Might the lending protocol earn more profit from relying on LSD than the LSD protocol itself? Yes, you heard that right, after the ETH Shanghai upgrade, this potential is also expected to be fully realized. There are not only investment/arbitrage opportunities here, but also open airdrop opportunities, and read this article to break it down for you.

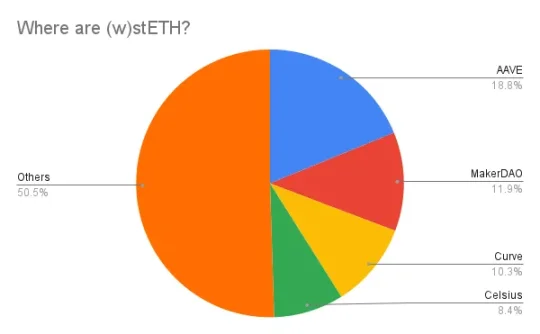

First, lets look at the current specific data. For stETH, which has not yet opened unstake and has large price fluctuations, 31% of it is currently on the two major lending agreements of AAVE/MakerDAO, and a small amount is on the lending agreements such as Compound/Euler. Even if the potential has not been fully tapped, stETH is still sitting The first application scenario is, after all, even Curve only accounts for 10%.

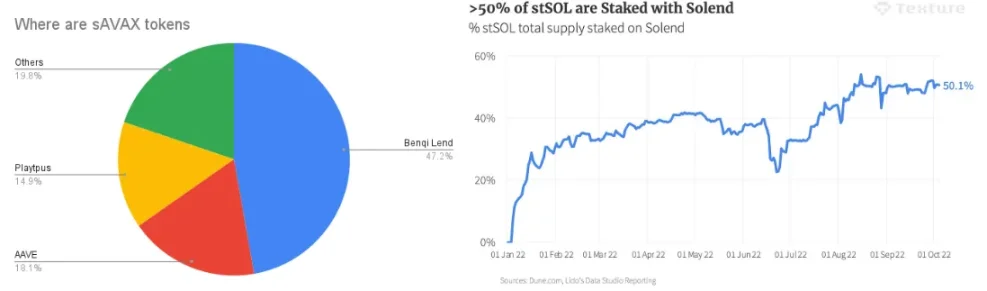

What is expected to happen after unstaking is turned on? Let’s take a look at Avax, an Alt-L1 with a relatively mature DeFi ecosystem. The two lending platforms Benqi/AAVE together account for as much as 65% of sAVAX (AVAX LSD). In the era when Solana was not suffering, more than half of stSOL was on Solend, Solanas largest lending platform. If other protocols such as Larix are added, the overall proportion is about 60%.

why? There are two reasons:

LSD is originally a high-quality collateral, and you can earn interest when you mortgage it. It is suitable for all ages, from 3AC to wormhole hackers.

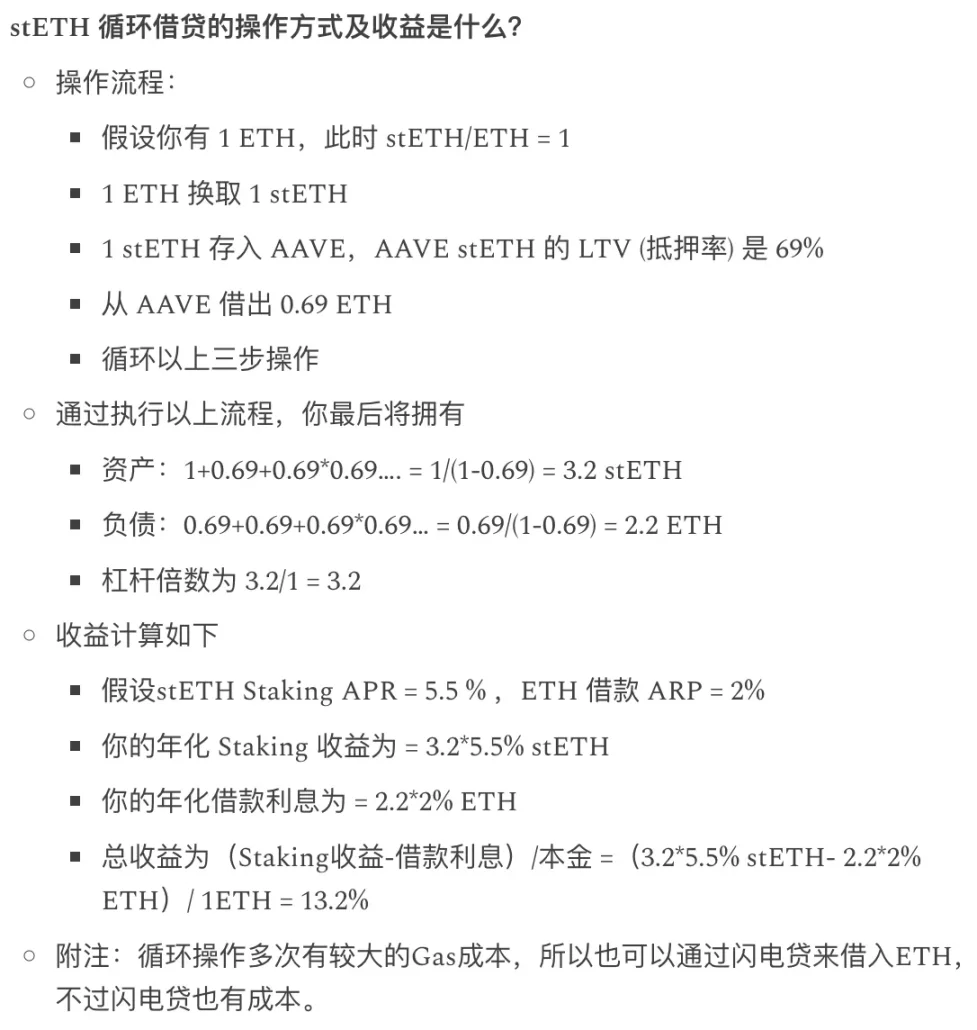

Leverage pledge is the first engine of LSD scale growth. Collateral and borrowing are highly correlated, increasing returns while reducing the risk of liquidation. See the figure below for details

Essentially, the lending agreement acts as a channel to transmit the pledge interest rate to the original assets. For example, the stETH revolving loan has greatly prompted the interest rate and volume of AAVE ETH, and AAVE has transmitted this interest rate to the combined DeFi ecology and influenced other platforms, thereby increasing the benchmark interest rate of ETH.

Since LSD is so profitable, lending agreements also have optimized policies for LSD, such as AAVE V3 Emode, if you only borrow ETH, then the mortgage rate LTV of stETH is as high as 90%, and Comp V3 has similar terms for stETH/cbETH. Under such terms, 1 ETH can eventually become 10 stETH, which quickly helps stETH expand its scale. For arbitrageurs who buy stETH at a discount, they can also use this 10-fold increase in arbitrage income.

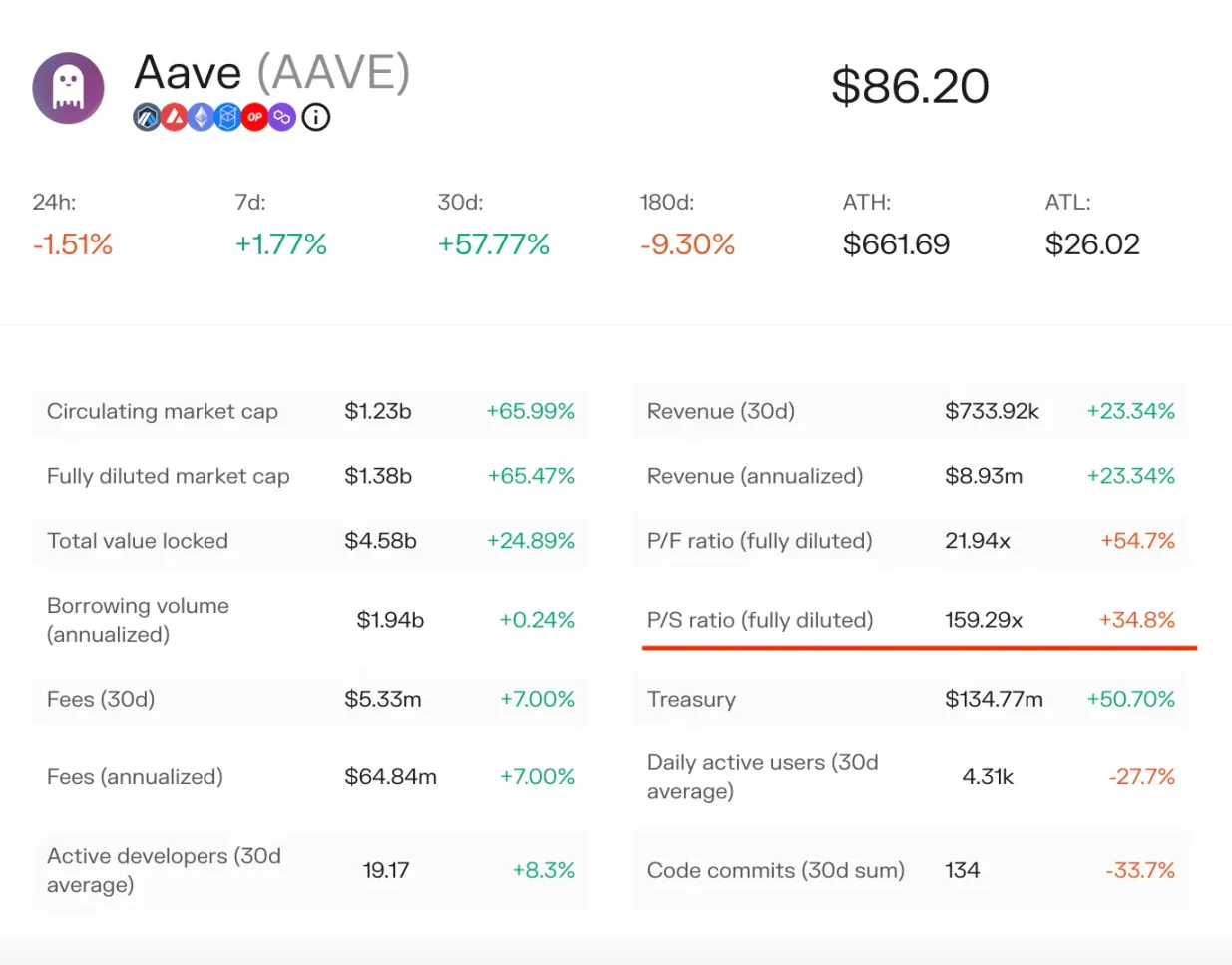

Based on the above data, we estimate the income of the loan agreement. Assuming that the total pledge reward of LSD is X, 60% of the LSD is in the loan agreement, the average LTV = 75%, the loan interest rate is 75% of the pledge interest rate, and the agreement is 15% (AAVE ETH commission), then the income earned by the lending agreement is X* 60% * 75% * 75% * 15% = X* 5.1%, and the pledge reward share of the Lido agreement is only 5%.

This is essentially because the lending agreement has a higher threshold and pays more attention to the accumulation of historical reputation (for example, AAVE still has a widening gap with Compound in the absence of liquidity mining rewards) and the current competition is basically slowing down, so you can set Higher rake ratio.

As mentioned above, with the increase in the scale of LSD coming from Shanghai’s upgrade and the reduction in price volatility, the loan agreement will make a fortune in silence, but it must be noted that the valuation of the loan agreement is generally Not too low, AAVE is as high as 160 times. Even if this good news lands, it will not be underestimated, so this opportunity still needs to observe the narrative changes.

It is not easy to grasp the narrative, but there are still a few airdrop opportunities to pay attention to here.

LSD staking naturally leads to some demands:

To avoid mortgage liquidation, you need appropriate leverage management tools

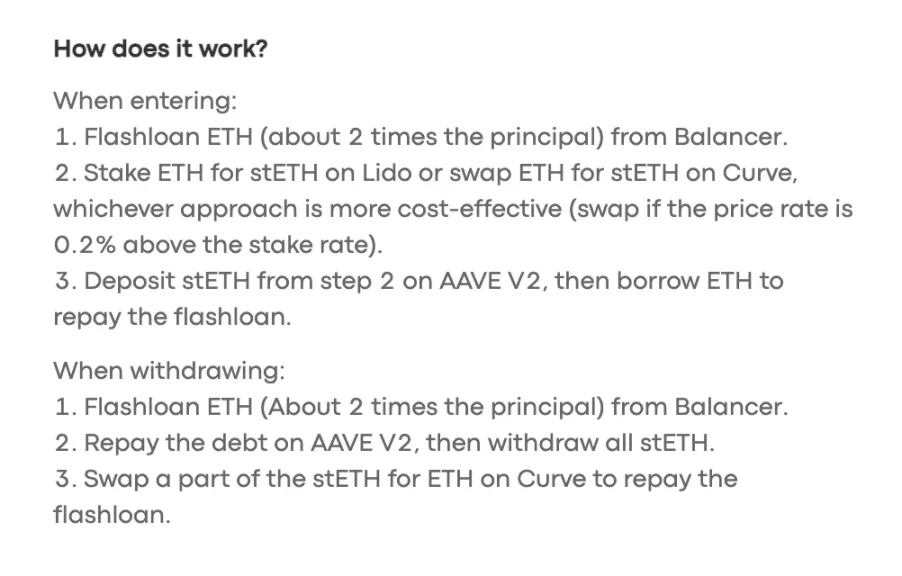

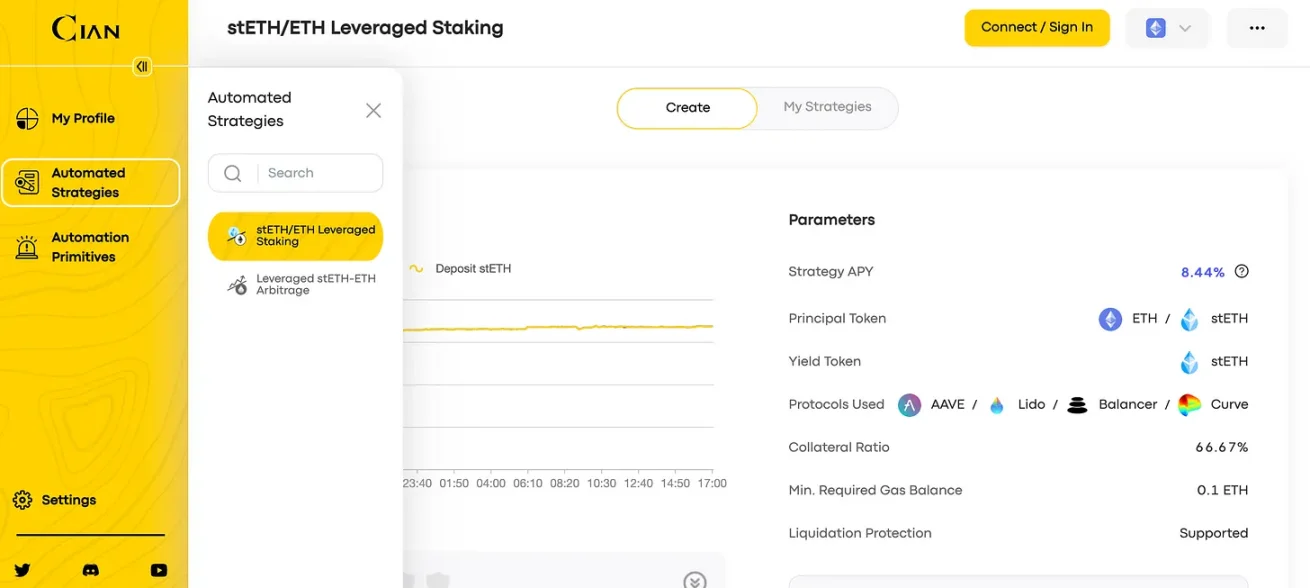

Leverage pledge operation is cumbersome and the cost of gas is high. It is much simpler to use flash loans, and an automated strategy is also required (see the strategy of cian.app in the figure below)

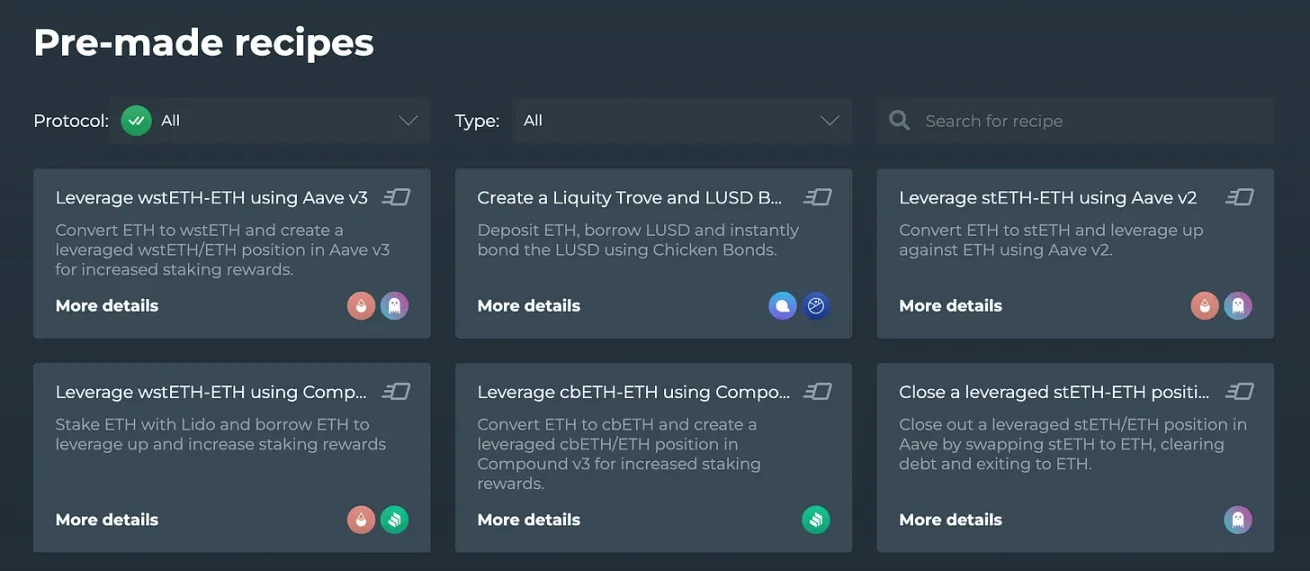

One is DeFiSaver, a long-established project that manages DeFi positions and has not yet issued coins. Its main business is leverage management, and it has also proposed many one-click automation strategies for LSD. Earning a lot of money, the desire to issue coins is also unknown, but DeFi Saver is listed on Arbi/OP, and there is not much gas after a try.

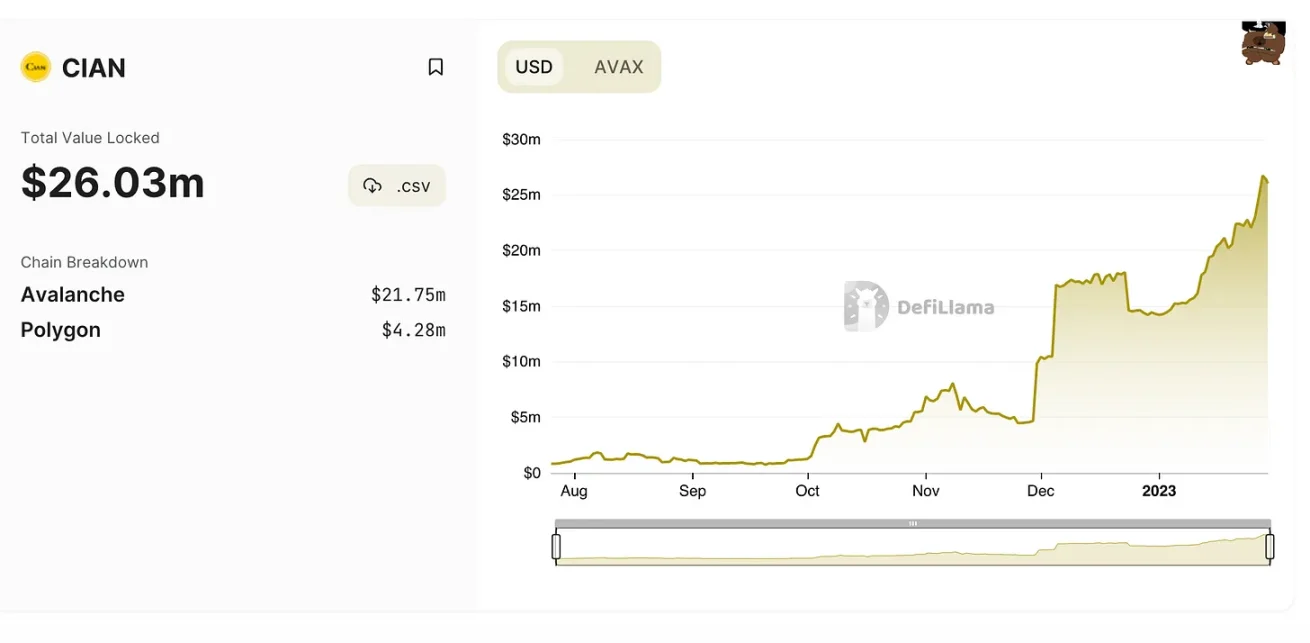

The other is cian.app, which is currently focusing on LSD-related automation strategies. This project is a basic airdrop, and it often distributes various NFTs. AMA also said that it will issue coins in 23 years, and the growth is not bad if you look at the TVL data. .

Cian supports the three chains of ETH/Polygon/Avax. Opening the official website, it is basically an LSD leveraged pledge strategy. It is estimated that the currency issuance in 23 years is also to seize the opportunity of this wave of Shanghai upgrades.

All in all, the final income of the lending agreement in LSD may not lose to LSD, but considering the current high valuation of the lending agreement, it still needs to be driven by narrative. Leveraged pledge can really expand the pledge income, and there are also airdrop opportunities at present. However, since leverage is involved, the risk is naturally higher than usual, so you still need to do more homework. Where do you learn your homework? Of course, it is to pay attention to Miao Frog Seeds, thank you Miao Frog Seeds.