Waterdrip Capital: In-depth discussion on the past, present and future of BTC Layer2

Original Author: Glimmer@Glimmerllx, William, Hankester @0x Hankester

Mentors: Jademont, Elaine, Bill @Waterdrip Capital

first level title

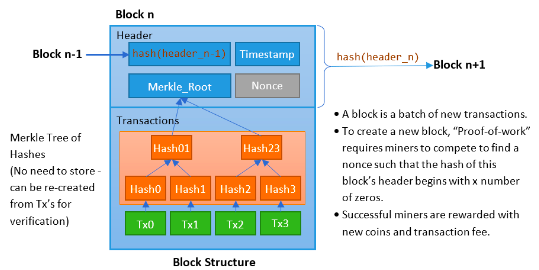

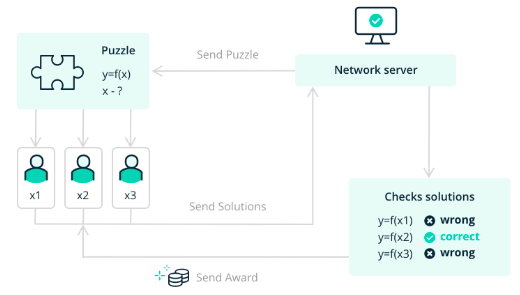

A technical brief on BTC

image description

image descriptionhttps://www 3.ntu.edu.sg/home/ehchua/programming/blockchain/bitcoin.html

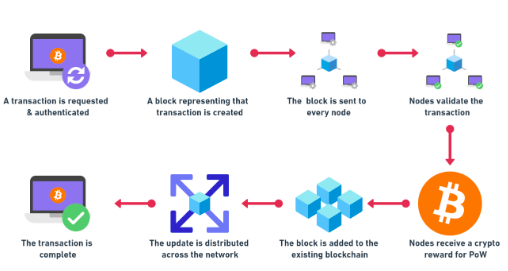

Image source of BTC bookkeeping workflow:https://hackernoon.com/exploring-the-feasibility-of-transitioning-btc-from-pow-to-pos

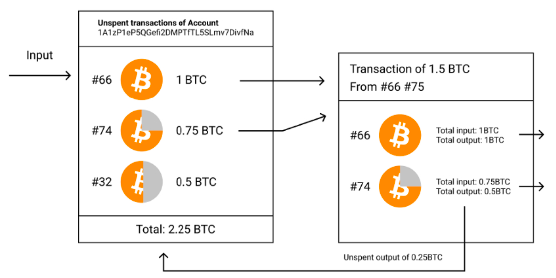

image description

UTXO diagram of a single account, image source:https://docs.safepal.io/blockchain-tutorials/utxo-what-is-it-and-how-to-use-it

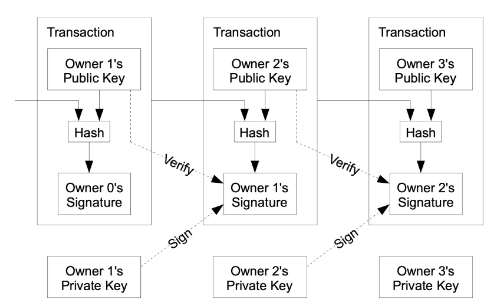

image description

Signature and verification of BTC account private key and public key, image source: Nakamoto, Satoshi."Bitcoin whitepaper."

image description

first level titlehttps://www.ledger.com/academy/blockchain/what-is-proof-of-work

Current status and problems of BTC

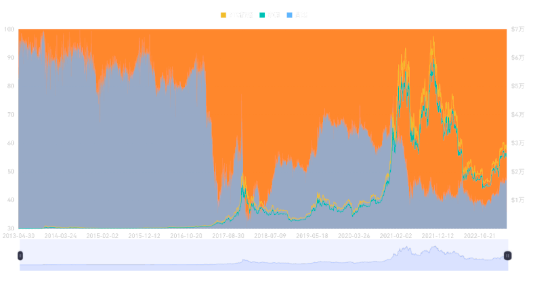

image description

BTC market capitalization ratio, source:https://www.coinglass.com/zh/pro/i/MarketCap

For a long time, BTC has been sought after by users for its pioneering status and high security. However, with the growth of cryptocurrency users, it is difficult for BTC to satisfy users' requirements for low fees, convenience, instant, privacy protection, and diverse assets of the cryptocurrency system. And the growing demand for diverse applications. In the long run, the ratio of the market value of BTC to the total market value of cryptocurrencies is slowly declining. Compared with Ethereum's prosperous ecology, Solana's low handling fee and high TPS (Transactions Per Second) and other public chains with their own merits, BTC seems to have no other core competitiveness except popularity and security, and faces the following problems:

Slow transaction speed, long confirmation time, and inconvenient: Each block of BTC has a capacity of 1 M, and the data of each transaction is about 250 B, so each block contains up to 4000 transactions. Based on the expected block time of 10 minutes, the TPS of BTC is only about 7. Transactions on BTC need to wait 6 blocks for credible confirmation, which results in a final confirmation time of about 1 hour. In addition, the transfer on BTC can only transfer all the balance out at one time. For change, you need to declare the transfer back to your own address, otherwise it will be rewarded to the miners. This cannot meet users' needs for transaction convenience and instant.

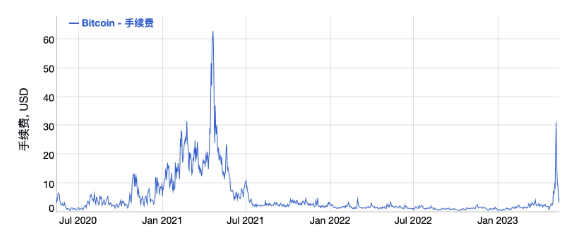

High transaction fees: When users use BTC to conduct transactions, they need to pay a fee to attract miners to pack the transaction. The higher the fee, the faster the transaction confirmation. When transactions are congested, handling fees will become extra expensive, reaching more than $60 in 2021. From May 14, 2020 to May 15, 2023, Bitcoin transaction fees will cost an average of $4.66. This fee cost prevents many users from using BTC.

image description

first level titlehttps://bitinfocharts.com/zh/comparison/bitcoin-transactionfees.html#3 y

Improving BTC's Resistance and Layer 2 Solutions

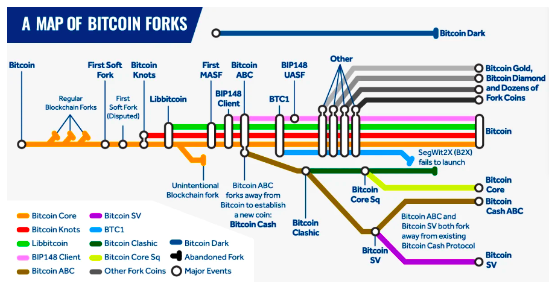

technical difficulty:The problems encountered by BTC stem from the fact that the old technical solutions cannot meet the current needs. Even if fine-tuning is performed directly on BTC, the problems cannot be completely solved, and new problems will be derived instead. If BTC is expanded, each block is increased from 1 M to 100 M, and the TPS is increased to 700, it will result in nearly 5 T of new ledger data every year, which will increase the threshold for operating nodes and affect the degree of decentralization of the system , increasing the system risk. Even without considering the size of the ledger data, calculated based on the median Internet bandwidth of 13 Mbps and the size of each transaction in a block being 250 B, the TPS upper limit of BTC is 13 Mbps/8 Mb/250 B ≈ 6815, which cannot be used on Polkadot , Solana and other public chains that can support tens of thousands or even hundreds of thousands of TPS compete. Bitcoin Cash (BCH) expands the block size of BTC and increases the block size of BTC. However, BCH client errors occur frequently, and it increases the operating cost of the full node, which brings centralization risks. In 2019, in order to combat attackers who exploited BCH code vulnerabilities, BCH mining pools launched a 51% attack to modify transaction data.

Community Resistance:Between security and scalability, the BTC community prioritizes security. BTC core developers are cautious about technical risks, so they are very conservative in the suggestion of directly extending BTC. The simplest extension is to increase the size of each block of BTC. rightProposals to Increase BTC Block Sizeimage description

image descriptionhttps://www.blocktempo.com/forks-history-5 years-review/

BCH network total computing power history, image source:https://explorer.btc.com/zh-CN/bch/insights-hashrate

Layer 2 solution:first level title

The goal and development history of the second layer of BTC

BTC Layer 2 refers to the second-layer expansion technology of Bitcoin (BTC). This type of technology aims to increase the transaction speed of Bitcoin, reduce handling fees, increase scalability, and solve a series of problems faced by BTC.

Layer 2 development goals:

Improve transaction speed:Layer 2 tries to increase the transaction speed of Bitcoin by optimizing the transaction processing method, batch processing transactions under the chain, and using the latest technology to synchronize and verify each transaction under the chain, thereby expanding the application and application of Bitcoin globally. promote.

Reduce transaction costs:Layer 2 processes transactions in batches under the BTC chain, and only writes the final state after the transaction is completed into BTC. The intermediate transactions and states in the final state and initial state exist under the chain and are not synchronized on BTC, which reduces transaction fees. And lighten the burden on Bitcoin's underlying blockchain.

Increased scalability:The introduction of Layer 2 technology aims to alleviate the scalability problem of Bitcoin's underlying blockchain, making it more capable to cope with future transaction volume growth.

In recent years, Layer 2 has been one of the most important investment themes in the crypto industry, but it specifically refers to Ethereum’s Layer 2 expansion plan in most scenarios. However, BTC’s expansion plan is much earlier than the Ethereum expansion proposal. Even Ethereum was created after Vitalik Buterin's proposed improvements to BTC were rejected.

In 2012, the concept of Pegged Sidechains was first proposed, derived from Two-way Peg, which allows assets to be seamlessly transferred between the two chains. This proposal laid the foundation for later sidechain technology.

In 2014, Blockstream was established to start researching and developing sidechain technology to improve the scalability of Bitcoin.

In 2015, the Lightning Network white paper was released, and Tadge Dryja and Joseph Poon were the authors of the white paper. Lightning Network is a solution that separates small transactions from the main chain. By creating a two-way payment channel, there is no need to record intermediate transactions on the blockchain, and only the final state needs to be recorded on BTC.

Because the design of BTC is relatively simple, and it is not flexible and scalable, it is difficult for the early BTC Layer 2 scheme to be embedded in Bitcoin, so it has not aroused great repercussions.

Until 2017, SegWit (Segregated Witness) was upgraded and activated, which solved the problem of transaction plasticity in the Bitcoin blockchain and made possible the development of Layer 2 technology.

Since 2018, developers have gradually begun to deploy Lightning Network nodes, and have gained certain users and support. according towww.bitcoinvisuals.comAccording to statistics, as of June 4, 2023, the number of nodes in the Lightning Network has exceeded 18,000, the number of payment channels that can accommodate more than 70,000, the network capacity of more than 5,000 bitcoins, and a value of more than 100 million US dollars.

lightning network

lightning network

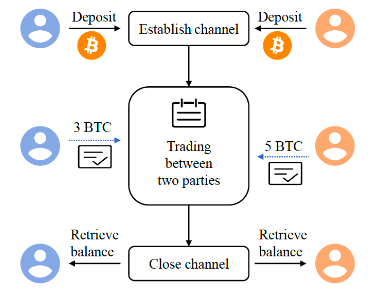

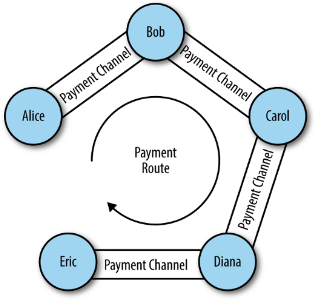

The Lightning Network was first proposed in 2015 by Joseph Poon and Thaddeus Dryja in their white paper. The Lightning Network uses micro-payments channel technology to place a large number of transactions outside the Bitcoin blockchain, and only put key links on the chain for confirmation. The transaction process is as follows: a user who needs to trade opens a room for offline transactions. When entering the room, the user pledges the currency to obtain a bill, and uses the new bill to distribute the pledged currency of both parties. After the transaction is completed, when the room is out, the transaction is settled. The latest note redemption currency.

A technical brief on the Lightning Network

In order to construct a safe and reliable micropayment channel, Lightning Network adopts Recoverable Sequence Maturity Contract (RSMC) and Time Lock Contract (Hashed Timelock Contract, HTLC) as key technologies.

image description

The transaction process of Lightning Network, image source:https://ieeexplore.ieee.org/stamp/stamp.jsp? tp=&arnumber= 8962150

image description

Payment channels and routing of the Lightning Network, image source:https://cypherpunks-core.github.io/bitcoinbook/ch 12.html

However, the early Lightning Network had the following problems:

Each transaction requires two parties to operate: In the channel, each transaction requires both parties to confirm the signature, and no unilateral transfer is possible

A game between the two sides of the transaction is required: if A and B conduct a transaction, and A uses the old transaction result to initiate a withdrawal, B can only submit an updated version of the transaction result as a rebuttal within 1000 blocks of time, otherwise A’s withdrawal will take effect

Channel state management: Users need to dynamically synchronize and back up the state of the channel, otherwise, if an old state is submitted, the counterparty can initiate a fraudulent rebuttal, request a claim, and obtain all assets in the channel

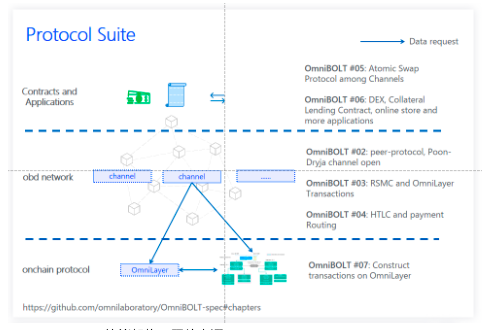

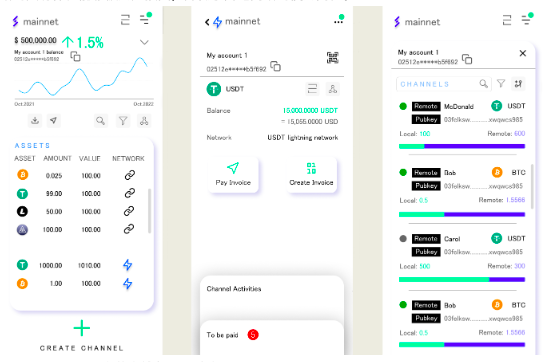

In fact, early versions of the Lightning Network required users to run full-node wallets or use fully-custodial wallets due to the aforementioned issues. Full-node wallets require users to manually manage temporary private keys and channel status, and the transaction experience is not good. Fully managed wallets, such as Chivo used in El Salvador, have a low threshold for use, and the custodian automatically operates on behalf of the user. However, the custodian has control over the private key of the user account, and its security is worrying. As developers continue to develop the Lightning Network, the above-mentioned problems are gradually being resolved, and a more complete Lightning Network and supporting facilities have been developed, such as OmniBOLT and the OBAndroid Lightning Network wallet developed by its team.

OmniBOLTimage description

OmniBOLT protocol architecture, image source:https://omnilaboratory.github.io/obd/#/

OBAndroidimage description

first level titlehttps://github.com/omnilaboratory/OBAndroid

Other BTC Layer 2 projects

Besides the Lightning Network, there are other BTC Layer 2 projects in development:

SyscoinDepend onSYSLabimage description

Syscoin’s roadmap, source:https://syscoin.org/news/syscoin-roadmap-2022

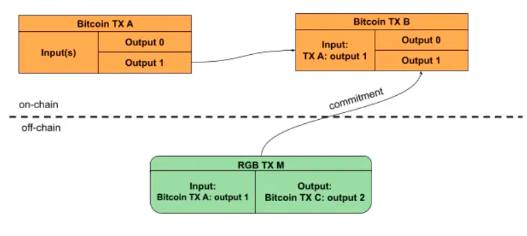

RGBimage description

image descriptionhttps://medium.com/@FedericoTenga/understanding-rgb-protocol-7dc7819d3059

first level titlehttps://www.rgbfaq.com/glossary/aluvm

BTC Layer 2 Summary and Outlook

Although Bitcoin is the world's earliest, safest, most well-known and highest-valued blockchain network, its ecological development has continued to deepen. For example, the channel capacity of its largest second-layer network, the Lightning Network, continues to grow, the Taproot upgrade improves Bitcoin’s efficiency and privacy, and the Taro protocol introduces stablecoin payments and on-chain native NFTs to the Lightning Network. However, compared with the number of Bitcoins on the Ethereum chain, the Bitcoin capacity of the Lightning Network is relatively low, and due to the full node data synchronization and channel state management, the use threshold of the Lightning Network is high, and the user scale is not as good as that of Ethereum, but This status quo may indicate huge growth potential. With the further development of Lightning Network-related ecology, the continuous development of the improved version of the Lightning Network protocol like OmniBOLT and the OBAndroid wallet that lowers the threshold for use will make the Lightning Network finally have good security and scalability. It is accepted by users because of its reliability and ease of use, which may bring the market value of BTC to a higher level.

At the same time, we also need to pay attention to the development of other Layer 2 projects, such as the RGB scheme with natural privacy protection and Syscoin compatible with the Ethereum ecosystem. These projects are not as well-known as the Lightning Network, but they can also solve the problems faced by BTC and have advantages that other solutions cannot match. However, compared to the second-tier extension projects of Ethereum, these projects are not well-known enough, have received less investment, and do not receive the support of the BTC core development team like the Lightning Network. Their expansion of BTC will most likely be later than Ethereum The implementation of extensions, such as Syscoin's Rollup solution. In terms of Layer 2 ecology, it seems that the Ethereum ecology has a better virtuous circle and is more favored by investors.

In the future, we may see accelerated expansion of the Bitcoin ecosystem. As the Lightning Network infrastructure improves and attracts more and more attention, Lightning Network-based projects like OmniBOLT and RGB can benefit from it, gaining a better development foundation, more users and even more investment. And BTC Layer 2 projects compatible with Ethereum such as Syscoin will also benefit from the rapid development of Ethereum's second-layer ecosystem and accelerate the progress of its roadmap. In addition, the discussion on the BTC expansion scheme has not stopped: the Bitcoin-based zk-rollups two-layer network proposed by John Light in 2022 may bring more functions, higher scalability and Better privacy while maintaining its decentralized nature; Block, a company led by former Twitter CEO Jack Dorsey, is promoting the liquidity improvement of the Lightning Network, which may mean that the Bitcoin ecosystem will be more popular in payments, DeFi, NFT, etc. Outside the field, open up a new track to cover more users.

[ 1 ] Nakamoto, Satoshi. "Bitcoin whitepaper." URL: https://bitcoin. org/bitcoin. pdf-(: 17.07. 2019) ( 2008).

[ 2 ] Poon, Joseph, and Thaddeus Dryja. "The bitcoin lightning network: Scalable off-chain instant payments." ( 2016).

[ 3 ] “Lightning Network Client Architectures.” URL: https://bolt.fun/guide/architecture

[ 4 ] Lin, Jian-Hong, et al. "Lightning network: a second path towards centralisation of the bitcoin economy." New Journal of Physics 22.8 ( 2020): 083022.

[5] Discussion on increasing BTC block size:https://bitcoin-development.narkive.com/3 MPEfZHu/elopment-block-size-increase