Read OPNX's first Launchpad project Raiser (RZR) in one article

secondary title

Raiser: a permissionless credit market

Raiser provides a permissionless credit market (RaiseR). By introducing a third-party credit estimation and evaluation agency, Raiser allows anyone to borrow based on their on-chain and social media credit scores without requiring any collateral (in fact, optional mode). In addition, Raiser will also provide a trading market (RaiDEX) that allows bonds to flow freely in the market.

The operation of Raiser relies on three types of roles - lenders (users who need funds), borrowers (users who provide funds), and traders (roles who are free to participate in the market).From the point of view of the operating mechanism, lenders can raise funds by issuing zero-coupon bonds, borrowers can obtain fixed income by purchasing these bonds, and traders can trade these bonds with a certain yield space in the secondary market, thereby promoting the bond market. of free movement.Specifically, the brief operation process of the three parties is as follows:

lender

Before issuing bonds, lenders first need to establish their own credit information (on-chain + off-chain), share relevant information with potential borrowers, and then pay a certain agreement fee (in RZR) to create a The fund pool subscribed by the borrower.

Some potential behaviors can improve the credit level of the lender, such as providing personally identifiable information, providing detailed social media links, verifying their ownership of certain assets (just capital verification, not as collateral), and choosing whether to use certain assets as collateral. Collateral (not mandatory).

Borrower

Borrower

Borrowers can decide whether to lend money according to the credit file and specific regulations provided by the lender. If they think it is feasible, they can directly inject funds into the above-mentioned fund pool.

After providing funds, the borrower receives a token representing the bond, which can be freely traded on the marketplace provided by Raiser.

trader

Traders can freely trade bond tokens on the marketplace provided by Raiser.

Token Economic Model

Token Economic Model

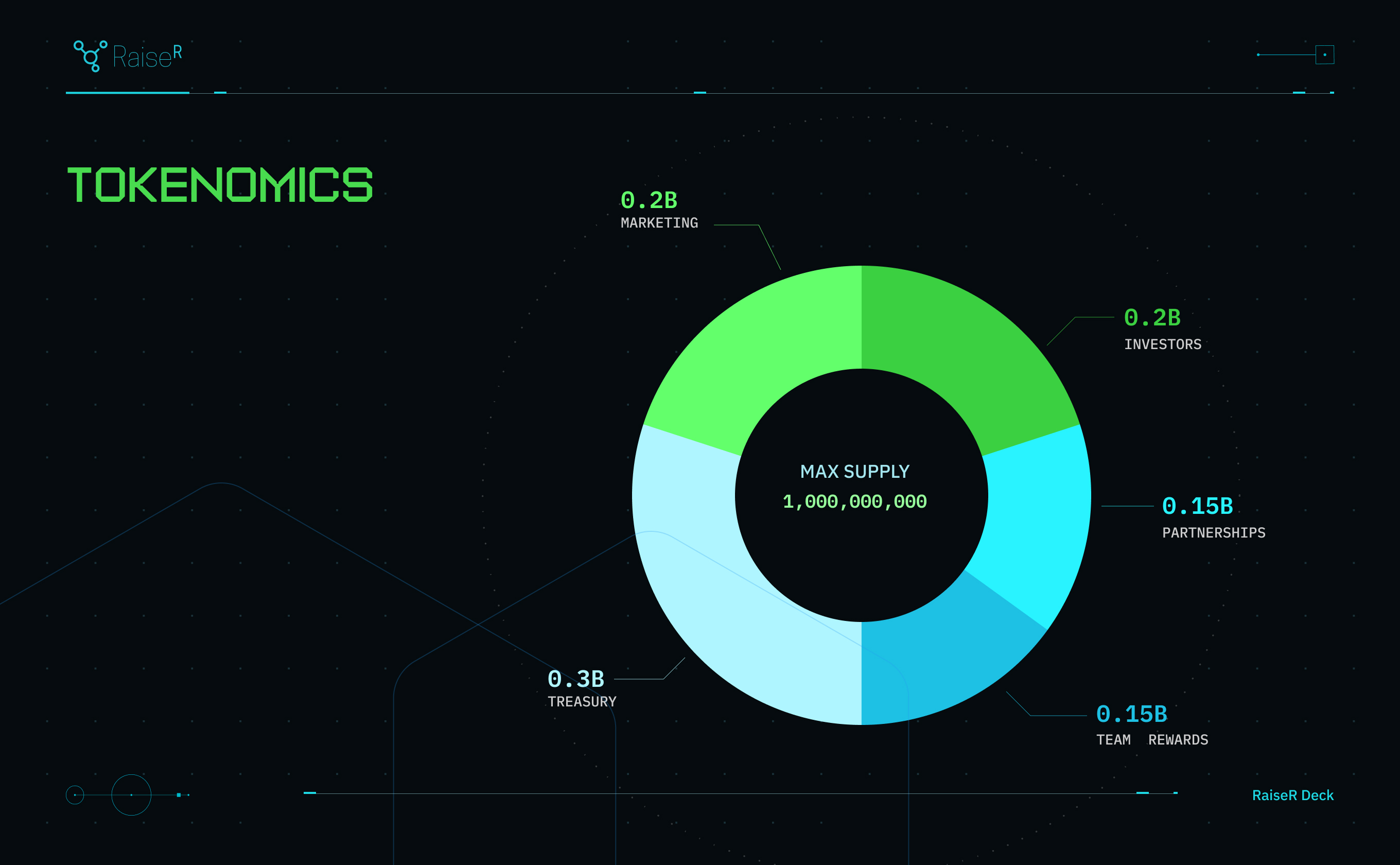

According to Raiser’s official documentation, the total supply of RZR is 1 billion pieces.

The specific distribution of RZR is as follows:

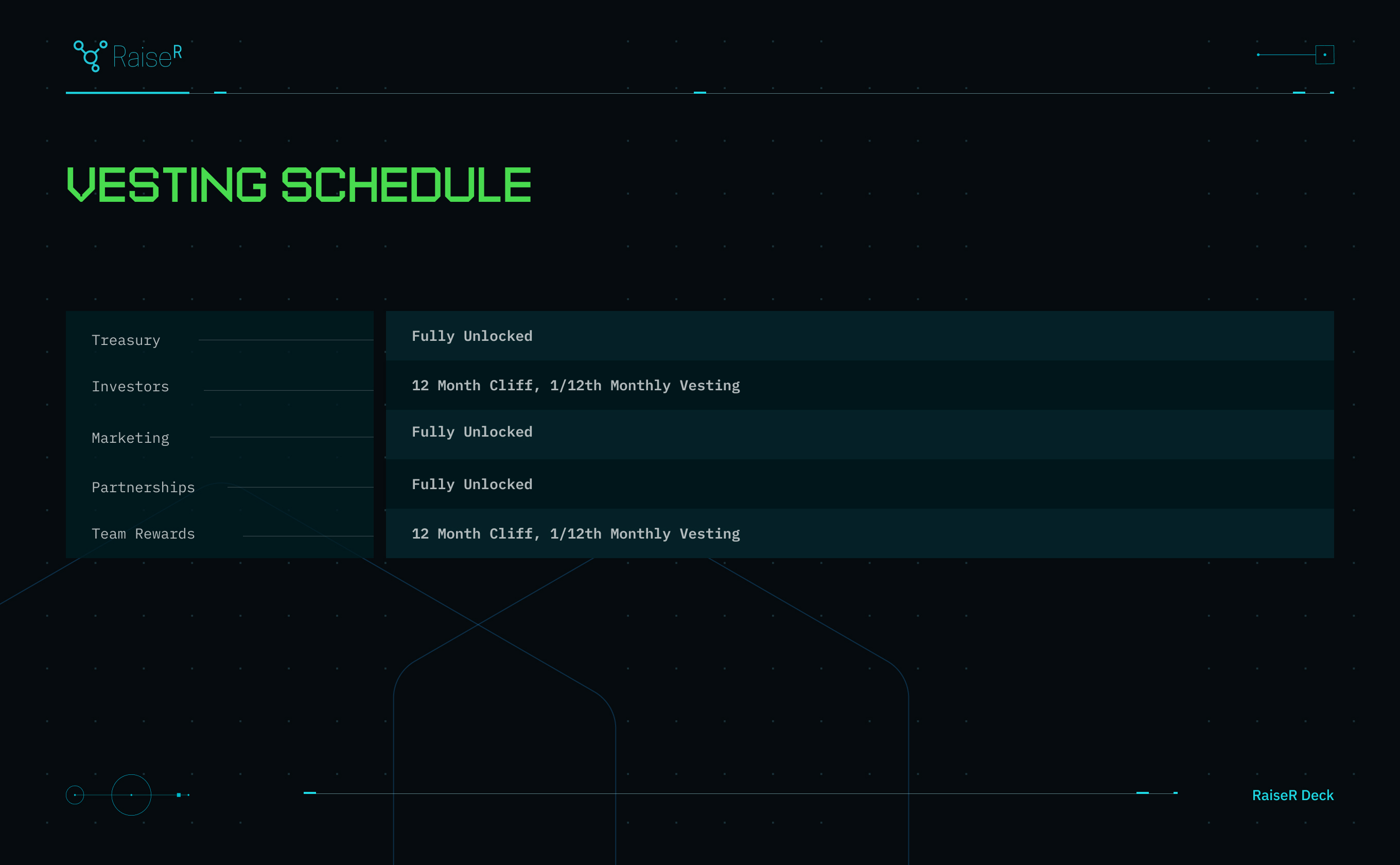

Investors will receive 200 million RZR, locked for 12 months, and then need to be unlocked linearly for 12 months;

The team obtained 150 million RZR, which is also locked for 12 months, and then needs to be unlocked linearly for 12 months;

The treasury obtained 300 million RZR, fully unlocked;

150 million RZR was allocated for the partnership, fully unlocked;

secondary title

Protocol Governance and Fees

Governance and fees are the two main functions that RZR serves within the Raiser system.

In terms of governance, Raiser's governance relies on the operation of 11 governors, of which 3 governors are held by core contributors of the agreement for a long time, and the other 8 are selected from the 8 addresses with the highest number of pledged RZR (veRZR can be obtained after pledge), and are updated every 90 days list once.

Any staker who holds veRZR can create a proposal, but only governors can vote on the proposal, and any proposal needs at least 50% of the governors' votes.

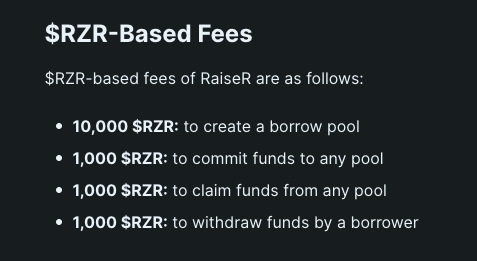

In terms of fees, Raiser will charge a certain RZR fee for various protocol operations at the initial stage.For example, lenders need to pay 10,000 RZR to create a pool, borrowers need to pay 1,000 RZR to provide funds, etc., but such fees can be adjusted through governance.

future plan

future plan

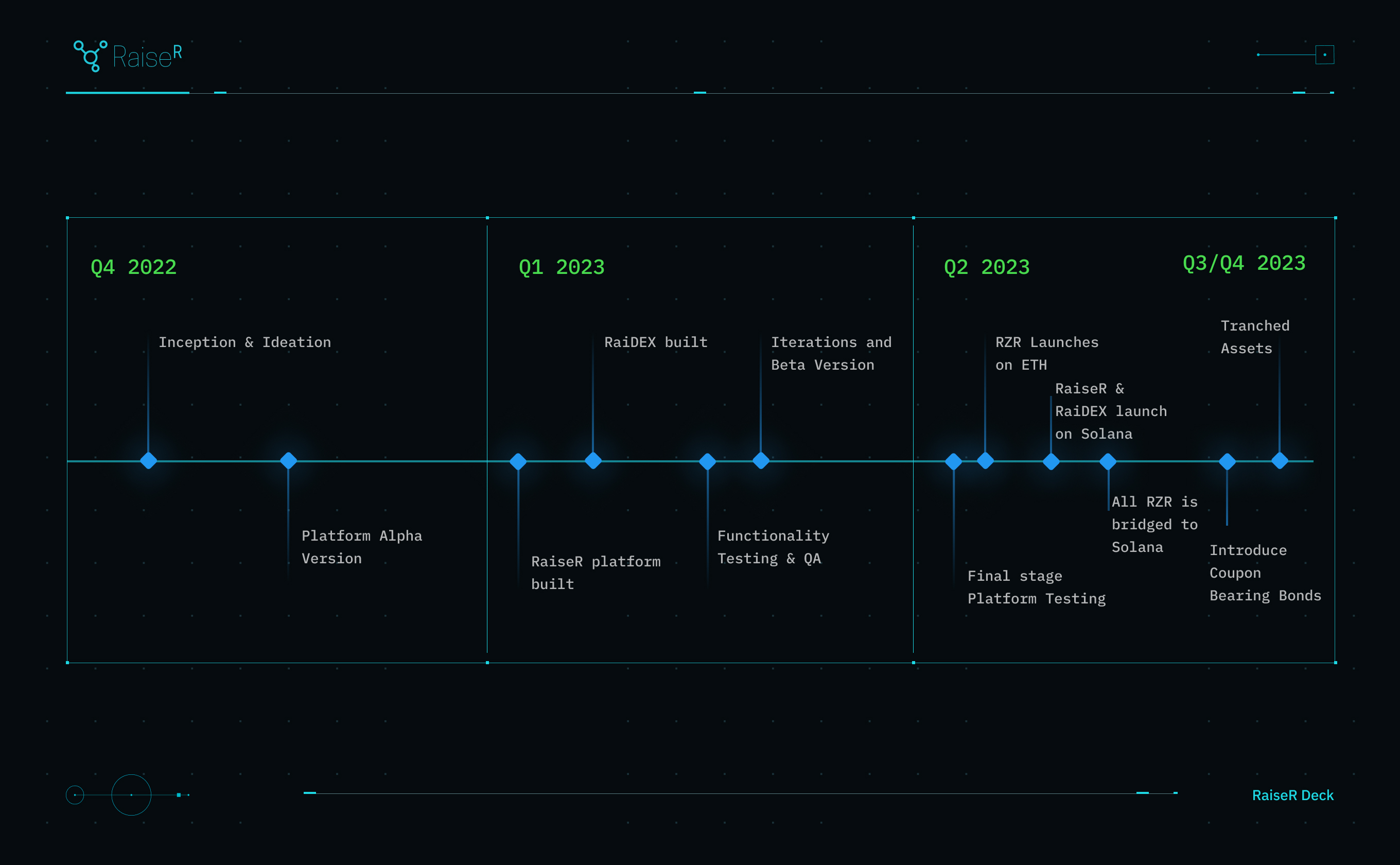

According to Raiser's roadmap planning, RZR will be issued on the Ethereum mainnet this quarter.

However, it is worth noting that the roadmap also mentions that Raiser will launch lending products (RaiseR) and trading products (RaiDEX) on Solana this quarter, and mentions that all RZRs will be bridged to Solana.

Perhaps, the lower-cost Solana is the main position for the future development of the project.