Original Author: Snap Finger Research Institute

01 Encryption market and macroeconomic environment

People used to firmly believe that the encryption market cycle coincided with the 4-year halving cycle of Bitcoin, and that the bull market would definitely follow the halving of BTC production. However, from the timeline, the time of the bull market is increasingly deviated from the halving time node. Especially with the mainstreaming and U.S. stocks of Bitcoin, changes in the Federal Reserves monetary policy have an increasing impact on the rise and fall of Bitcoin and the encryption market, and even determine the bull-bear form of Bitcoin to a large extent . And because the encrypted market does not need to undergo monetary policy transmission, it will respond quickly to changes in macro monetary policy.

Judging from the trend of the encryption market in 2022, the encryption market is extremely sensitive to the Feds interest rate hike, not only falling fast, but also slow to recover. Since November 2021 when the Federal Reserve announced that it would raise interest rates, the encryption market has continued to fall for 4 months. In March 2022, the U.S. dollar interest rate hike will be implemented, the benchmark interest rate will be raised by 25 basis points to the range of 0.25% -0.50%, and the discount rate will be raised from 0.25% to 0.5%. rise. It can be seen that the short-term and long-term liquidity crisis caused by the interest rate hike of the US dollar has a very obvious impact on the encryption market.

Generally speaking, the recovery of asset prices will go through three stages: emotional restoration, liquidity support, and fundamental improvement. Due to higher expectations and faster emotional recovery in the crypto market, it will end the bottom slightly ahead of the rate hike cycle.

The current consensus among large Wall Street institutions is to bet on a U.S. recession in 2023:

Morgan Stanley: Global economic growth will weaken next year, inflation will fall, interest rate hikes will end, and the U.S. will narrowly escape a recession. Slowing economic growth and cooling inflation could prompt the Fed to stop raising interest rates.

Goldman Sachs: The U.S. economy is resilient and may narrowly avoid a recession (35% probability, median 65% in media polls). Goldman Sachs expects the Fed to raise interest rates by another 125 basis points to a peak of 5%-5.25%, and will not see any rate cuts in 2023 unless the economy enters a recession. In the second quarter of 2024, the Fed may cut interest rates by 25 basis points for the first time.

BlackRock: Central banks are deliberately tightening policy too much to curb inflation, thereby causing a recession, and this heralds a recession in 2023. Central banks may forego raising interest rates as the economic damage materializes.

In general, large institutions agree that the tightening of US dollar liquidity will not significantly improve in 2023, but the pressure of economic recession and financial stability may force the Fed to stop raising interest rates. According to the latest FOMC meeting (January 3), the Federal Reserve made it clear that it will not cut interest rates in 2023. So the real focus is on whether and when the aggressive rate hike line should be paused. For the crypto market, the current bear market state will end only if the Federal Reserve stops raising interest rates. The crypto industry is likely to remain under pressure in 2023 due to liquidity shortages and fears of contagion.

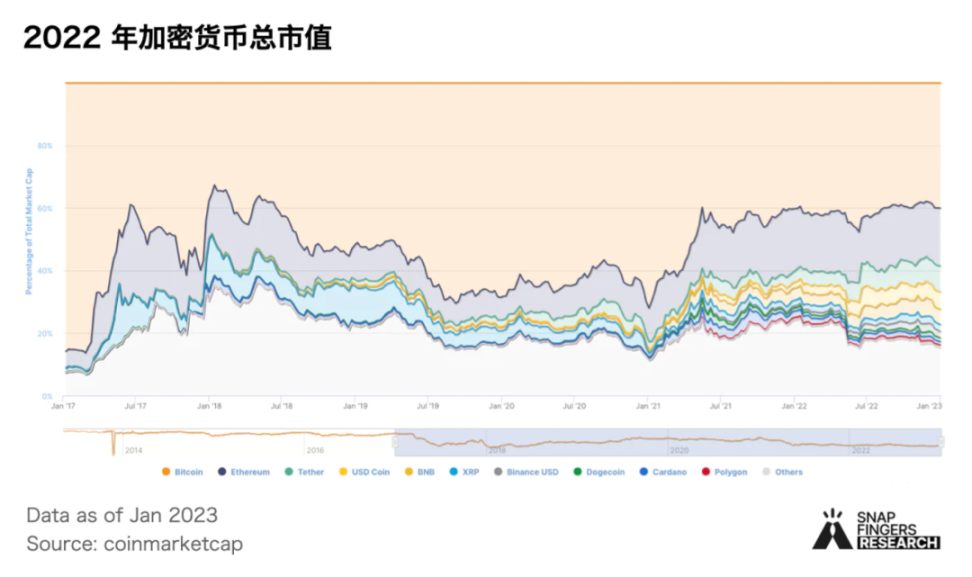

02 Overview of Cryptocurrency Market Cap in 2022

In 2022, the total market value of encryption will drop from 2.1 trillion US dollars at the beginning of the year to 800 billion US dollars at the end of the year, a drop of 61.9%, a drop of 72.4% from the historical peak of 2.9 trillion US dollars (2021/11).

In terms of market capitalization, BTC, ETH, stablecoins and DeFi account for 77.9% of the total crypto market capitalization.

BTC and ETH are the two assets with the largest market capitalization of cryptocurrencies. By the end of 2022, the market capitalization of BTC and ETH will be approximately US$320 billion and US$140 billion, accounting for 40% and 18% of the total market capitalization.

Stablecoins are an important part of the encryption market. As of the end of 2022, the total market value of the top five stablecoins by current market value will reach 133 billion US dollars, accounting for 16% of the total market value of cryptocurrencies. An increase in the supply of stablecoins is a bullish sign in the crypto market. Taking USDT, the stablecoin with the largest market value, as an example, its market value will increase by 4 times in 2020 and 2.7 times in 2021, while in 2022, USDT issuance will decrease by 15.3%. In March 2022, the circulation of UST increased at an average rate of 120 million US dollars per day, and created an astonishing monthly increase of 24.4%. billion dollars, the market value of LUNA directly came to the top five in the market value of cryptocurrencies. With the collapse of LUNA and UST in May, as well as a series of liquidations and thunderstorms of CeFi institutions, the encryption market was quickly brought into a bear market, and the corresponding stable currency market value fell off a cliff.

DeFi is the field with the largest market capitalization other than BTC, ETH and stablecoins. According to Trading View’s DeFi Theme Index, the DeFi market capitalization fell 81% from the beginning of the year to $31.7 billion, accounting for 3.9% of the total crypto market capitalization. According to data from defiLlama, DeFi TVL fell from US$166.5 billion at the beginning of the year to US$39.5 billion at the end of the year, a drop of 76.2%, with a historical peak of US$180 billion in December 2021.

03 Bitcoin and Ethereum

BTC

In 2022, BTC has experienced 6 single-day plunges of more than 10%, and the currency price has also fallen from about US$47,000 at the beginning of the year to about US$16,000 at present, a drop of more than 65%. The stock of the exchange has decreased, and the number of active addresses and new addresses has decreased:

The stock of BTC on the exchange decreased by 20.20% throughout the year (from about 2.64 million to about 2.1 million). Especially after the FTX incident, the stock of BTC on the exchange dropped significantly. From November 6th to 17th, it decreased About 240,000 pieces, a drop of nearly 10%.

The cumulative daily active addresses exceeded 910,000, a decrease of 7.70% from last year. The cumulative number of new addresses reached 141 million, a decrease of 9.50% from the same period last year

The cumulative total transaction volume for the year was approximately 1.256 billion BTC, a substantial increase of 36.37% over last year.

In 2022, the computing power of Bitcoin will continue to grow, and the difficulty of BTC mining will be adjusted 25 times. Generally speaking, the upward adjustment is greater than the downward adjustment. The daily mining revenue per unit of computing power has dropped by more than 77%. Judging from the relative changes in computing power and currency prices, the continuous decline in currency prices and the continuous growth of computing power occur at the same time, but the decline in currency prices is greater than the growth in computing power. Higher input costs and lower output value, coupled with rising energy prices, have put miners and mining companies under increasing pressure on the economic environment and are on the verge of bankruptcy. Therefore, in 2023, the industry will further integrate.

ETH

In the past 12 months, the price of ethereum has fallen by 70%, from about $3,700 at the end of last year to about $1,200.

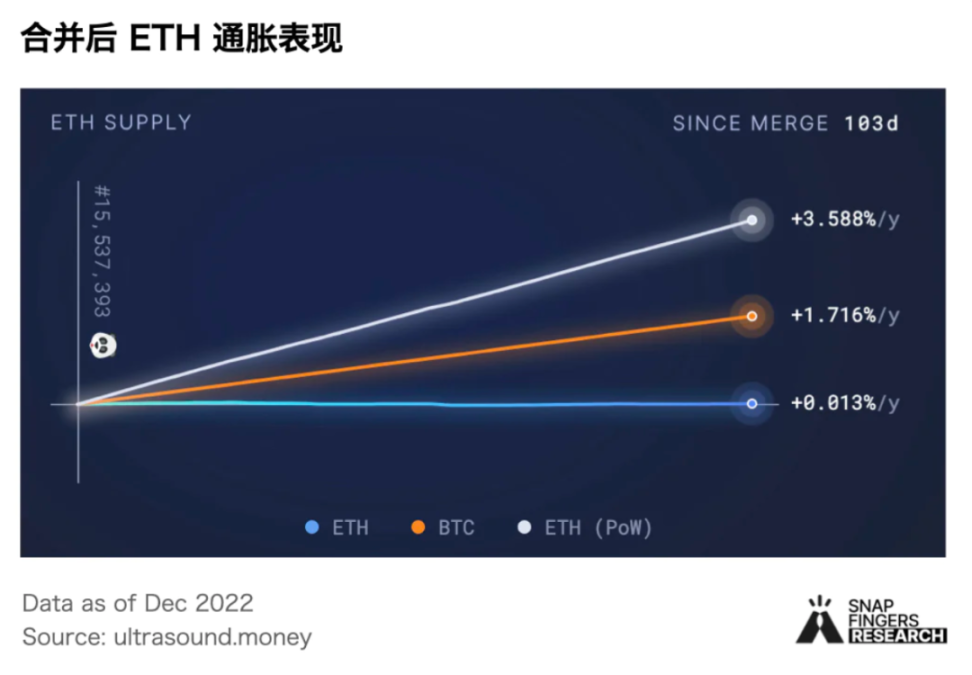

The merger of Ethereum completed on September 15 was a historic feat. According to ultrasound.money data, since the merger, the annual inflation rate of ETH has reached 0.013%, which is far lower than that of ETH (1.71%) and BTC ( 3.58%).

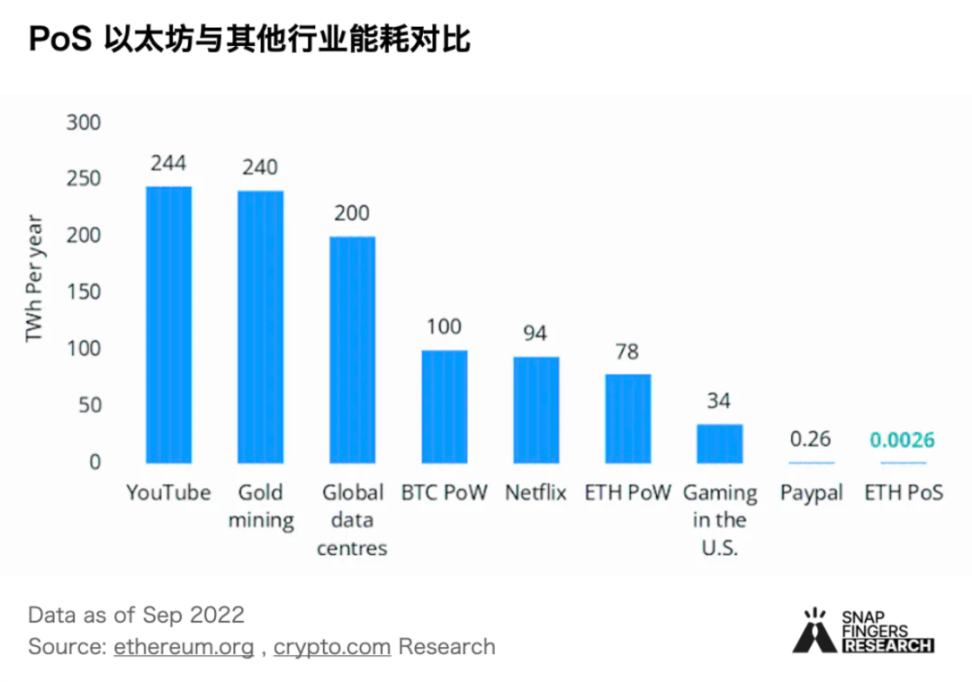

Ethereums merger on September 15, 2022 is widely regarded as one of the most anticipated cryptocurrency events of the year. One of the positive effects of the merger is that Ethereum’s energy consumption has dropped by 99.95%, since PoS does not require energy-intensive mining machines like PoW. In contrast, PoS blockchains rely on validators to validate transactions. It is estimated that the energy consumption of the PoS Ethereum blockchain is about 1% of that of PayPal, which is several orders of magnitude smaller than that of the PoW network.

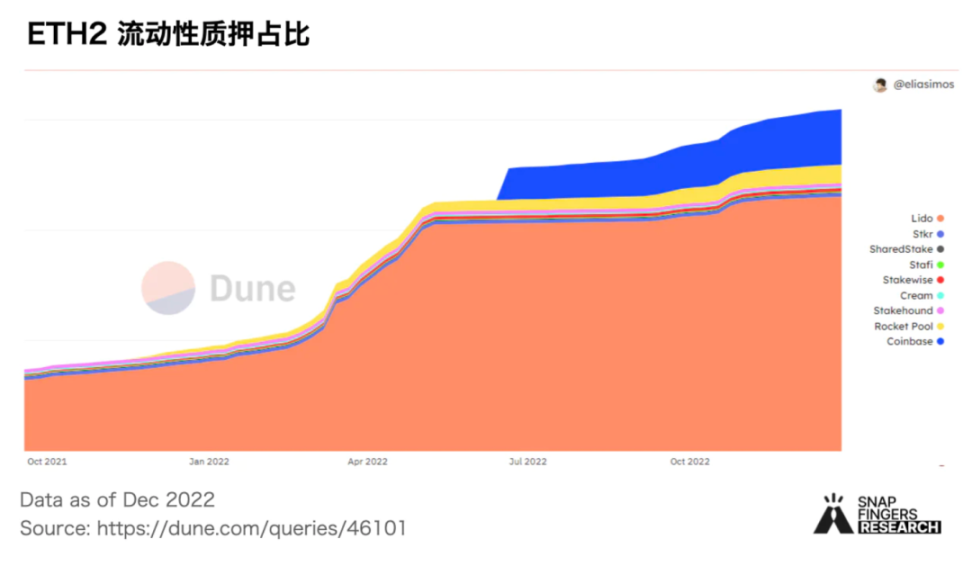

PoS staking requires locking tokens by default, which means token holders must choose between earning yield or retaining liquidity. Liquid Staking tries to solve the problem by allowing token holders to enjoy the best of both worlds - maintaining a certain level of liquidity while enjoying the benefits of PoS tokens. The flexibility liquid staking offers stakers is some of the reasons it will thrive in 2022. ETH is the most popular token choice based on the market capitalization of liquidity staking tokens. Lido Finance continues to lead the liquid staking market with approximately 78% market share.

The problems that Ethereum will face in the post-merger era:

Centralization of ETH staking becomes a key issue after Ethereum moves to PoS consensus, and most staked ETH and validators may be (indirectly) controlled by a small number of entities or governing bodies. Even Lido, a decentralized on-chain liquidity staking protocol, is at risk of being censored because the largest holders of governance tokens are identifiable fund and team members. Especially after the Tornado Cash agreement was sanctioned by OFAC in the United States, people were more concerned about the possibility of scrutiny.

With the merger of Ethereum and the transition to Proof of Stake, the verifier will gain the power to include, exclude, and order transactions, and the Maximal Extractable Value (MEV) brought by it. Previously, this benefit was obtained by miners. In the future, large institutions will obtain more MEV revenue. On the one hand, large institutions can obtain more user entrusted tokens, and on the other hand, they have the strength to develop stronger MEV search strategies.

After the upgrade of Ethereum Shanghai, the ETH pledged by PoS will be unlocked, bringing selling pressure to a certain extent.

04 Crypto Market Narratives and Major Events in 2022

Crypto Market Narrative

Curve war

Vetoken is a major innovation in the utility of DeFi governance tokens. At the beginning of 2022, Convex occupied the CRV staking market through proxy staking, and triggered Curve war. At the heart of the Curve war is the struggle for power to govern Curve. Similar to this, Lido, the largest ETH pledge platform, proposed a dual governance model in 2022. This model can solve the problem that platform governance rights are monopolized by large LDO holders. Although LDO will still be Lido’s governance token, stETH holds Some will be able to protect themselves through the veto.

Step N and X 2 Earn

StepN’s governance token, GMT, opened on Binance with 17 times revenue, with a maximum increase of 40 times, making x 2 Earn a blueprint for the GameFi model. However, with the advent of the negative spiral of the dual currency + NFT model, X 2 Earn is basically falsified.

SBT(Soul Bound Token)

The SBT proposed by Vitalik marks the users characteristics and achievements on the chain in the form of tokens, with verifiable information attached. It is therefore commonly used to build commitments, certificates or affiliations of social relationships in the Web3 world. With this native digital identity, the vision of a decentralized society is finally realized. SBT differs from DID in that SBT is a solution built from the bottom up. Focusing on certificates, characteristics, and qualification types, the address is the unit; while DID focuses on the global identity mark formed under multiple labels and multiple addresses, which is the result of the identity on the chain.

L2

Optimism issued coins and airdrops detonated L2 Optimism conducted the first round of airdrops to early adopters and active users in the ecosystem in early June this year. According to the published token economics: the initial supply of $OP is 4,294,967,296, 19% of which are used for airdrops. The first round only accounted for 5%, with more than 250,000 addresses eligible for air investment. The two largest optimistic rollups, Optimism and Arbitrum, have seen a significant increase in liquidity and community awareness this year. As the scaling technology matures, the wave of L2 tokens is not far away. The distribution of Token is conducive to catalyzing a large amount of funds into the ecosystem, detonating L2 under the conditions of scale and technology maturity.

Major events in the encryption industry

GMX Creates Derivatives AMM Model

Whether it is traditional finance or the encrypted world, derivatives are the largest market. The liquidity pool GLP provides decentralized perpetual and spot transactions with zero slippage and low cost, coupled with the innovative token release model, and the selection of Arbitrum to go online, which makes GMX the biggest dark horse of DeFi derivatives in 2022. In 2022, the total transaction volume will be 85 billion US dollars, the annual fee income will be 115 million US dollars, and the annual new users will be 200,000.

Hong Kong Embraces Crypto Industry, Supports Web3, NFT, GameFi Innovation

On October 31, the Hong Kong SAR government issued a major virtual asset policy declaration, which will create a convenient environment with financial regulators to promote the sustainable development of Hong Kongs virtual asset industry.

Aptos Sui and other Moves compete for new public chains

Aptos, Sui and other new Move public chains are favored by capital and the market. Aptos launched its mainnet in October and landed an airdrop. The Sui public chain has also received more and more attention, and completed a financing of 300 million US dollars. In addition, new public chains such as Fuel Network, Celestia, and Aleo have gradually entered the field of vision of more people.

Ethereum merger opens the 2.0 era

At 14:42 on September 15, 2022, Beijing time, Ethereum completed the merger process, and the consensus mechanism officially changed from Proof of Work (PoW) to Proof of Stake (PoS).

Sanctions on Tornado Cash spark regulatory and privacy debate

In August, the U.S. Treasury Department placed Tornado Cash on the sanctions list, prohibiting the use of U.S. citizens. Some project parties support and respond to the banning or blacklisting of Tornado Cash-related addresses; at the same time, some industry insiders expressed concern that this is a threat to a free society, and individual project parties have also tried to fight against the sanctions through legal means.

Terra crash exacerbates liquidity crisis

The Terra crash in May can be described as one of the most catastrophic events in the encryption industry, from the ecological peak (ATH: 21.18 billion US dollars, including the stable currency market value, with a total TVL of 29 billion US dollars) to the initial UST slight de-anchor, and then to Falling into a death spiral, the dual currency was almost reduced to zero, and the market value of tens of billions in the ecology evaporated within a few days, and the shock wave affected many institutions and encryption projects.

StepN Detonates GameFi x 2 Earn Mode

The announcement of Binances IEO on March 1 was an absolute turning point for STEPN. In a market stage that lacked narrative, STEPN’s GMT opened with 17 times earnings on Binance, and then pulled it all the way from $0.1 to $4, shocking both inside and outside the industry. Then STEPNs x 2 Earn model led the GameFi industry.

Yuga Labs Constructs Metaverse Ecological Pyramid

In March, Yuga Labs acquired two head NFT series, CryptoPunks and Meebits, from Larva Labs, including brands, art copyrights and other intellectual property rights. Subsequently, its representative NFT project, Bored Ape Yacht Club (BAYC), launched the APE token with a high profile. And on March 23, it completed the financing led by A16z at a valuation of US$4 billion, with a total of US$450 million in financing. In May, Yuga Labs publicly sold the land Otherdeed on the metaverse platform Otherside, and raised APE tokens worth more than 320 million US dollars.

U.S. President Biden officially signed an executive order to develop digital assets

It was the first executive order in the U.S. to focus specifically on the digital asset space, and bitcoin prices surged 8 percent to $42,000. Circle CEO Jeremy Allaire called it a watershed moment for encryption, digital assets, and Web 3, akin to the whole-of-government awakening to the commercial internet in 1996/1997.

Galaxy detonates Web3 marketing

At the beginning of 2022, the OAT of the Galaxy Project has gained huge traffic. OAT has greatly increased the number of participants in blockchain online activities and has become a standard configuration for blockchain online activities. Galaxy embodies the value of Web3 identity in the marketing field. In addition to marketing, DID also has great potential in the DeFi field, such as credit lending, governance, and can also be used for targeted airdrops.

05 CeFi storm and encryption hackers

2022 CeFi thunderstorm event

On November 16, Genesis suspended redemptions and new loan issuances, acknowledged that the Three Arrows default and the FTX storm had a huge impact on it, and announced that it would find new funds to save the business. There were market rumors that Genesis was preparing to file for bankruptcy, but was subsequently denied by Genesis.

On November 8, FTX filed for bankruptcy, with a liquidity gap of US$8 billion, directly affecting 100,000 creditors and more than 100 companies associated with FTX and Alameda. And FTXs all-time high market capitalization is $32 billion.

On July 6, Voyager Digital, a cryptocurrency broker, announced that it had filed for bankruptcy protection in New York court. It is estimated that there are more than 100,000 creditors, and its assets and liabilities are expected to be between 1 billion and 10 billion US dollars.

On June 17, PayPal Finance suspended the redemption and withdrawal of all products, directly affecting more than 500 institutional customers. Its all-time high valuation is $2 billion, with more than $3 billion in outstanding loans at the end of 2021.

On June 17, a run on BlockFi occurred, affecting 250,000 retail users and more than 200 institutional users. On June 21, the crisis lifted as FTX extended a $250 million line of credit to BlockFi. Following the FTX storm, BlockFi announced on November 11 that it would suspend withdrawal services. The highest deposit in BlockFis history is 10 billion+ US dollars, and the highest valuation is 3 billion US dollars.

On June 15, Three Arrows Capital filed for bankruptcy. As of July 20, 27 creditors had claimed USD 3.5 billion. Previously, Sanjian Capitals asset management scale reached US$10 billion.

On June 12, Celsius froze customer assets worth $11.8 billion, directly affecting 1.7 million users, and filed for bankruptcy on July 15. Celsius previously had the largest assets under management of $30 billion.

Breach in the Crypto space in 2022 is concentrated in CeFi (centralized finance) or CeDeFi (combination of CeFi and DeFi) entities such as Celsius, Three Arrows Capital (3AC), and FTX. The use of leverage to speculate on encrypted assets is a common method of CeFi institutions, especially in the case of insufficient supervision, the misappropriation of assets is inevitable. Many people in the industry believe that the problems reflected by CeFi mainly come down to trust and transparency, which also allows people to see the advantages of DeFi in this regard, and predicts that the development of self-custody and DeFi may accelerate.

Top 10 hacking incidents in 2022

On March 23, 173,600 ETH (worth more than 590 million U.S. dollars at the time) and 25.5 million USDC were stolen from the Ronin Bridge, which was the most expensive security attack in DeFi history. 2022 will be a very difficult year for most people due to the raging bear market. However, even more insecure than the bear market is the attack from hackers-2022 is the year with the most attacks and loss of funds in history. Judging from the data on DefiLlama, the top ten hacking incidents alone have caused losses of more than 3 billion US dollars.

From the perspective of attack targets, it can be found that the cross-chain bridge is the hardest hit area for hacker attacks, and the attacks caused a total loss of about 2.5 billion US dollars. Another surprising thing is that the top CEX--Binance FTX--appeared in the list of projects under attack.

From the perspective of attack methods, the main attack method of hackers is to use contract loopholes or steal private keys to achieve attacks. In addition, the flash loan method and the use of oracle machines to delay are also common methods used by hackers.

It can be seen that the encryption world at this stage is in the early informal stage, and the limitations of the security audit itself also determine that the occurrence of attacks cannot be completely avoided. The ideal safe ecological environment should be controlled by the project party (self-security protection), the audit party (Security audit assists in prevention) and users (security awareness) to improve together.

06 Crypto Market Penetration

Crypto.coms annual article noted that despite a challenging macro environment, crypto adoption remains strong. As of November 2022, the number of global cryptocurrency owners will reach 402 million (5.1% of the global population), growing exponentially.

The number of cryptocurrency holders is still expected to increase significantly in 2023 as traditional brands reaching billions of users begin to venture into the crypto space, including:

Facebook and Instagram began testing NFT sections.

Starbucks launches NFT loyalty program.

Encrypted communication platforms such as Telegram and Signal are using TON to integrate encryption into their platforms

Elon Musk made it clear that Twitter will also adopt encryption integration.

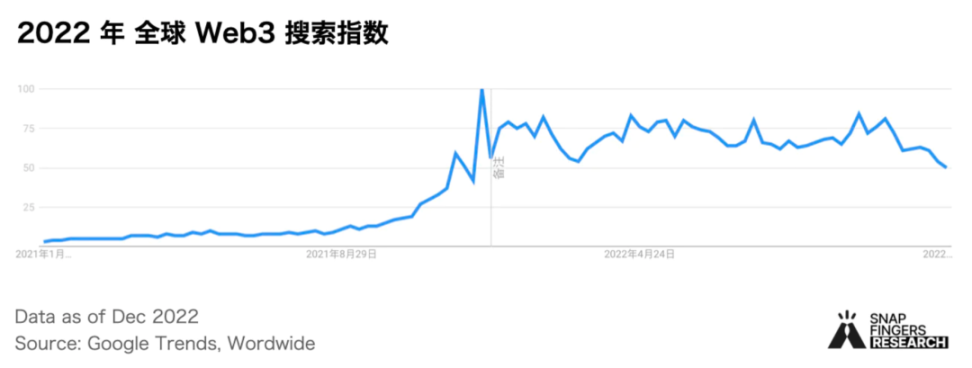

After reaching an all-time high of 100 at the end of 2021, the global Web3 search index will decline in 2022, but still maintain a certain degree of attention.

Although the encryption market will turn into a bear market in 2022, the primary market remains active. According to the Emerging Technology Indicators (ETI) report released by Pitchbook in December, Web3 has led the ETI ranking for five consecutive quarters. Over the past 12 months, more than $6.5 billion of ETI capital has been invested in Web3, more than double that of the second-ranked fintech category.

The primary market data compiled by Messari shows that the total investment in the first half of 2022 alone will exceed that of the whole year of 2021 ($28.5 billion). In the second half of 2022, the investment amount in the primary market will decrease by more than 70% compared with the first half of the year.

For A+ round companies, the venture capital market situation in 2023 will be more severe, and now is the time to prove that their business can continue to operate under the bear market and pressure. In 2023, the scale and speed of investment in the primary market will be greatly reduced, and some well-run companies may take advantage of historical opportunities to complete mergers and acquisitions.

epilogue

epilogue

As major institutions continue to be pessimistic about global economic growth and consensus bets on US recession, coupled with the continued impact of thunderstorms such as FTX in the past 22 years, the encryption world in 2023 may continue to have a long way to go, struggling to survive at the bottom . However, there are also opportunities in the crisis. Fomo is in a bull market, and it is a good time to immerse yourself in construction and lay a solid foundation during a bear market.

The overall macro environment of BTC will continue to exert downward pressure on high-risk assets such as cryptocurrencies, so more investors/institutions will further turn to high-quality assets such as BTC and ETH, but the greater demand for BTC will likely come from the global government level. For miners and mining companies, there will be further integration. Miners with small funds and high costs will be eliminated, and more and more miners will declare bankruptcy or reorganize. Color energy, cost optimization, efficiency provision, and sufficient funds will become breakthroughs in the development of the industry.

Although new chains such as Ethereum Killer continue to appear, Ethereum still firmly holds the leading position and continues to be the world leader in multi-chains. The Shanghai upgrade of Ethereum will be carried out in March. Once more ETH is unlocked, this will increase the demand for ETH liquidity pledges. An agreement similar to EigenLayers main re-mortgage may become an opportunity for the ETH ecology in 2023.

Original link