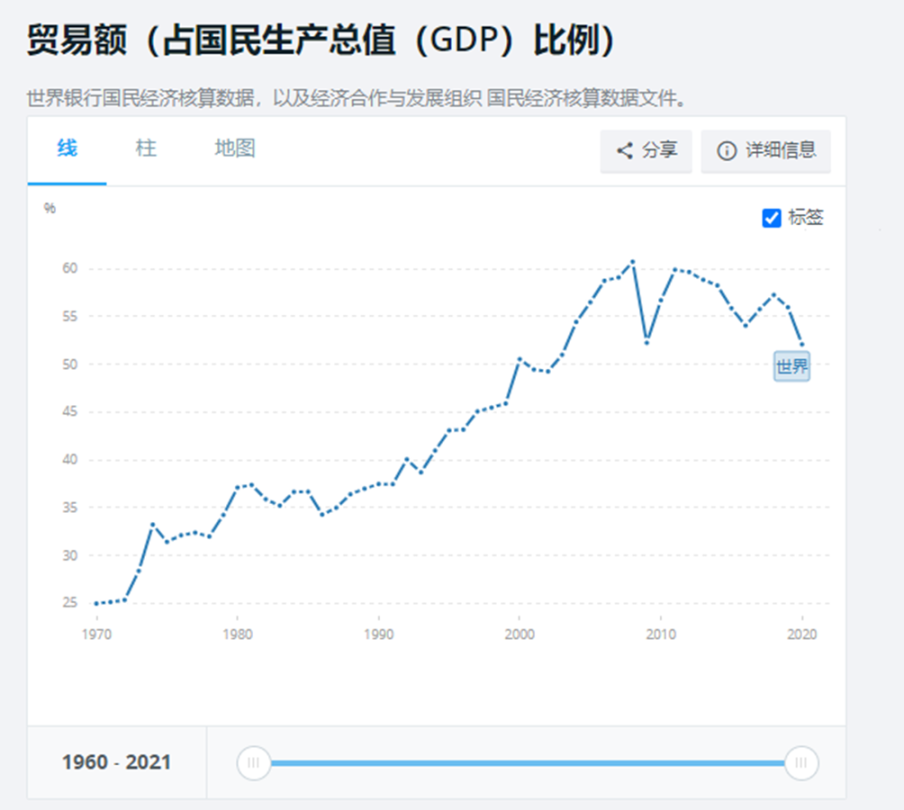

image description

image description

Figure 2-7 Trade dependence of major economies in the world (1970=100)

image description

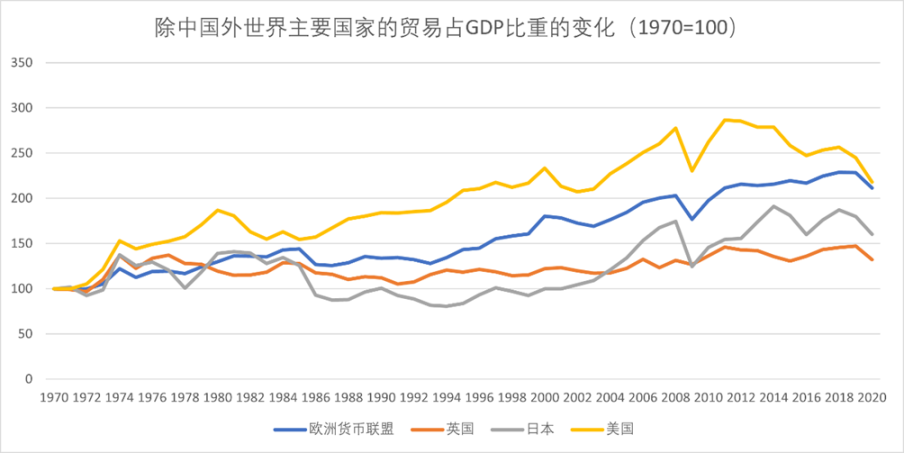

Figure 2-8 Trade dependence of major economies in the world except China (1970=100)

It can be seen that the trade dependence of the United States has also declined significantly since 2011, but the trade dependence of the EU and Japan is still in a spiral upward stage. The decline in U.S. trade dependence confirms the trend toward ebbing globalization.

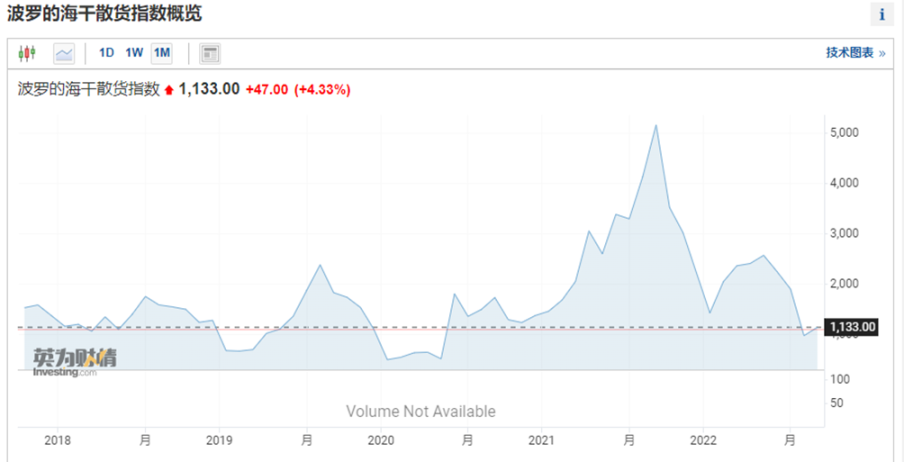

2) Supply chain crisis:

Strictly speaking, the supply chain crisis is the inevitable result of the ebb of globalization, but the epidemic and the Russia-Ukraine war have exacerbated this situation.

image description

Figure 2-9 Baltic Dry Bulk Index [8]

On the one hand, the supply chain crisis has caused inventory accumulation in the middle and upper reaches, and insufficient supply in the downstream, which has exacerbated the situation of short supply; at the same time, some production capacity that relies on supply chain management has lost its economy, so it has been eliminated in the market competition. The loss caused the total social output to decline.

There are also two clear trends on the demand side:

image description

Figure 2-10 Energy inflation [9]

image description

image description

image description

Figure 2-12 Food inflation [12]

image description

Figure 2-13 Retail sales (historical) [13]

image description

Figure 2-13 Retail sales (5 years) [14]

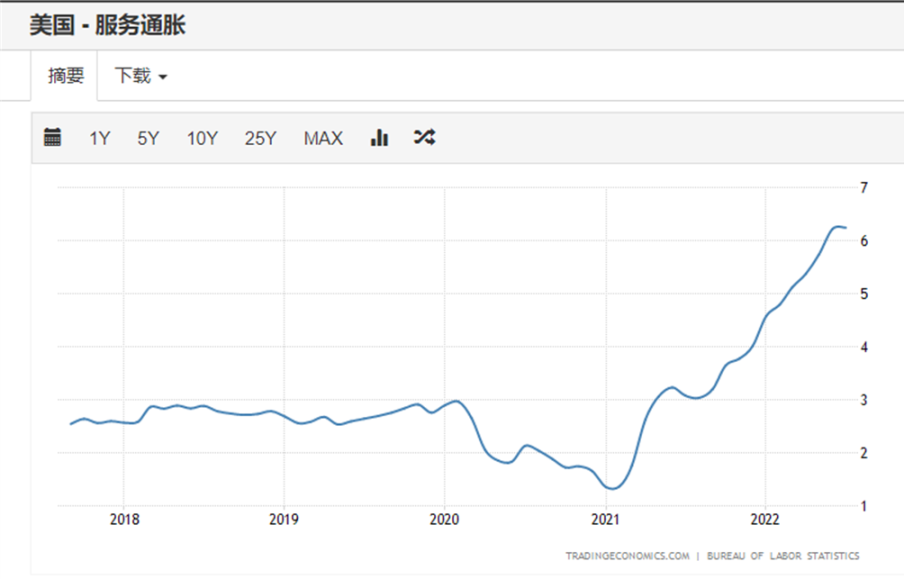

Judging from the data, this comprehensive inflation even directly skipped the stage of structural inflation, and took shape quickly in a short period of time. Starting from the first quarter of 2021, with the Democratic Party coming to power, the liberalization of epidemic control measures and the massive monetary easing, and the recovery of the economy, the above factors have led to successive rises in energy prices, service prices, rental costs, and food prices, fermenting More than a year later, under the catalysis of the Russia-Ukraine war in the first quarter of 2022, the overall inflation is completely out of control.

2. This inflation is stubborn and self-fulfilling

Stubbornness is reflected in two characteristics of this inflation:

It affects a wide range of areas: it involves trade in goods, trade in services, and the capital market. The range is large: it is far higher than the acceptable range of 2% for the inflation target.

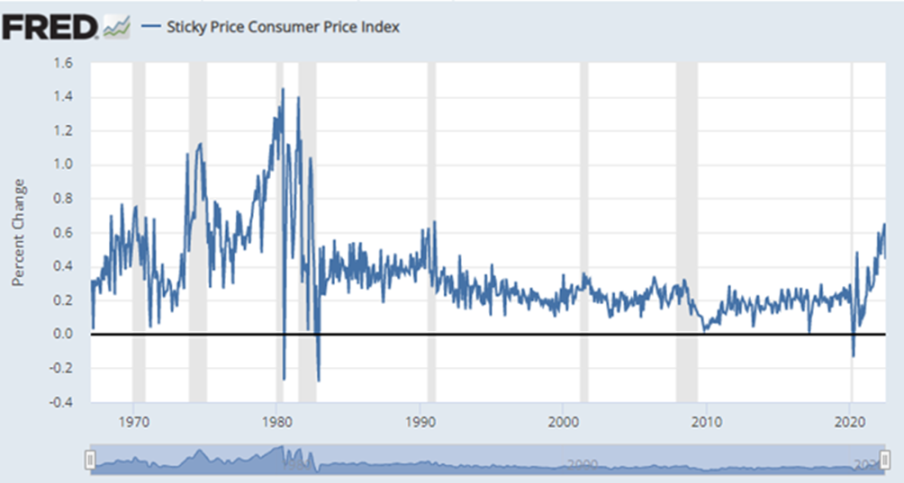

image description

Figure 2-14 Sticky Inflation Data [15]

Sticky Prices The Consumer Price Index (CPI) is calculated from the subset of goods and services included in the CPI that change prices relatively infrequently. Because the prices of these goods and services change relatively infrequently, they are considered to be a better indicator of expectations for future inflation than more frequently changing prices. One possible explanation for sticky prices could be the costs firms incur when changing prices. A rise in the sticky price index means that inflation itself will become more stubborn.

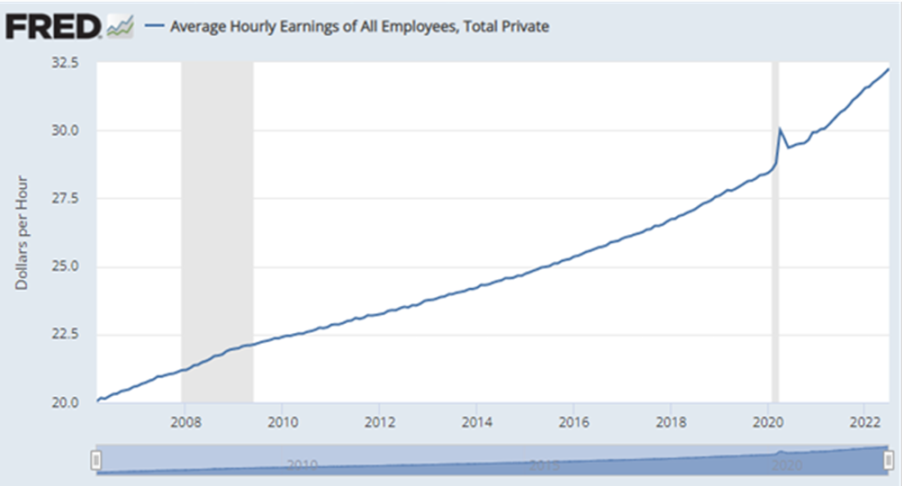

image description

Figure 2-14 Average hourly wages in the US private sector [16]

It is difficult to see the speed of wage increase from the picture.

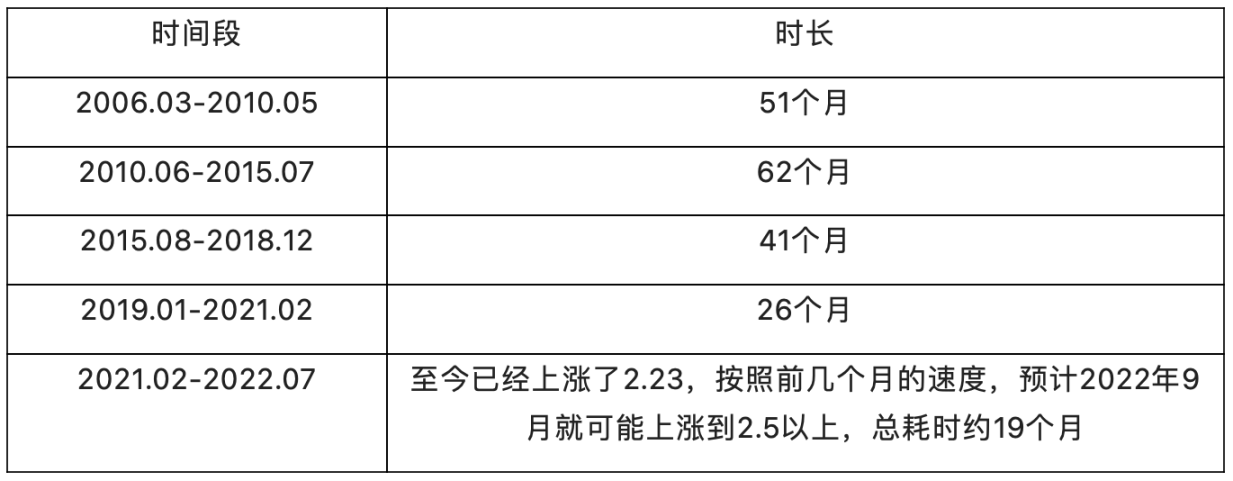

image description

Table 2-1 The Time It Takes for Every $2.50 Increase in the Average Hourly Wage in the U.S.

There are two main reasons why wages have risen since the outbreak:

Supply side: The COVID-19 pandemic has disrupted the U.S. job market, causing a mismatch between the supply and demand of human resources. At the same time, due to the impact of the disease itself, a large number of laborers have lost their ability to work or are unable to participate in labor, expanding the output gap.

Demand side: On the one hand, the rapid liberalization of epidemic prevention and control has led to a rapid recovery in demand for the service industry. On the other hand, rising inflation has forced business owners to offer higher wages to workers to attract workers.

Under the double blow, the contradiction between supply and demand in the labor market has rapidly intensified, and it has manifested itself in the form of rapid wage increases.

According to Keynesian theory, wages become rigid for a short period of time, so that once production starts to fall, there will be unemployment. But at the same time, the rigidity of wages also means that the wage level pushed up by inflation will not fall in a short period of time. According to the definition of the demand curve, an increase in wages will cause the entire labor demand curve to shift to the right. When the supply curve remains unchanged, prices will naturally rise, thus forming a continuous inflation-wage increase-inflation situation, and also It is the self-fulfilling nature of this inflation.

The stubbornness and self-fulfillment of inflation on the labor demand side also means that all demand controls without external force may not be able to effectively bridge the gap between supply and demand. The market may face a fundamental demand-side clearing to balance the total supply and demand in society.

Observing todays inflation from these three angles, we can draw the following conclusions:

The current inflation occurred around the time when the climate in Europe and the United States caused by the new crown epidemic quickly bottomed out, and then quickly pulled back. The main places of occurrence are Europe, which is still at the peak of economic prosperity, and the United States, which has already seen the peak of economic prosperity.

The excess currency issuance in Europe and the United States during the epidemic is one of the most important causes of this inflation.

According to general experience, this inflation cannot be restricted on the production side, that is, the output gap cannot be narrowed by expanding production capacity. At the same time, at the currency level, there is no precedent in history that can eliminate the impact of such a large-scale release of water. Therefore, in the future, we can only solve the inflation problem from the demand side.

From the perspective of the above specific time and space, capital and supply and demand, we can clearly find that this inflation has some very unusual characteristics compared with the inflation in the past 40 years. As for the warning signs of the coming recession risk and crisis, we will describe it in the third part.

introduction

introduction

text

text

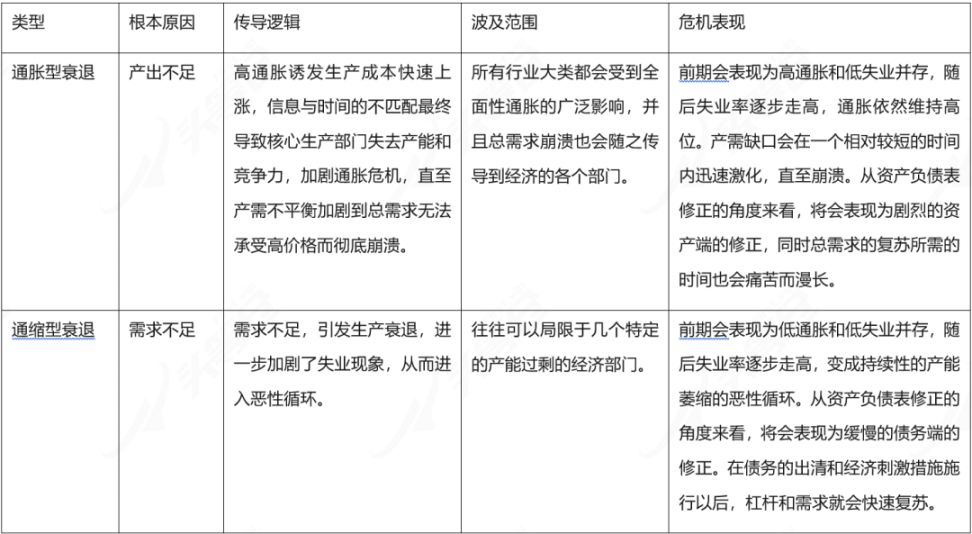

Given that the speed and strength of this inflation are far beyond the norm, we believe that this inflation will most likely turn into an inflationary recession.

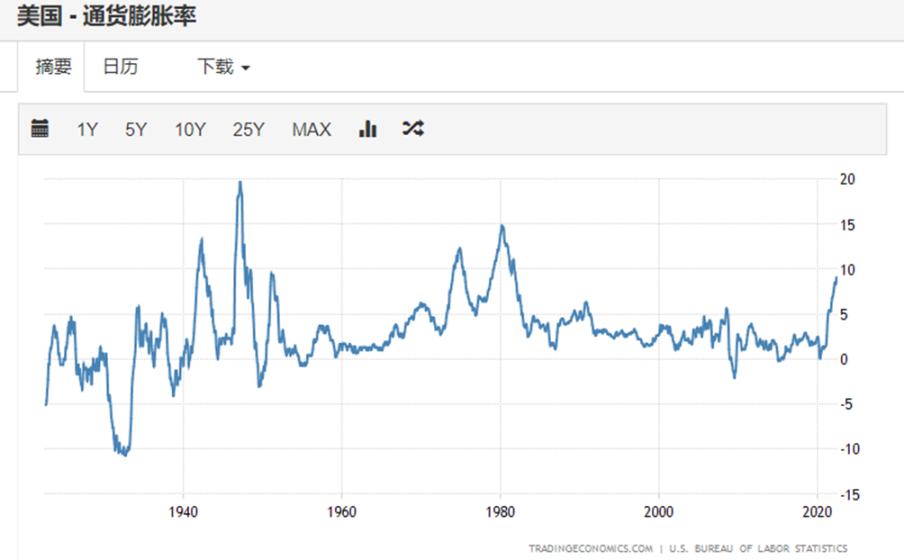

image description

Figure 3-1 US inflation rate [17]

From the figure, we can see that the development of comprehensive inflation this time has broken through the range of the past 40 years, and has already met the necessary conditions for developing into an inflationary recession. In addition to the data level, in the larger context, there are similarities between the current inflationary recession and the inflationary recession that occurred 40 years ago. For example, the second oil crisis corresponds to the Russia-Ukraine war. The Feds Paul Volckers aggressive rate hike corresponds to Powells aggressive rate hike.

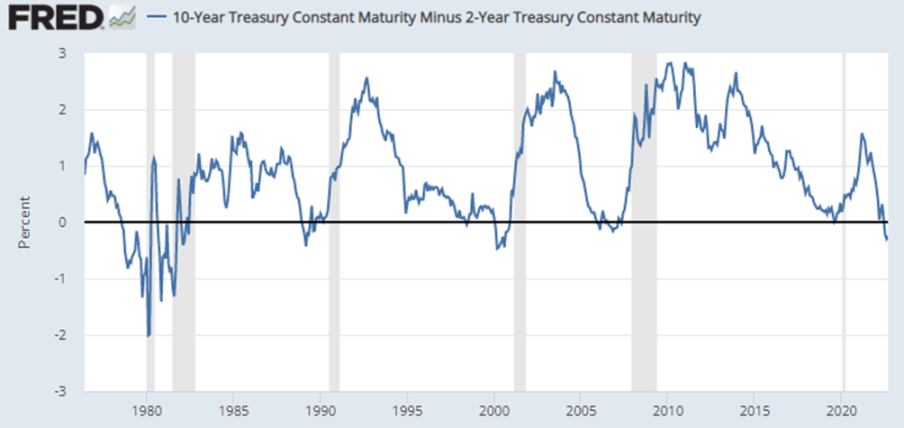

image description

Figure 3-2 The interest rate spread between long-term and short-term US treasury bonds [18]

The long-term short-term interest rate spread of the United States is the warning light of the crisis. Since the establishment of this indicator, every time the long-term short-term interest rate spread has inverted will correspond to a large-scale recession, and there are no exceptions so far.

There are many angles to understand why the long-term and short-term interest rate differentials in the United States cause recession. Here we only analyze from three perspectives: policy guidance, interest rate pricing, and the underlying logic of the financial market.

The inversion of long-term and short-term interest rate differentials means the failure of policy guidance and market regulation. Generally speaking, we regard the 2-year treasury bond rate as the policy rate expected by the market, that is, the markets expectation of the Federal Reserves adjustment range of the future federal funds rate. The interest rate of the 10-year treasury bond means the nominal interest rate faced by the market. When the difference between these two interest rates decreases, it means that the Fed has entered a tightening cycle. Generally speaking, the Federal Reserve will gradually raise the federal funds rate to the upper limit of the market-acceptable interest rate. Poor upside down. That is to say, under normal circumstances, the market can no longer accept the Feds interest rate guidance, so there will be a large-scale market clearing, that is, a recession.

The interest rate is the cost of funds. A very important point in interest rate pricing is the risk premium. The higher the risk, the higher the relative required interest rate. This part of the increased interest rate due to the increased risk is called the risk premium. Generally speaking, the risk will increase as the repayment time increases, so the long-term interest rate must be higher than the short-term interest rate under normal circumstances. The narrowing of the long-term and short-term interest rate spread means that the short-term risk is rapidly increasing, and the inversion means that the risk is imminent. The inverted interval can directly reflect the time period when the crisis may occur. In the current time-term structure of U.S. treasury bonds, the 1-year and 2-year treasury bonds have formed an inversion, which means that the market believes that a crisis is very likely to occur within one year.

The basic logic of the operation of the underlying financial market, especially the banking industry and the insurance industry, is to use the interest rate difference between long-term and short-term bonds to make profits while ensuring liquidity, and the reduction of long-term and short-term interest rate spreads will narrow the room for profit , once inverted, it means that the arbitrage space will not only disappear, but banks and insurance companies will have to subsidize short-term capital costs. At the same time, due to the particularity of national debt, the rapid rise of national debt interest rates means that the price of national debt has fallen rapidly, which is reflected in the balance sheet. Banks and insurance companies will have to recognize a large amount of asset losses, so they must sell part of their assets to make up for it. Capital, thus forming a passive shrinking balance sheet. Therefore, the inversion of long-term and short-term interest rate spreads will shake the cornerstone of the financial market from multiple levels, resulting in the bursting of the bubble on the asset side and the liquidation on the debt side.

When we go back and substitute the difference between inflationary recession and deflationary recession into the long-term and short-term spread chart, we can clearly see that the two inflationary recessions in 1980 and 1982 occurred at the turning point of the long-term and short-term spread At the moment, that is, the moment when the Federal Reserve stated that it might adjust monetary policy, a large-scale economic recession occurred in the negative range. The subsequent four deflationary recessions all occurred after the long-term and short-term interest rate differentials turned for a period of time, that is, after the Fed had just entered the easing cycle from the tightening cycle for a period of time, and after the long-term and short-term interest rate differentials turned positive. The reason is that the crisis induced by a deflationary recession comes from the slow clearing of the debt side, which is naturally formed, while the crisis induced by an inflationary recession often comes from the collapse of the asset side, which is deliberately guided by the Federal Reserve. Therefore, deflationary recession-induced crises tend to occur some time after the end of the tightening cycle, while inflationary recessions tend to occur at the peak of the tightening cycle.

From this observation of inflation this time, we can draw the following conclusions:

There is a high probability that this inflation will induce an inflationary recession, and the elements of crisis and recession are already in place.

The timing of the crisis is judged by the spread between long-term and short-term treasury bonds. Within half a year, the recession will last for one to two years.

There are two observation indicators that can be used to judge the specific timing of the crisis: the unemployment rate has risen and left the economic zone; the Fed has released a policy turning signal, and long-term and short-term interest rates have stopped inversion.

written in the last words

The crisis we are facing now has broad similarities to the crisis of the 1980s. Stagnant inflation, oil crisis, US-Japan trade war/China-US trade war. Behind the multiple coincidences is the stagnation of the development of human productivity. After more than 30 years of development, the information technology revolution has to find the direction of productivity growth again. The bad news is that an era is over, winter is coming, and the cold is about to hit each of us; the good news is that the representative of the next era of technological revolution may be blockchain technology. The economic downturn and the collapse of asset prices do not actually affect the development of technology too much. Most of the greatest Internet companies that we are familiar with today have developed steadily after the bubble burst at the beginning of the century. For value investors, now is the best time to observe team development and get involved in early projects. For broad price speculators, the future should also be optimistic: the recovery of the cryptocurrency world is likely to be much ahead of the recovery of the world economy. Since last year, BTC has retraced 70%+, and the leverage level of the cryptocurrency market has completed initial clearing after the LUNA crash. Accelerated Fed tightening and the resulting asset price crisis are a necessary condition for the next larger bull market for the foreseeable future. There is no doubt that we are standing at the watershed of the times, and opportunities lie ahead for those who are most prepared.

Remark:

[1] The orange line is the U.S. 2-year Treasury yield (the policy rate estimated by the market); the blue line is the U.S. 10-year Treasury yield (the market’s nominal interest rate); the gray line is the Fed’s federal funds rate Time dimension: May 15, 2017 to September 1, 2022

[2] https://fred.stlouisfed.org/series/WALCL

[3] https://sc.macromicro.me/collections/51/us-treasury-bond/4458/us-treasury-issuance-gross

[4] https://zh.tradingeconomics.com/united-states/government-debt-to-gdp

[5] https://zh.tradingeconomics.com/united-states/money-supply-m2

[6] https://zh.tradingeconomics.com/united-states/money-supply-m1

[7] https://data.worldbank.org.cn/indicator/NE.TRD.GNFS.ZS?end=2021&start=1960

[8] https://cn.investing.com/indices/baltic-dry

[9] https://zh.tradingeconomics.com/united-states/energy-inflation

[10] https://zh.tradingeconomics.com/united-states/services-inflation

[11] https://zh.tradingeconomics.com/united-states/rent-inflation

[12] https://zh.tradingeconomics.com/united-states/food-inflationl

[13] https://zh.tradingeconomics.com/united-states/retail-sales-annual

[14] https://zh.tradingeconomics.com/united-states/retail-sales-annual

[15] https://fred.stlouisfed.org/series/STICKCPIM157SFRBATL

[16] https://fred.stlouisfed.org/series/CES0500000003

[17] https://zh.tradingeconomics.com/united-states/inflation-cpi

[18] https://fred.stlouisfed.org/series/T10Y2Y