Original Author: Ryan Celaj

Original Source: Messari

Highlights:

1inch DAO voting decided to stop collecting Swap surplus and return it to users, while the DAO plans to explore other sources of revenue.

Ethereum accounts for over 70% of 1inch's total aggregated volume in the second quarter, maintaining its dominance.

The diversity of Fusion Resolvers and the total transaction volume processed by Resolvers continues to increase, surpassing $11.7 billion in the second quarter.

Development of 1inch Network hardware wallet is still ongoing, with 2 million USDC approved to complete the product's trading version.

Note: This report includes data from Ethereum, BNB Chain, Polygon, Optimism, Arbitrum, Avalanche, Gnosis Chain, and Fantom. Data from zkSync, Klaytn, and Aurora is currently not included.

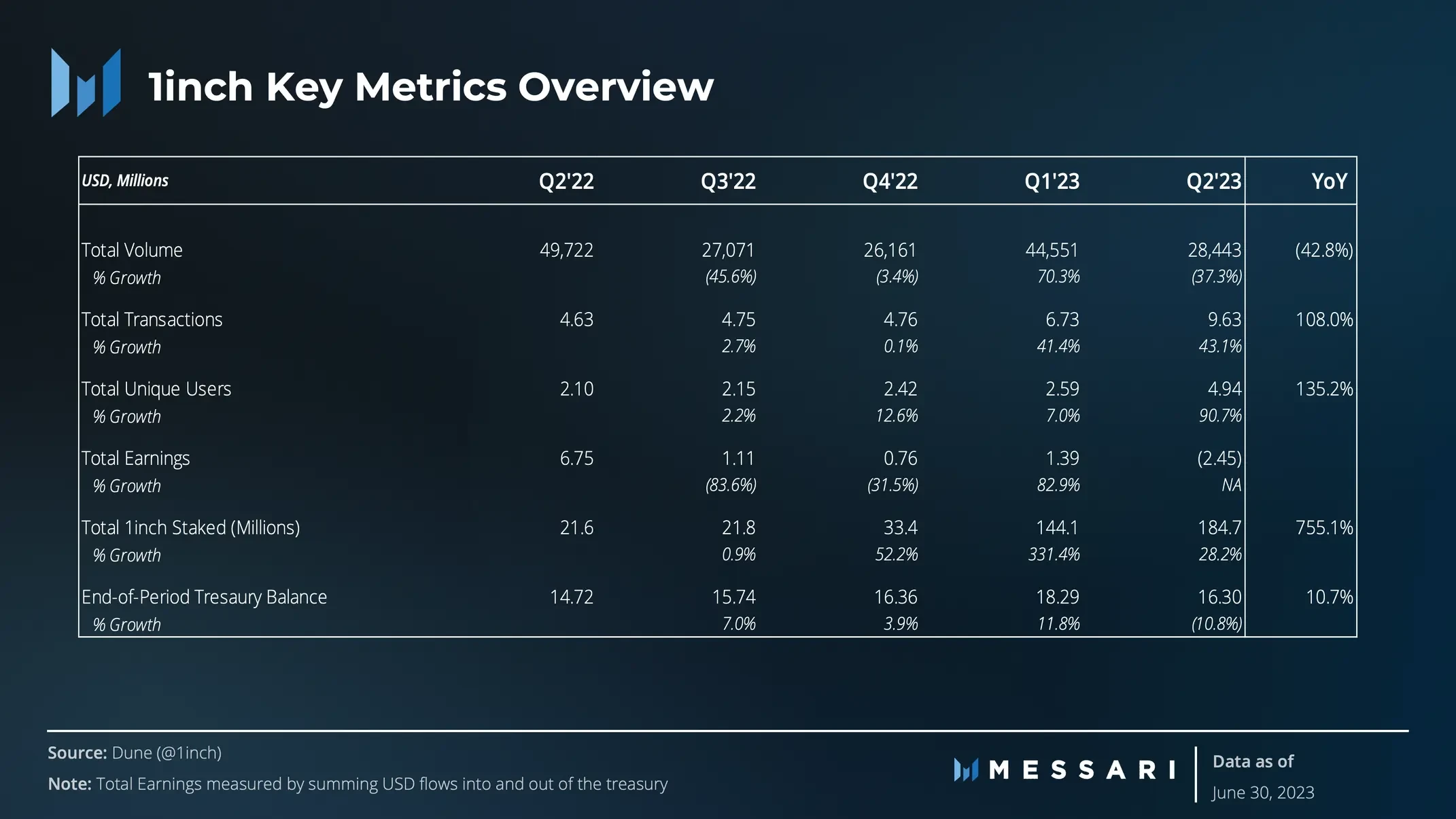

Key Metrics

Performance Analysis

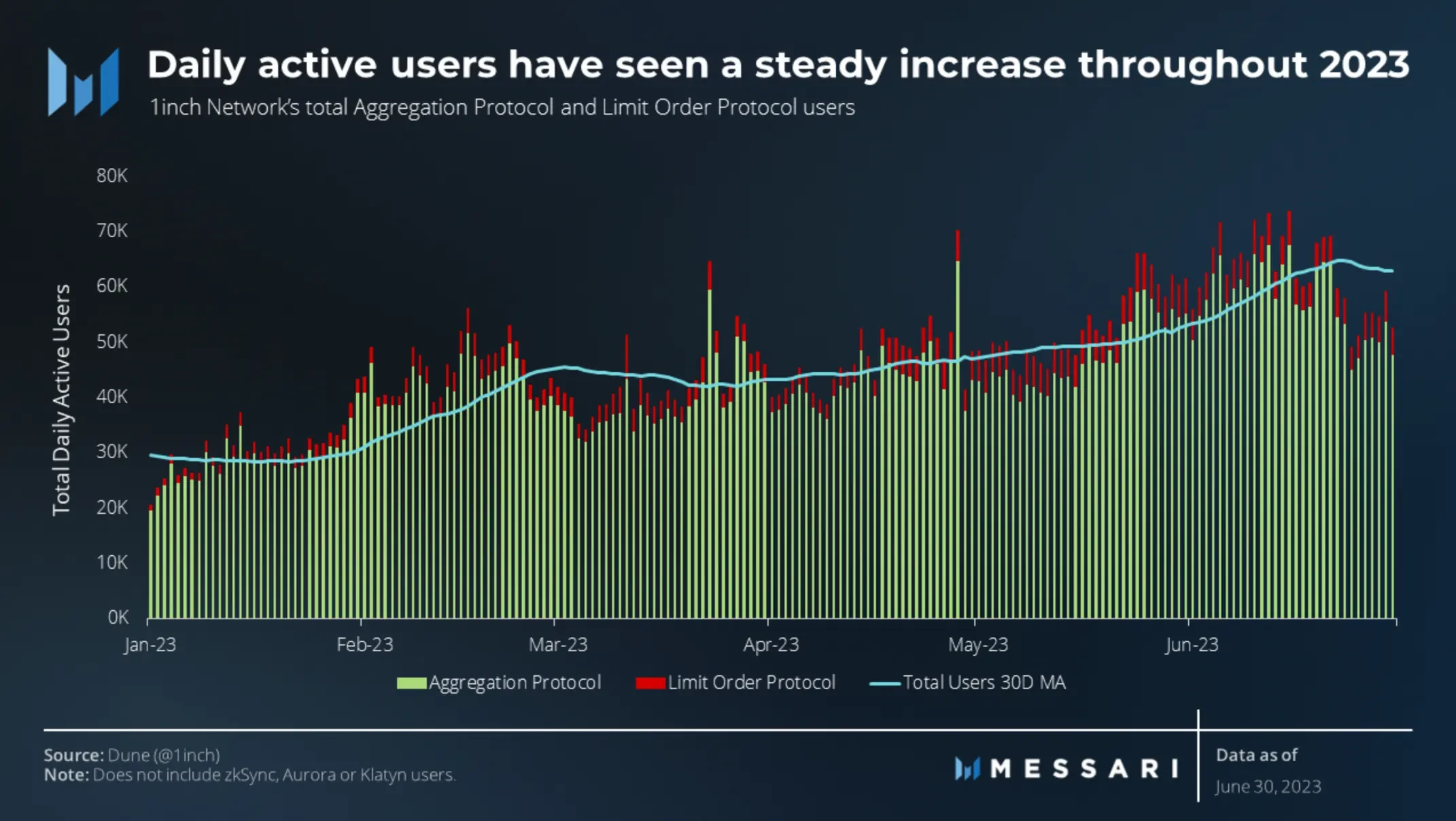

User Analysis

1 inch Network aggregation and limit order protocol user base has been growing over the past year. The total number of users for the aggregation protocol in the first quarter was 3.3 million, which increased to 4.5 million in the second quarter. Similarly, the user base for the limit order protocol increased from 261,000 in the first quarter to 438,000 in the second quarter, with a 68% increase in user count month-on-month. On average, 1 inch Network serves 54,300 users per day. On June 22nd, this metric reached a peak of 64,800 with a 30-day moving average.

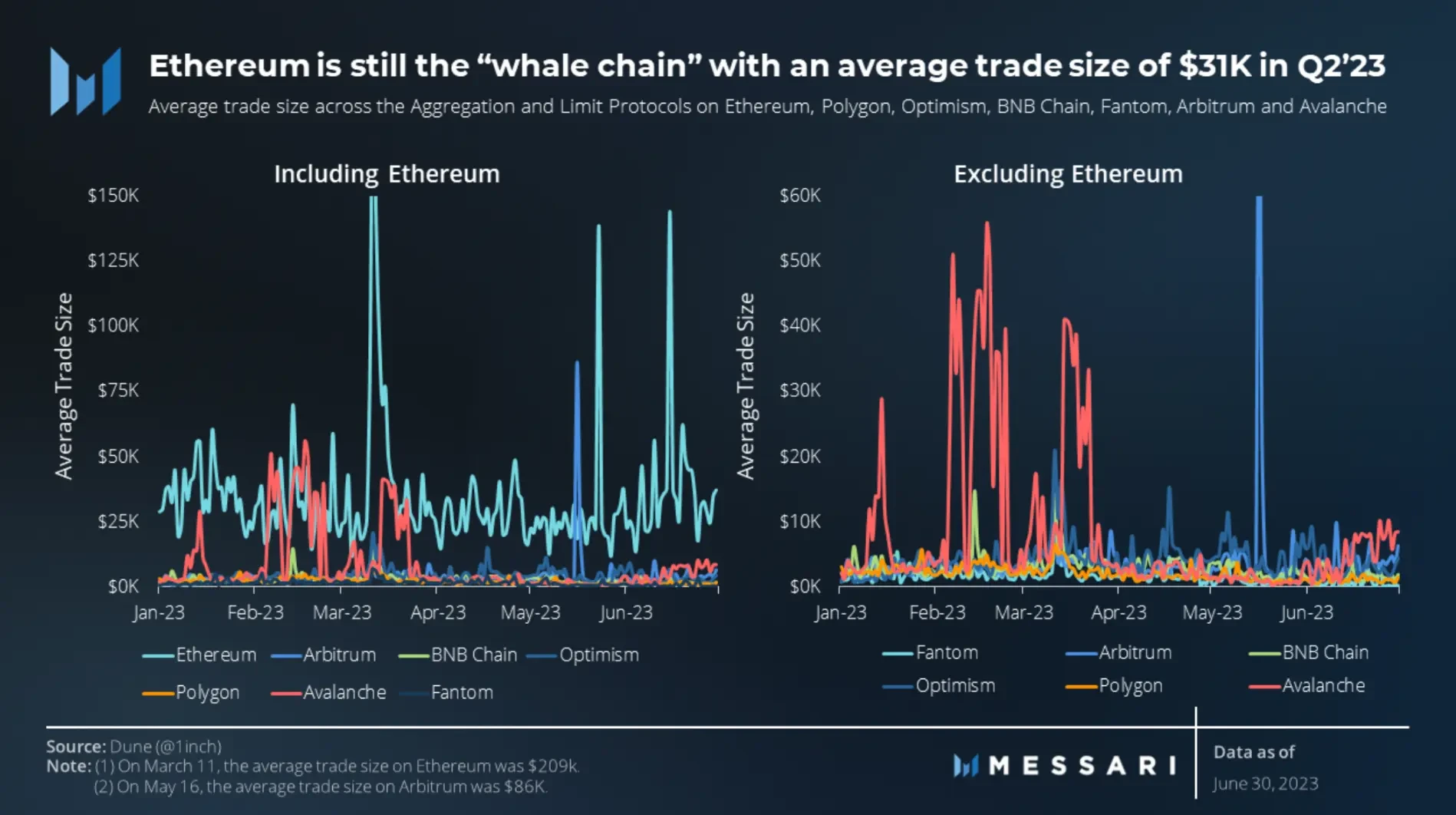

Ethereum continues to maintain its status as the "whale chain" in the second quarter, with an average transaction size of $31,000. Following Ethereum, Arbitrum and Optimism have average transaction sizes of $4,600 and $4,200, respectively. Fantom has the smallest average transaction size at $1,200. Across all chains, the overall average transaction size is $6,800. Compared to the average level of $9,600 in the first quarter, there was a 28.9% decrease, indicating smaller transaction sizes in the second quarter.

In Ethereum, the average transaction size in the second quarter spiked due to the Shanghai upgrade and the launch of ETH staking withdrawals. Although the upgrade happened on April 12th, Lido didn't enable withdrawals until May 15th. As a result, the two peaks in the average transaction size of Ethereum occurred on May 23rd and June 15th, when 96,000 stETH and 46,000 stETH were exchanged through the 1inch limit order protocol.

Analysis Execution

In the second quarter, the total transaction volume processed by the 1inch Network exceeded $28 billion, a 37% decrease from the first quarter. However, this decrease is not only due to a reduction in transaction volume in the second quarter but also related to the inflation of transaction volume in the first quarter caused by the USDC depegging event in March 2023. By excluding the transaction volume during the depegging period from March 10th to March 16th and replacing it with the average transaction volume of other times in the first quarter, the total transaction volume for that quarter should be $34.5 billion, meaning the second quarter only decreased by 19% compared to the first quarter.

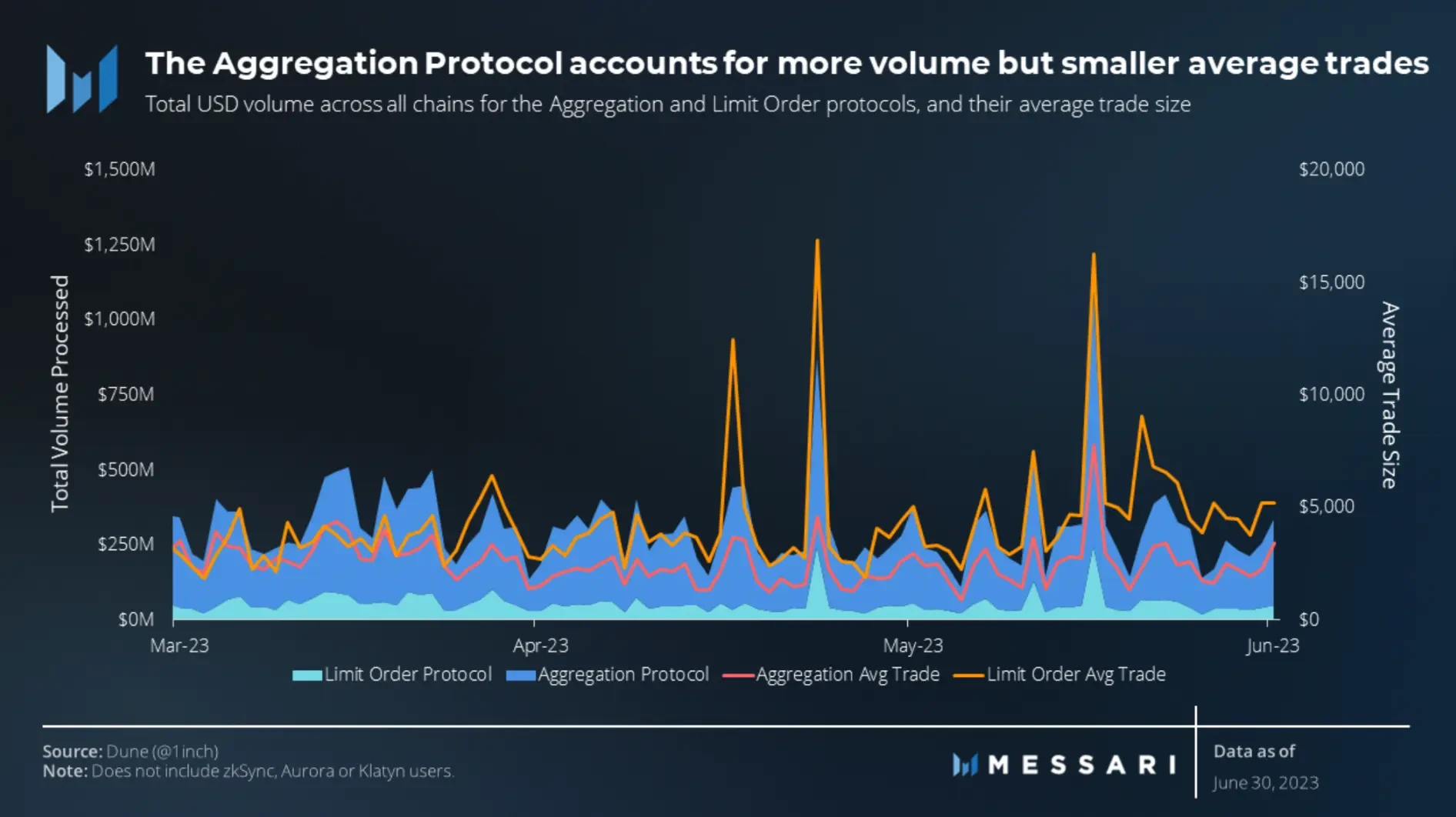

Regarding the average transaction size, the transaction size of the limit order protocol exceeds that of the aggregation protocol. This difference becomes more apparent on days with higher trading volume and increased market volatility. The greater volatility leads to more significant price fluctuations and more uncertainty in price execution, creating more opportunities for triggering limit orders.

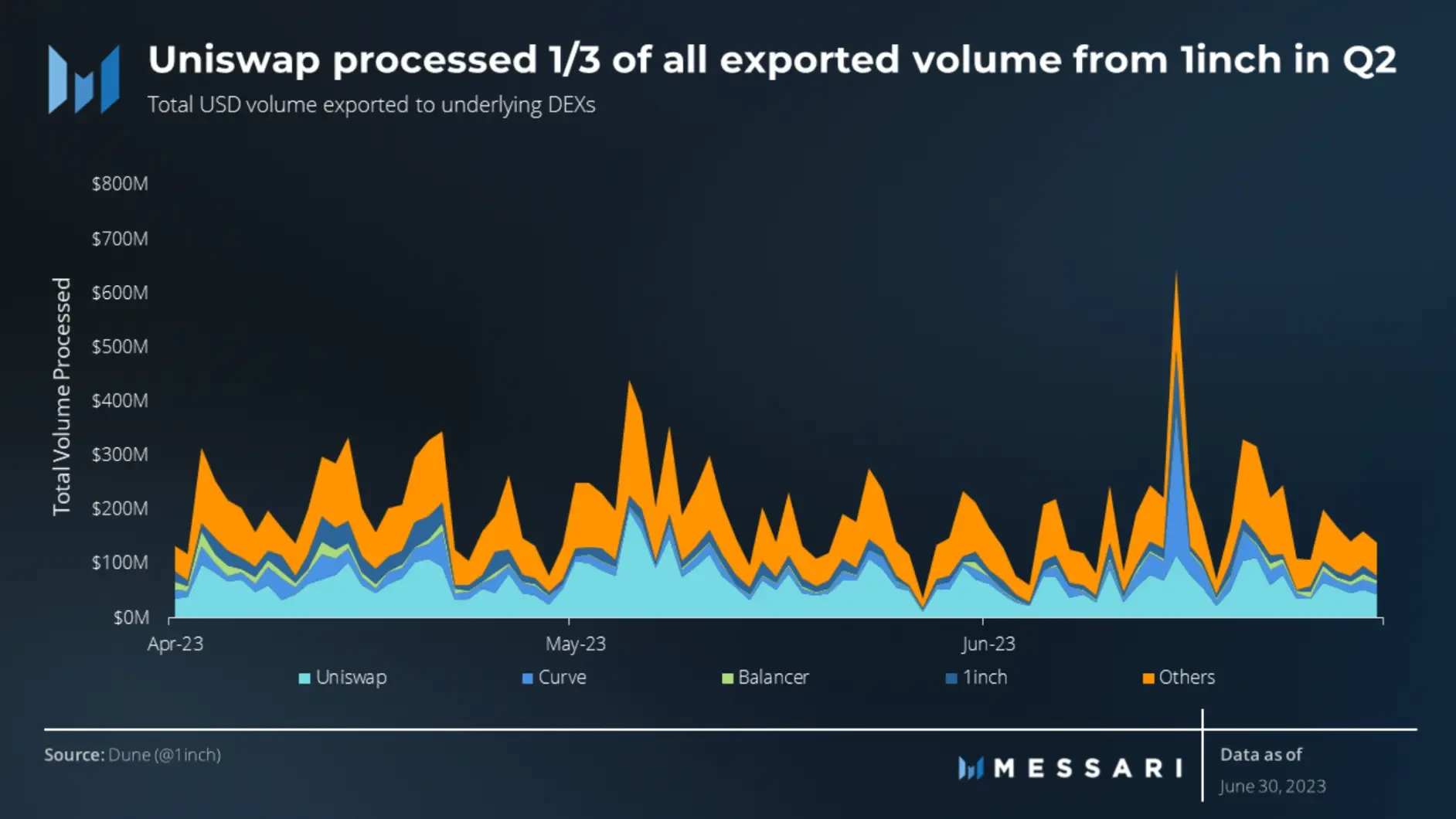

As for the exported volumes handled by decentralized exchanges (DEX) at the bottom layer, 1inch continues to maintain its leading position. Out of a total exported volume of 18 billion US dollars, Uniswap accounts for 6 billion US dollars, or 34%. This figure represents a decrease of about 9% compared to the first quarter when Uniswap accounted for 43% of the total exported volume.

The market share of 1inch Network in terms of transaction volume remains consistent with the first quarter, both accounting for 9%. There has been a notable change in the "other" DEX in the second quarter, with hundreds of sources included. These DEX accounted for 12.9% of the total transaction volume in the first quarter, but this figure sharply rose to 44% in the second quarter. This market share is mainly attributed to Uniswap and Curve, with both experiencing a quarter-on-quarter decrease of 9% and 14%, respectively, highlighting the diversification of transaction volume distribution.

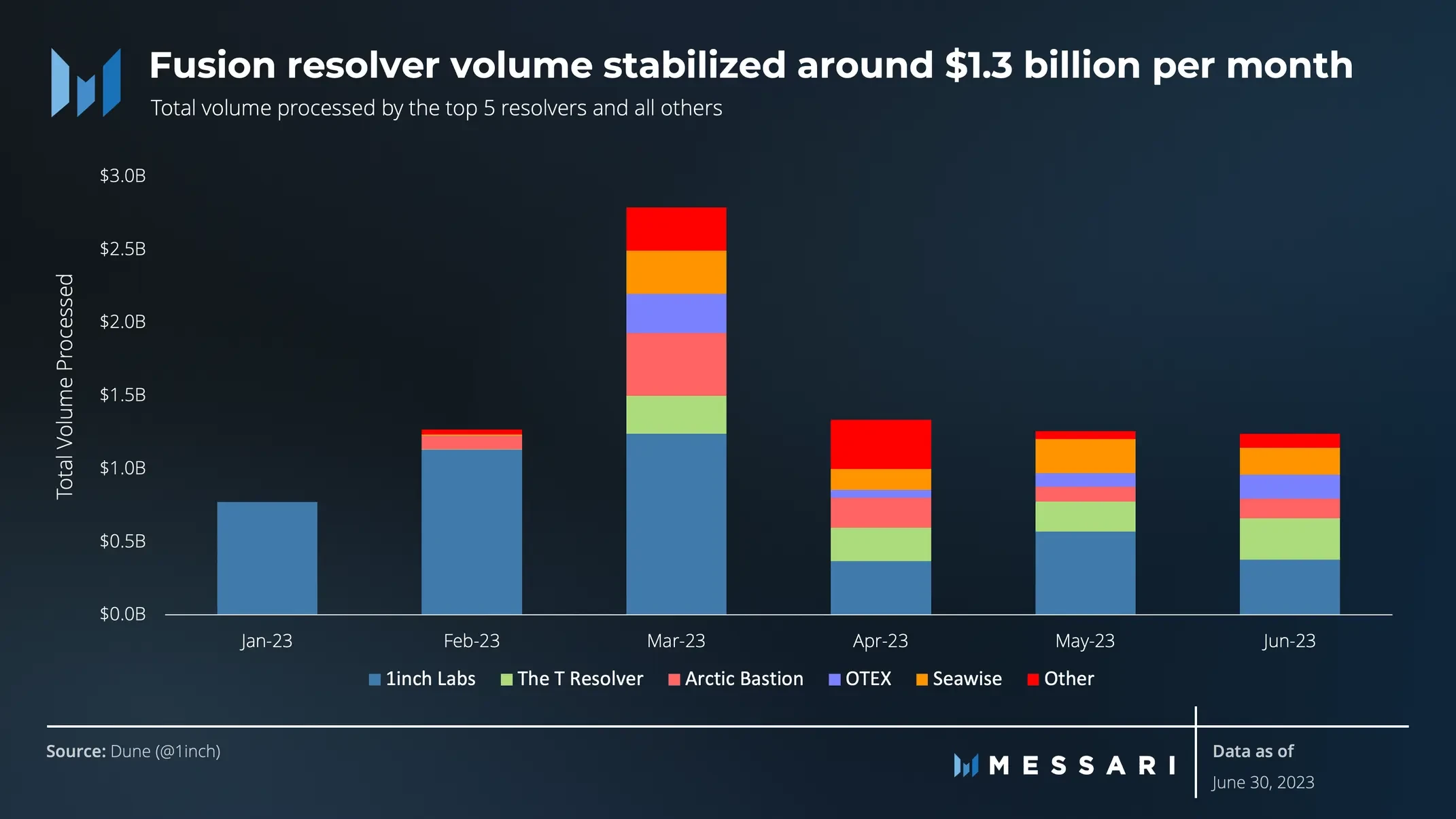

In the second quarter of 2023, Fusion Resolvers made positive progress, currently averaging a monthly transaction volume of 1.3 billion US dollars.

The transaction volume in the first quarter was boosted by the USDC detachment incident, which drove over 2 billion US dollars in volume in just two weeks. Excluding the volume from March 6th to March 19th, the weekly average transaction volume in the first quarter was 265 million US dollars, while in the second quarter, it increased to 293 million US dollars, a growth of 11%.

According to the ranking of Unicorn Power, only the top five Resolvers are eligible to handle Fusion transaction volume. According to Unicorn Power statistics, as of the end of the second quarter, 1 inch Labs accounted for 30.6% of the entire network. Other major Resolvers include Seawise, The T Resolver, Arctic Bastion, and OTEX, accounting for 28.9%, 16.1%, 11.1%, and 6.9% respectively. The share of Laertes, which follows closely behind, is relatively small at 4.3%.

Market Share Analysis

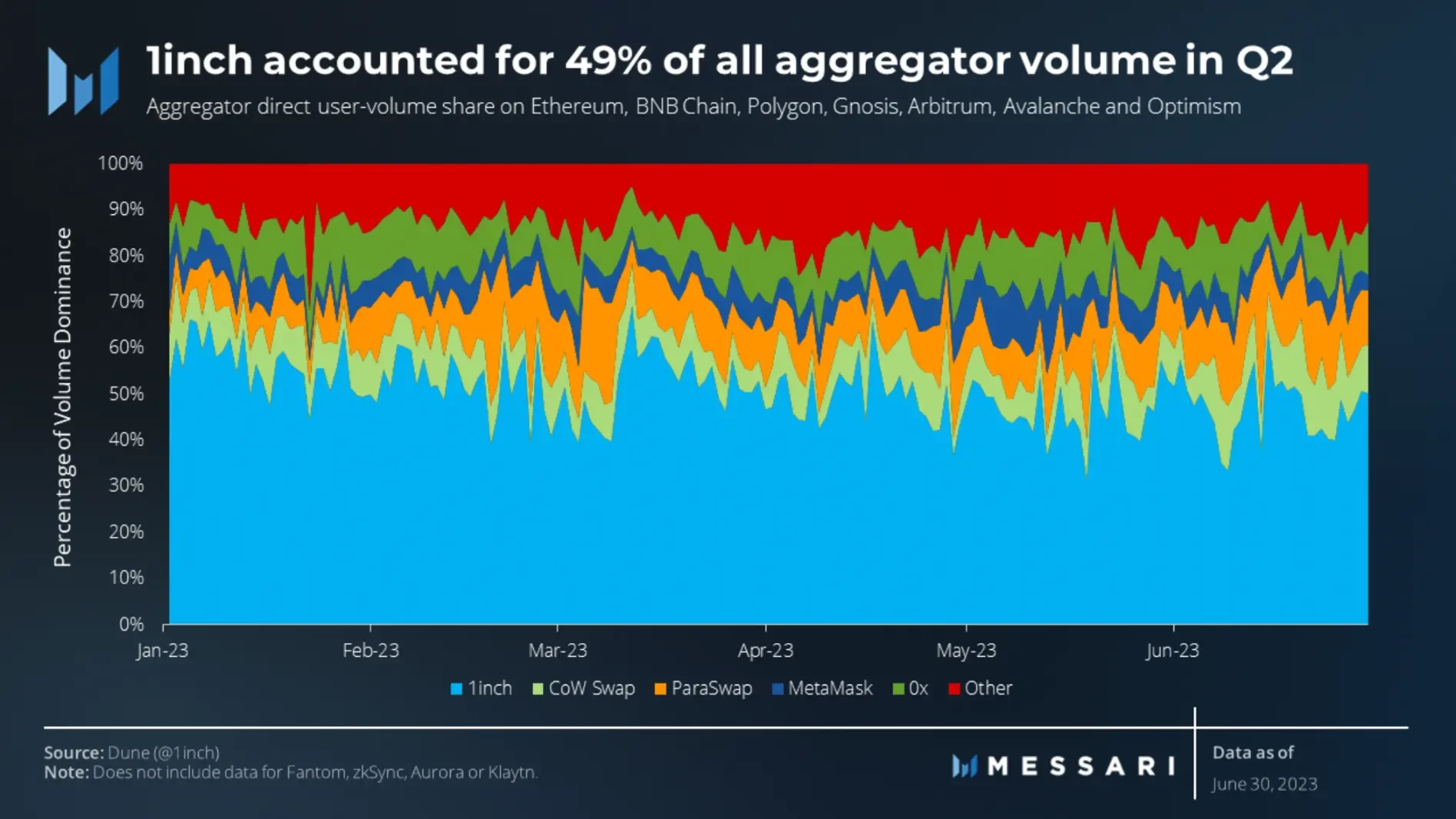

Quarter-on-quarter, the market share of aggregators has remained relatively stable. The "Other" category of aggregators saw the largest increase in market share at 5%, while 1 inch had the largest decline at 6%. Nevertheless, 1 inch still maintains a significant lead over other aggregators, accounting for 49% of all direct users in the second quarter.

Following closely behind 1 inch is ParaSwap, which accounts for 11% of all direct users. The "Other" category, which includes over 15 different aggregators, accounts for 15% of direct users in the second quarter. The landscape of aggregators seems to be expanding, with a slight redistribution of market share this quarter.

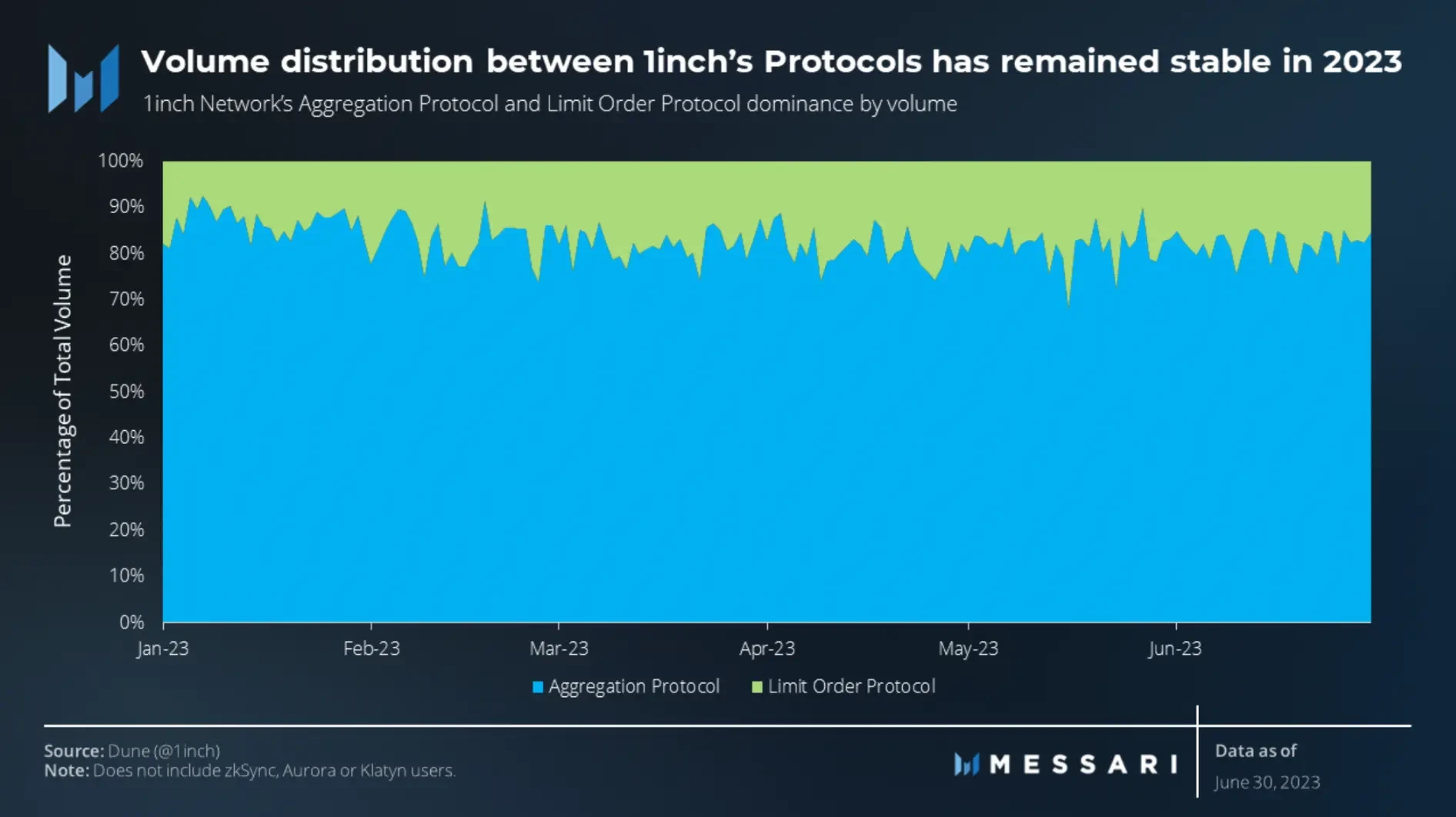

Throughout the second quarter, the 1-inch aggregation protocol maintained a significant share in total trading volume, accounting for 81%, slightly down from the first quarter (83%). The 1-inch limit order protocol reached its peak trading volume on May 16, contributing to 32% of the total trading volume that day, due to the impact of the Lido stETH withdrawals on May 15. In contrast, May 27 was the day with the lowest trading volume in the second quarter, with limit orders accounting for only 10% of the total trading volume.

Conceptually, the dominant position of the aggregation protocol in trading volume is logical. The limit order protocol operates based on price-triggered swaps, while the aggregation protocol facilitates immediate swaps, resulting in higher trading volume.

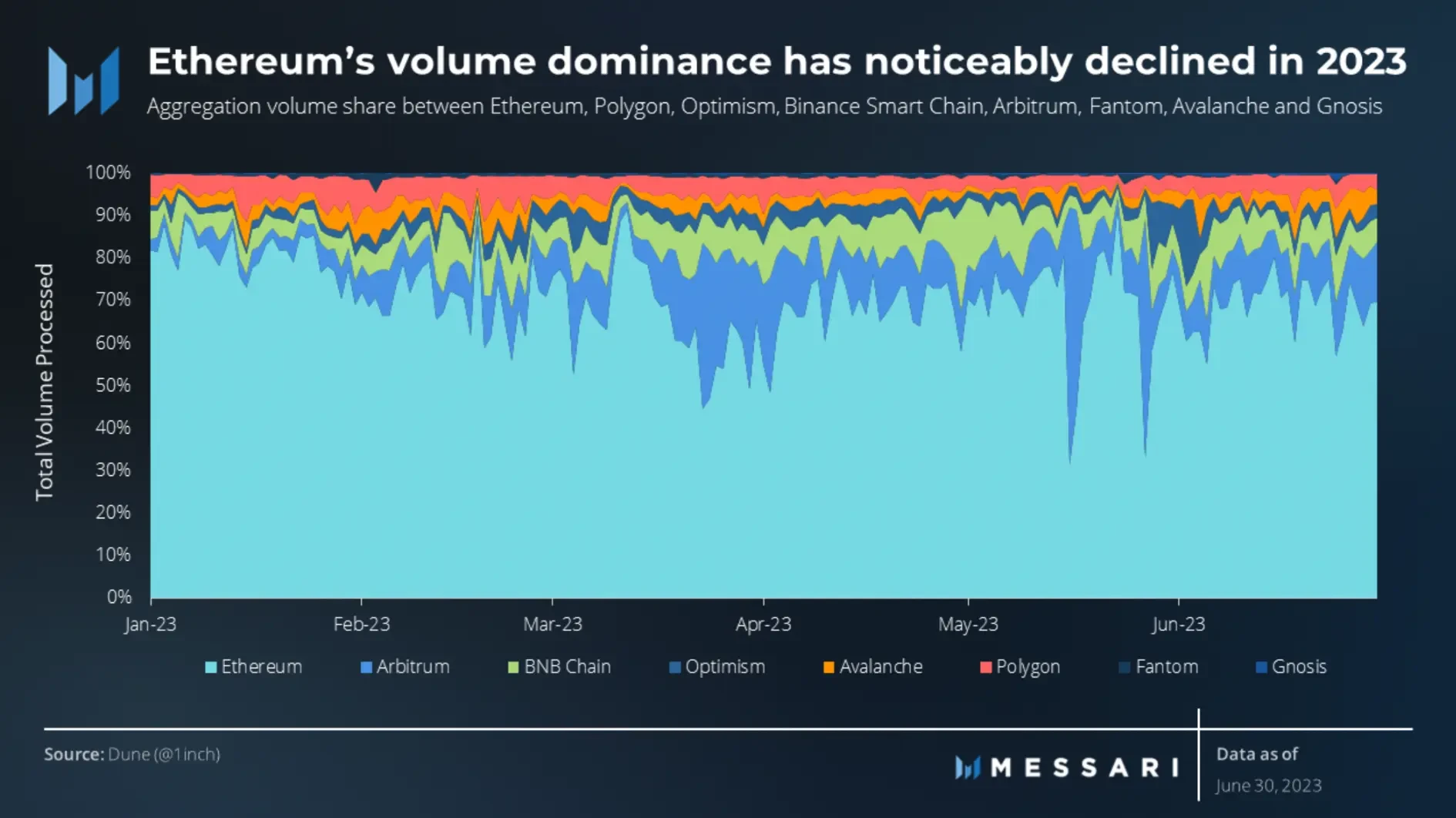

In the second quarter, Ethereum maintained its leading position in the 1-inch Network, accounting for 70% of the total aggregated volume across 8 chains. Arbitrum ranked second, contributing 12% of the total aggregated volume. Interestingly, this marks the second consecutive quarter where Arbitrum has been the preferred choice for aggregation traders (in terms of trading volume). This achievement was made following the native token ARB airdrop in late March 2023.

However, further analysis of Ethereum's performance shows a decline in its dominance. Ethereum's share of the total aggregated volume was 81% in January, but decreased to 71% by June. This trend indicates that as other networks continue to improve and mature, user activity will shift towards more cost-effective chains.

Overall, compared to the first quarter, the aggregate volume of all chains decreased in the second quarter. The total transaction volume of Ethereum significantly decreased by 42.5%, while Arbitrum had the smallest decline, only 0.3%. In contrast, Fantom had the largest decline, with its aggregate volume plummeting by 53.3%.

Treasury and Staking Analysis

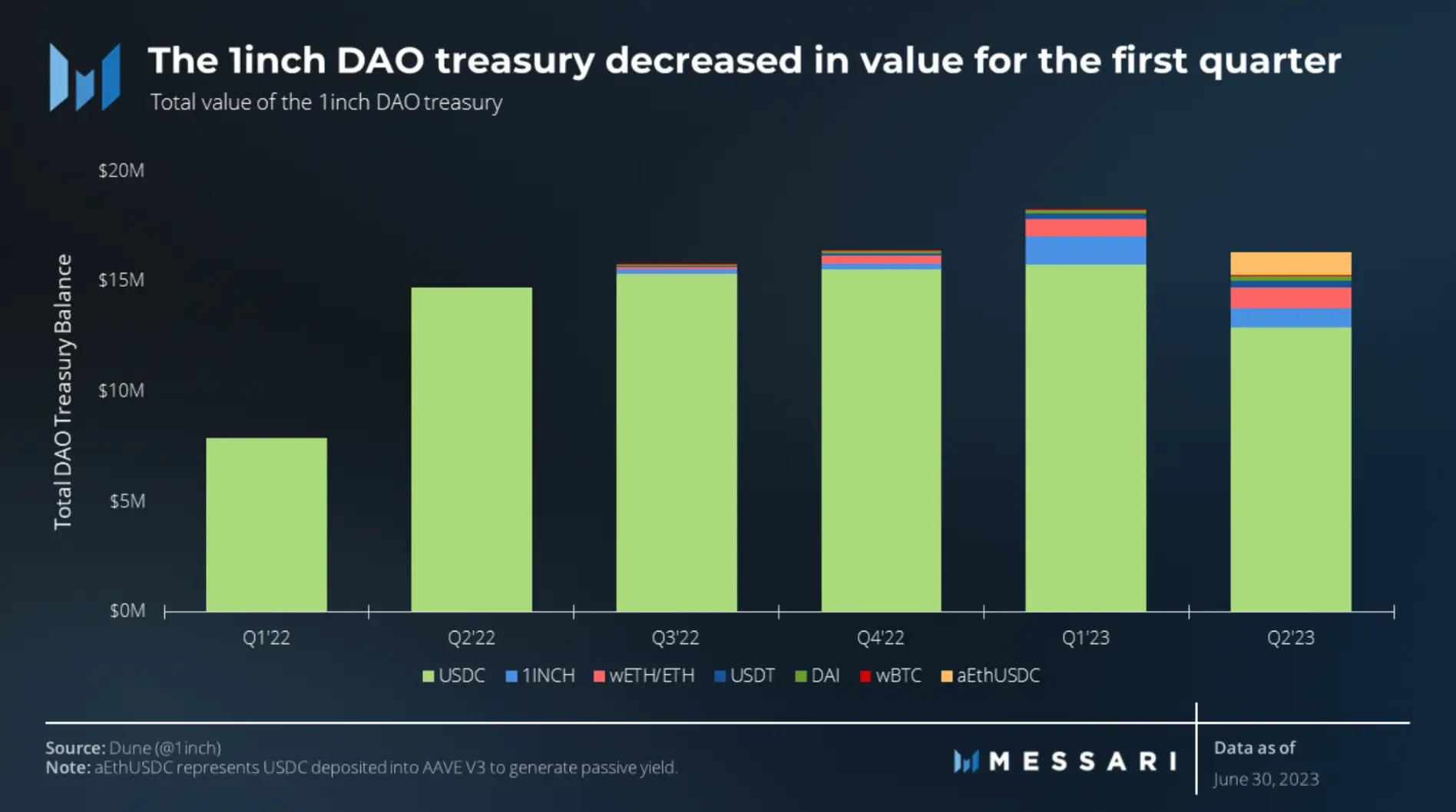

As of the end of the second quarter, 1inch DAO treasury assets decreased by 10.8%, amounting to $16.30 million. This decline can be attributed to several factors, including the approval of allocating 2 million USDC for 1IP30 proposal (aimed at completing the production of 1inch hardware wallet) and the approval of allocating 100,000 USDC for 1IP31 proposal (for 1inch Community Builders Program).

In addition, the termination of collecting surplus from swap, which was previously the main source of income for 1inch DAO, also contributed to this decline. In response, the DAO is exploring other revenue streams. One of the initiatives is depositing 1 million USDC into AAVE V3, which is expected to generate an estimated APR of 1-2%. Looking ahead, the company plans to further explore how Fusion mode can generate additional income.

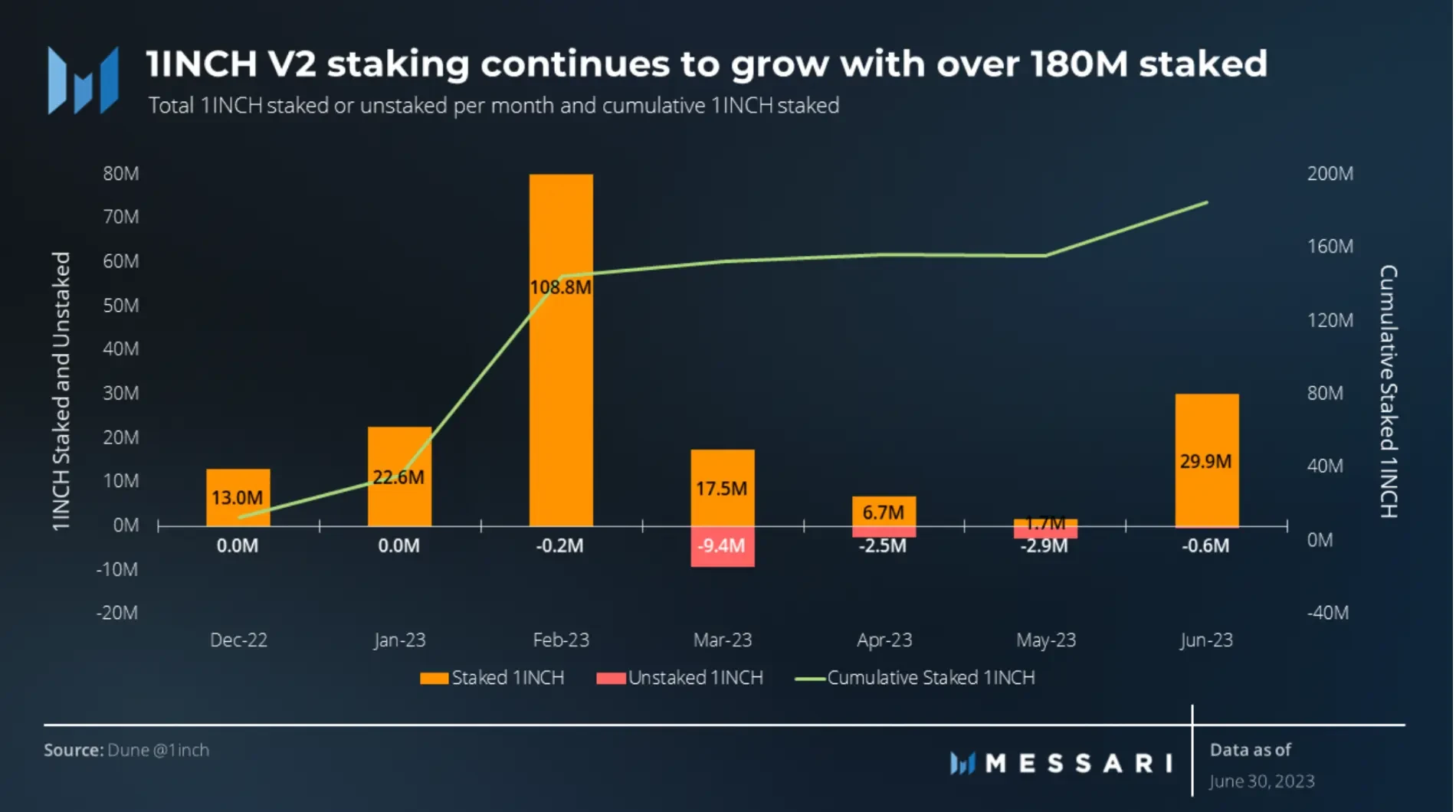

As of the end of the second quarter, the staked amount of 1 INCH V2 reached 184 million tokens, showing a significant growth of over 20% compared to the previous quarter. The staking incentives contributing to this growth include the accumulation of Unicorn Power, which can be used for voting on proposals in the 1inch DAO or delegated to a Resolver for earning rewards. Delegation incentives began at the end of January, leading to a significant influx of staked tokens in February.

However, the staked amount saw a slight decline of 1.2 million tokens in May, marking the first time that outflows exceeded inflows for 1 INCH V2 staking. This decrease aligns with a broader cryptocurrency market downturn during that time, as the total cryptocurrency market capitalization decreased by 11% compared to its peak in April 2023. In June, staking inflows increased to 29.3 million tokens.

Compared to the V1 staking contract, the V2 staking contract attracted more staked 1 INCH tokens. However, there have been changes in the percentage of staked tokens relative to circulating supply. The V1 staking contract reached a peak of 31.5% of the total staked 1 INCH in September 2021, while the V2 staking currently represents 19.8% of the circulating supply. It should also be noted that the circulating supply was 165 million tokens in September 2021, compared to the current supply of 943 million tokens.

Summary

In the second quarter of 2023, 1inch Network continues to increase user engagement while undergoing a series of changes. The daily number of users for the aggregator and limit order protocol has significantly grown, indicating the platform's expanding influence in the DeFi space. Although Ethereum continues to dominate the majority of its aggregated volume, users have gradually shifted towards more cost-effective networks. This quarter, the network also processed a total transaction volume of $28 billion. Governance changes, especially the termination of swap fee collection, will also drive 1inch to explore other sources of revenue. Overall, these changes reflect the platform's response to ever-changing market conditions and user demands.