Original author:CapitalismLab

Original author:

1/ @LexerMarkets decided to cooperate with Camelot at the beginning of January. So far, the public offering time has not been set. In this era of Fomo, choose a project that can be airdropped without Fomo~

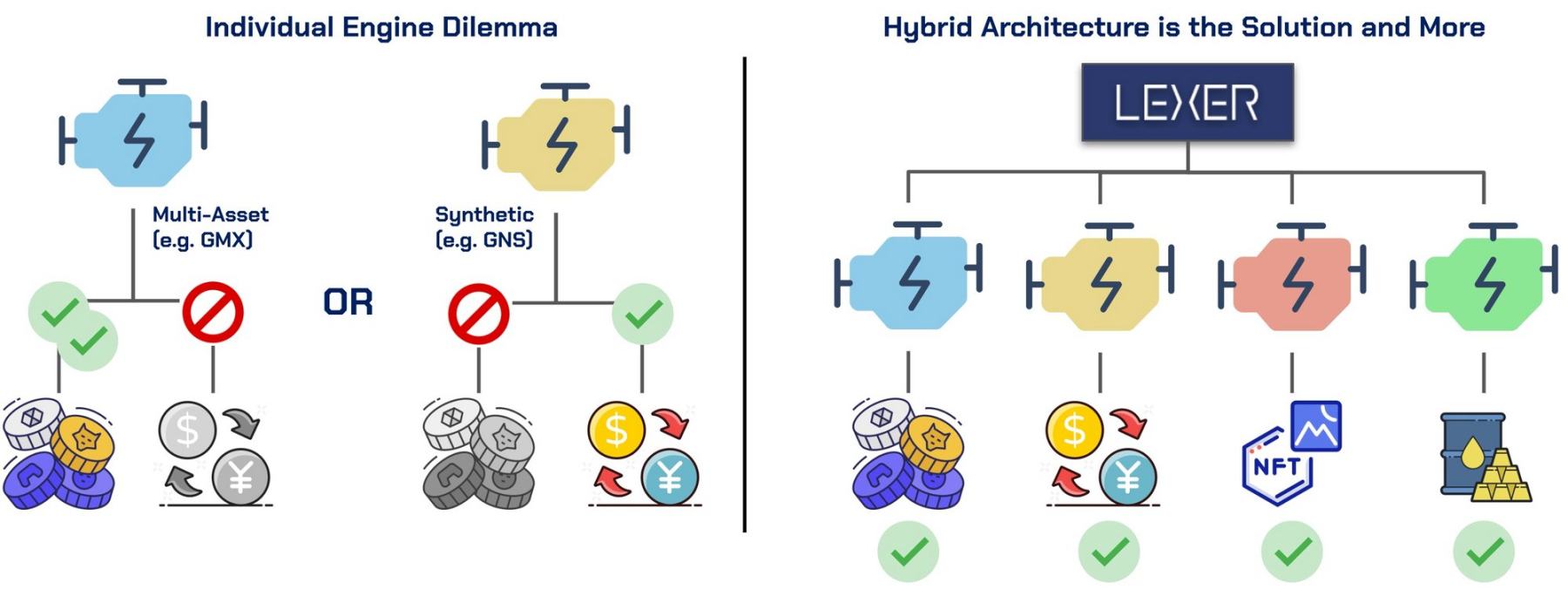

@LexerMarkets is a derivative project that integrates and improves GMX+GNS. This Thread will analyze its mechanism, advantages and disadvantages in detail, and discuss the correct iteration posture of the DEX Perp track

2/ In short, @LexerMarkets mainly did the following things:

1. Use GMX’s Index Asset model for cryptocurrencies, and GNS’s synthetic asset model for foreign exchange/stocks/commodities

2. Integrate all asset transactions into one platform, and fully support advanced mechanisms such as Spread/ Funding Fee

3/ From Bulgaria Seeds previousarticlearticle

Among them, it is not difficult to see that GMX/GNS does have unique competitive advantages.

One is that the volatility of cryptocurrencies is indeed extremely high, and GMX’s Index Asset LP full guarantee model can still survive the extreme market conditions relatively stably, and there is no need to temporarily change parameters to sacrifice user trading experience.

Read more

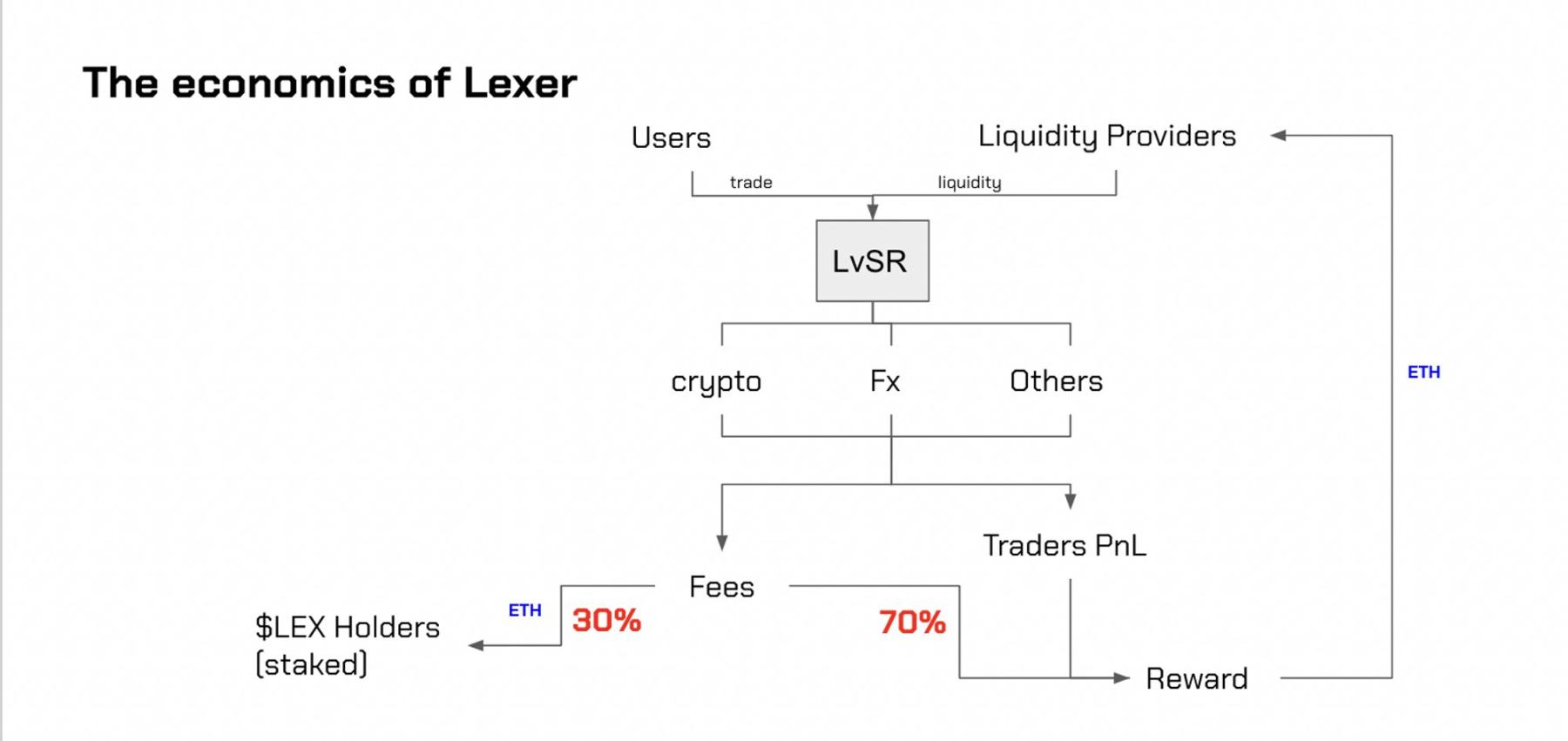

5/ Fork GMX/GNS and then modify a lot of items, full of tricks. However, few projects can really achieve the following two points that can improve product competitiveness:

1. For the LP side, reduce risks and increase returns

2. For the transaction side, improve the transaction experience

Many projects are just changed casually, or even negatively optimized, and then swipe data to attract exit liquidity.

6/ After all, GMX and GNS have gone through many iterations and are the winners in the market, and optimization is not easy.

For example, if you change the LP of GMX into a pure stable currency, and there is no risk control mechanism such as GNS, it may be troublesome when the market fluctuates violently, and you will really fall into a death spiral. I dont know if it will happen at that time Someone take this to Fud GMX meow.

7/ Lexer seems to be the current optimal solution for the LP side to choose to integrate, focusing on the optimization of the trading experience. It seems to be particularly concerned about avoiding negative optimization. For example, although it supports the unified margin mode that needs to be deposited into the account before trading, it also retains the mode of direct billing. In fact, as long as you have traded on the chain, it is not difficult to feel the advantages of direct billing:

8/ 1. Simple operation, fast speed, seamless experience

2. Greatly reduces the perception of centralization

If all transactions are required to be deposited just to promote a unified margin model, then it is a waste of money.

9/ Others are also some obvious improvements to the trading experience with relatively high certainty, such as compounding - helping you roll and increase leverage, which seems to be the way to make a lot of money by shorting in Luna; needless to say about partial liquidation; NFT of positions is you When you want to change your account, you can directly send the position to another address, instead of closing it here and opening it there again, saving some costs.

10/ But then again, although @LexerMarkets has integrated the advantages of the two and made some improvements with relatively high certainty, it seems to lack explosive points, and it feels too robust. After all, it needs to face the first-mover advantage of GMX/GNS. As a late-mover platform, if the experience advantage is not obvious, it is difficult to attract real users to migrate. (Note that it is a real user, do not take the example of swiping data)

11/ In order to grow, the team seems to be similar to GMX in terms of profit distribution, platform currency holders and LP 3/7 open, the team will not take it for the time being. At present, only 19% of GNS’s fee income is given to LPs. Because it is not fully open source and its mechanism is complicated, it is very difficult to imitate. If Lexer can do a good job here and add profit to LPs, there may be some opportunities. Of course, this will also make this market more rolled up.

12/ All in all, I have seen a lot of DEX PERP track projects, most of them are pure fork or negative optimization, Lexer is at least a relatively sure positive integration and optimization, but I always feel that there is a lack of a little explosive point, continue to observe. Considering that the coin issuance plan is undecided, the best way to participate is to participate in airdrops. Recently, several simulated trading competitions have been held. The official push said that there will be another one starting from March 3: https://lexer.markets/?r= capitalismlab