secondary title

Project highlights and expectations

The product level is very smooth to use, and transactions in the form of one click after a single authorization do not require repeated authorization.

There are nearly 100 trading pairs in a rich variety of transactions, including cryptocurrencies (40+), foreign exchange (20+) and tokenized stocks (30+), and commodities have also been launched recently.

Due to the relatively abundant transactions, LPs risks are diversified and profits are normalized.

secondary title

project information

Gains uses a somewhat similar model to GMX, but instead of providing liquidity to a basket of assets, users provide liquidity to a DAI-only vault. Like GLP, the vault acts as a counterparty to traders on the DEX, with users depositing DAI collateral to open long or short positions. Users can also act as LPs in the vault, where they will earn transaction fees and internalize traders profits and losses. Its flagship product is gTrade, a liquid, user-friendly decentralized leveraged trading platform. Allows trading stocks, cryptocurrencies and forex with leverage (up to 1000x). In addition to the exchange, Gains Network also has an NFT collection and staking program.

Gains has several unique features, such as support for stocks and forex in addition to cryptocurrencies. The exchange is a degens paradise (degens refers to individuals involved in high-risk transactions), as it supports 100-1000 times leverage, depending on the asset class users trade, and its leverage is the highest of all DEXs .

The entire gTrade trading platform runs on DAI and Gains Networks native token GNS. Leverage is synthetic, and the product module consists of DAI Vault, GNS/DAI Liquidity, and GNS Token. Withdraw DAI from the vault to pay the traders yield (+PnL), or receive DAI from the trader if the traders PnL is negative. With a single liquidity pool and DAI vault for all orders, gTrade can offer multiple trading pairs and leveraged products. There are 70 trading pairs on the exchange, including cryptocurrencies, forex, and tokenized stocks.

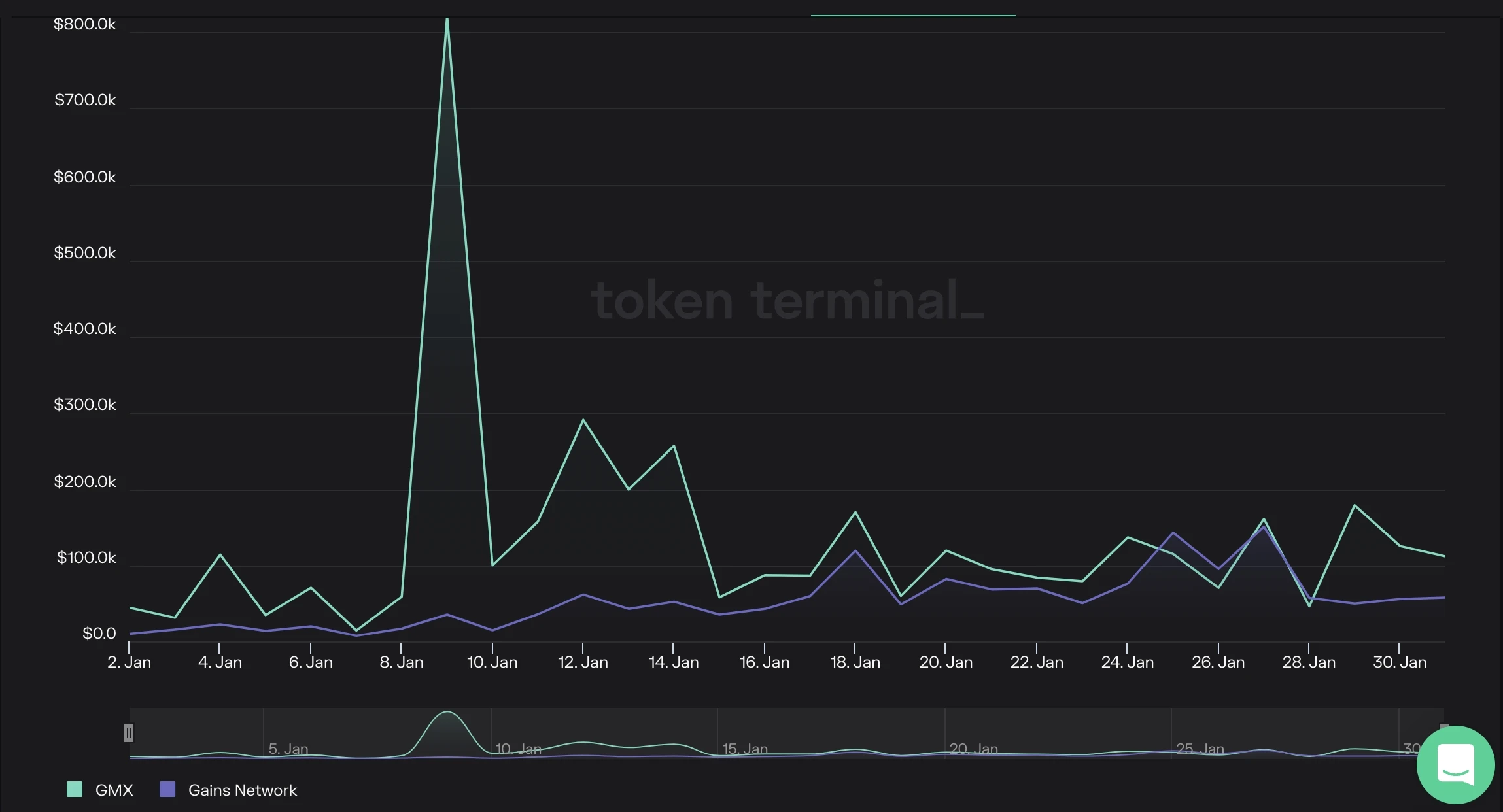

GNS has more than 8,000 unique users. On December 26, 2022, its daily active users will be about 300, and its TVL will be $21.94 M. The average daily new users are currently down to 10-30 users. $GNS has a market cap of $103M and achieved $22M in volume while collecting $14M in fees (0.08% of position value), with 32.5% redistributed to $GNS stakers/LPs.

Other product features:

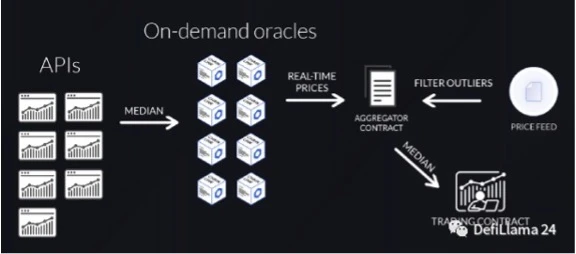

1) Oracle Oracle

Chainlink a DON (Decentralized Oracle Network) powers gTrade messages. gTrade has its custom-built network of real-time Chainlink node operators to obtain intermediate spot prices for each trade order.

2) Transaction fees

gTrade charges 0.08% of leveraged value for opening and closing positions / 0.008% for forex trades on all cryptocurrencies. Price Impact (%) = (Open Interest {Long/Short} + New Trade Position Size/2) / 1% Depth {Up/Down}. 0 price impact on forex, but works for cryptocurrencies and stocks.

gTrade also charges funding fees for position sizes and rollover fees for collateral based on the pairs net exposure and volatility to manage risk in the DAI vault. Fees are distributed to the team, project funds, liquidity providers and GNS collateral, affiliates, DAI vaults, LPs for GNS/DAI, and NFT holders to execute limit orders and liquidations in a decentralized manner.

3) Leverage permission in different markets

● gTrade currently provides cryptocurrency pair trading with leverage ranging from 4 times to 150 times.

secondary title

profit model

gTrade is divided into two pools: the DAI pool is the first line of defense, directly serving as the counterparty of the trader, which can be understood as a vault insurance pool. GNS/DAI is connected to quickswap as the second line of defense. When a trader makes a big profit and the DAI in the insurance pool is lower than the TVL deposited by the user, gTrade slowly sells GNS in the second line of defense in exchange for DAI, which is added to the first line of defense DAI pool . Conversely, if a trader loses a lot and the DAI pool is 10% higher than TV L1. It means that gTrade has made money as the counterparty, and the 110% more DAI will be repurchased in the GNS/DAI pool and destroyed.

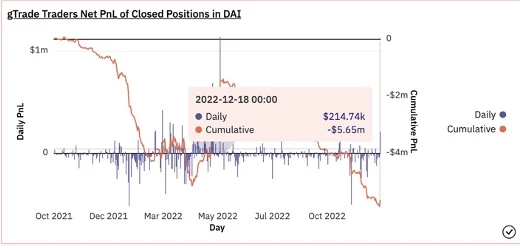

The profit model of gTrade is based on a theory: when the timeline is extended, retail investors generally lose money. gTrade is based on high leverage and the high volatility of cryptocurrencies, which further magnifies the profitability of this theory. According to this theory, gTrade actually ran for 14 months until the end of December, with a cumulative PNL of -5.65 m

secondary title

Other situations of the project

1) Security

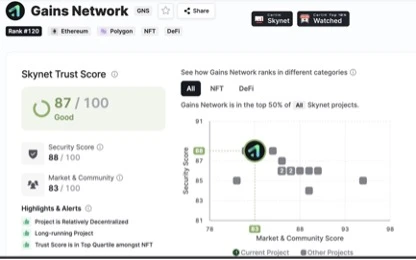

Gains Network is audited by CERTIK, a well-known auditing company. CERTIK has identified 7 issues with Gains Network v 9, 3 resolved and 3 acknowledged.

The most critical issue has to do with the centralization of the project. The overall trust score of kynet Trust Score is 87/100, which is quite a good result.

2 )GNS token

The Gains Network economy is powered by its native token, GNS. Its supply is capped at 100,000,000 GNS and is used as a failsafe mechanism that should never be triggered. GNS initially offers 38,500,000 GNS tokens. 25% of the initial supply was burned within a year, and the current supply is over 30.2 million, with 75.2% staked.

3 )GNS staking

$GNS can be pledged to earn DAI through trading activities on gTrade, 40% of market order fees and 15% of limit order fees are distributed to GNS stakers. Gains Network claims 70% of its trades are market orders, and an average of 32.5% of all orders will be spent on $GNS staking. The current GNS pool APY is 2% and the DAI pool APY is 7%.

4) DAI Vault vault

The revenue of the DAI Vault is the DAI transaction fee from the trader, and it is also used to pay the traders profit source. Users can pledge DAI and earn fees based on the transaction volume of the platform. If the vault is undercollateralized, the stakers may face losses. Since the start of December 2021 and through a variety of market conditions, not a single DAI staker has walked away with a loss.

5) GNS/DAI mining pool

Since the decentralized protocol requires a liquidity pool. Users are encouraged to offer LP support on GNS/DAI pools on Quickswap, earning both GNS rewards and dQUICK rewards (while still earning Quickswap swap fees).

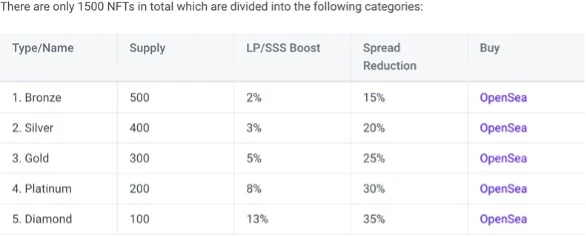

6 )GNS NFT

secondary title

text

The main difference between $GMX and $GNS is the product, $GMX relies on perpetual and spot transactions, while $GNS relies on synthetic asset transactions. Perpetual and spot trading require liquidity pools to trade, which is why $GLP exists. (and can face impermanent losses) However, it limits the amount of tradable assets because of the need for liquidity.

In contrast to $GMX, $GNS opts for a synthetic asset that does not require a liquidity pool. They can list as many tokens as they want, thereby improving capital efficiency. Synthetic assets and FX/stock trading open up new opportunities for traders as it does not require any tokenization, liquidity pools or 3rd party interactions. A limitation of synthetic assets is the need for data providers, as prices are not determined by offers/demand on the platform.

risk warning

risk warning

Team members have only one core developer

Customized DON oracle, without too much argument basis

The counterparty of the game is a trader, and the profit depends largely on the traders trading level

Disclaimer: There are risks in the market, and investment needs to be cautious. Readers are requested to strictly abide by local laws and regulations when considering any opinions, viewpoints or conclusions in this article. The above content does not constitute any investment advice.

Copyright statement: If you need to reprint, please add the assistant WeChat to communicate. If you reprint or wash the manuscript without permission, we will reserve the right to pursue legal responsibility.

Disclaimer: There are risks in the market, and investment needs to be cautious. Readers are requested to strictly abide by local laws and regulations when considering any opinions, viewpoints or conclusions in this article. The above content does not constitute any investment advice.