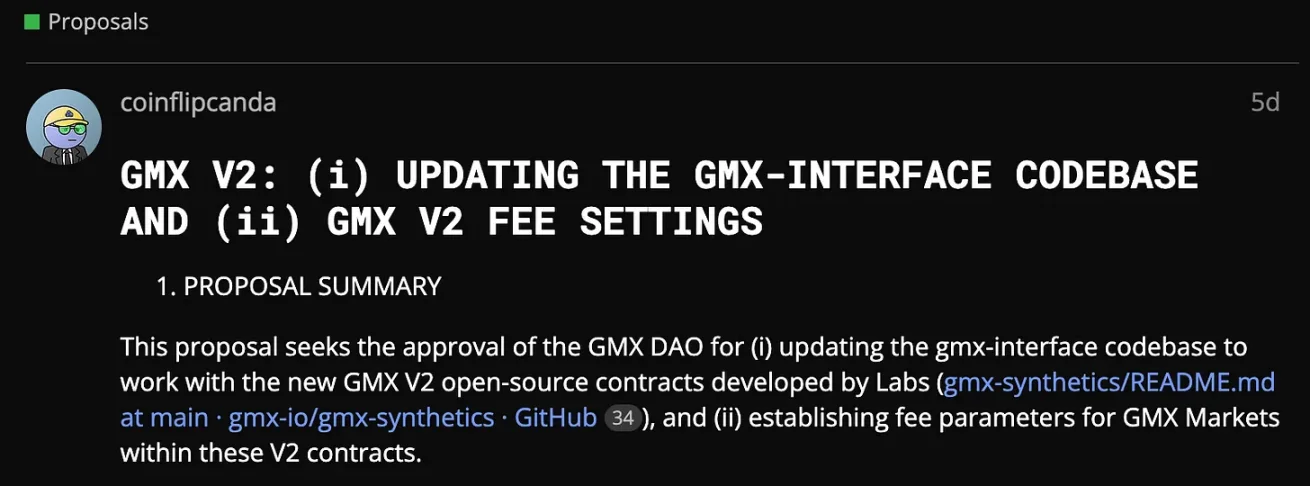

The GMX team recently released a proposal for V2, which indicates that the highly anticipated version of GMX synthetic assets is finally on the eve of its launch. This article will bring you a comprehensive interpretation of GMX V2 and a glimpse into the future of this derivative track leader.

market place

In GMX V2, each trading pair has a corresponding LP. Such as ETH/USD transaction, LP is also composed of ETH/USDs. The long collateral is ETH, the short collateral is stablecoin, and the index token is ETH.

image description

https://twitter.com/NintendoDoomed/status/1597229827844898817

In addition, the so-called synthetic assets mean that assets that are not on the chain can also be traded. For example, in the SOL/USD market, LP is ETH/USD, long collateral is ETH, short collateral is stablecoin, and index token is SOL. That is to say, the long transaction of SOL is supported by ETH.

Obviously, the security of SOL/USD cannot achieve the full guarantee effect of ETH/USD, but considering the correlation of SOL/ETH, compared with pure USD as LP, the risk will be much smaller. In addition, GMX also said that it will control the upper limit of OI to be less than the mortgage assets to reduce risks.

fee structure

In addition to the basic transaction fees. GMX V2 has three fees: Funding Fee, Borrow Fee, and Price Impact. These fees help to balance the long and short positions of LP and OI, avoid inefficient use of capacity and reduce the risk of price manipulation. Generally speaking, it makes GMX LP less risky and allows greater trading volume.

The main purpose of Funding Fee is to balance long and short. The specific formula is: (X) * (difference between long and short OI) ^ (Y) / (sum of long and short OI). Both X and Y are configurable parameters, long OI > short OI, longs pay funding fees to shorts, and vice versa

The main purpose of Borrow Fee is to reduce the inefficient occupation of transaction capacity. Because the transaction capacity of GMX is affected by the pool size, it is a limited resource. In V2, the borrow fee is also determined by the ratio of OI to pool capacity.

Borrowing fees are calculated as borrowing factor * (open interest in usd + pending pnl) ^ (borrowing exponent factor) / (pool usd) for longs and borrowing factor * (open interest in usd) ^ (borrowing exponent factor) / (pool usd) for shorts.

Price Impact has a triple effect

Incentives to balance the LP pool

Incentives to balance long and short positions

Reduce the risk of price manipulation

So how to achieve it, simply speaking, is the deposit and withdrawal of LP. If your deposit will cause the pool to become more unbalanced, you need to pay money, and if it is more balanced, you can get a profit. For opening and closing positions, the impact on long-short balance is considered.

(initial USD difference) ^ (price impact exponent) * (price impact factor / 2) - (next USD difference) ^ (price impact exponent) * (price impact factor / 2)

other improvements

Due to the more scientific Price Impact to check and balance, the spot exchange rate has been greatly reduced in the V2 parameter setting proposal. The basic exchange rate for non-stable currency pairs is only 0.05%, and the stable currency is even as low as 0.01%. This will give GMX the opportunity to capture a larger share of spot transactions.

In addition, in terms of trading experience, V2 also optimizes the mechanism of limit orders and stop loss orders, and supports spot limit orders.

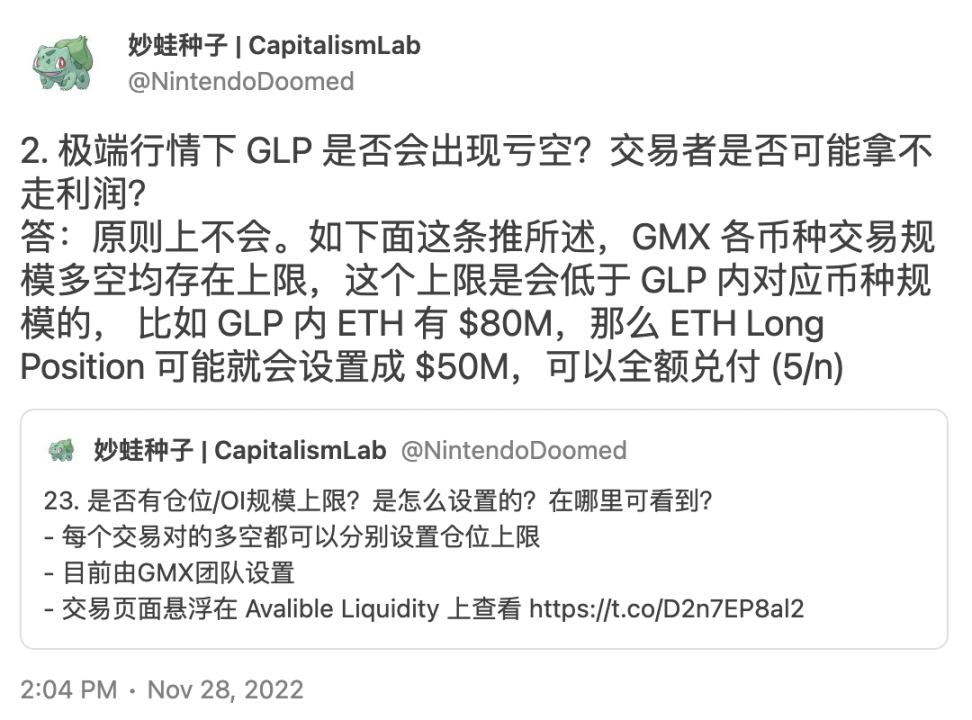

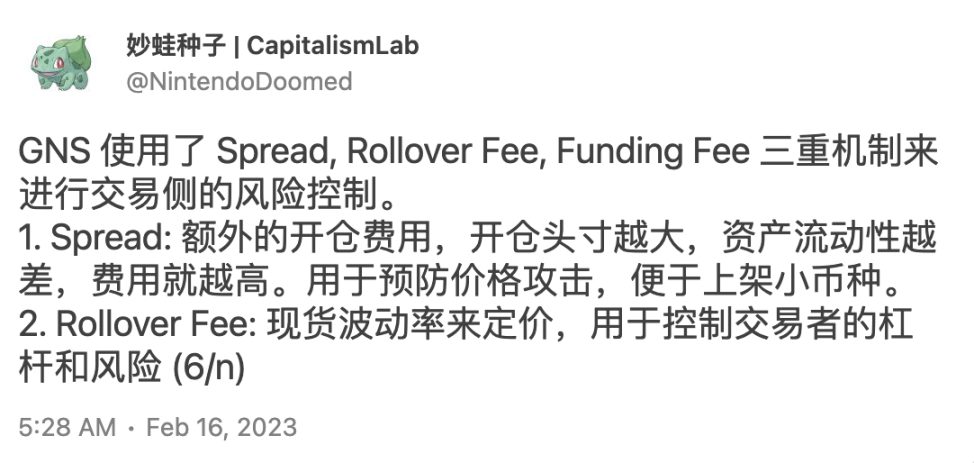

Horizontal comparison of GNS

image description

https://twitter.com/NintendoDoomed/status/1626091034253094912

In addition, GNS uses a single gDAI as LP, while GMX still uses the index asset model and uses independent liquidity. GNS still has more flexibility in terms of capital efficiency and online assets, while GMX goes further in risk control.

Vertical comparison of GMX V1

Compared with GLP, the independent liquidity pool can better isolate risks, because GMX can cover more long-tail assets (small currencies) after the synthetic assets are launched. However, the risks brought by these assets are relatively high. Avax transactions have encountered related attacks before, so risk isolation is necessary to prevent GMX from being dragged into the water when accidents happen. In addition, at present, the proportion of each currency in GLP is determined centrally by the team/DAO. After the independent liquidity pool is launched, it is actually left to the market to decide. This is undoubtedly more efficient, and you can also look forward to listing coins without permission.

For the newly added Funding Fee and Price Impact, these will help the transaction volume. GMX is currently closer to a leveraged trading platform. The fee rate is one-way. The market for perpetual contracts is obviously larger, which is very conducive to GMX attracting more users. And Price Impact can help balance the long-short ratio and reduce the risk of price manipulation, helping to increase trading capacity. It is much better than only one Borrow Fee before

Summarize

Summarize

To put it simply, GMX V2 makes GMX less risky, has a larger transaction capacity, and can support more asset transactions.