Author: Colin Wu

The content of this article is only for information sharing, and does not promote or endorse any business and investment behaviors. Readers are requested to strictly abide by the laws and regulations of their regions

According to the latest requirements of the Hong Kong Securities Regulatory Commission, if a licensed platform operator intends to provide virtual assets to retail customers, it should also ensure that the selected virtual assets are qualified large-scale virtual assets and meet the following specific token inclusion criteria. Qualified large-scale virtual assets refer to virtual assets included in at least two accepted indices launched by at least two independent index providers.

The index should be investable, meaning that the constituent virtual assets should have sufficient liquidity. The index should be calculated in an objective manner and be rule-based. Index providers should have the necessary professional knowledge and technical resources to construct, maintain and review the index compilation methods and rules.

A licensed platform operator should ensure that at least one of the two indices is launched by an index provider with experience in publishing indices for traditional non-virtual asset financial markets, such as an index tracked by an index fund authorized by the SFC provider.

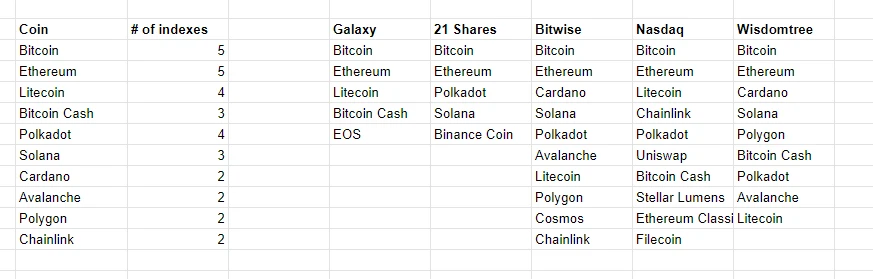

According to the statistics of @tier 10 k, the indexes launched by five mainstream traditional institutions are currently ranked as recorded in the table. Bitcoin BTC and Ethereum ETH are recorded in all indexes; the second is Litecoin LTC and Polkadot DOT, with four indexes included; the third is Bitcoin Cash (BCH), SOL, with three Included in the index; fourth place is Cardano Avalanche Polygon and Chainlink, with two indexed. In addition, EOS BNB STOM FIL ETC XLM UNI etc. are also counted once. However, it should be noted that the major indexes will also increase or decrease as the market changes.

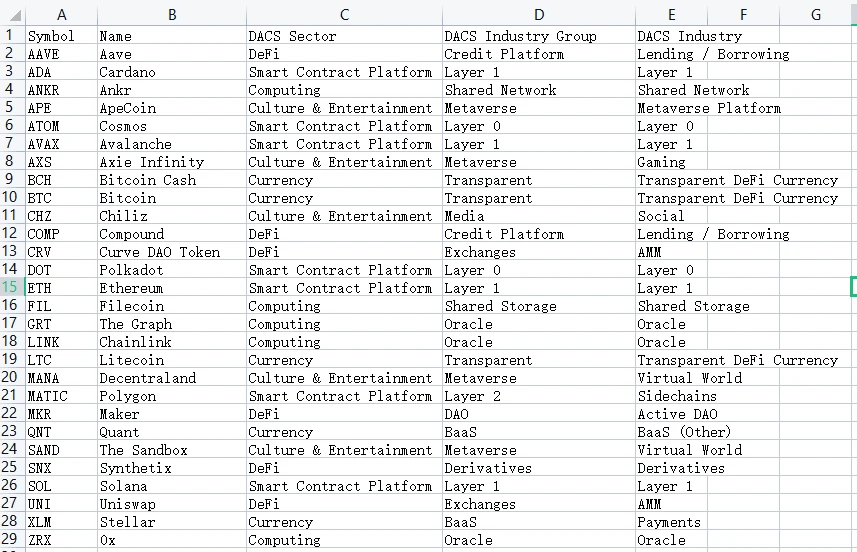

It is worth noting that the Hong Kong Securities Regulatory Commission emphasizes that it only needs to be included in a traditional index, which means that the above-mentioned ones that are included once have a chance. Because, for example, the index launched by CoinDesk is relatively extensive, including 28 cryptocurrencies. In addition, there are various categories such as DeFi entertainment smart contract platform index and so on.

Kaiko Research also discussed this in detail, emphasizing the importance of liquidity:

Measuring the value of a token using market cap alone is not enough, we need to incorporate other metrics, especially liquidity. Liquidity as one of the criteria for index construction is commonplace in traditional finance, and cryptocurrencies are no exception. According to Nasdaq, their indices are constructed using strict liquidity criteria. Im not sure how this justifies holding XLM, ETC or UNI. In December, I ranked the top 28 coins by liquidity: XLM was at the bottom, UNI was at 22nd, and ETC was illiquid to even be included.

The inclusion of Bitcoin Cash, Polkadot, and Litecoin worries me from a liquidity standpoint, and I believe that if the SFC is to be included in the broader market, they must use more liquid tokens in their selection. First, all three coins rank poorly in the 2% market depth, which is measured by the order volume on the current exchange order book within 2% of the current price.

We need a more robust approach to index construction that takes liquidity into account along with market capitalization. DOGE is more worthy of SFCs consideration because it has very superior liquidity. Some of the tokens that can be considered under the new rules of the SFC are not of the highest quality from a fundamental and liquidity standpoint. This is actually an issue with cryptocurrency index construction, but the SFC needs to give due consideration to liquidity as they may exclude some tokens with better fundamentals and liquidity because they are not included in both indices. Any coin included in the new parameters should see new investment and improved sentiment, and Asia may be increasingly well positioned to embrace a new wave of crypto investment.