Original title: Uniswap Difficult to Make Money? Pure spot DEX has no money way

$UNI has been widely criticized for being representative of a meaningless governance token. In fact, this matter is far from being as simple as turning on the sharing switch and then using the income for distribution or repurchase. Even as the leader of spot DEX, Uniswaps moat is far from as wide as imagined, and its profit potential is worrying. Why is this so? This article will use detailed cases and data to analyze it for you.

This article will analyze from the following points:

The connection between DEX and users is weak, and the moat is shallow

UNI no further development of added value

CEX spot trading is free, and it is more difficult to obtain pricing power

first level title

The connection between DEX and users is weak, and the moat is shallow

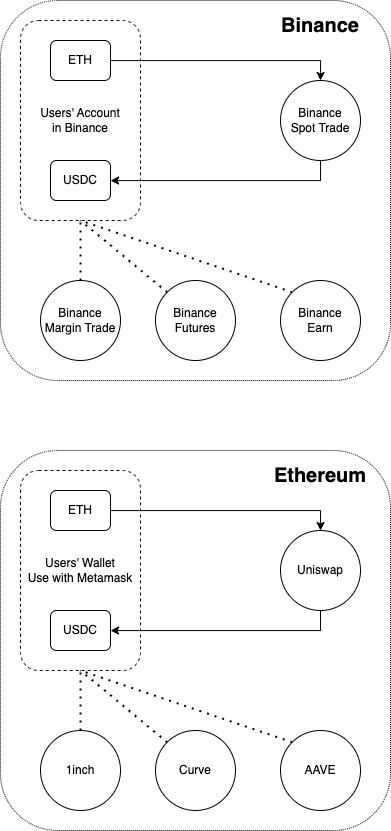

The markets expectations for DEX are largely derived from the excellent performance of CEX platform tokens in the past. However, the differences between DEX and CEX in many aspects lead to significant differences in their profitability. See the picture below, using Binance to trade spot means that your coins are stored in Binance, you are using Binance’s APP, funds are circulating in Binance’s ecosystem, and you are constantly connected and trusted with Binance’s ecosystem. However, Uniswap only works in the trading part, and the funds do not stay in Uniswap. The counterpart of Binance is Ethereum instead of Uniswap, and the connection and trust are accumulated in Ethereum. That is to say, CEX and L1 are at the same level, and spot DEX can only benchmark against one module in CEX.

This makes it impossible to expand horizontally as easily as CEX, and it also faces fierce competition in the ETH ecosystem:

Users can switch to competing products such as Curve at will

Aggregated transactions such as 1inch make full use of the overall liquidity of DeFi, and the price is bound to be better

The highly homogeneous competition of imitation disks, the cost of rolling and rolling, and the compression of profit margins

DEX is one of the few in DeFi that does not need to accumulate user (non-LP) funds, which makes its historical reputation value slightly lower

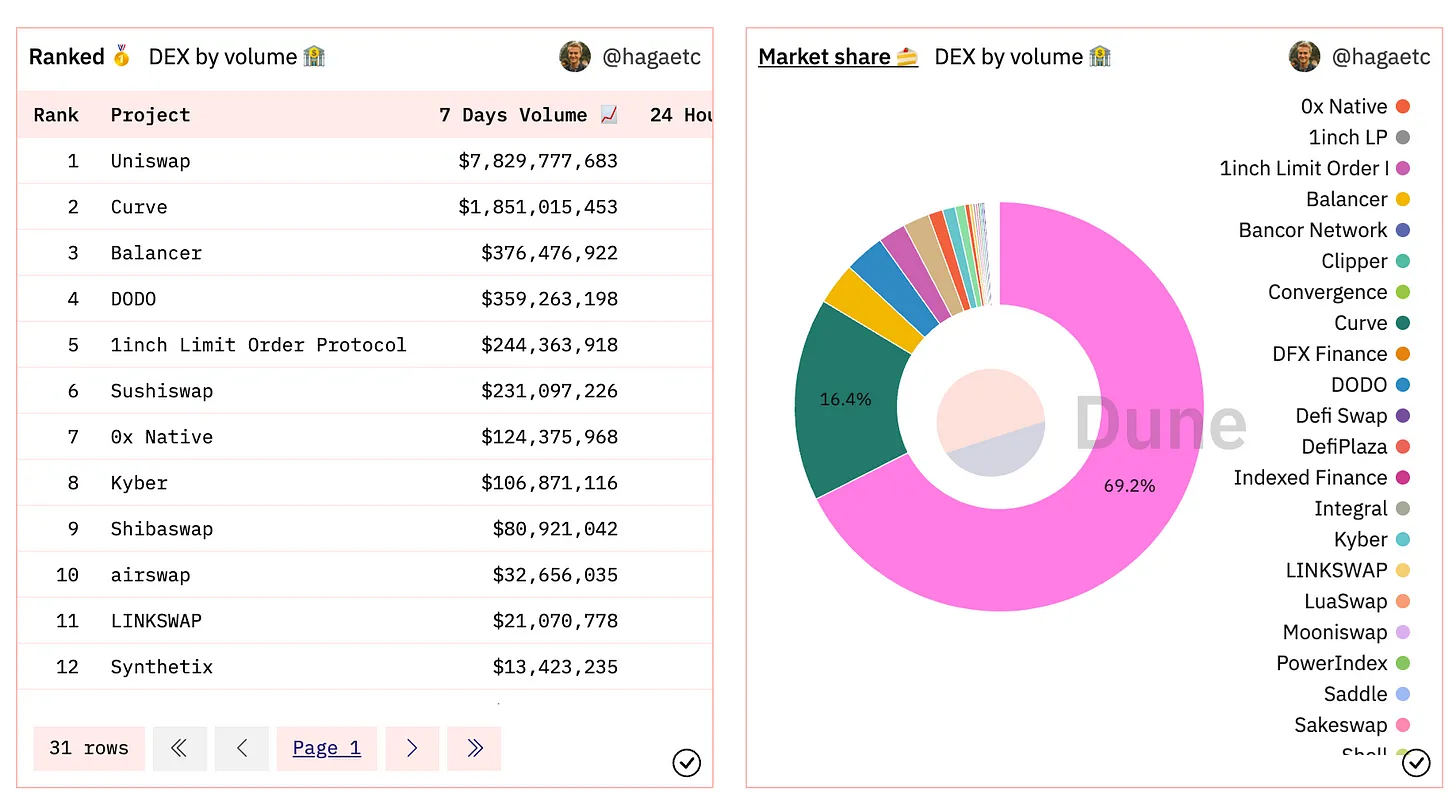

Therefore, although Uniswap is the leader in terms of trading volume, if it turns on the commission switch, it is likely to have a negative impact on its share. This time the UNI community rejected the switch proposal.

UNI no further development of added value

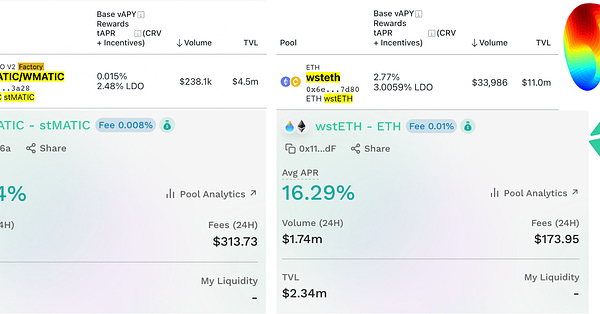

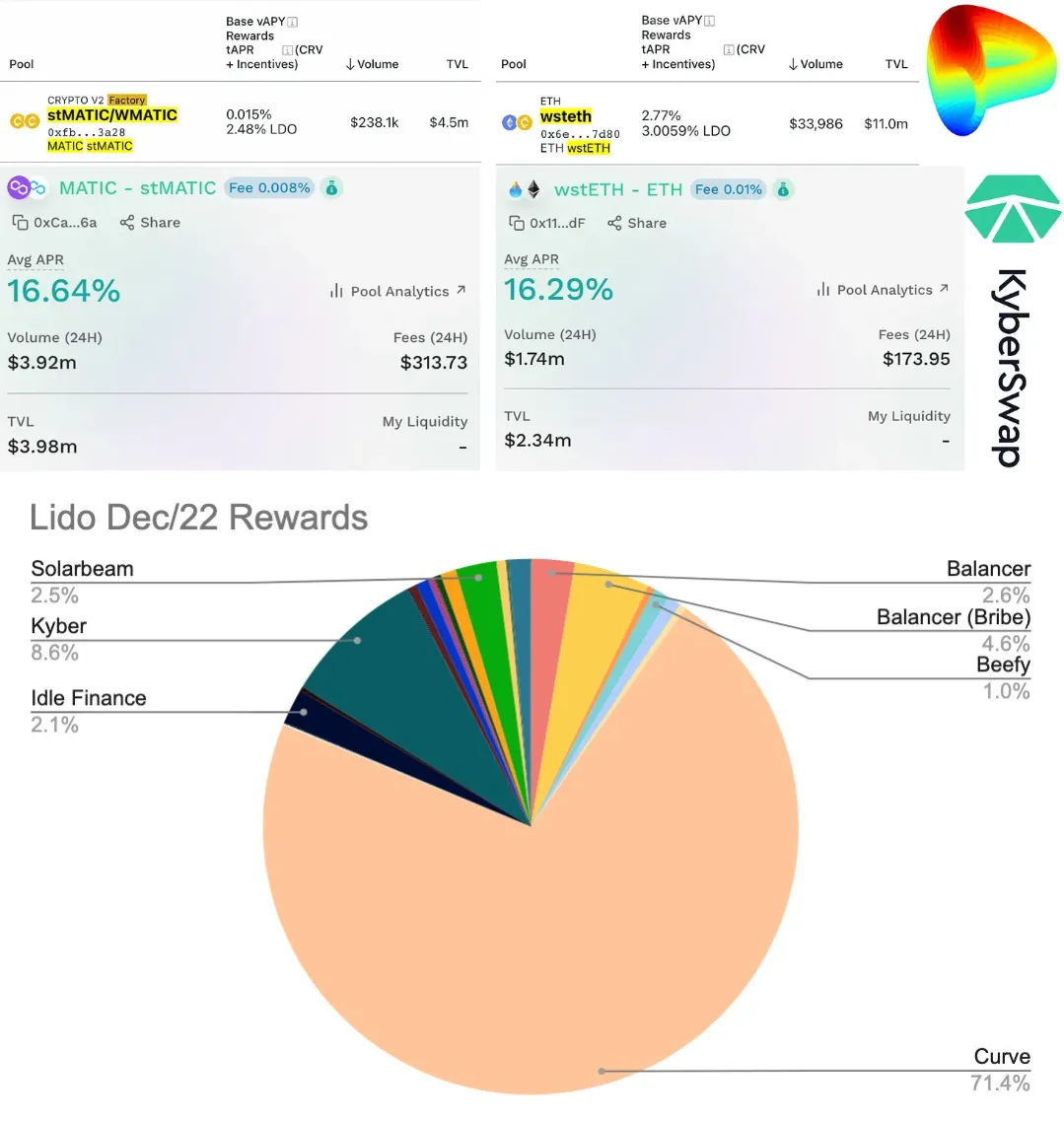

tweetstweetsIt can be seen how Curve thrived in LSD War.

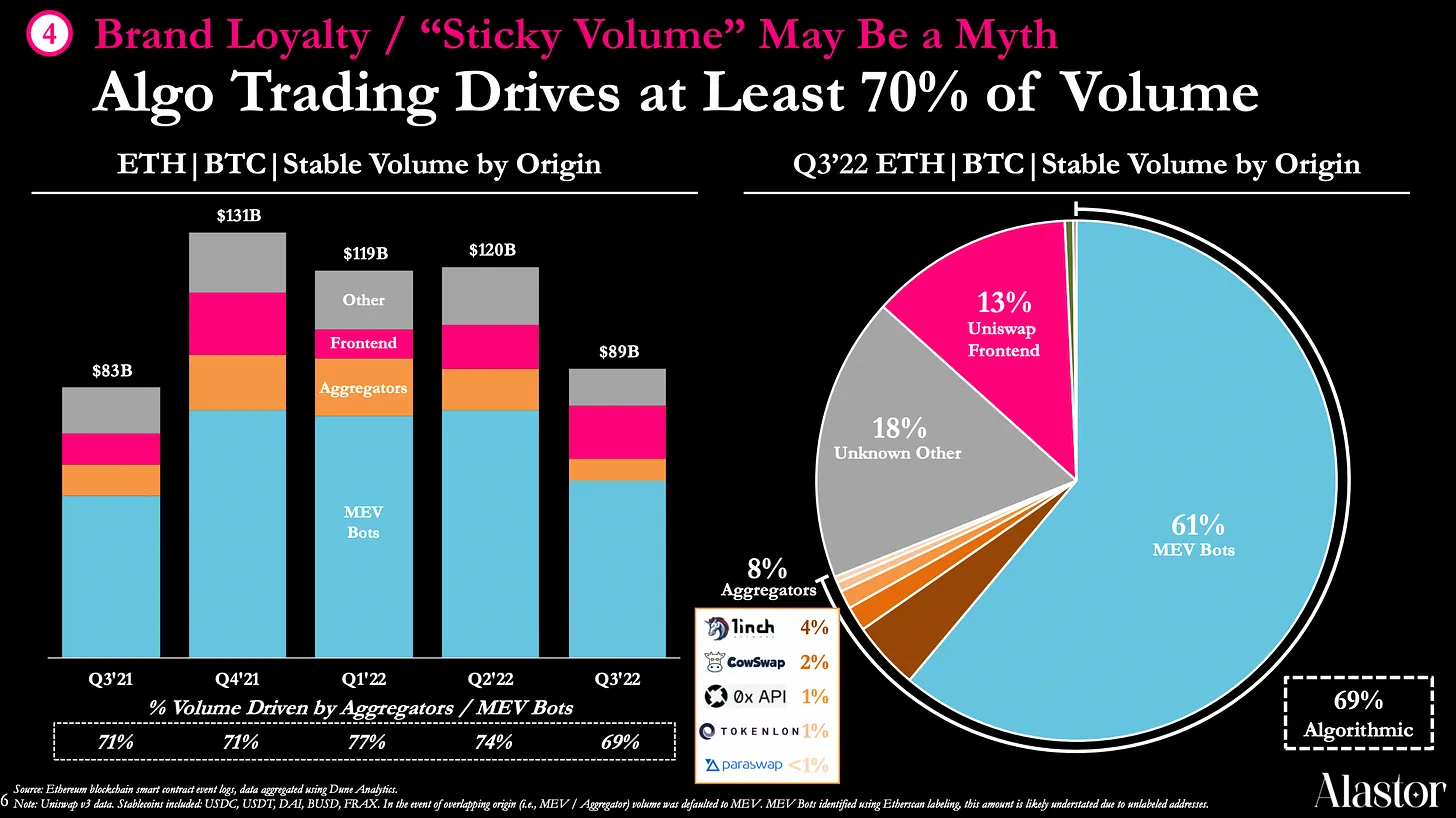

Look at the famous traffic distribution chart below. From a pessimistic point of view, most of the trading volume is MEV Bot, reflecting its current weak position compared to CEX. Only 13% of the trading volume comes from its own traffic; but From an optimistic point of view, 13% of its own traffic is much higher than the 8% of aggregator traffic, which has made it difficult for imitation disks to catch up. The traffic advantage brought by brand value is real. If Uniswap can do a good job in other added value, then there will naturally be some profit margins.

However, the UNI team has done nothing to increase the added value, resulting in the site that originally belonged to it being divided into imitations. In the Alt-L1/L2 LSD competition, Kyberswap, Uniswap V3s imitation disk, got a piece of the cake from the LDOs incentive budget after Curve because of its good incentives. Just imagine how powerful a Bribe system Uniswap would be with the same complete incentives as Curve, but UNI holders can only imagine it in their dreams now.

CEX spot trading is free, and it is more difficult to obtain pricing power

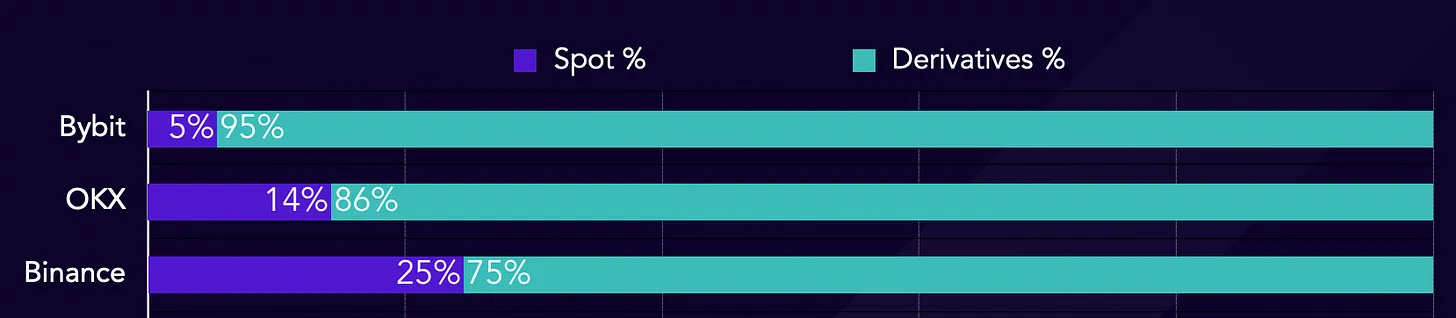

To make matters worse, in the past 22 years, it has become a common phenomenon that the contract trading volume of top exchanges far exceeds the spot trading volume, and there is also a trend of free spot trading. Binance waived handling fees for mainstream currencies such as BTC/ETH, while Bybit is free of handling fees for the entire spot line, which means that for CEX, the spot spot has become more of a means of acquiring and maintaining customer activity, making money through derivatives transactions such as contracts. In this way, it is more difficult for Uniswap to obtain pricing power, and as mentioned above, it does not have the same horizontal expansion ability as CEX, and can quickly establish an advantage in the derivatives track.

first level title

UNIs revenue is still low under optimistic circumstances, the valuation is not low and not enough to cover team expenses

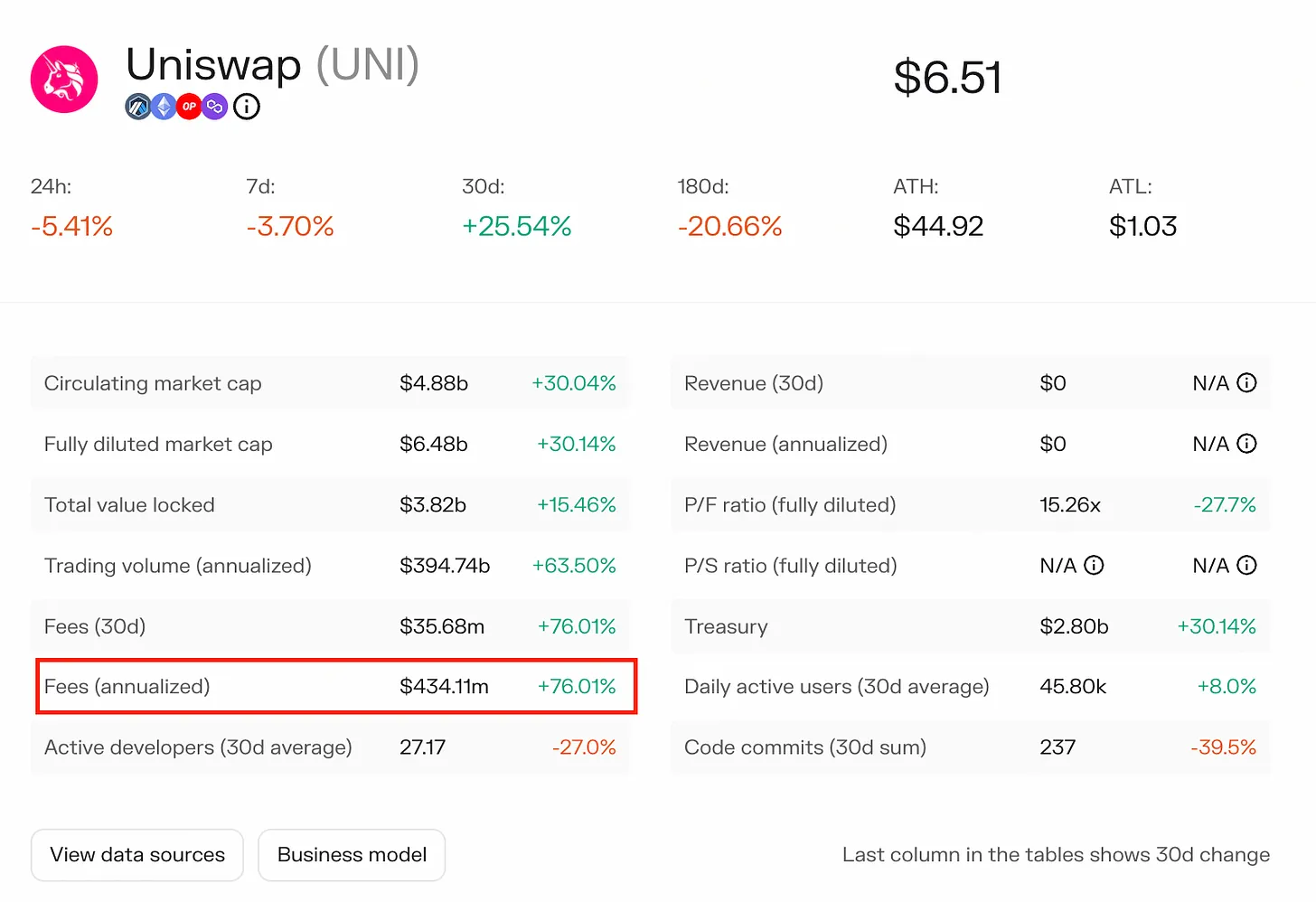

Uniswaps current year fee income is projected to be $434M. Even in the most ideal situation, if a 10% commission is charged for all trading pairs, then the revenue of the protocol is only $43 M, the full circulation market value/annual revenue (P/S) = 153, and the current GMX P/S= 15 , by comparison Uniswap is still 10 times more expensive.

And the income of the agreement is not equal to the profit that can be distributed to the currency holders. After all, it costs money to support the team. How much does the UNI team cost per year? The smaller MakerDAO is $34 M, and Lido is $24 M. The number of employees on Uniswap Linkedin is much larger than these two. It is estimated that $50 M will be spent a year. In this way, optimistically, Uniswap will lose 50-43 = $ 7 M a year.

Source: Tokenterminal

tweetstweets), and Uni not only missed the LSD market, but now it has not even turned on a split switch.

To sum up, the connection between DEX and users is weak, and the team ignores the construction of added value. The opening of Uniswap may affect market share and growth. Even if it is successfully opened, the current valuation is not low. In fact, if the UNI team is willing to face up to market demand in the future, it is not impossible to use its brand advantages to regain its glory. But not today, not now.