Author: Darren, Everest Ventures Group

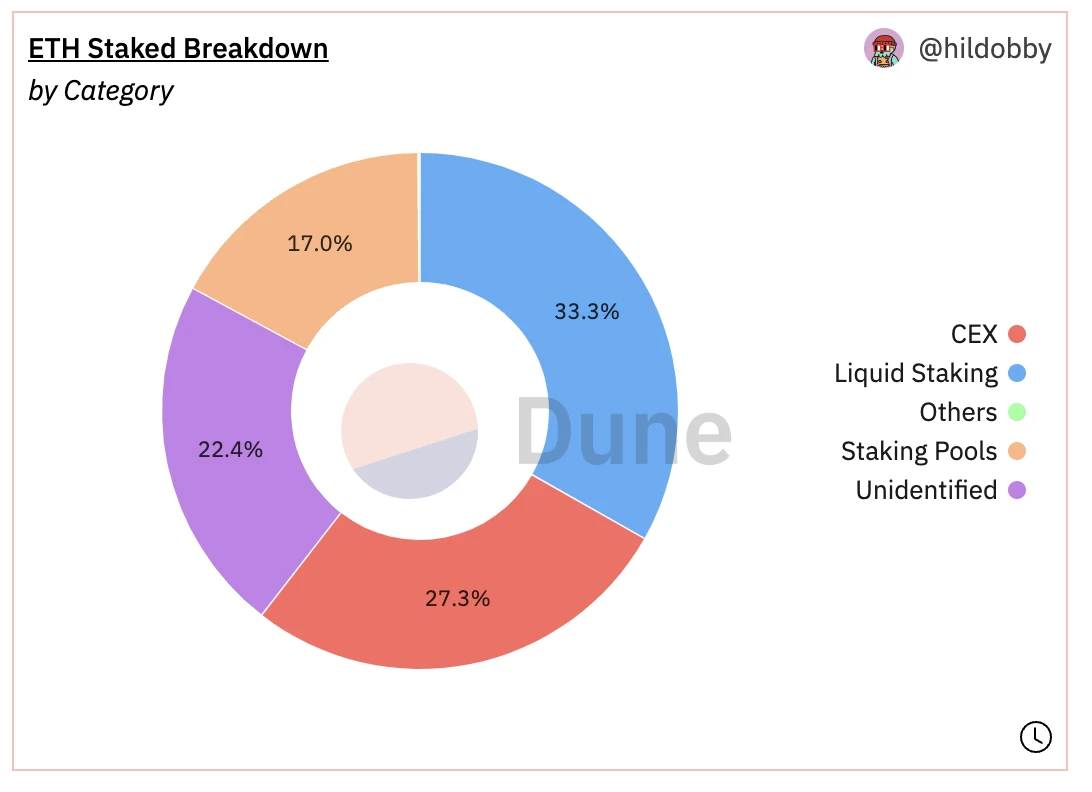

The Shanghai upgrade, tentatively scheduled for April 13, will allow validators to withdraw from the beacon chain and withdraw funds for the first time. Relevant expectations are superimposed, and the market once again focuses on the liquidity of Ethereum. After the Shanghai upgrade is completed, will there be a wave of selling, whether there will be large fluctuations in currency prices, what is the future prospect of the Ethereum pledge track, and what is the trend of pledge income? This article combines Ethereum currency prices, deflation rates, pledge rate trends, supply rates Trend and other data, analyzed and discussed, the conclusions are as follows:

After the Shanghai upgrade is completed, there may be a certain selling pressure (partial withdrawal) in the short term, and this part of the selling pressure will have an immediate effect on the market;

Only 40% of Ethereum pledgers (illiquid pledgers) are willing to sell. The cost of these 40% of Ethereum pledgers is relatively low, which will bring a certain amount of selling pressure, but this process is slow. In extreme cases It takes 125 days to withdraw all staked Ethereum;

The pledge rate of Ethereum can continue to grow in the next few years, and the growth rate of the pledge rate will slow down after reaching a critical value;

first level title

image description

Source:https://dune.com/hildobby/eth 2-staking

secondary title

1) Partial withdrawal and full withdrawal

Withdrawals are divided into partial withdrawals and full withdrawals.

Partial Withdrawal: Means that balances (earned rewards) over 32 ETH will be withdrawn directly to an Ethereum address, ready for immediate use, and validators will continue to be part of the Beacon Chain and validate as expected;

Full Withdrawal: means that the validator exits completely and is no longer part of the beacon chain, and the validators full balance (32 ETH and any other rewards) is then unlocked and allowed to be used after the exit mechanism is completed.

secondary title

2) Possible impact of partial withdrawals on Ethereum price

The rate of partial withdrawal is 16 withdrawal requests per block, and currently 1 block per 12 seconds, 5 blocks per minute, 300 blocks per hour, and about 7.2 k blocks per day; So assuming every validator is updated to 0x11 then expect partial withdrawals of about 115k validators per day.

According to beaconcha.in data, there are 558,062 verifiers so far, so it takes about 4 to 5 days to realize partial withdrawal. The average balance of each verifier is 34 Ethereum, so it is estimated that pledgers Earned about (34-32 ) ✖ 558062 = 1116124 Ethereum staking rewards (counted as 1.1 million). According to the current price of Ethereum ($1800), it will be worth $ within 4 to 5 days Ethereum was released around 1.98b.

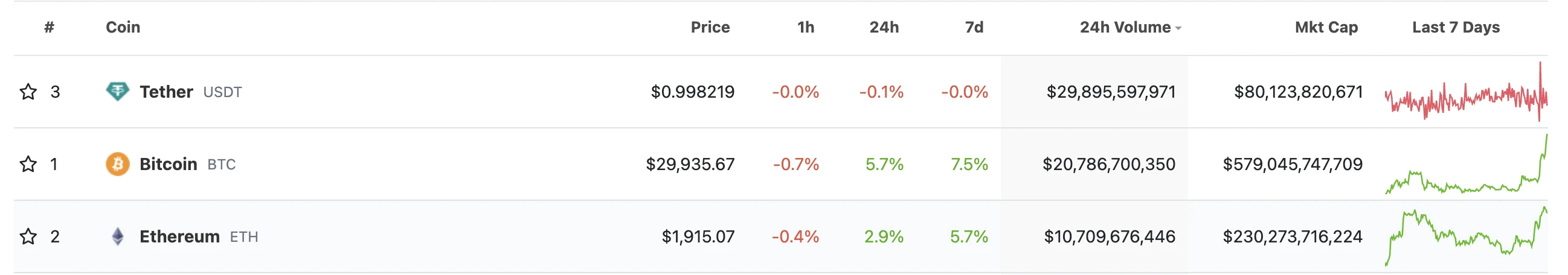

As shown in the figure below, according to CoinGecko data, the current total daily spot transaction volume of Ethereum is $10.4 b, so the total value of partial withdrawals is about 19% of the total daily spot transaction volume of Ethereum, and is released in an average of 5 days , the daily release volume is 3% to 4% of the daily spot trading volume.

image description

Source:https://www.coingecko.com/

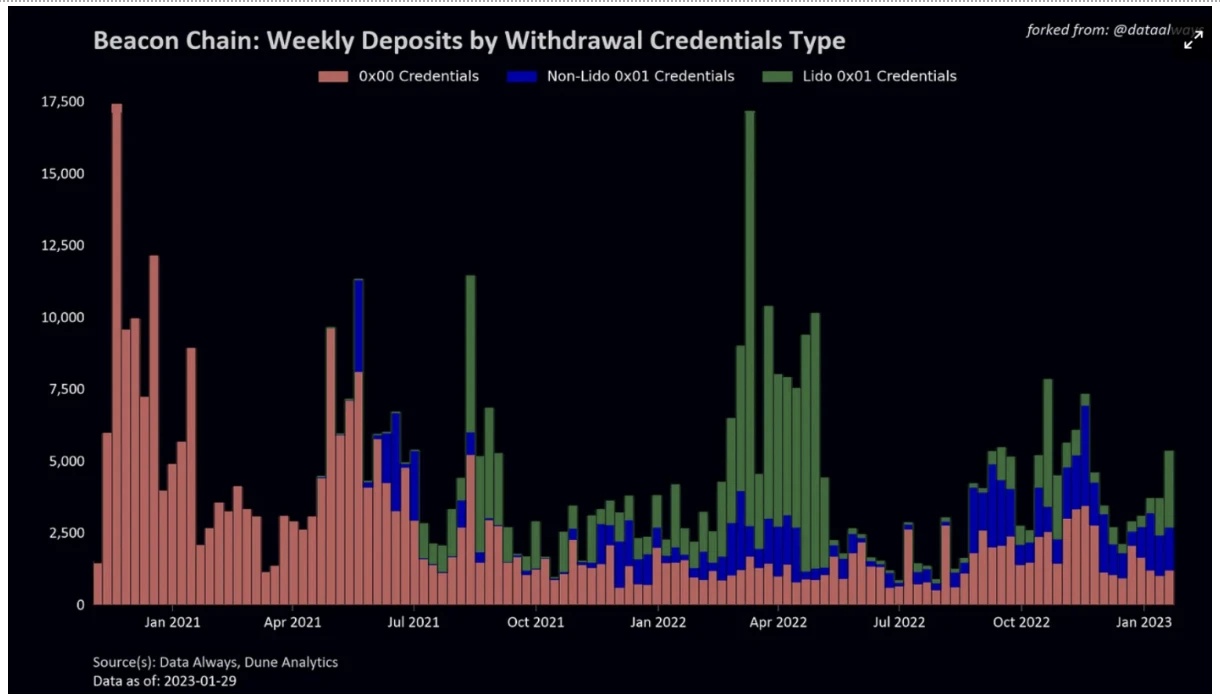

image description

Source:https://dataalways.substack.com/p/partial-withdrawals-after-the-shanghai

secondary title

3) The possible impact of full withdrawal on the price of Ethereum

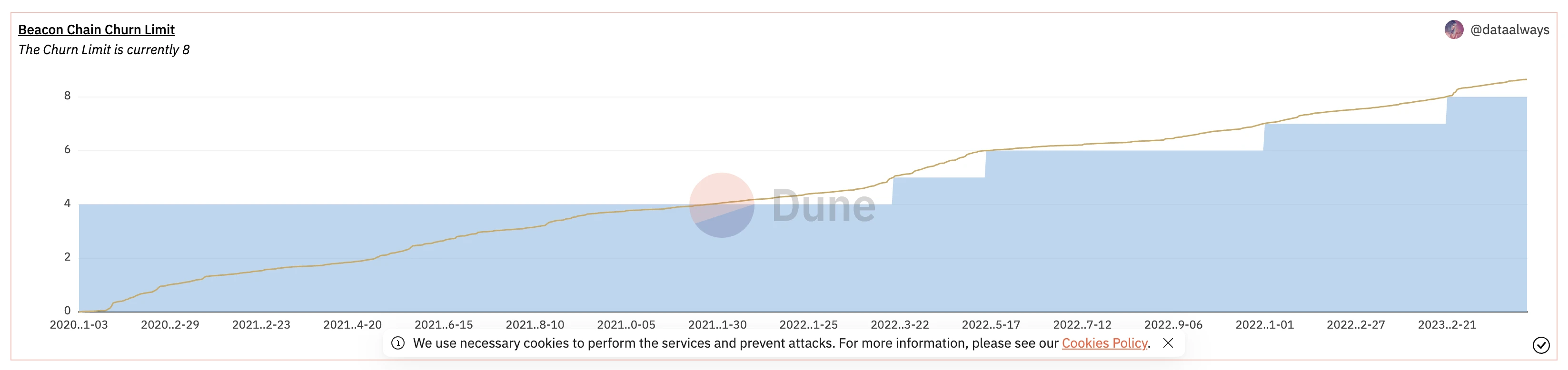

Full withdrawals and partial withdrawals have the same priority and are in the same withdrawal queue as partial withdrawals. When partial withdrawals are in progress, if the validator is marked as exited, then all of the balance➕rewards will be executed Refund. However, unlike partial withdrawals, the rate of full withdrawals is more restricted. As shown in the figure below, the current full withdrawal loss limit is 8, and the maximum daily withdrawal is 57.6 k ETH. Currently, a total of about 18 M Ethereum, of which LSD and CEX accounted for 60%.

image description

Source:https://dune.com/queries/1924507/3173695

As mentioned above, the two categories that account for 60% of the supply are LSD and CEX, most of which have issued mortgage liquidity derivatives, such as stETH, cbETH, rETH, bETH, etc.

Taking stETH as an example, the current exchange rate of stETH to ETH is 0.9996, and the price difference is extremely small. Therefore, if the pledger wants to sell, he can directly exchange the liquidity derivatives for Ethereum in the market and sell them without waiting for Shanghai to upgrade. Because of this, the cost of pledged Ethereum is actually very scattered and constantly changing. Many people holding stETH are not obtained by staking ETH, but are traded in the secondary market acquired. For these 60% of pledgers, regardless of the oversold behavior caused by market selling pressure, the Shanghai upgrade will not have a large impact on them.

secondary title

Source:https://dune.com/skynet/lido-stetheth-monitor

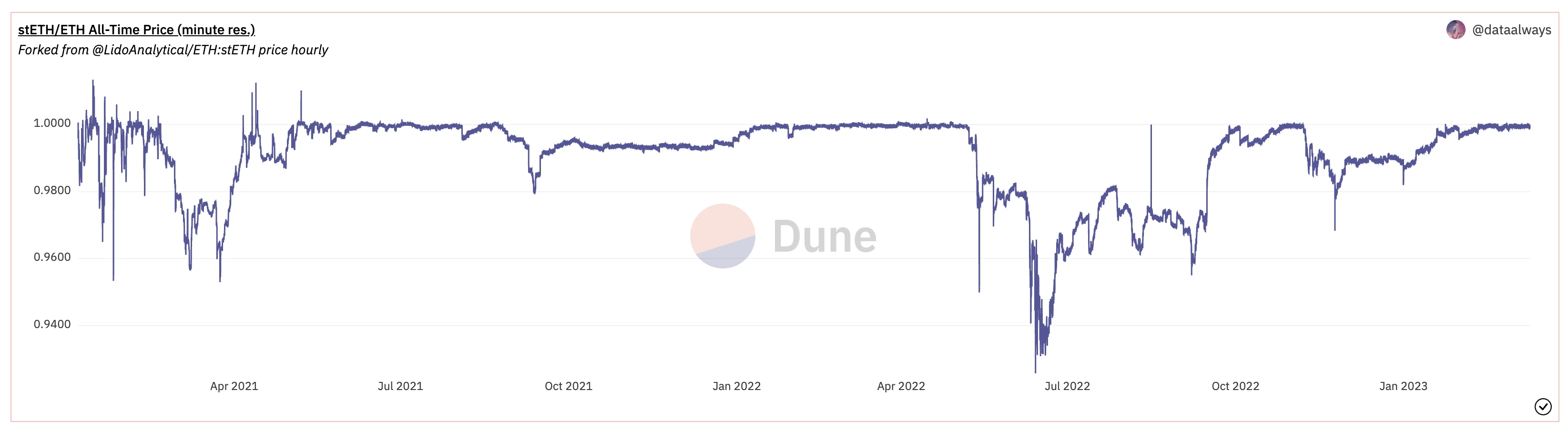

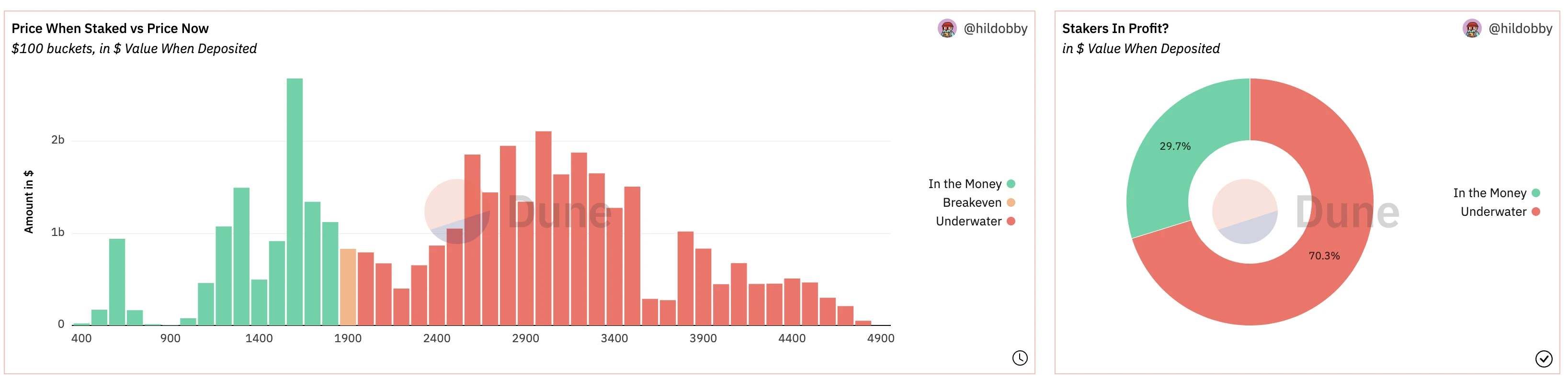

image description

Source:https://dune.com/hildobby/eth 2-staking

As shown in the figure above, there are currently more pledgers whose deposit costs are “underwater” than those who are “profitable”. Therefore, there are two views on this aspect: one of them thinks that these losers will propose deposits to stop losses, The other kind of thinking of losses will be more likely to hold due to the emotion of loss aversion.

In terms of Ethereum pledge, for most Ethereum pledgers (60%), there is no cost problem, because as mentioned above, before the Shanghai upgrade, stETH can also be exchanged for stETH through the secondary market. ETH and sold, so for the 60% stakers, it doesnt matter.

first level title

2. The impact on the Ethereum pledge rate and pledge rate of return

secondary title

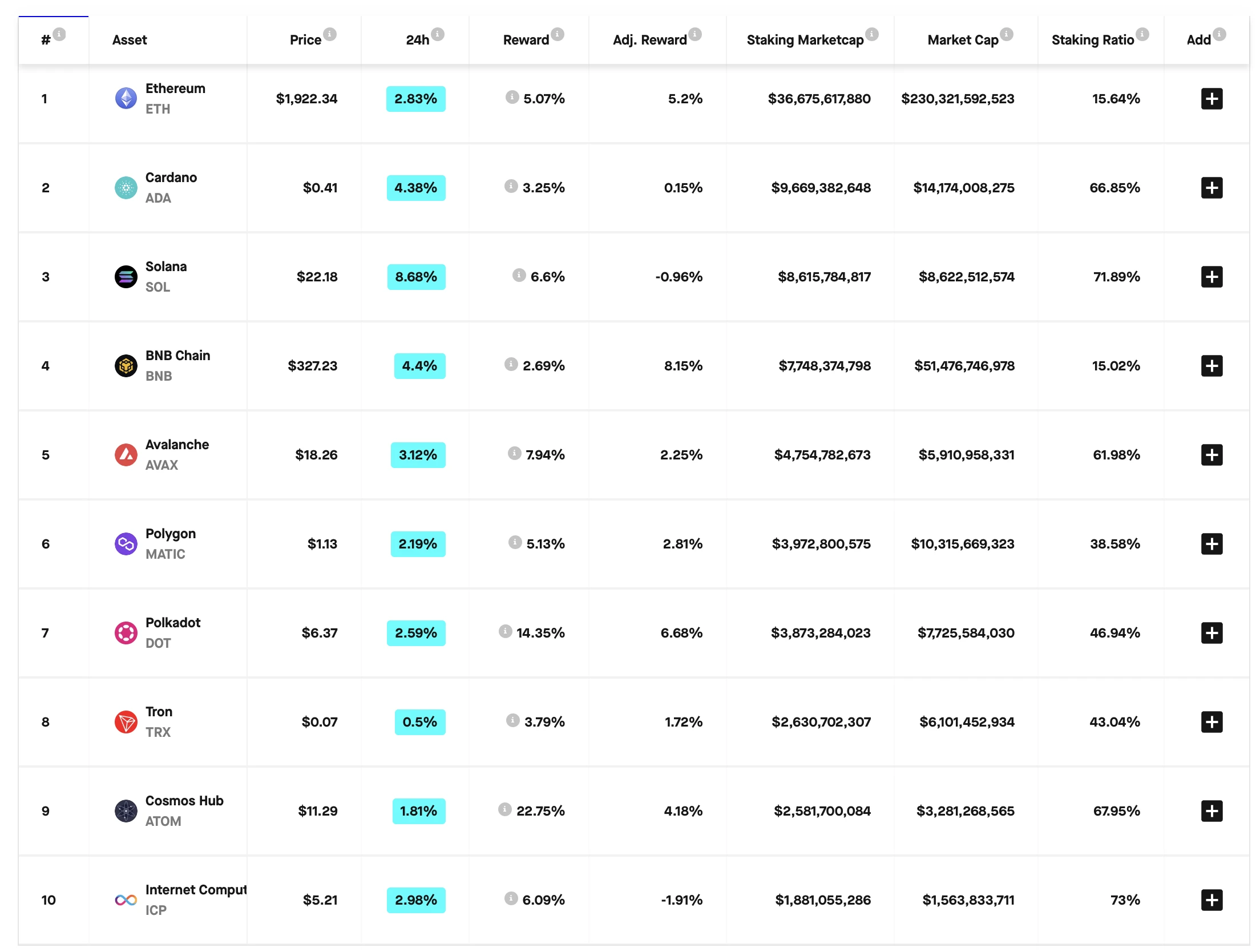

1) Factors affecting the pledge rate of Ethereum and the pledge rate of return

After analysis, we believe that the pledge rate of Ethereum will be higher than it is now after the Shanghai upgrade, but it is difficult to achieve such a high pledge rate (60% to 80%) like other public chains; in addition, with the increase of the pledge rate, Without counting Matryoshka, LSDFI and other playing methods, the pledge rate of return will drop.

The following three factors may favor the growth of Ethereum’s pledge rate.

image description

Source:https://www.stakingrewards.com/

ii) Before the Shanghai upgrade is completed, the Ethereum pledged on the beacon chain cannot flow, and a large amount of funds are locked on the beacon chain, resulting in inflexible use of funds, which may reduce users desire to pledge; and with the upgrade of Shanghai Once completed, the liquidity risk problem will be solved, the ethereum pledge will realize a closed loop from deposit to withdrawal, and the exchange rate of mortgage liquidity derivative tokens to ethereum token prices will return to 1:1, which may attract a large number of institutions And the pledge of capital, but in fact, this point does not have much reference value in the current pledge environment where LSD is prevalent.

iii) Ethereum is currently in a state of deflation, and the current inflation rate is -0.62%. According to the relationship between supply and demand, this shows that the value of Ethereum is constantly increasing over time, and the high pledge rate of other public chains is precisely because of Their pledge rate of return is higher, and the result behind this is the continuous issuance and depreciation of tokens. Therefore, from this point of view, for long-term pledgers, it may be a more attractive way to pledge funds on Ethereum. Moreover, it is still in a bear market, the market is less active, and Ethereum is already in a state of deflation. In the subsequent bull market, the daily consumption of gas will be more, and the amount of deflation of Ethereum will be even more impressive.

However, the Ethereum pledge rate will not grow infinitely, we believe:

i) Ethereum cannot provide as high a pledge rate of return as other public chains, so perhaps more users are more inclined to pledge their assets on a public chain with a higher rate of return.

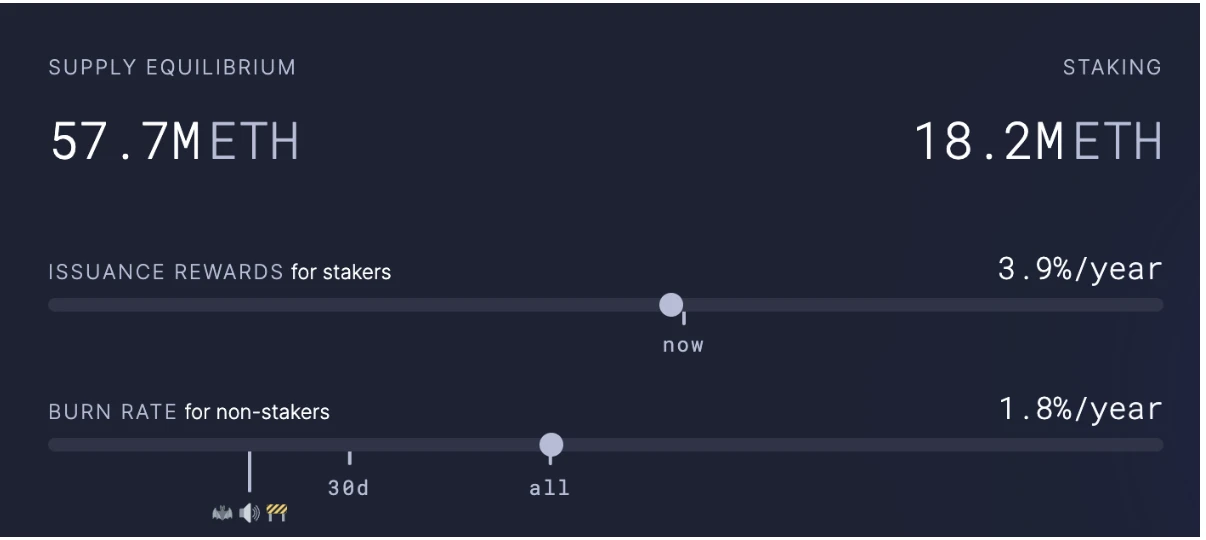

secondary title

Source:https://ultrasound.money/

image description

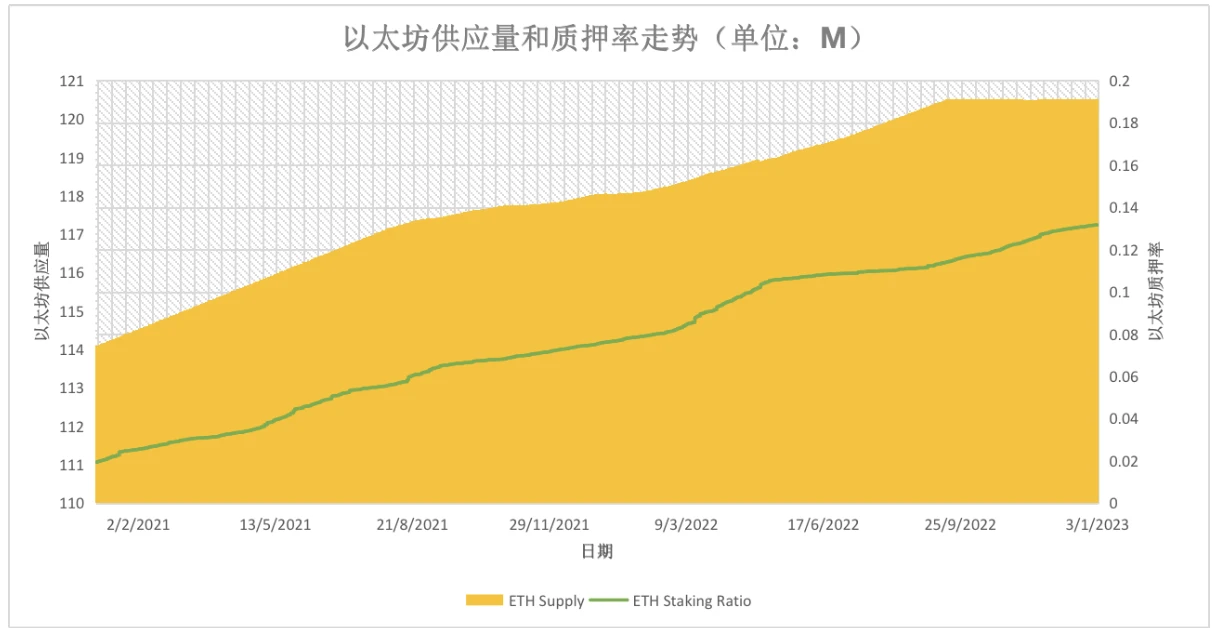

Ethereum supply and pledge rate trends from February 2021 to March 2023

As shown in the figure above, it can be seen that since September 2022, the supply growth of Ethereum has flattened or even declined. The upward trend in volume has not slowed down.

Based on this, we believe that:

In a bear market where market transactions are not active enough, the growth of Ethereum supply gradually slows down and shows a downward trend. It can be expected that with the arrival of a bull market, the sharp increase in transaction volume and the increase in gas consumption will further accelerate the deflation of Ethereum. The pledge rate of Ethereum will rise in the context of supply deflation. However, as the pledge rate of Ethereum continues to increase, the pledge rate of return of a single node will decrease. When the pledge rate of Ethereum reaches a certain value, it will enter the gap between the two. state of dynamic balance.

References:

References:

[ 1 ]Brace Yourselves, Shanghai Is Coming

[ 2 ]Partial withdrawals after the Shanghai fork

[ 3 ]The Future of ETH Liquid Staking