The Policy Declaration on the Development of Virtual Assets in Hong Kong issued by the Hong Kong government on October 31 focused on theAsset-backed token (asset-backed token, or ABT), which means that Hong Kong, as an international financial center, will focus on developing such virtual asset products in the future.

It is true that this is good, this article tries to study some practical issues:

Application scenarios of web3 virtual assets in Hong Kong

secondary title

1. Background

1.1 Timeline of Hong Kong’s virtual asset regulatory policies

It can be roughly divided into two periods:

The first stage: 2017-2018, mainly by the China Securities Regulatory Commission to regulate ICO behavior

The second stage: From the end of 2018 to the present, the regulatory thinking has changed, from the expansion of ICO to the supervision of the entire virtual asset activity, and gradually established the Sandbox Licensing Supervisionframe system

In terms of practical effect, it can be said that the sandbox-style card dealing has almost no cards issued. Only 8 companies have been approved for Hong Kong encryption business licenses in 4 years, and nowOnly two virtual asset trading platforms have successfully obtained trading licenses:

Issued to OSL, a member company of a technology group in 2020

Hashkey Group, which just obtained a license in the first half of this year

The participation threshold is also concentrated in"professional investor"level, namely:

Individual investors with financial assets up toHK$8 million or US$1 million

Institutional investors, with financial assets up toHK$4k or US$5 million

And the change will be at the Hong Kong Financial Technology Week on October 31, 2022. The Hong Kong SAR government officially issued the Policy Declaration on the Development of Virtual Assets in Hong Kong, clarifying that the government will develop a dynamic virtual asset industry and ecosystem in Hong Kong. policy positions and guidelines formulated. HighlightedAsset-backed token (asset-backed token, or ABT)secondary title

1.2 What is Asset Backed Token - ABT?

Generally speaking, tokens are divided into four types, and the way of distinction is defined by the purpose and source of value of tokens:

In fact, asset-backed tokens and security tokens have certain overlapping concepts. Because securities themselves are also assets, tokens backed by securities interests can actually be classified as asset-backed tokens.

In order to better distinguish between security tokens and utility tokens, I will give another example that is easy to confuse.

The classic Defi lending platform AAVE plans to issue the GHO stablecoin. The GHO in its concept is a functional token rather than an asset-backed token, because GHO will be similar to DAI based on the over-collateralization of assets on the chain, not off-chain. Physical assets, while GHO and DAI can be exchanged for stable currency to use fee income, so they are functional tokens.

Expandable reading:secondary title

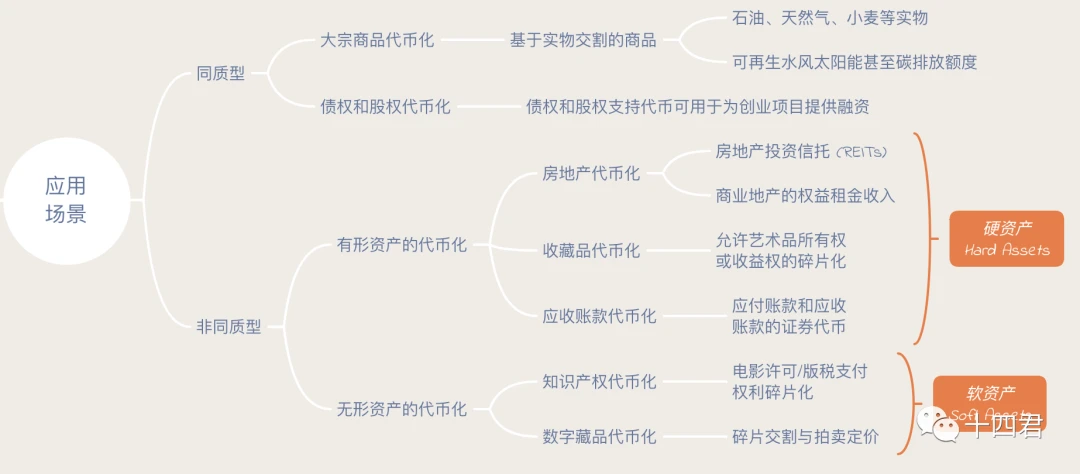

1.3 Application scenarios of ABT

The core of ABT is that there must be physical assets or rights and interests under the chain as the value target, and it can also be distinguished by homogeneity or not. According to the common scenarios where physical delivery can be tokenized, the application scenarios are briefly listed as follows:

secondary title

1.4 What is the value of tokenization?

Blockchain combined with smart contracts as a set of world state machines is synonymous with high efficiency, high liquidity, customizability, and equal participation. The combined comprehensive benefits are as follows

Fragmentation: refers to the division of property rights into several small pieces for the purpose of sale, making it easier to trade, price and circulate

Liquidity: Liquidity is defined by the speed at which assets are converted into cash, broadcast and shared on the order library chain

Cost-effectiveness: The cost of these external third parties will be eliminated or greatly reduced when blockchain-based smart contract transactions

Automation: Blockchain-based smart contracts do not require these manual interactions and have a trusted technical foundation

Transparency: One of the most distinctive features of on-chain transactions is immutable record-keeping

From the audience point of view:

For institutions, the splitting and conversion of large orders brings efficiency and cost benefits of fragmented liquidity

secondary title

1.4 What is the value of tokenization?

The author believes that the policy is not moving towards loosening, but a firm attempt to make a deeper attempt on the existing route.

There is no need to sneer at ABT, because anything that can bring real efficiency development is an unstoppable application trend, and will eventually form a complementarity, just as the development of e-commerce once impacted the offline physical industry, and it will also provide countless people who embrace change. bring opportunity. The end entity and online e-commerce have just the right target audience to achieve the combination of tactile experience and efficiency requirements.

first level title

secondary title

2.1. How is the mapping of real assets represented?

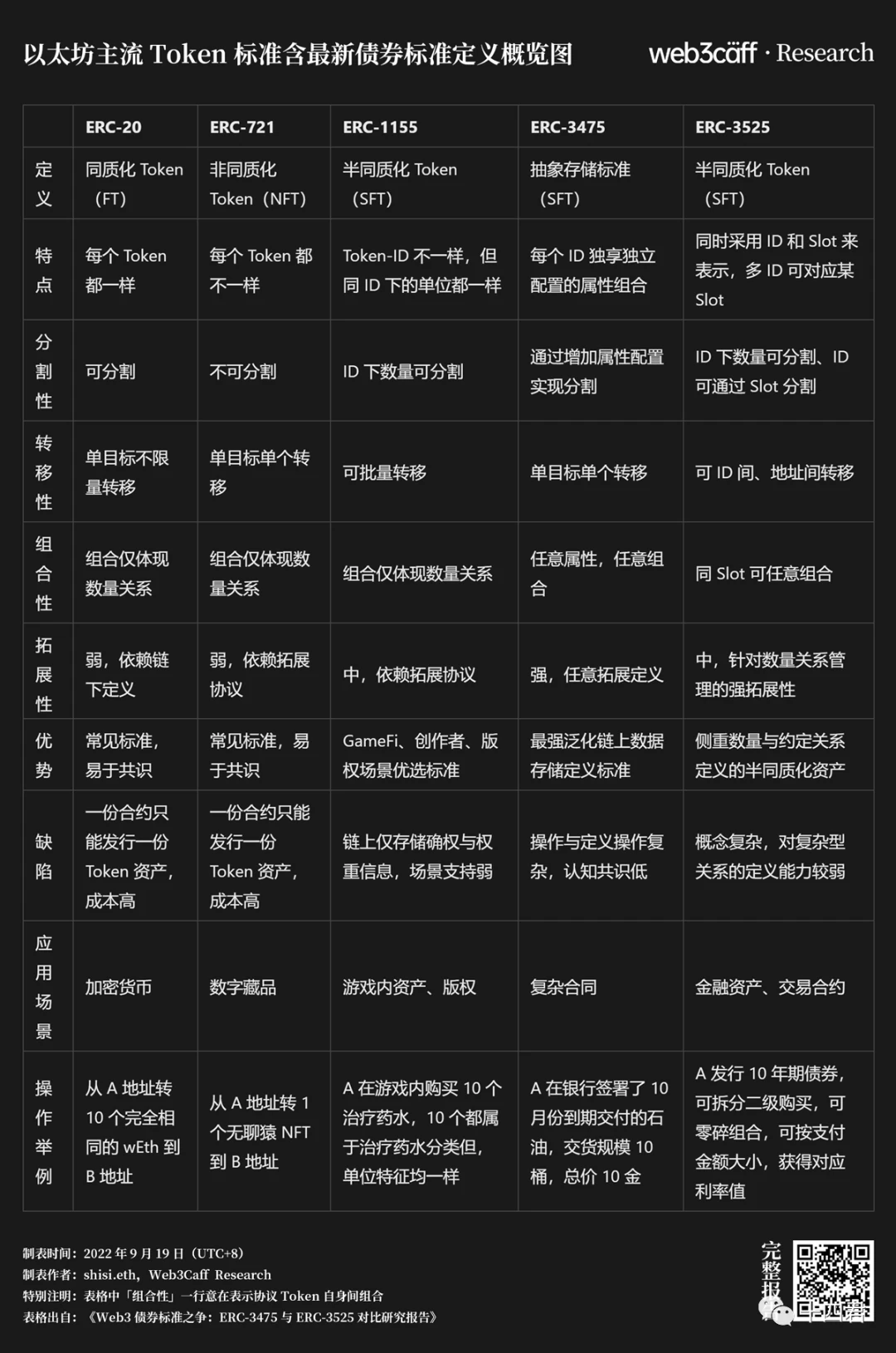

The two Token standards ERC-3475 ERC-3525 that have been passed in succession in the past six months have provided a more reasonable expression for the Token standard application scenarios that originally used ERC20 and 721 to mix and replace.

We can compare the limitations of previous standards (ERC20/721/1155) by comparing asset types in the real world:

Such limitations are simply too great

It can be seen that the scenes closely related to contracts, bonds and real finance are in the state of being replaced by ERC-20/721.

Asset applications of previous contract types (such as reality mapping of real estate contracts, mapping of investment and financing contracts), always require various combinations when using alternative standards,A contract = ownership of rights + size of rights + stipulations of rights:

Ownership of power: All kinds of land depend on the ID of ERC-721 to confirm the right, such as the land in otherside game.

In terms of power: rely on ERC-20 for quantity management, for example, aave governance Token has different voting rights according to shares.

In terms of power regulations: it only relies on off-chain documents, or URI data that is difficult to unify in various text descriptions in Ipfs.

secondary title

2.2. Overview and comparison chart of the five major Token standards

Lets use a picture to compare and summarize as follows: See the appendix at the end of the article for the link:

And ABTIt is very likely that the above five Token standards will be fully appliedsecondary title

2.3. Conventional ERC standards (20, 721, 1155)

You can expand the reading of previous interpretation articles:

NFT standard:[Source Code Interpretation] What exactly is the NFT you bought?

The originator of NFT:【Contract Interpretation】CryptoPunk is the worlds earliest decentralized NFT trading market

NFT lease:[Source Code Interpretation] How does the new Ethereum standard EIP-4907 realize NFT leasing?

ERC1155 standard:NFT Leasing Proposal EIP-5006 Enters Final Review! Make it possible to change the chain of large overseas games

ERC1155 application:secondary title

2.4 Comparison between ERC-3525 and ERC-3475

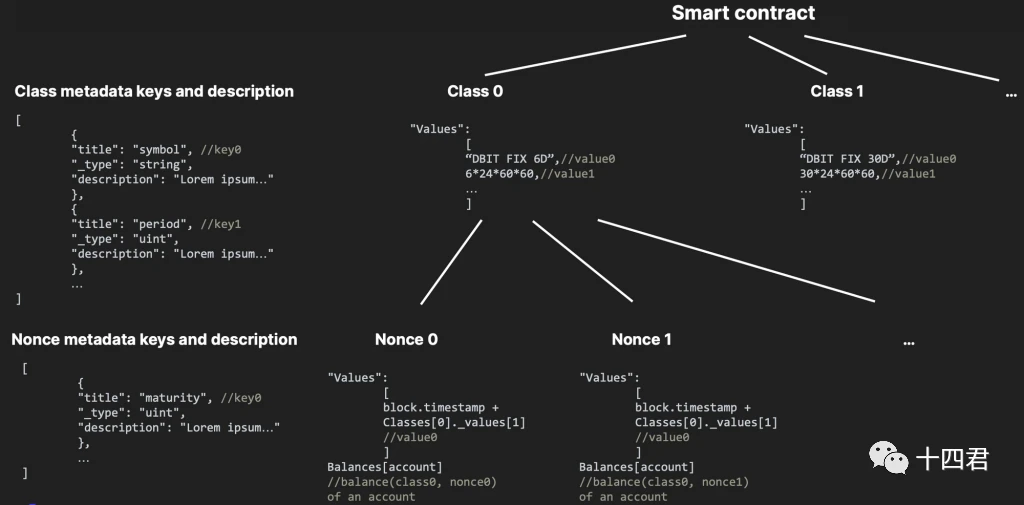

2.4.1. The core logic of ERC-3475

Lets start from the structure of its stored data, and give an example of developing a debt contract with 3475 to describe:

In 3475, each debt contract is a Class 0. A contract can issue multiple contracts, similar to NFT IDs. Each class manages multiple data, and records textual information such as the name, abbreviation, and description of the contract. Each The information can be further split into types and values, such as contract amount, contract time, delivery person, delivery object, notary institution, business license number, etc.

In fact, ERC-3475 is a very highly customized standard set that can support almost any information representation, and its main achievement is how to better save Gas and support under such a highly customized contract for on-chain storage. General functions such as batch transfer have been optimized. Similar to 4907, it only defined the data protocol, and did not undertake the management of the delivery amount and the mandatory restrictions on storage leases. It is just a set of standards that defines a very complete type so that anyone can issue a contract.

In summary, its features are:

Standards defined specifically for contracts, and decentralized storage on the chain

text

2.4.2. The core logic of ERC-3525

ERC-3525 is highly similar to ERC-1155, but with a new concept of slot.

If ERC-1155 is address → ID → quantity, then ERC-3525 is to wrap each ID with a relationship called Slot on the upper layer. For example, I am issuing No. 1 Token and No. 2 Token. When making Tokens, you can set them as a Slot, and name the Slot: Jay Chou’s autograph. Then, compared to ERC-1155, the 1st and 2nd NFTs are more important than the other 3rd, 4th, and 5th NFTs. different meanings.

Therefore, 3525 is Slot→ID→(quantity, holding address), where the address is just an attribute under id.

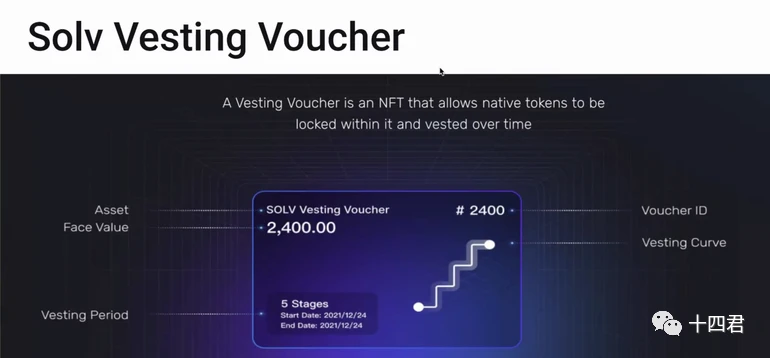

It is applied to bonds as shown above: Slot is the name of the asset, which has multiple Ids:

Asset (asset name): SOLV Vestion Voucher

Face Value: 2400.00

Voucher ID (number): #2400

Vesting Period (vesting period): Start on 2021/12/24 and end on 2021/12/24

Vesting Curve (attribution curve): attribution income calculation interest rate and other curve functions

secondary title

2.5. How to evaluate ERC-3525 and ERC-3475?

ERC-3525 focuses on the management of semi-homogeneous Tokens, and the improvement of asset portfolio splitting at the numerical level can be considered as a high-quality standard for traditional financial assets on the chain.

ERC-3475 focuses on the definition of semi-homogeneous tokens, and the definition of contracts with low standards is more standardized. It can be considered as a high-quality standard for traditional business agreements on the chain.

first level title

3. Summary

Are the five Token standards sufficient to support the Hong Kong Web3 pilot?

Recalling the logic of this article, by sorting out the timeline of Hong Kong’s historical policies, starting from the current policy focus of ABT, analyzing its application scenarios and the value points of the combination on the chain, and then sorting out the current mainstream five Token standards, two of which are newly released are easy to use Debt bond finance, commercial order contract scenarios play its core value

So how to prove that these standards really play a role?

Very simple, the financial pilot on the chain is already being carried out with real money.

On October 24, D/Bond, a decentralized bond trading and DeFi market-making platform, officially announced that it will cooperate with the Brazilian financial technology company a55 to issue $50 million worth of on-chain bonds that comply with regulatory rules. The on-chain bonds will pass the ERC-3475 standard Issued and registered with the Brazilian Securities Regulatory Authority (CVM)

In fact, the mapping and combination of off-chain assets on the chain can break the current limitations of DeFi.

DeFi has always been a pawn shop thinking. The core model is to calculate the loanable scale through over-collateralization. In this way, no matter what kind of constant product curve is used to calculate the exchange value, or to obtain deposit and loan income based on dynamic interest rates, it is essentially economic Internal circulation, under the pawn shop thinking of over-collateralization, hinders the application and amplification of financial value

Combined with the application of the new Token standard, Token has stronger processing capabilities in financial securities contracts, not only can define interest rates, amounts, and delivery terms, but also highly optimized gas costs, so that bonds of the same grade sold in batches can be easily local merger and split, secondary sales

If we look at the value of Web3 from the perspective of institutional economics

Web3 is a new economic infrastructure for coordination and exchange. It starts with a fundamental system of property rights and shifts trust in complex systems from individual organizations to decentralized nodes and verifiable code. It has unique economic characteristics that make it possible to complement, and in some cases directly compete with, existing mechanisms.

A smart contract is a contract that is guaranteed to be automatically enforced with code. With the subdivision and improvement of the property rights system, many components of economic activities, including repetitive mechanical parts, computational rules and orders in production and transactions, may be replaced by machines and smart contracts.

text

Regulation and technology are not in absolute contradiction

The two major countries in the world have chosen two different directions on this track. We chose the metaverse to take the direction of hardware entity empowerment, while the United States chose the direction of web3.0 to take the direction of software creation. The direction also determines the policy. I believe that in the near future In the future, on the ABT pilot in Hong Kong, more applications will see the value of combining with the trusted technical power of the blockchain.

You are welcome to contact the author from the background of the official account to discuss web3 industry issues.

Like and follow 14, bring you value from a technical perspective.