Flashbots released Mev-Share, marking a new era for the track. MEV revenue is expected to contribute no less than 70% of ETH Staking revenue in the bull market, which may be the next LSD-level track.

first level title

MEV & MEV-Share

The so-called MEV (Maximal extractable value MEV) refers to the maximum value that a verifier can extract by manipulating the transactions and transaction order in the block.

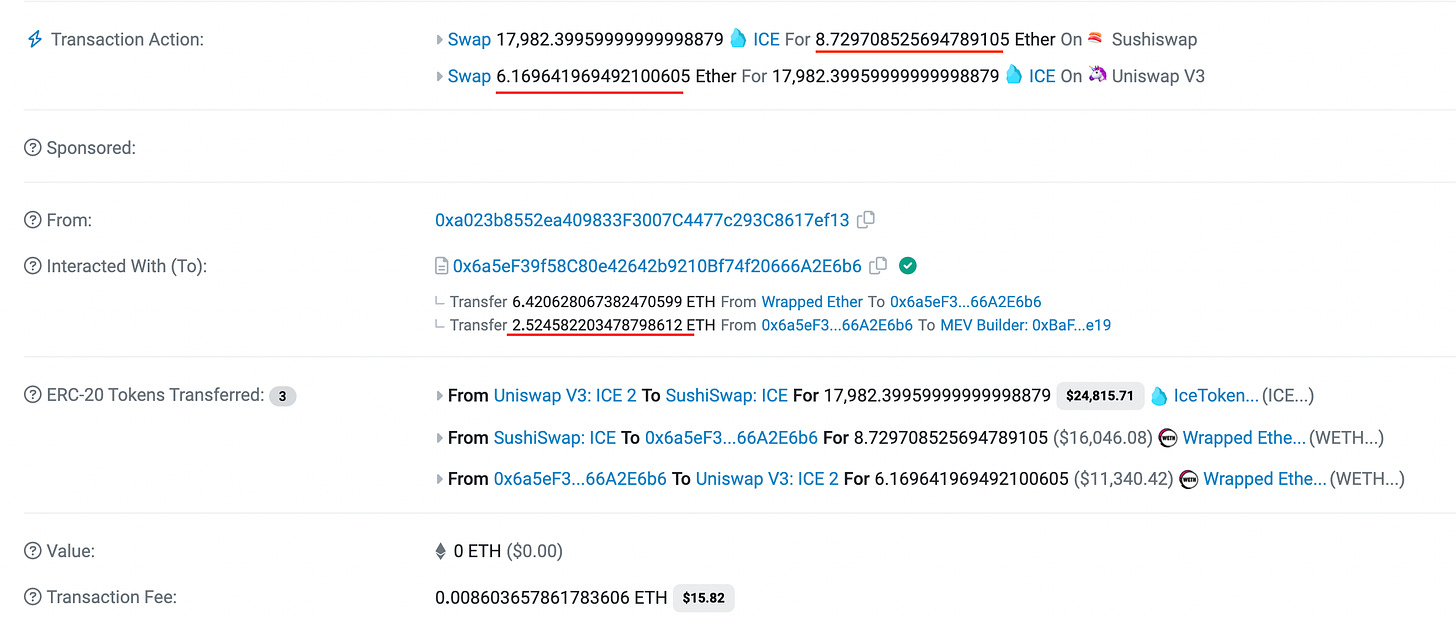

For example, in the following arbitrage transaction between Uniswap and Sushi, the ICE bought on Uniswap for 6.17 E was sold on Sushi for 8.73 E, and then 2.52 E was paid to the Builder, leaving only 8.73-6.17-2.52-0.01( Gas) = a small profit of 0.03 E. Builder is expected to eventually contribute to Validator as well.

Here comes the question, why pay tribute? Because the ranking is determined by the verifier (this description is for the convenience of understanding, not completely accurate), and it is public information that the price on Sushi is higher than that on Uniswap, so naturally a large group of people (Searchers) found this opportunity and rushed to do this Buying and selling, and the one who decides who can make the deal is the Validator who holds the power, so naturally Validators account for the majority. As for how the Validator maximizes the benefits by manipulating such transactions and sorting is MEV.

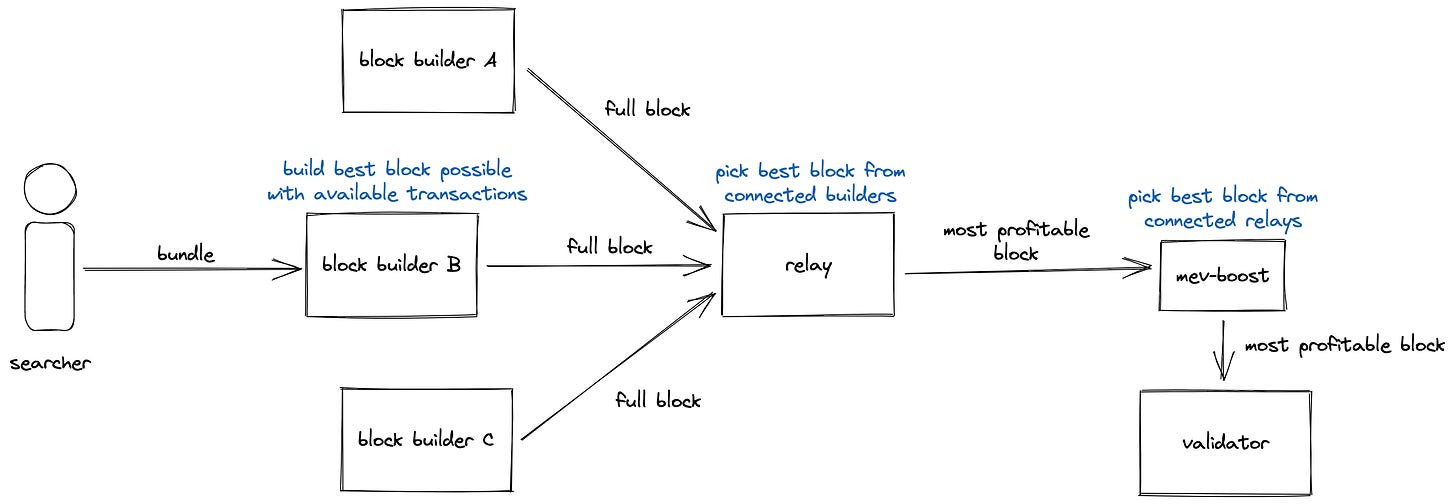

In order for the Validator (miner before Merge) to rank itself in the front, ETH has become a dark forest, and Searchers have raised their gas fees one after another. Multiple Searchers can only submit one transaction for the same transaction, resulting in a large waste of resources. Searcher cooperates with Miner privately, and Miner will even directly avoid the middleman to earn the price difference, and submit Searcher to arbitrage transaction to copy and replace it. All in all, the picture below

For users who initiate transactions, they are also plagued by problems such as sandwich attacks (commonly known as clamping). DEX transactions need to set slippage. For example, the current price of ETH is 1000 USDC. If you set a 1% slippage to buy, then even if you can accept it at 1010 USDC, then Searchers can first buy the price to 1008, and wait for you to press 1010. You can make a profit by selling the car later, so your buying cost becomes higher.

Under such circumstances, Flashbots quickly became bigger and stronger. It gave Searchers a chance to reach a private consensus. Everyone decided on the Flashbots auction without going to the chain first, without wasting money. Users who initiate transactions can also send transactions to Flashbots instead of broadcasting publicly to avoid being caught. After the transaction information becomes unique to Flashbots, the MEV income from these transactions also becomes unique to Flashbots, making it stronger, which is a win-win operation.

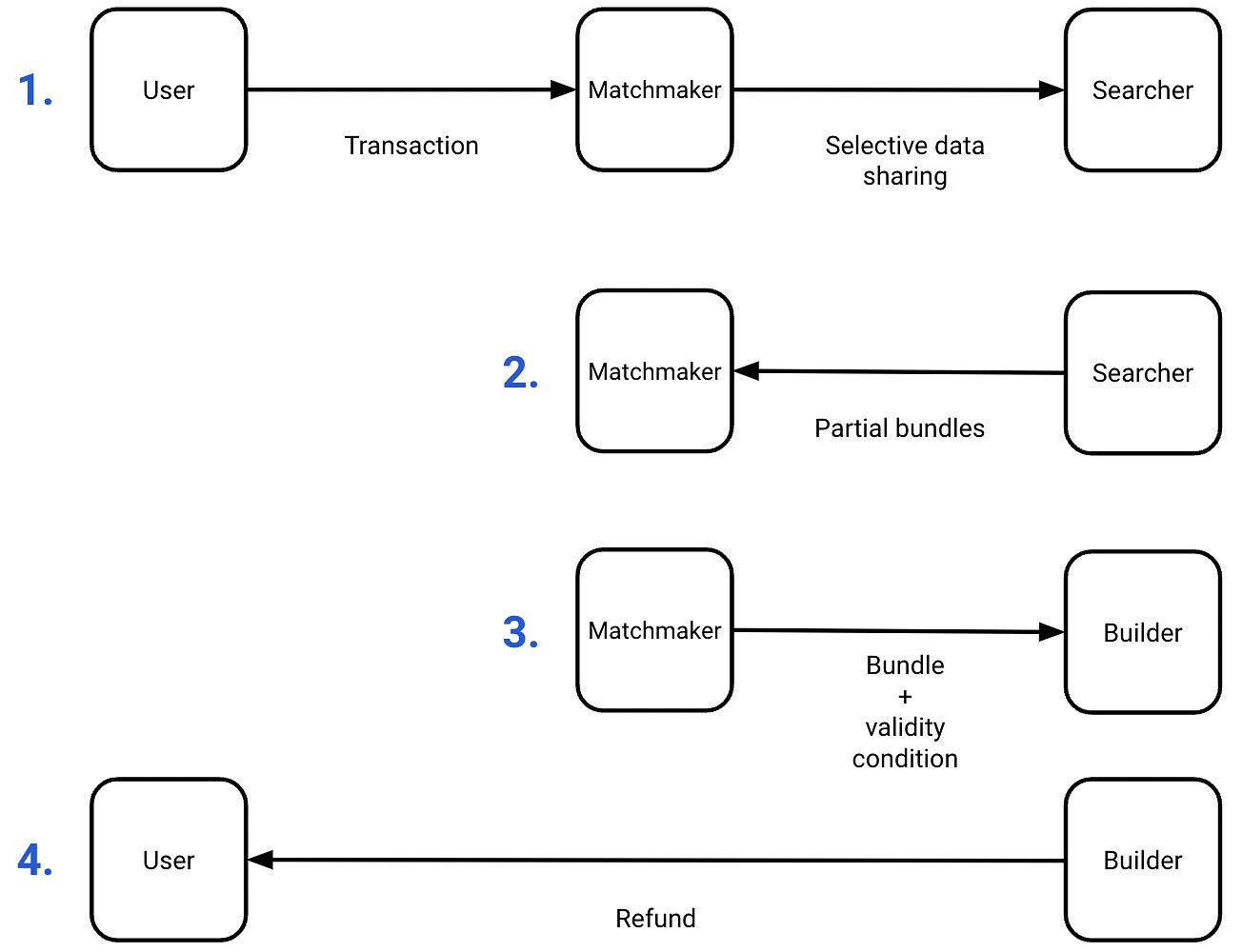

As for MEV-Share, the user sends his transaction information to Flashbots, and 90% of the MEV revenue brought by the transaction will be returned to the user. Of course, front-running transactions are not allowed, so instead of letting you be caught and giving a part of the share, it means that you spent a lot of money, for example, when a small DEX transaction directly pulls the price above the market price, someone else arbitrages behind you You can share 90% of the money you earn.

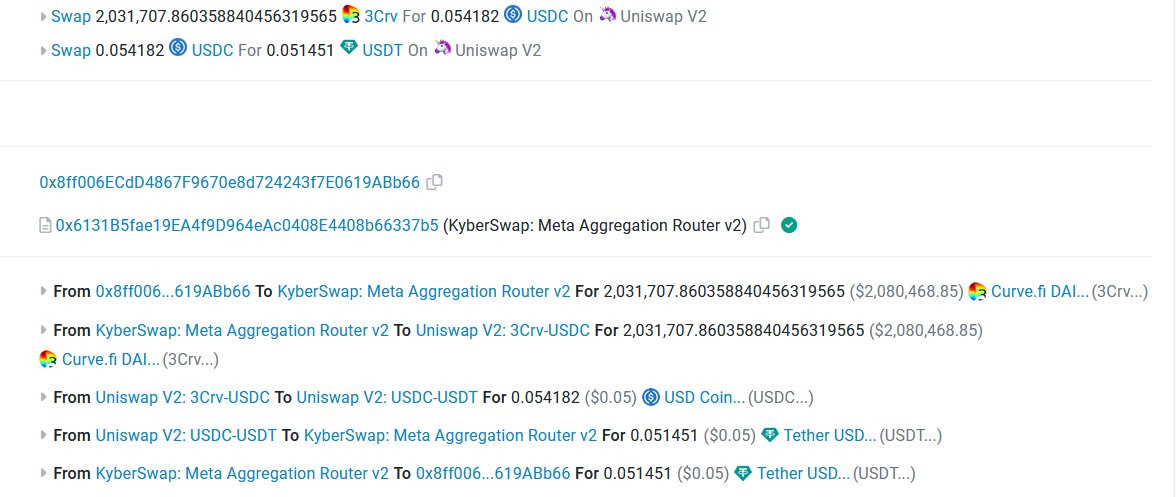

like beforethis old manTragic mishandling traded $0.05 with 3 CRV worth $2M, the arbitrageur bought $2M 3 CRV for almost nothing, if he used MEV-Share, he might get back $1.8M in no time.

For all parties:

Using Flashbots, users can avoid being caught and reduce the loss of inadvertently spending money

Flashbots get exclusive information and can profit more than others

Searchers save money and get more deals with Flashbots

first level title

MEV Track Outlook

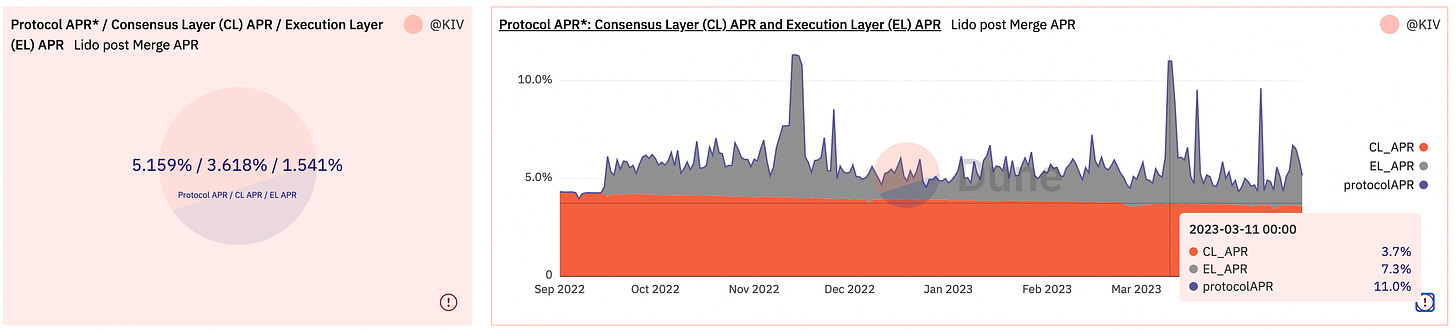

As shown in the figure below, we can see that since the Merge, EL APR, which is dominated by MEV income, has accounted for about 1/3 of the total income of stETH. When the Internet was hot, the proportion was even close to 70%. When the bull market comes, it may become normal for MEV revenue to account for 70% of the total Staking revenue, and the market size of this segment is very impressive.

In addition, this business mentioned above also has an obvious scale effect, so the profit earned by the top project may be comparable to that of LSD, which means that this may also be an LSD-level track. And because the income of MEV will achieve non-linear growth in the bull market, the ceiling is extraordinary.

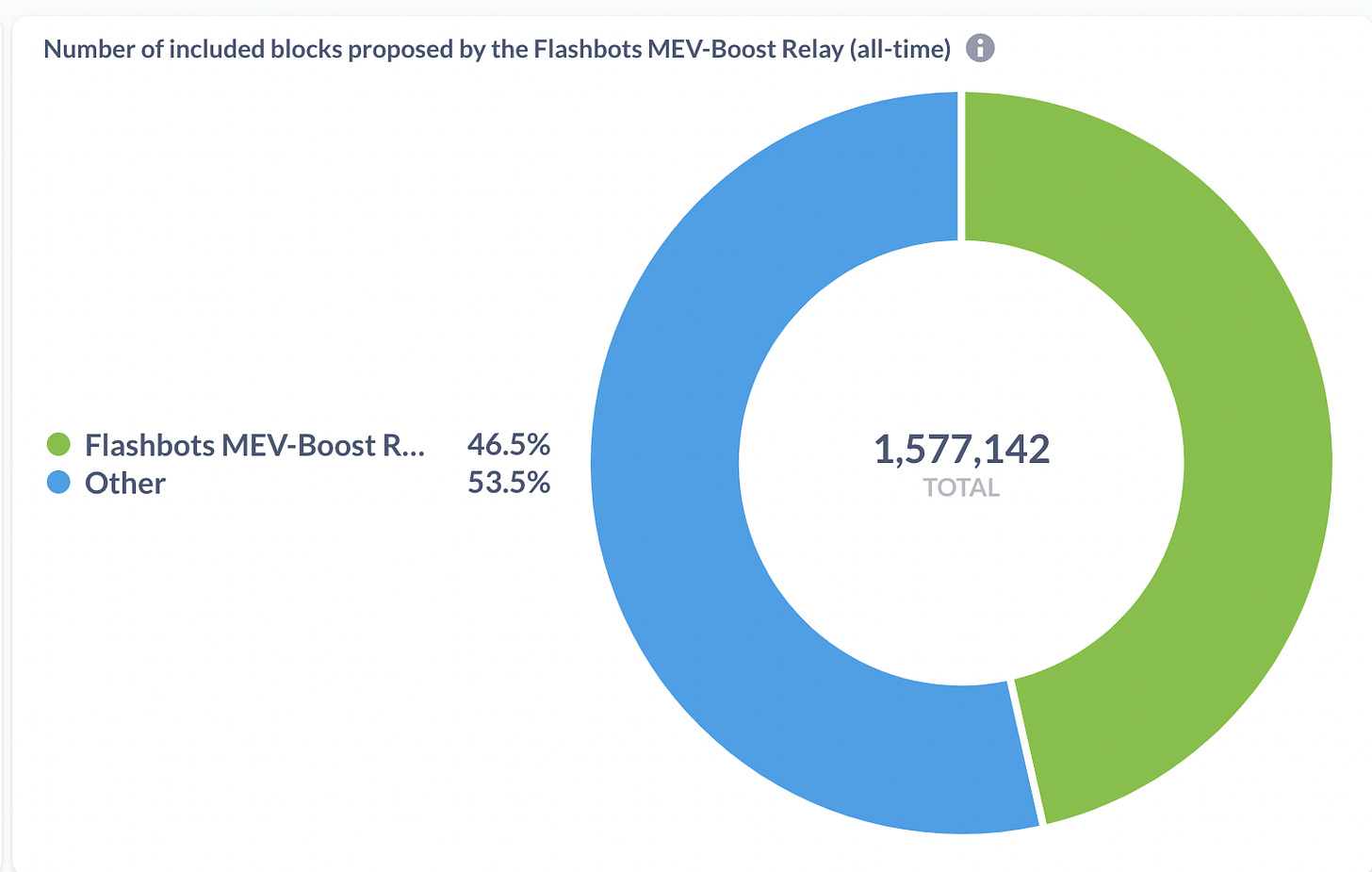

Since Merge, the number of blocks submitted through Flashbots has accounted for nearly half, and its dominance is even stronger than Lido. After all, although Lido occupies 70% of LSD, it only accounts for 30% of Staking as a whole. % share.

Flashbots Lianchuang Hasu is also Lidos consultant with a relatively strong background, but has not disclosed much information about the issuance of coins. Mev-share has built the foundation for flywheel growth. At this time, competitors may also get a share if they fork and issue coins to compete. However, this technical threshold is relatively high, and it can be said that it is the same as LSD Fi.

Summarize

Summarize

The MEV track has great prospects and is currently in its infancy. Flashbots is dominant, and Mev-share has built the foundation for its rapid growth, but there should be many opportunities in the future.