Original Author: flowie

2022 is a year of frequent negative events, and it is also a crucial year for encryption regulation to force the industry to conform to planning. Encryption financial transparency, compliance, auditability and encryption taxation are also one of the important regulatory directions.

In an interview with Bloomberg after the bankruptcy of FTX, Gensler, chairman of the US SEC, hinted that regulators will still focus on the financial records of encryption companies. “Crypto firms should do this by adhering to tried-and-true custody, customer fund segregation rules, and accounting rules.”

In 2022, some important policies in the field of encrypted accounting have been implemented. One is the new regulations of the Financial Accounting Standards Board (FASB) on fair value accounting. In June 2022, the FASB issued a ruling requiring companies to use fair value accounting when reporting crypto assets in their financial statements. That is to say, the company needs to accurately report the value of its encrypted currency assets on the balance sheet, which puts forward higher requirements for the financial management of encrypted enterprises. In addition, the FASB revealed in a recent interview with the Wall Street Journal that it is working on developing clear accounting and disclosure rules for companies holding Bitcoin and other encrypted assets, and hopes to issue proposals in the first half of 2023.

The second is that the Organization for Economic Cooperation and Development (OECD) released its new global tax transparency framework, the Encrypted Assets Reporting Framework (CARF), which was formulated by 38 member states. Many governments have confirmed that they will implement these standards in 2023. These include EU member states. The draft CARF contains some references to potential tax reporting rules related to DeFi protocols, stablecoins, and NFTs, which could cost businesses or individuals more tax after the OECD requires crypto companies and platforms to provide additional data.

Encrypted financial compliance regulation is bound to become stricter, which also forces companies and individuals in the encrypted field to invest more in financial management and compliance, and projects and innovations related to encrypted accounting are on the rise.

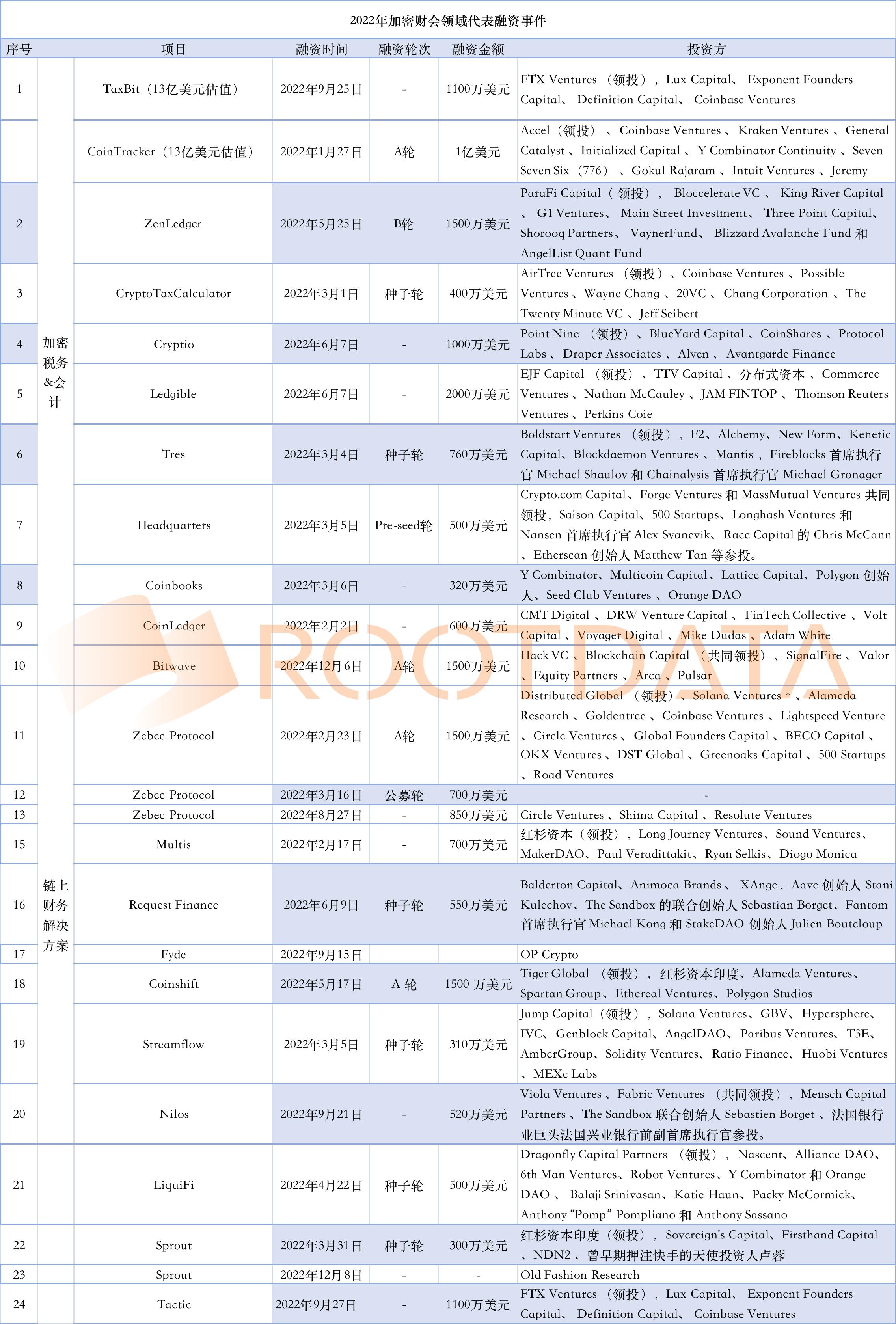

According to RootData data, in 2022, there will be frequent financing of encrypted projects related to encrypted finance accounting taxation and on-chain financial solutions. There will be more than 20 financing events in this field, including Sequoia Capital, Paradigim, Tiger Global, CoinbaseVentures , Fenbushi Capital and other well-known funds participated. But at present, most projects are concentrated in early financing stages such as seed rounds, and the headquarters of most agreements are in the United States, where policies are stricter and regulatory frameworks are clearer. Among them, Coninbase has invested a lot in encryption accounting and taxation in 2022. More than half of the projects financed have Coninbases participation in the investment. In addition, most of the projects customers or partners have Coninbases participation.

Despite still being in a bear market, many crypto accounting protocols have seen impressive growth. For example, the sales of ZenLedger, an encrypted accounting taxation platform, will increase by 5 times in 2022; ZebecProtocol, an on-chain salary flow payment agreement with tax functions on Solana, will achieve a revenue of 20 million US dollars in 2022 alone, bringing 2 million- $6 million net profit.

This article takes stock of projects with a financing amount of more than US$10 million and briefly analyzes their main business directions and some future development trends.

Data source: Rootdata

1、TaxBit

TaxBit was established in 2018 and is headquartered in the United States. It has disclosed a total of 4 rounds of financing. Among them, after receiving US$130 million in Series B financing in August 2021, it has become a unicorn with a valuation of US$1.3 billion. Well-known investors include Paradigm, Coinbase Ventures, Galaxy Digital, and PayPal Ventures.

TaxBit was founded by CPAs, tax attorneys, and software developers to serve ordinary individuals, businesses, and governments. For users in the general encryption field, using TaxBit can quickly integrate encrypted currency asset data, obtain standardized data and tax calculations, and complete encrypted tax form declarations. For corporations, there are also enterprise-level asset management and bonded solutions. On the government side, TaxBit works with some of the largest regulatory agencies in the world, providing services such as data analysis, tax calculation and inspection support.

The government business is one of the more competitive aspects of TaxBit. In May 2021, TaxBit won an exclusive cooperation with the Internal Revenue Service of the United States. Haun Ventures, the latest round of strategic investors in 2022, is a venture capital firm founded in March this year by Katie Haun, a former federal prosecutor and former general partner of a16z. Experience helps.

It is worth mentioning that after the bankruptcy of FTX, several accounting firms including Mazars and Armanino withdrew from encryption audits one after another, and the four major accounting firms also announced that they would not conduct reserve certificate audits for private encryption companies. But soon after, Ernst Young LLP (EY), one of the Big Four accounting firms, chose to form a strategic alliance (EY–TaxBit) with TaxBit. The purpose of the alliance is to help companies with digital asset transactions to provide Experience better tax solutions, avoid costly fines or audits, and increase industry transparency. EY–TaxBit mentions that innovative tax reporting solutions could help taxpayers and regulators address an estimated $50 billion tax gap.

As of now, TaxBit has submitted more than 30 million tax returns in 2022, has more than 5 million taxpayer users, and supports more than 500 protocols in vertical fields such as exchanges, wallets, DeFi, and NFT. At present, the main encryption enterprise customers are Binance US, Uniswap, Coinbase, Okcoin, etc.

2、CoinTracker

Founded in 2018 and headquartered in the United States, CoinTracker has disclosed two rounds of financing. Well-known investors include Coinbase Ventures, Kraken Ventures, and Y Combinator. After obtaining the B round of financing in January 2022, the valuation rose to 1.3 billion U.S. dollars, becoming a new unicorn in the encrypted tax field,

The founding team of CoinTracker is from Google engineers. From the perspective of product business, on the one hand, CoinTracker can help crypto investors track and manage almost all mainstream exchanges, NFT, and DeFi data; Provide professional tax accounting and bonded solutions for corporate customers. Enterprise-level customers can be certified public accountants, funds or other companies that are interested in encrypted financial accounting and bonded.

secondary title

3、Zenledger

Founded in 2017 and headquartered in the United States, Zenledger has received four rounds of financing in total, with major investors including Vestigo Ventures, Castle Island, and CoinGecko Ventures.

Compared with Taxbit and CoinTracker, ZenLedger mainly serves investors and tax professionals with frequent transactions, helping them simplify the tax accounting process of DeFi, NFT and encryption. In addition to bonded tools, more professional crypto accounting tax consulting can also be provided. ZenLedger is planning to launch a new product customized for prospective clients of registered investment advisors (rIAs) and certified public accountants (CPAs).

ZenLedger supports over 400 cryptocurrency wallets and exchanges and over 30 DeFi protocols and 10+ NFT platforms. Compared with other competitors, ZenLedger has access to a more comprehensive encryption platform. ZenLedger currently has over 50,000 users. In its May 2022 funding announcement, ZenLedger revealed a 500% increase in sales in 2022.

4、Ledgible

Founded in 2017 and headquartered in the United States, Ledgible has disclosed a round of financing. The main investors are Fenbushi Capital, TTV Capital, Commerce Ventures, Nathan McCauley, and JAM FINTOP.

Ledgibles core team leadership consists of crypto, tax and accounting experts from various industries. Similar to ZenLedger, Ledgible focuses on tax professionals, corporate and institutional customers. On the one hand, it helps customers simplify corporate cryptocurrency and digital asset accounting operations, and tracks encrypted currency assets according to institutional and business needs; on the other hand, it provides customers with encrypted bonded Software integration helps customers to serve bonded users on their platform.

Currently, the enterprise clients represented by Ledgible include ACUITY, Agorand, Aprio, Blockchain, etc.

5、Bitwave

Founded in 2018 and headquartered in the United States, Bitwave has disclosed a total of 2 rounds of financing. The main investors include Hack VC, Blockchain Capital, Nascent, Nima Capital, and Arca.

Bitwave mainly serves enterprise-level customers and has a wider business scope. In addition to encrypted accounting and taxation, Bitwave also helps companies provide compliance solutions. The product Bitwave Institutional, which was built after financing last year, is aimed at custodians, exchanges, financial institutions, wealth management institutions and other organizations that face huge risks, supervision and control complexity of holding, managing and investing users. Digital assets, which can provide businesses with services such as digital asset accounting, taxation, bookkeeping, invoicing, but also have other functions such as separated balance sheet tracking, internal and external system reconciliation, proof of debt and release of reserves.

Bitwaves main clients include Near, BlockDaemon, Cimpound, OpenSea, Messari, Fifment, Bankless, etc.

6、Zebec Protocol

Zebec Protocol was established in 2021 and is headquartered in the United States. It has disclosed a total of 4 rounds of financing, including three consecutive rounds of financing in 2022. Its main investors include Coinbase, Solana Ventures, Distributed Global, OKX Blockdream Ventures, Circle Venture, etc. More than 20 global first-line investment institutions.

Zebec Protocol is a streaming payment protocol in the Solana ecosystem, which supports sending funds in real-time and continuous payments, and can be used in payroll, investment and other scenarios. During the entire flow payment process, the payer uses the Solana ecological wallet to connect to Zebec, enters the payees wallet address, sets the time interval, token type (any SPL token), and amount, and then starts the flow payment fund transfer Recipients receive funds instantly in their wallets and can withdraw them at any time, all handled entirely on-chain.

Zebec has also launched a Zk-Rollup-based flow payment public chain Zebec Chain solution to further improve privacy protection and compliance, and has basically completed the migration to BNB Chain, and issued the BEP 20 standard $ZBC token .

The founder of Zebec said in a recent interview that about one-third of Solana projects use the Zebec system to pay salaries, and more than 250 projects have been built on top of Zebec. The number of early users of Zebec Protocol has reached 30,000+. In any case of staking mining, the TVL has exceeded the scale of 300 million US dollars.

In terms of revenue, Zebec will achieve a revenue of 20 million US dollars in 2022, bringing a net profit of 2 million to 6 million US dollars to the ecology, and it is expected to achieve a revenue of 40 million to 50 million US dollars within one year (by August 2023). Additionally, Zebec Protocol plans to launch its own stablecoin when revenue reaches $1 trillion.

Currently, Zebec Protocols Web3 partners include ARB, Synchrony, Francium, Mirror World, HalkSight, Drippies, Rewards Bunny, Aver Exchange, Moonlana, etc. Through cooperation with Rewards Bunny, Zebec Protocol has indirectly cooperated with more than 1,000 Web2 companies including ebay, alibaba, travel, booking.com, etc.

In addition, Zebec Protocol acquired 5 Web2 payment companies with over 10,000 users.

7、Coinshift

Founded in 2021 and headquartered in India, Coinshift disclosed a total of two rounds of financing. The main investors include Tiger Global, Spartan Group, Ethereal Ventures, Polygon Studios, Sequoia India, HashKey Capital, ConsenSys Mesh, and Alliance DAO.

Coinshift mainly establishes multi-chain financial management and large-scale streaming payments for Web3 enterprises and DAO organizations using the multi-signature wallet GnosisSafe. Coinshift allows users to integrate Gnosis Safes safes on multiple chains, and use the multi-signature function to manage fund balances, and has made a dashboard for easy viewing operations. Users can access contacts, tags, budgets, reports, and vaults, signers and Advanced access level control for non-signers.

In addition to financial management, in September 2022, Coinshift integrated the streaming payment protocol Superfluid, which allows users to create, view, manage, and edit real-time fund flows directly from the Coinshift dashboard, and automatically batch salary payments, such as sending funds simultaneously in a single transaction. Funds are transferred from Gnosis Safe to a hundred people, this bulk payment saves 90% on gas fees. Coinshift is expected to launch asset allocation, risk assessment, and insurance functions to help users make asset allocation strategies more efficiently and mitigate the risks of various DeFi protocols.

Currently Coinshift customers include Consensys, Messari, UNI Grants Program, Balancer Grants, etc.

8、Tactic

Tactic was established in 2021 and has disclosed a round of financing. The main investors are FTX Ventures, Coinbase Ventures, and Lux Capital.

Tactic’s business focuses on aggregating cryptoasset data from disparate sources, giving businesses “a complete financial view of their balances and activity,” and helping companies automatically classify transactions and apply accounting logic, such as calculating dollar gains and losses and taxable items . Accountants can then reconcile the enterprises encrypted sub-books with traditional Web2 accounting software such as QuickBooks.

The founder of Tactic has stated in an interview that “DeFi” transactions or other decentralized finance have the highest financial complexity, and that a single interaction with a smart contract can generate hundreds of “nested transactions”, all of which require to decompose. So Tactic has partnered with accounting firms to help explain accounting principles for DeFi-specific activities such as staking, NFT minting, and airdrops.

Tactic currently has dozens of customers in the NFT and DeFi fields, ranging from early-stage startups to multi-billion-dollar companies across industries.

The development of the encrypted financial track still faces many problems

Although funds have begun to flow into the encrypted accounting track frequently, the development of related projects still faces many difficulties and uncertainties.

Following the bankruptcy of FTX, the audit firms Armanino and PragerMetis may face scrutiny. After learning from the past, based on concerns about their own reputation, several accounting firms, Mazars and Armanino, withdrew from encryption audits one after another, and the four major accounting firms also announced that they would not conduct reserve certificate audits for private encryption companies.

On the one hand, the hot encryption audit stems from the continuous changes in encryption policies and encryption project innovations, which makes it difficult to form effective audit standards. On the other hand, it also exposes the poor financial processes and infrastructure of most encryption companies.

The core reason is that on-chain transactions are incompatible with many traditional financial infrastructures. Financial matters such as tax reporting and transaction tracking, payroll, and invoices for crypto businesses are often manually entered and reconciled through Excel spreadsheets. These solutions are inefficient, error-prone and unsustainable as enterprises grow in size and complexity.

Encrypted companies have special systems in terms of organizational structure and financial transactions, which are too different from traditional companies. Due to the innovation and diversity of cryptocurrencies, it is difficult to adopt uniform and standardized accounting rules. Although cryptocurrencies meet certain characteristics of intangible assets and inventories, the existing accounting standards do not have clear accounting regulations for intangible assets and inventories held for investment purposes.

In addition, due to the natural international nature of Web3 companies, for the accounting industry that relies heavily on regulatory policies and laws, there is an urgent need for countries to unify encryption accounting standards instead of relying solely on US policies. Therefore, the encryption accounting agreement will face the pain of unclear and inconsistent policies for a long time.

Of course, the driving force for the rise of encrypted tax solutions is the gradual clarification of encrypted tax-related policies. As more relevant policies are implemented in 2023, this field will maintain a certain degree of financing enthusiasm; and flow payment is a payment based on blockchain technology. The new paradigm, in addition to encrypted finance, has many application spaces.

It is believed that in 2023, under the external drive of stricter regulation and the internal drive of enterprises own operational efficiency improvement and operating cost cutting down, there will be more noteworthy solutions in the field of encrypted accounting.