Original author:CapitalismLab

Original author:

Recently, Trade joe V2 became popular because it grabbed a large amount of Arb trading shares from Uniswap, and the currency price doubled rapidly. So how exactly does it do it? What needs to be paid attention to to provide liquidity?

This article will take you to understand the mechanism of Joe V2 in simple terms, analyze why it can obtain a large share in $ARB transactions, and the advantages and disadvantages of the product, to help you better understand DEX.

A brief summary of Trade Joe V2:

AMMs are like order books, using discontinuous liquidity

Minimum price precision is based on a scale rather than a fixed value

Vertically aggregated liquidity brings better composability

Liquidity incentives based on transaction fees obtained by LPs and effective TVL

AMM mechanism

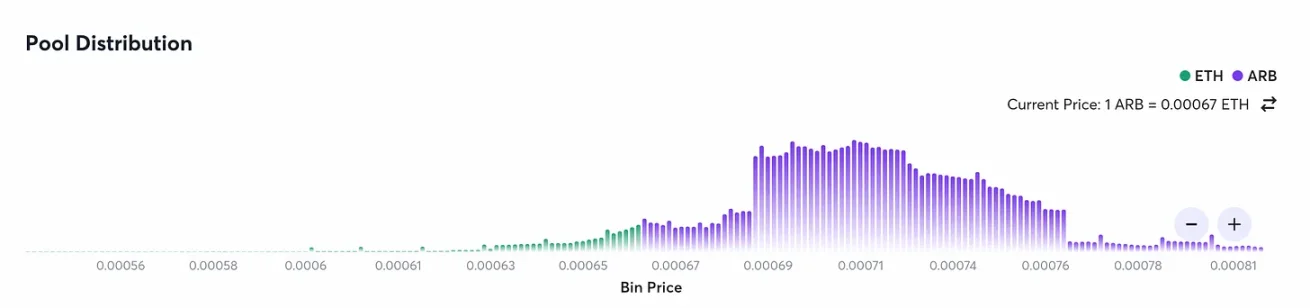

Next, take the ARB/ETH 20 bps pool in Joe V2 as an example for in-depth analysis. First, let’s take a look at the liquidity distribution of the pool. At first glance, it looks quite similar to UNI V3.

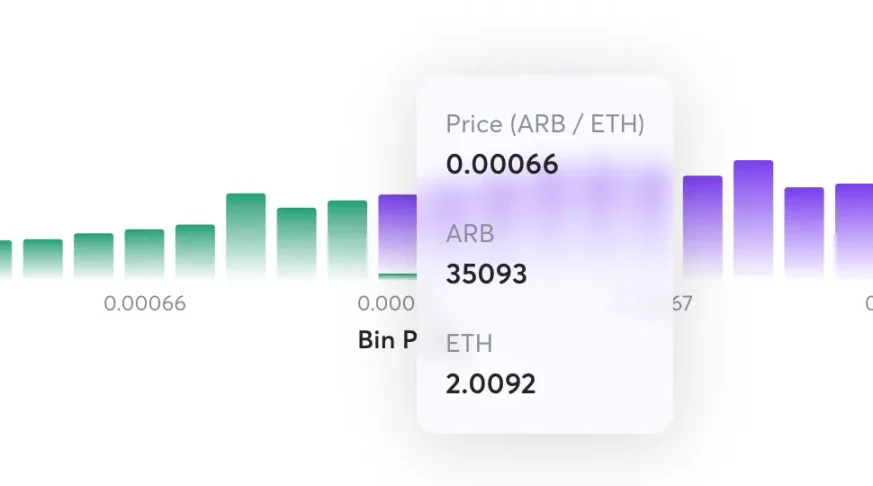

So whats the fundamental difference? A long bar (bin) of Joe V2 corresponds to a single point price, which means that unless you exhaust the liquidity of this bin, the price will not change. For example, in the picture below, you can see that there are about 35 k Arb and 2 ETH in the Bin. If someone sells Arb worth 2 E at 0.00066 at this time, the transaction Bin will move one bit to the left, and the price will change .

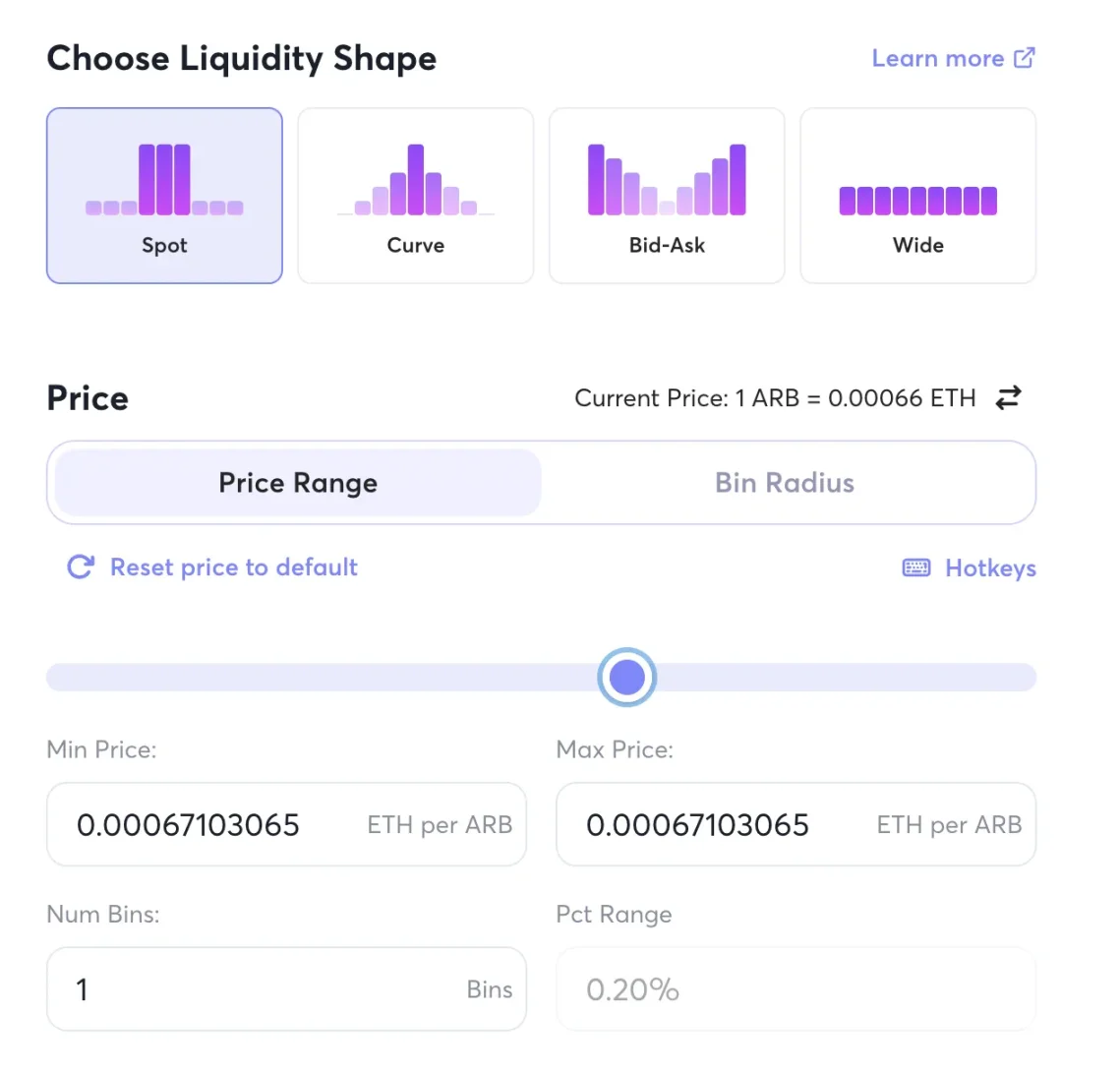

We then tried to add liquidity to the pool, and found that it is possible to add single-point liquidity, which means that the added liquidity is at one price, which is actually equivalent to placing a Maker order in the order book. Whats with the Pct Rage = 0.20% next to it?

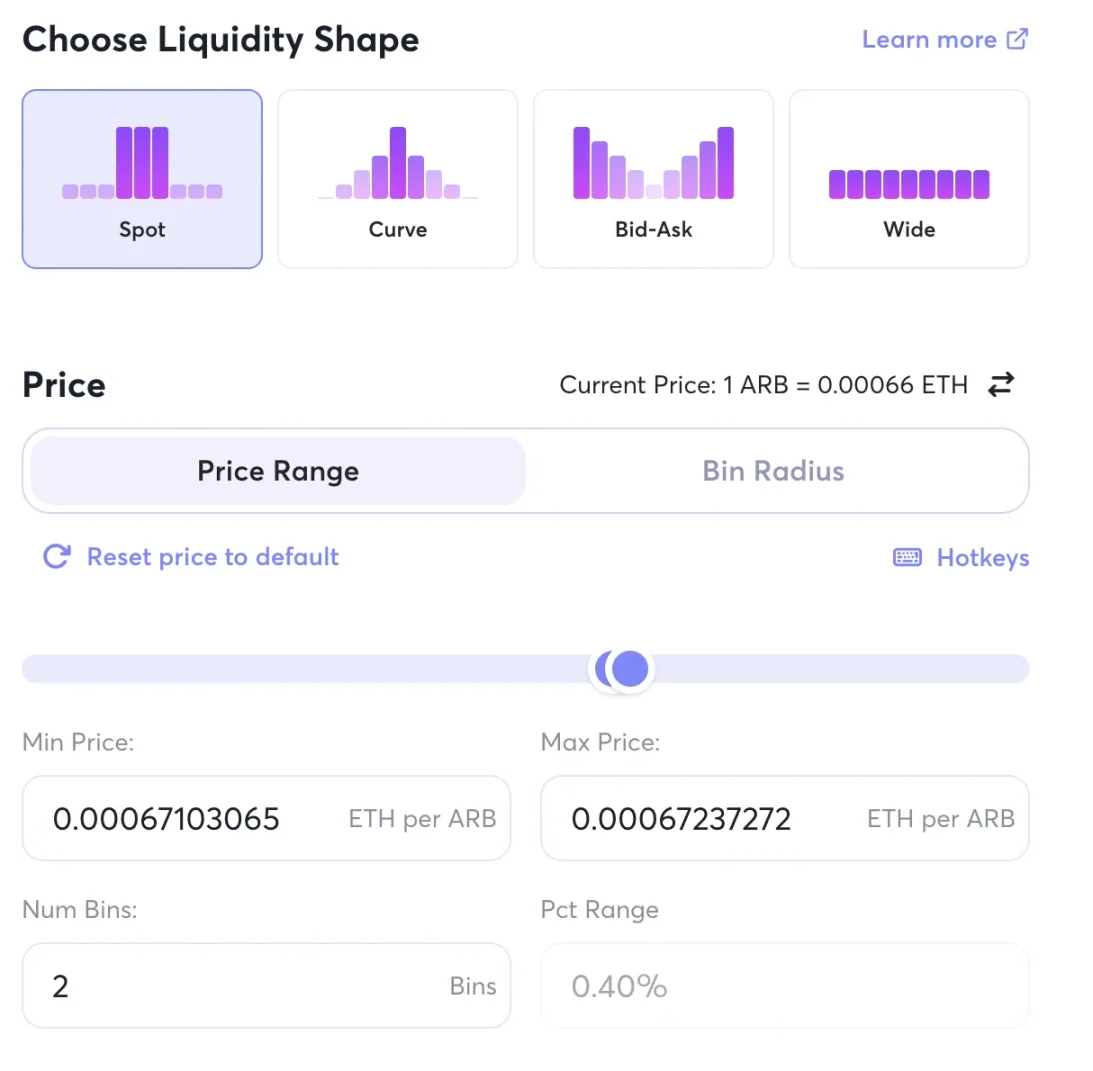

( 0.00067237272-0.00067103065)/0.00067103065 = 0.20%

Lets move the right slider a little bit to expand the price range to 2B in, and calculate the relative difference between the two prices.

That is to say, 0.20% is the minimum price accuracy

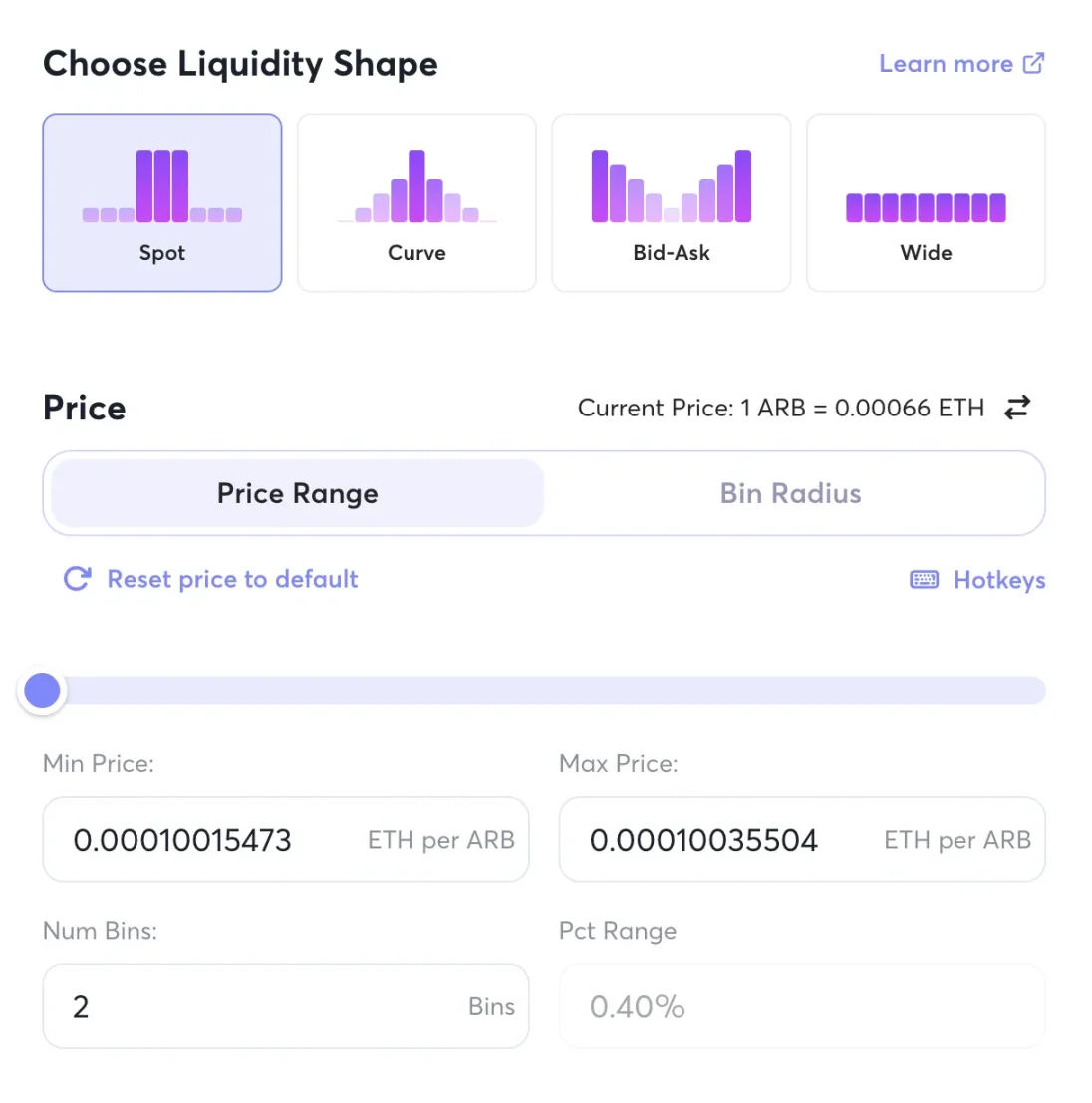

(0.00010035504-0.00010015473 )/0.00010015473 = 0.20%

Lets see how it deviates from the current price, such as ARB/ETH = 0.0001. It can be concluded

Yes, it can be understood that the difference between the upper and lower prices of any position is 0.2%, based on a ratio rather than a fixed value. This is a big difference from traditional order books. Traditional order books generally give a minimum precision of a fixed value, such as 0.01 USDT.

Joes UI also gives 4 ways to add liquidity. Click learn more in the upper right corner of the above picture to learn its detailed definition, but except for Spot, the other four are using official settings The parameter value of is not controllable. So I recommend using Spot, the storage method is similar to UNI V3, at most, you can store a few more in different price ranges. In addition, Joe V2 currently has liquidity incentives, and the benefits of this must be considered.

liquidity incentive

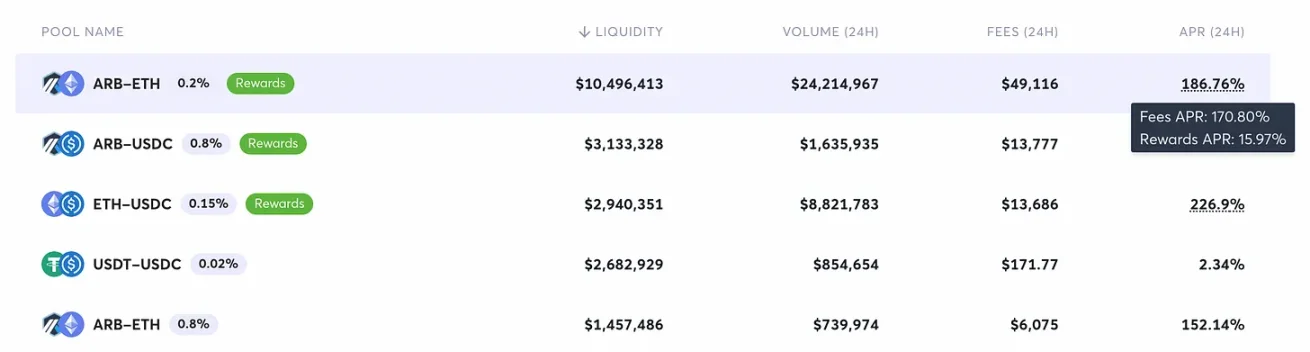

At present, these pools with the label Rewards after the name have liquidity mining incentives

Joe V2s liquidity mining incentive distribution model:

Calculate the score based on the transaction fee actually obtained by LP and MakerTVL, see the figure below

MakerTVL currently only looks at the current price +- 5 bins, such as the Arb/ETH 0.2% bin width, then only the TVL within the current price +- 1% will be credited

When an Epoch is over, the scores within the Epoch will be counted and distributed in proportion

For more details, seedocument。

document

Why $ARB Transactions Gain Large Shares

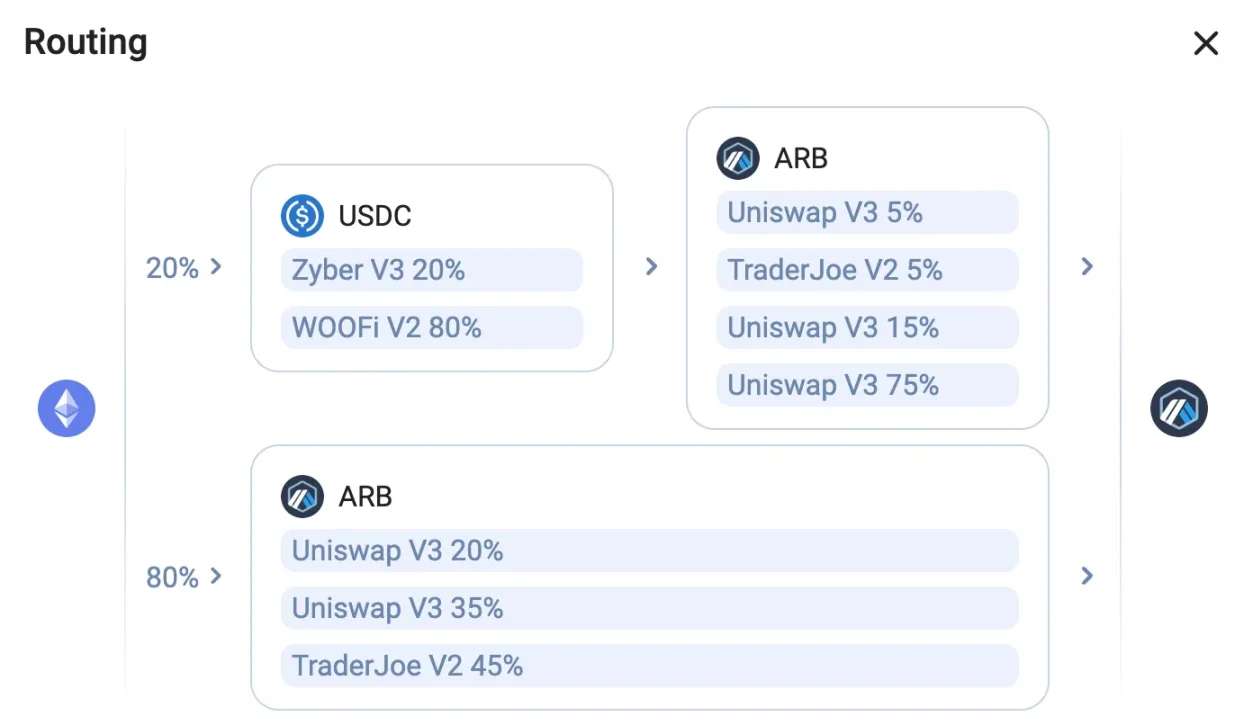

Assuming that the current market is continuously buying Arb, Uniswap Arb/USDC = 1.005, assuming that the price accuracy of Joe V2 is 1%, and the bin distribution is [ 0.99, 1.00, 1.01 …]. At this time, Joes current bin should be 1.00, which is 0.5% cheaper than Uni. As long as the transaction fee is smaller than this gap, the transaction of buying Arb through an aggregator such as 1inch will naturally go to Joe first. On the contrary, if it is selling Arb, Joe will no advantage. In other words, it has an advantage in a unilateral market with high volatility, while it is relatively mediocre in a monkey market with low volatility.

In addition, Joe set a fee of 0.2% for the ARB/ETH trading pair. At that time, due to high volatility expectations, UNI could only set four levels of 0.01% / 0.05% / 0.3% / 1%. Most LPs are located in The gear above 0.3% is inferior to Joes 0.2%.

The recurring exchange rate advantage under high volatility + relatively low fee rate allowed Joe V2 to gain a large share in the early days of ARB 0.00. At present, with the decline of volatility, its exchange rate no longer has a regular advantage; UNI V3 LP returns to the pool with a fee of 0.05%, and basically loses its advantage in rate. Fortunately, its reputation has been established, and it has a good incentive mechanism. Give the project party more room for operation.

Product advantages and disadvantages

In fact, in the Arb transaction share discussion above, the advantages and disadvantages of its AMM mechanism have been explained. This section discusses other aspects:

Advantage:

Vertically aggregated liquidity brings better composability

High efficiency + support incentives, you can get incentives from partners, for example, you are expected to benefit from LSD war

Disadvantages:

There is no mature token empowerment mechanism such as Bribe, and token holders have limited benefits

Relatively large loss of impermanence

Advantage: Composability

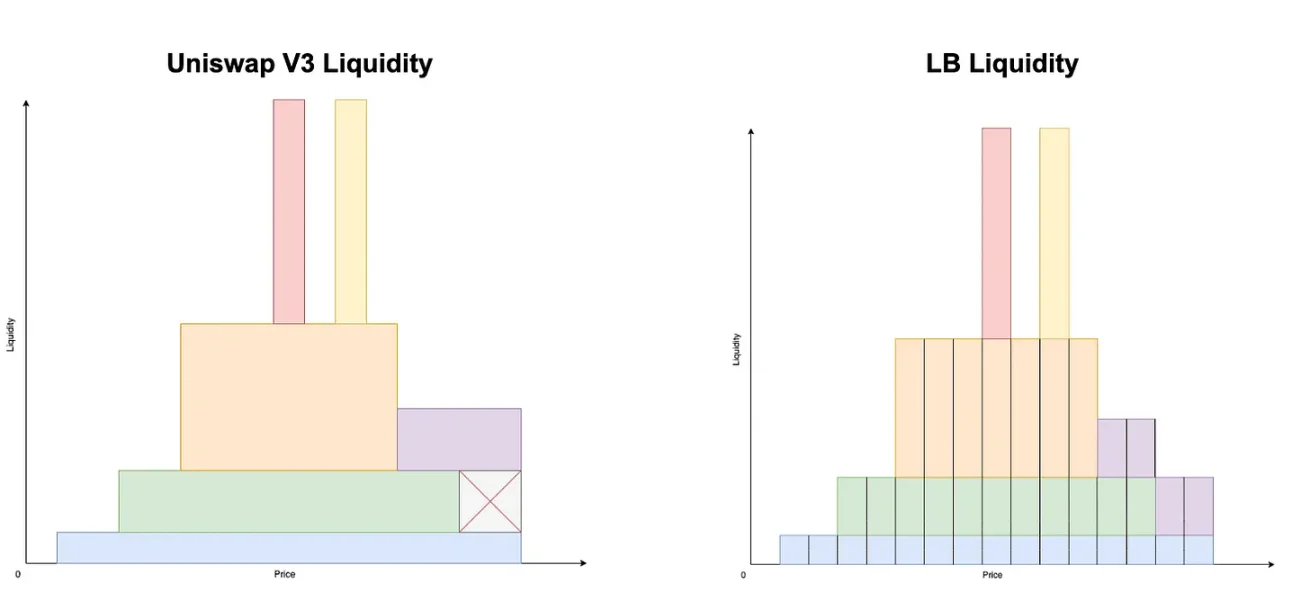

Because in Joe V2, liquidity is aggregated vertically through each bin, while in Uniswap V3, liquidity is aggregated horizontally. The main benefit of vertical aggregation is that it allows for liquidity fungibility.

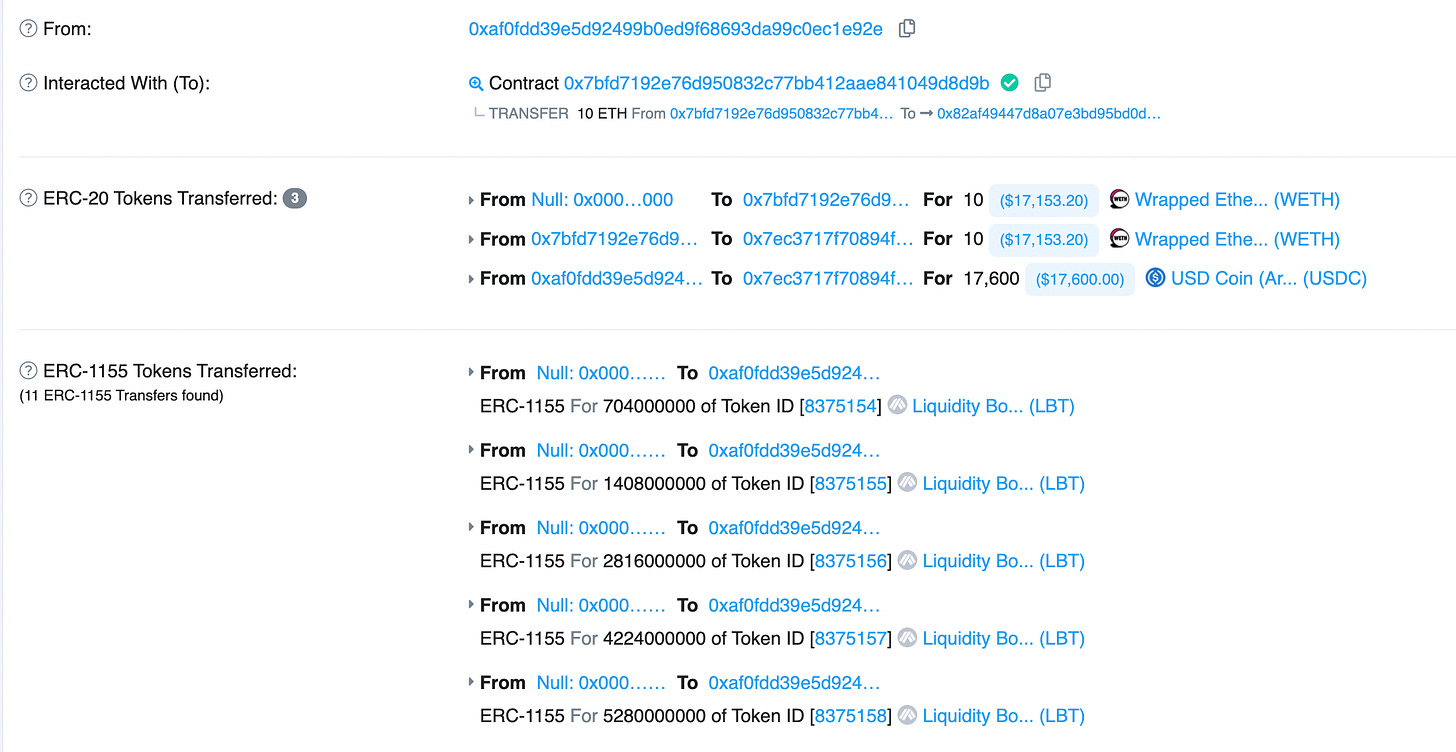

If we look at a specific transaction that adds liquidity, we will find that after the user adds ETH/USDC, Joe returns a large number of ERC-1155 LBTs with different Token IDs to the user, reflecting the users liquidity distribution at different price levels.

This is quite different from UNI V3 which returns a single NFT. Because the same Token ID means that the liquidity is located within a single Bin/price level, which is homogeneous and has better composability.

Advantages: Partners motivate expectations

High efficiency of centralized liquidity + support for incentives is expected to attract partners with liquidity needs such as LSD to provide incentives. For example, Kyberswap, the previous UNI V3+ incentive model, received incentive distribution from Lido second only to Curve (see tweet below ), and accounted for a large share of Alt-l1/L2 LSD volume.

Then Joe V2, which can provide similar value, theoretically also has this opportunity, thereby increasing TVL and transaction volume.

Disadvantage: Token empowerment issuesas meprevious tweet

As mentioned above, pure spot DEX is more difficult without additional enabling mechanisms such as bribe, and TVL and trading volume can not be converted into token holders income.

At present, Joe earns income through commission commissions, but if he draws too much, it will inevitably affect the share. Although Joe has Ve Joe, it is not copying Curve and taking the road of Bribe. It does not seem to be very successful so far, so token empowerment is still a problem.

Disadvantage: relatively large loss of impermanence

Joe will set the fee reasonably to make up for this, such as 0.8% for ARB/USDC with 1% bin width, and 0.2% for ARB/ETH with 0.2% bin width. Plus its not easy to notice, so its ok (laughs

Summarize

Summarize