1. Bitcoin Market

From April 5 to April 11, 2025, the specific trend of Bitcoin is as follows:

April 5: The price of Bitcoin rose slightly from $82,839 to $84,508 in the early morning, and then moved sideways for a while, fluctuating around $84,000, and then slowly dropped to around $83,570. After moving sideways for a while, it fell slightly to $82,642.

April 6: Bitcoin maintained a sideways trend, climbing slowly to $83,593 and then slowly falling to $82,252, before plummeting to $78,898. Previously, due to the escalation of global trade tensions caused by US President Trump’s tariff policy, the market chain reaction caused the Bitcoin market to crash at the end of the day.

April 7: It went sideways for a short period of time and failed to stop the decline. It fluctuated and fell to $77,206. It then recovered slightly to $79,115 but failed to stabilize. It continued to break down and fell below the support level of $77,500, falling to $74,727. Afterwards, it first fluctuated and climbed to around $77,500, and then instantly rose to $79,454.

April 8: It showed a fluctuating upward trend, starting from $77,776, and then climbing to $79,022, $79,870, and $80,718. It then experienced a short-term correction and remained around $79,800, and then quickly fell sharply to $76,529.

April 9: Continuing the decline of the previous day, the price fluctuated downward to $75,005 and then started a correction trend. It fluctuated slightly upward to $77,741, then fluctuated downward to $75,858, and then recovered to around $77,525.

April 10: Stimulated by the news that Trump may consider canceling some tariffs, the market risk appetite rebounded in the short term, driving the price of Bitcoin to rise rapidly. Bitcoin broke through multiple resistance levels from $77,131 in a short period of time and rose strongly to $82,555. Then, it experienced a small technical correction under the pressure of profit-taking, but the bullish momentum continued and the price surged to the intraday high of $83,428 again. In the evening, market sentiment weakened and selling pressure intensified. The price quickly fell back to around $78,707 and temporarily stopped falling, forming an overall positive-driven high-rise and fall trend.

April 11: After Bitcoin stopped falling at the end of the previous trading day, the overall trend on April 11 tended to be stable, market sentiment turned cautious, and the volatility was significantly reduced. The price fluctuated upward to $79,959 during the day, briefly retreated to $78,969, and then resumed its upward trend, reaching a high of $80,356. Since then, the market has continued to fluctuate in a narrow range and repair upward. As of the time of writing, Bitcoin is temporarily reported at $80,751.97. The overall volatility during the day is under control, and the market has entered a short-term wait-and-see state.

Summarize

This week, the Bitcoin market showed a high volatility and wide range of fluctuations driven by macro news. Affected by negative news, it fell below key technical support levels many times, and the market was short-term. On April 10, stimulated by the news that Trump may cancel some tariffs, the markets risk aversion temporarily eased, and Bitcoin rebounded sharply in the short term, rising to $83,428 during the session. However, due to the lack of sustained buying support, the rebound failed to stabilize and then fell back. Overall, Bitcoin is still in an adjustment cycle dominated by macro uncertainty. The lack of risk appetite and technical weakness have led to cautious market sentiment, and there is still the possibility of further fluctuations in the short term.

Bitcoin price trend (2025/04/05-2025/04/11)

2. Market dynamics and macro background

Fund Flows

1. Performance of exchange fund flows

According to CryptoQuant and Glassnode on-chain data, the net outflow of Bitcoin from exchanges has shrunk significantly this week, from an average daily net outflow of 9,500 in the same period last month to a low of 2,800 this week. Among them:

During the sharp drop on April 6-7, some short- and medium-term holding users panic-sold, pushing the exchanges short-term net inflows to turn positive. On-chain data showed that the average daily net inflow of Bitcoin on those two days exceeded 4,200, reflecting the concentrated release of panic selling pressure in the market.

At the same time, a large number of highly leveraged long positions were forcibly liquidated during the decline, further intensifying liquidity pressure, and some funds chose to flow back to stablecoins for risk aversion.

During the rebound on April 10, although the price of Bitcoin rose rapidly, on-chain data showed that funds did not flow back into exchanges on a large scale to build positions, indicating that the momentum of the rebound mainly came from short-term short covering rather than the entry of new funds.

2. On-chain activity and whale behavior:

Whale addresses (holding more than 1,000 BTC) remained relatively silent during this weeks decline, with no significant signs of buying or bottom fishing, indicating that large investors are in a wait-and-see mood.

Medium-sized holding addresses (10 – 100 BTC) have a small amount of position increase at low levels, but the scale is small and overall not enough to reverse the market trend.

The number of active addresses on the chain fell by more than 13% within a week, and user participation enthusiasm has weakened significantly, further proving that the current market is a technical rebound dominated by low trading volume.

3. Stablecoin Funding Dynamics:

The on-chain activity of USDT and USDC increased slightly this week, indicating that some funds temporarily stayed in the stablecoin state after short-term outflow of the crypto market, and were in a wait-and-see stage;

However, there has been no rapid return of large amounts of stablecoins to exchanges to open positions, indicating that overall funds are still mainly based on defensive strategies.

Technical indicator analysis

1. RSI (14 days)

This week, the RSI indicator fell below 30 and entered a severe oversold area. It rebounded to around 45 on April 10, but did not break through the 50 neutral line, indicating that the market rebounded in the short term but is still in a weak repair stage. The RSI structure showed a preliminary bottom divergence pattern. If the market rebounds in volume in the future, it may be confirmed as a phased stop-loss signal.

2. MACD

MACD formed a death cross on April 6, with the fast line crossing below the slow line and then spreading downward, and the short momentum column was greatly enlarged; although there was a slight convergence on April 10, there was no sign of a golden cross yet, indicating that the market has not yet seen a trend reversal, the rebound is of a technical repair nature, and the short trend is still continuing.

Market sentiment analysis

1. Fear Greed Index

It was in the neutral area (about 27) at the beginning of the week, but it quickly fell from April 6 to the extreme fear of 17; on April 10, it briefly rebounded to the greed of 60 due to news stimulation, but failed to hold steady, and fell back to the lower edge of the neutral on April 11; the overall reflection is that investors confidence is extremely fragile and highly sensitive to news.

2. Derivatives market sentiment

The BTC perpetual contract funding rate turned negative several times (April 6-8): indicating that shorts are dominant and short-selling sentiment is strong;

Option IV (implied volatility) surged: the markets expectations for future uncertainty increased, reflecting increased demand for risk aversion;

The long-short position ratio is unbalanced in the short term: longs are deleveraging rapidly and speculative funds are flowing out of the market in large quantities.

This week, the Bitcoin market sentiment was strongly affected by external macro variables, showing a panic-dominated emotional trading structure. Although there was a short-term rebound due to positive stimulus, the overall sentiment is still bearish and confidence needs to be restored. Investors short-term behavior is more conservative, mainly hedging, waiting or betting on rebounds. The real emotional repair depends on the resonance of news landing and technical repair.

Macroeconomic Background

US tariff policy and global trade tensions

On April 6, Trump announced that some tariffs might be lifted, which triggered a short-term boost in the market. However, due to the increasing uncertainty in global trade, risk aversion still dominated the market, and Bitcoin encountered heavy selling pressure. The adjustment of Trumps tariff policy failed to effectively alleviate the markets concerns about economic slowdown.

Monetary Policy and Risk Appetite

The Feds easing policy expectations have strengthened the markets demand for risky assets such as Bitcoin, but the global economic slowdown and stock market volatility have reduced market risk appetite, and safe-haven funds have flowed out of traditional markets, causing Bitcoin to come under pressure. The strengthening of the US dollar has further suppressed Bitcoins rising potential.

Global financial market linkage

The volatility of global stock markets has affected the Bitcoin market, with funds flowing into safe-haven assets such as the U.S. dollar and gold, causing Bitcoin to fall in the short term. Although the tariff news on April 10 pushed Bitcoin to rebound, the overall market sentiment remains cautious and is waiting for an effective recovery.

3. Hash rate changes

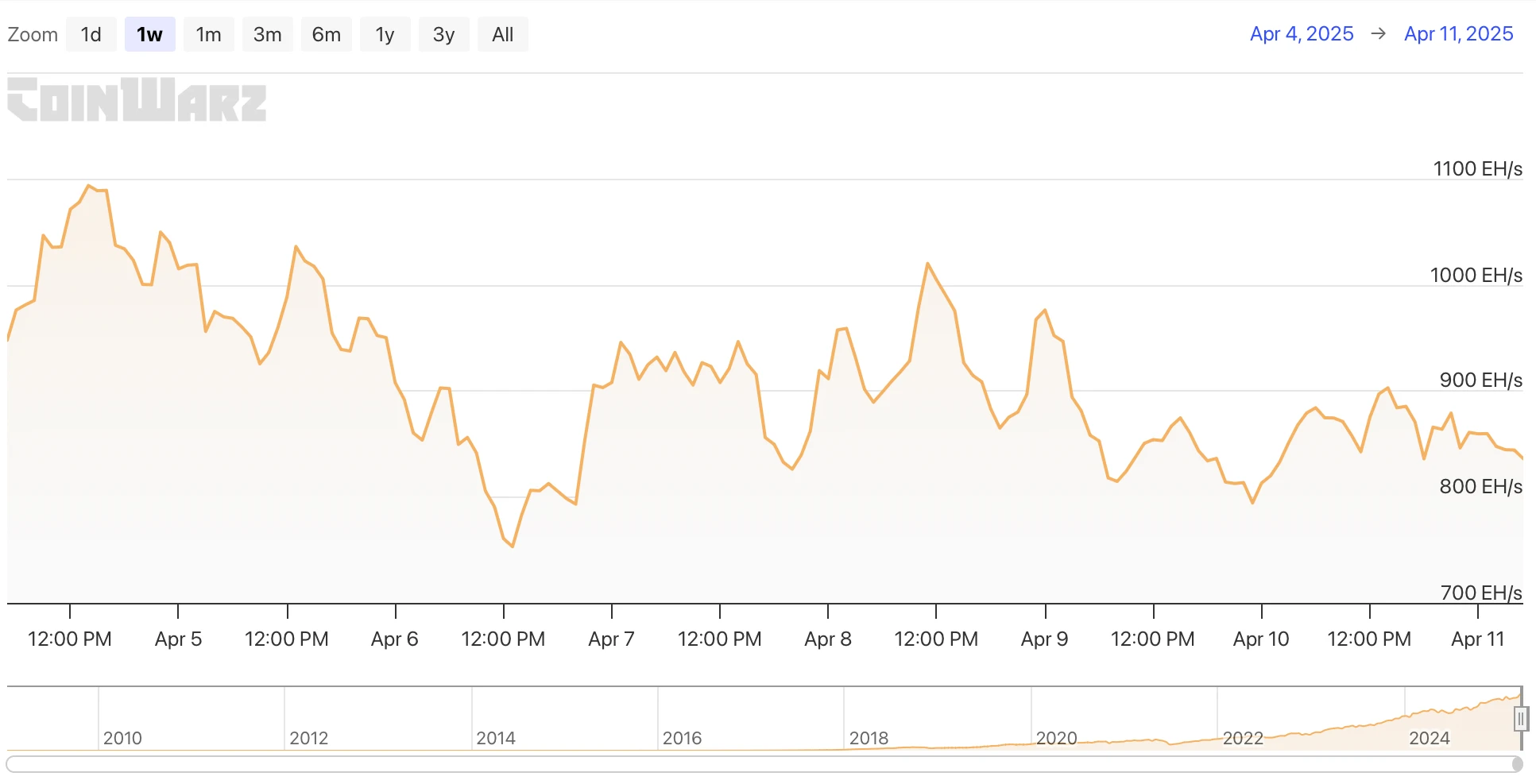

Between April 5 and April 11, 2025, the Bitcoin network hash rate fluctuated as follows:

On April 5, the hash rate quickly fell from 1018.82 EH/s to 925.26 EH/s, and then rebounded to 1035.81 EH/s, but failed to maintain the high level. It fell again to around 950 EH/s during the day, indicating that the market was under certain pressure in the high computing power range. On April 6, the volatility intensified, and the hash rate first fell sharply to 853.38 EH/s. After a short repair, it fell again to the lowest point of this cycle, 753.01 EH/s, indicating that some miners may adjust their computing power investment in the short term, and then quickly rebounded to 907.71 EH/s, reflecting that there is a strong computing power replenishment momentum in the low range.

On April 7, the network computing power briefly stabilized at around 930 EH/s, but then fell back again, reaching 825.98 EH/s, indicating that the market has not yet gotten rid of the impact of the fluctuation range. It rebounded to 911.22 EH/s at the end of the trading day, reflecting a certain recovery trend. On April 8, the fluctuation range of the hash rate increased significantly, and it quickly sawed between 958.68 EH/s and 864.75 EH/s throughout the day, rising to a maximum of 1019.86 EH/s, and finally closed at 976 EH/s. The fluctuation range was significantly enlarged, reflecting that the computing power resources of miners were in a high-frequency switching state.

On April 9, the fluctuation range narrowed significantly, and the hash rate overall operated in the range of 800 EH/s to 900 EH/s, showing a weak oscillation pattern. On the same day, it first fell to 814.50 EH/s, then rebounded slightly to 874.33 EH/s, and fell back to 794.16 EH/s at the end of the trading day. The market performance tended to be cautious. On April 10, the computing power operation tended to be stable, rising to 883.89 EH/s at the highest, and fluctuated in a narrow range of 800-900 EH/s throughout the day, reflecting that the markets computing power distribution has entered a wait-and-see period in the short term. On April 11, the fluctuation range of the hash rate further converged, and the overall level remained around 850 EH/s, marking the end of the previous violent fluctuation stage and the miners computing power strategy tended to operate in a steady state.

In summary, the overall trend of Bitcoin network hash rate this week is affected by multiple factors such as miners computing power adjustment, changes in block revenue expectations, and market environment uncertainty. We need to continue to pay attention to the impact of subsequent price fluctuations on small and medium-sized miners, as well as the impact of the upcoming difficulty adjustment rhythm on hash rate stability.

Bitcoin network hash rate data

4. Mining income

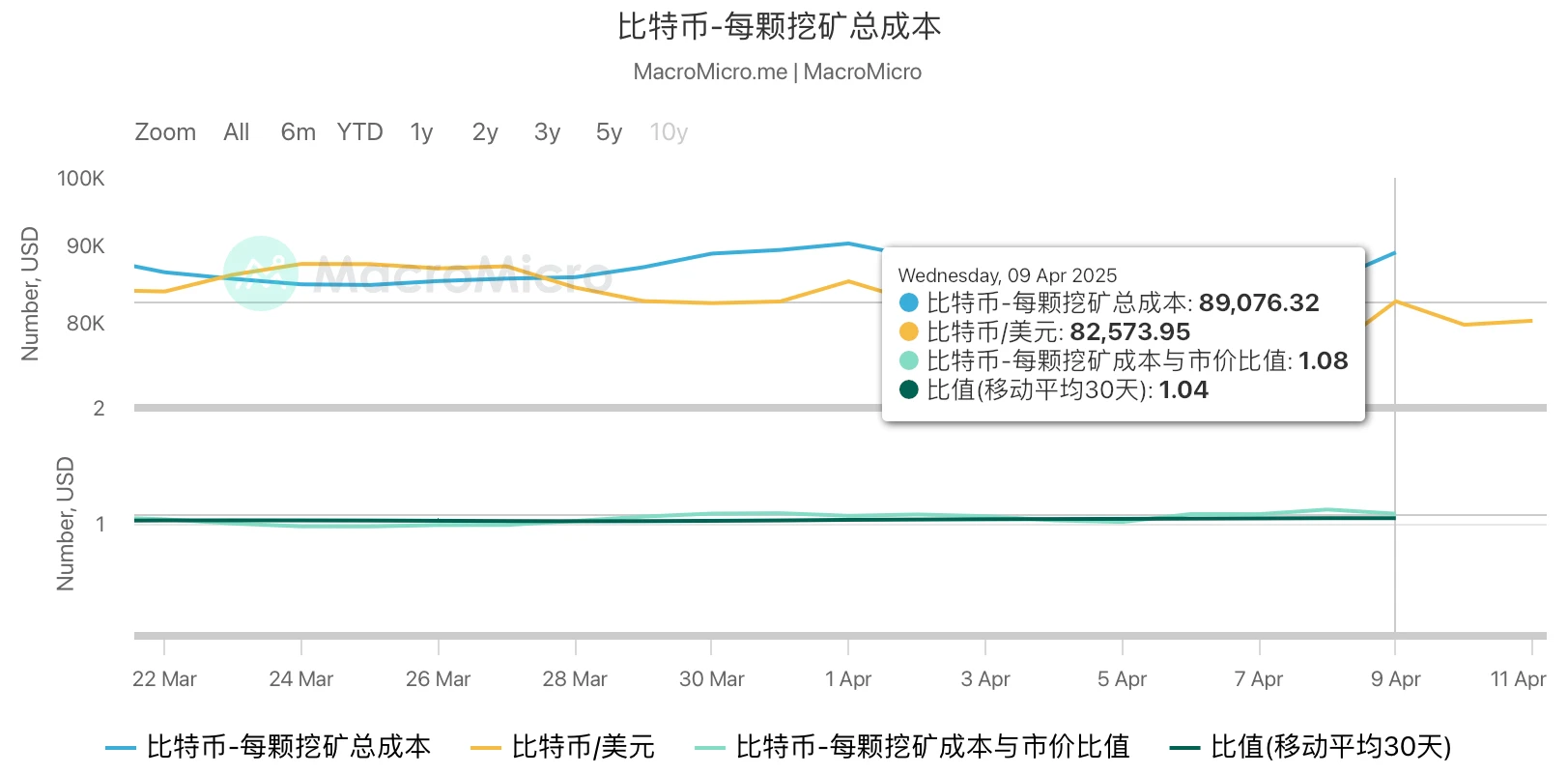

According to the latest MacroMicro model, as of April 9, 2025, the unit production cost of Bitcoin is about $89,076.32, while the spot price on that day is about $82,573.95, and the corresponding mining cost-to-market price ratio is 1.08. This ratio is significantly higher than 1, indicating that the current market price is lower than the average mining cost of the entire network, the network as a whole is operating below the break-even point, and most miners are in a state of profit compression or loss.

This phenomenon reflects that in the current market environment, miners profit margins have been significantly squeezed, especially miners with high electricity prices or using inefficient equipment, especially small and medium-sized mines that rely on the previous generation of ASIC mining machines, which may have entered a marginal loss or even a full loss range. Historical data shows that when the cost-price ratio is continuously higher than 1, it usually causes a part of the inefficient computing power to exit the market, pushing the computing power of the entire network down, and triggering a downward adjustment of the mining difficulty (Difficulty Adjustment Down) to rebalance the network operation cost and entry threshold.

In early April 2025, Bitcoin miners are facing multiple challenges: the market price is lower than the mining cost, and the profit margin is compressed; the mining difficulty and computing power are at a high level, and the competition is fierce; the unit computing power income continues to be sluggish, and profitability has declined; the cost of mining machines and policy changes have increased operational uncertainty. In this context, miners need to pay close attention to market dynamics and optimize operational strategies, such as using high-efficiency mining machines and deploying computing power in areas with low electricity prices to cope with revenue fluctuations and cost pressures.

Bitcoin mining cost data

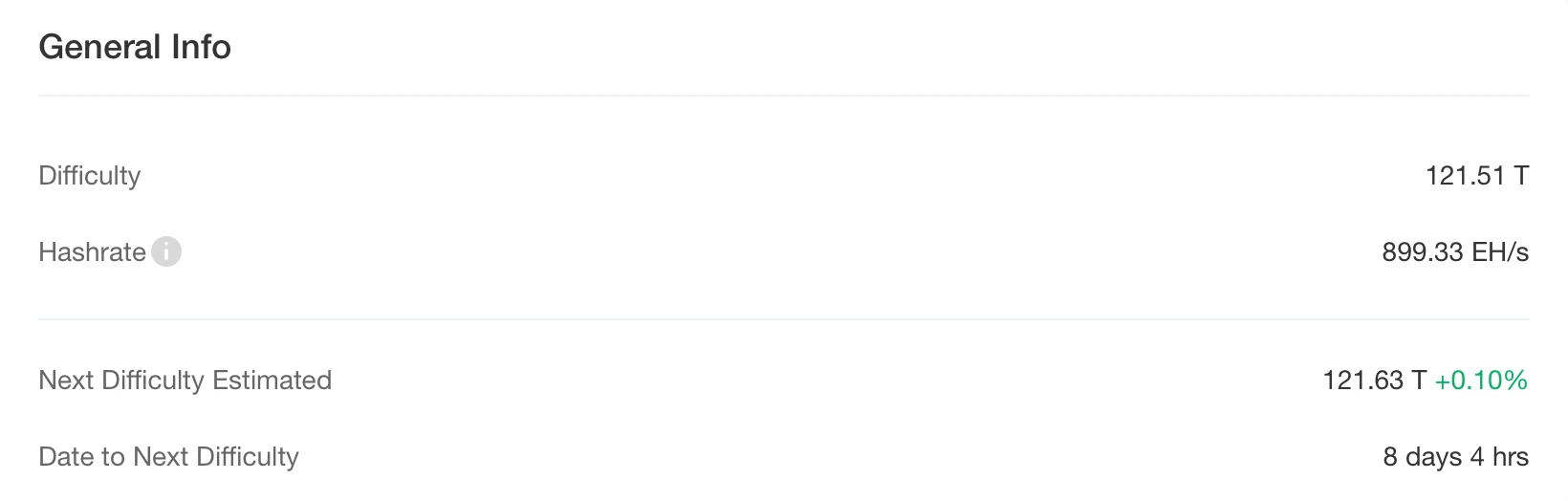

5. Energy costs and mining efficiency

According to CloverPool data, Bitcoin completed its latest difficulty adjustment at block height 891,072 (21:50:26 Beijing time on April 5), with the difficulty increased by 6.81% to 121.51 T, setting a new record high. As of the time of writing, the total computing power of the entire network is about 899.33 EH/s, and the current mining difficulty has risen to 121.63 T. According to the current block interval, the next round of difficulty adjustment is expected to be carried out in about 8 days, with an estimated increase of +0.10%. As the network difficulty continues to rise, miners requirements for equipment performance and energy efficiency ratio are simultaneously increased, and mining operations are gradually adjusted towards high efficiency and high energy efficiency, which in turn affects the overall energy consumption structure.

It is worth mentioning that on April 7, multiple on-chain data platforms simultaneously monitored that the Bitcoin hash rate exceeded 1 Zetahash per second (ie 1,000 EH/s) for the first time in its 16-year development history, marking the network entering the Z era of computing power, further highlighting the unprecedented intensity of computing power and energy input required for current mining.

At the same time, judging from the on-chain indicators, the short-term market sentiment is still under pressure. According to data released by CryptoQuant on April 8, about 25.8% of the circulating supply of Bitcoin (i.e. 5,124,348 BTC) is currently in a state of negative unrealized gains and losses, that is, in a book loss. This ratio reflects that in the current context of high difficulty and high energy consumption, many investors and some miners are facing potential cost pressures, especially those operating in areas with high energy costs, whose profit margins are being squeezed.

Bitcoin mining difficulty data

6. Policy and regulatory news

Nigeria Recognizes Bitcoin and Cryptocurrencies as Securities

On April 8, Nigeria recognized Bitcoin and cryptocurrencies as securities.

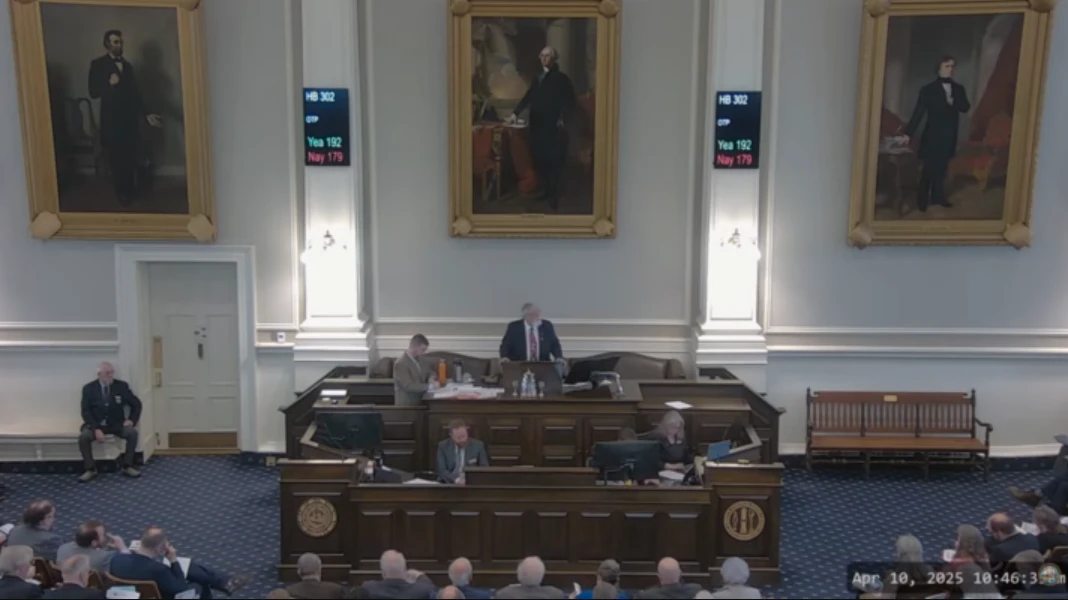

New Hampshire passes Bitcoin Reserve Act, becoming the fourth state to advance related legislation

According to Cointelegraph, on April 10, local time, the New Hampshire House of Representatives passed the Bitcoin Reserve Act HB302 with 192 votes to 179, marking the state as the fourth state to pass a Bitcoin reserve-related bill in the first house of the legislature after Arizona, Texas, and Oklahoma. The bill will allow the state government to explore the possibility of establishing a Bitcoin reserve and will be submitted to the Senate for deliberation.

Florida Bitcoin Reserve Bill Gets Initial Advancement, Taking the First Step in Legislative Process

Cointelegraph reported that on April 10, the Florida House of Representatives Insurance and Banking Committee unanimously passed the states Bitcoin Reserve Bill HB 487. The bill aims to promote state governments to hold Bitcoin as a reserve asset, but it still needs to pass the review of three committees in the House of Representatives before entering a broader legislative process. This move shows that U.S. states are increasingly interested in promoting digital asset reserves.

Related images

7. Mining News

Trump tariffs could lower Bitcoin mining prices outside the U.S.

On April 9, the Trump administration’s widespread tariffs could lead to a collapse in demand for Bitcoin mining machines in the United States, which will benefit mining operations outside the United States as manufacturers will look for markets outside the United States to sell their excess inventory at cheaper prices, said Jaran Mellerud, CEO of Hashlabs Mining.

“As U.S. machine prices rise, their prices elsewhere in the world may paradoxically fall,” Mellerud said in a note dated April 8. “Demand for shipping machines to the U.S. is expected to plummet, possibly to near zero.”

Manufacturers will be left with excess inventory that was originally intended for the U.S. market. To deal with this excess inventory, they may need to lower prices to attract buyers from other regions. Mellerud said that falling mining machine prices could enable mining operations outside the United States to expand and capture a larger share of Bitcoins total computing power.

Major listed mining companies mined a total of 3,648 bitcoins in March

On April 9, Farside Investors published a statement that all major listed Bitcoin mining companies have announced their production data for March 2025. The data showed that these mining companies mined a total of 3,648 Bitcoins in March, setting a new high after the block halving.

Pakistan plans to use some of its surplus electricity for Bitcoin mining

On April 10, Bilal Bin Saqib, CEO of the Pakistan Cryptocurrency Commission, said that Pakistan plans to allocate part of its surplus electricity to Bitcoin mining and artificial intelligence data centers, adding that it has held talks with a number of Bitcoin mining companies and that the specific location of mining will be determined based on the excess electricity supply in a specific area.

Related images

8. Bitcoin related news

Bitcoin holdings of global companies and countries (statistics for this week)

1. El Salvador: This week, the country increased its holdings of Bitcoin twice, by 1 each time. The current total holdings are 6,143.18 BTC, with a total market value of approximately US$488 million.

2. Australia Monochrome: Its spot Bitcoin ETF (IBTC) holdings have risen to 321 BTC, with a market value of approximately US$40.14 million.

3. Canada’s Neptune Digital Assets: This week announced that it had increased its Bitcoin holdings to 401 BTC, with an average purchase price of US$31,564 per coin.

The author of Rich Dad Poor Dad: The current market crash has arrived, and it is recommended to invest in Bitcoin, gold and silver

On April 5, Robert Kiyosaki, author of Rich Dad Poor Dad, said on social media that the largest stock market crash he warned about in his book Rich Dad Prophecy has arrived, and the current economy has entered a recession and may fall into depression. He suggested that investors pay attention to non-Wall Street assets, especially physical gold, silver and Bitcoin.

Kiyosaki pointed out that after the collapse of the paper asset market, the Federal Reserve and the Treasury Department may start printing money at full speed, and the value of gold, silver and Bitcoin will rise. He emphasized that the rise in the prices of these assets actually reflects the decline in the value of the US dollar, which leads to higher prices for necessities such as food, housing and energy, that is, inflation.

US Treasury Secretary: Bitcoin is becoming a store of value

According to Coingape on April 5, U.S. Treasury Secretary Scott Bessent said in an interview with Tucker Carlson that Bitcoin is becoming an emerging value storage tool. He compared Bitcoin to gold, emphasizing that both have value storage properties.

Analyst: Bitcoins current decline is more resilient than during previous crises

On April 8, Bernstein analysts believe that the current decline in Bitcoin is more resilient than the declines during previous crises. Analysts cited historical data to point out that in previous crises (such as market panic caused by the new crown epidemic, interest rate shocks, etc.), Bitcoin has fallen by 50% to 70%. The current price trend (down 26%) shows that the demand for Bitcoin is coming from more resilient capital.

Analysts believe that Bitcoin prices, as a leading indicator of risk appetite, will not undermine its long-term superior performance as a means of storing value in the digital space. From a time scale perspective, Bitcoin is probabilistic gold, and it trades like gold with higher volatility and greater liquidity.

Opinion: Global banking industry is making a big push into Bitcoin as regulators embrace cryptocurrencies

Messari CEO Eric Turner and Sygnum Bank co-founder Thomas Eichenberger said at a panel discussion at Paris Blockchain Week on April 9 that they expect a major shift in the banking industry’s involvement in cryptocurrencies in the second half of this year.

The global banking industry is making a big push into Bitcoin Crypto services have huge potential in the second half of 2025 as regulators accept cryptocurrencies, including stablecoins and banks’ crypto services, according to executives.

Related images

Cardano founder: Bitcoin may rise to $250,000 by the end of this year

On April 10, Cardano founder Charles Hoskinson said in an interview with CNBC that with the entry of technology giants such as Microsoft and Apple into the field of cryptocurrency, Bitcoin may reach $250,000 as early as this year.

Charles Hoskinson said: The tariffs may end up being just a lot of noise but little action, and people will realize that most countries in the world are willing to negotiate. The market will stabilize a little and gradually adapt to the new normal, and then the Federal Reserve will cut interest rates, and a lot of money will flow in, and these funds will eventually flow into the crypto market. I believe Bitcoin will reach $250,000 by the end of this year or next year.

Grayscale: Tariffs and trade tensions may have a positive impact on Bitcoins medium-term adoption

On April 10, asset management company Grayscale Investments said in a research report released on Wednesday that in the medium term, tariffs and trade tensions may eventually have a positive impact on the adoption of Bitcoin (BTC). The report pointed out that the imposition of tariffs will lead to economic stagflation, that is, stagnant economic growth and inflation coexist, which is not good for traditional assets, but is good for scarce commodities such as gold; trade tensions may put pressure on the demand for US dollar reserves, leaving room for competitive assets including other legal currencies, gold and Bitcoin; historical precedents show that a weak dollar and above-average inflation may persist, and Bitcoin may benefit from such a macro background; Rapid improvement in market structure supported by changes in US government policies may help expand Bitcoins investor base.

Adam Back: Bitcoin will usher in larger institutional allocations

On April 11, Adam Back, an early Bitcoin developer and CEO of Blockstream, said that the progress of US regulation (such as the approval of Bitcoin spot ETFs) has provided a clear and compliant investment path for large global institutional investors. He pointed out that the current entry of institutional funds is just the beginning, and with the improvement of traditional financial infrastructure (such as custody and derivatives), Bitcoin will usher in a larger scale of institutional allocation.