Original title: Market Byte: Tariffs, Stagflation, and Bitcoin

Original author: Zach Pandl

Compiled by: Asher ( @Asher_0210 )

Editors note: This article analyzes the impact of recent changes in U.S. global tariff policies on financial markets, especially the unique performance of Bitcoin in this process; explores the long-term impact of tariffs on the economy, especially the choice of asset allocation during periods of stagflation, and the performance of Bitcoin and gold in this environment; analyzes the impact of current trade tensions on the U.S. dollar and the potential adoption of Bitcoin, and finally looks forward to the economic outlook for the next few years, pointing out that scarce commodity assets such as Bitcoin and gold may receive more attention and demand in a high inflation environment.

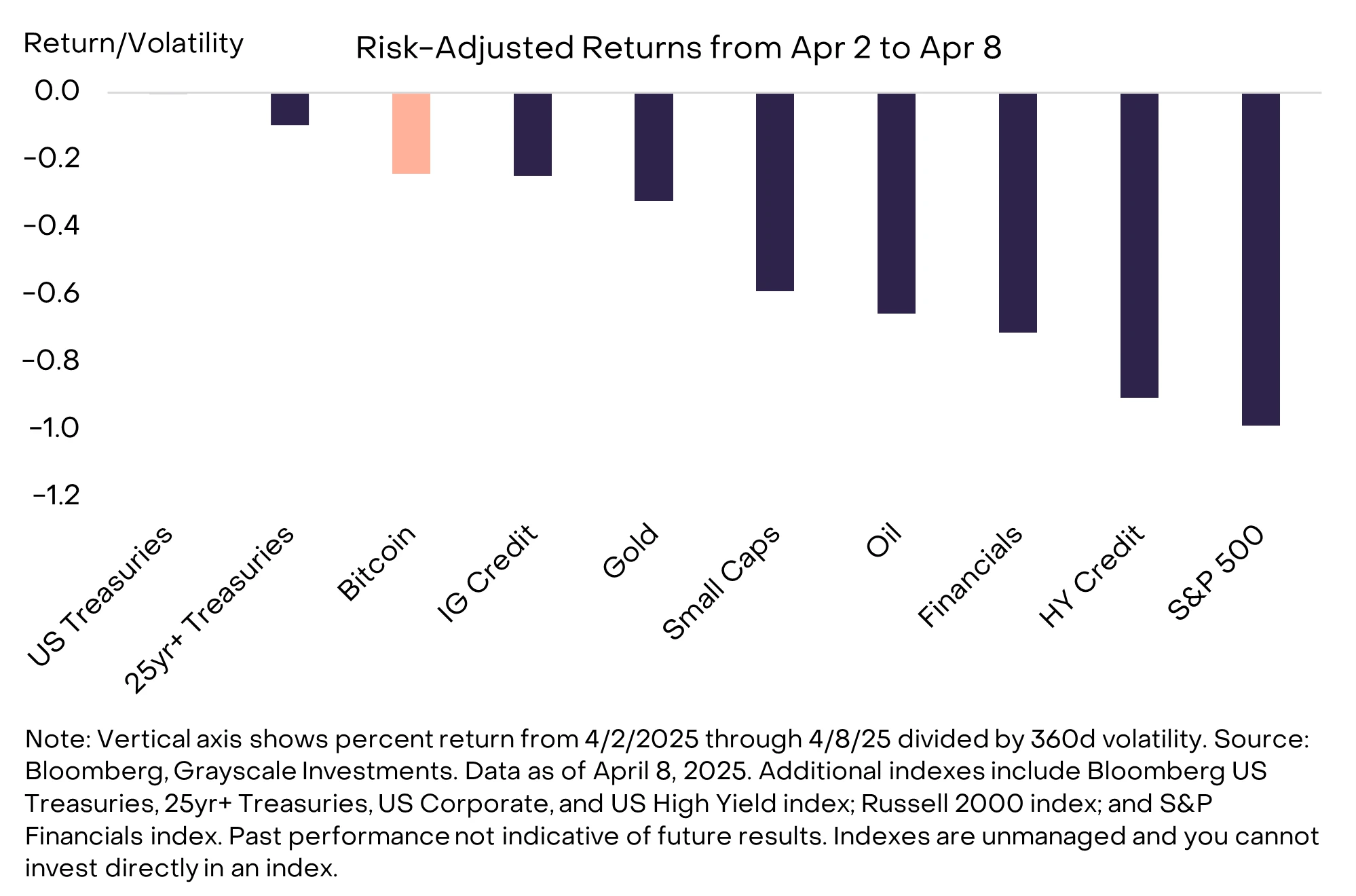

Since the announcement of new global tariffs on April 2, global asset prices have fallen sharply, only to gradually recover with Trumps announcement this morning that the tariffs would be suspended (except for China). However, the initial tariff announcement affected almost all assets, and Bitcoins decline was relatively small on a risk-adjusted basis during this period. Therefore, if Bitcoin had a 1:1 correlation with stock market returns , a decline in the SP 500 should mean a 36% decline in the price of Bitcoin . However, the actual situation is that Bitcoin has only fallen by 10%, highlighting that even when the market experiences a deep drawdown, holding Bitcoin as part of a portfolio can still provide significant diversification benefits.

Bitcoin price declines relatively modest after risk adjustment

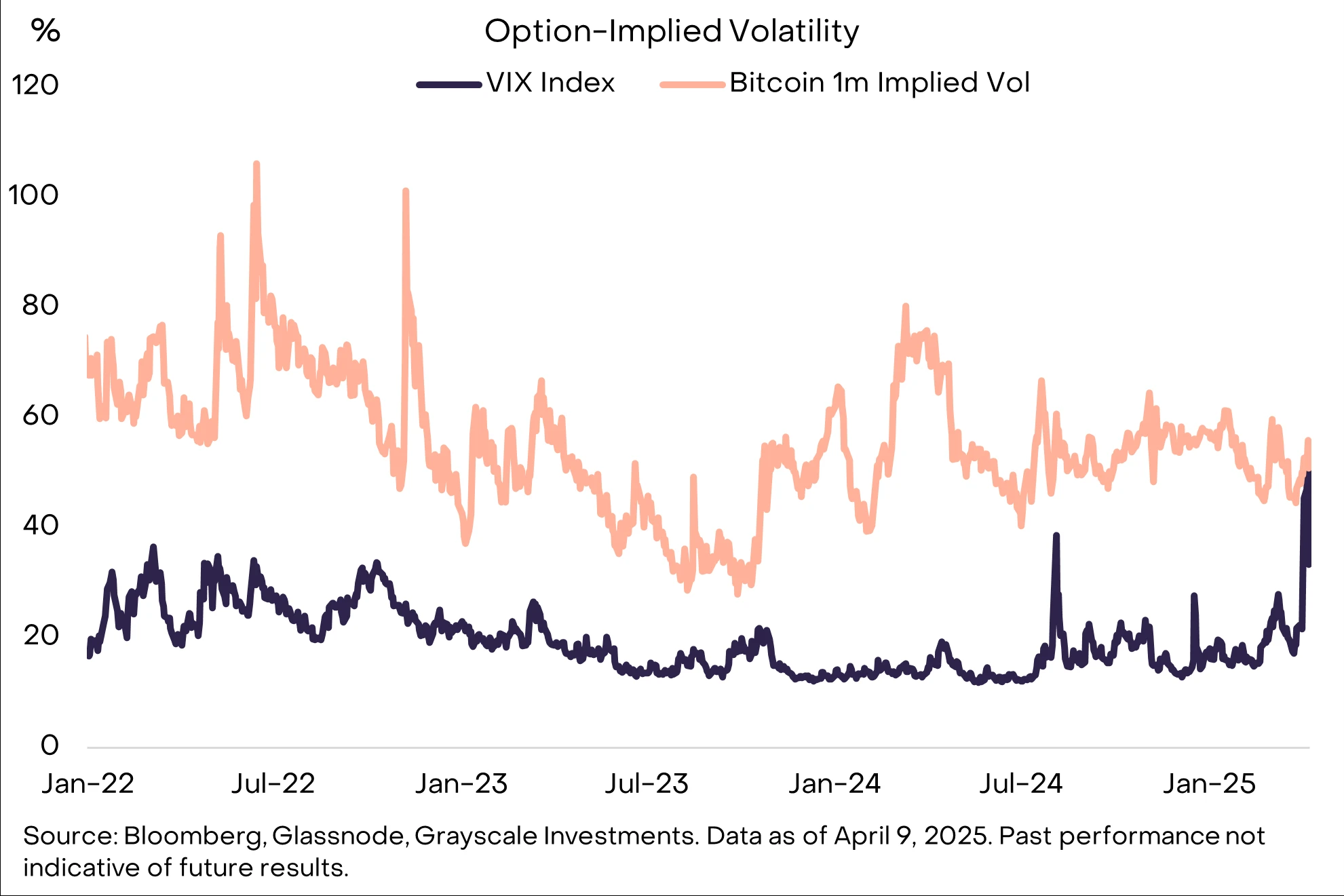

In the short term, the outlook for global markets will likely depend on trade negotiations between the White House and other countries. While negotiations could lead to lower tariffs, setbacks in negotiations could also trigger more retaliatory actions. Actual and implied volatility in traditional markets remains high, making it difficult to predict how trade conflicts will evolve in the coming weeks. Therefore, investors should be cautious in adjusting their positions in a high-risk market environment. In addition, the increase in Bitcoins price volatility is much lower than that of stocks, and multiple indicators show that speculative traders in the cryptocurrency market have relatively low positions. If macro risks ease in the coming weeks, the market value of cryptocurrencies should be expected to rebound.

Implied volatility of stocks approaches that of Bitcoin

Regarding Bitcoin, despite its price decline over the past week, the impact of higher tariffs on Bitcoin in the longer term will depend on its impact on the economy and international capital flows. Tariffs (and changes in non-tariff trade barriers associated with them) can lead to stagflation and may lead to structural weakness in demand for the US dollar, so in this case, increased tariffs and changes in global trade patterns may be positive factors for Bitcoin adoption in the medium and long term.

Asset Allocation in Stagflation

Stagflation refers to an economic state of slow/slowing economic growth and high/accelerating inflation. Tariffs raise the price of imported goods, so (at least in the short term) this will lead to higher inflation. At the same time, tariffs may also slow economic growth by reducing real incomes for residents and adjusting costs for businesses. In the long run, this effect may be partially offset by increased domestic manufacturing investment, and most economists expect these new tariffs to remain a drag on the economy for at least another year.

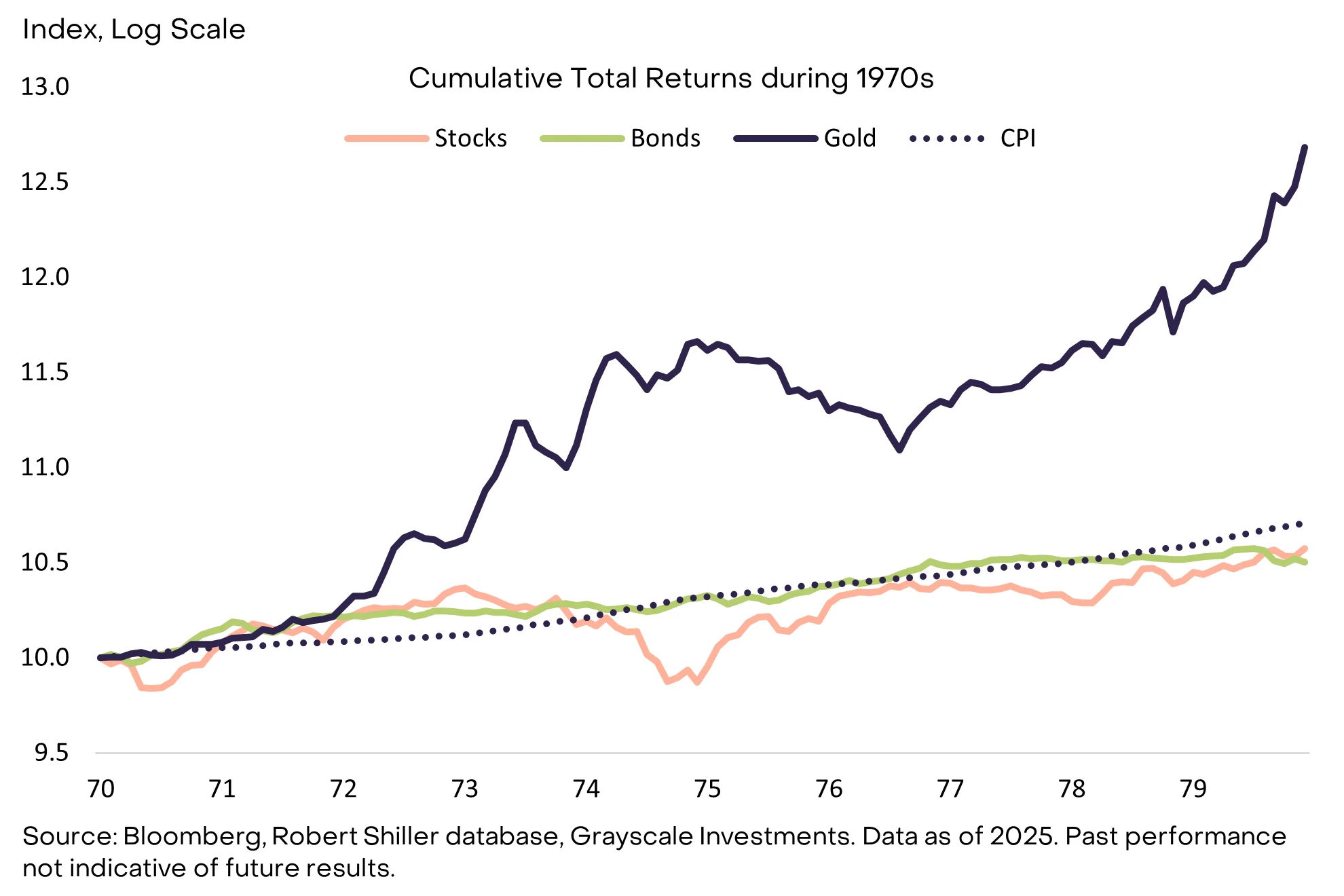

From a historical perspective, the effects of stagflation on financial markets are most vividly demonstrated by asset returns in the 1970s (Bitcoin has been around too long to backtest its performance). During that decade, U.S. stocks and long-term bonds both returned about 6% annualized, below the 7.4% average inflation rate at the time. In contrast, golds price rose about 30% annualized, far exceeding inflation.

Traditional assets had negative real returns in the 1970s

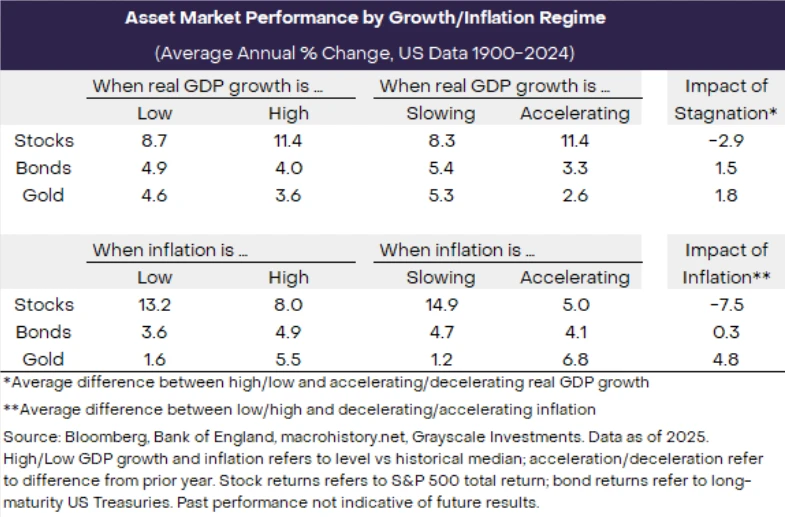

Typically, periods of stagflation are rare, but their impact on asset returns is roughly consistent over time. The chart below shows the average annual returns of U.S. stocks, government bonds, and gold in different economic growth and inflation cycles from 1900 to 2024.

Stagflation lowers stock returns, boosts gold returns

Historical data reveals three key points:

Stock market returns generally improve when GDP is high or accelerating and inflation is low or slowing. Therefore, during periods of stagflation, stock market returns will fall as expected, and investors may need to reduce their equity allocations;

Gold tends to perform better when economic growth is sluggish and inflation is rising, especially during periods of stagflation, when it becomes the primary hedge against inflation. This suggests that gold is generally a more attractive investment option in such an environment;

Bond performance is closely tied to changes in inflation. When inflation is low, bond returns generally do better, while when inflation rises, bonds generally perform worse. Therefore, in periods of rising inflation, bond investors may face the risk of declining returns.

In summary, different assets perform differently during economic cycles, and investors should adjust their asset allocation according to the macroeconomic environment. Stagflation periods are particularly important because they tend to have a negative impact on stocks, while gold may usher in growth .

Bitcoin and the US Dollar

Tariffs and trade tensions could drive Bitcoin adoption in the medium term, one reason being pressure on demand for the U.S. dollar. Specifically, if overall trade flows with the United States decline, and much of that trade flow is denominated in dollars, then demand for transactions in the dollar will decrease. In addition, if tariffs also lead to conflicts with other major countries, then they could weaken demand for the dollar as a store of value.

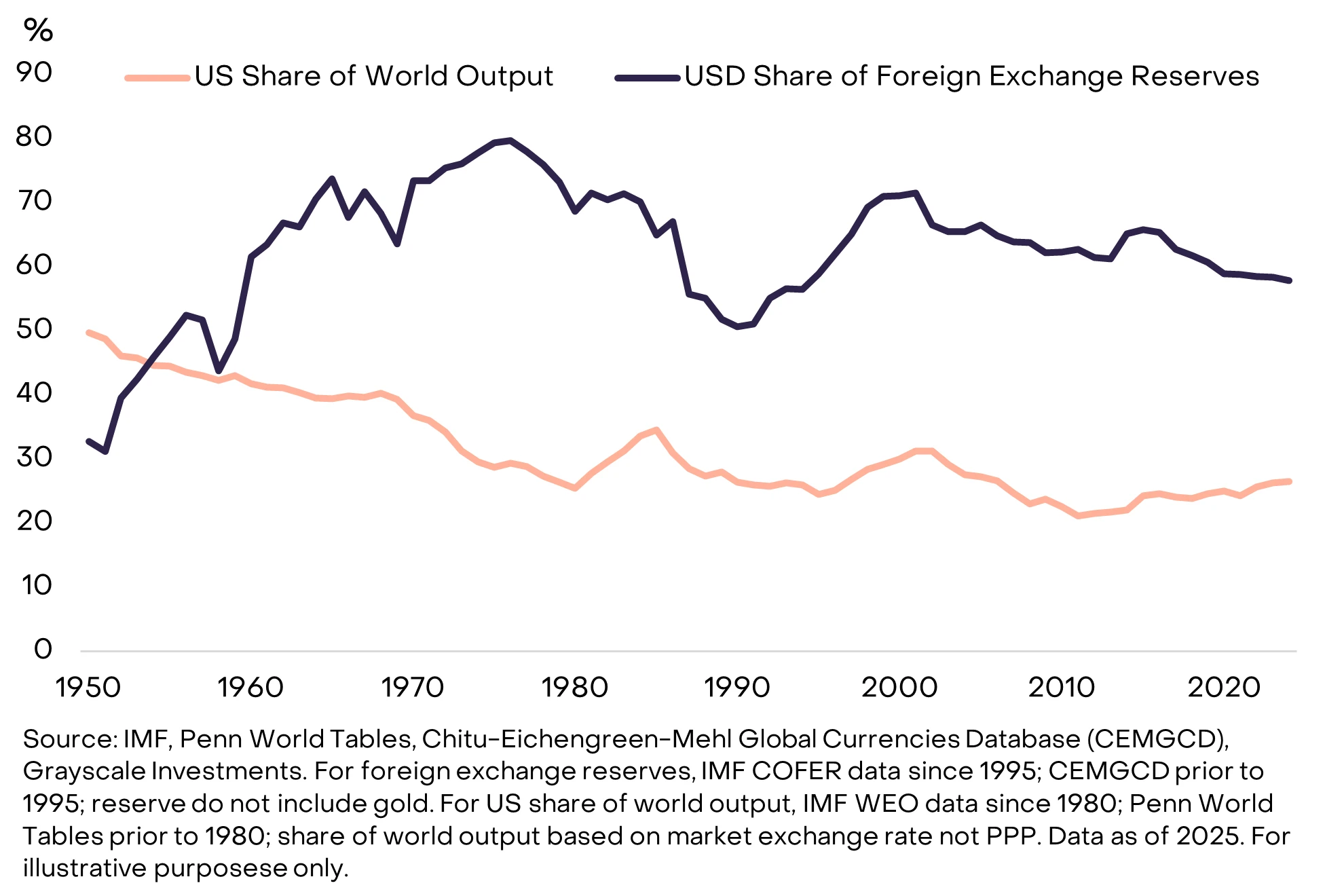

The dollar accounts for a much larger share of global foreign exchange reserves than the U.S. accounts for global economic output. There are many reasons for this, but network effects play a big role: countries trade with the U.S., borrow and lend in dollar markets, and often export commodities in dollars. If trade tensions lead to weaker links with the U.S. economy/dollar-based financial markets, countries may accelerate the diversification of their foreign exchange reserves.

The dollar accounts for a much larger share of global reserves than the U.S. does in the global economy

Many central banks have stepped up their gold purchases in the wake of Western sanctions against Russia. As far as we know, no central bank other than Iran currently holds Bitcoin on its balance sheet. However, the Czech National Bank has begun exploring this option, the United States has also established a strategic Bitcoin reserve, and some sovereign wealth funds have publicly announced investments in Bitcoin. In our view, disruptions to the dollar-centric international trade and financial system could lead central banks to further diversify their reserves, including investments in Bitcoin.

The moment in U.S. history most similar to President Trump’s “Liberation Day” announcement may be the “Nixon Shock” of August 15, 1971. That evening, President Nixon announced a 10% tariff across the board and an end to the dollar’s convertibility into gold, a system that had underpinned the global trade and financial system since the end of World War II. The action sparked diplomacy between the United States and other countries, culminating in the Smithsonian Accord in December 1971, where other countries agreed to appreciate their currencies relative to the dollar. The dollar ultimately depreciated by 27% between the second quarter of 1971 and the third quarter of 1978. Over the past 50 years, several rounds of trade tensions have been followed by (partially negotiated) dollar weakness.

Recent trade tensions are expected to lead to continued weakness in the dollar again. According to relevant indicators, the U.S. dollar is already overvalued, the Federal Reserve System has room to lower interest rates, and the White House wants to reduce the U.S. trade deficit. Although tariffs will change the effective import and export prices, the depreciation of the dollar may gradually achieve a rebalancing of trade flows through market mechanisms, thus achieving the desired effect.

Bitcoin, the child of the times

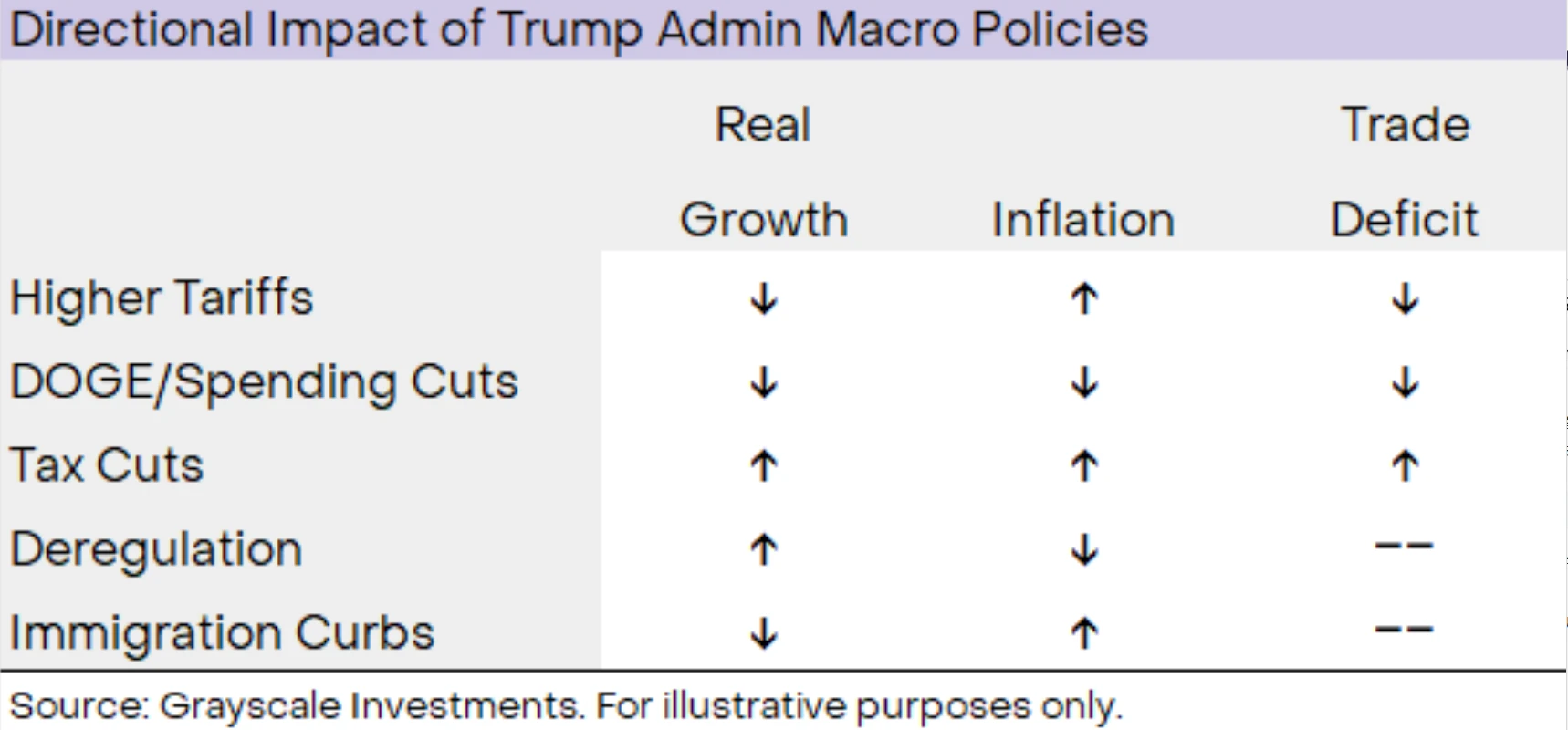

The sudden change in U.S. trade policy is causing financial markets to adjust, which will have a short-term negative impact on the economy, however, the market conditions of the past week are unlikely to become the norm for the next four years. The Trump administration is implementing a range of policy measures that will have different effects on GDP growth, inflation, and the trade deficit. For example, while tariffs may reduce economic growth and increase inflation (i.e., cause stagflation), certain types of deregulation may increase growth and reduce inflation (i.e., reduce stagflation), and the ultimate outcome will depend on the extent to which the White House implements its policy agenda in these areas.

U.S. macroeconomic policies will have a range of impacts on growth and inflation

Despite the uncertainty in the outlook, the best guess is that the U.S. governments policies will lead to persistently weak dollar and generally above-target inflation over the next 1-3 years. Tariffs themselves are likely to slow growth, but this effect may be partially offset by tax cuts, deregulation, and a weaker dollar. If the White House also actively pursues other growth-enhancing policies, GDP growth may hold up relatively well despite the initial hit from tariffs. Regardless of whether actual growth is strong, history suggests that a period of persistent inflationary pressures can be bullish for scarce commodities such as Bitcoin and gold.

Moreover, like gold in the 1970s, Bitcoin today has a rapidly improving market structure—supported by policy changes in the U.S. government. So far this year, the White House has implemented a wide range of policy changes that should support investment in the digital asset industry, including the withdrawal of a series of lawsuits, ensuring the suitability of assets for traditional commercial banks, and allowing regulated institutions (such as custodians) to provide cryptocurrency services. This, in turn, has triggered a wave of MA activity and other strategic investments. The new tariffs are a short-term headwind to the valuation of digital assets such as Bitcoin, but the Trump administrations cryptocurrency-specific policies have been supportive of the industry. Taken together, rising macroeconomic demand for scarce commodity assets and an improving operating environment for investors could be a potent combination for widespread Bitcoin adoption in the coming years.