Original author: Mengqi | Editor: Mengqi

1. Bitcoin Market

From March 22 to March 28, 2025, the specific trend of Bitcoin is as follows:

March 22: The volatility of the Bitcoin market narrowed, and the overall trend was volatile. The price changed slightly on that day, rising slightly from $83,599 to $84,436, and the market sentiment was relatively stable.

March 23: Bitcoin price rose from $84,018 to $84,272 in the morning, then fell back to $83,794, briefly fell below the $84,000 support level and quickly rebounded. The market rose significantly in the evening, with the price breaking through $84,338 and then quickly rising to $84,936, and finally further rising to $85,302, with a significant increase in market activity.

March 24: Bitcoin prices fell slightly to $84,847 at the opening, but then continued the upward trend, breaking through the key resistance level and rising to $86,394. Although it then briefly fell back to $85,585, the market bullish sentiment dominated, and Bitcoin prices continued to rise, breaking through the previous range of fluctuations and eventually climbing to this weeks highest point of $88,740.

March 25: Bitcoin experienced a sharp correction after consolidating around $88,300, hitting a low of $86,436. Subsequently, the price rebounded slightly to $86,844, but failed to stabilize. After a brief adjustment, it rebounded again and eventually rose back to $88,154. The market performance was quite dramatic.

March 26: Bitcoin continued its upward momentum from the previous day, further rising to $88,447. However, the market subsequently experienced two rounds of corrections, with prices dropping to $87,283 and $87,117 respectively. Despite this, Bitcoin quickly rebounded to $88,241. Market volatility intensified in the evening, with prices plummeting from $88,241 to $86,598, before recovering slightly to around $86,800.

March 27: The market short-selling force increased, and the price of Bitcoin fell below the key support level of $86,000, reaching a low of $85,929. However, it quickly rebounded to $87,373, and after a brief adjustment, it fell again to $86,602, and finally rebounded to $87,667. The market showed a violent fluctuation pattern.

March 28: The price fluctuation of Bitcoin narrowed, and the price fluctuated in the range of 86,895-87,590 US dollars, basically maintaining above 86,800 US dollars.

Summarize

This week, the overall trend of Bitcoin showed a trend of breaking through first, but in the second half of the week, the bulls and bears fought many times, and the market showed a shock consolidation. In the first half of the week, the market was under pressure and the price remained below $84,630 until March 23 and 24, when the price broke through this key range. After successfully breaking through the resistance level on the 24th, it experienced a short-term correction on the 25th.

As of now, the price of Bitcoin is stable around $87,220, and market sentiment is gradually stabilizing. The key focus in the future will be whether Bitcoin can further break through the current key resistance area, which may open up space for further gains.

Bitcoin price trend (2025/03/22-2025/03/28)

2. Market dynamics and macro background

Fund Flows

1. Exchange fund flow

Bitcoin spot ETF fund flows :

According to SoSoValue data, as of March 28, 2025, the flow of funds to Bitcoin spot ETFs has shown significant growth. Specific data shows that on March 27 (EST), the total net inflow of Bitcoin spot ETFs was US$89.0638 million, marking the 10th consecutive day of net inflow in the market.

In terms of specific ETF performance, Fidelity Bitcoin ETF (FBTC) performed particularly well, with a single-day net inflow of $97.1373 million on March 27, and a cumulative historical net inflow of $11.563 billion. It was followed by BlackRock Bitcoin ETF (IBIT), with a single-day net inflow of $3.9675 million and a total historical net inflow of $39.946 billion.

In contrast, the Bitcoin ETF (BTCO) jointly launched by Invesco and Galaxy Digital experienced net outflows on the same day, with a single-day net outflow of US$6.9519 million. The current historical total net inflow of BTCO is US$98.1845 million.

As of the time of this article’s publication, the total net asset value (AUM) of Bitcoin spot ETFs is $98.288 billion, and the ETF’s net asset ratio (i.e., market capitalization ratio) is 5.67%. At the same time, the market’s historical cumulative net inflow has reached $36.338 billion.

Exchange volume changes :

On March 23, 2025, Binance exchange’s Bitcoin trading volume exceeded 22,500 BTC, further demonstrating a significant increase in market participation. This data shows that market activity is continuing to grow and investors’ willingness to participate is also on the rise.

2. Funding movements of institutions and whale accounts

From March 24 to March 25, on-chain data showed that some institutional funds began to increase their holdings, and the total number of Bitcoin whales holding 100 to 10,000 BTC addresses began to rise from 16,600 to 17,889. The net increase in holdings during this period supported the upward trend of Bitcoin.

From March 26 to March 27, some whale accounts began to reduce their holdings, and the stock of Bitcoin on exchanges increased, indicating a clear trend of short-term profit-taking. This phenomenon is consistent with the flow of funds in the derivatives market, and the market short-selling force has increased, leading to a sharp retracement in the price of Bitcoin.

Technical indicator analysis

Moving Average (MA) : The 50-day moving average (MA 50) crossed above the 200-day moving average (MA 200) on March 22, forming a golden cross, which is generally regarded as a bullish signal, indicating the possibility of a long-term uptrend.

Relative Strength Index (RSI) : On March 22, the RSI fell back to 50, indicating a balance of forces between bulls and bears and a weakening of short-term upward momentum.

Stochastic : On March 22, the Stochastic indicator showed that the market was in a volatile state and the short-term upward momentum weakened.

Bollinger Bands : From March 15 to March 25, the Bollinger Bands expanded significantly, with the upper band reaching $90,000 and the lower band at $80,000, reflecting the increase in market volatility.

Volume : Bitcoin’s trading volume on Binance reached 22,500 BTC on March 23, and Ethereum reached 1.2 million ETH on March 24, showing increased market participation.

Market sentiment

1. Market sentiment indicator analysis

Fear Greed Index: According to coinmarketcap data, on March 25, the index rose to 34 from 27 in the previous few days, reflecting that market sentiment has been in fear.

2. Investor Behavior and Market Dynamics

Trading volume changes: On March 23, Binance exchange’s Bitcoin trading volume reached 22,500 BTC, showing an increase in market participation.

Short Position Liquidation: On March 26, the Bitcoin price reached $87,100, which led to the liquidation of a large number of short positions and improved market sentiment.

Macroeconomic Background

The rise in Bitcoin prices between March 22 and March 28, 2025 is supported by the following specific data:

SP 500 rebounds: The SP 500 rose 1.7% and broke through its 200-day moving average (200 DMA) on March 25. This breakthrough provided technical support for the markets rebound and enhanced the appeal of risky assets.

Fed interest rate expectations: According to CMEs Fed Watch, the market expects the Fed to maintain interest rates unchanged in May with a probability of 86.4% and a 25 basis point rate cut with a probability of 13.6%. Such easing expectations have enhanced the markets risk appetite and helped funds flow into non-traditional assets such as Bitcoin.

However, in the news on March 28, the tariff threat dragged down the U.S. stock and Bitcoin markets, bringing new uncertainty:

Trumps tariff threat: Trump announced a 25% tariff on all non-US-made cars, and warned that if Canada and the EU jointly retaliate, they will face more severe tariff retaliation. This tough statement has intensified the panic in the market, causing US stocks to fall for the second consecutive day. The SP 500 closed down 0.33%, the Dow fell 0.37%, and the Nasdaq fell 0.53%. The crypto market also fell generally. Bitcoin fell below $86,000 due to the low opening of US stocks, but then narrowed its losses as US stocks rebounded. At press time, it was $87,216, down 0.4% in 24 hours.

Market focus on February PCE inflation data: The market is currently focusing on the February PCE inflation data to be released at 20:30 tonight. PCE inflation is expected to be 2.5% year-on-year, and core PCE may rise to 2.7%. If the data continues to be strong, the markets expectations for the timing of interest rate cuts may be delayed. In addition, the final tone of Trumps reciprocal tariff policy has also attracted much attention, which may have a further impact on market sentiment.

3. Hash rate changes

Between March 22 and March 28, 2025, the Bitcoin network hash rate fluctuated as follows:

On March 22, the hash rate fluctuated slightly, maintaining between 800 and 850 EH/s. The next day, the hash rate first rose slightly to 891.27 EH/s, and then fell back to 806.07 EH/s. On March 24, the hash rate fluctuated greatly, climbing rapidly from 807.75 EH/s to 1073.38 EH/s, then falling slightly to 989.16 EH/s, and finally falling rapidly to 801.75 EH/s. On March 25, the hash rate fell further to 753.03 EH/s, and then continued to rise, and finally reached 880.44 EH/s. On March 26, the hash rate further increased to 959.06 EH/s, fell back to 819.21 EH/s, and then rose slightly again to 857.36 EH/s. On March 27, the Bitcoin network hash rate fluctuated, first falling to 767.72 EH/s, then rising back to 858.80 EH/s, and after a slight correction, it climbed again to 916.41 EH/s. As of March 28, the hash rate stabilized at around 895 EH/s, maintaining a high level.

This week, the hash rate showed greater volatility overall, especially on March 24, when it rose significantly. This change may be closely related to factors such as the adjustment of miners computing power, fluctuations in market sentiment, and instability in energy supply.

Key factors for subsequent trends will include the distribution of hashrate across the network, the upcoming mining difficulty adjustment, and changes in the broader macro market environment, all of which may have a profound impact on the stability of the hash rate. Therefore, it is necessary to continue to pay attention to the dynamic changes of these factors to better predict the trend of the hash rate in the future.

Bitcoin network hash rate data

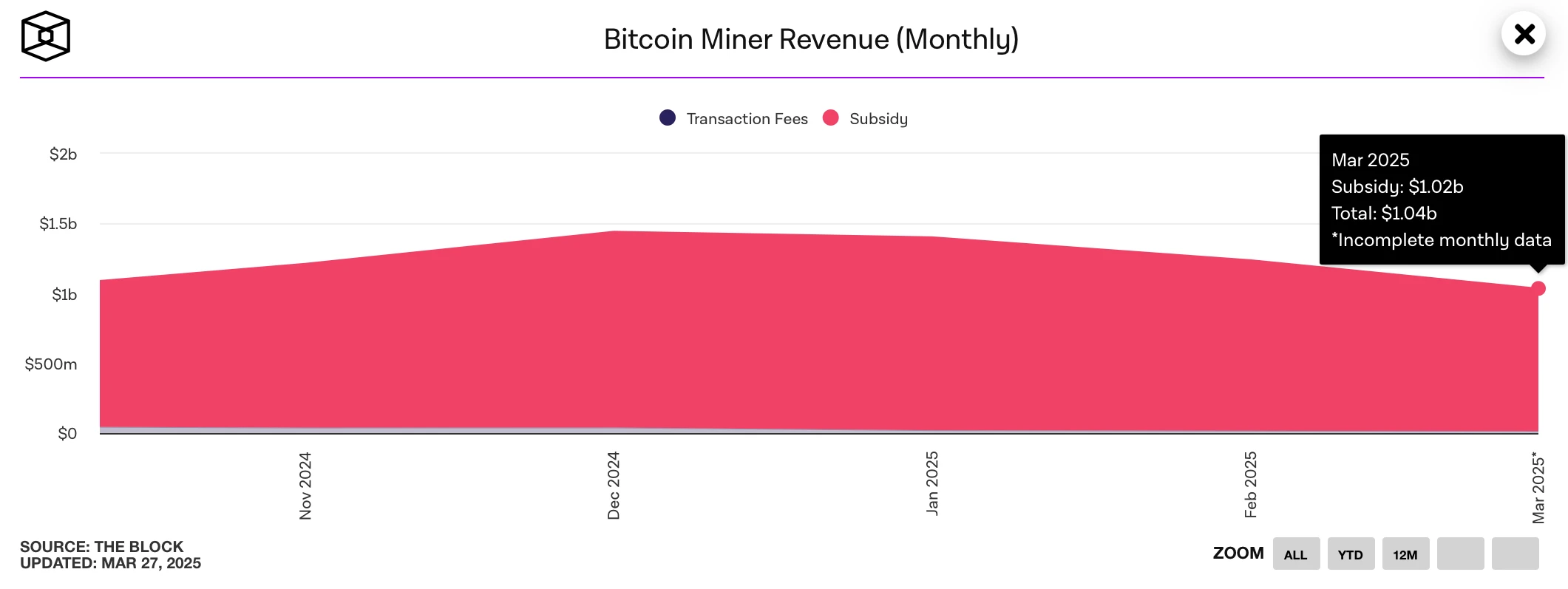

4. Mining income

According to data from The Block, in March 2025, the total revenue of Bitcoin miners was about $1.04 billion, down 16.12% from $1.24 billion in February. This decline was mainly affected by the fluctuation of Bitcoin prices. At the same time, due to the intensified competition among miners, the mining difficulty increased by 2.88% in March, further squeezing the profit margins of miners.

Despite the continued rise in mining difficulty, the hash price remains relatively stable. According to Cointelegraph data on March 23, Bitcoin mining difficulty increased by 1.4% to 113.76 trillion at block height 889,081, up from 112.1 trillion in the previous cycle. However, the Bitcoin hash price (i.e. the average daily revenue per unit of computing power for miners) remains at about $48/PH/s. As of March 28, the hash price was $48.71/PH/s, which is in the middle of the week.

A report from TheMinerMag pointed out that miners using older miners such as Antminer S 19 XP and S 19 Pro may face operational pressure when the hash price is below $50. The lower energy efficiency of older miners, coupled with the decline in transaction fee income, may cause some miners to lose profitability or even be forced to suspend operations until they upgrade to more efficient ASIC miners or the market environment improves.

Overall, the overall income of Bitcoin miners in March declined due to the dual impact of the increase in mining difficulty and the fluctuation of Bitcoin prices. Although the hash price is relatively stable, the profit pressure is still high for miners who rely on old mining machines, and the industry may see a trend of partial computing power optimization or equipment upgrades. In the future, the profitability of miners will still depend on the trend of Bitcoin prices, transaction fees and further changes in mining difficulty.

Bitcoin miners monthly income data

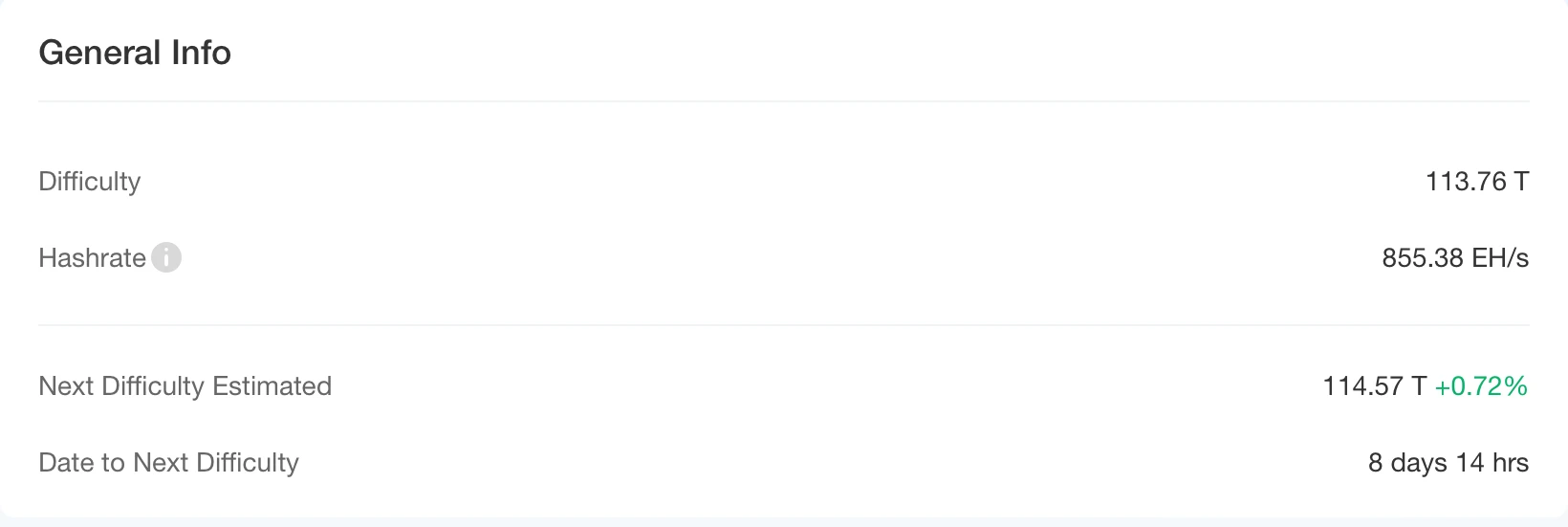

5. Energy costs and mining efficiency

According to CloverPool data, as of the time of writing, the total Bitcoin network hashrate has reached about 855.38 EH/s, and the current mining difficulty is 113.76 T. According to the current trend, it is expected that the Bitcoin mining difficulty will be further increased by about 0.72% to 114.57 T in the next difficulty adjustment (about 8 days later). The increase in difficulty means that the number of Bitcoins that can be mined per unit of hashrate will decrease, which in turn affects the miners yield and energy efficiency. At the same time, with the continuous upgrading of mining equipment, the overall mining efficiency has been optimized, and some miners may choose more energy-efficient ASIC mining machines to reduce the energy consumption cost per unit of hashrate.

According to the latest data from MacroMicro, on March 26, 2025, the total production cost of Bitcoin was approximately $85,204.87, while the mining cost-to-price ratio was 0.98. This ratio is close to 1, indicating that the current market price (approximately $86,000) is roughly the same as the mining cost, which means that miners profit margins are squeezed. When the ratio is close to or above 1, some miners with higher operating costs may face the risk of losses, especially individual or small mines that rely on less efficient mining machines.

In this context, it is crucial for miners to adjust their strategies. On the one hand, some mines may choose to optimize electricity procurement costs by moving to areas with lower electricity prices or using renewable energy to reduce operating costs. On the other hand, miners may speed up hardware upgrades and use more efficient ASIC mining machines to maintain profitability in an environment of intensified computing power competition. In addition, if the price of Bitcoin rises further, miners profitability is expected to be maintained even if the mining cost tends to be high, but if the price falls sharply, some high-cost miners may face pressure to shut down mining machines or adjust their operating models.

Overall, the profitability of Bitcoin mining is at a critical juncture. The dynamic changes in market prices, mining difficulty, and electricity costs will directly determine the survival space of miners and the overall computing power layout of the industry. In the future, with market fluctuations and difficulty adjustments, the mining industry may usher in a new round of computing power reorganization and industrial upgrading.

Bitcoin mining difficulty data

6. Policy and regulatory news

Bitcoin legislation in various U.S. states is accelerating, and many states are promoting the protection of reserves and self-custody rights

Kentucky officially signs the Bitcoin Rights Act - On March 24, 2024, the Governor of Kentucky officially signed HB 701, which protects residents rights to use self-hosted wallets and run blockchain nodes, and clarifies that such actions are not subject to money transmission licenses and securities supervision, while limiting local governments discriminatory management of related technology activities.

Oklahoma House Passes Strategic Bitcoin Reserve Act - On March 25, 2024, the Oklahoma House of Representatives voted to pass the Strategic Bitcoin Reserve Act, which allows the state to invest 10% of public funds in Bitcoin or digital assets with a market value of more than $500 billion, aiming to enhance the diversity and long-term profit potential of the state governments financial reserves.

North Carolina Bitcoin Investment Bill will create an investment authority to promote 5% fund investment in digital assets - On March 25, 2024, Bitcoin Laws disclosed the details of North Carolinas Bitcoin Investment Bill. The states House bill HB 506 will create the North Carolina Investment Authority (NCIA), led by the state treasurer, and authorize the agency to invest 5% of each fund in the state in digital assets. The HB 506 bill does not actually create a Bitcoin reserve. Its concept is closer to Floridas HB 487 and SB 550, which allows state-level public funds to invest in Bitcoin, but does not stipulate mandatory holdings.

South Carolina Bitcoin Reserve Act will allow 10% of state funds to be invested in Bitcoin, with a cap of 1 million BTC - On March 28, according to Bitcoin Laws, South Carolinas Bitcoin Reserve Act (Bill H 4256) will allow the state treasurer to invest 10% of state funds in Bitcoin. The upper limit of Bitcoin reserves is 1 million BTC. The bill was proposed by Congressman Jordan Pace.

26 states have introduced Bitcoin reserve bills, accounting for more than 50% - As of March 26, 2024, 26 states in the United States have introduced Bitcoin reserve bills, which means that more than half of the states in the United States are considering Bitcoin as part of government asset allocation, and some states have proposed allocating up to 10% of state funds to crypto assets. In addition, Wisconsin has become the first state to purchase a Bitcoin ETF, with holdings reaching $588 million as of the fourth quarter of 2024.

These legislative developments indicate that many U.S. states are actively promoting the legalization of Bitcoin and providing clearer legal protections in terms of government funding allocation and residents usage rights.

7. Mining News

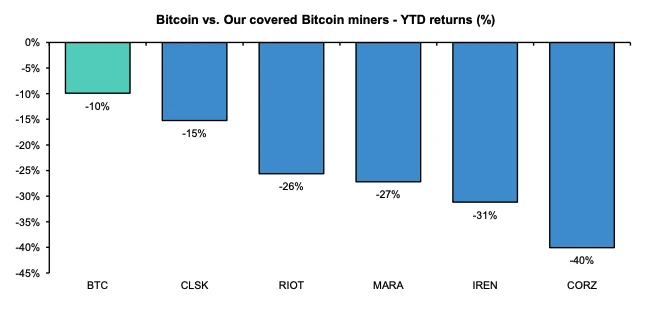

Bernstein lowered the target prices of several listed Bitcoin mining companies, but maintained the target price of BTC at $200,000 by the end of the year

On March 20, brokerage firm Bernstein lowered the target prices of several listed Bitcoin mining companies, including IREN, CleanSpark and Riot Platforms, because the stock prices of these companies have far underperformed BTC so far this year. Analyst Gautam Chhugani explained that Bitcoin mining companies have experienced painful adjustments this year, falling 20-40%, while Bitcoin has fallen 10%. Overall, the price trend of listed mining companies has been disappointing, with no significant increase in the fourth quarter of last year, and the performance so far this year has been worse than the adjustment of Bitcoin.

However, Bernstein analysts maintained their price target of $200,000 for Bitcoin by the end of the year.

Related images

Pakistan proposes using surplus energy to mine Bitcoin

On March 24, Pakistan proposed to use its excess energy to mine Bitcoin, marking a major shift from its previous anti-cryptocurrency stance. The proposal was made by Bilal Bin Saqib, CEO of the newly formed Crypto Council, at its first meeting on March 21, 2025. The meeting included senior figures such as lawmakers and the Governor of the Central Bank of Pakistan. The plan aims to build a robust crypto ecosystem in Pakistan, attract foreign investment, and position the country as a major cryptocurrency hub. The change came after the government had previously opposed cryptocurrencies due to global pro-crypto policies such as the Trump administration. The proposal is in line with international trends, embraces digital assets, and heralds a new chapter in Pakistans digital age.

Microsoft cuts data center plans, Bitfarms and other Bitcoin mining companies stock prices fall

On March 27, Microsoft canceled some of its data center investments in the United States and Europe due to concerns about oversupply of AI computing power, causing the stock prices of many crypto mining companies, including Bitfarms, CleanSpark, and Marathon, to fall by 4%-12% on the same day. Analysts said that this move has increased mining companies reliance on AI business, and the decline in revenue after Bitcoin halving has put pressure on the industry. Microsoft plans to turn to the transformation of existing center equipment and expects to further slow down expansion in the second half of 2025.

8. Bitcoin related news

Bitcoin holdings of global companies and countries (statistics for this week)

Hong Kong Asia Holdings: On March 20, Hong Kong Asia Holdings (01723.HK) purchased 10 bitcoins for a total of HK$6.6712 million (approximately US$858,500). The company currently holds a total of 18.88 BTC, with a total value of approximately US$1.72 million.

Metaplanet: On March 25, Metaplanet purchased an additional 150 bitcoins for a total of approximately 1.886 billion yen. As of now, the company holds a total of 3,350 BTC, with a total purchase amount of approximately 42.216 billion yen.

KULR: On March 25, KULR, a US-listed company, increased its holdings of 56.3 BTC at a price of US$88,824 per BTC, with a total holding of 668.3 BTC. The total purchase amount was approximately US$65 million, with an average holding cost of US$97,305 per BTC.

Fidelity: On March 25, Fidelity increased its holdings of 688.547 BTC through its Bitcoin ETF (FBTC), with a total value of approximately US$60.2 million.

The Blockchain Group: On March 27, French technology consulting company The Blockchain Group purchased 580 bitcoins at a price of approximately 81,550 euros (approximately 87,874 US dollars) per bitcoin. After this transaction, the companys total bitcoin holdings reached 620 bitcoins, valued at more than 54.2 million US dollars at current market prices, making it the worlds 28th largest corporate bitcoin holder.

KULR: On March 25, KULR, a US-listed company, increased its holdings of 56.3 BTC at a price of US$88,824 per BTC, with a total holding of 668.3 BTC. The total purchase amount was approximately US$65 million, with an average holding cost of US$97,305 per BTC.

IMF includes Bitcoin and other digital assets in global economic reporting framework for the first time

On March 23, the International Monetary Fund (IMF) released the seventh edition of the Balance of Payments Manual (BPM 7) on March 20, which included digital assets such as cryptocurrencies into the global economic reporting framework for the first time. This is the first update of the manual since 2009. According to the new framework, digital assets are divided into fungible tokens and non-fungible tokens, and are further classified according to whether they bear related liabilities:

- Unbacked assets such as Bitcoin are classified as non-productive non-financial assets and are classified in the capital account;

- Digital currencies backed by liabilities, such as stablecoins, are considered financial instruments;

- Platform tokens such as ETH and SOL may be classified as equity-like instruments if held across borders;

- Staking and cryptocurrency earning activities are considered as dividend income sources;

- Mining and staking related services are considered exportable computer services. (CrowFund Insider)

The IMF plans to promote widespread adoption of BPM 7 and the latest national accounts system by 2029-2030.

White House official: US could potentially use its gold reserves to buy more Bitcoin

On March 24, Bo Hines, executive director of President Trumps Digital Asset Advisory Committee, said in an interview that the United States could use the proceeds from its gold reserves to buy more Bitcoin. According to Hines, this move could be a budget-neutral way to increase the countrys Bitcoin reserves. Hines cited the Bitcoin Act of 2025 proposed by Senator Cynthia Lummis, which advocates that the United States obtain 1 million Bitcoins within five years, accounting for about 5% of the total supply of Bitcoin. The purchase of Bitcoin will be funded by selling the Federal Reserves gold certificates.

Author of Rich Dad Poor Dad: Fear of making mistakes makes poor people miss out on wealth opportunities, missing out on Bitcoin may be the biggest regret

On March 24, Robert Kiyosaki, author of Rich Dad Poor Dad, posted on the X platform that Bitcoin has ushered in a historic wealth opportunity, but many people have missed the opportunity due to FOMM (fear of making mistakes). He believes that FOMO investors will accumulate generational wealth, while FOMM people will wait until Bitcoin breaks through $200,000 before lamenting that it is too expensive.

Bitcoin supporters, such as Jeff Booth, Michael Saylor, Samson Mow and others, are optimistic about the wealth effect of Bitcoin in the long term, while the traditional education system makes many people afraid of failure and ultimately miss opportunities.

Arthur Hayes: Bitcoin predicted to break through 110,000 before retesting 76,500

On March 24, BitMEX co-founder Arthur Hayes wrote on the X platform that he predicted that Bitcoin would break through 110,000 before retesting 76,500, citing the Federal Reserve’s shift from quantitative tightening (QT) to quantitative easing (QE) for Treasury bonds, and tariffs are no longer important because “inflation is temporary,” as Jay Powell said. He said he would elaborate on this point in the next article.

Standard Chartered Bank: Bitcoin will have higher returns and lower volatility after replacing Tesla

On March 25, Standard Chartered Bank constructed a hypothetical index Mag 7 B, replacing Tesla with Bitcoin, and found that it had higher returns and lower volatility. Bitcoin has a high correlation with Nasdaq and may become part of a technology stock portfolio. Since December 2017, Mag 7 B has performed 5% better than Mag 7, and in the past 7 years, Mag 7 B has an average annual return of 1% higher. The addition of Bitcoin reduces portfolio volatility and has a higher information ratio. As Bitcoin trading becomes more convenient, it is expected to attract more institutional funds.

Related images

Michael Saylor predicts BTC will become a $200 trillion asset class and global settlement layer

On March 25, Strategy founder Michael Saylor predicted that BTC will become a $200 trillion asset class by 2024 and become the global settlement layer in the AI-driven Internet era. The United States adoption of a strategic reserve of Bitcoin will consolidate its dominance and force its global adoption. Strategy has accumulated more than 500,000 Bitcoins with $33 billion using innovative financial instruments such as convertible bonds and preferred stocks to fund its corporate Bitcoin funds, while financially designing a self-sustaining price increase cycle.

Michael Saylor has stated that he will destroy BTC before his death rather than donate the assets, as this practice is a more ethical and reasonable form of charity and will give Bitcoin economic immortality, making everyone in the Bitcoin network richer and more powerful.

T. Rowe Price exec says now is a “perfect time” to invest in Bitcoin

On March 26, according to CoinDesk, Dominic Rizzo, global technology portfolio manager at T. Rowe Price, which manages more than $1 trillion in assets, said at the Exchange Conference in Las Vegas that the current price of Bitcoin is close to the average mining cost, which is an attractive time to invest. He also suggested that investors can indirectly invest in digital assets through stocks such as Coinbase and Robinhood or blockchain-related companies.

Bitwise CIO: Now is the best time in history to buy Bitcoin at a risk-adjusted price

On March 27, Bitwise Chief Investment Officer Matt Hougan said that now is the best time in history to buy Bitcoin at a risk-adjusted price because almost all threats to survival, including regulation, have been eliminated. As the United States builds strategic Bitcoin reserves, Hougan believes that the last major risk has turned into long-term verification.

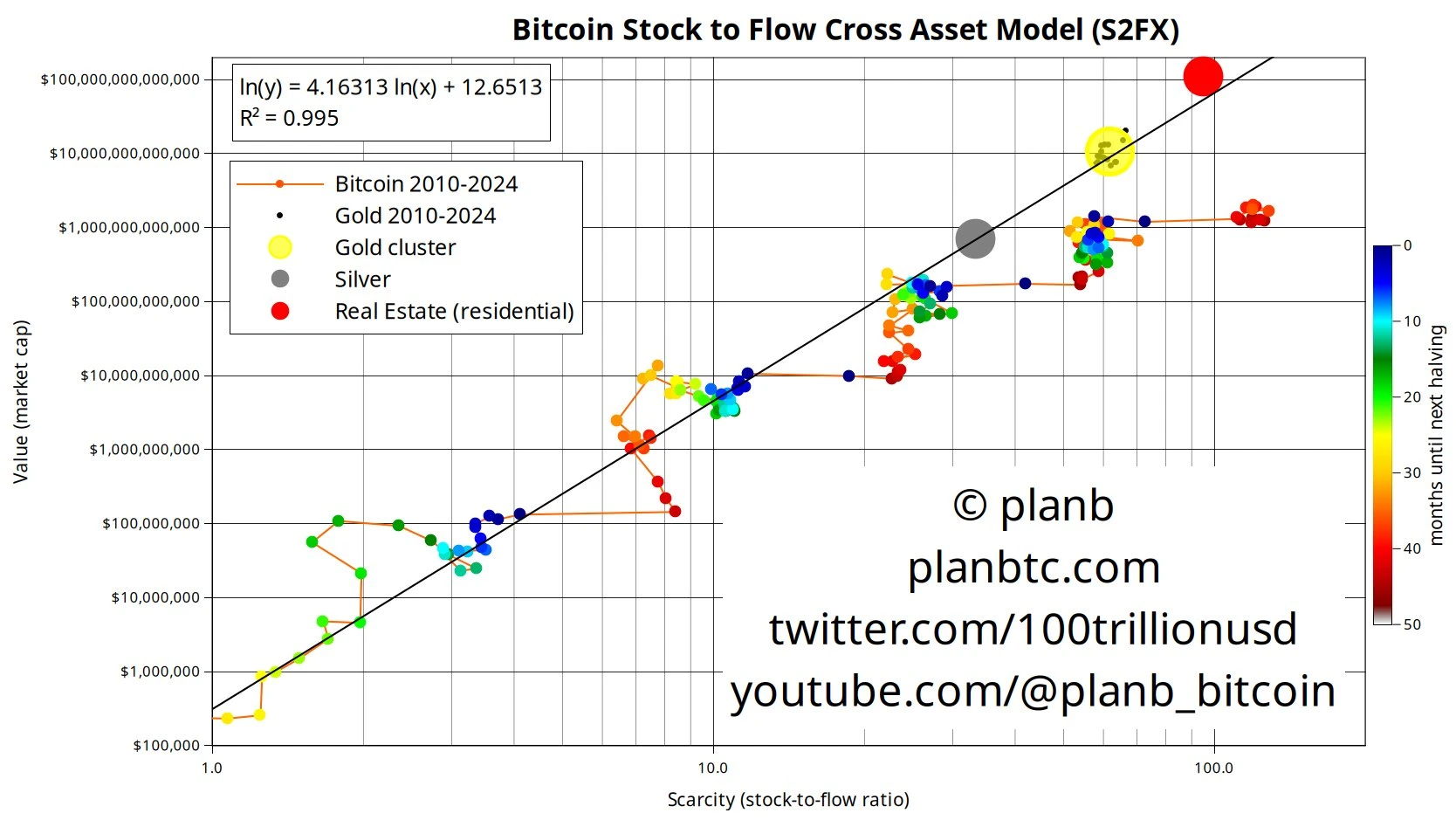

PlanB: Bitcoin is severely undervalued compared to gold and real estate markets

On March 28, analyst PlanB wrote on the X platform that Bitcoin is extremely undervalued compared to gold and the real estate market. Currently, the market value of Bitcoin is 2 trillion US dollars, while the market value of gold is as high as 20 trillion US dollars. In addition, the scarcity of Bitcoin (S2F ratio) is 120 years, far exceeding the 60 years of gold. Let us wait and see what changes this round of halving cycle will bring.

Related images