first level title

introduction

introduction

In the current international political and economic environment,Risk and policy narratives will remain the main axis of the market.first level title

1. Inflation remains stubborn and consumer demand diverges

After the Fed's consecutive aggressive interest rate hikes, although inflation in the United States has been controlled to a certain extent, but the price indicators in August and September are still unsatisfactory; the main reason is that the development of inflation in the United States has clearly differentiated. Specifically, it isimage description

Figure 1 US Inflation Rate [1]

image description

image description

Figure 3 US Food Inflation [3]

image description

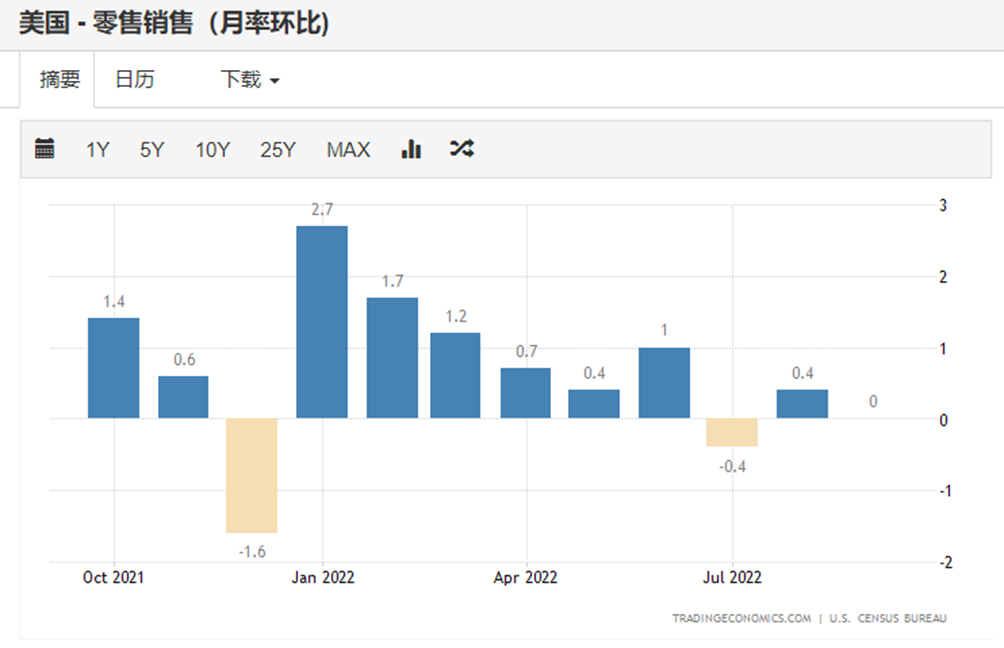

Figure 4 US retail sales [4]

image description

image description

image description

Figure 7 US Core Inflation Rate [7]

image description

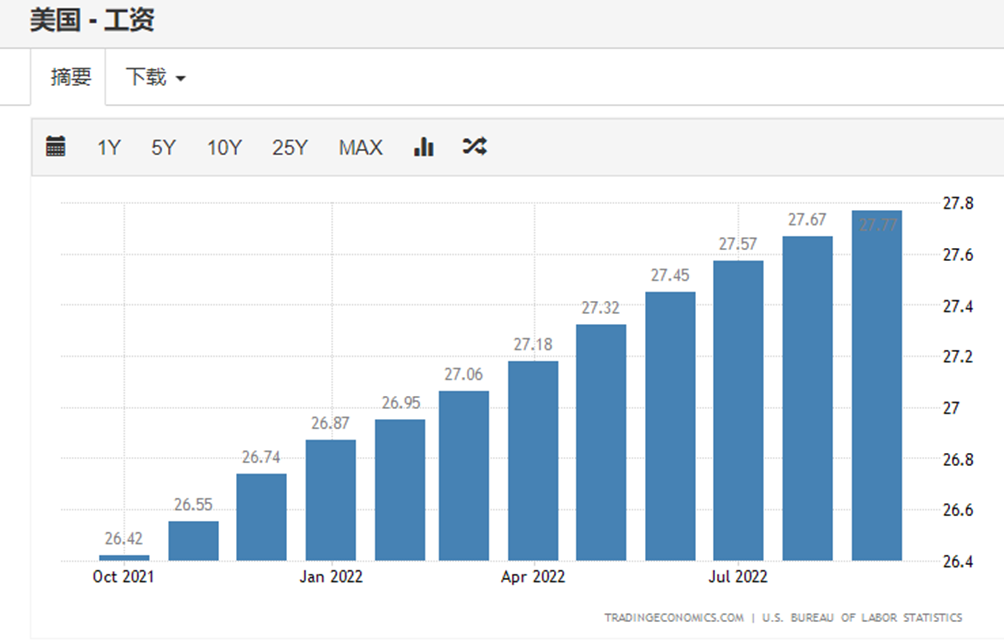

Figure 8 Average hourly wages in the United States [8]

The "wage-price" spiral has not been broken, and the average hourly wage in the United States still maintains a high-speed rise, which continues to push up prices.

Overall, the U.S. inflation rate has been falling for three consecutive months, which means that inflation has been brought under certain control; however, the last two inflation rates were higher than market expectations, mainly due to the fact that food and energy prices were removed. U.S. core inflation continues to rise, driven by accelerated increases in service inflation and rent inflation, which could also force the Fed to raise interest rates more aggressively.

In addition, judging from the detailed data, energy inflation has dropped significantly since July, and food inflation has also dropped to a certain extent in September (on October 30, Russia announced the suspension of the Black Sea grain export agreement, and the national grain price A small jump, the follow-up impact needs to continue to be observed). At the same time, the structure of rent inflation, service inflation, and wage increases has not reversed, and even service inflation and rent inflation have accelerated in August and September. certainlyThis is likely to be a delayed response, since service markets and labor markets tend to respond to demand more slowly than goods markets.We believe that in the short term, overall inflation in the United States may turn to structural inflation dominated by service inflation; but in the medium and long term, with the rapid decline in consumer demand for goods in the United States, it is only a matter of time before consumer demand for services declines, so Inflation is generally controllable. In addition, due to the influence of the base period effect, the rate of subsequent inflation rate decline may be faster than expected. However, it is worth noting that,The decline in inflation does not mean that inflation will quickly fall back to an acceptable range for the economy. The long-term negative impact of inflation on the economy and the market will continue, and the rapid decline in inflation also indicates an accelerated decline in the economy.first level title

2. The rise of the US dollar is hindered, but the structure is still strong

Against the background of the Federal Reserve's continued aggressive interest rate hikes, the dollar has been strengthening all the way. The U.S. dollar index, a benchmark measure of the greenback, rose to 114 at the end of September from around 95 before the rate hike in March. The three major weights of the U.S. dollar index, the euro against the U.S. dollar and the pound against the U.S. dollar, once fell below parity, and the yen depreciated against the U.S. dollar by more than 20%. Based on the pricing logic of the foreign exchange market, we believe that although the US dollarIn the short term, affected by the intervention of central banks in the foreign exchange market, there has been a short-term pullback, but in the medium and long term, the overall upward trend of the US dollar has not yet shown obvious signs of turning.

The pricing logic of the foreign exchange market, in simple terms, has three points:The principle of purchasing power parity, interest rate parity and pricing based on the balance of payments.

The principle of purchasing power parity is: the stronger the purchasing power of a country's currency, the stronger the exchange rate will be;Or to put it another way: when a country's inflation rate is lower relative to other countries, its exchange rate will be stronger. For example, the same McDonald's hamburger is sold for 3 euros in Europe and 3 dollars in the United States. However, due to the increase in raw material costs, the McDonald's hamburger in Europe has risen to 4 euros, but it is still 3 dollars in the United States. This phenomenon is reflected in the exchange rate. In the market, the purchasing power of the U.S. dollar has become stronger relative to the euro, that is, the U.S. dollar has appreciated relative to the euro.

The principle of interest rate parity is that when there is an interest rate difference between two countries, capital will be transferred from the country with low interest rate to the country with high interest rate; The country's exchange rate will appreciate.The easiest to understand example of the interest rate parity theory is the carry trade in the yen. Japan is currently the country with the lowest interest rate in the world. Foreign exchange arbitrageurs can lend Japanese yen at an interest rate of 0.25%, and then exchange it into US dollars in the international foreign exchange market, invest in US treasury bonds, and obtain a return of 3.25%. There will be a 3% risk-free arbitrage opportunity. In this process, a large amount of yen was lent out in the foreign exchange market and exchanged for dollars, which was used to invest in dollar bonds, which led to a sharp depreciation of the yen.

The last is the practical exchange rate analysis framework based on the balance of payments. What this actually says is: put aside complicated analytical theories and logic, and only focus on the most intuitive indicator, that is, the balance of payments of each country, because it honestly reflects the potential of each country to maintain the value of the currency. ability to stabilize.In fact, it is equivalent to that each country will have a currency liquidity pool that regularly publishes data to the outside world. If the foreign exchange in the liquidity pool keeps flowing out, the liquidity pool will be tilted, and more local currency is needed to exchange a certain amount. foreign currency. Therefore, the balance of payments of each country can often reflect the trend of exchange rate changes most intuitively.

To sum up, the core logic of looking at the direction of the exchange rate in the medium and long term is actually only three simple ones:The lower the inflation, the stronger the currency; the higher the interest rate, the stronger the currency; the more abundant the foreign exchange reserves, the stronger the currency.

However, in actual practice, due to the strong position of the world currency, the US dollar, there are often some developments beyond common sense in exchange rate changes. This requires us to observe the inflow and outflow of capital to judge the specific situation.

For example, during the expansion cycle of the US dollar, the renminbi tends to depreciate internally and rise externally, that is, domestic prices rise and purchasing power depreciates, but externally it shows a trend of exchange rate appreciation. This actually reflects that when U.S. capital flows into China in the form of U.S. dollars, on the one hand, it pushes up prices, and on the other hand, because China’s pace of interest rate cuts is slower than that of the U.S., there is isolation between domestic and international commodity and financial markets. Under such circumstances, there is a mismatch between the commodity price denominated in RMB and the time price. In the domestic market, commodity prices in renminbi dominate. In the international market, the time price of renminbi, that is, the interest rate, dominates, resulting in a situation of internal depreciation and external rise. In the same way, when the U.S. dollar quickly flows out of China, there will also be a mismatch phenomenon; the renminbi will often rise internally and depreciate externally, manifested as domestic deflation and a sharp depreciation of the renminbi.

Therefore, based on the above three pricing logics, let's look back at the three major weighted currencies of the US dollar index, the euro, the yen and the pound.

First of all, in the environment where the Federal Reserve continues to raise interest rates, any country that wants to maintain a relatively stable currency value without serious currency depreciation generally has only two methods:Build walls high and accumulate food widely.Building high walls refers to raising interest rates in conjunction with the Fed's rate hikes, reducing interest rate differentials can reduce risk-free arbitrage behavior, thereby reducing capital outflows. Guangji grain has two meanings, one meaning is to continue to accumulate foreign exchange surplus in international trade to cope with currency depreciation through the price advantage brought about by the depreciation of the local currency; the other meaning is to use the existing foreign exchange reserves in hand to Intervening in the foreign exchange market, for example, Japan has repeatedly intervened in the yen foreign exchange market to prevent the rapid depreciation of the yen. In addition, there are some unconventional methods. For example, during the Hong Kong financial crisis in 1997, the Monetary Authority quickly raised the cost of Hong Kong dollar borrowing and financing, cracked down on foreign exchange short positions, or adopted some administrative measures to restrict the free flow of capital. But at present, Europe, the United Kingdom and Japan are all lacking in these points. Europe and the UK can currently build high walls and follow the pace of the Fed to raise interest rates, but both are affected by the current economic situation, and the sustainability of the interest rate hike policy is worrying. The European Union and the United Kingdom themselves do not have enough foreign exchange reserves to support relatively long-term exchange rate movements. Due to the influence of long-term MMT practice, Japan has lost the ability to build high walls. At present, it can only survive the crisis by relying on its long-term accumulated foreign exchange reserves.

Specifically by region,The main points of observation for the future of the euro are the development of the situation in Russia and Ukraine and the economic prospects of the European Union.From the current point of view, it is difficult to say that there will be more radical developments in the Russia-Ukraine war. The Beixi pipeline was bombed, and it may be a good thing for the situation in Russia and Ukraine to make all the bad news. But from a longer-term perspective, the trend of "de-industrialization" of the European economy is difficult to reverse. The contradiction between Germany and France has intensified, the European Union has split, and the decline of the euro is irreversible. Moreover, the weak European economy cannot withstand the long-term high interest rate environment. From this perspective, Europe may be the first to surrender among the global economies, and the price of the euro may also be in jeopardy again.

In the short term,The main observation for sterling is when the turbulent political situation in the UK will return to relative stability and how the market will restore confidence.But regardless of whether the market can restore confidence, the risks accumulated in the current British financial market, especially the national debt market, are huge. If one is not careful, pension bankruptcy may become a reality. In the long run, the economic development of the United Kingdom is no less than that of Europe. Even after Brexit and anti-China, it has lost a lot of potential market share. The United States has not done what it promised before Brexit Generally sign new trade deals with the UK. Therefore, in the long run, we cannot expect the pound to maintain a strong and stable currency price.

The main point to watch for the yen is the persistence of Japan's zero interest rate policy, as long as the zero interest rate policy is maintained and the yen carry trade continues to exist, the Bank of Japan will sooner or later face the situation of choosing between Japanese government bonds and the yen. The action of the Bank of Japan to save the yen is tantamount to slow suicide. Simply put, the Bank of Japan sells U.S. treasury bonds in exchange for dollars, then uses dollars to buy yen, and then buys Japanese government bonds after obtaining yen. This kind of behavior is destined to be unsustainable. It can be said that every penny earned by foreign exchange traders from the risk-free arbitrage of the yen is spent from the foreign exchange reserves of the Bank of Japan, and as long as the Bank of Japan maintains zero interest rates And YCC (long-term yield curve control) policy, this trend is irreversible. According to Modern Monetary Theory, once the Bank of Japan chooses not to be, or is incapable of becoming, the ultimate purchaser of Japanese government bonds, the huge amount of government bonds accumulated by the Japanese government may face a moment of complete liquidation. After all, the market intervention adopted by the Bank of Japan is palliative, not the root cause. It can only sanction some radical yen shorts, but cannot fundamentally change the long-term depreciation trend of the yen.

first level title

3. The risk of U.S. debt is rising, and we should be wary of unexpected factors

Since the United States entered the tightening cycle, with the "second European debt crisis" imminent, the "false alarm" of the British pension crisis, the short-term circuit breaker of the Japanese government bond market, and the current U.S. Treasury Secretary and former Federal Reserve Chairman Yellen's criticism of the U.S. The two warning speeches in the national debt market, the risks of the national debt market began to be gradually exposed to the market. At present, this gray rhinoceros is still taking shape, but its threat to the market cannot be underestimated.

As we all know, treasury bonds are the underlying assets of the entire financial market, and treasury bond interest rates are often considered by the market to be risk-free interest rates under different maturities. Because of this, once there are major risks or fluctuations in the national bond market, the impact on the market will be no less than a financial tsunami. Specifically, the national bond market will affect the entire capital market through the following paths.

1. The underlying financial leverage has collapsed and systemic risks have intensified.To put it simply, the rise in the yield of treasury bonds represents a fall in the price of treasury bonds, while the Fed's aggressive rate hikes have caused a sharp rise in treasury bonds and a collapse in the price of treasury bonds. For the banking and insurance industries, treasury bonds are one of the most important targets in their balance sheets and investment portfolios. The capital loss caused by the short-term sharp drop in the price of treasury bonds requires them to replenish sufficient margins in a short period of time or Capital is used to maintain the payment or guarantee the return rate commitment of wealth management products, which will lead to a liquidity crisis or be forced to sell other financial assets to ensure the health of the balance sheet. For the market, this means that financial leverage will fall from the bottom There is looseness and therefore there is panic. The British pension crisis is actually the same narrative. The sharp drop in British national debt has led to the Liability-Driven Investment (LDI) strategy adopted by the British pension plan to replenish a huge amount of margin in the short term to keep the leverage from being liquidated. This led to a liquidity crisis, which forced the Bank of England to announce short-term unlimited bond purchases to maintain the stability of the national bond market, and to buy enough time for the pension plan to sell some assets to replenish margins.

2. The crowding-out effect of the treasury bond market on other capital markets has intensified.The continued rise in the ten-year U.S. Treasury bond rate, which is the anchor of the risk-free rate, will place higher demands on the expected yields of other assets. For investors, investing in an asset with lower expected returns and greater risks is not as good as buying U.S. treasury bonds. Therefore, in this middle treasury bond market, there will be great competitive pressure and crowding out effects on other capital markets. Among them, as investors' risk appetite declines, the most severely affected may be technology stocks and growth stocks that are riskier and more sensitive to long-term interest rates.

At present, the core reason why the national debt markets of various countries have such a big crisis lies in the MMT mentioned in the previous article, Modern Monetary Theory.

A fiscal-driven currency designed based on modern monetary theory binds the Treasury and the central bank through the treasury bond market. The Ministry of Finance issues treasury bonds, and the central bank purchases treasury bonds, ensuring the controllability of money supply. But it also brings an unsolvable problem, that is,The gradual centralization and inefficiency of the national bond market, leading to loss of flexibility in fiscal policy and monetary policy. Specifically, the excessive manipulation of national debt by the central bank will cause the national debt market to lose its opponents, which in turn will cause fiscal and monetary policies to lose the important market tool of national debt. Theoretically, in the process of loosening economic policy, the central bank buys a large amount of government bonds from the market through the QE policy. As the price of government bonds rises and interest rates fall, major financial institutions sell Chinese bonds to the central bank at high prices in exchange for liquidity, and further invest in liquidity In the process of economic policy tightening, the central bank sold a large number of medium and long-term treasury bonds to the market through the QT policy (shrinking the balance sheet) or chose not to renew short-term treasury bonds due to maturity. The price of treasury bonds fell and interest rates rose. Major financial institutions Institutions have bought treasury bonds at low prices and held treasury bonds to obtain income. Using administrative means and market means, let the entire market follow the steps of the central bank to dance, so as to regulate the economy more efficiently.

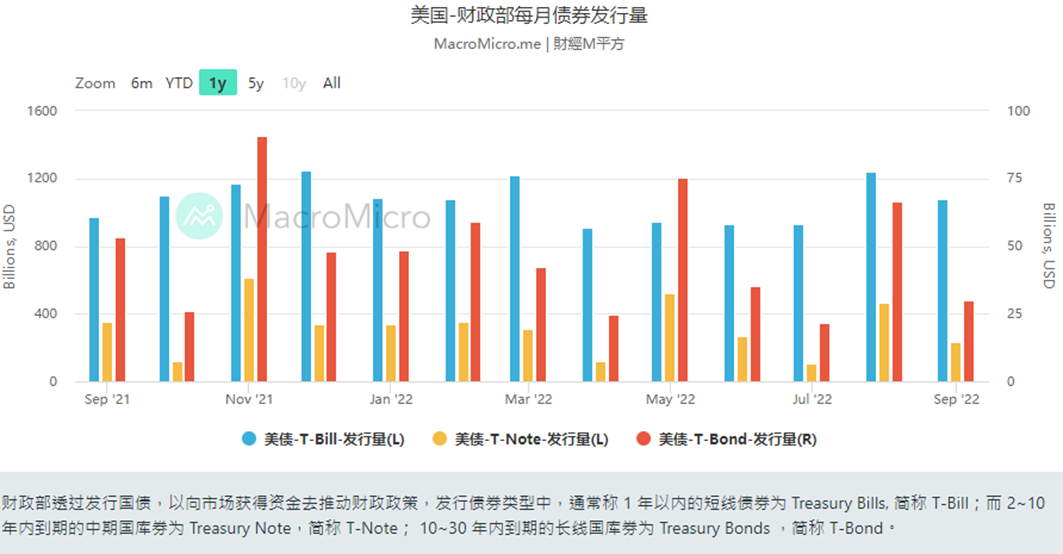

However, this theory will face big problems in the actual operation process, because first of all, in the incremental market of national debt,The amount of national debt required for central bank operations is so large that it completely distorts the supply and demand market for national debt.Let's do a simple supply and demand analysis of the national bond market (because short-term U.S. bonds are mainly used for sequels, so we only focus on the supply and demand of medium and long-term U.S. bonds): 957.2 billion U.S. dollars in medium and long-term treasury bonds, but during the same period, the Federal Reserve reduced its holdings of 82.4 billion[9] medium and long-term treasury bonds,This is equivalent to an 8.6% increase in the net release of medium and long-term U.S. treasury bonds in the market.At the same time, let's look at the demand level of U.S. debt. The primary market for U.S. debt has been rumored many times since the Fed began to tighten its policy.U.S. bond auctions go unnoticedThe news of the winning bid has been rising all the way; at the same time, in the secondary market, the previous macro report "The US Dollar and the World Economic System" mentionedThe Commodity-Dollar-Treasury Triangular Trade Is Back in TroubleNow, China and Japan, the two major holders of U.S. debt, not only no longer buy U.S. debt in large quantities, but sell U.S. debt for their own reasons. In the US domestic market, not many financial institutions are willing to act as counterparties to the central bank to undertake an asset that is still facing continuous selling pressure.As a result, the supply and demand relationship of U.S. treasury bonds was further unbalanced, prices collapsed, and liquidity crisis occurred.Secondly, in the stock market of treasury bonds, as the cycle of economic fluctuations is getting shorter and wider, it is often difficult for the Fed to clear all the treasury bonds purchased during the easing cycle during the tightening cycle. China's balance sheet is becoming more and more bloated, and the excess currency is becoming more and more difficult to recover through monetary means, which will further aggravate inflation and affect the implementation efficiency of the entire monetary policy.image description

image description

Figure 10 Major holders of US debt

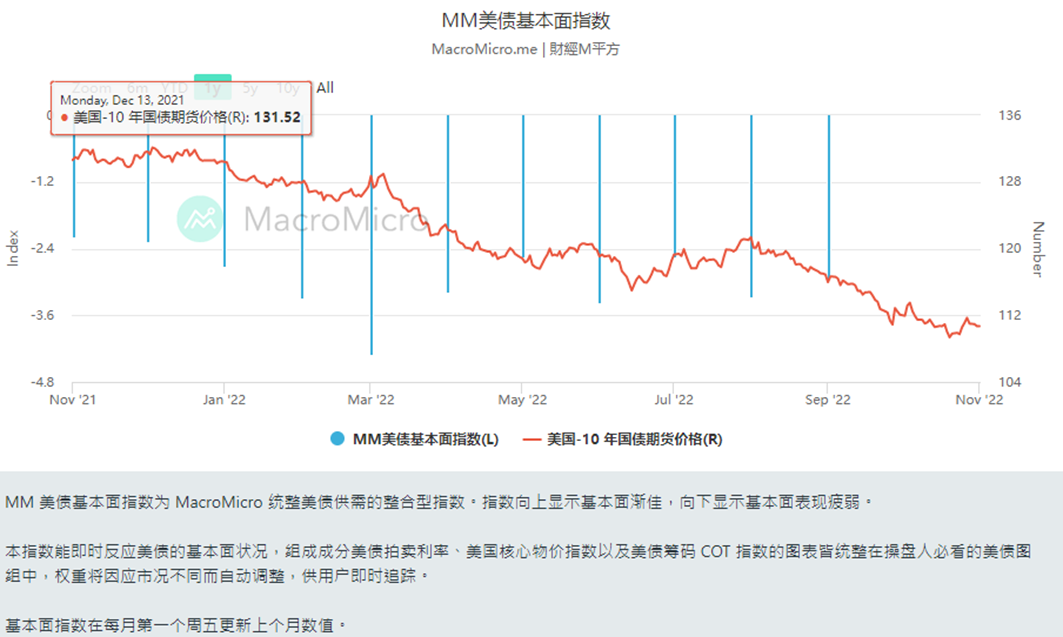

The imbalance between supply and demand of U.S. debt directly leads to the collapse of the price of U.S. debt. Taking the ten-year U.S. Treasury bond as an example, the current coupon rate is 2.75%. The total amount of principal and interest paid back is 131 U.S. dollars, but the price of U.S. ten-year treasury bonds has fallen from about 130 to 110 this year alone. That is to say, you bought a $100 bond at a premium of $130 at the beginning of this year, and the coupon rate 2.75% 10-year U.S. treasury bonds, holding until maturity, you may only earn less than 1 dollar, but once you want to sell the U.S. treasury bonds in your hand within this year, you have to bear the risk of more than 10% in a short period of time loss.image description

Figure 11 Prices of U.S. Bonds

first level title

4. The end point of interest rate hike is near, but the starting point of interest rate cut is still far away

Based on the content of the above three chapters, we can make a rough judgment on the Fed's willingness and ability to tighten in the future.

First of all, the Fed currently maintains a strong willingness to tighten.Because on the one hand inflation is still stubborn, and the U.S. economy itself is still relatively resilient, especially because the labor market remains buoyant and the unemployment rate has not risen significantly. On the other hand, the short-term rise of the U.S. dollar is not conducive to the United States forcing international capital to return to the United States, and it is also not conducive to the United States using its exchange rate advantage to acquire assets in other countries at low prices in the future.Therefore, for the current Fed, continuing to raise interest rates or even aggressively raising interest rates will still be a priority for the Fed.

Secondly, from the perspective of tightening ability, because the Fed’s rate hike process is too aggressive this time, the risks in the U.S. treasury bond market are constantly exposed, resulting inThe Fed may not have the ability to maintain the current aggressive rate hikes in the medium to long term.

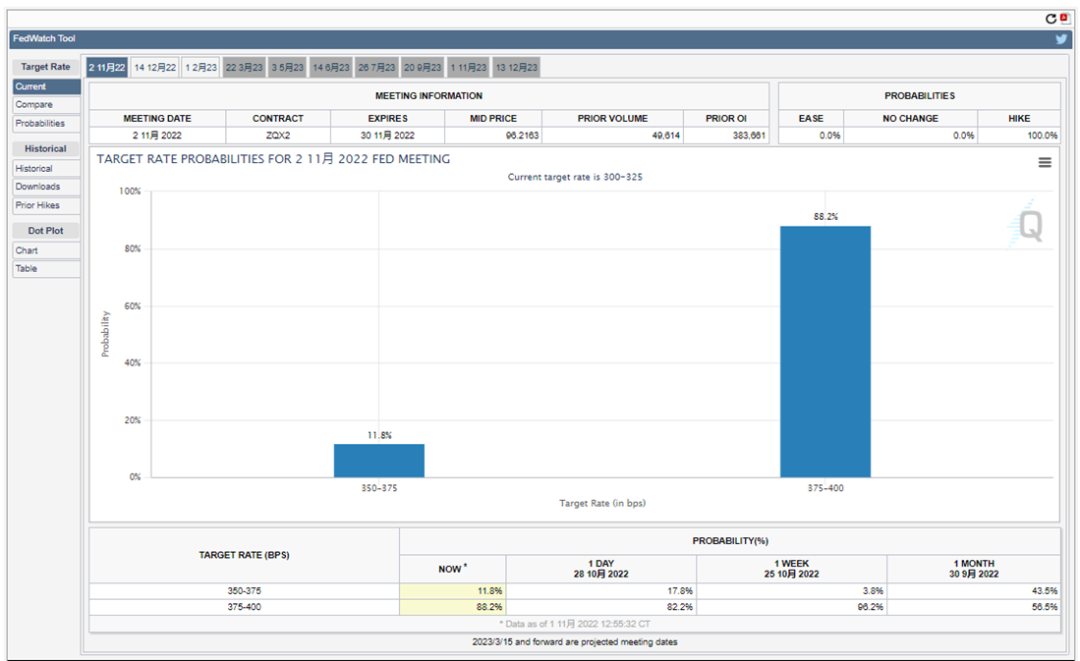

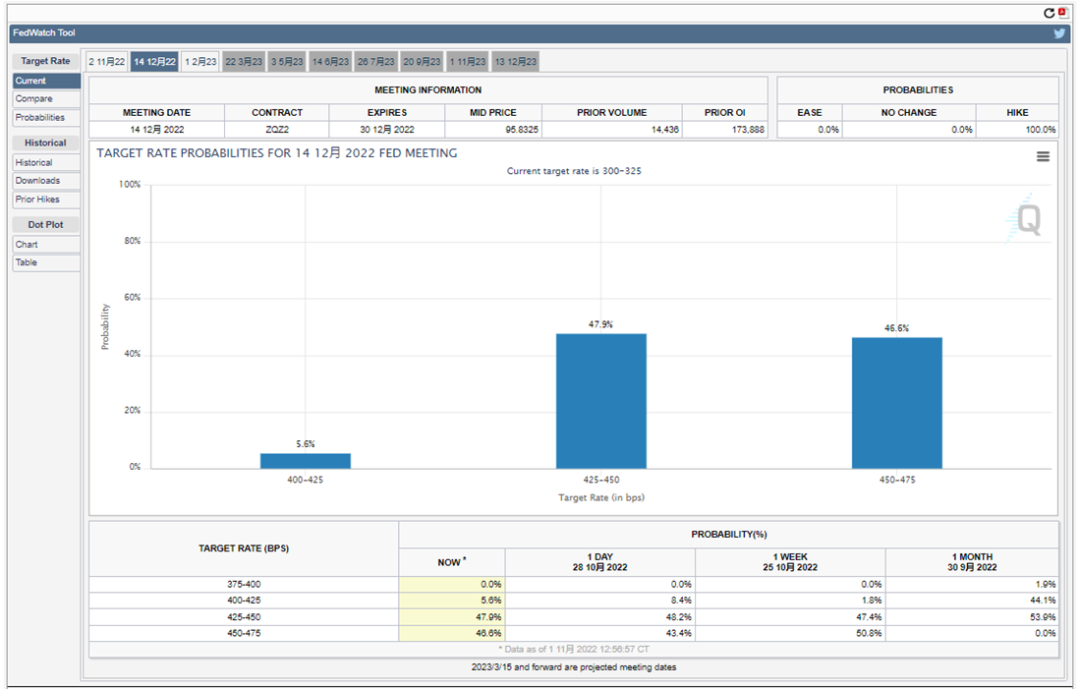

image description

image description

image description

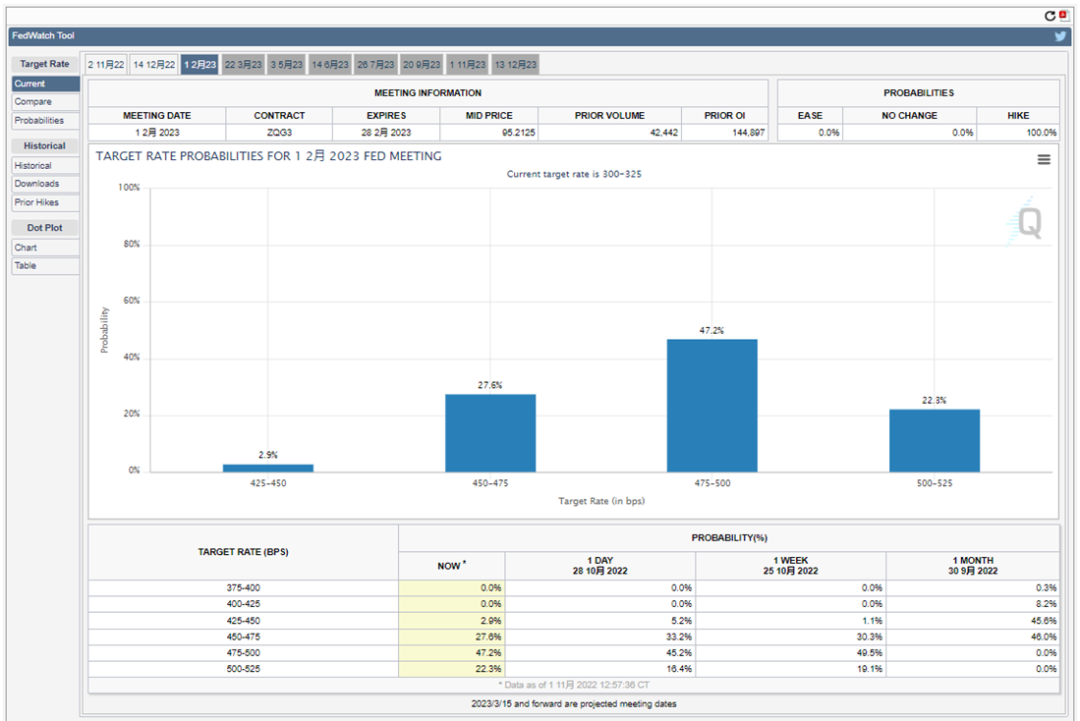

Figure 13 CME Fed Watch tool (February 2 meeting)

According to the Fed Watch tool launched by the Chicago Mercantile Exchange, the current market generally believes that the Fed will likely raise interest rates by 3 yards at the Fed meeting on November 2, and raise interest rates at a slower pace by 2 yards at the Fed meeting on December 14. Even 1 yard, and let the policy rate finally reach 4.75-5% at the Fed meeting on February 1, 23. This means that the market generally believes that the Fed's aggressive rate hikes are unsustainable.

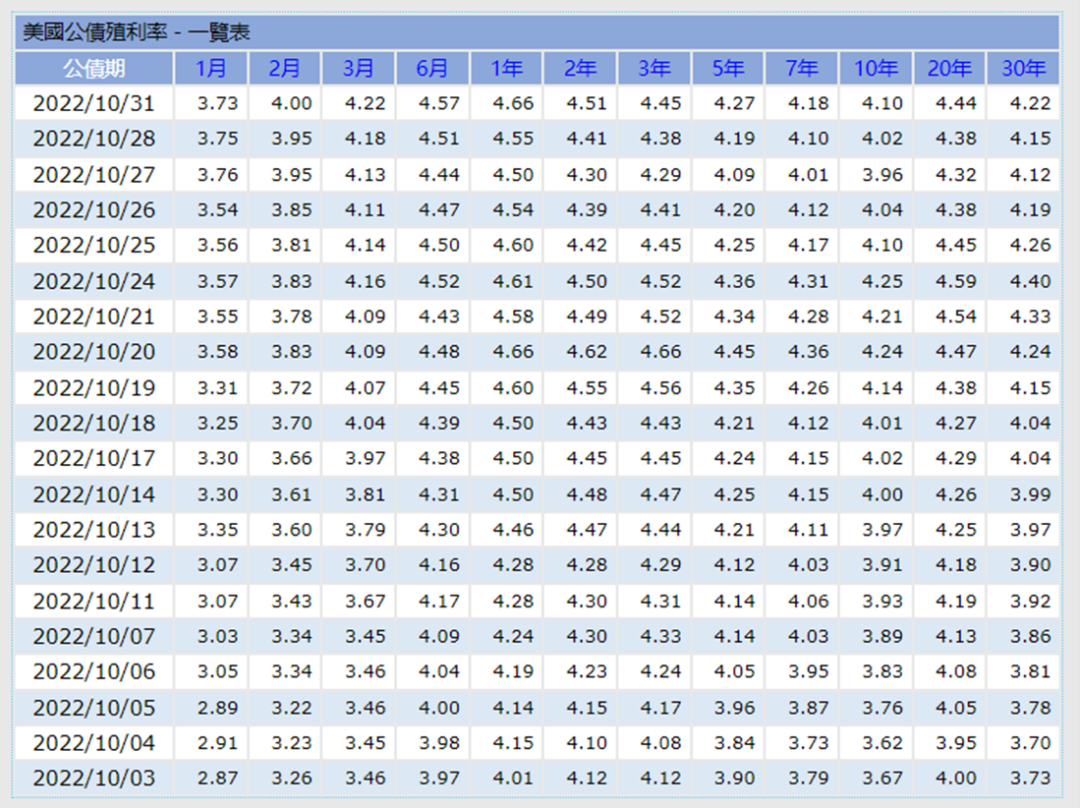

In addition, by observing the interest rate term structure of U.S. Treasury bonds in October, we can find that the current two-year U.S. Treasury bonds have risen and fallen at about 4.62%, which means that by February 2023, the policy rate level that the market can accept About 4.5-4.75% in this interval, that is, there is still room for 6 yards to raise interest rates.image description

Figure 14 Term Structure of U.S. Treasury Bond Rates [14]

Final conclusion: Based on various information, we have reason to believe that the end of the Fed’s current round of interest rate hikes may not be far away, but this does not mean that the market’s expected release of water and interest rate cuts will come soon.Regardless of the dot plot provided by the Federal Reserve or the CME Fed Watch tool, the possibility of the Fed cutting interest rates in the first half of 2023 is infinitely close to zero, and the possibility of raising interest rates in the second half of the year is also very small.Original link