Market Overview

Overall market overview

This week, the cryptocurrency market is in a volatile downward trend, and the market sentiment index has fallen from 11% to 8%. The market value of stablecoins has basically begun to grow rapidly (USDT reached 142.7 billion, USDC reached 57.2 billion, with an increase of 0.49% and 2.32% respectively), indicating that institutional funds have begun to enter the market again, with the growth rate of US funds being the main one. It can be seen that after the decline in the past two weeks, US investors have begun to enter the market again; although the release of data and the release of the Feds revelation paper have gradually eliminated the markets concerns about the US economic recession, and the market has gradually begun to price in the Feds three interest rate cuts this year and the interest rate cuts in May, but it has not been able to ease market sentiment. On the contrary, due to the recent repeated policy changes, the strong fluctuations in Bitcoin prices have made market sentiment more panic, and Altcoins generally perform weaker than the benchmark index.

Next weeks forecast

Bullish targets: BTC, S, AAVE, BERA

BTC: The recent trend of BTC and the Crypto industry has been weak, mainly because: at the macro level, the implementation of Trumps tariff policy has led to market investors concerns about the future rise in US inflation rates and the decline in US GDP expectations, which may trigger a short-term economic recession, the suspension of the US-Ukraine mineral agreement, and the Feds uncertainty about future interest rate cuts; in terms of BTC itself, the price of BTC has remained high for the past two months, and some long-term holders and some whales have begun to gradually sell at high levels, but there is no new positive news and subsequent funding in the market, and the Bitcoin strategic reserve signed by Trump is less than the markets previous expectations, so the price of BTC has begun to fall sharply in the near future, and with the sharp drop in the price of BTC, it has caused panic selling by market users, and continued selling by institutions led by BlackRock. There are two main reasons for the bullish outlook: there have been some changes in the macro level. Due to the release of data and the Feds unveiling paper, the market has gradually eliminated concerns about a US recession, and the market has begun to gradually price in three interest rate cuts by the Fed this year and the rate cuts that began in May; in BTC itself, after a rapid decline, there was a panic sell-off. According to on-chain data, most holders did not sell during this decline and began to gradually absorb chips, which makes the trend of BTC next week optimistic.

S: Although the S token ended its strong trend in recent weeks and fell with the market this week, the fundamentals of Sonic have not changed. Sonics TVL this week is still on a growth trend, with an increase of 9.23%. The main Defi projects on the Sonic chain have also achieved growth this week. And the APY provided to users by Defi on the Sonic chain has not decreased, and it remains at a high level. In Beets, the main liquidity staking project on its chain, the APY of the liquidity pool based on the S token can reach up to about 30%, which is basically the same as last weeks level. The average interest rate for users to borrow money in the lending agreement on the Sonic chain is about 14%, which is higher than 10% last week, proving the increase in on-chain lending. And it has been observed that the daily income on the Sonic chain is 210,000 US dollars, ranking 6th among all public chains, much higher than other public chains with the same TVL. Since most of its chains are Defi projects, it can be seen that Defi activities on the Sonic chain are very frequent. Therefore, it can be concluded that the decline in the price of S tokens this week is not due to problems with the project itself, but more because it follows the trend of the market price. Since the fundamentals of Sonic have not changed, its bullish logic still exists.

AAVE: This week, AAVE rose against the trend, with a weekly increase of 21.38%, ranking among the top 50 tokens by market capitalization. In addition, Aaves TVL performance is very outstanding, with a growth rate of 5.86% this week, ranking second in the growth rate among the top 20 Defi projects by TVL, second only to Infrared Finance on Berachain. Aaves popularity this week is mainly due to its optimized governance and token economic model (repurchase of tokens, increase in staking rewards, and optimization of liquidity) and the White Houses support for the abolition of DeFi transaction reporting rules, reducing compliance burdens and stimulating innovation. Although it is only a proposal at present, with Aaves strong financial situation and attitude of supporting innovation, the proposal should be able to be realized, and Aaves repurchase proposal this time may promote a round of repurchase boom in the Defi industry, bringing a bit of vitality to the currently dormant industry, so Aaves development in the future is very optimistic.

BERA: This week, BERA tokens, like S tokens, ended their strong trend in recent weeks and fell, but Berachains on-chain data and fundamentals have not changed, and all data have achieved upward growth. This week, the TVL growth of the top DEX, Lending, and LSD projects in the Berachain ecosystem has slowed down this week, mainly due to the growth of LSD project Infrared Finance and DEX project BEX, which can reach 31.15% and 25.22% respectively. This is mainly because Infrared Finance stabilized the APY of WBERA at around 120%, and BEX stabilized the APY of the stablecoin pool at around 16%. In the current market, investors are still in a panic, and high-interest stable returns are still very attractive to investors. At the same time, the interest rate of the Lending project Dolomite to borrowers is as high as 48.08%, which has increased users demand for BERA. Therefore, it can be seen that the decline in the price of BERA tokens is mainly due to the influence of the market environment, not because of changes in the Berachain project itself, so the logic of the rise in BERA tokens still exists.

Bearish targets: APE, APT, MERL, TON

APE: APE is the governance and utility token of the Bored Ape community and related communities. It is used to authorize and incentivize decentralized community construction at the forefront of web3. At the same time, APE has also become a utility token or currency in web3 projects such as games and virtual worlds. It can be seen that the tracks mainly involved in APE are NFT and Gamefi. However, in this round of market conditions, most of the market share of the NFT and Gamefi tracks has been occupied by the Meme track. Most of the projects in the NFT and Gamefi tracks have lost attention in the market, and the number of users has gradually decreased, with almost no new funds. Therefore, ApeCoin, as a project that benefited from the Metaverse and Gamefi dividends in the last round, is basically ignored in this round. At the same time, the APE token will usher in the unlocking of 15.37 million APE on March 16, accounting for 1.54% of the total locked amount. The unlocking this time is large, and most of them are VCs at the time. After the project loses its vitality, most investment institutions will continue to sell tokens to recover funds, so APE will face greater selling pressure after this unlocking.

APT: Aptos performed well this week mainly because Bitwise submitted an application for the spot Aptos ETF on March 5, which gave it certain expectations in the future. However, Aptos is not among the several cryptocurrency reserves announced by Trump before. So if the details of establishing a cryptocurrency reserve are announced at the first White House Crypto Summit this Friday, the announced tokens will receive market attention in a short period of time, and funds and attention will be transferred from other projects. If this happens, it will not be friendly to Aptos, which is also a top public chain. And the APT token will usher in the unlocking of 11.3 million APTs on March 12, accounting for 1% of the total locked amount. The tokens unlocked this time are all in the hands of institutions, so there may be continuous shipments to form selling pressure, and the transfer of attention and funds may be superimposed, which may exacerbate the panic of market investors about APT.

MERL: This week, Merlins TVL dropped significantly, with a drop of 12.44%. From the perspective of its TVL composition structure, the largest drop was mainly in its on-chain DEX, Restaking and cross-chain projects, of which MerlinSwap dropped by 34.33% and Pell Network dropped by 87.11%. The TVL of the cross-chain project Meson is relatively small, so it is negligible. Because Merlin is a BTC-L2, there is not much ecology based on BTC-L2, mainly DEX, Lending and Restaking projects, so it can be seen that the decline in Merlins TVL is due to the large-scale decline of its main ecological projects, and funds are constantly withdrawing from Merlin. At the same time, combined with the recent development of BTC ecological projects, it has not received much attention in the market, and due to the recent sharp drop in BTC, many pledged BTC have withdrawn from the protocol. However, the decline of MERL this week is not large, only -1.8%. Given the continued outflow of funds from its on-chain ecosystem, it can be judged that there is a high probability that it will experience a compensatory decline next week.

TON: This week, the TVL on the Toncoin chain has dropped significantly, with a drop of 10.68%. From the perspective of its on-chain TVL composition, the TVL of almost all ecological projects on its chain has dropped, and from its TVL history line, Toncoins TVL has been on a downward trend since last year, that is, after the popularity of the on-chain mini-games based on Telegram, it has been in a state of capital withdrawal, and combined with the fact that the SocialFi project has been on the edge of the entire Crypto industry in recent months, it has not created a popular star project, and as the popularity of the on-chain mini-games fades, the users money-making effect is getting worse and worse, even worse than the APY of ordinary Defi projects, so funds have been continuously withdrawing from Toncoin. In addition, the recent sentiment in the Crypto industry is low, and the price of TON has fallen sharply, so investors are generally not optimistic about Toncoins on-chain ecological projects. Therefore, it can be judged that TON is likely to be in a downward trend.

Market Sentiment Index Analysis

The market sentiment index rose from 11% last week to 8%, and overall entered the extreme panic range.

Hot Tracks

Aave

status quo

This week, Aave, one of the leading Defi projects, performed very well. Aave ranked second in growth rate among the top 20 Defi projects by TVL, second only to Infrared Finance on Berachain, with a growth rate of 5.86%. For a Defi project with a TVL of US$19.227 billion, a growth rate of more than 5% is huge, and the price of AAVE also rose by 21.38%, which is very outstanding among the top 50 tokens by market value.

Hot reasons

There are two reasons why Aave is so popular this week: First, Aave plans to optimize its ecosystem governance and token economic model through a series of proposals, including launching a buy and distribute plan, using the protocols excess revenue to repurchase AAVE tokens at a scale of $1 million per week and inject them into the ecosystem reserve, reducing the circulating supply and increasing the value of tokens; establishing the Umbrella mechanism and the Aave Financial Committee (AFC), distributing part of the excess revenue to aToken stakers, and optimizing fund management; launching the Anti-GHO token to enhance rewards for StkAAVE and StkBPT stakers; terminating the LEND migration contract and recovering $65 million of AAVE injected reserves; and adopting a hybrid model to optimize secondary liquidity management and achieve greater liquidity at a lower cost. Second, the White House supports the abolition of IRS rules on DeFi transaction reporting, reducing the compliance burden of DeFi projects and retaining the decentralized nature, while attracting capital and talent back to stimulate innovation.

Future Outlook

Aave is one of the iconic projects in the Defi industry, and its every move may affect the future development direction of the Defi industry. Recently, there is a lack of innovation in the Crypto market, the development of the AI industry is moving towards the Meme direction, and the Meme wave has retreated, which has led to the entire Crypto industry being in a downturn. Therefore, investors in the market are no longer convinced of the stories and route development of various industries at this stage, but focus on the real benefits that the project brings to users. After all, real benefits are the most important for users. Therefore, high APY projects have emerged in the market, such as Berachain and Sonic, which provide users with high APY to attract users to participate. However, Aave has taken a fancy to the growth method of DeFi dividends. Due to Aaves monopoly in the Lending track in recent years, it has accumulated sufficient capital reserves for it. Aave DAOs cash reserves have reached 115 million US dollars, and the supply of GHO stablecoins has exceeded 200 million US dollars. Therefore, Aaves repurchase proposal shows multiple advantages, including strong cash reserve support, diversified income structure, and high-quality asset rewards. This has made investors in the market believe that Aave will have very good development in the future, and at the same time has opened up new growth points for investors and project parties in the market. It is foreseeable that as current investors pay more and more attention to the value capture ability of DeFi protocols, many DeFi projects will surely begin to turn to dividend or repurchase models to enhance the value feedback ability of tokens.

At the same time, we can calculate from Aaves weekly repurchase of $1 million that it repurchases about $52 million of AAVE every year. AAVEs current market value is $3.165 billion, and it can be concluded that Aaves P/E ratio is 60.86 times. Among the projects that are repurchasing, Maker is the most well-known and best project in the industry. According to Makers website, its current P/E ratio is 20.75.

Therefore, from the comparison between Aave and Maker, it can be concluded that Aaves P/E ratio is much higher than Maker. Therefore, it can be concluded that although Aave is currently expected by the market, the cost-effectiveness of purchasing AAVE is much lower than that of MKR.

Berachain

status quo

This week, the entire market is in a volatile downward trend. Most of the top ten projects in TVL are in a downward trend. Among them, Berachain has the largest increase, reaching 17.21%. However, compared with other public chains, the fact that it has continued to grow for several weeks in the current pessimistic Crypto industry environment is itself a good indicator of its strong trend. Its TVL has reached 3.449 billion US dollars, ranking sixth among all public chain TVLs. However, the price of its token BERA has rebounded this week, with a drop of 12.94%.

Hot reasons

This week, the TVL growth of the top DEX, Lending, and LSD projects in the Berachain ecosystem slowed down this week, mainly due to the growth of LSD project Infrared Finance and DEX project BEX, which grew by 31.15% and 25.22% respectively. This is mainly because Infrared Finance stabilized the APY of WBERA at around 120%, and BEX stabilized the APY of the stablecoin pool at around 16%. In the current market, investors are still in a panic, and high-interest stable returns are still very attractive to investors. At the same time, the interest rate of the Lending project Dolomite to borrowers is as high as 48.08%, which has increased users demand for BERA.

Future Outlook

We can conclude from the reasons why Berachain is so popular that the main reason is that the Defi project on the Berachain chain increases APY to attract users, allowing users on the chain to obtain higher returns in the current unstable market, thereby achieving the purpose of attracting traffic on the Berachain chain. It can be seen from this that the key to achieving efficient growth in a blockchain ecosystem is to drive the positive cycle of the economic flywheel. Berachains core strategy is to focus on the DeFi track, empower on-chain assets through the dual-wheel drive of pledge and liquidity release, so that they can generate compound interest in scenarios such as DEX, lending and asset management, and thus achieve the goal of pledge is productivity. Specifically, the on-chain ecology needs to form a sustainable growth cycle through the path of pledge lock → liquidity release → DeFi empowerment → token appreciation → user return → re-pledge → developer gathering. However, once the funds of new users are not enough to cover the arbitrage selling pressure, the decline in the price of BERA tokens will lead to a decline in yields, which will in turn cause arbitrageurs to leave the market, causing a negative impact on the ecology. However, this week, Berachain is also facing a downward trend in the Crypto industry. First, it stabilized the APY given to users, ensuring that the users rate of return is greater than the decline in its tokens, so that arbitrage users can always make profits. At the same time, in order to reduce the supply, the founder of Berachain said that it has been buying back the supply of the seed round and subsequent rounds such as round A. Therefore, from the perspective of Berachains development, it is crucial to continue to pay attention to the APY performance of DeFi projects on the Berachain chain. The level of APY directly reflects the vitality and development potential of the ecosystem. As a real-income project, Berachains lifeline and barometer are the changes in its APY and TVL.

We can see from the largest staking project on Berachain, Infrared Finance, that the TVL of Infrared Finance is 1.844 billion US dollars, of which the TVL of BERA tokens is only 182 million US dollars. The current circulating market value of BERA is about 721 million US dollars, accounting for about 25.24% of the circulating proportion. Adding other staking projects on the chain, it can be concluded that the staking projects on the Berachain chain have pledged about 30% of the circulating market value of BERA tokens. The staking ratio of about 30% can be said to be relatively low in non-POS chains. And the number of BERA staked on the Berachain chain is rising at a 45° angle, so we can foresee that there will be more BERA staked on the Berachain chain in the future, thereby reducing the number of BERA in circulation, so we are very optimistic about the future of Berachain.

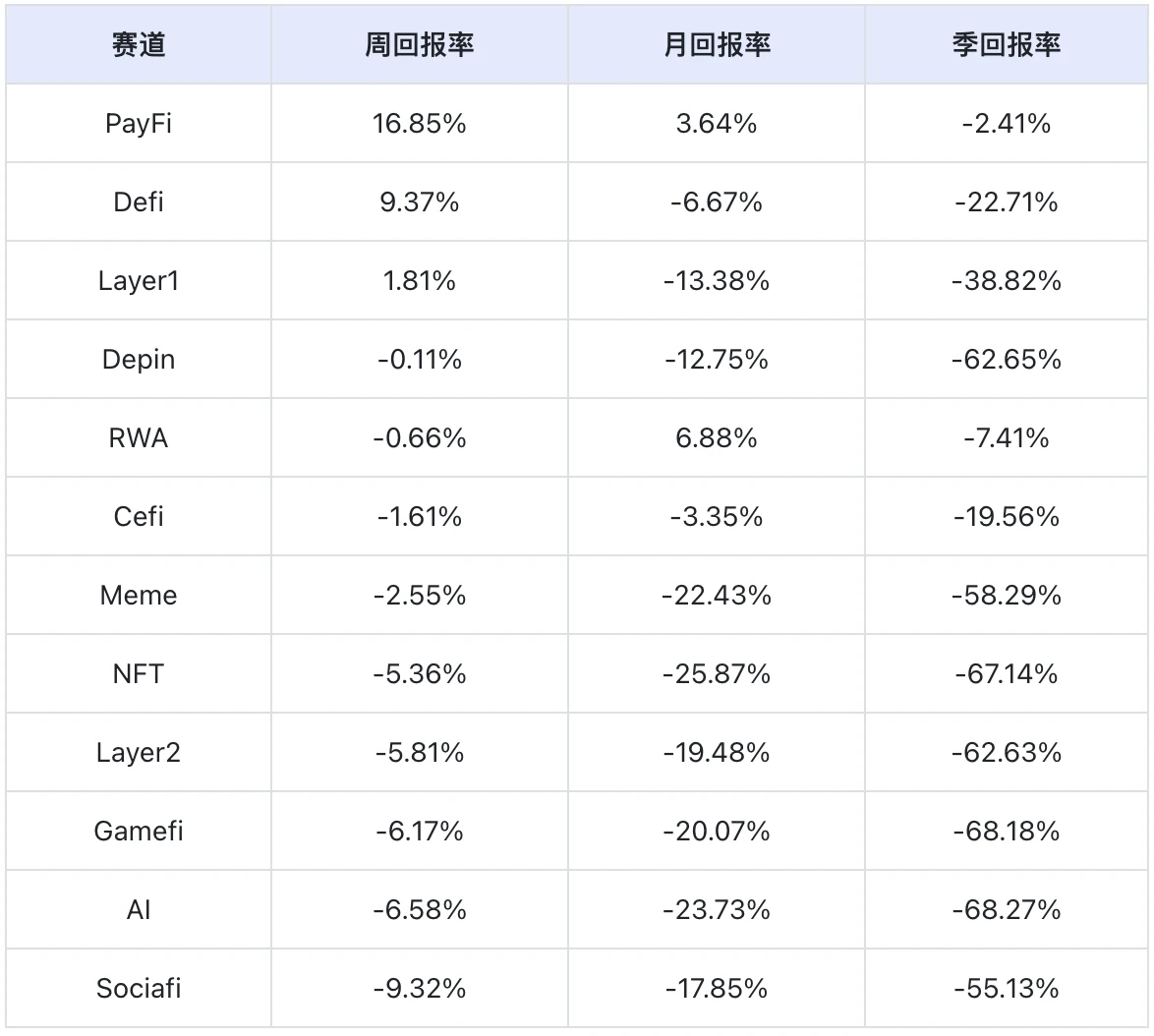

Overall overview of market themes

Data source: SoSoValue

In terms of weekly returns, the Sociafi track performed the best, while the Sociafi track performed the worst.

PayFi track: XRP, LTC, and XLM account for a large proportion in the PayFi track, with a total share of 95.07%. This week, their increases and decreases were 18.96%, -18.47%, and 6.23%, respectively, making the PayFi track the best performing.

Sociafi track: TON and CHZ account for a large proportion in the PayFi track, with a total share of 94.39%, while the declines this week were -10.68% and -2.31% respectively, resulting in the worst index performance of the entire Sociafi track.

Crypto Events Next Week

Wednesday (March 12) US February seasonally adjusted CPI annual rate

Thursday (March 13) Web3 Amsterdam 2025

Summarize

Overall, the crypto market this week showed a complex pattern of volatility and panic. Despite the return of stablecoin funds and the solid fundamentals of some hot tracks, the overall market is still affected by macro policy uncertainty and lack of investor confidence. Looking ahead, projects such as BTC, AAVE and Berachain are expected to become market highlights with their fundamental advantages and innovative strategies, while investors need to continue to pay attention to on-chain data, macro policy trends and the further impact of upcoming unlocking events on market sentiment in order to seize potential opportunities and avoid risks.