The main points

first level title

The main points

Economic data continued to point to more persistent inflationary pressures than the Fed had hoped. It is now basically foreseeable that interest rates will be raised twice in the first half of 2022;

Silvergate has attracted interest from many prominent buyers despite being the most shorted stock in the U.S. stock market.

first level title

SEC Continues Regulation Through Enforcement Amid Lack of Digital Assets Legislation

Last week, the U.S. Securities and Exchange Commission (SEC) took two significant actions related to digital assets. The actions follow allegations last month that Genesis and Gemini offered and sold crypto-asset securities without registration through the Gemini Earn lending program.

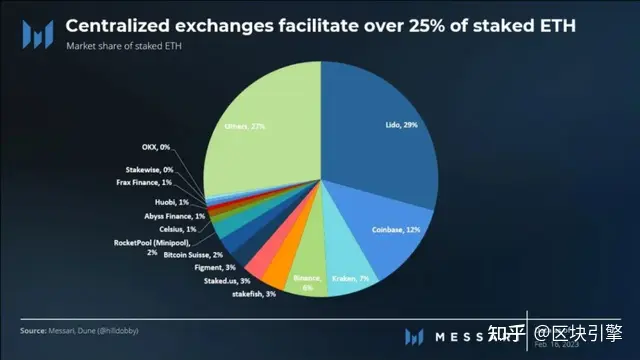

The first action occurred on February 9, when the SEC continued to regulate through enforcement in the absence of digital asset legislation. The SEC charged Payward Ventures, Inc. and Payward Trading Ltd. (both commonly known as Kraken)” failed to register its “Offer and Sale of Cryptoasset Staking as a Service” program. The Kraken entity settled with the SEC by paying $30 million and immediately ceased offering or selling securities through the U.S.-based crypto asset pledge service or pledge program. Additionally, without admitting or denying the allegations in the SEC complaint, Kraken has agreed to permanently Stop doing staking business in the United States.

The announcement drew multiple responses from industry leaders and the SEC. The first came from SEC Commissioner Hester Peirce, who opposed her organizations decision. Peirce claimed that registration is impossible and that “cryptocurrency-related products are difficult to navigate through the SEC registration pipeline.” Furthermore, she hinted that there is currently insufficient guidance for companies like Kraken to make registration-related decisions. wise decision.

Industry leaders then responded. Coinbase CEO Brian Armstrong and its chief legal officer Paul Grewal, along with Kraken chairman Jesse Powell, echoed Peirces objections on Twitter. They responded that there is currently no way to enroll in such a program.

The following day, Feb. 10, Coinbase backed up its executives claims. Coinbase published an official statement written by Paul Grewal stating that staking is not a security under the Securities Act of 1933 and the Howey test. The exchange added that securities laws would prevent U.S. consumers from accessing basic crypto services and force them to use offshore platforms. On Twitter, Brian Armstrong added that the company would be happy to defend Coinbase staking in court.

On the same day, SEC Chairman Gary Gensler gave interviews to Bloomberg and CNBC to clarify the regulators decision. In Kraken’s case, Gensler explained that Kraken made no disclosures that would allow investors in the general public to understand the company’s handling of token deposits. More broadly speaking, exchanges and platforms are generally non-compliant, and business functions need to be differentiated and registered separately. There is sufficient guidance, forms and employee support to help companies register and draft disclosures, he added.

When Bloombergs David Westin asked if there was further action, Gensler responded: Whether you call it earn, lend, staking-as-a-service, annual yield, the labels dont matter, the economics matter, and the investing public is Putting their hard-earned money into a platform and getting those benefits, the law says they need to disclose, companies need to register.”

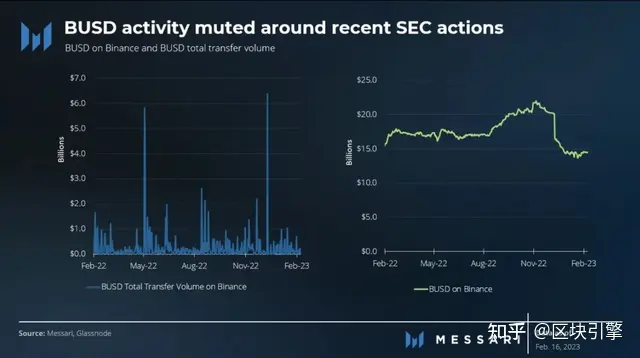

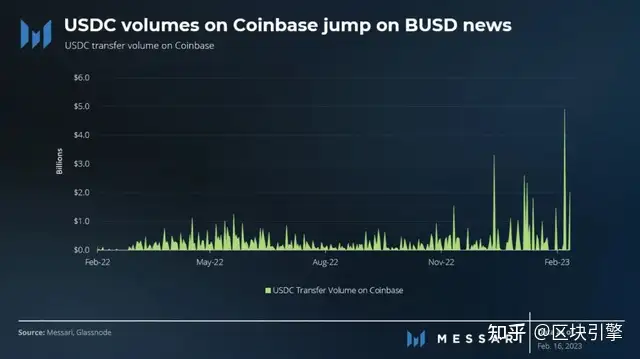

Immediately after the SEC threatened legal action, Paxos announced that it was terminating its relationship with Binance and would stop issuing new BUSD tokens, effective February 21, as directed by the New York Department of Financial Services (NYDFS). Additionally, the firm assured BUSD holders that they will be able to redeem their funds in U.S. dollars or the regulated U.S. dollar-backed stablecoin Pax Dollar (USDP) until at least February 2024.

The next day, February 13, Binance CEO Changpeng Zhao responded that the exchange will continue to support BUSD for the foreseeable future and will begin to adjust its products accordingly, removing the use of BUSD. Later that day, Paxos emailed The Block a statement confirming receipt of the SECs notice and saying it categorically disagrees with the SECs assertion and that it will actively filed a lawsuit and clearly have no other allegations against Paxos.

first level title

some inspiration

These two actions by the SEC leave a lot of room for public speculation. However, some first-order effects can reasonably be inferred from the representations of all interested parties.

Second, mass investors should expect long-term volatility in digital assets due to litigation proceedings and settlements between companies and regulators. There are clear differences of opinion on whether there are enough rules and forms to cooperate with regulators. Moreover, industry leaders are determined, at least in rhetoric, to take on regulators in court rather than settle out of court.

Third, any business engaged in issuing and trading unregistered stablecoins should anticipate future actions by the SEC. Gensler made it clear that the SEC considers stablecoins to be securities in part because of their similarities to money market accounts and money market mutual funds. However, due to past efforts, such as Circle’s attempt to go public last December, some issuers and stablecoins may be further along in compliance than others.

first level title

Its been a busy week for key macroeconomic data. Much-anticipated inflation data is released on Tuesday. CPI and Core CPI came in at 6.4% and 5.6%, beating expectations by 0.2% and 0.1%, respectively. Both doves and hawks can point to areas to support their positions. The hawks pointed to a sharp rise in household food prices (+11.3% yoy) and double-digit increases in electricity prices. The report also includes updated category weights and methodological changes that make it more difficult to draw conclusions from the data.

Later in the week, the market saw both retail sales and producer price index (PPI) well above expectations. Initial jobless claims were below the downward trend, suggesting that the labor market remains strong despite tightening fiscal conditions. Stock markets fell sharply on the PPI news, while cryptocurrencies continued to post gains. By the end of the week, the case for the Fed to hike rates twice in March and May looked strong. Markets are pricing in an 82% chance of a rate hike in March and a 67% chance of a hike in May.

first level title

Silvergate Capital shares continue to gain attention from financial institutions

Its been a month since we last reported on Silvergate Capitals (SI) Q4 2022 earnings and Block.one and Brendan Blumers massive ownership acquisition in November 2022. Following the report, SI shares jumped more than 50% amid a string of lawsuits from FTX clients, an alleged DOJ fraud investigation and the departure of Silvergate board member Rebecca Rettig. Despite the headlines and legal headwinds, SIs clients are likely to stick with the worlds largest digital asset trading network.

Two weeks ago, MicroStrategy chairman Michael Saylor told CNBC that the company would remain a client of SI. He said, We will continue to do business with Silvergate. Mismanaged institutions have collapsed - FTX, Alameda, Voyager, BlockFi. Silvergate is a responsible institution. He added, I think they have done so in a responsible manner Doing business the right way, they are good citizens of the ecosystem.

During the same period, investors and financial institutions seemed to agree with Saylor. Overall, funds and investors are net long SI stock, even though it was recently the most shorted stock with a 73% short interest. Interest in SI has only grown since the end of January:

January 31 - BlackRock increases its stake from 5.9% to 7.20%;

February 2 - State Street increased its stake from 5.3% to 9.32%;

February 9 - Vanguard increases its stake from 8.59% to 9.47%;

February 10 - Block.one increased its stake from 7.46% to 8.09%;

February 10th - Brendan Blumer increased his stake from 9.27% to 9.90%;

Feb. 13 - Group One Trading has a 7.27% long position. 93.64% of this position is in call options. The company also held a short position equivalent to 90.73% of its long position;

February 14 - Citadel Securities has a 5.50% long position. 92.63% of this position is in call options. The company also has a short position that is 77.56% of the long position;

February 14 - Susquehanna Intl holds a 7.5% long position. 81.81% of this position is in call options. The company also holds a short position that is 92.93% of its long position size;

Hedge funds such as Citadel Securities and Susquehanna Intl made headlines earlier this week for disclosing their ownership of SI stock as the 13G filings came due. However, a closer look at the 13 Fs of the aforementioned listed hedge funds reveals that the markets reaction has been largely exaggerated. While these funds are net long, they also hold a large short position relative to their long position. That suggests the funds are making markets, not the way the headlines would have the public believe. All in all, this could mean investors can expect a higher degree of volatility in the months ahead.

Summarize

first level title

Summarize

The SEC continues to regulate digital assets through enforcement actions, such as the recent charges against Kraken and potential charges against Paxos. Industry leaders responded by disagreeing with the SECs position, with some willing to challenge it in court. The actions could lead to long-term volatility in digital assets as companies and regulators battle in court. Regulation remains the biggest risk facing cryptocurrencies.

Originally by Messari - Tom Dunleavy, Chris Collar