Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

This column aims to cover the low-risk return strategies based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be ruled out) to help users who hope to gradually increase the scale of funds through U-based financial management to find more ideal interest-earning opportunities.

Previous records

New opportunities

Movement Incentive Program

The Movement Foundation announced the launch of the DeFi Spring program on April 24. The activity will last for one year and will provide up to 250 million MOVE as incentives.

The DeFi Spring plan is divided into two parts: the first part is the liquidity incentive based on Move. Users can obtain incentives by trading or providing liquidity in Dapps such as Arche Protocol, Canopy, Echelon, Joule Finance, LayerBank, Meridian, Mirage Protocol, Mosaic, Movedrome, MovePosition, PicWe, Pontem Lumio, Route-X, YUZU, etc. This part of the incentive is now online; the second part is the redeposit incentive for Cornucopia assets. The redeposit window will be opened after the Cornucopia assets are unlocked.

Currently, it is recommended to deposit through lending protocols such as Echelon and LayerBank, or to form LP through DEX such as Meridian and YUZU. The annualized yield of some stablecoin pools can exceed 20%.

Infrared Points Program

Berachains leading project Infrared has officially launched the points plan, and early interactive behaviors will automatically trace points.

We have highlighted Infrared in our article on March 31, and have also written a special article to introduce the interactive strategy. For details, please refer to Raising over US$18.75 million, how to scoop up Infrared, the only leader in Berachain .

Symbiotic receives financing

The re-staking protocol Symbiotic announced last week that it had completed a $29 million Series A financing round, led by Pantera Capital, with participation from Coinbase Ventures and more than 100 angel investors from teams such as Aave, Polygon and StarkWare, including Stani Kulechov, Sandeep Nailwal, Anton Bukov, Anurag Arjun, Andrew Huang and Eric Wall.

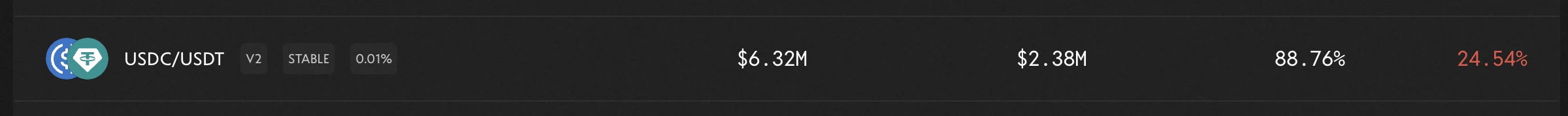

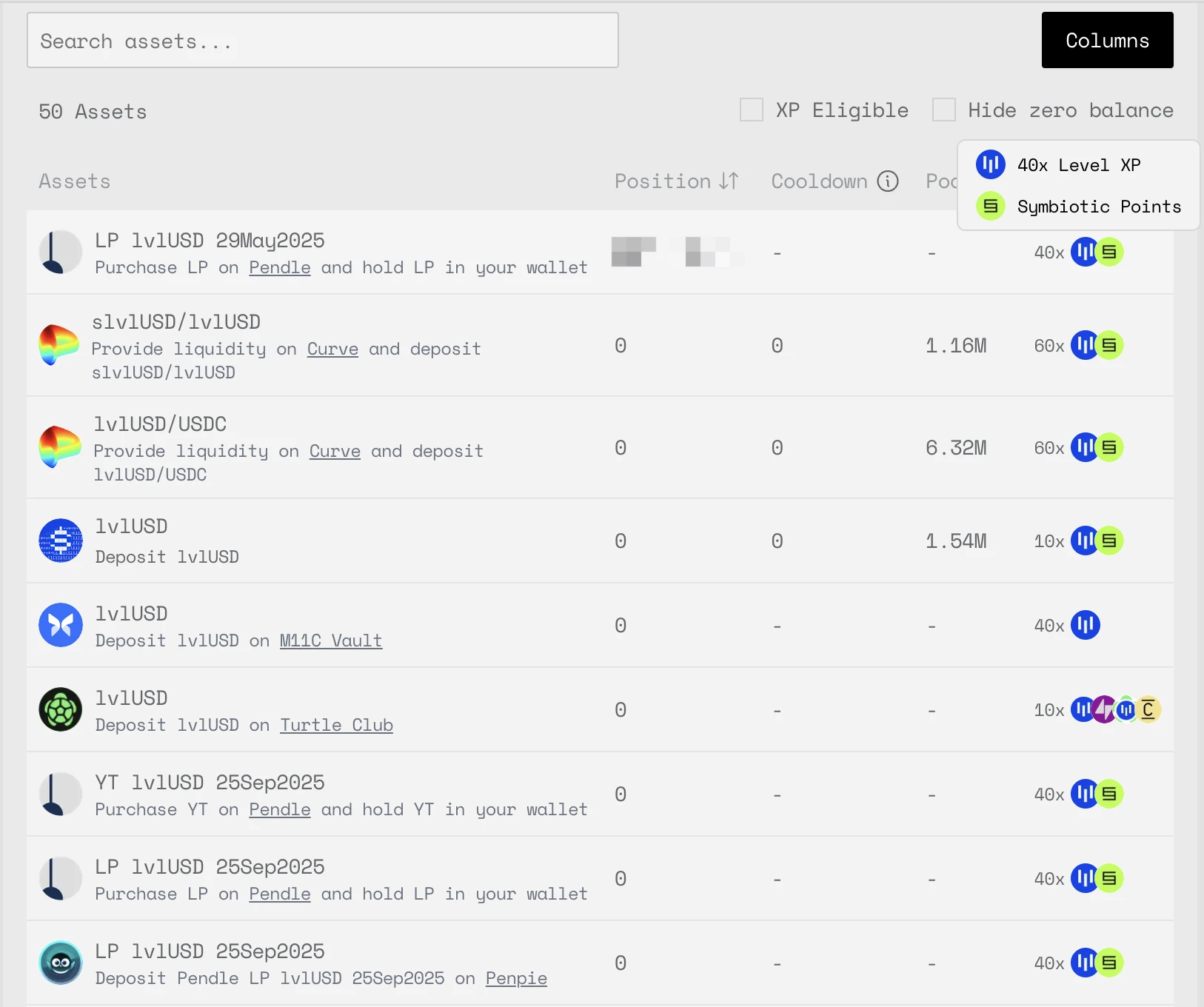

Symbiotic launched the points program a long time ago, but there is still a relatively efficient opportunity at the moment - using another popular stablecoin Level (portal: https://app.level.money/farm?referralCode=8vinem ) to kill two birds with one stone.

Due to the partnership between Level and Symbiotic, currently operations such as staking or forming LP on Level can simultaneously obtain multiple rewards such as basic income, Level points, Symbiotic points, etc.

Perenas new strategy

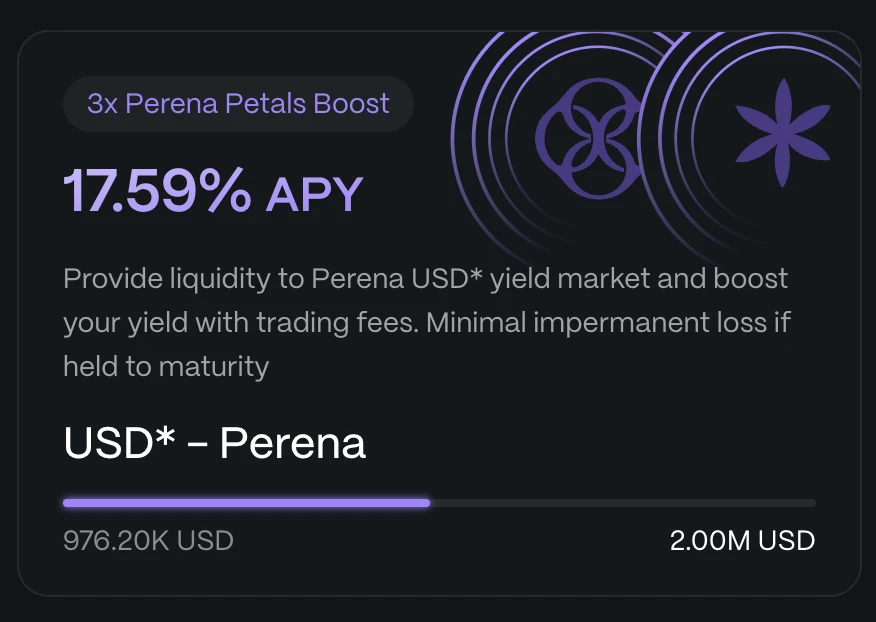

The Solana ecosystem stablecoin project Perena (optional invitation code: GRLJKL), which has been recommended many times before, fixed the points display problem last week. Now you can check your points and rankings in real time.

In addition, Perena has also cooperated with Exponent to renew a new pool. LPs who are currently forming USD* in Exponent can get 3 times the Perena points bonus (4 times for users who formed the previous pool), and can also get an APY of 17.59%.

Unexpected situation: Loopscale was stolen

Earlier yesterday, the previously mentioned Solana ecosystem lending protocol Loopscale was attacked due to the manipulation of the RateX PT token pricing function, resulting in the theft of approximately 5.7 million USDC and 1,200 SOL, accounting for approximately 12% of the platforms total funds.

Fortunately, Loopscale followed up this morning to say that the hacker has agreed to return most of the stolen money, so this incident ended up being just a false alarm.

The code risks of on-chain protocols can never be eliminated. Taking this as a lesson, it is important to remember to do a good job of warehouse segmentation.