first level title

f(x) protocol overview

first level title

background introduction

AladdinDAO

background introduction

AladdinDAO is a DAO composed of DeFi experts, aiming to screen high-quality DeFi projects and provide community members with high-yield investment opportunities. In the Curve War, a war for CRV voting rights, AladdinDAO launched two new tools: Concentrator and Clever, to help users win more profits and influence.

Since the USDC crisis, the core members of AladdinDAO have re-examined the shortcomings of stablecoins in the current market, and proposed a new solution, which is the f(x) protocol.

stable currency

stable currency

Before discussing the f(x) protocol, let's first review the definition of a stablecoin:

A stablecoin is a digital currency whose value is pegged to another currency, commodity or financial instrument in order to reduce price volatility compared to other volatile cryptocurrencies such as Bitcoin.

The primary role of stablecoins is to provide liquidity and stability in the cryptocurrency market as a store of value and medium of exchange. Most stablecoins are anchored to the U.S. dollar or other fiat currencies, which makes them easy to interact and exchange with the traditional financial system. However, from a crypto-native perspective, if the crypto world continues to grow and grow, stablecoins are relatively inflated because they fail to capture the appreciation of cryptocurrencies relative to fiat currencies. Therefore, stablecoins may lose their attractiveness and competitiveness, and more people will seek an asset that can follow the development of the crypto market.

There are currently three main types of stablecoins: legal currency support, some algorithmic stablecoins, and CDP algorithmic stablecoins

Purely algorithmic (uncollateralized or under-collateralized) stablecoins, such as Terra's UST, are the most obvious type of risk, as they are difficult to guarantee safe and reliable, and are not suitable as long-term options. It then divides existing stablecoins into three broad categories:

1. Fiat-backed stablecoins (such as USDC, USDT), which rely on third-party institutions to maintain fiat currency reserves, but also face the risk of centralization.

2. Algorithmic, but partially or fully fiat-backed stablecoins (e.g. DAI, FRAX), which are also subject to the centralization risk of fiat-backed stablecoins.

3. Fully decentralized CDP algorithm stablecoins (such as LUSD), which only accept decentralized collateral, but have room for improvement in terms of scalability and capital efficiency.

In the f(x) protocol, the price of ETH is defined as the market, and β is a measure of the volatility of a given cryptocurrency relative to ETH. ETH itself has a beta of 1, while a perfect stablecoin has a beta of 0. Asset X has a target beta of 0.5, meaning it only reflects 50% of the change in the price of ETH.

secondary title

How the protocol works

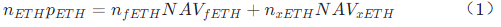

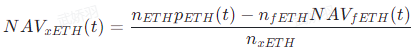

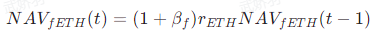

The protocol keeps f(x) constant by adjusting the NAV (Net Asset Value) of fETH and xETH, namely:

In this way, xETH captures all the ETH price movement that fETH masks out, thereby providing leveraged returns.

secondary title

Fractional ETH - Low Volatility Asset / "Floating" Stablecoin

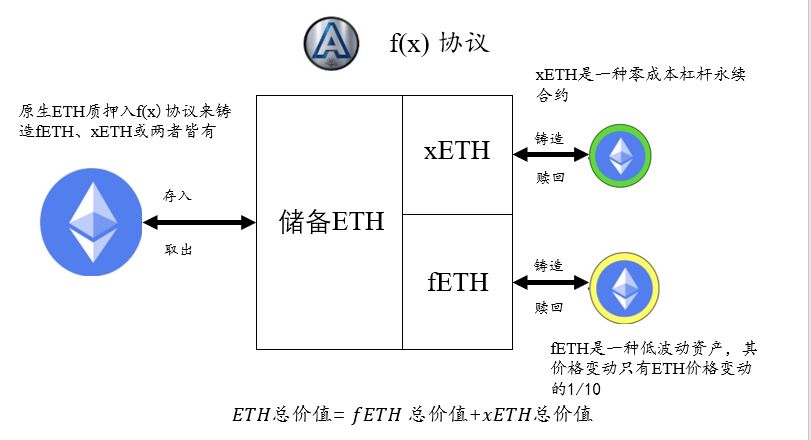

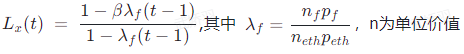

At the beginning of the protocol, the price of fETH is set at $1. The protocol controls the volatility of fETH by adjusting its NAV so that it only reflects 10% of the change in ETH price (i.e. β_f = 0.1). When the price of ETH changes, the NAV of fETH will be updated according to the following formula:

where rETH is the rate of return of ETH between time t and t-1.

The advantages of stablecoins are mainly reflected in low price volatility, low inherent risk, and deep liquidity. fETH is a low-volatility asset, and its beta = 0.1, meaning that its price change is only one-tenth of the change in ETH's price. In this way, fETH can avoid the risk of centralization while capturing the growth or decline of a part of the ETH market.

Overall, fETH as a store of value and medium of exchange provides liquidity and stability in the cryptocurrency market while retaining some of the market's growth potential.

Leveraged ETH

secondary title

Leveraged ETH, also known as xETH, is a decentralized, composable leveraged long ETH futures contract with low liquidation risk and zero funding costs (in extreme cases, xETH minters can even earn fees), Designed as a companion asset to fETH. xETH holders collectively bear most of the volatility in fETH supply, and by using the f(x) minting and redemption modules or off-the-shelf on-chain AMM liquidity pools, traders can shift positions as they please.

Calculation of leverage multiples of xETH

text

Determined according to the following formula:\lambda_f= 0, L_x= 1 $$,If the amount of fETH minted is 0, then $$

The actual effective leverage of xETH tokens varies over time as the relative supply of xETH and fETH are minted and redeemed. The higher the supply of xETH relative to fETH, the lower the effective leverage of xETH, as the excess volatility of fETH is spread across more tokens. Conversely, a larger supply of fETH concentrates volatility on fewer xETH tokens, resulting in higher effective leverage.

secondary title

system stability

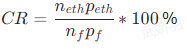

Whether it is minting fETH or xETH, or adjusting the net asset value of the two tokens, it will affect the value of CR. If the system CR falls to 100%, it means that the value of xETH is zero. At this time, the β value of fETH is 1, which means It will be fully exposed to the price fluctuations of ETH, and will no longer exist as a low-volatility asset. Therefore, f(x) has designed a four-level risk management module for risk control.

Wind control

text

The risk control system of f(x) is a four-level module, which is used to take corresponding measures to maintain the low volatility of fETH and the positive assets of xETH when the mortgage rate (CR) of the risk control system drops to a certain threshold Net worth, thereby increasing CR. These measures include:Stable mode:

When the CR is lower than 130%, the minting of fETH is prohibited, the redemption fee of fETH is canceled, the redemption fee of xETH is increased, and the minter of xETH is given additional rewards.User Balance Mode

: When CR is lower than 120%, users are encouraged to redeem fETH to increase the mortgage rate of the system, and additional rewards are given to redeemers.Protocol balance mode:

When the CR is lower than 114%, the protocol automatically uses the ETH in the reserve to purchase and destroy fETH in the market to increase the mortgage rate of the system.secondary title

income

The revenue of the f(x) protocol is achieved by charging fees to the minting and redemption of fETH and xETH. These fees are an operational parameter and will be determined at launch. Additionally, when the risk management module kicks in, holders of fETH are also required to pay stability fees, which are distributed to other users who help balance the system, or to the protocol itself.

secondary title

In order to better understand the impact of beta on assets, we will analyze and evaluate the change of beta from 0 to 1 from three different perspectives: store of value, medium of exchange, and crypto-native. These three perspectives cover the main functions and characteristics of the assets, as well as their place and role in the cryptocurrency market.

store of value

store of value

From a store of value perspective, as β goes from 0 to 1, the value stability of assets gradually decreases as they are increasingly affected by market volatility. Stablecoins (β = 0) can maintain the same purchasing power as fiat currencies, while ETH (β = 1) will increase and decrease as the market rises and falls. fETH (β = 0.1 ) is somewhere in between, and it preserves some of the market's growth potential while limiting volatility.

medium of exchange

From a medium of exchange perspective, as β goes from 0 to 1, assets become increasingly liquid and scalable as they become more in line with the needs and characteristics of the cryptocurrency market. Stablecoins (β = 0) can be easily exchanged with fiat currencies, but there are also centralization risks and trust issues. ETH (β = 1) is a fully decentralized and Ethereum-native asset, but also suffers from high volatility and price uncertainty. fETH (β = 0.1) is in between, it avoids centralization risk while maintaining low volatility and high liquidity.

From a crypto-native perspective, as β goes from 0 to 1, assets become increasingly decentralized and innovative as they increasingly embody the spirit and value of cryptocurrencies. Stablecoins (β = 0) are assets anchored to fiat currencies, and they rely on the support and supervision of traditional financial systems and institutions. ETH (β = 1) is the native asset of the Ethereum network, a leader and innovator in the cryptocurrency space. fETH (β = 0.1) is a new type of asset created based on the f(x) protocol. It is a low-volatility, decentralized, scalable, native Ethereum asset. It is paired with xETH, which is a High volatility, leveraged, perpetual contract tokens.

first level title

Assumptions under extreme market conditions

first level title

Summarize

In general, the positions of fETH and xETH in the Ethereum ecosystem and their future development trends are not isolated, but will be closely affected by market demand and trader behavior. Market demand is determined by a combination of factors, such as the price trend of Ethereum and the overall cryptocurrency market conditions. The behavior of traders is determined by multiple factors such as their expectations of market trends, risk tolerance, and their understanding and emphasis on the value of decentralization and composability. These factors are intertwined and jointly shape the roles and development prospects of fETH and xETH in the Ethereum ecosystem. Therefore, to predict and understand the development trend of fETH and xETH, it is necessary to deeply explore the changes in market demand and trader behavior, understand how they interact, and jointly affect the status and development direction of these two assets in the Ethereum ecosystem.

Disclaimer: This article is for research information only and does not constitute any investment advice or recommendation. The project mechanism introduced in this article only represents the author's personal opinion, and has no interest in the author of this article or this platform. Blockchain and digital currency investments are subject to various uncertainties such as extremely high market risk, policy risk, and technical risk. The price of tokens in the secondary market fluctuates violently. Investors should make cautious decisions and independently bear investment risks. The author of this article or this platform is not responsible for any losses caused by investors using the information provided in this article.